Current Report Filing (8-k)

January 25 2023 - 4:16PM

Edgar (US Regulatory)

0000051143falseCapital stock, par value $.20 per shareIBMCHX0000051143exch:XNYSus-gaap:CommonStockMember2023-01-252023-01-250000051143exch:XNYSibm:Notes2.875PercentDue2025Member2023-01-252023-01-250000051143exch:XNYSibm:Notes1.750PercentDue2031Member2023-01-252023-01-250000051143exch:XNYSibm:Notes1.750PercentDue2028Member2023-01-252023-01-250000051143exch:XNYSibm:Notes1.500PercentDue2029Member2023-01-252023-01-250000051143exch:XNYSibm:Notes1.25PercentDue2023Member2023-01-252023-01-250000051143exch:XNYSibm:Notes1.250PercentDue2034Member2023-01-252023-01-250000051143exch:XNYSibm:Notes1.250PercentDue2027Member2023-01-252023-01-250000051143exch:XNYSibm:Notes1.200PercentDue2040Member2023-01-252023-01-250000051143exch:XNYSibm:Notes1.125PercentDue2024Member2023-01-252023-01-250000051143exch:XNYSibm:Notes0.950PercentDue2025Member2023-01-252023-01-250000051143exch:XNYSibm:Notes0.875PercentDue2030Member2023-01-252023-01-250000051143exch:XNYSibm:Notes0.875PercentDue2025Member2023-01-252023-01-250000051143exch:XNYSibm:Notes0.650PercentDue2032Member2023-01-252023-01-250000051143exch:XNYSibm:Notes0.375PercentDue2023Member2023-01-252023-01-250000051143exch:XNYSibm:Notes0.300PercentDue2028Member2023-01-252023-01-250000051143exch:XNYSibm:Notes0.300PercentDue2026Member2023-01-252023-01-250000051143exch:XNYSibm:Debentures7.125PercentDue2096Member2023-01-252023-01-250000051143exch:XNYSibm:Debentures7.00PercentDue2045Member2023-01-252023-01-250000051143exch:XNYSibm:Debentures7.00PercentDue2025Member2023-01-252023-01-250000051143exch:XNYSibm:Debentures6.50PercentDue2028Member2023-01-252023-01-250000051143exch:XNYSibm:Debentures6.22PercentDue2027Member2023-01-252023-01-250000051143exch:XNYSibm:Debentures5.875PercentDue2032Member2023-01-252023-01-250000051143exch:XCHIus-gaap:CommonStockMember2023-01-252023-01-2500000511432023-01-252023-01-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15 (d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: January 25, 2023

(Date of earliest event reported)

INTERNATIONAL BUSINESS MACHINES CORPORATION

(Exact name of registrant as specified in its charter)

| | | | |

New York | | 1-2360 | | 13-0871985 |

(State of Incorporation) | | (Commission File Number) | | (IRS employer Identification No.) |

| | |

One New Orchard Road Armonk, New York | | 10504 |

(Address of principal executive offices) | | (Zip Code) |

914-499-1900

(Registrant’s telephone number)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of each class | | Trading symbol(s) | | Name of each exchange

on which registered |

Capital stock, par value $.20 per share | | IBM | | New York Stock Exchange |

| | | | NYSE Chicago |

1.250% Notes due 2023 | | IBM 23A | | New York Stock Exchange |

0.375% Notes due 2023 | | IBM 23B | | New York Stock Exchange |

1.125% Notes due 2024 | | IBM 24A | | New York Stock Exchange |

2.875% Notes due 2025 | | IBM 25A | | New York Stock Exchange |

0.950% Notes due 2025 | | IBM 25B | | New York Stock Exchange |

0.875% Notes due 2025 | | IBM 25C | | New York Stock Exchange |

0.300% Notes due 2026 | | IBM 26B | | New York Stock Exchange |

1.250% Notes due 2027 | | IBM 27B | | New York Stock Exchange |

0.300% Notes due 2028 | | IBM 28B | | New York Stock Exchange |

1.750% Notes due 2028 | | IBM 28A | | New York Stock Exchange |

1.500% Notes due 2029 | | IBM 29 | | New York Stock Exchange |

0.875% Notes due 2030 | | IBM 30 | | New York Stock Exchange |

1.750% Notes due 2031 | | IBM 31 | | New York Stock Exchange |

0.650% Notes due 2032 | | IBM 32A | | New York Stock Exchange |

1.250% Notes due 2034 | | IBM 34 | | New York Stock Exchange |

1.200% Notes due 2040 | | IBM 40 | | New York Stock Exchange |

7.00% Debentures due 2025 | | IBM 25 | | New York Stock Exchange |

6.22% Debentures due 2027 | | IBM 27 | | New York Stock Exchange |

6.50% Debentures due 2028 | | IBM 28 | | New York Stock Exchange |

5.875% Debentures due 2032 | | IBM 32D | | New York Stock Exchange |

7.00% Debentures due 2045 | | IBM 45 | | New York Stock Exchange |

7.125% Debentures due 2096 | | IBM 96 | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

The registrant’s press release dated January 25, 2023, regarding its financial results for the periods ended December 31, 2022, including consolidated financial statements for the periods ended December 31, 2022, is Exhibit 99.1 of this Form 8-K.

In an effort to provide investors with additional information regarding the company’s results as determined by generally accepted accounting principles (GAAP), the company has disclosed in the attached press release certain non-GAAP information which management believes provides useful information to investors. Reconciliations of these non-GAAP financial measures to the most directly comparable financial measures calculated and presented in accordance with GAAP are included in the press release, which is Exhibit 99.1 to this Form 8-K. The rationale for management’s use of non-GAAP measures is included in Exhibit 99.2 to this Form 8-K.

The information in this Item 2.02, including the corresponding Exhibits 99.1 and 99.2, is being furnished with the Commission and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

The following exhibits are being furnished as part of this report:

The following exhibit is being filed as part of this report:

| | |

Exhibit No. | | Description of Exhibit |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL Document) |

IBM’s web site (www.ibm.com) contains a significant amount of information about IBM, including financial and other information for investors (www.ibm.com/investor/). IBM encourages investors to visit its various web sites from time to time, as information is updated and new information is posted.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | |

Date: January 25, 2023 | |

| |

| | |

| By: | /s/ Robert F. Del Bene |

| | Robert F. Del Bene |

| | Vice President and Controller |

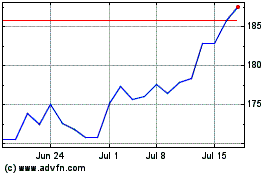

International Business M... (NYSE:IBM)

Historical Stock Chart

From Mar 2024 to Apr 2024

International Business M... (NYSE:IBM)

Historical Stock Chart

From Apr 2023 to Apr 2024