Acquisition of Magellan midstream

partners May 2023 Filed by Magellan Midstream Partners, L.P. pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934 Subject Company: Magellan Midstream

Partners, L.P. Commission File No. 001-16335 Date: May 14, 2023 The following presentation was published on Magellan Midstream Partners, L.P.'s website on May 14, 2023 for information regarding the proposed merger between ONEOK,

Inc. and Magellan Midstream Partners, L.P.

Forward-Looking Statements This

presentation includes “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities and Exchange Act of 1934, as amended. All statements, other than statements

of historical fact, included in this presentation that address activities, events or developments that ONEOK or Magellan expects, believes or anticipates will or may occur in the future are forward-looking statements. Words such as

“estimate,” “project,” “predict,” “believe,” “expect,” “anticipate,” “potential,” “create,” “intend,” “could,”

“would,” “may,” “plan,” “will,” “guidance,” “look,” “goal,” “future,” “build,” “focus,” “continue,”

“strive,” “allow” or the negative of such terms or other variations thereof and words and terms of similar substance used in connection with any discussion of future plans, actions, or events identify forward-looking

statements. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements include, but are not limited to, statements regarding the proposed transaction between ONEOK and Magellan

(the “proposed transaction”), the expected closing of the proposed transaction and the timing thereof and as adjusted descriptions of the post-transaction company and its operations, strategies and plans, integration, debt levels and

leverage ratio, capital expenditures, cash flows and anticipated uses thereof, synergies, opportunities and anticipated future performance, including maintaining current ONEOK management, enhancements to investment-grade credit profile, an expected

accretion to earnings and free cash flow, dividend payments and potential share repurchases, increase in value of tax attributes and expected impact on EBITDA. Information adjusted for the proposed transaction should not be considered a forecast of

future results. There are a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements included in this presentation. These include the risk that ONEOK’s and Magellan’s

businesses will not be integrated successfully; the risk that cost savings, synergies and growth from the proposed transaction may not be fully realized or may take longer to realize than expected; the risk that the credit ratings of the combined

company or its subsidiaries may be different from what the companies expect; the possibility that shareholders of ONEOK may not approve the issuance of new shares of ONEOK common stock in the proposed transaction or that shareholders of ONEOK or

unitholders of Magellan may not approve the proposed transaction; the risk that a condition to closing of the proposed transaction may not be satisfied, that either party may terminate the Merger Agreement or that the closing of the proposed

transaction might be delayed or not occur at all; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the proposed transaction; the parties do not receive

regulatory approval of the proposed transaction; the occurrence of any other event, change, or other circumstances that could give rise to the termination of the merger agreement relating to the proposed transaction; the risk that ONEOK may not be

able to secure the debt financing necessary to fund the cash consideration required for the proposed transaction; the risk that changes in ONEOK’s capital structure and governance could have adverse effects on the market value of its

securities; the ability of ONEOK and Magellan to retain customers and retain and hire key personnel and maintain relationships with their suppliers and customers and on ONEOK’s and Magellan’s operating results and business generally; the

risk the proposed transaction could distract management from ongoing business operations or cause ONEOK and/or Magellan to incur substantial costs; the risk that ONEOK may be unable to reduce expenses or access financing or liquidity; the impact of

the COVID-19 pandemic, any related economic downturn and any related substantial decline in commodity prices; the risk of changes in governmental regulations or enforcement practices, especially with respect to environmental, health and safety

matters; and other important factors that could cause actual results to differ materially from those projected. All such factors are difficult to predict and are beyond ONEOK’s or Magellan’s control, including those detailed in

ONEOK’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that are available on ONEOK’s website at www.oneok.com and on the website of the Securities and Exchange Commission (the

“SEC”) at www.sec.gov, and those detailed in Magellan’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that are available on Magellan’s website at www.magellanlp.com and on the

website of the SEC. All forward-looking statements are based on assumptions that ONEOK and Magellan believe to be reasonable but that may not prove to be accurate. Any forward-looking statement speaks only as of the date on which such statement is

made, and neither ONEOK nor Magellan undertakes any obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law. Readers are cautioned not to

place undue reliance on these forward-looking statements, which speak only as of the date hereof. Non-GAAP Financial Measures This presentation contains references to certain non-GAAP financial measures. The non-GAAP financial measures presented may

not provide information that is directly comparable to that provided by other companies, as other companies may calculate such financial results differently. ONEOK’s or Magellan’s non-GAAP financial measures are not measurements of

financial performance under GAAP and should not be considered as alternatives to amounts presented in accordance with GAAP. ONEOK or Magellan views these non-GAAP financial measures as supplemental and they are not intended to be a substitute for,

or superior to, the information provided by GAAP financial results. Cautionary statement

No Offer or Solicitation This presentation

is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any

jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act of 1933, as amended. Important Additional Information Regarding the Merger Will Be Filed with the SEC and Where to Find It In connection with the proposed transaction between ONEOK and Magellan, ONEOK

intends to file with the SEC a registration statement on Form S-4 (the “Registration Statement”) to register the shares of ONEOK’s common stock to be issued in connection with the proposed transaction. The Registration Statement

will include a document that serves as a prospectus of ONEOK and joint proxy statement of ONEOK and Magellan (the “joint proxy statement/prospectus”), and each party will file other documents regarding the proposed transaction with the

SEC. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS, AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, AND OTHER RELEVANT DOCUMENTS FILED BY ONEOK AND MAGELLAN WITH THE SEC

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT ONEOK AND MAGELLAN, THE PROPOSED TRANSACTION, THE RISKS RELATED THERETO AND RELATED MATTERS. After the Registration Statement has been declared effective, a definitive joint proxy

statement/prospectus will be mailed to shareholders of ONEOK and unitholders of Magellan. Investors will be able to obtain free copies of the Registration Statement and the joint proxy statement/prospectus, as each may be amended from time to time,

and other relevant documents filed by ONEOK and Magellan with the SEC (when they become available) through the website maintained by the SEC at www.sec.gov. Copies of documents filed with the SEC by ONEOK, including the joint proxy

statement/prospectus (when available), will be available free of charge from ONEOK’s website at www.ONEOK.com under the “Investors” tab. Copies of documents filed with the SEC by Magellan, including the joint proxy

statement/prospectus (when available), will be available free of charge from Magellan’s website at www.magellanlp.com under the “Investors” tab. Participants in the Solicitation ONEOK and certain of its directors, executive

officers and other members of management and employees, Magellan, and certain of the directors, executive officers and other members of management and employees of Magellan GP, LLC which manages the business and affairs of Magellan, may be deemed to

be participants in the solicitation of proxies from ONEOK’s shareholders and the solicitation of proxies from Magellan’s unitholders, in each case with respect to the proposed transaction. Information about ONEOK’s directors and

executive officers is available in ONEOK’s Annual Report on Form 10-K for the 2022 fiscal year filed with the SEC on February 28, 2023 and its definitive proxy statement for the 2023 annual meeting of stockholders filed with the SEC on April

5, 2023, and in the joint proxy statement/prospectus (when available). Information about Magellan’s directors and executive officers is available in its Annual Report on Form 10-K for the 2022 fiscal year and its definitive proxy statement for

the 2023 annual meeting of unitholders, each filed with the SEC on February 21, 2023, and the joint proxy statement/prospectus (when available). Other information regarding the participants in the solicitations and a description of their direct and

indirect interests, by security holdings or otherwise, will be contained in the Registration Statement, the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction when they become

available. Shareholders of ONEOK, unitholders of Magellan, potential investors and other readers should read the joint proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. Cautionary

statement (continued)

ü ü ü ü ü ü

ü ü ü ü ü ü Strategic Alignment Committed to safe, reliable and environmentally responsible operations Committed to financial discipline and prudent financial policy Possesses high-quality assets with leading service

offerings Focused on total investor returns and return on invested capital Complementary businesses, asset compatibility and operating philosophy Primarily fee-based earnings Headquartered in Tulsa, Oklahoma CULTURALLY: Pro Forma Asset Map NGL

(ONEOK) G&P (ONEOK) Gas Pipelines (ONEOK) Refined Products (Magellan) Crude Oil (Magellan)

Transaction overview Stock and cash

acquisition Consideration to Magellan ONEOK (NYSE: OKE) will acquire all outstanding common units of Magellan Midstream Partners (NYSE: MMP) Mix of 63% stock / 37% cash Current ONEOK shareholders expected to own ~77% of the pro forma company with

current Magellan unitholders owning the remaining ~23% Total consideration for each Magellan unit is $67.50 Consideration consists of $25.00 in cash and 0.6670 shares of ONEOK common stock, based on ONEOK’s May 12, 2023 closing price of $63.72

Represents a premium of 22% to Magellan’s closing price and 22% to Magellan’s 20-day VWAP as of May 12, 2023 $18.8 billion transaction value Closing timeline $8.8 billion ONEOK equity issued to Magellan unitholders $5.1 billion of cash

consideration, supported by fully committed financing and expected to be primarily financed through a notes offering prior to close $5.0 billion of existing net debt assumed Transaction is expected to close in Q3 2023 Subject to customary closing

conditions, including shareholder, unitholder and regulatory approval

Diversifies product mix and earnings

resilience by adding stable, fee-based refined products and crude oil transportation businesses Expected to be accretive to EPS in 2024, with 3% to 7% annual accretion expected for 2025 through 2027 Average annual free cash flow per share accretion

of >20%, driven by expected transaction synergies and tax benefits Increases scope and adds complementary assets with significant free cash flow and high ROIC Larger scale enhances existing investment-grade credit profile Benefits to both oneok

and Magellan Diversifies product mix and earnings resilience by adding stable, fee-based natural gas and NGL-focused businesses Unitholders receive upfront premium with significant cash component Equity component allows participation in future

upside in an entity with greater growth, scale, and earnings diversity ONEOK is a member of the S&P 500 Index, providing improved shareholder liquidity by expanding investor access Provides opportunity to participate in ONEOK’s strong

growth project backlog and in tax deferral benefits ONEOK Magellan Combined entity will be a more resilient, highly diversified North American infrastructure company well-positioned for future success

Oneok Financial impact: by the numbers

Accretive beginning in 2024 ~3-7% annual EPS accretion expected from 2025 through 2027 Significant synergy potential Step change in FCF after dividends Resilient balance sheet >20% average FCF/share accretion expected from 2024 through 2027

$200MM expected with $400MM+ total annual potential ~$15 billion of tax deductions expected ~$1 billion of average annual FCFAD expected from 2024 through 2027 ~4x increase over status quo ~4.0x pro forma year end 2024E net debt-to-EBITDA Expected

to decline below 3.5x by 2026 Note: Numbers shown assume transaction close prior to 12/31/23.

Diversifying transaction adds scope and

scale ONEOK PRO FORMA MAGELLAN NGL 60% G&P 26% Gas Pipelines 14% Crude Oil 25% Refined Products 75% NGL 44% Refined Products 21% Gas Pipes 10% G&P 18% Crude 7% Source: ONEOK and Magellan SEC filings available on EDGAR Note: Breakdown shown

represents 2022 Operating Income plus Equity Earnings, totaling $3.0 billion and $1.1 billion for ONEOK and Magellan, respectively. Natural Gas Liquids Primary NGL transportation provider for the Williston and Powder River basins and Mid-Continent

End market connectivity: Williston Basin to Gulf Coast Natural Gas Gathering and Processing Primarily fee-based contracts with a percent-of-proceeds component A leading natural gas processer in the Williston Basin Natural Gas Pipelines Connected

directly to end-use markets Historically >95% transportation capacity contracted Refined Products Longest refined petroleum products pipeline system in the U.S., with 9,800 miles and 54 terminals Stable, demand driven business platform that can

access nearly 50% of U.S. refining capacity Crude Oil Take-or-pay commitments supporting long-haul pipe capacity from creditworthy counterparties Strategically connected to Houston and Cushing market hubs and control over 39 million barrels of crude

oil storage Highly complementary asset base with significant long-term growth potential Fee-based business model with limited commodity exposure and >85% fee-based earnings Diversified services and product mix with strategically located and

market connected assets ~50,000-mile pipeline network in geographically contiguous states Committed to shareholder value through disciplined capital allocation

2022 ROIC(a) Source: ONEOK and Magellan

SEC filings available on EDGAR (a) ROIC defined as 2022 EBIT (net income plus interest expense plus tax expense) divided by total debt and equity capital as of 12/31/22. (b) Adjusted ROIC is calculated identically to ROIC, except that total capital

is adjusted to include cumulative impairments (including impairments to equity investments) since 2014. (c) Peer average includes EPD, ET, KMI, MPLX, PAA, TRGP and WMB. (c) ONEOK and Magellan both produce top-tier ROIC The combined company will

continue to focus on ROIC as a key metric 18.5% 13.9% 9.3% Adjusted ROIC(b) Combination of returns-focused businesses Strong stewards of shareholder capital

Complementary Assets and market

positions Key positions in market hubs Liquids-focused infrastructure Strong industrial logic with significant potential to increase utilization Significant potential to increase utilization of complementary NGL and refined product systems Enhanced

product offerings increase customer relevance and service portfolio cross-selling Increased international export opportunities and operational and construction expertise Pro Forma Liquids-Focused Infrastructure NGL (ONEOK) Refined Products

(Magellan) Crude Oil (Magellan)

$200MM of annual synergies…with

potential upside Potential synergies to unlock value creation Significant synergy value expected from cost, operational, commercial and financial components Potential for future upside exists through asset optimization Ability to deduct ~$15 billion

of Magellan’s enterprise value will defer ~$3 billion of cash taxes NPV of ~$1.5 billion based on currently forecasted utilization Future acquisitions or capital projects may increase tax attribute utilization and the NPV of Magellan’s

tax attributes Upside synergy estimate of $400MM+ and potential tax deferral value of ~$3 billion $2.2 billion ~$1.5 billion ~$3.7 billion Base synergy estimate of $200MM Note: Numbers shown assume transaction close prior to 12/31/23.

Oneok’s disciplined capital

allocation Note: Figures on this slide represent ONEOK standalone and do not reflect the impact of the Magellan transaction. (a) ~$10 billion of growth capital expenditures includes $1.1 billion of expected 2023 growth capital expenditures at the

guidance midpoint provided in February 2023. (b) ROIC defined as 2022 EBIT (net income plus interest expense plus tax expense) divided by total debt and equity capital as of 12/31/22. (c) 2023E EBITDA shown is based on the midpoint of EBITDA

guidance provided in February 2023 of $4.575 billion less $539 million of EBITDA related to the insurance settlement. (d) Represents annualization of current quarterly dividend of 95.5 cents per share declared on April 20, 2023. Returning value to

our shareholders CONSISTENT REINVESTMENT IN OUR BUSINESS EXPECTED TO INCREASE EBITDA ~$1.6 BILLION SINCE 2018 ALLOWING US TO RETURN $7.7 BILLION IN DIVIDENDS OVER THE LAST 5 YEARS EBITDA ($BN) ANNUALIZED DIVIDEND ~$10 billion of growth capital

expenditures invested from 2018 – 2022, and including 2023 guidance(a) Delivering long-term value to shareholders with a ~15% ROIC (b) 65% increase (c) No dividend reduction during COVID, target payout of less than 85% (d)

Changes in 2024E-2027E FCFAD(a) Expect

greater cash flow available for debt reduction, dividend increases and/or share repurchases Flexibility to invest in larger growth capital projects or strategic acquisitions without need to access capital markets Ability to increase the size and

pace of investment in developing businesses that could be relevant in a lower carbon future Step change in free cash flow profile ~$1 billion of annual free cash flow after dividends ~$1 billion ~$4 billion Note: Numbers shown assume transaction

close prior to 12/31/23. (a) Free cash flow after dividends defined as EBITDA plus distributions received from investments in excess of equity earnings, less interest expense, cash taxes, capital expenditures and dividends paid.

Immediately increases scale and

resilience of cash flows by adding >$1.5 billion of expected diversified annual EBITDA which is >85% fee-based Expect pro forma net debt-to-EBITDA of 4.0x at year end 2024 with leverage expected to decline below 3.5x by 2026 Anticipate

allocating discretionary cash first toward growth projects and additional debt reduction and then toward either dividend increases or share repurchases financial resilience Strong investment-grade credit with enhanced scale and diversification

Approaching $6 billion 2024E EBITDA Stable, fee-based businesses Product diversity among five segments Strong investment-grade credit ratings Premier large cap infrastructure company positioned for resilience across market cycles Expect net

debt-to-EBITDA below 3.5x by YE 2026 4.0x <3.5x Reduces Bakken earnings concentration Note: Numbers shown assume transaction close prior to 12/31/23.

Culturally aligned on key esg criteria

Committed to operating in a safe and sustainable manner ESG reporting transparency and performance disclosures Aligned corporate values of safety and health performance Commitment to promoting a diverse and inclusive workforce Board engagement and

oversight of ESG strategies Environmental and Safety performance metrics included in employee incentive compensation ü Source: ONEOK and Magellan websites ü ü ü ü ü ü ü ü ü

COMPELLING LONG-TERM VALUE PROPOSITION

Industry Leaders in Return on Capital Strong Balance Sheet Diverse Free Cash Flow Generation Highly Attractive Dividend Enhanced Growth Opportunities S&P 500 Index Member

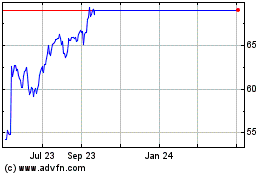

Magellan Midstream Partn... (NYSE:MMP)

Historical Stock Chart

From Aug 2024 to Sep 2024

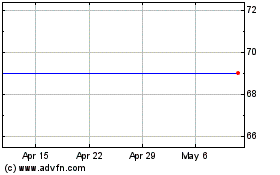

Magellan Midstream Partn... (NYSE:MMP)

Historical Stock Chart

From Sep 2023 to Sep 2024