- Second quarter consolidated revenues increase 39 percent to

$200.1 million with EPS of $1.32

- Irrigation revenues increase 52 percent on continued strength

in agricultural markets and favorable pricing

- Infrastructure revenues decrease 23 percent on lower Road

Zipper System® sales

Lindsay Corporation (NYSE: LNN), a leading global manufacturer

and distributor of irrigation and infrastructure equipment and

technology, today announced results for its second quarter of

fiscal 2022, which ended on February 28, 2022.

Second Quarter Summary

Revenues for the second quarter of fiscal 2022 were $200.1

million, an increase of $56.6 million, or 39 percent, compared to

revenues of $143.6 million in the prior year second quarter. Net

earnings for the quarter were $14.6 million, or $1.32 per diluted

share, compared with net earnings of $11.9 million, or $1.08 per

diluted share, for the prior year second quarter.

“Global agricultural market conditions continue to be favorable

and have contributed to an increase in demand for our irrigation

equipment,” said Randy Wood, President and Chief Executive Officer.

“At the same time, the effects of the global pandemic continue to

impact our business and create operational challenges. During the

quarter we experienced a short-term disruption in labor

availability in our Nebraska manufacturing facility due to an

increase in employee absences caused by the Omicron variant. Our

teams have continued to prioritize safety and manage well in this

dynamic environment, and we were pleased to see absences decline as

we completed the quarter.”

Second Quarter Segment Results

Irrigation segment revenues for the second quarter of fiscal

2022 were $180.7 million, an increase of $62.2 million, or 52

percent, compared to $118.6 million in the prior year second

quarter. North America irrigation revenues of $100.7 million

increased $20.6 million, or 26 percent, compared to the prior year

second quarter. The increase in North America irrigation revenues

resulted primarily from higher average selling prices. Unit sales

volume was lower year-over-year due to the impact of

Omicron-related employee absences on production and shipping

capabilities. International irrigation revenues of $80.0 million

increased $41.6 million, or 108 percent, compared to the prior year

second quarter. The increase in international irrigation revenues

resulted primarily from higher unit sales volumes, along with

higher selling prices. Revenues in Brazil more than tripled

compared to the prior year second quarter, and we also completed

final deliveries of a large project in Egypt.

Irrigation segment operating income for the second quarter of

fiscal 2022 was $24.7 million, an increase of $6.7 million, or 37

percent, compared to the prior year second quarter. Operating

margin was 13.7 percent of sales, compared to 15.2 percent of sales

in the prior year second quarter. The impact of higher irrigation

system unit volume was partially offset by the impact of higher

input costs that were not fully recovered by higher pricing. Second

quarter operating results were also reduced by approximately $2.8

million resulting from the impact of the LIFO method of accounting

for inventory (under which higher raw material costs are recognized

in cost of goods sold rather than in ending inventory values), and

by approximately $1.8 million of non-recurring expenses related to

factory maintenance and outside consulting services.

Infrastructure segment revenues for the second quarter of fiscal

2022 were $19.4 million, a decrease of $5.6 million, or 23 percent,

compared to $25.0 million in the prior year second quarter. The

decrease resulted from lower Road Zipper System® sales and lease

revenue, which were partially offset by increased sales of road

safety products compared to the prior year.

Infrastructure segment operating income for the second quarter

of fiscal 2022 was $0.3 million, a decrease of $6.0 million, or 95

percent, compared to the prior year second quarter. Operating

margin was 1.7 percent of sales, compared to 25.4 percent of sales

in the prior year second quarter. Current year results reflect

lower revenues and a less favorable margin mix of revenues compared

to the prior year second quarter and under absorbed overhead

costs.

The backlog of unfilled orders at February 28, 2022 was $111.0

million compared with $101.4 million at February 28, 2021. A higher

backlog of orders in irrigation was partially offset by a lower

backlog in infrastructure.

Outlook

“Strong agricultural commodity prices and farm income

projections support a solid demand environment for irrigation

equipment in North America. We expect these same dynamics, along

with increased concerns around food security, to drive growth in

our international markets. Inflationary pressures and supply chain

challenges are also expected to persist in the near term, and we

continue to focus on protecting and improving margins in this

environment,” said Mr. Wood. “In our infrastructure business, we

are actively managing projects through our sales funnel and expect

an increase in project sales in the second half of the fiscal

year.”

Mr. Wood concluded, “We continue to invest in our innovation

growth strategy that addresses the needs of a growing population

and provides solutions that improve efficiency and promote

sustainability.”

Second Quarter Conference Call

Lindsay’s fiscal 2022 second quarter investor conference call is

scheduled for 11:00 a.m. Eastern Time today. Interested investors

may participate in the call by dialing (833) 535-2202 in the U.S.,

or (412) 902-6745 internationally, and requesting the Lindsay

Corporation call. Additionally, the conference call will be

simulcast live on the Internet and can be accessed via the investor

relations section of the Company's Web site, www.lindsay.com.

Replays of the conference call will remain on our Web site through

the next quarterly earnings release. The Company will have a slide

presentation available to augment management's formal presentation,

which will also be accessible via the Company's Web site.

About the Company

Lindsay Corporation (NYSE: LNN) is a leading global manufacturer

and distributor of irrigation and infrastructure equipment and

technology. Established in 1955, the company has been at the

forefront of research and development of innovative solutions to

meet the food, fuel, fiber and transportation needs of the world’s

rapidly growing population. The Lindsay family of irrigation brands

includes Zimmatic® center pivot and lateral move agricultural

irrigation systems, FieldNET® remote irrigation management and

scheduling technology, and industrial IoT solutions. Also a global

leader in the transportation industry, Lindsay Transportation

Solutions manufactures equipment to improve road safety and keep

traffic moving on the world’s roads, bridges and tunnels, through

the Barrier Systems®, Road Zipper® and Snoline™ brands. For more

information about Lindsay Corporation, visit www.lindsay.com.

Concerning Forward-looking Statements

This release contains forward-looking statements that are

subject to risks and uncertainties and which reflect management’s

current beliefs and estimates of future economic circumstances,

industry conditions, Company performance and financial results. You

can find a discussion of many of these risks and uncertainties in

the annual, quarterly and current reports that the Company files

with the Securities and Exchange Commission. Forward-looking

statements include information concerning possible or assumed

future results of operations and planned financing of the Company

and those statements preceded by, followed by or including the

words “anticipate,” “estimate,” “believe,” “intend,” "expect,"

"outlook," "could," "may," "should," “will,” or similar

expressions. For these statements, the Company claims the

protection of the safe harbor for forward-looking statements

contained in the Private Securities Litigation Reform Act of 1995.

The Company undertakes no obligation to update any forward-looking

information contained in this press release.

LINDSAY CORPORATION AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF EARNINGS

(Unaudited)

Three months ended

Six months ended

(in thousands, except per share

amounts)

February 28, 2022

February 28, 2021

February 28, 2022

February 28, 2021

Operating revenues

$

200,137

$

143,577

$

366,288

$

252,062

Cost of operating revenues

157,193

102,403

285,907

179,480

Gross profit

42,944

41,174

80,381

72,582

Operating expenses:

Selling expense

7,932

7,778

15,922

15,110

General and administrative expense

13,022

14,275

25,901

27,727

Engineering and research expense

3,652

3,312

6,859

6,402

Total operating expenses

24,606

25,365

48,682

49,239

Operating income

18,338

15,809

31,699

23,343

Other income (expense):

Interest expense

(1,176

)

(1,205

)

(2,339

)

(2,406

)

Interest income

160

268

338

571

Other income (expense), net

1,882

(311

)

(1,018

)

(65

)

Total other income (expense)

866

(1,248

)

(3,019

)

(1,900

)

Earnings before income taxes

19,204

14,561

28,680

21,443

Income tax expense

4,638

2,685

6,213

2,472

Net earnings

$

14,566

$

11,876

$

22,467

$

18,971

Earnings per share:

Basic

$

1.33

$

1.09

$

2.05

$

1.75

Diluted

$

1.32

$

1.08

$

2.04

$

1.74

Shares used in computing earnings per

share:

Basic

10,974

10,884

10,950

10,865

Diluted

11,014

10,981

11,020

10,934

Cash dividends declared per share

$

0.33

$

0.32

$

0.66

$

0.64

LINDSAY CORPORATION AND

SUBSIDIARIES

SUMMARY OPERATING

RESULTS

(Unaudited)

Three months ended

Six months ended

(in thousands)

February 28, 2022

February 28, 2021

February 28, 2022

February 28, 2021

Operating revenues:

Irrigation:

North America

$

100,730

$

80,178

179,705

$

132,968

International

80,029

38,394

146,962

72,961

Irrigation segment

180,759

118,572

$

326,667

$

205,929

Infrastructure segment

19,378

25,005

39,621

46,133

Total operating revenues

$

200,137

$

143,577

$

366,288

$

252,062

Operating income (loss):

Irrigation segment

$

24,734

$

18,045

$

41,946

$

28,678

Infrastructure segment

324

6,341

3,090

10,597

Corporate

(6,720

)

(8,577

)

(13,337

)

(15,932

)

Total operating income

$

18,338

$

15,809

$

31,699

$

23,343

The Company manages its business activities in two reportable

segments as follows:

Irrigation - This reporting segment includes the manufacture and

marketing of center pivot, lateral move, and hose reel irrigation

systems, as well as various innovative technology solutions such as

GPS positioning and guidance, variable rate irrigation, remote

irrigation management and scheduling technology, irrigation

consulting and design and industrial IoT solutions.

Infrastructure – This reporting segment includes the manufacture

and marketing of moveable barriers, specialty barriers, crash

cushions and end terminals, and road marking and road safety

equipment.

LINDSAY CORPORATION AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

(in thousands)

February 28, 2022

February 28, 2021

August 31, 2021

ASSETS

Current assets:

Cash and cash equivalents

$

68,951

$

110,775

$

127,107

Marketable securities

24,934

19,555

19,604

Receivables, net

134,694

94,211

93,609

Inventories, net

187,328

121,566

145,244

Other current assets, net

34,350

29,509

30,539

Total current assets

450,257

375,616

416,103

Property, plant, and equipment, net

92,291

89,221

91,997

Intangibles, net

19,311

22,383

20,367

Goodwill

67,679

68,087

67,968

Operating lease right-of-use assets

16,724

20,173

18,281

Deferred income tax assets

5,352

10,347

8,113

Other noncurrent assets, net

24,970

10,821

14,356

Total assets

$

676,584

$

596,648

$

637,185

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities:

Accounts payable

$

74,345

$

39,934

$

45,209

Current portion of long-term debt

220

215

217

Other current liabilities

86,837

74,687

92,814

Total current liabilities

161,402

114,836

138,240

Pension benefits liabilities

5,567

6,182

5,754

Long-term debt

115,428

115,599

115,514

Operating lease liabilities

17,170

20,174

18,301

Deferred income tax liabilities

783

900

832

Other noncurrent liabilities

19,696

19,933

20,099

Total liabilities

320,046

277,624

298,740

Shareholders' equity:

Preferred stock

—

—

—

Common stock

19,061

18,990

18,991

Capital in excess of stated value

90,711

84,206

86,495

Retained earnings

543,355

511,728

528,130

Less treasury stock - at cost

(277,238

)

(277,238

)

(277,238

)

Accumulated other comprehensive loss,

net

(19,351

)

(18,662

)

(17,933

)

Total shareholders' equity

356,538

319,024

338,445

Total liabilities and shareholders'

equity

$

676,584

$

596,648

$

637,185

LINDSAY CORPORATION AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited)

Six months ended

(in thousands)

February 28, 2022

February 28, 2021

CASH FLOWS FROM OPERATING ACTIVITIES:

Net earnings

$

22,467

$

18,971

Adjustments to reconcile net earnings to

net cash (used in) provided by operating activities:

Depreciation and amortization

9,912

9,878

Provision for uncollectible accounts

receivable

322

246

Deferred income taxes

3,052

206

Share-based compensation expense

2,411

4,047

Unrealized foreign currency transaction

gain

(111

)

(754

)

Other, net

627

1,804

Changes in assets and liabilities:

Receivables

(41,286

)

(10,769

)

Inventories

(42,412

)

(16,245

)

Other current assets

(2,541

)

(9,492

)

Accounts payable

28,757

10,962

Other current liabilities

(8,317

)

334

Other noncurrent assets and

liabilities

(8,732

)

1,940

Net cash (used in) provided by operating

activities

(35,851

)

11,128

CASH FLOWS FROM INVESTING ACTIVITIES:

Purchases of property, plant, and

equipment

(6,926

)

(16,556

)

Purchases of marketable securities

(18,468

)

(8,313

)

Proceeds from maturities of marketable

securities

12,752

8,043

Other investing activities, net

(2,974

)

(860

)

Net cash used in investing activities

(15,616

)

(17,686

)

CASH FLOWS FROM FINANCING ACTIVITIES:

Proceeds from exercise of stock

options

2,821

3,814

Common stock withheld for payroll tax

obligations

(1,181

)

(1,269

)

Proceeds from employee stock purchase

plan

235

—

Principal payments on long-term debt

(108

)

(88

)

Dividends paid

(7,242

)

(6,967

)

Net cash used in financing activities

(5,475

)

(4,510

)

Effect of exchange rate changes on cash

and cash equivalents

(1,214

)

440

Net change in cash and cash

equivalents

(58,156

)

(10,628

)

Cash and cash equivalents, beginning of

period

127,107

121,403

Cash and cash equivalents, end of

period

$

68,951

$

110,775

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220404006038/en/

LINDSAY CORPORATION: Brian Ketcham Senior Vice President

& Chief Financial Officer 402-827-6579 THREE PART

ADVISORS: Hala Elsherbini 214-442-0016

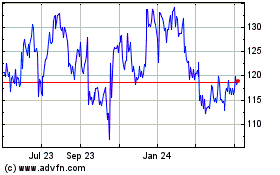

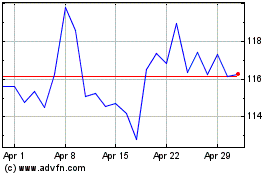

Lindsay (NYSE:LNN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Lindsay (NYSE:LNN)

Historical Stock Chart

From Jul 2023 to Jul 2024