New Tallest Skyscraper Planned for Tokyo

August 31 2015 - 8:40AM

Dow Jones News

TOKYO—Mitsubishi Estate Co. said Monday that it plans to build

Japan's tallest building as part of an $8.3 billion development in

central Tokyo, the latest sign of a boom in the capital's property

market.

Mitsubishi Estate said it will build a 1,279-feet skyscraper and

three other structures just north of Tokyo's main railway station,

in the heart of the city's financial hub and priciest real estate.

The targeted completion date is 2027, and the total cost will

likely top ¥ 1 trillion ($8.3 billion), with the land alone valued

at ¥ 600 billion, company officials said.

Mitsubishi Estate President Hirotaka Sugiyama said he hopes the

new development will improve the city's standing as a global

financial center, while attracting a wide range of professionals in

other industries.

"I want this building to be as symbolic and as competitive [as

other landmark buildings] in the world," Mr. Sugiyama said.

The project's long time horizon underscores Mitsubishi Estate's

commitment to the city center even as some analysts have expressed

worries about the longer-term outlook.

Tokyo's high-end property market is booming again following

years of struggle in the wake of the 2008 global financial crisis

and the March 2011 earthquake and tsunami. High-quality properties

have become nearly as expensive as during the most recent market

peak in 2007. But some fear the market will lose momentum after the

2020 Tokyo Olympics, if not sooner.

Yasuo Kono, Japan strategist at U.S.-based LaSalle Investment

Management Inc., said the recovery in office properties is

accelerating, leading to more development projects, but this

unlikely to last until 2020.

Still, projects such as the one announced by Mitsubishi Estate

fit well with the long-term redevelopment theme for Tokyo—tall,

multi-purpose buildings at the city center, and such investments

should perform relatively well, he said.

The average office vacancy rate in the central business

districts fell to 4.9% in July, down from 9.3% three years ago,

according to brokerage Miki Shoji Co. The average rent for new

buildings rose 18% during the period.

Big investors have returned. Last year, Singapore

sovereign-wealth fund GIC Pte. bought 24 floors of Pacific Century

Place Marunouchi, a building just south of Tokyo Station, for $1.7

billion.

In January, LaSalle Investment Management and sovereign-wealth

fund China Investment Corp. teamed up to buy the Meguro Gajoen

commercial property complex in Tokyo for around ¥ 140 billion ($1.2

billion).

Mitsubishi Estate's new skyscraper would be twice as tall as its

current landmark building, the Marunouchi Building just west of

Tokyo Station, and unusually high for earthquake-prone countries

like Japan. Still, it will rank well behind some of the world's

tallest buildings. The tallest building in the U.S., One World

Trade Center, is nearly 500 feet taller at 1,776 feet.

Mitsubishi Estate officials say the company's seismic-resistance

technology prevents its buildings from suffering damage or

sustained swaying during big earthquakes.

The ¥ 1 trillion price tag for the project doesn't represent the

company's coming investment. It already owns a majority stake in

the land and existing properties.

The company plans to take a majority stake in the new project.

Mr. Sugiyama said it will able to finance the project within its

regular operating budget and doesn't plan any special

financing.

Mitsubishi Estate or its group predecessors and affiliates have

been major landlords in that area of Tokyo since purchasing the

land from the government in 1890. Local real-estate professionals

say the company has never stopped redeveloping the area—even during

the worst of Japan's property market bust in the 1990s.

Write to Kosaku Narioka at kosaku.narioka@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 31, 2015 08:25 ET (12:25 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

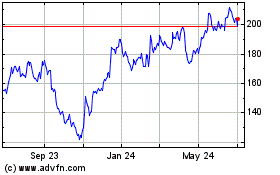

Jones Lang LaSalle (NYSE:JLL)

Historical Stock Chart

From Mar 2024 to Apr 2024

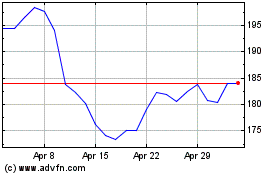

Jones Lang LaSalle (NYSE:JLL)

Historical Stock Chart

From Apr 2023 to Apr 2024