0001609550False00016095502023-11-072023-11-07

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________

FORM 8-K

_________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 7, 2023

_________________________

INSPIRE MEDICAL SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

_________________________ | | | | | | | | | | | | | | |

| Delaware | | 001-38468 | | 26-1377674 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

5500 Wayzata Blvd., Suite 1600

Golden Valley, Minnesota 55416

(Address of principal executive offices) (Zip Code)

(844) 672-4357

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.001 par value per share | | INSP | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 7, 2023, Inspire Medical Systems, Inc. (the “Company”) issued a press release announcing its financial results for the quarter ended September 30, 2023. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in Item 2.02 of this Current Report on Form 8-K (“Form 8-K”) (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | INSPIRE MEDICAL SYSTEMS, INC. |

| | |

| Date: | November 7, 2023 | By: | /s/ Richard J. Buchholz |

| | | Richard J. Buchholz |

| | | Chief Financial Officer |

Exhibit 99.1

Inspire Medical Systems, Inc. Announces Third Quarter 2023 Financial Results and Updates 2023 Outlook

Inspire Reports Year-over-Year Revenue Growth of 40% in the Third Quarter

MINNEAPOLIS, Minnesota - November 7, 2023 - Inspire Medical Systems, Inc. (NYSE: INSP) (Inspire), a medical technology company focused on the development and commercialization of innovative, minimally invasive solutions for patients with obstructive sleep apnea (OSA), today reported financial results for the quarter ended September 30, 2023.

Recent Business Highlights

•Generated revenue of $153.3 million in the third quarter of 2023, a 40% increase over the same quarter last year

•Achieved gross margin of 84.1% in the third quarter of 2023

•Reduced loss per share to 29 cents compared to 60 cents in the prior year period

•Activated 62 new centers in the U.S. in the third quarter of 2023, bringing the total to 1,107 U.S. medical centers providing Inspire therapy

•Created 13 new U.S. sales territories in the third quarter of 2023, bringing the total to 274 U.S. sales territories

•Surpassed 50,000 patients treated with Inspire therapy

"We are pleased with our strong performance in the third quarter, growing revenue 40% year-over-year. Our growth continues to be driven primarily by higher utilization at existing sites and was complemented by the addition of 62 new implanting centers and 13 new U.S. sales territories," said Tim Herbert, President, and Chief Executive Officer of Inspire Medical Systems. "During the quarter, we achieved several important milestones, including surpassing 50,000 patients implanted with Inspire therapy and we also made significant progress with market access by expanding coverage policies with several large national health plans to include our recently expanded indications."

“Early in the year, we implemented a pilot program regarding prior authorization submissions by our customers, and in tracking the results of the program, we observed a decline in prior authorization submissions for patients seeking Inspire therapy,” continued Mr. Herbert. “After recognizing this trend, we reinvigorated our efforts to facilitate patient access to Inspire therapy by more closely engaging with our customers with the prior authorization submission process, including involving our corporate prior authorization team to assure consistency and accuracy of submissions. These challenges had a short-term impact on the number of implant procedures early in the third quarter, but the increase in patient prior authorizations at the end of the quarter reinforces our confidence in the fourth quarter and beyond. Therefore, we are increasing our full-year revenue to be in the range of $608 to $612 million, up from $600 to $610 million, representing a 49% to 50% increase compared to 2022."

Third Quarter 2023 Financial Results

Revenue was $153.3 million for the three months ended September 30, 2023, a 40% increase from $109.2 million in the corresponding period in the prior year. U.S. revenue for the quarter was $147.5 million, an increase of 39% as compared to the prior year quarter. Third quarter revenue outside the U.S. was $5.8 million, an increase of 99% as compared to the third quarter of 2022.

Gross margin was 84.1% for the three months ended September 30, 2023, compared to 81.9% for the corresponding prior year period. Recall in the third quarter of 2022, we had inventory obsolescence charges associated with new product launches which negatively impacted gross margin.

Operating expenses increased to $142.4 million for the third quarter of 2023, as compared to $106.6 million in the corresponding prior year period, an increase of 34%. This increase primarily reflected ongoing investments in the expansion of the U.S. sales organization, direct-to-patient marketing programs, continued product development efforts, as well as increased general corporate costs.

Net loss was $8.5 million for the third quarter of 2023, as compared to $16.8 million in the corresponding prior year period. The diluted net loss per share for the third quarter of 2023 was $0.29 per share, as compared to $0.60 in the prior year period.

As of September 30, 2023, cash, cash equivalents, and investments increased to $467.2 million from $451.4 million on December 31, 2022.

Full Year 2023 Guidance

Inspire is increasing and narrowing its full year 2023 revenue guidance to between $608 million to $612 million, which represents growth of 49% to 50% over full year 2022 revenue of $407.9 million. This compares to the prior revenue guidance of $600 million to $610 million.

The Company is maintaining its full year 2023 gross margin guidance of 83% to 85%.

Inspire is also maintaining its guidance relating to the opening of new U.S. medical centers of 52 to 56 per quarter for the remaining quarter of the year, as well as its guidance of 12 to 14 new U.S. territories for the fourth quarter of 2023.

Webcast and Conference Call

Inspire’s management will host a conference call after market close today, Tuesday, November 7, 2023, at 5:00 p.m. Eastern Time to discuss these results and answer questions.

To access the conference call, please preregister on

https://register.vevent.com/register/BI1b19ca88a7ac4c3bb9f3432b25f72365. Registrants will receive confirmation with dial-in details.

A live webcast of the event can be accessed on https://edge.media-server.com/mmc/p/qv623ga2/. A replay of the webcast will be available on https://investors.inspiresleep.com starting approximately two hours after the event and archived on the site for two weeks.

About Inspire Medical Systems

Inspire is a medical technology company focused on the development and commercialization of innovative, minimally invasive solutions for patients with obstructive sleep apnea. Inspire’s proprietary Inspire therapy is the first and only FDA-approved neurostimulation technology that provides a safe and effective treatment for moderate to severe obstructive sleep apnea.

For additional information about Inspire, please visit www.inspiresleep.com.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts are forward-looking statements, including, without limitation, statements regarding full year 2023 financial outlook, our expectations to activate new U.S. medical centers and add new territories per quarter in 2023 and the impact of such additions, and our strategy and investments to grow and scale our business. In some cases, you can identify forward-looking statements by terms such as ‘‘may,’’ ‘‘will,’’ ‘‘should,’’ ‘‘expect,’’ ‘‘plan,’’ ‘‘anticipate,’’ ‘‘could,’’ “future,” “outlook,” “guidance,” ‘‘intend,’’ ‘‘target,’’ ‘‘project,’’ ‘‘contemplate,’’ ‘‘believe,’’ ‘‘estimate,’’ ‘‘predict,’’ ‘‘potential,’’ ‘‘continue,’’ or the negative of these terms or other similar expressions, although not all forward-looking statements contain these words.

These forward-looking statements are based on management’s current expectations and involve known and unknown risks and uncertainties that may cause our actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements. Such risks and uncertainties include, among others, estimates regarding the annual total addressable market for our Inspire therapy in the U.S. and our market opportunity outside the U.S.; future results of operations, financial position, research and development costs, capital requirements and our needs for additional financing; commercial success and market acceptance of our Inspire therapy; the impact of COVID-19; general and international economic, political, and other risks, including currency, inflation, stock market fluctuations and the uncertain economic environment; our ability to achieve and maintain adequate levels of coverage or reimbursement for our Inspire system or any future products we may seek to commercialize; competitive companies and technologies in our industry; our ability to enhance our Inspire system, expand our indications and develop and commercialize additional products; our business model and strategic plans for our products, technologies and business, including our implementation thereof; our ability to accurately forecast customer demand for our Inspire system and manage our inventory; our dependence on third-party suppliers, contract manufacturers and shipping carriers; consolidation in the healthcare industry; our ability to expand, manage and maintain our direct sales and marketing organization, and to market and sell our Inspire system in markets outside of the U.S.; risks associated with international operations; our ability to manage our growth; our ability to increase the number of active medical centers implanting Inspire therapy; our ability to hire and retain our senior management and other highly qualified personnel; risk of product liability claims; risks related to information technology and cybersecurity; risk of damage to or interruptions at our facilities; our ability to commercialize or obtain regulatory approvals for our Inspire therapy and system, or the effect of delays in commercializing or obtaining regulatory approvals; FDA or other U.S. or foreign regulatory actions affecting us or the healthcare industry generally, including healthcare reform measures in the U.S. and international markets; and the timing or likelihood of regulatory filings and approvals. Other important factors that could cause actual results, performance or achievements to differ materially from those contemplated in this press release can be found under the captions “Risk Factors” and "Management's Discussion and Analysis of Financial Condition and Results of Operations“ in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as updated in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2023 to be filed with the SEC, and as such factors may be updated from time to time in our other filings with the SEC, which are accessible on the SEC’s website at www.sec.gov and the Investors page of our website at www.inspiresleep.com. These and other important factors could cause actual results to differ materially from those indicated by the forward-looking statements made in this press release. Any such forward-looking statements represent management’s estimates as of the date of this press release. While we may elect to update such forward-looking statements at some point in the future, unless required by applicable law, we disclaim any obligation to do so, even if subsequent events cause our views to change. Thus, one should not assume that our silence over time means that actual events are bearing out as expressed or implied in such forward-looking statements. These forward-looking statements should not be relied upon as representing our views as of any date after the date of this press release.

Investor & Media Contact

Ezgi Yagci

Vice President, Investor Relations

ezgiyagci@inspiresleep.com

617-549-2443

Inspire Medical Systems, Inc.

Consolidated Statements of Operations and Comprehensive Loss (unaudited)

(in thousands, except share and per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | | $ | 153,302 | | | $ | 109,188 | | | $ | 432,291 | | | $ | 269,956 | |

| Cost of goods sold | | 24,382 | | | 19,786 | | | 68,522 | | | 43,963 | |

| Gross profit | | 128,920 | | | 89,402 | | | 363,769 | | | 225,993 | |

| Operating expenses: | | | | | | | | |

| Research and development | | 29,144 | | | 20,993 | | | 85,484 | | | 47,397 | |

| Selling, general and administrative | | 113,247 | | | 85,603 | | | 327,853 | | | 225,853 | |

| Total operating expenses | | 142,391 | | | 106,596 | | | 413,337 | | | 273,250 | |

| Operating loss | | (13,471) | | | (17,194) | | | (49,568) | | | (47,257) | |

| Other (income) expense: | | | | | | | | |

| Interest and dividend income | | (5,495) | | | (1,350) | | | (14,690) | | | (1,681) | |

| Interest expense | | — | | | 656 | | | — | | | 1,677 | |

| Other expense, net | | 224 | | | 101 | | | 268 | | | 290 | |

| Total other (income) expense | | (5,271) | | | (593) | | | (14,422) | | | 286 | |

| Loss before income taxes | | (8,200) | | | (16,601) | | | (35,146) | | | (47,543) | |

| Income taxes | | 340 | | | 246 | | | 770 | | | 488 | |

| Net loss | | (8,540) | | | (16,847) | | | (35,916) | | | (48,031) | |

| Other comprehensive loss: | | | | | | | | |

| Foreign currency translation loss | | (181) | | | (148) | | | (4) | | | (106) | |

| Unrealized gain (loss) on investments | | 122 | | | (14) | | | 134 | | | (202) | |

| Total comprehensive loss | | $ | (8,599) | | | $ | (17,009) | | | $ | (35,786) | | | $ | (48,339) | |

| Net loss per share, basic and diluted | | $ | (0.29) | | | $ | (0.60) | | | $ | (1.23) | | | $ | (1.73) | |

Weighted average common shares used to

compute net loss per share, basic and diluted | | 29,365,968 | | 28,226,345 | | 29,229,626 | | 27,782,093 |

Inspire Medical Systems, Inc.

Consolidated Balance Sheets (unaudited)

(in thousands, except share and per share amounts)

| | | | | | | | | | | | | | |

| | September 30,

2023 | | December 31, 2022 |

| Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 329,897 | | | $ | 441,592 | |

| Investments, short-term | | 134,317 | | | 9,821 | |

Accounts receivable, net of allowance for credit losses of

$1,376 and $36, respectively | | 71,460 | | | 61,228 | |

| Inventories, net | | 26,115 | | | 11,886 | |

| Prepaid expenses and other current assets | | 7,802 | | | 5,505 | |

| Total current assets | | 569,591 | | | 530,032 | |

| Investments, long-term | | 2,961 | | | — | |

| Property and equipment, net | | 32,249 | | | 17,249 | |

| Operating lease right-of-use assets | | 23,081 | | | 6,880 | |

| Other non-current assets | | 11,612 | | | 10,715 | |

| Total assets | | $ | 639,494 | | | $ | 564,876 | |

| Liabilities and stockholders' equity | | | | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 40,031 | | | $ | 26,847 | |

| Accrued expenses | | 29,964 | | | 34,339 | |

| | | | |

| Total current liabilities | | 69,995 | | | 61,186 | |

| | | | |

| Operating lease liabilities, non-current portion | | 25,173 | | | 7,536 | |

| Other non-current liabilities | | 146 | | | 146 | |

| Total liabilities | | 95,314 | | | 68,868 | |

| Stockholders' equity: | | | | |

Preferred Stock, $0.001 par value, 10,000,000 shares authorized; no shares

issued and outstanding | | — | | | — | |

| Common Stock, $0.001 par value per share; 200,000,000 shares authorized; 29,403,189 and 29,008,368 issued and outstanding at September 30, 2023 and December 31, 2022, respectively | | 29 | | | 29 | |

| Additional paid-in capital | | 904,293 | | | 820,335 | |

| Accumulated other comprehensive income (loss) | | 44 | | | (86) | |

| Accumulated deficit | | (360,186) | | | (324,270) | |

| Total stockholders' equity | | 544,180 | | | 496,008 | |

| Total liabilities and stockholders' equity | | $ | 639,494 | | | $ | 564,876 | |

Document and Entity Information

|

Nov. 07, 2023 |

| Cover [Abstract] |

|

| Entity Registrant Name |

INSPIRE MEDICAL SYSTEMS, INC.

|

| Entity Central Index Key |

0001609550

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 07, 2023

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38468

|

| Entity Tax Identification Number |

26-1377674

|

| Entity Address, Address Line One |

5500 Wayzata Blvd.

|

| Entity Address, Address Line Two |

Suite 1600

|

| Entity Address, City or Town |

Golden Valley

|

| Entity Address, State or Province |

MN

|

| Entity Address, Postal Zip Code |

55416

|

| City Area Code |

844

|

| Local Phone Number |

672-4357

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value per share

|

| Trading Symbol |

INSP

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

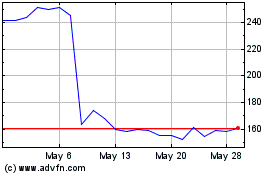

Inspire Medical Systems (NYSE:INSP)

Historical Stock Chart

From Apr 2024 to May 2024

Inspire Medical Systems (NYSE:INSP)

Historical Stock Chart

From May 2023 to May 2024