0001585855

false

N-CSRS

0001585855

2023-01-01

2023-06-30

0001585855

ggz:SeriesBCumulativePreferredStockMember

2023-01-01

2023-06-30

0001585855

ggz:CommonStocksMember

2023-01-01

2023-06-30

0001585855

ggz:CumulativePreferredStocksMember

2023-01-01

2023-06-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

June 30, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22884

The Gabelli Global Small and Mid Cap Value Trust

(Exact name of registrant as specified in charter)

One Corporate Center

Rye, New York 10580-1422

(Address of principal executive offices) (Zip code)

John C. Ball

Gabelli Funds, LLC

One Corporate Center

Rye, New York 10580-1422

(Name and address of agent for service)

Registrant’s telephone number, including area

code: 1-800-422-3554

Date of fiscal year end: December 31

Date of reporting period: June 30, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission

to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of

1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection,

and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A

registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid

Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden

estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington,

DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

| (a) | The Report to Shareholders

is attached herewith. |

The

Gabelli Global Small and Mid Cap Value Trust

Semiannual

Report — June 30, 2023

(Y)our

Portfolio Management Team

| |

|

|

|

|

|

|

|

|

| |

Mario

J. Gabelli, CFA |

|

Christopher

J. Marangi |

|

Kevin

V. Dreyer |

|

Jeffrey

J. Jonas, CFA |

|

|

Chief

Investment Officer |

|

Co-Chief

Investment Officer

BA, Williams College

MBA, Columbia

Business School |

|

Co-Chief

Investment Officer

BSE, University of

Pennsylvania

MBA, Columbia

Business School |

|

Portfolio

Manager

BS, Boston College |

|

To

Our Shareholders,

For

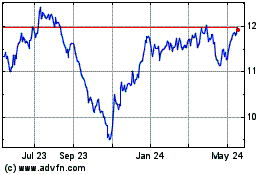

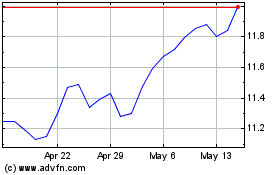

the six months ended June 30, 2023, the net asset value (NAV) total return of The Gabelli Global Small and Mid Cap Value Trust (the Fund)

was 8.9%, compared with a total return of 7.7% for the Morgan Stanley Capital International (MSCI) World SMID Cap Index. The total return

for the Fund’s publicly traded shares was 9.8%. The Fund’s NAV per share was $14.11, while the price of the publicly traded

shares closed at $11.99 on the New York Stock Exchange (NYSE). See page 3 for additional performance information.

Enclosed

are the financial statements, including the schedule of investments, as of June 30, 2023.

Investment

Objective (Unaudited)

The

Gabelli Global Small and Mid Cap Value Trust is a diversified, closed-end management investment company whose primary investment objective

is long-term growth of capital. Under normal market conditions, the Fund will invest at least 80% of its total assets in equity securities

of companies with small or medium sized market capitalizations (“smallcap” and “mid-cap” companies, respectively),

and, under normal market conditions, will invest at least 40% of its total assets in the equity securities of companies located outside

the United States and in at least three countries.

As

permitted by regulations adopted by the Securities and Exchange Commission, paper copies

of the Fund’s annual and semiannual shareholder reports will no longer be sent by mail,

unless you specifically request paper copies of the reports. Instead, the reports will be

made available on the Fund’s website (www.gabelli.com), and you will be notified by

mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive sharehold-er reports electronically, you will not be affected

by this change and you need not take any action. To elect to receive all future reports on

paper free of charge, please contact your financial intermediary, or, if you invest directly

with the Fund, you may call 800-422-3554 or send an email request to info@gabelli.com.

|

Performance

Discussion (Unaudited)

The

stock market continued to digest the impact of higher interest rates and slowing economic growth. While employment in the United

States remains strong, we are starting to see more layoffs and cost cutting announcements from companies, especially in the

technology sector. The service sector of the economy remains strong, but manufacturing data turned negative as the quarter

progressed. In March, several banks failed unexpectedly due to poor risk management and the rapid loss of deposits. This will

further tighten credit conditions in the economy and has led the market to expect that the Federal Reserve will stop raising

interest rates soon.

While

economic growth has slowed, it has remained robust enough to keep recessionary fears at bay. Continued interest rate hikes around

the world are bringing inflation under control, although more work remains to be done. Falling energy and commodity prices have been

a big component of this and are a significant tailwind to consumers around the world, especially in Europe. China appears to be

planning a new round of economic stimulus for its economy. The U.S. Dollar has also weakened, which helps the revenue and earnings

of U.S. multinational companies and also helps the value of our foreign holdings. However, corporate earnings growth has slowed down

this year and most of the market’s return has come from multiple expansion and has been concentrated in a small number of

large technology companies.

Better

performing positions in the first half of the year included Ferrari NV (0.9% of the portfolio as of June 30, 2023), the luxury automaker

and Davide Campari (1.2%), which continued to see strong demand and has maintained its pricing power.

Detractors

included Flushing Financial Corp. (0.3%), a regional bank that saw its stock suffer in the bank crisis early this year, and National

Fuel Gas Co. (0.8%), a gas and pipeline utility with a growing exploration and production business.

Thank

you for your investment in the Gabelli Global Small and Mid Cap Value Trust.

We

appreciate your confidence and trust.

The

views expressed reflect the opinions of the Fund’s portfolio managers and Gabelli Funds,

LLC, the Adviser, as of the date of this report and are subject to change without notice

based on changes in market, economic, or other conditions. These views are not intended to

be a forecast of future events and are no guarantee of future results.

|

Comparative

Results

Average

Annual Returns through June 30, 2023 (a) (Unaudited)

| | |

Six

Months | | |

1

Year | | |

3

year | | |

5

year | | |

Since

Inception

(6/23/14) | |

| The

Gabelli Global Small and Mid Cap Value Trust (GGZ) | |

| | | |

| | | |

| | | |

| | | |

| | |

| NAV

Total Return (b) | |

| 8.93 | % | |

| 14.47 | % | |

| 14.27 | % | |

| 4.23 | % | |

| 5.31 | % |

| Investment

Total Return (c) | |

| 9.80 | | |

| 15.00 | | |

| 17.27 | | |

| 5.22 | | |

| 3.51 | |

| MSCI

World SMID Cap Index | |

| 7.71 | | |

| 12.81 | | |

| 9.90 | | |

| 4.97 | | |

| 6.01 | (d) |

| (a) | Performance

returns for periods of less than one year are not annualized. Returns represent past performance

and do not guarantee future results. Investment returns and the principal value of an investment

will fluctuate. The Fund’s use of leverage may magnify the volatility of net asset

value changes versus funds that do not employ leverage. When shares are sold, they may be

worth more or less than their original cost. Current performance may be lower or higher than

the performance data presented. Visit www.gabelli. com for performance information as of

the most recent month end. The MSCI World SMID Cap Index captures mid and small cap representation

across 23 developed markets. Dividends are considered reinvested. You cannot invest directly

in an index. |

| (b) | Total

returns and average annual returns reflect changes in the NAV per share, reinvestment of

distributions at NAV on the ex-dividend date, and adjustments for rights offerings and are

net of expenses. Since inception return is based on an initial NAV of $12.00. |

| (c) | Total

returns and average annual returns reflect changes in closing market values on the NYSE,

reinvestment of distributions, and adjustments for rights offerings. Since inception return

is based on an initial offering price of $12.00. |

| (d) | From

June 30, 2014, the date closest to the Fund’s inception for which data are available. |

Investors

should carefully consider the investment objectives, risks, charges, and expenses of the Fund before investing.

Summary

of Portfolio Holdings (Unaudited)

The

following table presents portfolio holdings as a percent of total investments as of June 30, 2023:

The

Gabelli Global Small and Mid Cap Value Trust

| Food

and Beverage | |

| 13.6 | % |

| U.S.

Government Obligations | |

| 9.0 | % |

| Diversified

Industrial | |

| 6.8 | % |

| Entertainment | |

| 6.6 | % |

| Health

Care | |

| 6.0 | % |

| Business

Services | |

| 5.1 | % |

| Machinery | |

| 5.0 | % |

| Equipment

and Supplies | |

| 4.8 | % |

| Consumer

Products | |

| 3.5 | % |

| Financial

Services | |

| 3.5 | % |

| Broadcasting | |

| 2.8 | % |

| Automotive:

Parts and Accessories | |

| 2.7 | % |

| Electronics | |

| 2.7 | % |

| Hotels

and Gaming | |

| 2.7 | % |

| Aerospace | |

| 2.2 | % |

| Automotive | |

| 2.2 | % |

| Energy

and Utilities: Water | |

| 2.1 | % |

| Retail | |

| 2.1 | % |

| Specialty

Chemicals | |

| 1.7 | % |

| Cable

and Satellite | |

| 1.5 | % |

| Transportation | |

| 1.4 | % |

| Building

and Construction | |

| 1.2 | % |

| Consumer

Services | |

| 1.2 | % |

| Energy

and Utilities: Integrated | |

| 1.1 | % |

| Aviation:

Parts and Services | |

| 1.0 | % |

| Environmental

Services | |

| 0.9 | % |

| Energy

and Utilities: Natural Gas | |

| 0.9 | % |

| Telecommunications | |

| 0.8 | % |

| Metals

and Mining | |

| 0.8 | % |

| Energy

and Utilities: Electric | |

| 0.8 | % |

| Energy

and Utilities: Services | |

| 0.7 | % |

| Publishing | |

| 0.6 | % |

| Wireless

Communications | |

| 0.5 | % |

| Manufactured

Housing and Recreational Vehicles | |

| 0.4 | % |

| Computer

Software and Services | |

| 0.3 | % |

| Real

Estate | |

| 0.3 | % |

| Agriculture | |

| 0.3 | % |

| Energy

and Utilities: Alternative Energy | |

| 0.1 | % |

| Educational

Services | |

| 0.1 | % |

| | |

| 100.0 | % |

The

Fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission (the SEC) for the first and third quarters

of each fiscal year on Form N-PORT. Shareholders may obtain this information at www.gabelli.com or by calling the Fund at 800-GABELLI

(800-422-3554). The Fund’s Form N-PORT is available on the SEC’s website at www.sec.gov and may also be reviewed and copied

at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained

by calling 800-SEC-0330.

Proxy

Voting

The

Fund files Form N-PX with its complete proxy voting record for the twelve months ended June 30, no later than August 31 of each year.

A description of the Fund’s proxy voting policies, procedures, and how each Fund voted proxies relating to portfolio securities

is available without charge, upon request, by (i) calling 800-GABELLI (800-422-3554); (ii) writing to The Gabelli Funds at One Corporate

Center, Rye, NY 10580-1422; or (iii) visiting the SEC’s website at www.sec.gov.

The

Gabelli Global Small and Mid Cap Value Trust

Schedule

of Investments — June 30, 2023 (Unaudited)

| Shares | | |

| |

Cost | | |

Market

Value | |

| | | | |

COMMON

STOCKS — 90.8% | |

| | | |

| | |

| | | | |

Aerospace

— 2.2% | |

| | | |

| | |

| | 32,000 | | |

Aerojet

Rocketdyne Holdings Inc.† | |

$ | 1,513,394

| | |

$ | 1,755,840 | |

| | 14,000 | | |

Allied

Motion Technologies Inc. | |

| 355,269 | | |

| 559,160 | |

| | 4,000 | | |

Avio

SpA† | |

| 53,864 | | |

| 40,724 | |

| | 11,700 | | |

Kaman

Corp. | |

| 426,824 | | |

| 284,661 | |

| | 1,000 | | |

L3Harris

Technologies Inc. | |

| 79,530 | | |

| 195,770 | |

| | 256,666 | | |

Rolls-Royce

Holdings plc† | |

| 558,173 | | |

| 492,371 | |

| | | | |

| |

| 2,987,054 | | |

| 3,328,526 | |

| | | | |

Agriculture

— 0.3% | |

| | | |

| | |

| | 12,000 | | |

American

Vanguard Corp. | |

| 252,171 | | |

| 214,440 | |

| | 12,000 | | |

Limoneira

Co. | |

| 195,742 | | |

| 186,720 | |

| | | | |

| |

| 447,913 | | |

| 401,160 | |

| | | | |

Automotive

— 2.2% | |

| | | |

| | |

| | 4,000 | | |

Daimler

Truck Holding AG | |

| 102,037 | | |

| 144,038 | |

| | 4,100 | | |

Ferrari

NV | |

| 157,078 | | |

| 1,333,361 | |

| | 143,800 | | |

Iveco

Group NV† | |

| 967,701 | | |

| 1,294,859 | |

| | 24,000 | | |

Traton

SE | |

| 426,429 | | |

| 513,301 | |

| | | | |

| |

| 1,653,245 | | |

| 3,285,559 | |

| | | | |

Automotive:

Parts and Accessories — 2.7% | |

| | | |

| | |

| | 50,013 | | |

Brembo

SpA | |

| 363,195 | | |

| 741,117 | |

| | 98,000 | | |

Dana

Inc. | |

| 1,723,683 | | |

| 1,666,000 | |

| | 44,002 | | |

Garrett

Motion Inc.† | |

| 217,851 | | |

| 333,095 | |

| | 2,000 | | |

Linamar

Corp. | |

| 71,250 | | |

| 105,107 | |

| | 33,000 | | |

Modine

Manufacturing Co.† | |

| 411,768 | | |

| 1,089,660 | |

| | 7,200 | | |

Uni-Select

Inc.† | |

| 50,583 | | |

| 255,716 | |

| | | | |

| |

| 2,838,330 | | |

| 4,190,695 | |

| | | | |

Aviation:

Parts and Services — 1.0% | |

| | | |

| | |

| | 15,500 | | |

AAR

Corp.† | |

| 501,595 | | |

| 895,280 | |

| | 1,000 | | |

Curtiss-Wright

Corp. | |

| 69,929 | | |

| 183,660 | |

| | 9,000 | | |

Ducommun

Inc.† | |

| 333,119 | | |

| 392,130 | |

| | | | |

| |

| 904,643 | | |

| 1,471,070 | |

| | | | |

Broadcasting

— 2.8% | |

| | | |

| | |

| | 63,000 | | |

Beasley

Broadcast Group Inc., Cl. A† | |

| 178,470 | | |

| 64,260 | |

| | 5,700 | | |

Cogeco

Inc. | |

| 287,301 | | |

| 240,392 | |

| | 78,000 | | |

Corus

Entertainment Inc., Cl. B | |

| 238,417 | | |

| 77,132 | |

| | 300,000 | | |

Grupo

Televisa SAB, ADR | |

| 2,665,317 | | |

| 1,539,000 | |

| | 240,000 | | |

ITV

plc | |

| 464,788 | | |

| 208,178 | |

| | 500 | | |

Liberty

Broadband Corp., Cl. A† | |

| 25,308 | | |

| 39,865 | |

| | 103 | | |

Liberty

Broadband Corp., Cl. C† | |

| 4,934 | | |

| 8,251 | |

| | 2,000 | | |

Liberty

Media Corp.- Liberty SiriusXM, Cl. A† | |

| 74,602 | | |

| 65,620 | |

| Shares | | |

| |

Cost | | |

Market

Value | |

| | 188 | | |

Liberty

Media Corp.- Liberty SiriusXM, Cl. C† | |

$ | 4,788 | | |

$ | 6,153 | |

| | 87,500 | | |

Sinclair

Inc. | |

| 2,418,613 | | |

| 1,209,250 | |

| | 25,000 | | |

Sirius

XM Holdings Inc. | |

| 131,250 | | |

| 113,250 | |

| | 47,000 | | |

TEGNA

Inc. | |

| 847,783 | | |

| 763,280 | |

| | | | |

| |

| 7,341,571 | | |

| 4,334,631 | |

| | | | |

Building

and Construction — 1.2% | |

| | | |

| | |

| | 12,241 | | |

Arcosa

Inc. | |

| 386,636 | | |

| 927,500 | |

| | 3,500 | | |

Bouygues

SA | |

| 124,314 | | |

| 117,479 | |

| | 1,000 | | |

Carrier

Global Corp. | |

| 19,630 | | |

| 49,710 | |

| | 3,000 | | |

IES

Holdings Inc.† | |

| 52,566 | | |

| 170,640 | |

| | 6,000 | | |

Johnson

Controls International plc | |

| 220,391 | | |

| 408,840 | |

| | 4,000 | | |

Knife

River Corp.† | |

| 143,960 | | |

| 174,000 | |

| | | | |

| |

| 947,497 | | |

| 1,848,169 | |

| | | | |

Business

Services — 5.1% | |

| | | |

| | |

| | 55,000 | | |

Diebold

Nixdorf Inc.† | |

| 192,477 | | |

| 2,915 | |

| | 40,500 | | |

Herc

Holdings Inc. | |

| 1,424,363 | | |

| 5,542,425 | |

| | 67,200 | | |

JCDecaux

SE† | |

| 1,625,878 | | |

| 1,338,981 | |

| | 13,500 | | |

Loomis

AB | |

| 399,150 | | |

| 393,784 | |

| | 50,000 | | |

Rentokil

Initial plc | |

| 377,744 | | |

| 390,525 | |

| | 4,000 | | |

Ströeer

SE & Co. KGaA | |

| 86,799 | | |

| 194,234 | |

| | | | |

| |

| 4,106,411 | | |

| 7,862,864 | |

| | | | |

Cable

and Satellite — 1.5% | |

| | | |

| | |

| | 3,800 | | |

Cogeco

Communications Inc. | |

| 232,972 | | |

| 202,772 | |

| | 40,000 | | |

Liberty

Global plc, Cl. A† | |

| 899,575 | | |

| 674,400 | |

| | 58,000 | | |

Liberty

Global plc, Cl. C† | |

| 1,473,762 | | |

| 1,030,660 | |

| | 51,000 | | |

Megacable

Holdings SAB de CV | |

| 168,047 | | |

| 118,167 | |

| | 35,500 | | |

WideOpenWest

Inc.† | |

| 512,138 | | |

| 299,620 | |

| | | | |

| |

| 3,286,494 | | |

| 2,325,619 | |

| | | | |

Computer

Software and Services — 0.3% | |

| | | |

| | |

| | 8,955 | | |

CareCloud

Inc.† | |

| 71,446 | | |

| 26,417 | |

| | 5,000 | | |

Donnelley

Financial Solutions Inc.† | |

| 218,850 | | |

| 227,650 | |

| | 5,000 | | |

PAR

Technology Corp.† | |

| 172,612 | | |

| 164,650 | |

| | | | |

| |

| 462,908 | | |

| 418,717 | |

| | | | |

Consumer

Products — 3.5% | |

| | | |

| | |

| | 10,000 | | |

BellRing

Brands Inc. | |

| 220,301 | | |

| 366,000 | |

| | 27,000 | | |

Edgewell

Personal Care Co. | |

| 870,159 | | |

| 1,115,370 | |

| | 29,000 | | |

Energizer

Holdings Inc. | |

| 1,063,301 | | |

| 973,820 | |

| | 5,500 | | |

Essity

AB, Cl. B | |

| 167,500 | | |

| 146,407 | |

| | 300 | | |

L’Oreal

SA | |

| 48,140 | | |

| 139,815 | |

| | 12,000 | | |

Marine

Products Corp. | |

| 84,716 | | |

| 202,320 | |

| | 15,000 | | |

Mattel

Inc.† | |

| 178,197 | | |

| 293,100 | |

| | 45,000 | | |

Nintendo

Co. Ltd., ADR | |

| 494,517 | | |

| 512,100 | |

| | 5,500 | | |

Salvatore

Ferragamo SpA | |

| 101,774 | | |

| 90,504 | |

See

accompanying notes to financial statements.

The

Gabelli Global Small and Mid Cap Value Trust

Schedule

of Investments (Continued) — June 30, 2023 (Unaudited)

| Shares | | |

| |

Cost | | |

Market

Value | |

| | | | |

COMMON

STOCKS (Continued) | |

| | | |

| | |

| | | | |

Consumer

Products (Continued) | |

| | | |

| | |

| | 37,000 | | |

Scandinavian

Tobacco Group A/S | |

$ | 579,886

| | |

$ | 615,447 | |

| | 6,000 | | |

Shiseido

Co. Ltd. | |

| 108,513 | | |

| 269,989 | |

| | 7,000 | | |

Spectrum

Brands Holdings Inc. | |

| 405,090 | | |

| 546,350 | |

| | 2,000 | | |

Unilever

plc, ADR | |

| 101,177 | | |

| 104,260 | |

| | | | |

| |

| 4,423,271 | | |

| 5,375,482 | |

| | | | |

Consumer

Services — 1.2% | |

| | | |

| | |

| | 3,000 | | |

Allegion

plc | |

| 268,079 | | |

| 360,060 | |

| | 11,500 | | |

Ashtead

Group plc | |

| 214,712 | | |

| 795,096 | |

| | 500 | | |

Boyd

Group Services Inc. | |

| 72,110 | | |

| 95,395 | |

| | 350 | | |

Cie

de L’Odet SE | |

| 487,193 | | |

| 593,504 | |

| | | | |

| |

| 1,042,094 | | |

| 1,844,055 | |

| | | | |

Diversified

Industrial — 6.8% | |

| | | |

| | |

| | 105,000 | | |

Ampco-Pittsburgh

Corp.† | |

| 481,774 | | |

| 333,900 | |

| | 34,700 | | |

Ardagh

Group SA† | |

| 537,226 | | |

| 326,180 | |

| | 4,000 | | |

AZZ

Inc. | |

| 136,622 | | |

| 173,840 | |

| | 19,500 | | |

EnPro

Industries Inc. | |

| 1,280,580 | | |

| 2,603,835 | |

| | 33,200 | | |

Greif

Inc., Cl. A | |

| 1,648,083 | | |

| 2,287,148 | |

| | 19,000 | | |

Griffon

Corp. | |

| 326,904 | | |

| 765,700 | |

| | 700 | | |

Haynes

International Inc. | |

| 18,622 | | |

| 35,574 | |

| | 8,000 | | |

Jardine

Matheson Holdings Ltd. | |

| 453,243 | | |

| 405,200 | |

| | 2,400 | | |

Moog

Inc., Cl. A | |

| 143,517 | | |

| 260,232 | |

| | 25,500 | | |

Myers

Industries Inc. | |

| 410,923 | | |

| 495,465 | |

| | 5,000 | | |

Smiths

Group plc | |

| 95,104 | | |

| 104,394 | |

| | 22,000 | | |

Steel

Partners Holdings LP† | |

| 304,830 | | |

| 1,045,000 | |

| | 8,500 | | |

Sulzer

AG | |

| 524,083 | | |

| 730,294 | |

| | 40,000 | | |

Toray

Industries Inc. | |

| 316,267 | | |

| 221,879 | |

| | 40,000 | | |

Tredegar

Corp. | |

| 522,799 | | |

| 266,800 | |

| | 12,000 | | |

Trinity

Industries Inc. | |

| 242,785 | | |

| 308,520 | |

| | 7,000 | | |

Wartsila

OYJ Abp | |

| 87,437 | | |

| 78,790 | |

| | | | |

| |

| 7,530,799 | | |

| 10,442,751 | |

| | | | |

Educational

Services — 0.1% | |

| | | |

| | |

| | 15,000 | | |

Universal

Technical Institute Inc.† | |

| 59,076 | | |

| 103,650 | |

| | | | |

| |

| | | |

| | |

| | | | |

Electronics

— 2.7% | |

| | | |

| | |

| | 7,500 | | |

Flex

Ltd.† | |

| 130,663 | | |

| 207,300 | |

| | 30,000 | | |

Mirion

Technologies Inc.† | |

| 239,189 | | |

| 253,500 | |

| | 20,000 | | |

Resideo

Technologies Inc.† | |

| 195,763 | | |

| 353,200 | |

| | 100 | | |

Rogers

Corp.† | |

| 15,470 | | |

| 16,193 | |

| | 37,000 | | |

Sony

Group Corp., ADR | |

| 1,659,814 | | |

| 3,331,480 | |

| | | | |

| |

| 2,240,899 | | |

| 4,161,673 | |

| | | | |

Energy

and Utilities: Alternative Energy — 0.1% | |

| | | |

| | |

| | 2,000 | | |

NextEra

Energy Partners LP | |

| 78,153 | | |

| 117,280 | |

| Shares | | |

| |

Cost | | |

Market

Value | |

| | | | |

Energy

and Utilities: Electric — 0.8% | |

| | | |

| | |

| | 31,200 | | |

Algonquin

Power & Utilities Corp. | |

$ | 241,060 | | |

$ | 257,890 | |

| | 7,500 | | |

Fortis

Inc. | |

| 222,079 | | |

| 323,212 | |

| | 12,500 | | |

PNM

Resources Inc. | |

| 611,124 | | |

| 563,750 | |

| | | | |

| |

| 1,074,263 | | |

| 1,144,852 | |

| | | | |

Energy

and Utilities: Integrated — 1.1% | |

| | | |

| | |

| | 17,000 | | |

Avista

Corp. | |

| 746,503 | | |

| 667,590 | |

| | 3,500 | | |

Emera

Inc. | |

| 147,092 | | |

| 144,148 | |

| | 15,500 | | |

Hawaiian

Electric Industries Inc. | |

| 498,850 | | |

| 561,100 | |

| | 100,000 | | |

Hera

SpA | |

| 300,327 | | |

| 297,025 | |

| | | | |

| |

| 1,692,772 | | |

| 1,669,863 | |

| | | | |

Energy

and Utilities: Natural Gas — 0.9% | |

| | | |

| | |

| | 24,000 | | |

National

Fuel Gas Co. | |

| 1,226,542 | | |

| 1,232,640 | |

| | 1,200 | | |

Southwest

Gas Holdings Inc. | |

| 62,843 | | |

| 76,380 | |

| | | | |

| |

| 1,289,385 | | |

| 1,309,020 | |

| | | | |

Energy

and Utilities: Services — 0.7% | |

| | | |

| | |

| | 42,000 | | |

Dril-Quip

Inc.† | |

| 1,060,298 | | |

| 977,340 | |

| | 3,000 | | |

Pineapple

Energy Inc.† | |

| 55,158 | | |

| 4,110 | |

| | 2,000 | | |

Weatherford

International plc† | |

| 110,746 | | |

| 132,840 | |

| | | | |

| |

| 1,226,202 | | |

| 1,114,290 | |

| | | | |

Energy

and Utilities: Water — 2.1% | |

| | | |

| | |

| | 70,000 | | |

Beijing

Enterprises Water Group Ltd. | |

| 44,488 | | |

| 16,616 | |

| | 1,800 | | |

Consolidated

Water Co. Ltd. | |

| 23,158 | | |

| 43,614 | |

| | 17,000 | | |

Mueller

Water Products Inc., Cl. A | |

| 150,695 | | |

| 275,910 | |

| | 90,000 | | |

Primo

Water Corp. | |

| 786,054 | | |

| 1,128,600 | |

| | 55,000 | | |

Severn

Trent plc | |

| 1,560,035 | | |

| 1,792,351 | |

| | | | |

| |

| 2,564,430 | | |

| 3,257,091 | |

| | | | |

Entertainment

— 6.6% | |

| | | |

| | |

| | 235,000 | | |

Entain

plc | |

| 2,371,434 | | |

| 3,796,284 | |

| | 5,400 | | |

GAN

Ltd.† | |

| 30,574 | | |

| 8,856 | |

| | 10,000 | | |

Golden

Entertainment Inc.† | |

| 267,249 | | |

| 418,000 | |

| | 10,000 | | |

IMAX

Corp.† | |

| 177,640 | | |

| 169,900 | |

| | 30,000 | | |

Liberty

Media Corp.- Liberty Braves, Cl. A† | |

| 769,784 | | |

| 1,227,600 | |

| | 27,011 | | |

Liberty

Media Corp.- Liberty Braves, Cl. C† | |

| 629,414 | | |

| 1,070,176 | |

| | 2,600 | | |

Madison

Square Garden Entertainment Corp.† | |

| 95,824 | | |

| 87,412 | |

| | 4,600 | | |

Madison

Square Garden Sports Corp. | |

| 775,707 | | |

| 865,030 | |

| | 10,000 | | |

Manchester

United plc, Cl. A | |

| 175,413 | | |

| 243,800 | |

| | 25,000 | | |

Paramount

Global, Cl. A | |

| 798,807 | | |

| 464,000 | |

See

accompanying notes to financial statements.

The

Gabelli Global Small and Mid Cap Value Trust

Schedule

of Investments (Continued) — June 30, 2023 (Unaudited)

| Shares | | |

| |

Cost | | |

Market

Value | |

| | | | |

COMMON

STOCKS (Continued) | |

| | | |

| | |

| | | | |

Entertainment

(Continued) | |

| | | |

| | |

| | 4,000 | | |

Sphere

Entertainment Co.† | |

$ | 126,075 | | |

$ | 109,560 | |

| | 7,000 | | |

Ubisoft

Entertainment SA† | |

| 323,049 | | |

| 197,682 | |

| | 15,000 | | |

Universal

Music Group NV | |

| 343,898 | | |

| 333,089 | |

| | 80,000 | | |

Vivendi

SE | |

| 995,159 | | |

| 733,810 | |

| | 24,000 | | |

Warner

Bros Discovery Inc.† | |

| 455,136 | | |

| 300,960 | |

| | | | |

| |

| 8,335,163 | | |

| 10,026,159 | |

| | | | |

Environmental

Services — 0.9% | |

| | | |

| | |

| | 18,000 | | |

Renewi

plc† | |

| 70,014 | | |

| 117,729 | |

| | 6,000 | | |

Stericycle

Inc.† | |

| 376,340 | | |

| 278,640 | |

| | 20,000 | | |

TOMRA

Systems ASA | |

| 117,808 | | |

| 321,421 | |

| | 5,000 | | |

Waste

Connections Inc. | |

| 453,201 | | |

| 714,650 | |

| | | | |

| |

| 1,017,363 | | |

| 1,432,440 | |

| | | | |

Equipment

and Supplies — 4.8% | |

| | | |

| | |

| | 1,700 | | |

A.O.

Smith Corp. | |

| 57,029 | | |

| 123,726 | |

| | 24,500 | | |

Commercial

Vehicle Group Inc.† | |

| 228,014 | | |

| 271,950 | |

| | 31,500 | | |

Flowserve

Corp. | |

| 1,181,272 | | |

| 1,170,225 | |

| | 11,000 | | |

Graco

Inc. | |

| 552,353 | | |

| 949,850 | |

| | 17,000 | | |

Interpump

Group SpA | |

| 235,221 | | |

| 943,844 | |

| | 31,700 | | |

Mueller

Industries Inc. | |

| 907,015 | | |

| 2,766,776 | |

| | 1,000 | | |

Snap-on

Inc. | |

| 216,933 | | |

| 288,190 | |

| | 4,500 | | |

Watts

Water Technologies Inc., Cl. A | |

| 422,438 | | |

| 826,785 | |

| | | | |

| |

| 3,800,275 | | |

| 7,341,346 | |

| | | | |

Financial

Services — 3.5% | |

| | | |

| | |

| | 1,000 | | |

Credit

Acceptance Corp.† | |

| 390,020 | | |

| 507,930 | |

| | 5,800 | | |

EXOR

NV | |

| 445,054 | | |

| 516,949 | |

| | 51,000 | | |

FinecoBank

Banca Fineco SpA | |

| 336,185 | | |

| 685,345 | |

| | 100 | | |

First

Citizens BancShares Inc., Cl. A | |

| 61,371 | | |

| 128,345 | |

| | 38,000 | | |

Flushing

Financial Corp. | |

| 730,798 | | |

| 467,020 | |

| | 22,000 | | |

FTAI

Aviation Ltd. | |

| 268,756 | | |

| 696,520 | |

| | 185,000 | | |

GAM

Holding AG† | |

| 373,487 | | |

| 111,614 | |

| | 1,000 | | |

Groupe

Bruxelles Lambert NV | |

| 82,544 | | |

| 78,741 | |

| | 11,000 | | |

I3

Verticals Inc., Cl. A† | |

| 222,091 | | |

| 251,460 | |

| | 8,000 | | |

Janus

Henderson Group plc | |

| 239,400 | | |

| 218,000 | |

| | 18,000 | | |

Kinnevik

AB, Cl. A† | |

| 296,486 | | |

| 279,045 | |

| | 25,000 | | |

Kinnevik

AB, Cl. B† | |

| 478,874 | | |

| 346,303 | |

| | 1,800 | | |

PROG

Holdings Inc.† | |

| 52,138 | | |

| 57,816 | |

| | 70,000 | | |

Resona

Holdings Inc. | |

| 336,109 | | |

| 334,877 | |

| | 22,500 | | |

Synovus

Financial Corp. | |

| 807,483 | | |

| 680,625 | |

| | | | |

| |

| 5,120,796 | | |

| 5,360,590 | |

| | | | |

Food

and Beverage — 13.6% | |

| | | |

| | |

| | 7,000 | | |

Britvic

plc | |

| 68,455 | | |

| 76,098 | |

| Shares | | |

| |

Cost | | |

Market

Value | |

| | 280 | | |

Chocoladefabriken

Lindt & Spruengli AG | |

$ | 1,410,500 | | |

$ | 3,516,228 | |

| | 35,500 | | |

Chr.

Hansen Holding A/S | |

| 1,649,568 | | |

| 2,463,955 | |

| | 70,000 | | |

ChromaDex

Corp.† | |

| 109,302 | | |

| 109,900 | |

| | 3,000 | | |

Corby

Spirit and Wine Ltd., Cl. A | |

| 32,090 | | |

| 32,157 | |

| | 130,000 | | |

Davide

Campari-Milano NV | |

| 770,475 | | |

| 1,800,153 | |

| | 12,000 | | |

Fevertree

Drinks plc | |

| 171,334 | | |

| 185,776 | |

| | 9,000 | | |

Fomento

Economico Mexicano SAB de CV, ADR | |

| 680,678 | | |

| 997,560 | |

| | 1,000 | | |

Heineken

Holding NV | |

| 68,070 | | |

| 86,914 | |

| | 39,000 | | |

ITO

EN Ltd. | |

| 1,199,322 | | |

| 1,072,740 | |

| | 14,000 | | |

Kameda

Seika Co. Ltd. | |

| 647,551 | | |

| 419,626 | |

| | 10,500 | | |

Kerry

Group plc, Cl. A | |

| 893,272 | | |

| 1,014,570 | |

| | 39,000 | | |

Kikkoman

Corp. | |

| 1,074,135 | | |

| 2,214,131 | |

| | 7,500 | | |

Luckin

Coffee Inc., ADR† | |

| 58,296 | | |

| 168,675 | |

| | 100,000 | | |

Maple

Leaf Foods Inc. | |

| 1,814,874 | | |

| 1,953,576 | |

| | 105,000 | | |

Nissin

Foods Co. Ltd. | |

| 80,373 | | |

| 89,778 | |

| | 25,000 | | |

Nomad

Foods Ltd.† | |

| 448,380 | | |

| 438,000 | |

| | 5,000 | | |

Post

Holdings Inc.† | |

| 210,232 | | |

| 433,250 | |

| | 190,000 | | |

Premier

Foods plc | |

| 110,648 | | |

| 307,416 | |

| | 9,000 | | |

Remy

Cointreau SA | |

| 956,602 | | |

| 1,443,167 | |

| | 1,800 | | |

Symrise

AG | |

| 97,498 | | |

| 188,599 | |

| | 2,000 | | |

The

Hain Celestial Group Inc.† | |

| 39,730 | | |

| 25,020 | |

| | 9,000 | | |

Treasury

Wine Estates Ltd. | |

| 47,872 | | |

| 67,328 | |

| | 40,000 | | |

Tsingtao

Brewery Co. Ltd., Cl. H | |

| 264,487 | | |

| 363,451 | |

| | 215,000 | | |

Vitasoy

International Holdings Ltd. | |

| 279,436 | | |

| 267,790 | |

| | 16,000 | | |

Yakult

Honsha Co. Ltd. | |

| 826,068 | | |

| 1,009,598 | |

| | | | |

| |

| 14,009,248 | | |

| 20,745,456 | |

| | | | |

Health

Care — 5.8% | |

| | | |

| | |

| | 18,237 | | |

Avantor

Inc.† | |

| 308,295 | | |

| 374,588 | |

| | 11,000 | | |

Bausch

+ Lomb Corp.† | |

| 178,795 | | |

| 220,770 | |

| | 40,000 | | |

Bausch

Health Cos. Inc.† | |

| 468,398 | | |

| 320,000 | |

| | 600 | | |

Bio-Rad

Laboratories Inc., Cl. A† | |

| 176,718 | | |

| 227,472 | |

| | 150 | | |

Bio-Rad

Laboratories Inc., Cl. B† | |

| 35,257 | | |

| 56,865 | |

| | 5,000 | | |

Catalent

Inc.† | |

| 364,536 | | |

| 216,800 | |

| | 500 | | |

Charles

River Laboratories International Inc.† | |

| 52,615 | | |

| 105,125 | |

| | 450 | | |

Chemed

Corp. | |

| 183,159 | | |

| 243,752 | |

| | 11,500 | | |

Cutera

Inc.† | |

| 196,316 | | |

| 173,995 | |

| | 2,500 | | |

DaVita

Inc.† | |

| 193,331 | | |

| 251,175 | |

| | 10,000 | | |

DENTSPLY

SIRONA Inc. | |

| 479,029 | | |

| 400,200 | |

| | 5,000 | | |

DICE

Therapeutics Inc.† | |

| 232,568 | | |

| 232,300 | |

| | 4,000 | | |

Endo

International plc† | |

| 1,340 | | |

| 70 | |

| | 13,000 | | |

Evolent

Health Inc., Cl. A† | |

| 153,137 | | |

| 393,900 | |

See

accompanying notes to financial statements.

The

Gabelli Global Small and Mid Cap Value Trust

Schedule of Investments (Continued) — June 30, 2023 (Unaudited)

| Shares | | |

| |

Cost | | |

Market

Value | |

| | | | |

COMMON

STOCKS (Continued) | |

| | | |

| | |

| | | | |

Health

Care (Continued) | |

| | | |

| | |

| | 5,000 | | |

Halozyme

Therapeutics Inc.† | |

$ | 182,224 | | |

$ | 180,350 | |

| | 700 | | |

Harmony

Biosciences Holdings Inc.† | |

| 26,461 | | |

| 24,633 | |

| | 6,000 | | |

Henry

Schein Inc.† | |

| 435,761 | | |

| 486,600 | |

| | 1,750 | | |

ICU

Medical Inc.† | |

| 321,152 | | |

| 311,832 | |

| | 5,000 | | |

Idorsia

Ltd.† | |

| 63,344 | | |

| 36,032 | |

| | 20,000 | | |

InfuSystem

Holdings Inc.† | |

| 195,470 | | |

| 192,600 | |

| | 5,500 | | |

Integer

Holdings Corp.† | |

| 316,983 | | |

| 487,355 | |

| | 5,000 | | |

IVERIC

bio Inc.† | |

| 191,748 | | |

| 196,700 | |

| | 13,000 | | |

Option

Care Health Inc.† | |

| 112,945 | | |

| 422,370 | |

| | 28,000 | | |

Patterson

Cos. Inc. | |

| 631,785 | | |

| 931,280 | |

| | 35,000 | | |

Perrigo

Co. plc | |

| 1,340,562 | | |

| 1,188,250 | |

| | 1,003 | | |

Silk

Road Medical Inc.† | |

| 31,959 | | |

| 32,587 | |

| | 700 | | |

STERIS

plc | |

| 86,397 | | |

| 157,486 | |

| | 6,000 | | |

SurModics

Inc.† | |

| 130,405 | | |

| 187,860 | |

| | 1,500 | | |

Teladoc

Health Inc.† | |

| 62,691 | | |

| 37,980 | |

| | 7,000 | | |

Tenet

Healthcare Corp.† | |

| 443,649 | | |

| 569,660 | |

| | 400 | | |

The

Cooper Companies Inc. | |

| 108,748 | | |

| 153,372 | |

| | | | |

| |

| 7,705,778 | | |

| 8,813,959 | |

| | | | |

Hotels

and Gaming — 2.7% | |

| | | |

| | |

| | 2,500 | | |

Caesars

Entertainment Inc.† | |

| 85,978 | | |

| 127,425 | |

| | 901 | | |

Flutter

Entertainment plc† | |

| 80,235 | | |

| 180,795 | |

| | 24,000 | | |

Full

House Resorts Inc.† | |

| 70,181 | | |

| 160,800 | |

| | 40,000 | | |

International

Game Technology plc | |

| 557,674 | | |

| 1,275,600 | |

| | 656,250 | | |

Mandarin

Oriental International Ltd.† | |

| 1,132,805 | | |

| 1,082,813 | |

| | 9,000 | | |

MGM

Resorts International | |

| 262,595 | | |

| 395,280 | |

| | 300,000 | | |

The

Hongkong & Shanghai Hotels Ltd.† | |

| 407,957 | | |

| 264,165 | |

| | 5,500 | | |

Wynn

Resorts Ltd. | |

| 582,328 | | |

| 580,855 | |

| | | | |

| |

| 3,179,753 | | |

| 4,067,733 | |

| | | | |

Machinery

— 5.0% | |

| | | |

| | |

| | 21,000 | | |

Astec

Industries Inc. | |

| 837,999 | | |

| 954,240 | |

| | 160,000 | | |

CNH

Industrial NV, Borsa Italiana | |

| 1,202,309 | | |

| 2,305,487 | |

| | 224,000 | | |

CNH

Industrial NV, New York | |

| 1,638,281 | | |

| 3,225,600 | |

| | 2,400 | | |

Tennant

Co. | |

| 145,956 | | |

| 194,664 | |

| | 13,000 | | |

Twin

Disc Inc.† | |

| 99,365 | | |

| 146,380 | |

| | 7,500 | | |

Xylem

Inc. | |

| 418,641 | | |

| 844,650 | |

| | | | |

| |

| 4,342,551 | | |

| 7,671,021 | |

| | | | |

Manufactured

Housing and Recreational Vehicles — 0.4% | |

| | | |

| | |

| | 2,200 | | |

Cavco

Industries Inc.† | |

| 245,097 | | |

| 649,000 | |

| | | | |

| |

| | | |

| | |

| | | | |

Metals

and Mining — 0.8% | |

| | | |

| | |

| | 2,000 | | |

ATI

Inc.† | |

| 31,636 | | |

| 88,460 | |

| Shares | | |

| |

Cost | | |

Market

Value | |

| | 25,000 | | |

Cameco

Corp. | |

$ | 245,432 | | |

$ | 783,250 | |

| | 120,000 | | |

Sierra

Metals Inc.† | |

| 334,971 | | |

| 36,000 | |

| | 4,000 | | |

TimkenSteel

Corp.† | |

| 34,761 | | |

| 86,280 | |

| | 5,800 | | |

Wheaton

Precious Metals Corp. | |

| 186,176 | | |

| 250,676 | |

| | | | |

| |

| 832,976 | | |

| 1,244,666 | |

| | | | |

Publishing

— 0.6% | |

| | | |

| | |

| | 1,400 | | |

Graham

Holdings Co., Cl. B | |

| 620,724 | | |

| 800,072 | |

| | 10,000 | | |

The

E.W. Scripps Co., Cl. A† | |

| 141,538 | | |

| 91,500 | |

| | | | |

| |

| 762,262 | | |

| 891,572 | |

| | | | |

Real

Estate — 0.3% | |

| | | |

| | |

| | 20,000 | | |

Starwood

Property Trust Inc., REIT | |

| 510,432 | | |

| 388,000 | |

| | 37,000 | | |

Trinity

Place Holdings Inc.† | |

| 93,748 | | |

| 19,980 | |

| | | | |

| |

| 604,180 | | |

| 407,980 | |

| | | | |

Retail

— 2.1% | |

| | | |

| | |

| | 5,000 | | |

AutoNation

Inc.† | |

| 400,962 | | |

| 823,050 | |

| | 600 | | |

Biglari

Holdings Inc., Cl. A† | |

| 318,354 | | |

| 570,000 | |

| | 8,000 | | |

Camping

World Holdings Inc., Cl. A | |

| 312,130 | | |

| 240,800 | |

| | 4,186 | | |

Hertz

Global Holdings Inc.† | |

| 41,852 | | |

| 76,981 | |

| | 361 | | |

Hertz

Global Holdings Inc., New York† | |

| 0 | | |

| 6,639 | |

| | 7,500 | | |

MarineMax

Inc.† | |

| 107,717 | | |

| 256,200 | |

| | 6,000 | | |

Movado

Group Inc. | |

| 101,296 | | |

| 160,980 | |

| | 1,500 | | |

Penske

Automotive Group Inc. | |

| 55,315 | | |

| 249,945 | |

| | 10,000 | | |

PetIQ

Inc.† | |

| 227,232 | | |

| 151,700 | |

| | 20,000 | | |

Pets

at Home Group plc | |

| 131,616 | | |

| 95,656 | |

| | 8,000 | | |

Rush

Enterprises Inc., Cl. B | |

| 234,783 | | |

| 544,480 | |

| | 225,000 | | |

Sun

Art Retail Group Ltd. | |

| 216,188 | | |

| 58,001 | |

| | | | |

| |

| 2,147,445 | | |

| 3,234,432 | |

| | | | |

Specialty

Chemicals — 1.7% | |

| | | |

| | |

| | 7,500 | | |

Ashland

Inc. | |

| 460,741 | | |

| 651,825 | |

| | 2,000 | | |

Darling

Ingredients Inc.† | |

| 120,054 | | |

| 127,580 | |

| | 53,000 | | |

Element

Solutions Inc. | |

| 582,869 | | |

| 1,017,600 | |

| | 2,000 | | |

H.B.

Fuller Co. | |

| 95,917 | | |

| 143,020 | |

| | 13,547 | | |

Huntsman

Corp. | |

| 368,167 | | |

| 366,040 | |

| | 14,000 | | |

SGL

Carbon SE† | |

| 129,553 | | |

| 128,554 | |

| | 6,000 | | |

T.

Hasegawa Co. Ltd. | |

| 114,881 | | |

| 142,625 | |

| | 2,000 | | |

Takasago

International Corp. | |

| 51,764 | | |

| 37,423 | |

| | 700 | | |

Treatt

plc | |

| 3,479 | | |

| 5,556 | |

| | | | |

| |

| 1,927,425 | | |

| 2,620,223 | |

| | | | |

Telecommunications

— 0.8% | |

| | | |

| | |

| | 5,000 | | |

Gogo

Inc.† | |

| 19,504 | | |

| 85,050 | |

| | 6,000 | | |

Hellenic

Telecommunications Organization SA, ADR | |

| 41,840 | | |

| 51,300 | |

See

accompanying notes to financial statements.

The

Gabelli Global Small and Mid Cap Value Trust

Schedule of Investments (Continued) — June 30, 2023 (Unaudited)

| Shares | | |

| |

Cost | | |

Market

Value | |

| | | | |

COMMON

STOCKS (Continued) | |

| | | |

| | |

| | | | |

Telecommunications

(Continued) | |

| | | |

| | |

| | 100,000 | | |

Pharol

SGPS SA† | |

$ | 34,664 | | |

$ | 4,321 | |

| | 33,000 | | |

Telekom

Austria AG | |

| 210,582 | | |

| 244,145 | |

| | 17,500 | | |

Telephone

and Data Systems Inc. | |

| 175,565 | | |

| 144,025 | |

| | 21,000 | | |

Telesat

Corp.† | |

| 601,316 | | |

| 197,820 | |

| | 60,000 | | |

Vodafone

Group plc, ADR | |

| 972,175 | | |

| 567,000 | |

| | | | |

| |

| 2,055,646 | | |

| 1,293,661 | |

| | | | |

Transportation

— 1.4% | |

| | | |

| | |

| | 64,000 | | |

Bollore

SE | |

| 316,096 | | |

| 398,768 | |

| | 22,000 | | |

FTAI

Infrastructure Inc. | |

| 53,492 | | |

| 81,180 | |

| | 12,500 | | |

GATX

Corp. | |

| 837,621 | | |

| 1,609,250 | |

| | | | |

| |

| 1,207,209 | | |

| 2,089,198 | |

| | | | |

Wireless

Communications — 0.5% | |

| | | |

| | |

| | 37,000 | | |

Millicom

International Cellular SA, SDR† | |

| 718,042 | | |

| 565,531 | |

| | 15,000 | | |

United

States Cellular Corp.† | |

| 447,865 | | |

| 264,450 | |

| | | | |

| |

| 1,165,907 | | |

| 829,981 | |

| | | | |

TOTAL

COMMON STOCKS | |

| 106,656,484 | | |

| 138,726,434 | |

| | | | |

| |

| | | |

| | |

| | | | |

PREFERRED

STOCKS — 0.2% | |

| | | |

| | |

| | | | |

Health

Care — 0.2% | |

| | | |

| | |

| | 10,000 | | |

XOMA

Corp., Ser. A,8.625% | |

| 225,998 | | |

| 239,700 | |

| | | | |

| |

| | | |

| | |

| | | | |

Retail

— 0.0% | |

| | | |

| | |

| | 450 | | |

Qurate

Retail Inc., 8.000%,03/15/31 | |

| 39,466 | | |

| 16,884 | |

| | | | |

| |

| | | |

| | |

| | | | |

TOTAL

PREFERRED STOCKS | |

| 265,464 | | |

| 256,584 | |

| | | | |

| |

| | | |

| | |

| | | | |

RIGHTS

— 0.0% | |

| | | |

| | |

| | | | |

Energy

and Utilities: Services — 0.0% | |

| | | |

| | |

| | 13,750 | | |

Pineapple

Energy Inc.,CVR† | |

| 0 | | |

| 48,537 | |

| | | | |

| |

| | | |

| | |

| | | | |

Health

Care — 0.0% | |

| | | |

| | |

| | 45,000 | | |

Achillion

Pharmaceuticals Inc., CVR† | |

| 0 | | |

| 22,500 | |

| | 1,500 | | |

Tobira

Therapeutics Inc.,CVR† (a) | |

| 90 | | |

| 0 | |

| | | | |

| |

| 90 | | |

| 22,500 | |

| | | | |

TOTAL

RIGHTS | |

| 90 | | |

| 71,037 | |

| Shares | | |

| |

Cost | | |

Market

Value | |

| | | | |

WARRANTS

— 0.0% | |

| | | |

| | |

| | | | |

Diversified

Industrial — 0.0% | |

| | | |

| | |

| | 64,000 | | |

Ampco-Pittsburgh

Corp., expire 08/01/25† | |

$ | 43,720 | | |

$ | 31,360 | |

| | | | |

| |

| | | |

| | |

| | | | |

Energy

and Utilities: Services — 0.0% | |

| | | |

| | |

| | 539 | | |

Weatherford

International plc, expire 12/13/23† | |

| 0 | | |

| 226 | |

| | | | |

| |

| | | |

| | |

| | | | |

TOTAL

WARRANTS | |

| 43,720 | | |

| 31,586 | |

Principal

Amount | | |

| |

| | |

| |

| | | | |

U.S.

GOVERNMENT OBLIGATIONS — 9.0% | |

| | | |

| | |

| $ | 13,895,000 | | |

U.S.

Treasury Bills, 5.067% to 5.435%††, 08/10/23 to 12/14/23 | |

| 13,741,940 | | |

| 13,744,864 | |

| | | | |

| |

| | | |

| | |

| TOTAL

INVESTMENTS—100.0% | |

$ | 120,707,698 | | |

| 152,830,505 | |

| | |

| | | |

| | |

| Other

Assets and Liabilities (Net) | |

| | | |

| 806,371 | |

| |

|

|

|

| |

| | | |

| | |

PREFERRED

SHARES

(3,200,000 preferred shares outstanding) | |

| | | |

| (32,000,000 | ) |

| | |

| | | |

| | |

NET

ASSETS — COMMON SHARES

(8,619,082 common shares outstanding) | |

| | | |

$ | 121,636,876 | |

| | |

| | | |

| | |

NET

ASSET VALUE PER COMMON SHARE

($121,636,876 ÷ 8,619,082 shares outstanding) | |

| | | |

$ | 14.11 | |

| (a) | Security

is valued using significant unobservable inputs and is classified as Level 3 in the fair

value hierarchy. |

| † | Non-income

producing security. |

| †† | Represents

annualized yields at dates of purchase. |

| ADR | American

Depositary Receipt |

| CVR | Contingent

Value Right |

| REIT | Real

Estate Investment Trust |

| SDR | Swedish

Depositary Receipt |

See

accompanying notes to financial statements.

The

Gabelli Global Small and Mid Cap Value Trust

Schedule of Investments (Continued) — June 30, 2023 (Unaudited)

Geographic

Diversification | |

%

of Total

Investments | | |

Market

Value | |

| United

States | |

| 56.6 | % | |

$ | 86,544,486 | |

| Europe | |

| 29.3 | | |

| 44,856,832 | |

| Japan | |

| 6.3 | | |

| 9,566,467 | |

| Canada | |

| 4.2 | | |

| 6,380,563 | |

| Asia/Pacific | |

| 1.8 | | |

| 2,783,816 | |

| Latin

America | |

| 1.8 | | |

| 2,698,341 | |

| Total

Investments | |

| 100.0 | % | |

$ | 152,830,505 | |

See

accompanying notes to financial statements.

The

Gabelli Global Small and Mid Cap Value Trust

Statement

of Assets and Liabilities

June

30, 2023 (Unaudited)

| Assets: | |

| | |

| Investments,

at value (cost $120,707,698) | |

$ | 152,830,505 | |

| Cash | |

| 551,857 | |

| Foreign

currency, at value (cost $45,908) | |

| 45,700 | |

| Receivable

for investments sold | |

| 57,480 | |

| Dividends

and interest receivable | |

| 371,905 | |

| Deferred

offering expense | |

| 139,082 | |

| Prepaid

expenses | |

| 350 | |

| Total

Assets | |

| 153,996,879 | |

| Liabilities: | |

| | |

| Distributions

payable | |

| 23,111 | |

| Payable

for Fund shares repurchased | |

| 4,711 | |

| Payable

for investment advisory fees | |

| 124,733 | |

| Payable

for payroll expenses | |

| 77,889 | |

| Payable

for accounting fees | |

| 7,500 | |

| Series

B Cumulative Preferred Shares (5.20%, $10 liquidation value, 4,000,000 shares authorized with 3,200,000 shares issued and outstanding) | |

| 32,000,000 | |

| Other

accrued expenses | |

| 122,059 | |

| Total

Liabilities | |

| 32,360,003 | |

| Net

Assets Attributable to Common Shareholders | |

$ | 121,636,876 | |

| | |

| | |

| Net

Assets Attributable to Common Shareholders Consist of: | |

| | |

| Paid-in

capital | |

$ | 92,355,191 | |

| Total

distributable earnings | |

| 29,281,685 | |

| Net

Assets | |

$ | 121,636,876 | |

| | |

| | |

| Net

Asset Value per Common Share: | |

| | |

| ($121,636,876

÷ 8,619,082 shares outstanding at $0.001 par value; unlimited number of shares authorized) | |

$ | 14.11 | |

Statement

of Operations

For

the Six Months Ended June 30, 2023 (Unaudited)

| Investment

Income: | |

| | |

| Dividends

(net of foreign withholding taxes of $61,464) | |

$ | 1,370,433 | |

| Interest | |

| 337,478 | |

| Total

Investment Income | |

| 1,707,911 | |

| Expenses: | |

| | |

| Investment

advisory fees | |

| 762,246 | |

| Interest

expense on preferred stock | |

| 686,933 | |

| Payroll

expenses | |

| 86,011 | |

| Shareholder

communications expenses | |

| 57,741 | |

| Legal

and audit fees | |

| 53,390 | |

| Trustees’

fees | |

| 30,803 | |

| Custodian

fees | |

| 26,712 | |

| Accounting

fees | |

| 22,500 | |

| Shareholder

services fees | |

| 14,371 | |

| Shelf

offering expense | |

| 14,178 | |

| Interest

expense | |

| 87 | |

| Miscellaneous

expenses | |

| 33,776 | |

| Total

Expenses | |

| 1,788,748 | |

| Less: | |

| | |

| Expenses

paid indirectly by broker (See Note 5) | |

| (1,288 | ) |

| Net

Expenses | |

| 1,787,460 | |

| Net

Investment Loss | |

| (79,549 | ) |

| | |

| | |

| Net

Realized and Unrealized Gain/(Loss) on Investments and Foreign Currency: | |

| | |

| Net

realized gain on investments | |

| 1,521,451 | |

| Net

realized loss on foreign currency transactions | |

| (2,694 | ) |

| Net

realized gain on investments and foreign currency transactions | |

| 1,518,757 | |

| Net

change in unrealized appreciation/depreciation: | |

| | |

| on

investments | |

| 8,459,504 | |

| on

foreign currency translations | |

| 2,314 | |

| Net

change in unrealized appreciation/depreciation on investments and foreign currency translations | |

| 8,461,818 | |

| Net

Realized and Unrealized Gain/(Loss) on Investments and Foreign Currency | |

| 9,980,575 | |

| Net

Increase in Net Assets Attributable to Common Shareholders Resulting from Operations | |

$

| 9,901,026 | |

See

accompanying notes to financial statements.

The

Gabelli Global Small and Mid Cap Value Trust

Statement

of Changes in Net Assets Attributable to Common Shareholders

| | |

Six

Months Ended

June 30,

2023

(Unaudited) | | |

Year

Ended

December 31,

2022 | |

| Operations: | |

| | | |

| | |

| Net

investment loss | |

$ | (79,549 | ) | |

$ | (1,399,968 | ) |

| Net

realized gain on investments and foreign currency transactions | |

| 1,518,757 | | |

| 5,683,906 | |

| Net

change in unrealized appreciation/depreciation on investments and foreign currency translations | |

| 8,461,818 | | |

| (38,558,055 | ) |

| Net

Increase/(Decrease) in Net Assets Resulting from Operations | |

| 9,901,026 | | |

| (34,274,117 | ) |

| | |

| | | |

| | |

| Distributions

to Preferred Shareholders from Accumulated Earnings | |

| — | | |

| (272,500 | ) |

| | |

| | | |

| | |

| Net

Increase/(Decrease) in Net Assets Attributable to Common Shareholders Resulting from Operations | |

| 9,901,026 | | |

| (34,546,617 | ) |

| | |

| | | |

| | |

| Distributions

to Common Shareholders: | |

| | | |

| | |

| Accumulated

earnings | |

| (817,362 | )* | |

| (5,667,064 | ) |

| Return

of capital | |

| (1,965,146 | )* | |

| — | |

| Total

Distributions to Common Shareholders | |

| (2,782,508 | ) | |

| (5,667,064 | ) |

| | |

| | | |

| | |

| Fund

Share Transactions: | |

| | | |

| | |

| Net

decrease from repurchase of common shares | |

| (1,593,413 | ) | |

| (2,085,542 | ) |

| Net

Decrease in Net Assets from Fund Share Transactions | |

| (1,593,413 | ) | |

| (2,085,542 | ) |

| | |

| | | |

| | |

| Net

Increase/(Decrease) in Net Assets Attributable to Common Shareholders | |

| 5,525,105 | | |

| (42,299,223 | ) |

| | |

| | | |

| | |

| Net

Assets Attributable to Common Shareholders: | |

| | | |

| | |

| Beginning

of year | |

| 116,111,771 | | |

| 158,410,994 | |

| End

of period | |

$ | 121,636,876 | | |

$ | 116,111,771 | |

| * | Based

on year to date book income. Amounts are subject to change and recharacterization at year

end. |

See

accompanying notes to financial statements.

The

Gabelli Global Small and Mid Cap Value Trust

Statement

of Cash Flows

For

the Six Months Ended June 30, 2023 (Unaudited)

| Net

increase in net assets attributable to common shareholders resulting from operations | |

$ | 9,901,026 | |

| | |

| | |

| Adjustments

to Reconcile Net Increase in Net Assets Resulting from Operations to Net Cash from Operating Activities: | |

| | |

| Purchase

of long term investment securities | |

| (4,722,797 | ) |

| Proceeds

from sales of long term investment securities | |

| 9,751,808 | |

| Net

sales of short term investment securities | |

| 698,971 | |

| Net

realized gain on investments | |

| (1,521,451 | ) |

| Net

change in unrealized appreciation on investments | |

| (8,459,504 | ) |

| Net

amortization of discount | |

| (336,904 | ) |

| Decrease

in receivable for investments sold | |

| 343,346 | |

| Increase

in dividends and interest receivable | |

| (30,066 | ) |

| Decrease

in deferred offering expense | |

| 14,177 | |

| Decrease

in prepaid expenses | |

| 1,707 | |

| Decrease

in payable for investments purchased | |

| (634,737 | ) |

| Decrease

in payable for investment advisory fees | |

| (2,469 | ) |

| Increase

in payable for payroll expenses | |

| 13,654 | |

| Decrease

in payable for accounting fees | |

| (3,750 | ) |

| Decrease

in other accrued expenses | |

| (9,660 | ) |

| Net

cash provided by operating activities | |

| 5,003,351 | |

| | |

| | |

| Net

decrease in net assets resulting from financing activities: | |

| | |

| Distributions

to common shareholders | |

| (2,777,175 | ) |

| Increase

in payable for Fund shares redeemed | |

| 4,711 | |

| Decrease

from repurchase of common shares | |

| (1,593,413 | ) |

| Decrease

in payable to bank | |

| (52,598 | ) |

| Net

cash used in financing activities | |

| (4,418,475 | ) |

| Net

increase in cash | |

| 584,876 | |

| Cash

(including foreign currency): | |

| | |

| Beginning

of year | |

| 12,681 | |

| End

of period | |

$ | 597,557 | |

|

| |

| | |

| Supplemental

disclosure of cash flow information: | |

| | |

| Interest

paid on preferred shares | |

$ | 686,933 | |

| Interest

paid on bank overdrafts | |

| 87 | |

The

following table provides a reconciliation of cash and foreign currency reported within the Statement of Assets and Liabilities that sum

to the total of the same amount above at June 30, 2023:

| Cash | |

$ | 551,857 | |

| Foreign

currency, at value | |

| 45,700

| |

| | |

$ | 597,557 | |

See

accompanying notes to financial statements

The

Gabelli Global Small and Mid Cap Value Trust

Financial

Highlights

Selected

data for a common share of beneficial interest outstanding throughout each period:

| | |

Six

Months Ended

June 30,

2023 | | |

Year

Ended December 31, | |

| |

(Unaudited) | | |

2022 | | |

2021 | | |

2020 | | |

2019 | | |

2018 | |

| Operating

Performance: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net

asset value, beginning of year | |

$ | 13.26 | | |

$ | 17.73 | | |

$ | 15.17 | | |

$ | 13.85 | | |

$ | 12.41 | | |

$ | 14.63 | |

| Net

investment income/(loss) | |

| (0.01 | ) | |

| (0.16 | ) | |

| (0.04 | ) | |

| (0.02 | ) | |

| 0.11 | (a) | |

| 0.07 | |

| Net

realized and unrealized gain/(loss) on investments and foreign currency transactions | |

| 1.15 | | |

| (3.67 | ) | |

| 3.79 | | |

| 2.09 | | |

| 2.01 | | |

| (2.25 | ) |

| Total

from investment operations | |

| 1.14 | | |

| (3.83 | ) | |

| 3.75 | | |

| 2.07 | | |

| 2.12 | | |

| (2.18 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Distributions

to Preferred Shareholders: (b) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net

investment income | |

| — | | |

| — | | |

| (0.02 | ) | |

| — | | |

| (0.05 | ) | |

| (0.05 | ) |

| Net

realized gain | |

| — | | |

| (0.03 | ) | |

| (0.16 | ) | |

| (0.18 | ) | |

| (0.12 | ) | |

| (0.11 | ) |

| Total

distributions to preferred shareholders | |

| — | | |

| (0.03 | ) | |

| (0.18 | ) | |

| (0.18 | ) | |

| (0.17 | ) | |

| (0.16 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net

Increase/(Decrease) in Net Assets Attributable to Common Shareholders Resulting from Operations | |

| 1.14 | | |

| (3.86 | ) | |

| 3.57 | | |

| 1.89 | | |

| 1.95 | | |

| (2.34 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Distributions

to Common Shareholders: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net

investment income | |

| (0.04 | )* | |

| (0.02 | ) | |

| (0.14 | ) | |

| — | | |

| (0.12 | ) | |

| — | |

| Net

realized gain | |

| (0.06 | )* | |

| (0.62 | ) | |

| (0.90 | ) | |

| (0.05 | ) | |

| (0.28 | ) | |

| — | |

| Return

of capital | |

| (0.22 | )* | |

| — | | |

| — | | |

| (0.59 | ) | |

| (0.16 | ) | |

| — | |

| Total

distributions to common shareholders | |

| (0.32 | ) | |

| (0.64 | ) | |

| (1.04 | ) | |

| (0.64 | ) | |

| (0.56 | ) | |

| — | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Fund

Share Transactions: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Increase

in net asset value from repurchase of common shares | |

| 0.03 | | |

| 0.03 | | |

| 0.03 | | |

| 0.07 | | |

| 0.05 | | |

| 0.13 | |

| Offering

costs and adjustment to offering costs for preferred shares charged to paid-in capital | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (0.00 | )(c) |

| Offering

costs for common shares charged to paid-in capital | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (0.01 | ) |

| Total

Fund share transactions | |

| 0.03 | | |

| 0.03 | | |

| 0.03 | | |

| 0.07 | | |

| 0.05 | | |

| 0.12 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net

Asset Value Attributable to Common Shareholders, End of Period | |

$ | 14.11 | | |

$ | 13.26 | | |

$ | 17.73 | | |

$ | 15.17 | | |

$ | 13.85 | | |

$ | 12.41 | |

| NAV

total return † | |

| 8.93 | % | |

| (21.64 | )% | |

| 23.90 | % | |

| 16.01 | % | |

| 16.27 | % | |

| (15.17 | )% |

| Market

value, end of period | |

$ | 11.99 | | |

$ | 11.22 | | |

$ | 15.90 | | |

$ | 13.05 | | |

$ | 11.84 | | |

$ | 9.80 | |

| Investment

total return †† | |

| 9.80 | % | |

| (25.42 | )% | |

| 30.20 | % | |

| 17.99 | % | |

| 26.77 | % | |

| (23.08 | )% |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Ratios

to Average Net Assets and Supplemental Data: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net

assets including liquidation value of preferred shares, end of period (in 000’s) | |

$ | 153,637 | | |

$ | 148,112 | | |

$ | 228,411 | | |

$ | 167,684 | | |

$ | 160,989 | | |

$ | 150,353 | |

| Net

assets attributable to common shares, end of period (in 000’s) | |

$ | 121,637 | | |

$ | 116,112 | | |

$ | 158,411 | | |

$ | 137,684 | | |

$ | 130,989 | | |

$ | 120,353 | |

| Ratio

of net investment income/(loss) to average net assets attributable to common shares before preferred share distributions | |

| (0.13 | )%(d) | |

| (1.11 | )% | |

| (0.20 | )% | |

| (0.18 | )% | |

| 0.83 | %(a) | |

| 0.49 | % |

| Ratio

of operating expenses to average net assets attributable to common shares (e)(f) | |

| 2.96 | %(d) | |

| 3.17 | % | |

| 1.78 | % | |

| 1.82 | % | |

| 1.73 | % | |

| 1.68 | % |

| Portfolio

turnover rate | |

| 3 | % | |

| 9 | % | |

| 23 | % | |

| 14 | % | |

| 35 | % | |

| 80 | % |

See

accompanying notes to financial statements.

The

Gabelli Global Small and Mid Cap Value Trust

Financial

Highlights (Continued)

Selected

data for a common share of beneficial interest outstanding throughout each period:

| | |

Six Months

Ended

June 30,

2023 | | |

Year Ended December 31, | |

| | |

(Unaudited) | | |

2022 | | |

2021 | | |

2020 | | |

2019 | | |

2018 | |

| 5.450%

Series A Cumulative Preferred Shares (g) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Liquidation

value, end of period (in 000’s) | |

| — | | |

| — | | |

$ | 30,000 | | |

$ | 30,000 | | |

$ | 30,000 | | |

$ | 30,000 | |

| Total

shares outstanding (in 000’s) | |

| — | | |

| — | | |

| 1,200 | | |

| 1,200 | | |

| 1,200 | | |

| 1,200 | |

| Liquidation

preference per share | |

| — | | |

| — | | |

$ | 25.00 | | |

$ | 25.00 | | |

$ | 25.00 | | |

$ | 25.00 | |

| Average

market value (h) | |

| — | | |

| — | | |

$ | 25.86 | | |

$ | 25.62 | | |

$ | 25.51 | | |

$ | 24.97 | |

| Asset

coverage per share | |

| — | | |

| — | | |

$ | 81.58 | | |

$ | 139.74 | | |

$ | 134.16 | | |

$ | 125.31 | |

| 5.200%

Series B Cumulative Preferred Shares (i) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Liquidation

value, end of period (in 000’s) | |

$ | 32,000 | | |

$ | 32,000 | | |

$ | 40,000 | | |

| — | | |

| — | | |

| — | |

| Total

shares outstanding (in 000’s) | |

| 3,200 | | |

| 3,200 | | |

| 4,000 | | |

| — | | |

| — | | |

| — | |

| Liquidation

preference per share | |

$ | 10.00 | | |

$ | 10.00 | | |

$ | 10.00 | | |

| — | | |

| — | | |

| — | |

| Liquidation

value | |

$ | 10.00 | | |

$ | 10.00 | | |

$ | 10.00 | | |

| — | | |

| — | | |

| — | |

| Asset

coverage per share | |

$ | 48.01 | | |

$ | 46.28 | | |

$ | 32.63 | | |

| — | | |

| — | | |

| — | |

| Asset

Coverage (j) | |

| 480 | % | |

| 463 | % | |

| 326 | % | |

| 559 | % | |

| 537 | % | |

| 501 | % |

|

† | Based

on net asset value per share, adjusted for reinvestment of distributions at net asset value

on the ex-dividend dates and adjustments for the rights offering. |

| †† | Based

on market value per share, adjusted for reinvestment of distributions at prices determined

under the Fund’s dividend reinvestment plan and adjustments for the rights offering. |

| * | Based

on year to date book income. Amounts are subject to change and recharacterization at year

end. |

| (a) | Includes

income resulting from special dividends for the year ended December 31, 2019. Without these

dividends, the per share income amount would have been $0.06 and the net investment income

ratio would have been 0.46%. |

| (b) | Calculated

based on average common shares outstanding on the record dates throughout the periods. |

| (c) | Amount

represents less than $0.005 per share. |

| (e) | The

Fund received credits from a designated broker who agreed to pay certain Fund operating expenses.

For all years presented, there was no impact on the expense ratios. |

| (f) | Ratio

of operating expenses to average net assets including liquidation value of preferred shares

for the six months ended June 30, 2023 and years ended December 31, 2022, 2021, 2020, 2019,

and 2018, would have been 2.35%, 2.37%, 1.44%, 1.44%, 1.40%, and 1.39%, respectively. |

| (g) | The

Fund redeemed and retired all its outstanding Series A Preferred Shares on February 28, 2022. |

| (h) | Based

on weekly prices. |

| (i) | The

Series B Preferred was issued November 1, 2021. |

| (j) | Asset

coverage per share is calculated by combining all series of preferred shares. |

See

accompanying notes to financial statements.

The

Gabelli Global Small and Mid Cap Value Trust

Notes

to Financial Statements (Unaudited)

1.

Organization. The Gabelli Global Small and Mid Cap Value Trust (the Fund) was organized on August 19, 2013 as a Delaware statutory

trust. The Fund is a diversified closed-end management investment company registered under the Investment Company Act of 1940, as amended

(the 1940 Act). The Fund commenced investment operations on June 23, 2014.

The

Fund’s investment objective is to seek long term growth of capital. The Fund will attempt to achieve its investment objective by

investing, under normal market conditions, at least 80% of its total assets in equity securities (such as common stock and preferred

stock) of companies with small or medium sized market capitalizations (small cap and mid cap companies, respectively) and at least 40%

of its total assets in the equity securities of companies located outside the U.S. and in at least three countries.

2.

Significant Accounting Policies. As an investment company, the Fund follows the investment company accounting and reporting guidance,

which is part of U.S. generally accepted accounting principles (GAAP) that may require the use of management estimates and assumptions

in the preparation of its financial statements. Actual results could differ from those estimates. The following is a summary of significant

accounting policies followed by the Fund in the preparation of its financial statements.

The

global outbreak of the novel coronavirus disease, known as COVID-19, has caused adverse effects on many companies, sectors, nations,