Great Ajax Corp. Announces Record Date for Stockholders Meeting to Approve Strategic Transaction With Rithm Capital Corp.

April 10 2024 - 12:56PM

Business Wire

Great Ajax Corp. (NYSE: AJX; the “Company”), a real estate

investment trust, announced today that its board of directors has

fixed a record date of April 22, 2024 for its 2024 meeting of

stockholders (the “Meeting”) to, among other things, consider and

vote upon certain matters relating to the previously announced

strategic transaction (the “Transaction”) by and between the

Company and Rithm Capital Corp. (together with its subsidiaries,

“Rithm”).

At the Meeting, the Company will seek stockholder approval for

the following actions: (1) the issuance of common stock to certain

exchanging investors in excess of the 19.99% cap imposed by the New

York Stock Exchange rules; (2) the issuance of common stock and

warrant shares to Rithm in connection with the Transaction, which

may be deemed to constitute a “change of control;” (3) the election

of four directors to serve until the 2025 annual meeting of

stockholders; (4) the Company’s entry into a Management Agreement,

by and among the Company, Great Ajax Operating Partnership L.P. and

RCM GA Manager LLC, an affiliate of Rithm, pursuant to which RCM GA

Manager LLC will become the Company’s external manager; and (5) the

adoption of Amendment No. 1 to the Company’s 2016 Equity Incentive

Plan.

The Company will present the preceding proposals at the Meeting

in order to obtain the vote of the Company’s stockholders. In

addition, the Company will present a proposal to ratify the

appointment of Moss Adams LLP to serve as its registered

independent public accounting firm for the fiscal year ending

December 31, 2024. For more information about the Meeting and the

Transaction, please see Great Ajax’s Current Report on Form 8-K,

accessible on Great Ajax’s website.

Additional Information and Where to Find It

This communication may be deemed to be solicitation material in

respect of obtaining approval of the stockholders of Great Ajax of

the proposed transactions (the “Stockholder Approval”). In

connection with obtaining the Stockholder Approval, Great Ajax will

file with the Securities and Exchange Commission (the “SEC”) and

furnish to the Company’s stockholders a proxy statement and other

relevant documents. This communication does not constitute a

solicitation of any vote or approval. BEFORE MAKING ANY VOTING

DECISION, GREAT AJAX’S STOCKHOLDERS ARE URGED TO READ THE PROXY

STATEMENT IN ITS ENTIRETY AND ANY OTHER DOCUMENTS TO BE FILED THE

SEC IN CONNECTION WITH THE STOCKHOLDER APPROVAL OR INCORPORATED BY

REFERENCE IN THE PROXY STATEMENT BECAUSE THEY CONTAIN IMPORTANT

INFORMATION ABOUT THE TRANSACTION. Stockholders are able to obtain

free copies of the proxy statement and other documents containing

important information about the Company once such documents are

filed with the SEC, through the website maintained by the SEC at

http://www.sec.gov.

Participants in the Solicitation

Great Ajax and its executive officers, directors, other members

of management and employees may be deemed, under SEC rules, to be

participants in the solicitation of proxies from Great Ajax’s

stockholders with respect to the proposed transaction. Information

regarding the executive officers and directors of Great Ajax is set

forth in its definitive proxy statement for its 2024 annual meeting

filed with the SEC on April 9, 2024, as amended. More detailed

information regarding the identity of potential participants, and

their direct or indirect interests, by securities holdings or

otherwise, will be set forth in the proxy statement and other

materials to be filed with the SEC in connection with the proposed

transaction.

Forward-Looking Statements

This communication contains forward-looking statements within

the meaning of the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements are not

historical in nature and can be identified by words such as

“believe,” “expect,” “anticipate,” “estimate,” “project,” “plan,”

“continue,” “intend,” “should,” “would,” “could,” “goal,”

“objective,” “will,” “may,” “seek” or similar expressions or their

negative forms. Forward-looking statements are subject to numerous

assumptions, risks and uncertainties, which change over time and

are beyond our control. Forward-looking statements speak only as of

the date they are made. Rithm and Great Ajax do not assume any duty

or obligation (and do not undertake) to update or supplement any

forward-looking statements. Because forward-looking statements are,

by their nature, to different degrees, uncertain and subject to

numerous assumptions, risks and uncertainties, actual results or

future events, circumstances or developments could differ, possibly

materially, from those that Rithm and Great Ajax anticipated in its

forward-looking statements, and future results and performance

could differ materially from historical performance. Factors that

could cause or contribute to such differences include, but are not

limited to, those set forth in the section entitled “Risk Factors”

in Rithm and Great Ajax’s most recent Annual Reports on Form 10-K

and Quarterly Reports on Form 10-Q filed with the SEC, and other

reports filed by Rithm and Great Ajax with the SEC, copies of which

are available on the SEC’s website, www.sec.gov. The list of

factors presented here is not, and should not be, considered a

complete statement of all potential risks and uncertainties.

Unlisted factors may present significant additional obstacles to

the realization of forward-looking statements.

About Rithm Capital Corp.

Rithm Capital (NYSE: RITM) is a global asset manager focused on

real estate, credit and financial services. Rithm makes direct

investments and operates several wholly-owned operating businesses.

Rithm’s businesses include Sculptor Capital Management, Inc., an

alternative asset manager, as well as Newrez LLC and Genesis

Capital LLC, leading mortgage origination and servicing platforms.

Rithm seeks to generate attractive risk-adjusted returns across

market cycles and interest rate environments. Since inception in

2013, Rithm has delivered approximately $5.0 billion in dividends

to shareholders. Rithm is organized and conducts its operations to

qualify as a real estate investment trust (REIT) for federal income

tax purposes and is headquartered in New York City.

About Great Ajax Corp.

Great Ajax (NYSE: AJX) is a real estate investment trust that

focuses primarily on acquiring, investing in and managing

re-performing loans (“RPLs”) and non-performing loans (“NPLs”)

secured by single-family residences and commercial properties. In

addition to its continued focus on RPLs and NPLs, it also

originates and acquires small balance commercial mortgage loans

secured by multi-family retail/residential and mixed-use

properties. Great Ajax is externally managed by Thetis Asset

Management LLC, an affiliated entity. Great Ajax’s mortgage loans

and other real estate assets are serviced by Gregory Funding LLC,

an affiliated entity.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240410321525/en/

Rithm Investor Relations (212) 850-7770

ir@rithmcap.com

Great Ajax Mary Doyle Chief Financial Officer (503)

444-4224 mary.doyle@great-ajax.com

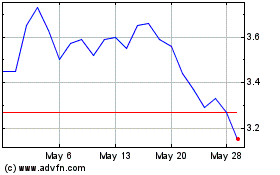

Great Ajax (NYSE:AJX)

Historical Stock Chart

From Nov 2024 to Dec 2024

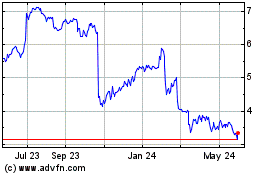

Great Ajax (NYSE:AJX)

Historical Stock Chart

From Dec 2023 to Dec 2024