Highwoods Obtains New $200 Million Term Loan

October 11 2022 - 4:30PM

Highwoods Properties, Inc. (NYSE:HIW) has obtained

a $200.0 million, two-year unsecured bank term loan that is

scheduled to mature in October 2024. Assuming no defaults have

occurred, the Company has an option to extend the maturity for one

additional year. The Company expects to use the additional $200

million of borrowings for working capital purposes, the short-term

funding of our development and acquisition activity and the

repayment of other debt.

The interest rate on the new term loan is SOFR

plus a related spread adjustment of 10 basis points and a borrowing

spread of 95 basis points. The borrowing spread will be reduced by

one basis point provided Highwoods meets certain sustainability

goals with respect to the ongoing reduction of greenhouse gas

emissions.

Ted Klinck, President and Chief Executive

Officer of Highwoods Properties, said, “We appreciate the

confidence shown in Highwoods by our bank group. We have now

obtained $550 million of term loans in 2022. Our bank group’s

support and partnership has provided us the financial capacity

needed to pursue our strategic objectives while preserving our

financial flexibility.”

BofA Securities, Inc., PNC Capital Markets LLC,

Truist Securities, Inc. and U.S. Bank National Association served

as Joint Lead Arrangers on the new term loan, with BofA Securities,

Inc. and PNC Capital Markets LLC serving as Joint Bookrunners. Bank

of America, N.A. is Administrative Agent and PNC Bank, National

Association is Syndication Agent. Truist Bank and U.S. Bank

National Association served as Co-Documentation Agents. Regions

Bank and TD Bank, N.A. served as Co-Managing Agents.

About HighwoodsHighwoods

Properties, Inc., headquartered in Raleigh, is a publicly-traded

(NYSE:HIW) real estate investment trust (“REIT”) and a member of

the S&P MidCap 400 Index. The Company is a

fully-integrated office REIT that owns, develops, acquires, leases

and manages properties primarily in the best business districts

(BBDs) of Atlanta, Charlotte, Dallas, Nashville, Orlando, Raleigh,

Richmond and Tampa. For more information about Highwoods, please

visit our website at www.highwoods.com.

Forward-Looking StatementsSome

of the information in this press release may contain

forward-looking statements. Such statements include, in particular,

statements about our plans, strategies and prospects such as the

following: the planned sales of non-core assets and expected

pricing and impact with respect to such sales, including the tax

impact of such sales; the expected financial and operational

results and the related assumptions underlying our expected

results, including but not limited to potential losses related to

customer difficulties, anticipated building usage and expected

economic activity due to COVID-19; the continuing ability to borrow

under the Company’s revolving credit facility; the anticipated

total investment, projected leasing activity, estimated replacement

cost and expected net operating income of acquired properties and

properties to be developed; and expected future leverage of the

Company. You can identify forward-looking statements by our use of

forward-looking terminology such as “may,” “will,” “expect,”

“anticipate,” “estimate,” “continue” or other similar words.

Although we believe that our plans, intentions and expectations

reflected in or suggested by such forward-looking statements are

reasonable, we cannot assure you that our plans, intentions or

expectations will be achieved.

Factors that could cause actual results to

differ materially from Highwoods' current expectations include,

among others, the following: buyers may not be available and

pricing may not be adequate with respect to the planned

dispositions of non-core assets; comparable sales data on which we

based our expectations with respect to the sales price of the

non-core assets may not reflect current market trends; the extent

to which the ongoing COVID-19 pandemic impacts our financial

condition, results of operations and cash flows depends on future

developments, which are highly uncertain and cannot be predicted

with confidence, including the scope, severity and duration of the

pandemic and its impact on the U.S. economy and potential changes

in customer behavior that could adversely affect the use of and

demand for office space; the financial condition of our customers

could deteriorate or further worsen, which could be further

exacerbated by the COVID-19 pandemic; our assumptions regarding

potential losses related to customer financial difficulties due to

the COVID-19 pandemic could prove incorrect; counterparties under

our debt instruments, particularly our revolving credit facility,

may attempt to avoid their obligations thereunder, which, if

successful, would reduce our available liquidity; we may not be

able to lease or re-lease second generation space, defined as

previously occupied space that becomes available for lease, quickly

or on as favorable terms as old leases; we may not be able to lease

newly constructed buildings as quickly or on as favorable terms as

originally anticipated; we may not be able to complete development,

acquisition, reinvestment, disposition or joint venture projects as

quickly or on as favorable terms as anticipated; development

activity in our existing markets could result in an excessive

supply relative to customer demand; our markets may suffer declines

in economic and/or office employment growth; unanticipated

increases in interest rates could increase our debt service costs;

unanticipated increases in operating expenses could negatively

impact our operating results; natural disasters and climate change

could have an adverse impact on our cash flow and operating

results; we may not be able to meet our liquidity requirements or

obtain capital on favorable terms to fund our working capital needs

and growth initiatives or repay or refinance outstanding debt upon

maturity; and the Company could lose key executive officers.

This list of risks and uncertainties, however,

is not intended to be exhaustive. You should also review the other

cautionary statements we make in “Risk Factors” set forth in our

2021 Annual Report on Form 10-K. Given these uncertainties, you

should not place undue reliance on forward-looking statements. We

undertake no obligation to publicly release the results of any

revisions to these forward-looking statements to reflect any future

events or circumstances or to reflect the occurrence of

unanticipated events.

|

Contact: |

Brendan

Maiorana |

| |

Executive Vice President and Chief Financial Officer |

| |

brendan.maiorana@highwoods.com |

| |

919-872-4924 |

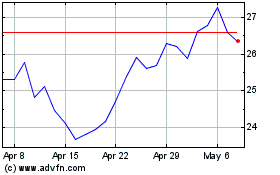

Highwoods Properties (NYSE:HIW)

Historical Stock Chart

From Aug 2024 to Sep 2024

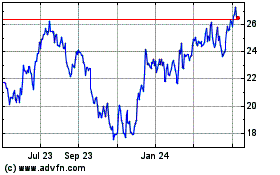

Highwoods Properties (NYSE:HIW)

Historical Stock Chart

From Sep 2023 to Sep 2024