Current Report Filing (8-k)

April 15 2022 - 8:05AM

Edgar (US Regulatory)

0001839175

false

0001839175

2021-03-12

2021-03-12

0001839175

MBAC:UnitsEachConsistingOfOneShareOfClassMember

2021-03-12

2021-03-12

0001839175

MBAC:ClassOrdinarySharesIncludedAsMember

2021-03-12

2021-03-12

0001839175

MBAC:RedeemableWarrantsIncludedAsPartOfMember

2021-03-12

2021-03-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest

event reported): March 12, 2021

M3-Brigade Acquisition II

Corp.

(Exact Name of Registrant

as Specified in its Charter)

| Delaware |

|

001-40162 |

|

86-1359752 |

|

(State or other

jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

1700 Broadway—19th Floor

New York, NY 10019

(Address of principal executive

offices, including zip code)

(212) 202-2200

Registrant’s telephone number,

including area code

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Units, each consisting of one share of Class A Ordinary Share, $0.0001 par value, and one-third of one redeemable warrant |

|

MBAC.U |

|

The New York Stock Exchange |

| Class A Ordinary Shares included as part of the units |

|

MBAC |

|

The New York Stock Exchange |

| Redeemable

warrants included as part of the units, each whole warrant exercisable for one Class A Ordinary Share at an

exercise price of $11.50 |

|

MBAC.WS |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934 .

Emerging growth company ☒

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

Item

4.02 Non-Reliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review.

The Securities and Exchange Commission (the “SEC”)

has recently expressed concern about a number of matters relating to special purpose acquisition companies (“SPACs”). The

discussions surrounding these concerns has caused many SPACs, including M3-Brigade Acquisition II Corp. (the “Company”), to

review their financial statements for prior reporting periods and consider whether amendments are appropriate in order to ensure that

such financial statements are compliant with various SEC rules and practices.

In reviewing its financial statements for prior reporting

periods, management of the Company has determined that the following modifications are appropriate:

| ● | In connection with the initial public offering (the “IPO”) of the Company, the underwriter

was granted a customary overallotment option which permitted it to purchase up to an additional 15% of the Units sold in IPO within 45-days

following the closing of the IPO. At the time of the IPO and in its financial statements for reporting periods thereafter, the Company

failed to record an approximately $1.4 million liability for the value of the overallotment option, as contemplated by FASB ASC 480, “Distinguishing Liabilities

from Equity” and to derecognize that liability when the overallotment option expired without being exercised on April 19, 2021. |

| ● | As had previously been disclosed, a subsidiary of the Company and one of its subsidiaries entered

into a merger agreement with Syniverse Corporation on August 16, 2021 and subsequently announced on February 9, 2022 that the merger

agreement had been terminated by mutual agreement of the parties. In connection with the transaction contemplated by that merger

agreement, the Company incurred a variety of expenses, which the Company disclosed in the proxy statement relating to the merger

transaction were projected to be approximately $17.1 million in the aggregate. Included in these projected expenses was

approximately $5.4 million in fees for a professional in connection with the proposed merger transaction for which payment would be due

upon the closing of the transaction. Those professional fees were not, however, shown as accrued expenses on the Company’s

financial statements for the relevant reporting periods. |

On April 14, 2022, the audit committee of the board

of directors of the Company (the “Audit Committee”) determined, after considering information provided by the Company’s

management and the Company’s independent registered public accounting firm, Marcum LLP, that (a) the value of the overallotment

option described above should have been recorded as a liability at the time of the IPO and then reversed upon expiry of such option and

(b) the Company’s professional fees relating to the proposed merger with Syniverse should have been reflected as accrued expenses

during the relevant reporting periods. As a result of these omissions, the Audit Committee also determined that the Company’s audited

balance sheet as of March 8, 2021 as reported in the Company’s Form 8-K filed on March 12, 2021 and the Company’s quarterly

reports on Form 10-Q for all periods thereafter should no longer be relied upon due to these changes and should be restated.

Because the overallotment option has expired prior to

the date hereof and the professional fees relating to the proposed Syniverse merger transaction ultimately will not be payable by the

Company, the Company does not anticipate that these changes will have an effect upon future reporting periods.

The Company also does not expect any of the above changes will

have any impact on its cash position or the cash held in the trust account.

SIGNATURES

Pursuant to the requirements of the Securities and Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

M3-BRIGADE ACQUISITION II CORP. |

| |

|

|

| Date: April 15, 2022 |

By: |

/s/ Mohsin Y. Meghji |

| |

Name: |

Mohsin Y. Meghji |

| |

Title: |

Chairman and Chief Executive Officer |

2

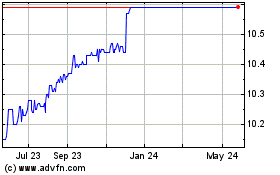

M3Brigade Acquisition II (NYSE:MBAC)

Historical Stock Chart

From Dec 2024 to Jan 2025

M3Brigade Acquisition II (NYSE:MBAC)

Historical Stock Chart

From Jan 2024 to Jan 2025