Second Quarter

Fiscal 2025 Highlights

- GAAP Results include a $159 million pre-tax charge related to

the Restructuring Plan announced on October 1, 2024

- GAAP Results as Compared to Second Quarter Fiscal 2024:

- Net sales declined 8% to $1,601 million

- Income from operations declined 94% to $19 million

- Net income declined $251 million to a loss of $36 million

- Diluted EPS declined $1.73 to a loss of $0.25

- Non-GAAP Results as Compared to Second Quarter Fiscal 2024:

- Adjusted Income from Operations(1) declined 41% to $178

million

- Adjusted Net Income(1) declined 55% to $95 million

- Adjusted Diluted EPS(1) declined 54% to $0.66

- Adjusted EBITDA(1) declined 25% to $282 million

- Paid $51.6 million in cash dividends to common

shareholders

Updated Fiscal 2025 Outlook

- Net sales of $6.35 billion to $6.45 billion

- GAAP net income target of $330 million to $350 million, and

Diluted EPS target of $2.30 to $2.45

- Adjusted EBITDA(1) of $1,170 million to $1,210 million

- Adjusted Net Income(1) target of $440 million to $460 million

and Adjusted Diluted EPS(1) target of $3.05 to $3.20

Lamb Weston Holdings, Inc. (NYSE: LW) announced today its

results for the second quarter of fiscal 2025 and updated its full

year financial targets for fiscal 2025.

“Our financial results in the second quarter were below our

expectations,” said Tom Werner, President and CEO.

“Higher-than-expected manufacturing costs and softer volumes

accounted for the shortfall, while price/mix and operating expenses

were broadly in line with our targets for the quarter.”

“In terms of the broader operating environment, we expect

challenging conditions to persist through the remainder of fiscal

2025 and into fiscal 2026, driven primarily by an accelerating rate

of capacity additions and continued near-term softening of global

frozen potato demand below historical rates, particularly outside

North America, until demand trends improve and capacity expansion

normalizes. As a result, we are reducing our fiscal 2025 financial

targets.”

“The Company continues to take prudent steps to successfully

adapt to this dynamic environment. In addition to the cost benefits

we expect to realize from our Restructuring Plan, including our

previously announced actions to permanently close or temporarily

curtail production lines to better manage our factory utilization

rates, we are actively evaluating additional cost-savings

opportunities as we work to better align our operations with the

current environment. This includes efforts to reduce manufacturing

and supply chain costs and operating expenses to protect and

improve profitability. We are executing with urgency and discipline

to make lasting improvements to our operations as we weather what

we believe are transitory challenges, and we remain focused on

leveraging our solid fundamentals and balance sheet to deliver

value to shareholders.”

Summary of Second Quarter FY

2025 Results

($ in millions, except per

share)

Q2 2025

Year-Over-Year

Growth Rates

YTD

FY 2025

Year-Over-Year

Growth Rates

Net sales

$

1,600.9

(8

)%

$

3,255.0

(4

)%

Income from operations

$

18.5

(94

)%

$

230.6

(63

)%

Net income (loss)

$

(36.1

)

(117

)%

$

91.3

(80

)%

Diluted EPS

$

(0.25

)

(117

)%

$

0.64

(79

)%

Adjusted Income from Operations(1)

$

178.3

(41

)%

$

365.5

(42

)%

Adjusted Net Income(1)

$

94.5

(55

)%

$

199.2

(56

)%

Adjusted Diluted EPS(1)

$

0.66

(54

)%

$

1.40

(55

)%

Adjusted EBITDA(1)

$

281.9

(25

)%

$

571.8

(28

)%

Q2 2025 Commentary

Restructuring Plan

On October 1, 2024, the Company announced a restructuring plan

(the “Restructuring Plan”), which is designed to drive operational

and cost efficiencies and improve cash flows. The Restructuring

Plan includes the permanent closure of a manufacturing facility,

the temporary curtailment of certain production lines and schedules

across the Company's manufacturing network in North America, and

reductions in employee headcount, other operating expenses, and

capital expenditures.

In connection with the Restructuring Plan, the Company expects

to recognize total pre-tax charges of $190 million to $210 million.

Any changes to estimates or timing will be reflected in the

Company's results of operations in future periods. The Company

expects actions in connection with the Restructuring Plan will be

substantially complete by the end of the fourth quarter of fiscal

2025. The Company estimates that the Restructuring Plan will

generate approximately $55 million in pre-tax cost savings and

reduce working capital in fiscal 2025.

Net income (loss) for the thirteen and twenty-six weeks ended

November 24, 2024 included:

- $159.1 million ($123.6 after-tax, or $0.86 per share) of

pre-tax charges, of which $114.5 million were cash expenses and

$44.6 million of non-cash expenses;

- $75.5 million ($57.4 million after-tax, or $0.40 per share) was

included in Cost of sales;

- $74.6 million ($59.3 million after-tax, or $0.41 per share) was

included in Restructuring expense; and

- $9.0 million ($6.9 million after-tax, or $0.05 per share) was

included in Equity method investment earnings.

Q2 Results of Operations

Net sales declined $131.2 million, to $1,600.9 million, down 8

percent versus the prior year quarter. Volume declined 6 percent,

largely reflecting the impact of soft global restaurant traffic

trends; customer share losses, net of gains; and the carryover

effect of the Company's decision in the prior year to exit certain

lower-priced and lower-margin business in Europe to strategically

manage customer and product mix. Price/mix declined 2 percent,

reflecting the impact of planned investments in price and trade

support to attract and retain volume in North America, pricing

actions in key international markets in response to a more

competitive environment, and unfavorable channel and product mix.

The decline in price/mix was partially offset by the benefit of

inflation-driven pricing actions in EMEA.

Gross profit declined $197.8 million versus the prior year

quarter to $277.8 million, and included $75.5 million of pre-tax

charges ($57.4 million after-tax, or $0.40 per share) related to

the Restructuring Plan, and $9.8 million ($7.3 million after-tax,

or $0.05 per share) of unrealized gains related to mark-to-market

adjustments associated with commodity hedging contracts. The prior

year quarter included $4.6 million ($3.5 million after-tax, or

$0.02 per share) of unrealized losses related to mark-to-market

adjustments associated with commodity hedging contracts, and $1.8

million of benefit ($1.3 million after-tax, or $0.01 per share)

associated with the sale of inventory stepped-up to fair value

following the completion of the Company's acquisition of the

remaining interest in Lamb-Weston/Meijer v.o.f. (“LW EMEA”), its

former joint venture in Europe.

Adjusted Gross Profit(1) declined $134.9 million versus the

prior year quarter to $343.5 million due to unfavorable price/mix,

higher manufacturing costs per pound, and lower sales volumes. The

higher manufacturing costs per pound largely reflected input cost

inflation, which was primarily driven by higher raw potato costs;

utilization-related production costs and inefficiencies; higher

transportation and warehousing costs; and $15.8 million of higher

depreciation expense largely associated with the Company's recent

capacity expansions in China and the U.S. Manufacturing costs in

the prior year quarter included a $64.6 million pre-tax charge for

the write-off of excess raw potatoes.

Selling, general and administrative expenses (“SG&A”)

increased $14.7 million versus the prior year quarter to $184.7

million, and included a gain of $3.3 million ($2.7 million

after-tax, or $0.02 per share) related to blue chip swap

transactions in Argentina(2), $9.6 million ($7.2 million after-tax,

or $0.05 per share) of foreign currency exchange losses, $12.8

million ($9.5 million after-tax, or $0.07 per share) of unrealized

losses related to mark-to-market adjustments associated with

currency hedging contracts, and $0.4 million ($0.3 million

after-tax, no per share impact) of expenses related to ongoing

shareholder activism matters. The prior year quarter included a

gain of $7.1 million ($5.3 million after-tax, or $0.04 per share)

related to blue chip swap transactions in Argentina(2), $2.1

million ($1.6 million after-tax, or $0.01 per share) of foreign

currency exchange gains, $3.0 million ($2.2 million after-tax, or

$0.01 per share) of unrealized gains related to mark-to-market

adjustments associated with currency hedging contracts, and $4.8

million of LW EMEA integration and acquisition-related expenses

($3.6 million after-tax, or $0.02 per share).

Adjusted SG&A(1) declined $12.2 million versus the prior

year quarter to $165.2 million, despite including an incremental

$6.5 million of non-cash amortization and expense related to the

Company's new enterprise resource planning (“ERP”) system. Savings

from expense reduction initiatives, including savings associated

with the Restructuring Plan, lower performance-based compensation

and benefits accruals, and lower net investments in information

technology, more than offset inflation.

Income from operations declined $287.1 million versus the prior

year quarter to $18.5 million and included the amounts listed

above. Adjusted Income from Operations(1) declined $122.7 million

versus the prior year quarter to $178.3 million, driven by lower

net sales and Adjusted Gross Profit(1), partially offset by lower

Adjusted SG&A(1).

Net income declined $251.1 million from the prior year quarter

to a loss of $36.1 million. Net loss in the second quarter of

fiscal 2025 included $130.6 million ($168.8 million before tax, or

$0.91 per share) of gains resulting from blue chip swap

transactions in Argentina(2), foreign currency exchange losses,

unrealized mark-to-market derivative gains and losses, and items

impacting comparability. Net income in the prior year quarter

included a total net gain of $3.3 million ($4.6 million before tax,

or $0.03 per share) for gains resulting from blue chip swap

transactions in Argentina(2), foreign currency exchange gains,

unrealized mark-to-market derivative gains and losses, and items

impacting comparability.

Adjusted Net Income(1) declined $117.2 million versus the prior

year quarter to $94.5 million, and Adjusted Diluted EPS(1) declined

$0.79 from the prior year quarter to $0.66. The declines in

Adjusted Net Income(1) and Adjusted Diluted EPS(1) largely reflect

lower Adjusted Income from Operations(1) due to the factors

described above; a higher effective tax rate, reflecting discrete

tax items in the current and prior year quarters; and increased

interest expense primarily due to higher total debt.

Adjusted EBITDA(1) declined $95.0 million from the prior year

quarter to $281.9 million, primarily due to lower net sales and

Adjusted Gross Profit(1). Adjusted EBITDA(1) in the prior year

quarter included a $70.9 million pre-tax charge for the write-off

of excess raw potatoes, of which $6.3 million was recorded in

Equity Method Investment Earnings.

The Company’s effective tax rate(3) in the second quarter of

2025 was (59.0) percent, versus 23.5 percent in the second quarter

of fiscal 2024. During the second quarter of 2025, the Company

recorded a $38.2 million tax benefit related to gains resulting

from blue chip swap transactions in Argentina(2), foreign currency

exchange losses, unrealized mark-to-market derivative gains and

losses, and other items impacting comparability, which included a

$35.5 million tax benefit related to Restructuring Plan charges,

and a $14.4 million discrete tax expense, primarily related to the

establishment of a non-cash full valuation allowance against

certain international deferred tax assets. Excluding the impact of

the items above, the Company’s effective tax rate(3) in the second

quarter of fiscal 2025 was 25.5 percent versus 23.5 percent in the

second quarter of fiscal 2024, with the increase largely due to a

higher proportion of earnings in the Company's International

segment.

Q2 2025 Segment

Highlights

North America Summary

Net sales for the North America segment, which includes all

sales to customers in the U.S., Canada and Mexico, declined $95.0

million to $1,072.1 million, down 8 percent versus the prior year

quarter. Volume declined 5 percent, largely reflecting the impact

of declining restaurant traffic in the U.S. and customer share

losses in away-from-home channels.

Price/mix declined 3 percent, due to planned investments in

price and trade support across all sales channels to attract and

retain volume, as well as unfavorable channel and product mix.

North America Segment Adjusted EBITDA declined $54.6 million to

$266.7 million. Unfavorable price/mix, lower sales volumes, and

higher manufacturing costs per pound largely drove the decline.

North America Segment Adjusted EBITDA in the prior year quarter

included a pre-tax charge of $63.3 million charge for the write-off

of excess raw potatoes.

International Summary

Net sales for the International segment, which includes all

sales to customers outside of North America, declined $36.2 million

to $528.8 million, down 6 percent versus the prior year quarter.

Volume declined 6 percent, largely reflecting declining or

softening restaurant traffic in key international markets, the

impact of customer share losses net of gains, and the carryover

effect of the Company's decision in the prior year to exit certain

lower-priced and lower-margin business in Europe to strategically

manage customer and product mix. Price/mix was flat with the prior

year quarter as pricing actions in key international markets, in

response to a more competitive environment, were offset by the

benefit of inflation-driven pricing actions in EMEA.

International Segment Adjusted EBITDA declined $52.8 million to

$47.4 million. Higher manufacturing costs per pound and lower

volume largely drove the decline. International Segment Adjusted

EBITDA in the prior year quarter included a $7.6 million allocated

charge for the write-off of excess raw potatoes.

Equity Method Investment Earnings

Equity method investment earnings from unconsolidated joint

ventures were $2.1 million and $4.7 million for the second quarter

of fiscal 2025 and 2024, respectively. The results in the current

quarter include $9.0 million ($6.9 million after-tax, or $0.05 per

share) of costs associated with the Restructuring Plan. Excluding

this item, Adjusted Equity Method Investment Earnings(1) increased

$6.4 million compared to the prior year quarter. Equity method

investment earnings in the prior year quarter included a $6.3

million charge for the write-off of excess raw potatoes. The

results for the current and prior year quarters reflect earnings

associated with the Company's 50 percent interest in Lamb

Weston/RDO Frozen, an unconsolidated potato processing joint

venture in Minnesota.

Cash Flows, Capital Expenditures and Liquidity

Net cash provided by operating activities for the first half of

fiscal 2025 was $429.3 million, down $25.9 million versus the prior

year period, primarily due to lower earnings, which was partially

offset by favorable changes in working capital.

Capital expenditures, net of proceeds from blue chip swap

transactions, during the first half of fiscal 2025 were $486.4

million, down $73.0 million versus the prior year period, primarily

reflecting higher investments to support strategic capacity

expansion projects in China, the U.S., the Netherlands, and

Argentina during the prior year period. The projects in China and

the U.S. were completed during the second and fourth quarters of

fiscal 2024, respectively. The project in the Netherlands was

completed during the second quarter of fiscal 2025, while the

project in Argentina is on track to be completed by mid-calendar

2025.

As of November 24, 2024, the Company had $79.0 million of cash

and cash equivalents, with $1,211.9 million of available liquidity

under its revolving credit facility.

Capital Returned to Shareholders

In the second quarter of fiscal 2025, the Company returned $51.6

million to shareholders through cash dividends. There were no

repurchases of common stock under the Company's share repurchase

program during the quarter. In the first half of fiscal 2025, the

Company returned $103.3 million to shareholders through cash

dividends and repurchased $82.0 million of its common stock, with

an aggregate of 1,412,852 shares repurchased at an average price of

$58.04 per share.

In December 2024, the Board of Directors approved an increase of

$250 million in the Company's existing $500 million share

repurchase authorization under the program to an aggregate total of

$750 million. After giving effect to this increase, approximately

$558 million remained authorized and available for repurchase under

the share repurchase program.

In addition, the Board of Directors declared a quarterly

dividend of $0.37 per share of Lamb Weston common stock, a $0.01

increase. The dividend is payable on February 28, 2025 to

stockholders of record as of the close of business on January 31,

2025.

Updated Fiscal 2025

Outlook

The Company updated its financial targets for fiscal 2025 as

follows:

- The Company reduced its annual net sales target range to $6.35

billion to $6.45 billion, from a previous range of $6.6 billion to

$6.8 billion to primarily reflect the increased competitive

environment on price/mix and volume in its International Segment,

incremental volume pressure in North America, and its financial

performance in the second quarter. Accordingly, the Company is

targeting net sales of $3.1 billion to $3.2 billion in the second

half of fiscal 2025, or growth of approximately 1 percent to 4

percent versus the prior year period, and expects the growth will

be driven by higher volume.

- The Company reduced its target ranges for GAAP net income to

$330 million to $350 million and Diluted EPS to $2.30 to $2.45,

including a net loss from Restructuring Plan charges and other

items impacting comparability of $107.9 million ($143.9 million

before-tax, or $0.76 per share) during the first half of fiscal

2025. The Company previously targeted a GAAP net income range of

$395 to $445 and a Diluted EPS range of $2.70 to $3.15.

- The Company reduced its Adjusted EBITDA(1) target range to

$1,170 million to $1,210 million from a previous target of

approximately $1,380 million, to primarily reflect its financial

performance in the second quarter, the reduction in forecasted

sales described above, and increased manufacturing costs.

- The Company reduced its Adjusted Net Income(1) target range to

$440 million to $460 million, and Adjusted Diluted EPS(1) to $3.05

to $3.20, largely reflecting the Company's lower forecast for net

sales and Adjusted Gross Profit(1), as well as a higher effective

tax rate. The Company previously estimated Adjusted Net Income(1)

of $600 million to $615 million and Adjusted Diluted EPS(1) of

$4.15 to $4.35.

- The Company expects to be at the top of the range for its

Adjusted SG&A(1) target range of $680 million to $690

million.

The Company's other financial targets are as follows:

- Depreciation and amortization expense of approximately $375

million;

- An effective tax rate(3) (full year) estimate of approximately

28 percent, excluding the impact of comparability items, which is

an increase from the Company's previous estimate of approximately

25 percent; and

- Cash used for capital expenditures, excluding acquisitions, if

any, of approximately $750 million.

End Notes

(1)

Adjusted Gross Profit, Adjusted SG&A,

Adjusted Income from Operations, Adjusted Net Income, Adjusted

Diluted EPS, Adjusted Equity Method Investment Earnings, and

Adjusted EBITDA, are non-GAAP financial measures. Please see the

discussion of non-GAAP financial measures, including a discussion

of guidance provided on a non-GAAP basis, and the associated

reconciliations at the end of this press release for more

information.

(2)

The Company enters into blue chip swap

transactions to transfer U.S. dollars into Argentina primarily

related to funding the Company’s announced capacity expansion in

Argentina. The blue chip swap rate can diverge significantly from

Argentina's official exchange rate.

(3)

The effective tax rate is calculated as

the ratio of income tax expense to pre-tax income, inclusive of

equity method investment earnings.

Webcast and Conference Call

Information

Lamb Weston will host a conference call to review its second

quarter fiscal 2025 results at 8:00 a.m. EST on December 19, 2024.

Participants in the U.S. and Canada may access the conference call

by dialing 888-394-8218 and participants outside the U.S. and

Canada should dial +1-323-994-2093. The conference ID is 5411916.

The conference call also may be accessed live on the internet.

Participants can register for the event at:

https://event.webcasts.com/starthere.jsp?ei=1699372&tp_key=bd61c9987b

A rebroadcast of the conference call will be available beginning

on Friday, December 20, 2024, after 2:00 p.m. EST at

https://investors.lambweston.com/events-and-presentations.

About Lamb Weston

Lamb Weston is a leading supplier of frozen potato products to

restaurants and retailers around the world. For more than 70 years,

Lamb Weston has led the industry in innovation, introducing

inventive products that simplify back-of-house management for its

customers and make things more delicious for their customers. From

the fields where Lamb Weston potatoes are grown to proactive

customer partnerships, Lamb Weston always strives for more and

never settles. Because, when we look at a potato, we see

possibilities. Learn more about us at lambweston.com.

Non-GAAP Financial

Measures

To supplement the financial information included in this press

release, the Company has presented Adjusted Gross Profit, Adjusted

SG&A, Adjusted Restructuring Expense, Adjusted Income from

Operations, Adjusted Income Tax Expense (Benefit), Adjusted Net

Income, Adjusted Diluted EPS, Adjusted Equity Method Investment

Earnings, and Adjusted EBITDA, each of which is considered a

non-GAAP financial measure. The non-GAAP financial measures

presented in this press release should be viewed in addition to,

and not as an alternative for, financial measures prepared in

accordance with accounting principles generally accepted in the

United States of America (“GAAP”) that are also presented in this

press release. These measures are not substitutes for their

comparable GAAP financial measures, such as gross profit, SG&A,

income from operations, restructuring expense, equity method

investment earnings (loss), net income, diluted earnings per share,

or other measures prescribed by GAAP, and there are limitations to

using non-GAAP financial measures. For example, the non-GAAP

financial measures presented in this press release may differ from

similarly titled non-GAAP financial measures presented by other

companies, and other companies may not define these non-GAAP

financial measures the same way as the Company does.

Management uses these non-GAAP financial measures to assist in

analyzing what management views as the Company's core operating

performance for purposes of business decision making. Management

believes that presenting these non-GAAP financial measures provides

investors with useful supplemental information because they (i)

provide meaningful supplemental information regarding financial

performance by excluding impacts of foreign currency exchange rates

and unrealized derivative activities and other items affecting

comparability between periods, (ii) permit investors to view

performance using the same tools that management uses to budget,

make operating and strategic decisions, and evaluate the Company’s

core operating performance across periods, and (iii) otherwise

provide supplemental information that may be useful to investors in

evaluating the Company's financial results. In addition, the

Company believes that the presentation of these non-GAAP financial

measures, when considered together with the most directly

comparable GAAP financial measures and the reconciliations to those

GAAP financial measures, provides investors with additional tools

to understand the factors and trends affecting the Company's

underlying business than could be obtained absent these

disclosures.

The Company has also provided guidance in this press release

with respect to certain non-GAAP financial measures, including

non-GAAP Adjusted Net Income, Adjusted Diluted EPS, Adjusted

SG&A, and Adjusted EBITDA. The Company cannot predict certain

items that are included in reported GAAP results, including items

such as strategic developments, integration and acquisition costs

and related fair value adjustments, impacts of unrealized

mark-to-market derivative gains and losses, foreign currency

exchange, and items impacting comparability. This list is not

inclusive of all potential items, and the Company intends to update

the list as appropriate as these items are evaluated on an ongoing

basis. In addition, the items that cannot be predicted can be

highly variable and could potentially have significant impacts on

the Company’s GAAP measures. As such, prospective quantification of

these items is not feasible without unreasonable efforts, and a

reconciliation of forward-looking non-GAAP Adjusted Net Income,

Adjusted Diluted EPS, Adjusted SG&A, and Adjusted EBITDA to

GAAP net income, diluted earnings per share, or SG&A has not

been provided.

Forward-Looking

Statements

This press release contains forward-looking statements within

the meaning of the federal securities laws. Words such as “expect,”

“will,” “believe,” “take,” “generate,” “continue,” “manage,”

“improve,” “reduce,” “deliver,” “drive,” “remain,” “realize,”

“evaluate,” “align,” “protect,” “execute,” “make,” “estimate,”

“outlook,” “target,” and variations of such words and similar

expressions are intended to identify forward-looking statements.

Examples of forward-looking statements include, but are not limited

to, statements regarding: the Company’s business and financial

outlook and prospects; the Company’s plans and strategies and

anticipated benefits therefrom, including with respect to the

Restructuring Plan, expected completion and impacts of

restructuring activities and cost-saving or efficiency initiatives,

capital expenditures and investments, dividends, share repurchases,

cash flows, conditions in the Company’s operating environment,

industry and the global economy. These forward-looking statements

are based on management’s current expectations and are subject to

uncertainties and changes in circumstances. Readers of this press

release should understand that these statements are not guarantees

of performance or results. Many factors could affect these

forward-looking statements and the Company’s actual financial

results and cause them to vary materially from the expectations

contained in the forward-looking statements, including those set

forth in this press release. These risks and uncertainties include,

among other things: consumer preferences, including restaurant

traffic in North America and the Company's international markets,

and an uncertain general economic environment, including

inflationary pressures and recessionary concerns, any of which

could adversely impact the Company’s business, financial condition

or results of operations, including the demand and prices for its

products; the availability and prices of raw materials and other

commodities; operational challenges; the Company's ability to

successfully implement the Restructuring Plan, including achieving

the benefits of restructuring activities and cost-saving or

efficiency initiatives and possible changes in the size and timing

of related charges; difficulties, disruptions or delays in

implementing new technology, such as the Company’s new ERP system;

levels of labor and people-related expenses; the Company’s ability

to successfully execute its long-term value creation strategies;

the Company’s ability to execute on large capital projects,

including construction of new production lines or facilities; the

competitive environment and related conditions in the markets in

which the Company operates; political and economic conditions of

the countries in which the Company conducts business and other

factors related to its international operations; disruptions in the

global economy caused by conflicts such as the war in Ukraine and

conflicts in the Middle East and the possible related heightening

of the Company’s other known risks; the ultimate outcome of

litigation or any product recalls or withdrawals; changes in the

Company’s relationships with its growers or significant customers;

impacts on the Company’s business due to health pandemics or other

contagious outbreaks, such as the COVID-19 pandemic, including

impacts on demand for its products, increased costs, disruption of

supply, other constraints in the availability of key commodities

and other necessary services or restrictions imposed by public

health authorities or governments; disruption of the Company’s

access to export mechanisms; risks associated with integrating

acquired businesses, including LW EMEA; risks associated with other

possible acquisitions; the Company’s debt levels; actions of

governments and regulatory factors affecting the Company’s

businesses; the Company’s ability to pay regular quarterly cash

dividends and the amounts and timing of any future dividends; and

other risks described in the Company’s reports filed from time to

time with the Securities and Exchange Commission. The Company

cautions readers not to place undue reliance on any forward-looking

statements included in this press release, which speak only as of

the date of this press release. The Company undertakes no

responsibility for updating these statements, except as required by

law.

Lamb Weston Holdings,

Inc.

Consolidated Statements of

Earnings

(unaudited, in millions, except

per share amounts)

Thirteen Weeks Ended

Twenty-Six Weeks Ended

November 24,

2024

November 26,

2023

November 24,

2024

November 26,

2023

Net sales

$

1,600.9

$

1,732.1

$

3,255.0

$

3,397.4

Cost of sales (1) (2)

1,323.1

1,256.5

2,621.2

2,422.3

Gross profit

277.8

475.6

633.8

975.1

Selling, general and administrative

expenses (3)

184.7

170.0

328.6

346.2

Restructuring expense (1)

74.6

—

74.6

—

Income from operations

18.5

305.6

230.6

628.9

Interest expense, net

43.3

29.1

88.5

59.8

Income (loss) before income taxes and

equity method earnings

(24.8

)

276.5

142.1

569.1

Income tax expense

13.4

66.2

64.2

136.1

Equity method investment earnings (1)

2.1

4.7

13.4

16.8

Net income (loss) (1) (4)

$

(36.1

)

$

215.0

$

91.3

$

449.8

Earnings (loss) per share:

Basic

$

(0.25

)

$

1.48

$

0.64

$

3.10

Diluted

$

(0.25

)

$

1.48

$

0.64

$

3.08

Dividends declared per common share

$

0.36

$

0.28

$

0.72

$

0.56

Weighted average common shares

outstanding:

Basic

142.8

144.9

143.2

145.3

Diluted

143.2

145.5

143.7

146.0

_______________________________________________

(1)

Net income (loss) for the thirteen and

twenty-six weeks ended November 24, 2024 included the following

related to the Restructuring Plan:

a.

Total pre-tax charges totaling $159.1

million ($123.6 after-tax, or $0.86 per share), of which $114.5

million is cash and $44.6 million is non-cash;

b.

Cost of sales included a $75.5 million

($57.4 million after-tax, or $0.40 per share) charge for contracted

raw potatoes that will not be used due to production line

curtailments, as well as other inventory write-offs;

c.

Restructuring expense included a $74.6

million ($59.3 million after-tax, or $0.41 per share) charge

related to accelerating depreciation of a manufacturing facility

closed in connection with the Restructuring Plan and other asset

retirements, and employee severance and benefits-related headcount

reductions in connection with the Restructuring Plan, and;

d.

Equity method investment earnings included

$9.0 million ($6.9 million after-tax, or $0.05 per share) related

to Restructuring Plan expenses for potato contract terminations and

other inventory write-offs.

(2)

Cost of sales for the thirteen and

twenty-six weeks ended November 24, 2024 included $9.8 million

($7.3 million after-tax, or $0.05 per share) and $12.7 million

($9.4 million after-tax, or $0.06 per share) of unrealized gains

related to mark-to-market adjustments associated with commodity

hedging contracts, respectively.

The thirteen and twenty-six weeks ended

November 26, 2023 included $4.6 million of unrealized losses ($3.5

million after-tax, $0.02 per share) and $27.1 million of unrealized

gains ($20.2 million after-tax, or $0.14 per share) related to

mark-to-market adjustments associated with commodity hedging

contracts, respectively. Also included is a net benefit of $1.8

million ($1.3 million after-tax, or $0.01 per share) related to the

step-up and sale of inventory following completion of the Company's

acquisition of the remaining interest in LW EMEA (the “LW EMEA

Acquisition”) for the thirteen weeks ended November 26, 2023; the

twenty-six weeks ended November 26, 2023 included $20.7 million

($15.4 million after-tax, or $0.11 per share) of costs related to

the step-up and sale of inventory following completion the LW EMEA

Acquisition.

(3)

Selling, general and administrative

expenses (SG&A) included the following:

a.

Blue chip swap transaction gains of $3.3

million ($2.7 million after-tax, or $0.02 per share) and $19.9

million ($19.3 million after-tax, $0.13 per share) for the thirteen

and twenty-six weeks ended November 24, 2024, respectively. The

prior year period included gains of $7.1 million ($5.3 million

after-tax, or $0.04 per share) for the thirteen and twenty-six

weeks ended November 26, 2023;

b.

Unrealized losses related to

mark-to-market adjustments associated with currency hedging

contracts of $12.8 million ($9.5 million after-tax, or $0.07 per

share) and $6.8 million ($5.1 million after-tax, or $0.04 per

share) for the thirteen and twenty-six weeks ended November 24,

2024, respectively. The prior year period included $3.0 million of

unrealized gains ($2.2 million after-tax, or $0.01 per share) and

$1.4 million unrealized losses ($1.0 million after-tax, or $0.01

per share) for the thirteen and twenty-six weeks ended November 26,

2023, respectively;

c.

Foreign currency exchange losses of $9.6

million ($7.2 million after-tax, or $0.05 per share) and $10.2

million ($7.6 million after-tax, or $0.05 per share) for the

thirteen and twenty-six weeks ended November 24, 2024,

respectively. The thirteen and twenty-six weeks ended November 26,

2023 included gains of $2.1 million ($1.6 million after-tax, or

$0.01 per share) and losses of $5.3 million ($3.9 million

after-tax, or $0.03 per share), respectively;

d.

Advisory fees related to shareholder

activism matters of $0.4 million ($0.3 million after-tax, no per

share impact) for the thirteen and twenty-six weeks ended November

24, 2024; and

e.

Integration and acquisition-related

expenses of $4.8 million ($3.6 million after-tax, or $0.02 per

share) and $8.8 million ($6.6 million after-tax, or $0.04 per

share) for the thirteen and twenty-six weeks ended November 26,

2023, respectively.

(4)

The twenty-six weeks ended November 24,

2024 include an approximately $39 million charge ($30 million

after-tax, or $0.21 per share) related to a previously announced

voluntary product withdrawal initiated in the fourth quarter of

fiscal 2024. This includes an approximately $15 million impact ($11

million after-tax, or $0.08 per share) in net sales and an

approximately $24 million charge ($18 million, or $0.13 per share)

in cost of sales. The total charge was allocated to the reporting

segments as follows: $21 million to North America and $18 million

to International.

Lamb Weston Holdings,

Inc.

Consolidated Balance

Sheets

(unaudited, in millions, except

share data)

November 24,

2024

May 26, 2024

ASSETS

Current assets:

Cash and cash equivalents

$

79.0

$

71.4

Receivables, net of allowances of $0.9

million and $0.9 million

695.0

743.6

Inventories

1,327.2

1,138.6

Prepaid expenses and other current

assets

89.7

136.4

Total current assets

2,190.9

2,090.0

Property, plant and equipment, net

3,609.6

3,582.8

Operating lease assets

119.7

133.0

Goodwill

1,028.3

1,059.9

Intangible assets, net

101.0

104.9

Other assets

402.6

396.4

Total assets

$

7,452.1

$

7,367.0

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Short-term borrowings

$

320.5

$

326.3

Current portion of long-term debt and

financing obligations

69.7

56.4

Accounts payable

846.0

833.8

Accrued liabilities

390.8

407.6

Total current liabilities

1,627.0

1,624.1

Long-term liabilities:

Long-term debt and financing obligations,

excluding current portion

3,693.6

3,440.7

Deferred income taxes

247.3

256.2

Other noncurrent liabilities

251.4

258.2

Total long-term liabilities

4,192.3

3,955.1

Commitments and contingencies

Stockholders’ equity:

Common stock of $1.00 par value,

600,000,000 shares authorized; 151,309,961 and 150,735,397 shares

issued

151.3

150.7

Treasury stock, at cost, 8,669,325 and

7,068,741 common shares

(634.4

)

(540.9

)

Additional distributed capital

(497.3

)

(508.9

)

Retained earnings

2,687.2

2,699.8

Accumulated other comprehensive loss

(74.0

)

(12.9

)

Total stockholders’ equity

1,632.8

1,787.8

Total liabilities and stockholders’

equity

$

7,452.1

$

7,367.0

Lamb Weston Holdings,

Inc.

Consolidated Statements of

Cash Flows

(unaudited, in millions)

Twenty-Six Weeks Ended

November 24,

2024

November 26,

2023

Cash flows from operating

activities

Net income

$

91.3

$

449.8

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization of

intangibles and debt issuance costs

211.0

140.7

Stock-settled, stock-based compensation

expense

21.9

22.2

Equity method investment (earnings) loss,

net of distributions

11.5

(11.3

)

Deferred income taxes

1.4

5.8

Blue chip swap transaction gains

(19.9

)

(7.1

)

Other

15.6

5.7

Changes in operating assets and

liabilities:

Receivables

39.0

(35.2

)

Inventories

(198.2

)

(216.0

)

Income taxes payable/receivable, net

(25.1

)

27.6

Prepaid expenses and other current

assets

75.2

68.8

Accounts payable

216.8

96.1

Accrued liabilities

(11.2

)

(91.9

)

Net cash provided by operating

activities

$

429.3

$

455.2

Cash flows from investing

activities

Additions to property, plant and

equipment

(474.6

)

(507.6

)

Additions to other long-term assets

(31.7

)

(58.9

)

Acquisition of business, net of cash

acquired

—

(11.2

)

Proceeds from blue chip swap transactions,

net of purchases

19.9

7.1

Other

1.5

(0.2

)

Net cash used for investing

activities

$

(484.9

)

$

(570.8

)

Cash flows from financing

activities

Proceeds from short-term borrowings

811.6

194.3

Repayments of short-term borrowings

(813.8

)

(60.6

)

Proceeds from issuance of debt

520.2

28.4

Repayments of debt and financing

obligations

(245.4

)

(27.7

)

Dividends paid

(103.3

)

(81.6

)

Repurchase of common stock and common

stock withheld to cover taxes

(92.8

)

(164.3

)

Other

(13.2

)

(0.5

)

Net cash provided by (used for)

financing activities

$

63.3

$

(112.0

)

Effect of exchange rate changes on cash

and cash equivalents

(0.1

)

1.1

Net increase (decrease) in cash and

cash equivalents

7.6

(226.5

)

Cash and cash equivalents, beginning of

period

71.4

304.8

Cash and cash equivalents, end of

period

$

79.0

$

78.3

Lamb Weston Holdings,

Inc.

Segment Information

(unaudited, in millions, except

percentages)

Thirteen Weeks Ended

November 24,

2024

November 26,

2023

%

Increase (Decrease)

Price/Mix

Volume

Segment net sales

North America

$

1,072.1

$

1,167.1

(8

%)

(3

%)

(5

%)

International

528.8

565.0

(6

%)

—

%

(6

%)

$

1,600.9

$

1,732.1

(8

%)

(2

%)

(6

%)

Segment Adjusted EBITDA (1)

North America

$

266.7

$

321.3

(17

%)

International

47.4

100.2

(53

%)

Twenty-Six Weeks Ended

November 24,

2024

November 26,

2023

% Increase

(Decrease)

Price/Mix

Volume

Segment net sales

North America

$

2,175.8

$

2,302.5

(6

%)

(1

%)

(5

%)

International

1,079.2

1,094.9

(1

%)

1

%

(2

%)

$

3,255.0

$

3,397.4

(4

%)

—

%

(4

%)

Segment Adjusted EBITDA (1)(2)

North America

$

542.8

$

700.7

(23

%)

International

97.9

189.8

(48

%)

______________________________________________

(1)

Segment Adjusted EBITDA includes equity

method investment earnings and losses and excludes unallocated

corporate costs including restructuring-related expenses, foreign

currency exchange gains and losses, unrealized mark-to-market

derivative gains and losses, and items discussed in footnotes (1) -

(4) to the Consolidated Statements of Earnings.

(2)

Includes an approximately $39 million

pre-tax charge related to the voluntary product withdrawal. See

footnote (4) to the Consolidated Statements of Earnings for more

information.

Lamb Weston Holdings,

Inc.

Reconciliation of Non-GAAP

Financial Measures

(unaudited, in millions, except

per share amounts)

Thirteen Weeks Ended November 24,

2024

Gross Profit

SG&A

Restructuring expense

Income

From

Operations

Interest

Expense

Income

Tax Expense

(Benefit) (1)

Equity

Method

Investment

Earnings

Net Income (Loss)

Diluted

EPS

As reported

$

277.8

$

184.7

$

74.6

$

18.5

$

43.3

$

13.4

$

2.1

$

(36.1

)

$

(0.25

)

Unrealized derivative gains and losses

(2)

(9.8

)

(12.8

)

—

3.0

—

0.8

—

2.2

0.02

Foreign currency exchange losses (2)

—

(9.6

)

—

9.6

—

2.4

—

7.2

0.05

Blue chip swap transaction gains (2)

—

3.3

—

(3.3

)

—

(0.6

)

—

(2.7

)

(0.02

)

Items impacting comparability (2):

Restructuring Plan expenses

75.5

—

(74.6

)

150.1

—

35.5

9.0

123.6

0.86

Shareholder activism expense (4)

—

(0.4

)

—

0.4

—

0.1

—

0.3

—

Total adjustments

65.7

(19.5

)

(74.6

)

159.8

—

38.2

9.0

130.6

0.91

Adjusted (3)

$

343.5

$

165.2

$

—

$

178.3

$

43.3

$

51.6

$

11.1

$

94.5

$

0.66

Thirteen Weeks Ended November 26,

2023

As reported

$

475.6

$

170.0

$

—

$

305.6

$

29.1

$

66.2

$

4.7

$

215.0

$

1.48

Unrealized derivative gains and losses

(2)

4.6

3.0

—

1.6

—

0.3

—

1.3

0.01

Foreign currency exchange gains (2)

—

2.1

—

(2.1

)

—

(0.5

)

—

(1.6

)

(0.01

)

Blue chip swap transaction gains (2)

—

7.1

—

(7.1

)

—

(1.8

)

—

(5.3

)

(0.04

)

Items impacting comparability (2):

Inventory step-up from acquisition

(1.8

)

—

—

(1.8

)

—

(0.5

)

—

(1.3

)

(0.01

)

Integration and acquisition-related items,

net

—

(4.8

)

—

4.8

—

1.2

—

3.6

0.02

Total adjustments

2.8

7.4

—

(4.6

)

—

(1.3

)

—

(3.3

)

(0.03

)

Adjusted (3)

$

478.4

$

177.4

$

—

$

301.0

$

29.1

$

64.9

$

4.7

$

211.7

$

1.45

Lamb Weston Holdings,

Inc.

Reconciliation of Non-GAAP

Financial Measures

(unaudited, in millions, except

per share amounts)

Twenty-Six Weeks Ended November 24,

2024

Gross Profit

SG&A

Restructuring expense

Income

From

Operations

Interest

Expense

Income

Tax Expense

(Benefit) (1)

Equity

Method

Investment

Earnings

Net (Loss) Income

Diluted

EPS

As reported

$

633.8

$

328.6

$

74.6

$

230.6

$

88.5

$

64.2

$

13.4

$

91.3

$

0.64

Unrealized derivative gains and losses

(2)

(12.7

)

(6.8

)

—

(5.9

)

—

(1.6

)

—

(4.3

)

(0.02

)

Foreign currency exchange losses (2)

—

(10.2

)

—

10.2

—

2.6

—

7.6

0.05

Blue chip swap transaction gains (2)

—

19.9

—

(19.9

)

—

(0.6

)

—

(19.3

)

(0.13

)

Items impacting comparability (2):

Restructuring Plan expenses

75.5

—

(74.6

)

150.1

—

35.5

9.0

123.6

0.86

Shareholder activism expense (4)

—

(0.4

)

—

0.4

—

0.1

—

0.3

—

Total adjustments

62.8

2.5

(74.6

)

134.9

—

36.0

9.0

107.9

0.76

Adjusted (3)

$

696.6

$

331.1

$

—

$

365.5

$

88.5

$

100.2

$

22.4

$

199.2

$

1.40

Twenty-Six Weeks Ended November 26,

2023

As reported

$

975.1

$

346.2

$

—

$

628.9

$

59.8

$

136.1

$

16.8

$

449.8

$

3.08

Unrealized derivative gains and losses

(2)

(27.1

)

(1.4

)

—

(25.7

)

—

(6.5

)

—

(19.2

)

(0.13

)

Foreign currency exchange losses (2)

—

(5.3

)

—

5.3

—

1.4

—

3.9

0.03

Blue chip swap transaction gains (2)

—

7.1

—

(7.1

)

—

(1.8

)

—

(5.3

)

(0.04

)

Items impacting comparability (2):

Inventory step-up from acquisition

20.7

—

—

20.7

—

5.3

—

15.4

0.11

Integration and acquisition-related items,

net

—

(8.8

)

—

8.8

—

2.2

—

6.6

0.04

Total adjustments

(6.4

)

(8.4

)

—

2.0

—

0.6

—

1.4

0.01

Adjusted (3)

$

968.7

$

337.8

$

—

$

630.9

$

59.8

$

136.7

$

16.8

$

451.2

$

3.09

______________________________________________

(1)

Items are tax effected at the marginal

rate based on the applicable tax jurisdiction.

(2)

See footnotes (1) - (4) to the

Consolidated Statements of Earnings for a discussion of the

adjustment items.

(3)

See “Non-GAAP Financial Measures” in this

press release for additional information.

(4)

Represents advisory fees related to

shareholder activism matters.

Lamb Weston Holdings, Inc.

Reconciliation of Non-GAAP Financial Measures (unaudited, in

millions)

To supplement the financial information included in this press

release, the Company is presenting Adjusted EBITDA, which the

Company defines as earnings, less interest expense, income tax

expense, depreciation and amortization, foreign currency exchange

and unrealized mark-to-market derivative gains and losses, and

certain items impacting comparability identified in the table

below. Adjusted EBITDA is a non-GAAP financial measure. The

following table reconciles net (loss) income to Adjusted EBITDA for

the identified periods.

Thirteen Weeks Ended

Twenty-Six Weeks Ended

November 24,

2024

November 26,

2023

November 24,

2024

November 26,

2023

Net income (loss) (1)

$

(36.1

)

$

215.0

$

91.3

$

449.8

Interest expense, net

43.3

29.1

88.5

59.8

Income tax expense

13.4

66.2

64.2

136.1

Income from operations including equity

method investment earnings (2)

20.6

310.3

244.0

645.7

Depreciation and amortization (3)

92.5

71.2

183.9

142.0

Unrealized derivative losses (gains)

(1)

3.0

1.6

(5.9

)

(25.7

)

Foreign currency exchange losses (gains)

(1)

9.6

(2.1

)

10.2

5.3

Blue chip swap transaction gains (1)

(3.3

)

(7.1

)

(19.9

)

(7.1

)

Items impacting comparability (1):

Restructuring Plan expenses (4)

159.1

—

159.1

—

Shareholder activism expense (5)

0.4

—

0.4

—

Inventory step-up from acquisition

—

(1.8

)

—

20.7

Integration and acquisition-related items,

net

—

4.8

—

8.8

Adjusted EBITDA (6)

$

281.9

$

376.9

$

571.8

$

789.7

Segment Adjusted EBITDA

North America

$

266.7

$

321.3

$

542.8

$

700.7

International

47.4

100.2

97.9

189.8

Unallocated corporate costs (7)

(32.2

)

(44.6

)

(68.9

)

(100.8

)

Adjusted EBITDA

$

281.9

$

376.9

$

571.8

$

789.7

_______________________________________________

(1)

See footnotes (1) - (4) to the

Consolidated Statements of Earnings for more information.

(2)

Lamb Weston holds a 50 percent equity

interest in a U.S. potato processing joint venture, Lamb-Weston/RDO

Frozen (“Lamb Weston RDO”). Lamb Weston accounts for its investment

in Lamb Weston RDO under the equity method of accounting. See Note

12, Joint Venture Investments, of the Notes to Consolidated

Financial Statements in the Company’s Annual Report on Form 10-K

for the fiscal year ended May 26, 2024, filed with the Securities

and Exchange Commission (“SEC”) on July 24, 2024, for more

information.

(3)

Depreciation and amortization included

interest expense, income tax expense, and depreciation and

amortization from equity method investments of $2.0 million and

$2.1 million for the thirteen weeks ended November 24, 2024 and

November 26, 2023, respectively; and $4.1 million and $4.3 million

for the twenty-six weeks ended November 24, 2024 and November 26,

2023, respectively. Depreciation expense does not include $28.9

million of accelerated depreciation related to the closure of the

Company's manufacturing facility in Connell, Washington.

(4)

On October 1, 2024, the Company announced

the Restructuring Plan. For more information about the

Restructuring Plan, see Note 4, Restructuring Plan, of the

Condensed Notes to Consolidated Financial Statements in the

Company's Quarterly Report on Form 10-Q for the fiscal quarter

ended November 24, 2024, to be filed with the SEC.

(5)

Represents advisory fees related to

shareholder activism matters.

(6)

See “Non-GAAP Financial Measures” in this

press release for additional information.

(7)

The Company’s two segments include

corporate support staff and services that are directly allocable to

those segments. Unallocated corporate costs include costs related

to corporate support staff and support service, which includes, but

are not limited to, the Company's administrative, information

technology, human resources, finance, and accounting functions that

are not specifically allocated to the segments. In the table,

Unallocated corporate costs exclude unrealized derivative gains and

losses, foreign currency exchange gains and losses, blue chip swap

transaction gains, and items impacting comparability. These items

are added back to reconcile Net income (loss) to Adjusted

EBITDA.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241219795808/en/

Investors: Dexter Congbalay 224-306-1535

dexter.congbalay@lambweston.com

Media: Erin Gardiner 208-202-7257

communication@lambweston.com

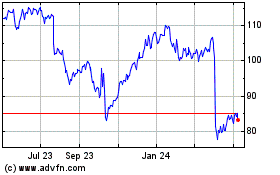

Lamb Weston (NYSE:LW)

Historical Stock Chart

From Nov 2024 to Dec 2024

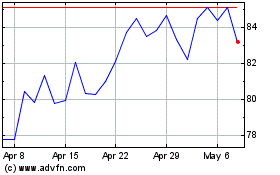

Lamb Weston (NYSE:LW)

Historical Stock Chart

From Dec 2023 to Dec 2024