0001669162false00016691622023-07-272023-07-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of report (Date of earliest event reported): July 27, 2023

KINSALE CAPITAL GROUP, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware | 001-37848 | 98-0664337 |

(State or other jurisdiction

of incorporation)

| (Commission File Number)

| (IRS Employer Identification No.)

|

2035 Maywill Street

Suite 100

Richmond, Virginia 23230

(Address of principal executive offices, including zip code)

(804) 289-1300

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | KNSL | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On July 27, 2023, Kinsale Capital Group, Inc. (the “Company”) issued a press release announcing its financial results for the three and six months ended June 30, 2023. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | Kinsale Capital Group, Inc. |

| | |

Dated: July 27, 2023 | By: | /s/ Bryan P. Petrucelli |

| | Bryan P. Petrucelli |

| | Executive Vice President, Chief Financial Officer and Treasurer |

Kinsale Capital Group Reports Second Quarter 2023 Results

Richmond, VA, July 27, 2023 - Kinsale Capital Group, Inc. (NYSE: KNSL) reported net income of $72.8 million, $3.12 per diluted share, for the second quarter of 2023 compared to $27.1 million, $1.17 per diluted share, for the second quarter of 2022. Net income was $128.6 million, $5.52 per diluted share, for the first half of 2023 compared to $58.9 million, $2.55 per diluted share, for the first half of 2022.

Net operating earnings(1) were $67.2 million, $2.88 per diluted share, for the second quarter of 2023 compared to $44.4 million, $1.92 per diluted share, for the second quarter of 2022. Net operating earnings(1) were $123.9 million, $5.32 per diluted share, for the first half of 2023 compared to $82.1 million, $3.56 per diluted share, for the first half of 2022.

Highlights for the quarter included:

•Net income increased by 168.7% compared to the second quarter of 2022

•Net operating earnings(1) of $67.2 million increased by 51.2% compared to the second quarter of 2022

•Gross written premiums increased by 58.2% to $438.2 million compared to the second quarter of 2022

•Net investment income increased by 128.2% to $24.2 million compared to the second quarter of 2022

•Underwriting income(2) was $61.5 million in the second quarter of 2023, resulting in a combined ratio of 76.7%

•Annualized operating return on equity(7) was 30.6% for the six months ended June 30, 2023

“Our second quarter performance reflects the continued focus on disciplined underwriting, technology-enabled expense management and operational excellence which allows us to capitalize on favorable market conditions. The combination of gross written premium growth of 58.2%, a combined ratio of 76.7% and annualized operating return on equity of 30.6% demonstrates our ability to take market share and generate attractive returns over the long term,” said President and Chief Executive Officer, Michael P. Kehoe.

Results of Operations

Underwriting Results

Gross written premiums were $438.2 million for the second quarter of 2023 compared to $277.0 million for the second quarter of 2022, an increase of 58.2%. Gross written premiums were $795.8 million for the first half of 2023 compared to $522.5 million for the first half of 2022, an increase of 52.3%. The increase in gross written premiums during the second quarter and first half of 2023 over the same periods last year reflected strong submission flow from brokers and a favorable pricing environment.

Underwriting income(2) was $61.5 million, resulting in a combined ratio of 76.7%, for the second quarter of 2023, compared to $44.1 million and a combined ratio of 77.4% for the same period last year. The increase in underwriting income(2) quarter over quarter was due to a combination of premium growth, favorable loss experience and lower net commissions. Loss(3) and expense(4) ratios were 55.7% and 21.0%, respectively, for the second quarter of 2023 compared to 54.9% and 22.5% for the second quarter of 2022. Results for the second quarters of 2023 and 2022 included net favorable development of loss reserves from prior accident years of $10.4 million, or 3.9 points, and $9.5 million, or 4.9 points, respectively.

Underwriting income(2) was $113.1 million, resulting in a combined ratio of 77.7%, for the first half of 2023, compared to $81.7 million and a combined ratio of 78.4% for the first half of 2022. The increase in underwriting income(2) was due to a combination of premium growth, favorable loss experience, lower net commissions and scale. Loss(3) and expense(4) ratios were 56.4% and 21.3%, respectively, for the first half of 2023 compared to 55.4% and 23.0% for the first half of 2022. Results for the first half of 2023 and 2022

included net favorable development of loss reserves from prior accident years of $19.5 million, or 3.8 points, and $17.9 million, or 4.7 points, respectively.

Summary of Operating Results

The Company’s operating results for the three and six months ended June 30, 2023 and 2022 are summarized as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| ($ in thousands) |

| Gross written premiums | $ | 438,222 | | | $ | 277,001 | | | $ | 795,810 | | | $ | 522,514 | |

| Ceded written premiums | (73,181) | | | (34,658) | | | (131,739) | | | (63,673) | |

| Net written premiums | $ | 365,041 | | | $ | 242,343 | | | $ | 664,071 | | | $ | 458,841 | |

| | | | | | | |

| Net earned premiums | $ | 257,046 | | | $ | 190,158 | | | $ | 494,204 | | | $ | 368,720 | |

| Fee income | 6,986 | | | 4,919 | | | 13,187 | | | 9,264 | |

| Losses and loss adjustment expenses | 147,042 | | | 107,040 | | | 286,076 | | | 209,545 | |

Underwriting, acquisition and insurance expenses | 55,473 | | | 43,891 | | | 108,219 | | | 86,781 | |

Underwriting income(2) | $ | 61,517 | | | $ | 44,146 | | | $ | 113,096 | | | $ | 81,658 | |

| | | | | | | |

Loss ratio(3) | 55.7 | % | | 54.9 | % | | 56.4 | % | | 55.4 | % |

Expense ratio(4) | 21.0 | % | | 22.5 | % | | 21.3 | % | | 23.0 | % |

Combined ratio(5) | 76.7 | % | | 77.4 | % | | 77.7 | % | | 78.4 | % |

| | | | | | | |

Annualized return on equity(6) | 34.5 | % | | 16.7 | % | | 31.8 | % | | 17.7 | % |

Annualized operating return on equity(7) | 31.8 | % | | 27.3 | % | | 30.6 | % | | 24.6 | % |

(1) Net operating earnings is a non-GAAP financial measure. See discussion of "Non-GAAP Financial Measures" below.

(2) Underwriting income is a non-GAAP financial measure. See discussion of "Non-GAAP Financial Measures" below.

(3) Loss ratio, expressed as a percentage, is the ratio of losses and loss adjustment expenses to the sum of net earned premiums and fee income. Prior periods have been revised to conform to the current period's presentation.

(4) Expense ratio, expressed as a percentage, is the ratio of underwriting, acquisition and insurance expenses to the sum of net earned premiums and fee income. Prior periods have been revised to conform to the current period's presentation.

(5) The combined ratio is the sum of the loss ratio and expense ratio as presented. Calculations of each component may not add due to rounding. Prior periods have been revised to conform to the current period's presentation.

(6) Annualized return on equity is net income expressed on an annualized basis as a percentage of average beginning and ending stockholders’ equity during the period.

(7) Annualized operating return on equity is net operating earnings expressed on an annualized basis as a percentage of average beginning and ending stockholders’ equity during the period.

The following tables summarize losses incurred for the current accident year and the development of prior accident years for the three and six months ended June 30, 2023 and 2022:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, 2023 | | Three Months Ended

June 30, 2022 |

| Losses and Loss Adjustment Expenses | | % of Sum of Earned Premiums and Fee Income | | Losses and Loss Adjustment Expenses | | % of Sum of Earned Premiums and Fee Income |

| Loss ratio: | ($ in thousands) |

| Current accident year | $ | 156,008 | | | 59.1 | % | | $ | 116,531 | | | 59.8 | % |

Current accident year - catastrophe losses | 1,451 | | | 0.5 | % | | 21 | | | — | % |

| Effect of prior accident year development | (10,417) | | | (3.9) | % | | (9,512) | | | (4.9) | % |

| Total | $ | 147,042 | | | 55.7 | % | | $ | 107,040 | | | 54.9 | % |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended

June 30, 2023 | | Six Months Ended

June 30, 2022 |

| Losses and Loss Adjustment Expenses | | % of Sum of Earned Premiums and Fee Income | | Losses and Loss Adjustment Expenses | | % of Sum of Earned Premiums and Fee Income |

| Loss ratio: | ($ in thousands) |

| Current accident year | $ | 302,511 | | | 59.6 | % | | $ | 227,320 | | | 60.1 | % |

Current accident year - catastrophe losses | 3,025 | | | 0.6 | % | | 83 | | | — | % |

| Effect of prior accident year development | (19,460) | | | (3.8) | % | | (17,858) | | | (4.7) | % |

| Total | $ | 286,076 | | | 56.4 | % | | $ | 209,545 | | | 55.4 | % |

Investment Results

Net investment income was $24.2 million in the second quarter of 2023 compared to $10.6 million in the second quarter of 2022, an increase of 128.2%. Net investment income was $44.9 million in the first half of 2023 compared to $19.7 million in the first half of 2022, an increase of 128.0%. These increases were driven by growth in the Company's investment portfolio generated largely from the investment of strong operating cash flows and higher interest rates relative to the prior year periods. Net operating cash flows were $423.6 million in the first half of 2023 compared to $278.7 million in the first half of 2022, an increase of 52.0%. The Company’s investment portfolio had an annualized gross investment return(8) of 3.8% for the first half of 2023 compared to 2.6% for the same period last year. Funds are generally invested conservatively in high quality securities with an average credit quality of "AA-" and the weighted average duration of the fixed-maturity investment portfolio, including cash equivalents, was 3.1 years and 3.5 years at June 30, 2023 and December 31, 2022, respectively. Cash and invested assets totaled $2.6 billion at June 30, 2023 and $2.2 billion at December 31, 2022.

(8) Gross investment return is investment income from fixed-maturity and equity securities (and short-term investments, if any), before any deductions for fees and expenses, expressed as a percentage of average beginning and ending book values of those investments during the period.

Other

The effective tax rates for the six months ended June 30, 2023 and 2022 were 18.9% and 17.4%, respectively. In the first half of 2023 and 2022, the effective tax rates were lower than the federal statutory rate of 21% primarily due to the tax benefits from stock-based compensation and tax-exempt investment income.

Stockholders' equity was $871.8 million at June 30, 2023 compared to $745.4 million at December 31, 2022. Book value per share was $37.64 at June 30, 2023 compared to $32.28 at December 31, 2022. Annualized

operating return on equity(7) was 30.6% for the first half of 2023, an increase from 24.6% for the first half of 2022, which was primarily due to continued profitable growth from favorable E&S market conditions and rate increases.

In the periods ending June 30, 2023, the Company reclassified policy fees to fee income. Historically, these fees were presented as a reduction to underwriting, acquisition and insurance expenses. The Company modified the definition of the loss and expense ratios to include fee income in the denominator of each ratio. The Company has reclassified prior periods' results to conform to the current period's presentation.

Non-GAAP Financial Measures

Net Operating Earnings

Net operating earnings is defined as net income excluding the effects of the change in the fair value of equity securities, after taxes, net realized investment gains and losses, after taxes, and change in allowance for credit losses on investments, after taxes. Management believes the exclusion of these items provides a useful comparison of the Company's underlying business performance from period to period. Net operating earnings and percentages or calculations using net operating earnings (e.g., diluted operating earnings per share and annualized operating return on equity) are non-GAAP financial measures. Net operating earnings should not be viewed as a substitute for net income calculated in accordance with GAAP, and other companies may define net operating earnings differently.

For the three and six months ended June 30, 2023 and 2022, net income and diluted earnings per share reconcile to net operating earnings and diluted operating earnings per share as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, | |

| | 2023 | | 2022 | | 2023 | | 2022 | |

| | ($ in thousands, except per share data) | |

| Net operating earnings: | | | | | | | | | |

| Net income | | $ | 72,791 | | | $ | 27,090 | | | $ | 128,591 | | | $ | 58,881 | | |

| Adjustments: | | | | | | | | | |

| Change in the fair value of equity securities, before taxes | | (5,811) | | | 23,353 | | | (9,329) | | | 31,104 | | |

Income tax expense (benefit) (1) | | 1,220 | | | (4,904) | | | 1,959 | | | (6,532) | | |

| Change in fair value of equity securities, after taxes | | (4,591) | | | 18,449 | | | (7,370) | | | 24,572 | | |

| | | | | | | | | |

| Net realized investment losses (gains), before taxes | | (1,291) | | | (1,413) | | | 3,361 | | | (1,708) | | |

Income tax (benefit) expense (1) | | 271 | | | 297 | | | (706) | | | 359 | | |

| Net realized investment losses (gains), after taxes | | (1,020) | | | (1,116) | | | 2,655 | | | (1,349) | | |

| | | | | | | | | |

| Change in allowance for credit losses on investments, before taxes | | (25) | | | — | | | 56 | | | — | | |

Income tax (benefit) expense (1) | | 5 | | | — | | | (12) | | | — | | |

| Change in allowance for credit losses on investments, after taxes | | (20) | | | — | | | 44 | | | — | | |

| Net operating earnings | | $ | 67,160 | | | $ | 44,423 | | | $ | 123,920 | | | $ | 82,104 | | |

| | | | | | | | | |

| Diluted operating earnings per share: | | | | | | | | | |

| Diluted earnings per share | | $ | 3.12 | | | $ | 1.17 | | | $ | 5.52 | | | $ | 2.55 | | |

| Change in the fair value of equity securities, after taxes, per share | | (0.20) | | | 0.80 | | | (0.32) | | | 1.06 | | |

| Net realized investment losses (gains), after taxes, per share | | (0.04) | | | (0.05) | | | 0.11 | | | (0.06) | | |

| | | | | | | | | |

Diluted operating earnings per share(2) | | $ | 2.88 | | | $ | 1.92 | | | $ | 5.32 | | | $ | 3.56 | | |

| | | | | | | | | |

| Operating return on equity: | | | | | | | | | |

Average equity(3) | | $ | 843,773 | | | $ | 649,818 | | | $ | 808,632 | | | $ | 666,701 | | |

Annualized return on equity(4) | | 34.5 | % | | 16.7 | % | | 31.8 | % | | 17.7 | % | |

Annualized operating return on equity(5) | | 31.8 | % | | 27.3 | % | | 30.6 | % | | 24.6 | % | |

(1) Income taxes on adjustments to reconcile net income to net operating earnings use a 21% effective tax rate.

(2) Diluted operating earnings per share may not add due to rounding.

(3) Computed by adding the total stockholders' equity as of the date indicated to the prior quarter-end or year-end total, as applicable, and dividing by two.

(4) Annualized return on equity is net income expressed on an annualized basis as a percentage of average beginning and ending stockholders’ equity during the period.

(5) Annualized operating return on equity is net operating earnings expressed on an annualized basis as a percentage of average beginning and ending stockholders’ equity during the period.

Underwriting Income

Underwriting income is defined as net income excluding net investment income, the change in the fair value of equity securities, net realized investment gains and losses, change in allowance for credit losses on investments, interest expense, other expenses, other income and income tax expense. The Company uses underwriting income as an internal performance measure in the management of its operations because the Company believes it gives management and users of the Company's financial information useful insight into the Company's results of operations and underlying business performance. Underwriting income should not be viewed as a substitute for net income calculated in accordance with GAAP, and other companies may define underwriting income differently.

For the three and six months ended June 30, 2023 and 2022, net income reconciles to underwriting income as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, | |

| | 2023 | | 2022 | | 2023 | | 2022 | |

| | (in thousands) | |

| Net income | | $ | 72,791 | | | $ | 27,090 | | | $ | 128,591 | | | $ | 58,881 | | |

| Income tax expense | | 17,319 | | | 5,352 | | | 29,912 | | | 12,433 | | |

| Income before income taxes | | 90,110 | | | 32,442 | | | 158,503 | | | 71,314 | | |

| Net investment income | | (24,172) | | | (10,594) | | | (44,867) | | | (19,682) | | |

Change in the fair value of equity securities | | (5,811) | | | 23,353 | | | (9,329) | | | 31,104 | | |

| Net realized investment losses (gains) | | (1,291) | | | (1,413) | | | 3,361 | | | (1,708) | | |

| Change in allowance for credit losses on investments | | (25) | | | — | | | 56 | | | — | | |

| Interest expense | | 2,724 | | | 337 | | | 5,294 | | | 590 | | |

Other expenses (6) | | 417 | | | 166 | | | 819 | | | 309 | | |

| Other income | | (435) | | | (145) | | | (741) | | | (269) | | |

| Underwriting income | | $ | 61,517 | | | $ | 44,146 | | | $ | 113,096 | | | $ | 81,658 | | |

(6) Other expenses are comprised of corporate expenses not allocated to the Company's insurance operations.

Conference Call

Kinsale Capital Group will hold a conference call to discuss this press release on Friday, July 28, 2023 at 9:00 a.m. (Eastern Time). Members of the public may access the conference call by dialing (888) 660-6493, conference ID# 3573726, or via the Internet by going to www.kinsalecapitalgroup.com and clicking on the "Investor Relations" link. A replay of the call will be available on the website until the close of business on August 25, 2023.

Forward-Looking Statements

This press release contains forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. In some cases, such forward-looking statements may be identified by terms such as "anticipates," "estimates," "expects," "intends," "plans," "predicts," "projects," "believes," "seeks," "outlook," "future," "will," "would," "should," "could," "may," "can have," "prospects" or similar words. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Although it is not possible to identify all of these risks and factors, they include, among others, the following: inadequate loss reserves to cover the Company's actual losses; inherent uncertainty of models resulting in actual losses that are materially different than the Company's estimates; adverse economic factors; a decline in the Company's financial strength rating; loss of one or more key executives; loss of a group of brokers that generate significant portions of the Company's business; failure of any of the loss limitations or exclusions the Company employs, or change in other claims or coverage issues; adverse performance of the Company's investment portfolio; adverse market conditions that affect its excess and surplus lines insurance operations; and other risks described in the Company's filings

with the Securities and Exchange Commission. These forward-looking statements speak only as of the date of this release and the Company does not undertake any obligation to update or revise any forward-looking information to reflect changes in assumptions, the occurrence of unanticipated events, or otherwise.

About Kinsale Capital Group, Inc.

Kinsale Capital Group, Inc. is a specialty insurance group headquartered in Richmond, Virginia, focusing on the excess and surplus lines market.

Contact

Kinsale Capital Group, Inc.

Bryan Petrucelli

Executive Vice President, Chief Financial Officer and Treasurer

804-289-1272

ir@kinsalecapitalgroup.com

KINSALE CAPITAL GROUP, INC. AND SUBSIDIARIES

Unaudited Consolidated Statements of Income and Comprehensive Income

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Revenues | | (in thousands, except per share data) |

| Gross written premiums | | $ | 438,222 | | | $ | 277,001 | | | $ | 795,810 | | | $ | 522,514 | |

| Ceded written premiums | | (73,181) | | | (34,658) | | | (131,739) | | | (63,673) | |

| Net written premiums | | 365,041 | | | 242,343 | | | 664,071 | | | 458,841 | |

| Change in unearned premiums | | (107,995) | | | (52,185) | | | (169,867) | | | (90,121) | |

| Net earned premiums | | 257,046 | | | 190,158 | | | 494,204 | | | 368,720 | |

| Fee income | | 6,986 | | | 4,919 | | | 13,187 | | | 9,264 | |

| Net investment income | | 24,172 | | | 10,594 | | | 44,867 | | | 19,682 | |

| Change in the fair value of equity securities | | 5,811 | | | (23,353) | | | 9,329 | | | (31,104) | |

| Net realized investment (losses) gains | | 1,291 | | | 1,413 | | | (3,361) | | | 1,708 | |

| Change in allowance for credit losses on investments | | 25 | | | — | | | (56) | | | — | |

| Other income | | 435 | | | 145 | | | 741 | | | 269 | |

| Total revenues | | 295,766 | | | 183,876 | | | 558,911 | | | 368,539 | |

| | | | | | | | |

| Expenses | | | | | | | | |

| Losses and loss adjustment expenses | | 147,042 | | | 107,040 | | | 286,076 | | | 209,545 | |

| Underwriting, acquisition and insurance expenses | | 55,473 | | | 43,891 | | | 108,219 | | | 86,781 | |

| Interest expense | | 2,724 | | | 337 | | | 5,294 | | | 590 | |

| Other expenses | | 417 | | | 166 | | | 819 | | | 309 | |

| Total expenses | | 205,656 | | | 151,434 | | | 400,408 | | | 297,225 | |

| Income before income taxes | | 90,110 | | | 32,442 | | | 158,503 | | | 71,314 | |

| Total income tax expense | | 17,319 | | | 5,352 | | | 29,912 | | | 12,433 | |

| Net income | | 72,791 | | | 27,090 | | | 128,591 | | | 58,881 | |

| | | | | | | | |

| Other comprehensive income (loss) | | | | | | | | |

| Change in net unrealized gains (losses) on available-for-sale investments, net of taxes | | (14,107) | | | (54,882) | | | 3,402 | | | (118,812) | |

| Total comprehensive income (loss) | | $ | 58,684 | | | $ | (27,792) | | | $ | 131,993 | | | $ | (59,931) | |

| | | | | | | | |

| Earnings per share: | | | | | | | | |

| Basic | | $ | 3.16 | | | $ | 1.19 | | | $ | 5.59 | | | $ | 2.59 | |

| Diluted | | $ | 3.12 | | | $ | 1.17 | | | $ | 5.52 | | | $ | 2.55 | |

| | | | | | | | |

| Weighted-average shares outstanding: | | | | | | | | |

| Basic | | 23,040 | | | 22,781 | | | 23,024 | | | 22,767 | |

| Diluted | | 23,301 | | | 23,103 | | | 23,293 | | | 23,095 | |

KINSALE CAPITAL GROUP, INC. AND SUBSIDIARIES

Unaudited Condensed Consolidated Balance Sheets

| | | | | | | | | | | | | | |

| | June 30, 2023 | | December 31, 2022 |

| Assets | | (in thousands) |

| Investments: | | | | |

Fixed-maturity securities at fair value | | $ | 2,183,686 | | | $ | 1,760,100 | |

| Equity securities at fair value | | 196,848 | | | 152,471 | |

| Assets held for sale | | 57,526 | | | — | |

| Real estate investments, net | | 19,482 | | | 76,387 | |

| Short-term investments | | 28,778 | | | 41,337 | |

| Total investments | | 2,486,320 | | | 2,030,295 | |

| | | | |

| Cash and cash equivalents | | 125,057 | | | 156,274 | |

| Investment income due and accrued | | 17,696 | | | 14,451 | |

| Premiums receivable, net | | 147,092 | | | 105,754 | |

| | | | |

| Reinsurance recoverables, net | | 229,903 | | | 220,454 | |

| Ceded unearned premiums | | 48,645 | | | 42,935 | |

Deferred policy acquisition costs, net of ceding commissions | | 85,326 | | | 61,594 | |

| Intangible assets | | 3,538 | | | 3,538 | |

| Deferred income tax asset, net | | 58,047 | | | 56,983 | |

| Other assets | | 68,578 | | | 54,844 | |

| Total assets | | $ | 3,270,202 | | | $ | 2,747,122 | |

| | | | |

| Liabilities & Stockholders' Equity | | | | |

| Liabilities: | | | | |

| Reserves for unpaid losses and loss adjustment expenses | | $ | 1,455,734 | | | $ | 1,238,402 | |

| Unearned premiums | | 675,254 | | | 499,677 | |

| Payable to reinsurers | | 42,143 | | | 32,024 | |

| Accounts payable and accrued expenses | | 22,457 | | | 31,361 | |

| Debt | | 195,876 | | | 195,747 | |

| | | | |

| Other liabilities | | 6,923 | | | 4,462 | |

| Total liabilities | | 2,398,387 | | | 2,001,673 | |

| | | | |

| Stockholders' equity | | 871,815 | | | 745,449 | |

| Total liabilities and stockholders' equity | | $ | 3,270,202 | | | $ | 2,747,122 | |

v3.23.2

DEI Document

|

Jul. 27, 2023 |

| Document and Entity Information [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 27, 2023

|

| Entity Registrant Name |

KINSALE CAPITAL GROUP, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-37848

|

| Entity Tax Identification Number |

98-0664337

|

| Entity Address, Address Line One |

2035 Maywill Street

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Richmond

|

| Entity Address, State or Province |

VA

|

| Entity Address, Postal Zip Code |

23230

|

| City Area Code |

804

|

| Local Phone Number |

289-1300

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

KNSL

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001669162

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

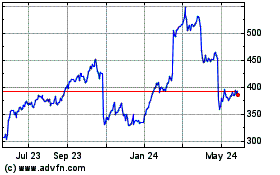

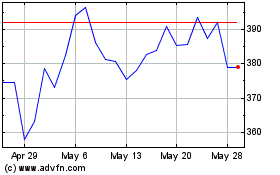

Kinsale Capital (NYSE:KNSL)

Historical Stock Chart

From Apr 2024 to May 2024

Kinsale Capital (NYSE:KNSL)

Historical Stock Chart

From May 2023 to May 2024