AutoNation Announces Share Buyback - Analyst Blog

March 27 2012 - 9:00AM

Zacks

AutoNation Inc. (AN) announced that its board

of directors has authorized the repurchase of up to an additional

$250 million of common stock. The company revealed that it has

exhausted its previous stock buyback program.

Last year, the automotive retailer has repurchased 18.6 million

shares for $635.2 million. This compared with repurchases of 26.6

million shares for $523.7 million in 2010.

In January, the company had announced that its board of

directors authorized the repurchase of up to an additional $250

million of its common stock. With the increased authorization, the

company had approximately $278 million worth of shares remaining

under the Board-approved share repurchase authorization as of

January 25, 2012. As of March 23, 2012, the company has about 124.6

million shares outstanding.

AutoNation is the largest automotive retailer in the U.S. and is

about twice the size of its nearest competitor. It sells 33

different brands of new vehicles, the core brands being

Ford (F), General Motors (GM),

Chrysler, Toyota (TM), Nissan

(NSANY), Honda (HMC) and BMW. These core brands

represent more than 90% of the company sales.

AutoNation’s effort to expand its dealer network by investing in

existing stores and service centers will help it to outgrow peers.

The company believes new vehicle sales will continue to improve

with the long-term recovery in the U.S. market. As of December 31,

2011, the company owned and operated 258 new vehicle franchises

that sell 32 brands located in major metropolitan markets in 15

states.

In the fourth quarter of 2011, the company saw a profit of $71

million or 51 cents per share compared with $68 million or 45 cents

per share in the same quarter of 2010 (excluding debt refinancing

costs of $1 million or 1 cent per share, after-tax), reflecting an

increase of 13% on a per-share basis. With this, the company has

beaten the Zacks Consensus Estimate of 48 cents per share.

Revenue went up 13% to $3.7 billion from $3.2 billion in the

year-ago period, driven by stronger retail new and used vehicle

sales. It was higher than the Zacks Consensus Estimate of $3.5

billion.

Gross profit per new vehicle retailed increased 2% to $2,451,

despite the decrease in additional incentives compared to the

year-ago period. However, gross profit per used vehicle retailed

fell 5% to $1,485. Finance and insurance gross profit per vehicle

retailed increased 5% to $1,223.

Due to the improved results and strong fundamentals, AutoNation

retains a Zacks #2 Rank on its stock, which translates to a

short-term (1 to 3 months) rating of “Buy”.

AUTONATION INC (AN): Free Stock Analysis Report

FORD MOTOR CO (F): Free Stock Analysis Report

GENERAL MOTORS (GM): Free Stock Analysis Report

HONDA MOTOR (HMC): Free Stock Analysis Report

NISSAN ADR (NSANY): Free Stock Analysis Report

TOYOTA MOTOR CP (TM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

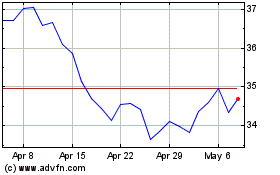

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Jun 2024 to Jul 2024

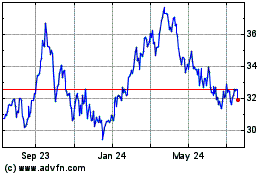

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Jul 2023 to Jul 2024