false000035495000003549502024-06-182024-06-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

__________________

FORM 8-K

__________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): June 18, 2024

__________________

THE HOME DEPOT, INC.

(Exact Name of Registrant as Specified in Charter)

__________________

| | | | | | | | | | | | | | |

| Delaware | | 1-8207 | | 95-3261426 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

2455 Paces Ferry Road, Atlanta, Georgia 30339

(Address of Principal Executive Offices) (Zip Code)

(770) 433-8211

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

__________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.05 Par Value Per Share | | HD | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Introductory Note

On June 18, 2024 (the “Closing Date”), The Home Depot, Inc., a Delaware corporation (the “Company”), completed its previously announced merger pursuant to the Agreement and Plan of Merger (the “Merger Agreement”), dated March 27, 2024, by and among the Company, Star Acquisition Merger Sub Inc., a Delaware corporation and wholly owned subsidiary of the Company (“Merger Sub”), Shingle Acquisition Holdings, Inc., a Delaware corporation (“SRS”), and Shingle Acquisition, LP, a Delaware limited partnership, solely in its capacity as the initial Holder Representative.

On the Closing Date, pursuant to the terms of the Merger Agreement, Merger Sub merged with and into SRS, with SRS as the surviving entity (the “Surviving Entity”) and a wholly owned subsidiary of the Company (such merger, the “Merger”). Each capitalized term used herein but not otherwise defined has the meaning given to it in the Merger Agreement.

Item 7.01 Regulation FD Disclosure.

On the Closing Date, the Company issued a press release announcing the completion of the Merger. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information in this Item 7.01, including Exhibit 99.1, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information, including Exhibit 99.1, be deemed to be incorporated by reference in any filings of the Company under the Securities Act of 1933 or the Exchange Act, regardless of any general incorporation language in such filings.

Item 8.01 Other Events.

The information set forth in the Introductory Note of this Current Report on Form 8-K is incorporated herein by reference.

On the Closing Date, following the satisfaction or waiver of the applicable closing conditions, including receipt of the requisite regulatory approvals, the Company completed the acquisition of SRS through the Merger. Pursuant to the Merger Agreement, the Company paid aggregate purchase price of $18,250,000,000, subject to customary adjustments for SRS’s debt, cash, transaction expenses and net working capital to determine the consideration paid to SRS equityholders (the “Merger Consideration”).

At the effective time of the Merger (the “Effective Time”) (i) each share of Class A common stock, par value $0.0001 per share, of SRS (the “SRS Class A Common Stock”) and each share of SRS Class B common stock par value $0.0001 per share, of SRS (the “SRS Class B Common Stock”, and together with the SRS Class A Common Stock, the “SRS Common Stock”) issued and outstanding immediately prior to the Effective Time (each such share, a “Share”) was converted into the right to receive the applicable portion of the estimated Merger Consideration, (ii) each option (“Option”) to purchase Shares under the 2018 Option Plan of SRS that was (x) vested, unexercised and outstanding immediately prior to the Effective Time and (y) in-the-money (as determined through an iterative mathematical process pursuant to the Merger Agreement), in each case, immediately prior to the Effective Time (each such option, an “In-the-Money Option”) was canceled and converted into the right to receive the applicable portion of the estimated Merger Consideration and (iii) each Option that was not an In-the-Money Option terminated and was forfeited for no consideration. In connection with the Merger, certain members of SRS’s management team reinvested a portion of their respective after-tax proceeds from the Merger Consideration into shares of the Company’s common stock. A portion of such shares of Company common stock are subject to service-based vesting conditions, and all such shares are subject to transfer restrictions of various durations.

The description of the Merger Agreement contained herein does not purport to be complete and is qualified in its entirety by reference to the Merger Agreement, a copy of which is filed as Exhibit 2.1 hereto and is incorporated herein by reference. This summary is not intended to modify or supplement any factual disclosures about the Company, and should not be relied upon as disclosure about the Company without consideration of the periodic and current reports and statements that the Company has filed and may file with the Securities and Exchange Commission. The terms of the Merger Agreement govern the contractual rights and relationships, and allocate risks, among the parties in relation to the transactions contemplated by the Merger Agreement. In particular, the representations and warranties made by the parties to each other in the Merger Agreement reflect negotiations between, and are solely for the benefit of, the parties thereto and may be limited or modified by a variety of factors, including: subsequent events, information included in public filings, disclosures made during negotiations, correspondence between the parties and disclosure schedules to the Merger Agreement. Accordingly, the representations and

warranties may not describe the actual state of affairs at the date they were made or at any other time and you should not rely on them as statements of fact.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit | | Description |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

*Certain schedules and other similar attachments to this exhibit have been omitted from this filing pursuant to Item 601(b)(2) of Regulation S-K. The registrant will provide a copy of such omitted documents to the Securities and Exchange Commission upon request.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| THE HOME DEPOT, INC. |

| | |

| Date: June 18, 2024 | By: | /s/ Richard V. McPhail |

| Name: | Richard V. McPhail |

| | Title: | Executive Vice President and Chief Financial Officer |

Exhibit 99.1

The Home Depot Completes Acquisition of SRS Distribution

ATLANTA, June 18, 2024 – The Home Depot®, the world's largest home improvement retailer, has completed the acquisition of SRS Distribution, Inc. (“SRS”) for a total enterprise value of approximately $18.25 billion. SRS is a leading residential specialty trade distribution company across several verticals serving the professional roofer, landscaper and pool contractor. The agreement to acquire SRS was announced on March 28, 2024.

“SRS is an excellent fit for The Home Depot – it's both complementary and additive to our growth,” said Ted Decker, chair, president and CEO. “Their ability to quickly build leadership positions in each of their specialty trade verticals is a testament to the team’s strong vision, leadership, culture and execution. SRS’s outstanding customer service, capabilities, and expertise will help us drive value for our customers, associates and shareholders, and we’re excited to welcome the SRS team to The Home Depot.”

The acquisition will increase the company’s total addressable market to approximately $1 trillion, an increase of approximately $50 billion. The combination of the two businesses will accelerate The Home Depot’s growth with the residential professional customer. SRS complements The Home Depot’s capabilities and enables the company to better serve the complex purchase occasion, while also establishing The Home Depot as a leading specialty trade distributor across multiple verticals.

About The Home Depot

The Home Depot is the world's largest home improvement specialty retailer. At the end of the first quarter of fiscal year 2024, the company operated a total of 2,337 retail stores in all 50 states, the District of Columbia, Puerto Rico, the U.S. Virgin Islands, Guam, 10 Canadian provinces and Mexico. The company employs approximately 465,000 associates. The Home Depot's stock is traded on the New York Stock Exchange (NYSE: HD) and is included in the Dow Jones industrial average and Standard & Poor's 500 index.

About SRS Distribution

Founded in 2008 and headquartered in McKinney, Texas, SRS has grown to become one of the fastest growing building products distributors in the United States. Since the Company’s inception, it has established a differentiated growth strategy and entrepreneurial culture that is focused on serving customers, partnering with suppliers, and attracting the industry’s best talent. SRS currently operates under a family of distinct local brands encompassing more than 760 locations across 47 states. For more information, visit www.srsdistribution.com.

###

Certain statements contained herein constitute "forward-looking statements" as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements may relate to, among other things, the acquisition of SRS Distribution Inc., which involves substantial risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements (the “acquisition”); statements about the potential benefits of the acquisition; risks related to the ability to realize the anticipated benefits of the acquisition, including the possibility that the expected benefits from the transaction will not be realized or will not be realized within the expected time period; the risk that the businesses will not be integrated successfully; disruption from the acquisition making it more difficult to maintain business and operational relationships; negative effects of announcing the consummation of the acquisition on the market price of our common stock, credit ratings or operating results; significant costs associated with the acquisition; unknown liabilities; the risk of litigation; the demand for our products and services, including as a result of macroeconomic conditions; net sales growth; comparable sales; the effects of competition; our brand and reputation; implementation of interconnected retail, store, supply chain and technology initiatives; inventory and in-stock positions; the state of the economy; the state of the housing and home improvement markets; the state of the credit markets, including mortgages, home equity loans, and consumer credit; the impact of tariffs; issues related to the payment methods we accept; demand for credit offerings; management of relationships with our associates, potential associates, suppliers and service providers; cost and availability of labor; costs of fuel and other energy sources; events that could disrupt our business, supply chain, technology infrastructure, or demand for our products and services, such as international trade disputes, natural disasters, climate change, public health issues, cybersecurity events, geopolitical conflicts, military conflicts, or acts of war; our ability to maintain a safe and secure store environment; our ability to address expectations regarding environmental, social and governance matters and meet related goals; continuation or suspension of share repurchases; net earnings performance; earnings per share; future dividends; capital allocation and expenditures; liquidity; return on invested capital; expense leverage; changes in interest rates; changes in foreign currency exchange rates; commodity or other price inflation and deflation; our ability to issue debt on terms and at rates acceptable to us; the impact and expected outcome of investigations, inquiries, claims, and litigation, including compliance with related settlements; the challenges of operating in international markets; the adequacy of insurance coverage; the effect of accounting charges; the effect of adopting certain accounting standards; the impact of legal and regulatory changes, including changes to tax laws and regulations; store openings and closures; guidance for fiscal 2024 and beyond; financial outlook; and the impact of acquired companies on our organization and the ability to recognize the anticipated benefits of any acquisitions.

Forward-looking statements are based on currently available information and our current assumptions, expectations and projections about future events. You should not rely on our forward-looking statements. These statements are not guarantees of future performance and are subject to future events, risks and uncertainties – many of which are beyond our control, dependent on the actions of third parties, or currently unknown to us – as well as potentially inaccurate assumptions that could cause actual results to differ materially from our historical experience and our expectations and projections. These risks and uncertainties include, but are not limited to, those described in Part I, Item 1A, "Risk Factors," and elsewhere in our Annual Report on Form 10-K for our fiscal year ended January 28, 2024 and also as may be described from time to time in future reports we file with the Securities and Exchange Commission. There also may be other factors that we cannot anticipate or that are not described herein, generally because we do not currently perceive them to be material. Such factors could cause results to differ materially from our expectations. Forward-looking statements speak only as of the date they are made, and we do not undertake to update these statements other than as required by law. You are advised, however, to review any further disclosures we make on related subjects in our filings with the Securities and Exchange Commission and in our other public statements.

For more information, contact:

| | | | | | | | |

| Financial Community | | News Media |

| Isabel Janci | | Sara Gorman |

| Vice President of Investor Relations and Treasurer | | Senior Director of Corporate Communications |

| 770-384-2666 | | 770-384-2852 |

| isabel_janci@homedepot.com | | sara_gorman@homedepot.com |

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

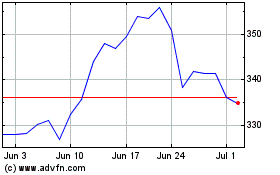

Home Depot (NYSE:HD)

Historical Stock Chart

From Jun 2024 to Jul 2024

Home Depot (NYSE:HD)

Historical Stock Chart

From Jul 2023 to Jul 2024