IBM Sales Slump Expected to Continue -- Earnings Preview

July 17 2019 - 5:59AM

Dow Jones News

By Asa Fitch

International Business Machines Corp. is expected to report

second-quarter earnings after the market closes Wednesday. The

results follow several quarters of declining revenue, although the

company is betting the recently closed $34 billion acquisition of

open-source software firm Red Hat Inc. will help revive its

fortunes. Here's what to expect:

EARNINGS FORECAST: Analysts surveyed by FactSet expect IBM to

report adjusted earnings of $3.08 a share, the same as the results

a year before. A year ago, the company reported $2.83 billion in

net income.

REVENUE FORECAST: IBM is expected to report $19.17 billion,

which would mark the fourth consecutive year-over-year decline in

quarterly sales.

WHAT TO WATCH:

-- SALES WOES: Chief Executive Ginni Rometty has struggled to

keep IBM revenue growing as artificial intelligence, blockchain

technology and other new areas of focus haven't offset declines in

legacy businesses such as computing infrastructure services.

Revenue fell year-over-year for 22 quarters in a row after Ms.

Rometty took over IBM in 2012. A three-quarter spell of rising

sales that began in late 2017 proved temporary. Investors now are

looking for fresh signs of a turnaround after the company's

first-quarter revenue fell short of analysts' expectations.

-- RED HAT FUTURE: The recently closed acquisition of

open-source software giant Red Hat -- the biggest acquisition in

IBM's 108-year history -- is the centerpiece of Big Blue's strategy

to dominate in what it calls the "hybrid cloud," a computing model

where companies do much of their business online but keep their

most sensitive data in-house. Red Hat's revenue won't be included

in IBM's results Wednesday because the closing happened after the

second quarter, but management may discuss the financial impact and

IBM's goals for the business. On Tuesday, IBM announced a multiyear

alliance with AT&T Inc. that incorporates Red Hat technology.

The companies didn't disclose financial terms, but IBM said it was

worth billions of dollars.

-- CLOUD GROWTH: IBM sees the hybrid cloud as central to its

return to top-line growth. The cloud businesses grew by 10% in the

year before the start of the second quarter. IBM's long-term

success as a cloud player, however, is still uncertain. It trails

rivals Amazon.com Inc. and Microsoft Corp., which are both seeing

far higher growth rates in their respective cloud operations.

Investors want to see IBM accelerate its growth, but Chief

Financial Officer James Kavanaugh in April said that the company's

midteen percentage growth target would still allow it to gain

market share in the hybrid-cloud market.

Write to Asa Fitch at asa.fitch@wsj.com

(END) Dow Jones Newswires

July 17, 2019 05:44 ET (09:44 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

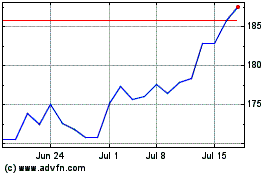

International Business M... (NYSE:IBM)

Historical Stock Chart

From Mar 2024 to Apr 2024

International Business M... (NYSE:IBM)

Historical Stock Chart

From Apr 2023 to Apr 2024