Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

October 27 2023 - 4:58PM

Edgar (US Regulatory)

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS

AUGUST 31, 2023

(amounts in 000’s, except number of option contracts)

(UNAUDITED)

|

Description

|

|

No. of

Shares/Units

|

|

Value

|

|

Long-Term Investments — 138.8%

|

|

|

|

|

|

|

Equity Investments(1) — 138.8%

|

|

|

|

|

|

|

Midstream Energy Company(2) — 121.8%

|

|

|

|

|

|

|

Antero Midstream Corporation

|

|

1,680

|

|

$

|

20,360

|

|

Aris Water Solutions, Inc.

|

|

478

|

|

|

4,898

|

|

Cheniere Energy, Inc.

|

|

723

|

|

|

118,026

|

|

Cheniere Energy Partners, L.P.

|

|

364

|

|

|

18,869

|

|

DT Midstream, Inc.

|

|

409

|

|

|

21,366

|

|

Enbridge Inc.(3)

|

|

1,030

|

|

|

36,122

|

|

Energy Transfer LP

|

|

16,788

|

|

|

226,130

|

|

Energy Transfer LP — Series A Preferred Unit(4)

|

|

2,000

|

|

|

1,840

|

|

EnLink Midstream, LLC

|

|

484

|

|

|

6,015

|

|

Enterprise Products Partners L.P.

|

|

7,281

|

|

|

193,756

|

|

Enterprise Products Partners L.P. — Convertible Preferred

Units(5)(6)(7)

|

|

23

|

|

|

22,803

|

|

Hess Midstream LP

|

|

548

|

|

|

15,850

|

|

Kinder Morgan, Inc.

|

|

1,480

|

|

|

25,477

|

|

Magellan Midstream Partners, L.P.(8)

|

|

555

|

|

|

36,890

|

|

MPLX LP

|

|

3,714

|

|

|

129,591

|

|

MPLX LP — Convertible Preferred Units(5)(6)(9)

|

|

2,255

|

|

|

78,690

|

|

NuStar Energy L.P.

|

|

650

|

|

|

10,894

|

|

ONEOK, Inc.(8)

|

|

1,345

|

|

|

87,706

|

|

Pembina Pipeline Corporation(3)

|

|

1,198

|

|

|

37,237

|

|

Plains All American Pipeline, L.P.

|

|

9,518

|

|

|

145,154

|

|

Streamline Innovations Holdings, Inc. — Series C Preferred

Shares(5)(6)(10)(11)(12)

|

|

4,125

|

|

|

20,213

|

|

Targa Resources Corp.(13)

|

|

1,739

|

|

|

150,019

|

|

TC Energy Corporation(3)

|

|

704

|

|

|

25,414

|

|

The Williams Companies, Inc.

|

|

4,798

|

|

|

165,686

|

|

Western Midstream Partners, LP

|

|

3,570

|

|

|

95,286

|

| |

|

|

|

|

1,694,292

|

|

Utility Company(2) — 7.4%

|

|

|

|

|

|

|

Duke Energy Corporation

|

|

107

|

|

|

9,484

|

|

NextEra Energy, Inc.

|

|

352

|

|

|

23,482

|

|

Sempra Energy

|

|

741

|

|

|

52,047

|

|

TransAlta Corporation(3)

|

|

815

|

|

|

7,820

|

|

Xcel Energy Inc.

|

|

187

|

|

|

10,700

|

| |

|

|

|

|

103,533

|

See accompanying notes to financial statements.

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS

AUGUST 31, 2023

(amounts in 000’s, except number of option contracts)

(UNAUDITED)

|

Description

|

|

No. of

Shares/Units

|

|

Value

|

|

Renewable Infrastructure Company(2) — 6.5%

|

|

|

|

|

|

|

Atlantica Sustainable Infrastructure plc(3)

|

|

1,825

|

|

$

|

40,970

|

|

Brookfield Renewable Partners L.P.(3)

|

|

625

|

|

|

15,895

|

|

Clearway Energy, Inc. — Class A

|

|

111

|

|

|

2,609

|

|

Clearway Energy, Inc. — Class C

|

|

403

|

|

|

9,970

|

|

NextEra Energy Partners, LP

|

|

420

|

|

|

20,949

|

| |

|

|

|

|

90,393

|

|

Energy Company(2) — 3.1%

|

|

|

|

|

|

|

Exxon Mobil Corporation

|

|

215

|

|

|

23,950

|

|

Phillips 66(13)

|

|

167

|

|

|

19,021

|

| |

|

|

|

|

42,971

|

|

Total Long-Term Investments — 138.8% (Cost — $1,780,921)

|

|

|

|

|

1,931,189

|

|

Liabilities

|

|

Strike

Price

|

|

Expiration

Date

|

|

No. of

Contracts

|

|

Notional

Amount(14)

|

|

|

|

Call Option Contracts Written(12)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Midstream Energy Company(2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Targa Resources Corp.

|

|

$

|

82.50

|

|

9/15/23

|

|

960

|

|

$

|

8,280

|

|

(403

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy Company(2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Phillips 66

|

|

|

115.00

|

|

9/15/23

|

|

650

|

|

|

7,420

|

|

(111

|

)

|

|

Phillips 66

|

|

|

120.00

|

|

9/15/23

|

|

650

|

|

|

7,420

|

|

(19

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

(130

|

)

|

|

Total Call Option Contracts Written (Premiums Received — $333)

|

|

|

|

|

(533

|

)

|

|

|

|

|

|

|

|

Debt

|

|

|

(305,218

|

)

|

|

Mandatory Redeemable Preferred Stock at Liquidation Value

|

|

|

(111,603

|

)

|

|

Current Income Tax Receivable, net

|

|

|

1,419

|

|

|

Deferred Income Tax Liability, net

|

|

|

(120,706

|

)

|

|

Other Liabilities in Excess of Other Assets

|

|

|

(3,163

|

)

|

|

Net Assets Applicable to Common Stockholders

|

|

$

|

1,391,385

|

|

See accompanying notes to financial statements.

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS

AUGUST 31, 2023

(amounts in 000’s, except number of option contracts)

(UNAUDITED)

At August 31, 2023, the Company’s geographic allocation was as follows:

|

Geographic Location

|

|

% of Long-Term

Investments

|

|

United States

|

|

91.5%

|

|

Canada

|

|

6.4%

|

|

Europe/U.K.

|

|

2.1%

|

See accompanying notes to financial statements.

Kayne Anderson Energy In... (NYSE:KYN)

Historical Stock Chart

From Apr 2024 to May 2024

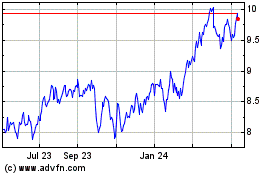

Kayne Anderson Energy In... (NYSE:KYN)

Historical Stock Chart

From May 2023 to May 2024