Intrepid Potash, Inc. ("Intrepid", the "Company", "we", "us",

"our") (NYSE:IPI) today reported its results for the third quarter

of 2023.

Key Highlights for Third Quarter 2023

Financial & Operational

- Total sales of $54.5 million, which compares to $74.8 million

in the third quarter of 2022, as potash and Trio® average net

realized sales prices(1) decreased to $433 and $298 per ton,

respectively.

- Net loss of $7.2 million (or $0.56 per diluted share), which

compares to net income of $13.1 million (or $0.97 per diluted

share) in the third quarter of 2022.

- Gross margin of $0.5 million, which compares to $26.8 million

in the third quarter of 2022.

- Cash flow used in operations of $0.3 million, which

compares to $14.1 million of cash flow used in operations in

the third quarter of 2022.

- Adjusted EBITDA(1) of $2.2 million, which compares to $27.0

million in the third quarter of 2022.

- Potash and Trio® sales volumes of 46 thousand and 52 thousand

tons, respectively, which compares to prior year figures of 46

thousand and 39 thousand tons, respectively.

Capital Expenditures

- Incurred capital expenditures of $16.6 million in the third

quarter of 2023. We expect full-year 2023 capital expenditures to

be between $65 to $75 million.

- Our capital expenditures continue to be primarily focused on

our potash assets to help us meet our goals of maximizing brine

availability and underground brine residence time, which will help

drive higher and more consistent potash production and improve our

unit economics.

Project Updates

- HB Solar Solution Mine in Carlsbad, New

Mexico:

- Eddy Shaft Brine Extraction Project: We successfully

commissioned the Eddy Shaft Brine Extraction Project in October.

This project targets a significant, high-grade brine pool in the

Eddy Cavern that is estimated to contain approximately 270 million

gallons of brine at an expected grade of over 9% potassium

chloride. Access to this brine pool immediately increases the brine

available to our pond system and we expect to see incremental

production contributions starting in the second half of 2024.

- Replacement Extraction Well ("IP30B"): We continue to work

through the permitting and contracting processes for IP30B and

expect construction to begin in early-2024 with commissioning now

expected in the first half of 2024 due to delays in permitting.

This new extraction well is designed to have a long-term

operational life and will initially target approximately 330

million gallons of high-grade brine from the Eddy Cavern at HB,

with this additional brine being at lower depths than the Eddy

Shaft project can access.

- Phase Two of HB Injection Pipeline Project: Phase Two is the

installation of an in-line pigging system to clean the pipeline and

remove scaling to help ensure more consistent flow rates. We

continue to work through the permitting requirements and anticipate

construction beginning in the first quarter of 2024, with

commissioning expected in the first half of 2024, assuming we have

no further delays in permitting. Upon Phase 2 commissioning, we

expect our brine injection rates to be the highest in company

history, which is key for maximizing brine availability and

residence time.

- Solar Solution Mine in Moab, Utah

- Summer 2023 Drilling Projects: The Well 45 (Cavern 4), Well 46,

and Twofer drilling projects were all successfully commissioned in

July 2023 and will help us meet our key goals of maximizing brine

availability and residence time. These projects provided

incremental production benefits in 2023 with more substantial

production contributions expected starting in 2024.

- Brine Recovery Mine in Wendover, Utah

- Primary Pond 7: We started construction on a new primary pond

at Wendover to increase the brine evaporative area, which will

result in two primary ponds when complete. Similar to our caverns

at Moab and HB, the primary ponds at Wendover serve as the brine

storage area, and adding another primary pond will help us meet our

goals of maximizing brine availability, increasing our brine grade,

and improving our production. Construction has started and we

expect this project to be commissioned in the third quarter of

2024.

- East Facility in Carlsbad, New Mexico

- Both of the new continuous miners have been placed into service

with the second miner operating for the full month of September. We

expect to see an improvement in operating efficiencies and

production during the fourth quarter of 2023 with both of the new

miners in service for the full quarter.

Liquidity

- As of October 31, 2023, Intrepid had approximately $7 million

in cash and cash equivalents and $146 million available under its

revolving credit facility, for total liquidity of approximately

$153 million.

- Intrepid maintains an investment account of short-and-long-term

fixed income securities that had a balance of approximately $4.4

million as of October 31, 2023.

Consolidated Results, Management Commentary, &

OutlookIn the third quarter of 2023, Intrepid generated

sales of $54.5 million, a 27% decrease from third quarter 2022

sales of $74.8 million. Consolidated gross margin totaled $0.5

million, while the net loss totaled $7.2 million, or a loss of

$0.56 per diluted share, which compares to third quarter 2022 net

income of $13.1 million, or $0.97 per diluted share. The Company

delivered adjusted EBITDA of $2.2 million, down from $27.0 million

in the same prior year period, with the lower profitability

primarily being driven by lower pricing for our key products and an

increase in our cost of goods sold. Our third quarter 2023 net

realized sales prices for potash and Trio® averaged $433 and $298

per ton, respectively, which compares to $734 and $488 per ton,

respectively, in the third quarter of 2022.

Bob Jornayvaz, Intrepid's Executive Chairman and CEO commented:

"Our third quarter results were highlighted by strong sales of

potash and Trio® and our volumes for the first nine months of the

year remain well ahead of last year's pace. Farmer economics

continue to be supported by elevated futures prices compared to

historical levels, while attractive fertilizer pricing in the eyes

of growers remains a key driver of demand. Since early-August, we

have seen modest improvements in market pricing for potash and all

signs point to a robust fall application season. Moreover, our

logistics and transportation advantages, as well as diversified

sales into other markets like feed, continue to help drive our

netbacks to levels above industry benchmark pricing.

While our financial results have experienced headwinds as we

work through higher carrying costs for our potash and Trio®, we

remain focused on improving our potash unit economics by means of

higher production. On this point, we've demonstrated very strong

project execution throughout the year and recently commissioned our

latest undertaking at HB, the Eddy Shaft Brine Extraction project.

This project serves as an important bridge to higher potash

production in the near-term as we are already extracting high-grade

brine that will start to meaningfully contribute to product tons

starting in the second half of next year.

We want to be clear that the capital spending for our potash

projects at HB, Moab, and Wendover is designed to have a long-term,

sustained impact on returning our potash production to historical

highs, but we do have the added benefit of also being able to

target near-term tons as we go through the normal brine injection,

extraction, and production cycle."

Segment Highlights

Potash

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

| |

|

(in thousands, except per ton data) |

| Sales |

|

$ |

27,602 |

|

$ |

42,354 |

|

$ |

127,363 |

|

$ |

147,622 |

| Gross margin |

|

$ |

3,411 |

|

$ |

19,872 |

|

$ |

30,716 |

|

$ |

73,862 |

| |

|

|

|

|

|

|

|

|

| Potash sales volumes (in

tons) |

|

|

46 |

|

|

46 |

|

|

213 |

|

|

172 |

| Potash production volumes (in

tons) |

|

|

43 |

|

|

36 |

|

|

145 |

|

|

164 |

| |

|

|

|

|

|

|

|

|

| Average potash net realized

sales price per ton(1) |

|

$ |

433 |

|

$ |

734 |

|

$ |

474 |

|

$ |

718 |

Potash segment sales in the third quarter of 2023 decreased 35%

to $27.6 million when compared to the same period in 2022. The

lower revenue was driven by a 41% decrease in our average net

realized sales price per ton to $433, which compares to $734 per

ton in the same prior year period. For the first nine months ended

September 30, 2023, our potash segment sales decreased 14% to

$127.4 million, with our higher sales volumes of 213 thousand tons

partially offsetting a 34% decrease in our average net realized

price to $474 per ton.

For the third quarter of 2023, segment gross margin totaled $3.4

million, which compares to $19.9 million in the third quarter of

2022, and for the first nine months ended September 30, 2023,

segment gross margin totaled $30.7 million, which compares to $73.9

million in the prior year period. The lower gross margin figures

were primarily driven by an increase in segment cost of goods sold

- which was due to higher sales volumes and an increase in our

weighted average carrying cost per ton - as well as lower potash

pricing in the first nine months of 2023 compared to the first nine

months of 2022.

Potash production totaled 43 thousand tons in the third quarter

of 2023, which compares to 36 thousand tons produced in the same

prior year period, while potash production for the first nine

months ended September 30, 2023 totaled 145 thousand tons, a

decrease from 164 thousand tons in the same prior year period.

Trio®

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

|

|

2023 |

|

|

|

2022 |

|

|

2023 |

|

|

|

2022 |

| |

|

(in thousands, except per ton data) |

| Sales |

|

$ |

22,030 |

|

|

$ |

24,043 |

|

$ |

81,052 |

|

|

$ |

100,561 |

| Gross (deficit) margin |

|

$ |

(4,290 |

) |

|

$ |

6,503 |

|

$ |

(1,617 |

) |

|

$ |

35,694 |

| |

|

|

|

|

|

|

|

|

| Trio® sales volume (in

tons) |

|

|

52 |

|

|

|

39 |

|

|

179 |

|

|

|

169 |

| Trio® production volume (in

tons) |

|

|

52 |

|

|

|

52 |

|

|

159 |

|

|

|

175 |

| |

|

|

|

|

|

|

|

|

| Average Trio® net realized

sales price per ton(1) |

|

$ |

298 |

|

|

$ |

488 |

|

$ |

329 |

|

|

$ |

482 |

Trio® segment sales of $22.0 million for the third quarter of

2023 were 8% lower compared to the same prior year period driven by

a lower average net realized sales price per ton of $298, a

decrease of 39% compared to the third quarter of 2022. This

decrease was partially offset by Trio® sales volumes increasing by

33% to 52 thousand tons. For the first nine months ended September

30, 2023, our Trio® segment sales decreased 19% to $81.1 million,

which was driven by a 32% decrease in our average net realized

price to $329 per ton.

For the third quarter of 2023, segment gross deficit totaled

$4.3 million, which compares to gross margin of $6.5 million in the

third quarter of 2022, and for the first nine months ended

September 30, 2023, segment gross deficit totaled $1.6 million,

which compares to gross margin of $35.7 million in the same prior

year period. The lower gross margin figures were primarily driven

by an increase in segment cost of goods sold and lower pricing.

Moreover, we recorded a lower of cost or net realizable value

inventory adjustment of $2.3 million in the third quarter of

2023.

Trio® production totaled 52 thousand tons in the third quarter

of 2023, which was flat compared to the prior year, while Trio®

production for the first nine months ended September 30, 2023

totaled 159 thousand tons, a decrease from 175 thousand tons in the

same prior year period. During the third quarter of 2023, we

experienced unplanned downtime during underground mining and at the

production mill, with these issues resulting in an estimated

production loss of approximately nine thousand tons. During the

first quarter of 2023, our East Facility experienced net unplanned

downtime of approximately eight days which also contributed to the

lower production during the first nine months of 2023.

Oilfield Solutions

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September

30, |

| |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

| |

|

(in thousands) |

| Sales |

|

$ |

4,904 |

|

$ |

8,423 |

|

$ |

14,265 |

|

$ |

22,936 |

| Gross margin |

|

$ |

1,370 |

|

$ |

395 |

|

$ |

3,126 |

|

$ |

6,201 |

Compared to the same period in 2022, our oilfield solutions

segment sales decreased $3.5 million in the third quarter of 2023,

due to a $4.2 million decrease in water sales, partially offset by

a $0.7 million increase in surface use, rights-of-way, and easement

revenues. While oil and gas activities near our Intrepid South

property remained strong during the third quarter of 2023, our

water sales decreased as we purchased less third-party water for

resale in the third quarter of 2023 when compared to the third

quarter of 2022.

Our cost of

goods sold decreased $4.5 million, or 56%, for the third quarter of

2023, compared to the same period in 2022, mainly due to decreased

water transportation costs and less third-party water purchased for

resale. Our gross margin for the third quarter of 2023 increased

$1.0 million compared to the third quarter of 2022.

For the first nine months of 2023, our oilfield solutions

segment sales decreased $8.7 million in the first nine months of

2023, compared to the same period in 2022, due to a $7.9 million

decrease in water sales, and a $1.3 million decrease in surface

use, rights-of-way and easement revenues, partially offset by a

$0.7 million increase in brine water sales.

LiquidityDuring the third quarter of 2023, cash

flow used in operations was $0.3 million, while cash used in

investing activities was $15.9 million. As of October 31, 2023, we

had approximately $7 million in cash and cash equivalents, $4

million in outstanding borrowings, and $146 million available to

borrow under our revolving credit facility, for total liquidity of

approximately $153 million.

Notes1 Adjusted net (loss) income, adjusted net

(loss) income per diluted share, adjusted earnings before interest,

taxes, depreciation, and amortization (or adjusted EBITDA) and

average net realized sales price per ton are non-GAAP financial

measures. See the non-GAAP reconciliations set forth later in this

press release for additional information.

Unless expressly stated otherwise or the context otherwise

requires, references to tons in this press release refer to short

tons. One short ton equals 2,000 pounds. One metric tonne, which

many international competitors use, equals 1,000 kilograms or

2,204.62 pounds.

Conference Call Information Intrepid will host

a conference call on Thursday, November 9, 2023, at 12:00 p.m.

Eastern Time to discuss the results and other operating and

financial matters and answer investor questions.

Management invites you to listen to the conference call by using

the U.S. toll-free dial-in number +1 (833) 470-1428 or

International dial-in number +1 (646) 904-5544; please use

participant access code 550193. The call will also be streamed on

the Intrepid website, intrepidpotash.com. A recording of the

conference call will be available approximately two hours after the

completion of the call by dialing +1 (866) 813-9403 for U.S.

toll-free, +1 (929) 458-6194 for International, or at

intrepidpotash.com. The replay of the call will require the input

of the replay access code 158078. The recording will be available

through November 16, 2023.

About Intrepid

Intrepid is a diversified mineral company that delivers

potassium, magnesium, sulfur, salt, and water products essential

for customer success in agriculture, animal feed, and the oil and

gas industry. Intrepid is the only U.S. producer of muriate of

potash, which is applied as an essential nutrient for healthy crop

development, utilized in several industrial applications, and used

as an ingredient in animal feed. In addition, Intrepid produces a

specialty fertilizer, Trio®, which delivers three key nutrients,

potassium, magnesium, and sulfate, in a single particle. Intrepid

also provides water, magnesium chloride, brine, and various

oilfield products and services. Intrepid serves diverse customers

in markets where a logistical advantage exists and is a leader in

the use of solar evaporation for potash production, resulting in

lower cost and more environmentally friendly production. Intrepid's

mineral production comes from three solar solution potash

facilities and one conventional underground Trio® mine.

Intrepid routinely posts important information, including

information about upcoming investor presentations and press

releases, on its website under the Investor Relations tab.

Investors and other interested parties are encouraged to enroll at

intrepidpotash.com, to receive automatic email alerts for new

postings.

Forward-looking Statements

This document contains forward-looking statements - that is,

statements about future, not past, events. The forward-looking

statements in this document relate to, among other things,

statements about Intrepid's future financial performance, cash flow

from operations expectations, water sales, production costs,

acquisition expectations and operating plans, and its market

outlook. These statements are based on assumptions that Intrepid

believes are reasonable. Forward-looking statements by their nature

address matters that are uncertain. The particular uncertainties

that could cause Intrepid's actual results to be materially

different from its forward-looking statements include the

following:

- changes in the price, demand, or supply of our products and

services;

- challenges and legal proceedings

related to our water rights;

- our ability to successfully identify

and implement any opportunities to grow our business whether

through expanded sales of water, Trio®, byproducts, and other

non-potassium related products or other revenue diversification

activities;

- the costs of, and our ability to

successfully execute, any strategic projects;

- declines or changes in agricultural

production or fertilizer application rates;

- declines in the use of

potassium-related products or water by oil and gas companies in

their drilling operations;

- our ability to prevail in

outstanding legal proceedings against us;

- our ability to comply with the terms

of our revolving credit facility, including the underlying

covenants;

- further write-downs of the carrying

value of assets, including inventories;

- circumstances that disrupt or limit

production, including operational difficulties or variances,

geological or geotechnical variances, equipment failures,

environmental hazards, and other unexpected events or

problems;

- changes in reserve estimates;

- currency fluctuations;

- adverse changes in economic

conditions or credit markets;

- the impact of governmental

regulations, including environmental and mining regulations, the

enforcement of those regulations, and governmental policy

changes;

- adverse weather events, including

events affecting precipitation and evaporation rates at our solar

solution mines;

- increased labor costs or

difficulties in hiring and retaining qualified employees and

contractors, including workers with mining, mineral processing, or

construction expertise;

- changes in the prices of raw

materials, including chemicals, natural gas, and power;

- our ability to obtain and maintain

any necessary governmental permits or leases relating to current or

future operations;

- interruptions in rail or truck

transportation services, or fluctuations in the costs of these

services;

- our inability to fund necessary

capital investments;

- global inflationary pressures and

supply chain challenges;

- the impact of global health issues,

such as the COVID-19 pandemic, and other global disruptions on our

business, operations, liquidity, financial condition and results of

operations; and

- the other risks, uncertainties, and

assumptions described in Item 1A. Risk Factors of our Annual Report

on Form 10-K for the year ended December 31, 2022.

In addition, new risks emerge from time to time. It is not

possible for Intrepid to predict all risks that may cause actual

results to differ materially from those contained in any

forward-looking statements Intrepid may make. All information in

this document speaks as of the date of this release. New

information or events after that date may cause our forward-looking

statements in this document to change. We undertake no obligation

to update or revise publicly any forward-looking statements to

conform the statements to actual results or to reflect new

information or future events.

Contact:Evan Mapes, CFA, Investor Relations

Manager Phone: 303-996-3042Email: evan.mapes@intrepidpotash.com

INTREPID POTASH,

INC.CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS (UNAUDITED)FOR THE THREE AND NINE

MONTHS ENDED SEPTEMBER 30, 2023 AND 2022 (In

thousands, except per share amounts)

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Sales |

|

$ |

54,465 |

|

|

$ |

74,752 |

|

|

$ |

222,420 |

|

|

$ |

270,891 |

|

| Less: |

|

|

|

|

|

|

|

|

|

Freight costs |

|

|

7,909 |

|

|

|

7,793 |

|

|

|

30,015 |

|

|

|

27,257 |

|

|

Warehousing and handling costs |

|

|

2,731 |

|

|

|

2,541 |

|

|

|

8,265 |

|

|

|

7,221 |

|

|

Cost of goods sold |

|

|

39,921 |

|

|

|

37,648 |

|

|

|

148,502 |

|

|

|

120,656 |

|

|

Lower of cost or net realizable value inventory adjustments |

|

|

3,413 |

|

|

|

— |

|

|

|

3,413 |

|

|

|

— |

|

| Gross

Margin |

|

|

491 |

|

|

|

26,770 |

|

|

|

32,225 |

|

|

|

115,757 |

|

| |

|

|

|

|

|

|

|

|

| Selling and

administrative |

|

|

7,685 |

|

|

|

8,551 |

|

|

|

24,491 |

|

|

|

22,558 |

|

| Accretion of asset retirement

obligation |

|

|

535 |

|

|

|

491 |

|

|

|

1,605 |

|

|

|

1,471 |

|

| Impairment of long-lived

assets |

|

|

521 |

|

|

|

— |

|

|

|

521 |

|

|

|

— |

|

| Loss on sale of assets |

|

|

59 |

|

|

|

10 |

|

|

|

252 |

|

|

|

1,176 |

|

| Other operating expense |

|

|

857 |

|

|

|

264 |

|

|

|

1,880 |

|

|

|

1,239 |

|

| Operating (Loss)

Income |

|

|

(9,166 |

) |

|

|

17,454 |

|

|

|

3,476 |

|

|

|

89,313 |

|

| |

|

|

|

|

|

|

|

|

| Other Income

(Expense) |

|

|

|

|

|

|

|

|

| Equity in earnings of

unconsolidated entities |

|

|

(54 |

) |

|

|

766 |

|

|

|

(292 |

) |

|

|

766 |

|

| Interest expense, net |

|

|

— |

|

|

|

(28 |

) |

|

|

— |

|

|

|

(85 |

) |

| Interest income |

|

|

88 |

|

|

|

77 |

|

|

|

249 |

|

|

|

94 |

|

| Other income (expense) |

|

|

19 |

|

|

|

(258 |

) |

|

|

75 |

|

|

|

281 |

|

| (Loss) Income Before

Income Taxes |

|

|

(9,113 |

) |

|

|

18,011 |

|

|

|

3,508 |

|

|

|

90,369 |

|

| |

|

|

|

|

|

|

|

|

| Income Tax Benefit

(Expense) |

|

|

1,917 |

|

|

|

(4,903 |

) |

|

|

(1,893 |

) |

|

|

(22,131 |

) |

| Net (Loss)

Income |

|

$ |

(7,196 |

) |

|

$ |

13,108 |

|

|

$ |

1,615 |

|

|

$ |

68,238 |

|

| |

|

|

|

|

|

|

|

|

| Weighted Average Shares

Outstanding: |

|

|

|

|

|

|

|

|

|

Basic |

|

|

12,789 |

|

|

|

13,256 |

|

|

|

12,750 |

|

|

|

13,221 |

|

|

Diluted |

|

|

12,789 |

|

|

|

13,489 |

|

|

|

12,876 |

|

|

|

13,567 |

|

| (Loss) Earnings Per

Share: |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.56 |

) |

|

$ |

0.99 |

|

|

$ |

0.13 |

|

|

$ |

5.16 |

|

|

Diluted |

|

$ |

(0.56 |

) |

|

$ |

0.97 |

|

|

$ |

0.13 |

|

|

$ |

5.03 |

|

INTREPID POTASH,

INC.CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)AS OF SEPTEMBER 30, 2023 AND DECEMBER

31, 2022(In thousands, except share and per share

amounts)

| |

|

September 30, |

|

December 31, |

| |

|

|

2023 |

|

|

|

2022 |

|

|

ASSETS |

|

|

|

|

| Cash and cash equivalents |

|

$ |

2,791 |

|

|

$ |

18,514 |

|

| Short-term investments |

|

|

3,463 |

|

|

|

5,959 |

|

| Accounts receivable: |

|

|

|

|

|

Trade, net |

|

|

24,091 |

|

|

|

26,737 |

|

|

Other receivables, net |

|

|

2,357 |

|

|

|

790 |

|

| Inventory, net |

|

|

108,360 |

|

|

|

114,816 |

|

| Prepaid expenses and other

current assets |

|

|

5,546 |

|

|

|

4,863 |

|

|

Total current assets |

|

|

146,608 |

|

|

|

171,679 |

|

| |

|

|

|

|

| Property, plant, equipment,

and mineral properties, net |

|

|

402,862 |

|

|

|

375,630 |

|

| Water rights |

|

|

19,184 |

|

|

|

19,184 |

|

| Long-term parts inventory,

net |

|

|

25,347 |

|

|

|

24,823 |

|

| Long-term investments |

|

|

7,930 |

|

|

|

9,841 |

|

| Other assets, net |

|

|

6,864 |

|

|

|

7,294 |

|

| Non-current deferred tax

asset, net |

|

|

183,996 |

|

|

|

185,752 |

|

| Total

Assets |

|

$ |

792,791 |

|

|

$ |

794,203 |

|

| |

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

| |

|

|

|

|

| Accounts payable |

|

$ |

8,756 |

|

|

$ |

18,645 |

|

| Accrued liabilities |

|

|

14,523 |

|

|

|

16,212 |

|

| Accrued employee compensation

and benefits |

|

|

8,047 |

|

|

|

6,975 |

|

| Other current liabilities |

|

|

6,871 |

|

|

|

7,044 |

|

|

Total current liabilities |

|

|

38,197 |

|

|

|

48,876 |

|

| |

|

|

|

|

| Advances on credit

facility |

|

|

2,000 |

|

|

|

— |

|

| Asset retirement obligation,

net of current portion |

|

|

28,169 |

|

|

|

26,564 |

|

| Operating lease

liabilities |

|

|

1,119 |

|

|

|

2,206 |

|

| Finance lease liabilities |

|

|

1,658 |

|

|

|

— |

|

| Other non-current

liabilities |

|

|

1,221 |

|

|

|

1,479 |

|

| Total

Liabilities |

|

|

72,364 |

|

|

|

79,125 |

|

| |

|

|

|

|

| Commitments and

Contingencies |

|

|

|

|

| Common stock, $0.001 par

value; 40,000,000 shares authorized; |

|

|

|

|

|

12,789,326 and 12,687,822 shares outstanding |

|

|

|

|

|

at September 30, 2023, and December 31, 2022, respectively |

|

|

13 |

|

|

|

13 |

|

| Additional paid-in

capital |

|

|

664,348 |

|

|

|

660,614 |

|

| Retained earnings |

|

|

78,078 |

|

|

|

76,463 |

|

| Less treasury stock, at

cost |

|

|

(22,012 |

) |

|

|

(22,012 |

) |

| Total Stockholders'

Equity |

|

|

720,427 |

|

|

|

715,078 |

|

| Total Liabilities and

Stockholders' Equity |

|

$ |

792,791 |

|

|

$ |

794,203 |

|

INTREPID POTASH,

INC.CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS (UNAUDITED)FOR THE THREE AND NINE MONTHS

ENDED SEPTEMBER 30, 2023 AND 2022(In

thousands)

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Cash Flows from

Operating Activities: |

|

|

|

|

|

|

|

|

| Net (loss) income |

|

$ |

(7,196 |

) |

|

$ |

13,108 |

|

|

$ |

1,615 |

|

|

$ |

68,238 |

|

| Adjustments to reconcile net

(loss) income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation, depletion and amortization |

|

|

10,122 |

|

|

|

8,362 |

|

|

|

28,305 |

|

|

|

25,285 |

|

|

Accretion of asset retirement obligation |

|

|

535 |

|

|

|

491 |

|

|

|

1,605 |

|

|

|

1,471 |

|

|

Amortization of deferred financing costs |

|

|

75 |

|

|

|

67 |

|

|

|

226 |

|

|

|

187 |

|

|

Amortization of intangible assets |

|

|

80 |

|

|

|

80 |

|

|

|

241 |

|

|

|

241 |

|

|

Stock-based compensation |

|

|

1,522 |

|

|

|

1,407 |

|

|

|

5,071 |

|

|

|

3,965 |

|

|

Lower of cost or net realizable value inventory adjustments |

|

|

3,413 |

|

|

|

— |

|

|

|

3,413 |

|

|

|

— |

|

|

Impairment of long-lived assets |

|

|

521 |

|

|

|

— |

|

|

|

521 |

|

|

|

— |

|

|

Loss on disposal of assets |

|

|

59 |

|

|

|

10 |

|

|

|

252 |

|

|

|

1,176 |

|

|

Allowance for doubtful accounts |

|

|

110 |

|

|

|

— |

|

|

|

110 |

|

|

|

— |

|

|

Allowance for parts inventory obsolescence |

|

|

140 |

|

|

|

150 |

|

|

|

140 |

|

|

|

1,750 |

|

|

Equity in earnings of unconsolidated entities |

|

|

54 |

|

|

|

(766 |

) |

|

|

292 |

|

|

|

(766 |

) |

|

Distribution of earnings from unconsolidated entities |

|

|

— |

|

|

|

— |

|

|

|

452 |

|

|

|

— |

|

| Changes in operating assets

and liabilities: |

|

|

|

|

|

|

|

|

|

Trade accounts receivable, net |

|

|

(381 |

) |

|

|

(5,590 |

) |

|

|

2,536 |

|

|

|

(2,820 |

) |

|

Other receivables, net |

|

|

(700 |

) |

|

|

(465 |

) |

|

|

(1,659 |

) |

|

|

(1,111 |

) |

|

Inventory, net |

|

|

(8,384 |

) |

|

|

(13,195 |

) |

|

|

2,379 |

|

|

|

(15,954 |

) |

|

Prepaid expenses and other current assets |

|

|

(1,804 |

) |

|

|

(2,177 |

) |

|

|

(898 |

) |

|

|

(1,504 |

) |

|

Deferred tax assets, net |

|

|

(1,920 |

) |

|

|

4,607 |

|

|

|

1,756 |

|

|

|

21,548 |

|

|

Accounts payable, accrued liabilities, and accrued employee

compensation and benefits |

|

|

2,916 |

|

|

|

12,411 |

|

|

|

(5,216 |

) |

|

|

999 |

|

|

Operating lease liabilities |

|

|

(409 |

) |

|

|

(386 |

) |

|

|

(1,218 |

) |

|

|

(1,619 |

) |

|

Other liabilities |

|

|

924 |

|

|

|

(32,231 |

) |

|

|

(1,298 |

) |

|

|

(31,974 |

) |

|

Net cash (used in) provided by operating activities |

|

|

(323 |

) |

|

|

(14,117 |

) |

|

|

38,625 |

|

|

|

69,112 |

|

| |

|

|

|

|

|

|

|

|

| Cash Flows from

Investing Activities: |

|

|

|

|

|

|

|

|

|

Additions to property, plant, equipment, mineral properties and

other assets |

|

|

(16,550 |

) |

|

|

(14,326 |

) |

|

|

(58,484 |

) |

|

|

(37,100 |

) |

|

Purchase of investments |

|

|

— |

|

|

|

(1,965 |

) |

|

|

(1,415 |

) |

|

|

(12,864 |

) |

|

Proceeds from sale of assets |

|

|

36 |

|

|

|

— |

|

|

|

125 |

|

|

|

46 |

|

|

Proceeds from redemptions/maturities of investments |

|

|

500 |

|

|

|

1,504 |

|

|

|

4,500 |

|

|

|

1,504 |

|

|

Other investing, net |

|

|

160 |

|

|

|

— |

|

|

|

668 |

|

|

|

— |

|

|

Net cash used in investing activities |

|

|

(15,854 |

) |

|

|

(14,787 |

) |

|

|

(54,606 |

) |

|

|

(48,414 |

) |

| |

|

|

|

|

|

|

|

|

| Cash Flows from

Financing Activities: |

|

|

|

|

|

|

|

|

|

Payments of financing lease |

|

|

(189 |

) |

|

|

— |

|

|

|

(399 |

) |

|

|

— |

|

|

Proceeds from short-term borrowings on credit facility |

|

|

2,000 |

|

|

|

— |

|

|

|

7,000 |

|

|

|

— |

|

|

Repayments of short-term borrowings on credit facility |

|

|

— |

|

|

|

— |

|

|

|

(5,000 |

) |

|

|

— |

|

|

Capitalized debt fees |

|

|

— |

|

|

|

(933 |

) |

|

|

— |

|

|

|

(933 |

) |

|

Employee tax withholding paid for restricted stock upon

vesting |

|

|

— |

|

|

|

— |

|

|

|

(1,337 |

) |

|

|

(4,362 |

) |

|

Repurchases of common stock |

|

|

— |

|

|

|

(2,881 |

) |

|

|

— |

|

|

|

(2,881 |

) |

|

Proceeds from exercise of stock options |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

110 |

|

|

Net cash provided by (used in) financing activities |

|

|

1,811 |

|

|

|

(3,814 |

) |

|

|

264 |

|

|

|

(8,066 |

) |

| |

|

|

|

|

|

|

|

|

| Net Change in Cash,

Cash Equivalents and Restricted Cash |

|

|

(14,366 |

) |

|

|

(32,718 |

) |

|

|

(15,717 |

) |

|

|

12,632 |

|

| Cash, Cash Equivalents

and Restricted Cash, beginning of period |

|

|

17,733 |

|

|

|

82,496 |

|

|

|

19,084 |

|

|

|

37,146 |

|

| Cash, Cash Equivalents

and Restricted Cash, end of period |

|

$ |

3,367 |

|

|

$ |

49,778 |

|

|

$ |

3,367 |

|

|

$ |

49,778 |

|

To supplement Intrepid's consolidated financial statements,

which are prepared and presented in accordance with GAAP, Intrepid

uses several non-GAAP financial measures to monitor and evaluate

its performance. These non-GAAP financial measures include adjusted

net (loss) income, adjusted net (loss) income per diluted share,

adjusted EBITDA, and average net realized sales price per ton.

These non-GAAP financial measures should not be considered in

isolation, or as a substitute for, or superior to, the financial

information prepared and presented in accordance with GAAP. In

addition, because the presentation of these non-GAAP financial

measures varies among companies, these non-GAAP financial measures

may not be comparable to similarly titled measures used by other

companies.

Intrepid believes these non-GAAP financial measures provide

useful information to investors for analysis of its business.

Intrepid uses these non-GAAP financial measures as one of its tools

in comparing period-over-period performance on a consistent basis

and when planning, forecasting, and analyzing future periods.

Intrepid believes these non-GAAP financial measures are used by

professional research analysts and others in the valuation,

comparison, and investment recommendations of companies in the

potash mining industry. Many investors use the published research

reports of these professional research analysts and others in

making investment decisions.

Adjusted Net (Loss) Income and Adjusted Net (Loss)

Income Per Diluted Share

Adjusted net (loss) income and adjusted net (loss) income per

diluted share are calculated as net (loss) income or net (loss)

income per diluted share adjusted for certain items that impact the

comparability of results from period to period, as set forth in the

reconciliation below. Intrepid considers these non-GAAP financial

measures to be useful because they allow for period-to-period

comparisons of its operating results excluding items that Intrepid

believes are not indicative of its fundamental ongoing

operations.

Reconciliation of Net (Loss) Income to Adjusted Net (Loss)

Income:

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| |

(in thousands) |

| Net (Loss) Income |

$ |

(7,196 |

) |

|

$ |

13,108 |

|

|

$ |

1,615 |

|

|

$ |

68,238 |

|

| Adjustments |

|

|

|

|

|

|

|

| Impairment of long-lived

assets |

|

521 |

|

|

|

— |

|

|

|

521 |

|

|

|

— |

|

| Loss on sale of assets |

|

59 |

|

|

|

10 |

|

|

|

252 |

|

|

|

1,176 |

|

| Calculated income tax

effect(1) |

|

(151 |

) |

|

|

(3 |

) |

|

|

(201 |

) |

|

|

(306 |

) |

| Total adjustments |

|

429 |

|

|

|

7 |

|

|

|

572 |

|

|

|

870 |

|

| Adjusted Net (Loss)

Income |

$ |

(6,767 |

) |

|

$ |

13,115 |

|

|

$ |

2,187 |

|

|

$ |

69,108 |

|

Reconciliation of Net (Loss) Income per Share to Adjusted Net

(Loss) Income per Share:

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

|

2023 |

|

|

|

2022 |

|

|

2023 |

|

|

|

2022 |

|

| Net (Loss) Income Per Diluted

Share |

$ |

(0.56 |

) |

|

$ |

0.97 |

|

$ |

0.13 |

|

|

$ |

5.03 |

|

| Adjustments |

|

|

|

|

|

|

|

| Impairment of long-lived

assets |

|

0.04 |

|

|

|

— |

|

|

0.04 |

|

|

|

— |

|

| Loss on sale of assets |

|

— |

|

|

|

— |

|

|

0.02 |

|

|

|

0.09 |

|

| Calculated income tax

effect(1) |

|

(0.01 |

) |

|

|

— |

|

|

(0.02 |

) |

|

|

(0.02 |

) |

| Total adjustments |

|

0.03 |

|

|

|

— |

|

|

0.04 |

|

|

|

0.07 |

|

| Adjusted Net (Loss) Income Per

Diluted Share |

$ |

(0.53 |

) |

|

$ |

0.97 |

|

$ |

0.17 |

|

|

$ |

5.10 |

|

(1) Assumes an annual effective tax rate of 26%

for 2023 and 2022.

Adjusted EBITDA

Adjusted earnings before interest, taxes, depreciation, and

amortization (or adjusted EBITDA) is calculated as net (loss)

income adjusted for certain items that impact the comparability of

results from period to period, as set forth in the reconciliation

below. Intrepid considers adjusted EBITDA to be useful, and believe

it to be useful for investors, because the measure reflects

Intrepid's operating performance before the effects of certain

non-cash items and other items that Intrepid believes are not

indicative of its core operations. Intrepid uses adjusted EBITDA to

assess operating performance.

Reconciliation of Net (Loss) Income to Adjusted EBITDA:

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

|

|

2023 |

|

|

|

2022 |

|

|

2023 |

|

|

2022 |

| |

|

(in thousands) |

| Net (Loss) Income |

|

$ |

(7,196 |

) |

|

$ |

13,108 |

|

$ |

1,615 |

|

$ |

68,238 |

| Impairment of long-lived

assets |

|

|

521 |

|

|

|

— |

|

|

521 |

|

|

— |

| Loss on sale of assets |

|

|

59 |

|

|

|

10 |

|

|

252 |

|

|

1,176 |

| Interest expense |

|

|

— |

|

|

|

28 |

|

|

— |

|

|

85 |

| Income tax (benefit)

expense |

|

|

(1,917 |

) |

|

|

4,903 |

|

|

1,893 |

|

|

22,131 |

| Depreciation, depletion, and

amortization |

|

|

10,122 |

|

|

|

8,362 |

|

|

28,305 |

|

|

25,285 |

| Amortization of intangible

assets |

|

|

80 |

|

|

|

80 |

|

|

241 |

|

|

241 |

| Accretion of asset retirement

obligation |

|

|

535 |

|

|

|

491 |

|

|

1,605 |

|

|

1,471 |

| Total adjustments |

|

|

9,400 |

|

|

|

13,874 |

|

|

32,817 |

|

|

50,389 |

| Adjusted EBITDA |

|

$ |

2,204 |

|

|

$ |

26,982 |

|

$ |

34,432 |

|

$ |

118,627 |

Average Potash and Trio®

Net Realized Sales Price per Ton

Average net realized sales price per ton for potash is

calculated as potash segment sales less potash segment byproduct

sales and potash freight costs and then dividing that difference by

the number of tons of potash sold in the period. Likewise, average

net realized sales price per ton for Trio® is calculated as Trio®

segment sales less Trio® segment byproduct sales and Trio® freight

costs and then dividing that difference by Trio® tons sold.

Intrepid considers average net realized sales price per ton to be

useful, and believe it to be useful for investors, because it shows

Intrepid's potash and Trio® average per ton pricing without the

effect of certain transportation and delivery costs. When Intrepid

arranges transportation and delivery for a customer, it includes in

revenue and in freight costs the costs associated with

transportation and delivery. However, some of Intrepid's customers

arrange for and pay their own transportation and delivery costs, in

which case these costs are not included in Intrepid's revenue and

freight costs. Intrepid uses average net realized sales price per

ton as a key performance indicator to analyze potash and Trio®

sales and price trends.

Reconciliation of Sales to Average Net Realized Sales Price per

Ton:

| |

|

Three Months Ended September 30, |

| |

|

|

2023 |

|

|

2022 |

| (in thousands, except per ton

amounts) |

|

Potash |

|

Trio® |

|

Potash |

|

Trio® |

| Total Segment Sales |

|

$ |

27,602 |

|

$ |

22,030 |

|

$ |

42,354 |

|

$ |

24,043 |

| Less: Segment byproduct

sales |

|

|

5,622 |

|

|

1,425 |

|

|

6,177 |

|

|

885 |

| Freight costs |

|

|

2,057 |

|

|

5,086 |

|

|

2,430 |

|

|

4,135 |

| Subtotal |

|

$ |

19,923 |

|

$ |

15,519 |

|

$ |

33,747 |

|

$ |

19,023 |

| |

|

|

|

|

|

|

|

|

| Divided by: |

|

|

|

|

|

|

|

|

| Tons sold |

|

|

46 |

|

|

52 |

|

|

46 |

|

|

39 |

| Average net realized sales

price per ton |

|

$ |

433 |

|

$ |

298 |

|

$ |

734 |

|

$ |

488 |

| |

|

|

|

|

|

|

|

|

| |

|

Nine Months Ended September 30, |

| |

|

|

2023 |

|

|

2022 |

| (in thousands, except per ton

amounts) |

|

Potash |

|

Trio® |

|

Potash |

|

Trio® |

| Total Segment Sales |

|

$ |

127,363 |

|

$ |

81,052 |

|

$ |

147,622 |

|

$ |

100,561 |

| Less: Segment byproduct

sales |

|

|

17,122 |

|

|

4,165 |

|

|

15,938 |

|

|

3,100 |

| Freight costs |

|

|

9,321 |

|

|

18,038 |

|

|

8,117 |

|

|

16,054 |

| Subtotal |

|

$ |

100,920 |

|

$ |

58,849 |

|

$ |

123,567 |

|

$ |

81,407 |

| |

|

|

|

|

|

|

|

|

| Divided by: |

|

|

|

|

|

|

|

|

| Tons sold |

|

|

213 |

|

|

179 |

|

|

172 |

|

|

169 |

| Average net realized sales

price per ton |

|

$ |

474 |

|

$ |

329 |

|

$ |

718 |

|

$ |

482 |

| |

|

|

|

|

|

|

|

|

| |

|

Three Months Ended September 30, 2023 |

|

Product |

|

Potash Segment |

|

Trio®

Segment |

|

Oilfield Solutions Segment |

|

Intersegment Eliminations |

|

Total |

|

Potash |

|

$ |

21,980 |

|

$ |

— |

|

$ |

— |

|

$ |

(71 |

) |

|

$ |

21,909 |

| Trio® |

|

|

— |

|

|

20,605 |

|

|

— |

|

|

— |

|

|

|

20,605 |

| Water |

|

|

48 |

|

|

1,368 |

|

|

1,133 |

|

|

— |

|

|

|

2,549 |

| Salt |

|

|

2,676 |

|

|

57 |

|

|

— |

|

|

— |

|

|

|

2,733 |

| Magnesium Chloride |

|

|

2,035 |

|

|

— |

|

|

— |

|

|

— |

|

|

|

2,035 |

| Brine Water |

|

|

863 |

|

|

— |

|

|

1,030 |

|

|

— |

|

|

|

1,893 |

| Other |

|

|

— |

|

|

— |

|

|

2,741 |

|

|

— |

|

|

|

2,741 |

| Total Revenue |

|

$ |

27,602 |

|

$ |

22,030 |

|

$ |

4,904 |

|

$ |

(71 |

) |

|

$ |

54,465 |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

Nine Months Ended September 30, 2023 |

|

Product |

|

Potash Segment |

|

Trio®

Segment |

|

Oilfield Solutions Segment |

|

Intersegment Eliminations |

|

Total |

|

Potash |

|

$ |

110,241 |

|

$ |

— |

|

$ |

— |

|

$ |

(260 |

) |

|

$ |

109,981 |

| Trio® |

|

|

— |

|

|

76,887 |

|

|

— |

|

|

— |

|

|

|

76,887 |

| Water |

|

|

228 |

|

|

3,890 |

|

|

5,320 |

|

|

— |

|

|

|

9,438 |

| Salt |

|

|

8,997 |

|

|

275 |

|

|

— |

|

|

— |

|

|

|

9,272 |

| Magnesium Chloride |

|

|

4,839 |

|

|

— |

|

|

— |

|

|

— |

|

|

|

4,839 |

| Brine Water |

|

|

3,058 |

|

|

— |

|

|

2,853 |

|

|

— |

|

|

|

5,911 |

| Other |

|

|

— |

|

|

— |

|

|

6,092 |

|

|

— |

|

|

|

6,092 |

| Total Revenue |

|

$ |

127,363 |

|

$ |

81,052 |

|

$ |

14,265 |

|

$ |

(260 |

) |

|

$ |

222,420 |

| |

|

Three Months Ended September 30, 2022 |

|

Product |

|

Potash Segment |

|

Trio®

Segment |

|

Oilfield Solutions Segment |

|

Intersegment Eliminations |

|

Total |

|

Potash |

|

$ |

36,177 |

|

$ |

— |

|

$ |

— |

|

$ |

(68 |

) |

|

$ |

36,109 |

| Trio® |

|

|

— |

|

|

23,158 |

|

|

— |

|

|

— |

|

|

|

23,158 |

| Water |

|

|

427 |

|

|

796 |

|

|

5,380 |

|

|

— |

|

|

|

6,603 |

| Salt |

|

|

2,845 |

|

|

89 |

|

|

— |

|

|

— |

|

|

|

2,934 |

| Magnesium Chloride |

|

|

2,008 |

|

|

— |

|

|

— |

|

|

— |

|

|

|

2,008 |

| Brine Water |

|

|

897 |

|

|

— |

|

|

792 |

|

|

— |

|

|

|

1,689 |

| Other |

|

|

— |

|

|

— |

|

|

2,251 |

|

|

— |

|

|

|

2,251 |

| Total Revenue |

|

$ |

42,354 |

|

$ |

24,043 |

|

$ |

8,423 |

|

$ |

(68 |

) |

|

$ |

74,752 |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

Nine Months Ended September 30, 2022 |

|

Product |

|

Potash Segment |

|

Trio® Segment |

|

Oilfield Solutions Segment |

|

Intersegment Eliminations |

|

Total |

|

Potash |

|

$ |

131,684 |

|

$ |

— |

|

$ |

— |

|

$ |

(228 |

) |

|

$ |

131,456 |

| Trio® |

|

|

— |

|

|

97,461 |

|

|

— |

|

|

— |

|

|

|

97,461 |

| Water |

|

|

1,564 |

|

|

2,722 |

|

|

13,260 |

|

|

— |

|

|

|

17,546 |

| Salt |

|

|

8,137 |

|

|

378 |

|

|

— |

|

|

— |

|

|

|

8,515 |

| Magnesium Chloride |

|

|

4,022 |

|

|

— |

|

|

— |

|

|

— |

|

|

|

4,022 |

| Brine Water |

|

|

2,215 |

|

|

— |

|

|

2,179 |

|

|

— |

|

|

|

4,394 |

| Other |

|

|

— |

|

|

— |

|

|

7,497 |

|

|

— |

|

|

|

7,497 |

| Total Revenue |

|

$ |

147,622 |

|

$ |

100,561 |

|

$ |

22,936 |

|

$ |

(228 |

) |

|

$ |

270,891 |

| Three Months

EndedSeptember 30, 2023 |

|

Potash |

|

Trio® |

|

Oilfield Solutions |

|

Other |

|

Consolidated |

| Sales |

|

$ |

27,602 |

|

$ |

22,030 |

|

|

$ |

4,904 |

|

$ |

(71 |

) |

|

$ |

54,465 |

| Less: Freight costs |

|

|

2,894 |

|

|

5,086 |

|

|

|

— |

|

|

(71 |

) |

|

|

7,909 |

| Warehousing and handling

costs |

|

|

1,541 |

|

|

1,190 |

|

|

|

— |

|

|

— |

|

|

|

2,731 |

| Cost of goods sold |

|

|

18,673 |

|

|

17,714 |

|

|

|

3,534 |

|

|

— |

|

|

|

39,921 |

| Lower of cost or net

realizable value inventory adjustments |

|

|

1,083 |

|

|

2,330 |

|

|

|

— |

|

|

— |

|

|

|

3,413 |

| Gross Margin (Deficit) |

|

$ |

3,411 |

|

$ |

(4,290 |

) |

|

$ |

1,370 |

|

$ |

— |

|

|

$ |

491 |

| Depreciation, depletion, and

amortization incurred1 |

|

$ |

7,272 |

|

$ |

1,754 |

|

|

$ |

950 |

|

$ |

226 |

|

|

$ |

10,202 |

| |

|

|

|

|

|

|

|

|

|

|

| Nine Months Ended

September 30, 2023 |

|

Potash |

|

Trio® |

|

Oilfield Solutions |

|

Other |

|

Consolidated |

| Sales |

|

$ |

127,363 |

|

$ |

81,052 |

|

|

$ |

14,265 |

|

$ |

(260 |

) |

|

$ |

222,420 |

| Less: Freight costs |

|

|

12,237 |

|

|

18,038 |

|

|

|

— |

|

|

(260 |

) |

|

|

30,015 |

| Warehousing and handling

costs |

|

|

4,630 |

|

|

3,635 |

|

|

|

— |

|

|

— |

|

|

|

8,265 |

| Cost of goods sold |

|

|

78,697 |

|

|

58,666 |

|

|

|

11,139 |

|

|

— |

|

|

|

148,502 |

| Lower of cost or net

realizable value inventory adjustments |

|

|

1,083 |

|

|

2,330 |

|

|

|

— |

|

|

— |

|

|

|

3,413 |

| Gross Margin (Deficit) |

|

$ |

30,716 |

|

$ |

(1,617 |

) |

|

$ |

3,126 |

|

$ |

— |

|

|

$ |

32,225 |

| Depreciation, depletion, and

amortization incurred1 |

|

$ |

20,753 |

|

$ |

4,365 |

|

|

$ |

2,772 |

|

$ |

656 |

|

|

$ |

28,546 |

| |

|

|

|

|

|

|

|

|

|

|

| Three Months

Ended September 30, 2022 |

|

Potash |

|

Trio® |

|

Oilfield Solutions |

|

Other |

|

Consolidated |

| Sales |

|

$ |

42,354 |

|

$ |

24,043 |

|

|

$ |

8,423 |

|

$ |

(68 |

) |

|

$ |

74,752 |

| Less: Freight costs |

|

|

3,726 |

|

|

4,135 |

|

|

|

— |

|

|

(68 |

) |

|

|

7,793 |

| Warehousing and handling

costs |

|

|

1,414 |

|

|

1,127 |

|

|

|

— |

|

|

— |

|

|

|

2,541 |

| Cost of goods sold |

|

|

17,342 |

|

|

12,278 |

|

|

|

8,028 |

|

|

— |

|

|

|

37,648 |

| Gross Margin |

|

$ |

19,872 |

|

$ |

6,503 |

|

|

$ |

395 |

|

$ |

— |

|

|

$ |

26,770 |

| Depreciation, depletion, and

amortization incurred1 |

|

$ |

6,318 |

|

$ |

1,072 |

|

|

$ |

867 |

|

$ |

185 |

|

|

$ |

8,442 |

| |

|

|

|

|

|

|

|

|

|

|

| Nine Months Ended

September 30, 2022 |

|

Potash |

|

Trio® |

|

Oilfield Solutions |

|

Other |

|

Consolidated |

| Sales |

|

$ |

147,622 |

|

$ |

100,561 |

|

|

$ |

22,936 |

|

$ |

(228 |

) |

|

$ |

270,891 |

| Less: Freight costs |

|

|

11,430 |

|

|

16,055 |

|

|

|

— |

|

|

(228 |

) |

|

|

27,257 |

| Warehousing and handling

costs |

|

|

3,947 |

|

|

3,274 |

|

|

|

— |

|

|

— |

|

|

|

7,221 |

| Cost of goods sold |

|

|

58,383 |

|

|

45,538 |

|

|

|

16,735 |

|

|

— |

|

|

|

120,656 |

| Gross Margin |

|

$ |

73,862 |

|

$ |

35,694 |

|

|

$ |

6,201 |

|

$ |

— |

|

|

$ |

115,757 |

| Depreciation, depletion and

amortization incurred1 |

|

$ |

19,350 |

|

$ |

3,122 |

|

|

$ |

2,458 |

|

$ |

596 |

|

|

$ |

25,526 |

(1) Depreciation, depletion, and amortization incurred for

potash and Trio® excludes depreciation, depletion, and amortization

amounts absorbed in or relieved from inventory.

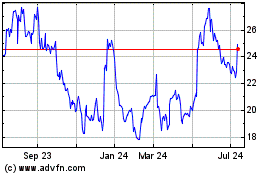

Intrepid Potash (NYSE:IPI)

Historical Stock Chart

From Dec 2024 to Jan 2025

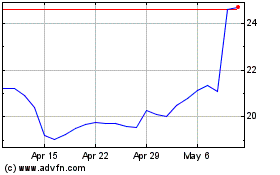

Intrepid Potash (NYSE:IPI)

Historical Stock Chart

From Jan 2024 to Jan 2025