Natural Gas Prices Rise as Coal-to-Gas Switching Expected

April 24 2019 - 3:54PM

Dow Jones News

By Dan Molinski

--Natural-gas prices rose slightly from three-year lows

Wednesday as the low prices increased the possibility the power

sector will begin using more gas and less coal.

--Natural gas for May delivery ended 0.3% higher at $2.4620 a

million British thermal units on the New York Mercantile Exchange.

Prices fell 2.7% on Tuesday to $2.4550/mmBtu, the lowest since June

3, 2016.

HIGHLIGHTS

Gas Vs Coal: Gas prices have fallen 17% this year, and that may

be encouraging electricity generating plants to start favoring a

higher mix of gas and reduced usage of coal, thus boosting gas

prices, or at least perhaps preventing further declines.

"U.S. natural gas is now cheaper than Powder River Basin (PRB)

coal. Historically, these low price levels have led to higher gas

burns from the power sector," said analysts at Bank of America

Merrill Lynch in a research note. "PRB coal prices should provide

temporary floor to U.S. nat gas despite the recent sell off."

Storage: Any hopes for a stronger rebound in gas prices

Wednesday were hurt by expectations that weekly storage data

Thursday will show another larger-than-normal increase in domestic

gas inventories as production remains strong and comfortable spring

weather keeps demand low. Analysts surveyed by The Wall Street

Journal said they expect the Energy Information Administration will

report an 89-billion-cubic-feet increased in storage for the week

ended April 19, compared with an average increase of 47 bcf for

that period.

INSIGHT

Sub-Zero: While the main, Henry Hub gas prices are at three-year

lows below $2.50/mmBtu, prices paid for gas in the Permian Basin of

west Texas and New Mexico have continued to fall well below zero,

and Apache Corp. said this week it has began deferring natural gas

production in the Permian as a result.

Apache, which is developing a new gas field in the area, said it

expects local gas prices to be volatile until Kinder Morgan's Gulf

Coast Express pipeline begins operating later this year.

"This is the proper approach from both an environmental and

economic perspective relative to other industry practicessuch as

flaring or selling associated gas at a negative or unprofitable

price," Chief Executive John Christmann said. He added that Apache

would pick up production again "as soon as practical."

AHEAD

--The EIA is scheduled to release its weekly report on gas

storage Thursday at 10:30 a.m. ET.

Rebecca Elliott contributed to this report.

Write to Dan Molinski at dan.molinski@wsj.com

(END) Dow Jones Newswires

April 24, 2019 15:39 ET (19:39 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

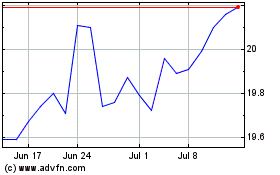

Kinder Morgan (NYSE:KMI)

Historical Stock Chart

From Mar 2024 to Apr 2024

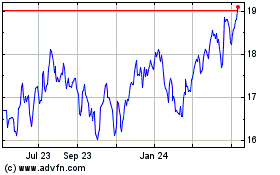

Kinder Morgan (NYSE:KMI)

Historical Stock Chart

From Apr 2023 to Apr 2024