Bullish on Vulcan - Analyst Blog

July 05 2012 - 10:30AM

Zacks

We recently upgraded our rating on Vulcan Material

Company (VMC) from Neutral to Outperform as it stands to

benefit largely from a recovering housing market.

With a gradual recovery in the overall economy, the homebuilding

industry is finally seeing signs of stabilization in 2012. The

downturn during 2006-2007 had hurt the homebuilding sector hard. We

believe that the housing market is starting to benefit from an

increase in employment rates and higher consumer confidence. Houses

are more affordable now as mortgage loans come with relatively low

interest rates while renting becomes more expensive. As the new

home construction market recovers, the demand for the company’s

products has also gone up.

Further, we are encouraged by the company’s better-than-forecast

first half results, in particular the impressive performance at the

Aggregates segment which is slowly gaining momentum.Vulcan is the

largest producer of construction aggregates in the US. The

Aggregates business, which accounts for the lion’s share of the

company’s revenue, is slowly gaining momentum with signs of

recovery in the in the U.S. construction sector. The segment is

witnessing consistent volume growth driven by improving demand. The

segment’s net sales increased $73 million and gross profit was up

$53 million in the trailing six months ended March 31, 2012 versus

the prior-year period. Management also projects a much improved

earnings in this segment in 2012.

We also like the company’s strong market standing, steady volume

growth and expanded cost initiatives. Demand for public

construction projects, which account for more than half of the

company’s revenues, remains strong. Moreover, the private sector is

slowly recovering which until now was considered fragile.

It is worthwhile to note that rival Martin Marietta

Materials Inc.’s (MLM) attempt to take over Vulcan has

almost fallen apart with a court’s recent ruling restricting Martin

Marietta by at least four months to take over Vulcan. The order

removes a significant overhang for Vulcan, at least for some time

to come. In a hostile move, in December 2011, Martin Marietta

proposed to purchase all outstanding shares of Vulcan at a fixed

exchange ratio of 0.50 shares of Martin Marietta common stock for

each Vulcan common share. Vulcan management however found the offer

grossly inadequate.

Had Martin Marietta succeeded in its attempts, its four

directors would have contested in the election at the upcoming

Vulcan annual meeting in June this year. However, with the stay

denied, Martin Marietta’s attempt to nominate its directors to

Vulcan’s board will most probably be delayed until the next annual

meeting.

MARTIN MRT-MATL (MLM): Free Stock Analysis Report

VULCAN MATLS CO (VMC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

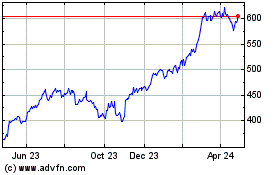

Martin Marietta Materials (NYSE:MLM)

Historical Stock Chart

From Jun 2024 to Jul 2024

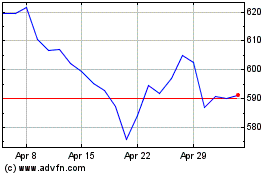

Martin Marietta Materials (NYSE:MLM)

Historical Stock Chart

From Jul 2023 to Jul 2024