Vulcan to Merge Operating Regions - Analyst Blog

December 21 2011 - 5:45AM

Zacks

Vulcan Materials Company (VMC) recently

announced its plan to consolidate its eight operating regions into

four, namely East, South, Central and West. The strategic move on

the company’s part is aimed at reducing overhead costs and

increasing operating efficiency.

The preliminary decision was taken by the senior management

during the first half of the year but the approval from the

company’s Board of Directors was received at its quarterly meeting

on December 09, 2011.

The company had long planned to decentralize its administration,

especially its sales, marketing and operating functions in order to

improve efficiency at a much lower cost. The recent announcement

will enable Vulcan to execute its plan.

The consolidation of operating regions is expected to generate

an ongoing annualized pre-tax cost savings of roughly $30 million,

apart from another $25 million in annual pre-tax overhead

reductions already realized in the current year. Additionally, as a

part of the process approximately 200 positions, including overhead

and administrative staffs, will be laid off.

Vulcan is optimistic about each of its operating segments for

the upcoming quarters. Almost all the segments are expected to

witness higher volumes and higher prices for its products,

offsetting higher costs.

Further, the company’s selling, general and administrative

expenses in 2011 are projected to be approximately $25 million,

which is lower than the prior-year level. Vulcan Materials

anticipates capital spending of $100 million for the year.

Based in Birmingham, Alabama, Vulcan Materials, a Zacks #3 Rank

(Hold rating) stock, is engaged in the production, distribution and

sale of construction aggregates, and other construction materials

and related services in the U.S. and Mexico.

Vulcan Materials is the nation’s largest producer of

construction aggregates and a leading producer of other

construction materials. The company’s key competitors include

CEMEX, S.A.B. de C.V. (CX), Lafarge

S.A. (LFRGY), Cement Roadstone Holdings

and Martin Marietta Materials Inc. (MLM).

CEMEX SA ADR (CX): Free Stock Analysis Report

LAFARGE SA-ADR (LFRGY): Free Stock Analysis Report

MARTIN MRT-MATL (MLM): Free Stock Analysis Report

VULCAN MATLS CO (VMC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

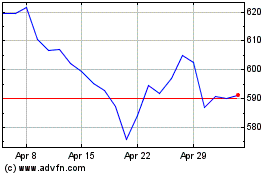

Martin Marietta Materials (NYSE:MLM)

Historical Stock Chart

From Jun 2024 to Jul 2024

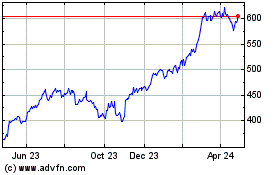

Martin Marietta Materials (NYSE:MLM)

Historical Stock Chart

From Jul 2023 to Jul 2024