0001992243false00019922432024-02-292024-02-290001992243fbinc:OrdinarySharesWithoutNominalValueMember2024-02-292024-02-290001992243fbinc:WarrantsEachWholeWarrantExercisableForOneOrdinaryShareAtAnExercisePriceOf1150Member2024-02-292024-02-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 29, 2024

FREYR Battery, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

Delaware | | 333-274434 | | 93-3205861 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer

Identification No.) |

6&8 East Court Square, Suite 300,

Newnan, Georgia 30263

| | | | | | | | |

| | |

| (Address of principal executive offices, including zip code) |

| | | |

Registrant’s telephone number, including area code: +(678) 632-3112

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | FREY | | The New York Stock Exchange |

| Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 | | FREY WS | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 29, 2024, FREYR Battery, Inc., a Delaware corporation, issued a press release announcing its financial results for the fourth quarter and year ended December 31, 2023.

The information set forth under Item 9.01 of this Current Report on Form 8-K is incorporated herein by reference.

The information in this Item 2.02, including the Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 7.01. Regulation FD Disclosure.

FREYR Battery, Inc. is also furnishing a Fourth Quarter and Full Year 2023 Earnings Call presentation, dated February 29, 2024 (the “Presentation”), attached as Exhibit 99.2 to this Current Report on Form 8-K, which may be referred to on FREYR Battery, Inc.’s fourth quarter and full year 2023 conference call to be held on February 29, 2024. The Presentation will also be available on FREYR Battery, Inc.’s website at https://www.freyrbattery.com

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | |

| | FREYR BATTERY, INC. |

| | |

Date: February 29, 2024 | By: | /s/ Oscar K. Brown |

| | Name: | Oscar K. Brown |

| | Title: | Group Chief Financial Officer |

News Release

FREYR Battery Reports Fourth Quarter and Full Year 2023 Results

New York, Oslo, and Newnan, GA, February 29, 2024, FREYR Battery, Inc. (NYSE: FREY) (“FREYR” or the “Company”), a developer of clean, next-generation battery cell production capacity, today reported financial results for the fourth quarter and full year of 2023.

Highlights:

•New operations update: another key milestone reached at Customer Qualification Plant. Building on recent technical achievements, FREYR’s Asset Mo team at the Customer Qualification Plant (“CQP”) conducted successful automated anode casting trials with active anode slurry in the second half of February. With the success of the cathode casting trials earlier in February and today’s announcement, the remaining major milestone before the expected start of automated production at the CQP is the integration of the casting webs across the cathode, anode, and merge units of the Casting and Unit Cell Assembly equipment using the highly complex Multi-Carrier System (“MCS”). FREYR expects to commence production of functional battery cells for customer samples using the full automation of the CQP in H1 2024.

•CQP progress to support U.S. Department of Energy Title 17 application. Based on recent achievements and the production road map at the CQP, FREYR is positioning the Company to qualify for a conditional commitment from the U.S. Department of Energy (“DOE”) Loan Programs Office by year-end 2024. The Company’s Title 17 application is tied to the development of Giga America using the 24M Technologies (“24M”) U.S.-based SemiSolidTM platform. Over the initial phase of the project, Giga America is expected to generate hundreds of jobs in Coweta County, GA and the surrounding areas.

•Launching FREYR 2.0 growth initiative. FREYR’s strong competitive and financial position is generating interest from a broad range of participants across the global battery value chain. Based on ongoing conversations with these stakeholders, the Company has established the FREYR 2.0 growth initiative, which encompasses the pursuit of five major opportunities tied to distinct projects using either the SemiSolid platform or conventional technology totaling more than 100 GWh of production capacity in the U.S. and Europe. The prospective end markets for these projects include both Energy Storage Systems (“ESS”) and passenger EV applications with the possibility to produce both LFP and NMC cells. Additionally, the 2.0 initiative includes separate potential inorganic opportunities to accelerate FREYR’s path to market and first revenues.

“The actions we have taken to strengthen our organization to accelerate FREYR’s path to first production and enhance our financial position are driving tangible progress,” said Birger Steen, FREYR’s Chief Executive Officer. “I am excited about the recent achievements of key milestones at the CQP, several exciting discussions we have ongoing with potential strategic partners, the completion of our redomicile to the U.S., and the continued progression of financing initiatives including the DOE Title 17 process. With the start of automated cell production at the CQP expected in the first half of 2024, we are executing our plan to demonstrate 24M at scale and to establish FREYR as the Western industrialization partner of choice in the global battery space.”

Recent news

•February operations update: On February 7th, 2024, FREYR published an operations and financial update indicating that the company had reached the milestone of automatically casting electrodes with active electrolyte slurry in a dry room environment at the Customer Qualification Plant (“CQP”) in Mo i Rana, Norway.

•Year-end 2023 cash balance of $276 million: Having ended the year with cash, restricted cash and equivalents of $275.7 million as indicated in the operations and financial update published on February 7th, and with FREYR’s reduced cash requirements for 2024 compared with 2023, FREYR has a two-year cash runway before any new financings associated with the DOE Title 17 process and/or the prospective

1 | News Release | FREYR Battery, Inc. | www.freyrbattery.com/news

project-level equity raise for Giga America. The Company’s 2024 spending will be focused on achieving production using the full automation at the CQP with 24M technology in H1 2024, the production ramp necessary to deliver testable cells from the CQP to our customers, the continued development of Giga America including costs necessary to obtain conditional credit approval in 2024 for the 24M-based gigafactory from the DOE Title 17 loan program, and pursuing a conventional technology agreement and project to accelerate the path to first revenues and diversify FREYR’s end markets. Timing and amounts of cash outlays could vary depending on the pace and progress of each of these and other initiatives.

•FREYR is now a U.S. company following completion of redomicile: On January 2nd, 2024, FREYR announced that the Company completed the process to redomicile from Luxembourg to the United States following a shareholder vote at the Company’s extraordinary general meeting on December 15, 2023. FREYR’s Board of Directors believes that redomiciling to the United States will enhance shareholder value by simplifying FREYR’s corporate structure and reporting requirements; expanding FREYR’s eligibility for inclusion in equity indexes which would trigger associated benchmarking by actively managed funds; aligning the Company more closely with New York Stock Exchange listing standards and SEC governance requirements; and positioning FREYR to better respond to global tax developments and U.S. incentive programs for battery manufacturers.

•CQP interim milestone: On October 4, 2023, FREYR published an operations update indicating that the teams at the CQP had successfully begun automatic electrode casting with solvent slurry. This technically complex step was an important milestone in the ongoing commissioning process at the CQP and a precursor to automated production of functional cells for customer samples at the CQP.

Business update

•CQP. FREYR’s teams at the CQP, in conjunction with the Company’s vendors and partners, are advancing towards the expected start of functional cell production for customer samples using the full automation of the CQP in H1 2024. As of publication, FREYR has completed handovers of 363 of 388 (94%) discrete production line equipment commissioning and testing packages. With operations under dry room conditions including automated production of electrodes underway and the commissioning process largely complete, the team’s’ collective emphasis has shifted from installation and commissioning the plant to producing functional cells. The remaining 6% of commissioning packages will be finalized upon final handover of the Casting & Unit Cell Assembly equipment to operations later this year, which is expected to take place after the commencement of functional cell production using the full automation of the CQP.

Results Overview, Financing, and Liquidity

•FREYR reported net loss attributable to stockholders for the fourth quarter of 2023 of $(24.2) million, or $(0.17) per diluted share compared to net income for the fourth quarter 2022 of $25.3 million or $0.20 per diluted share. The net loss in the fourth quarter of 2023 was primarily due to corporate overhead, spending to support FREYR's projects and business development activities, research and development spending, and severance and other termination benefits related to our restructuring, partially offset by a $8.5 million non-cash gain on warrant liability fair value adjustment. Net income in the fourth quarter of 2022 was driven by a $59.8 million non-cash gain on warrant liability fair value adjustment.

•For the full year ended December 31, 2023, FREYR reported net loss attributable to stockholders of $(71.9) million, or $(0.51) per diluted share compared to net loss of $(98.8) million, or $(0.83) per diluted share for the full year ended December 31, 2022. The net loss in 2023 was primarily due to corporate overhead, spending to support FREYR's projects and business development activities, and research and development spending, partially offset by gains on changes in warranty liabilities and foreign currency gains during the period.

•As of December 31, 2023, FREYR had cash, cash equivalents, and restricted cash of $275.7 million.

Business Outlook

FREYR is focused on advancing the following strategic mandates and milestones:

•Commencing production of functional cells for customer samples using the full automation of the CQP in H1 2024 is FREYR’s top strategic priority. Customer validation of the SemiSolid production process at

2 | News Release | FREYR Battery, Inc. | www.freyrbattery.com/news

giga scale and acceptance of product performance characteristics are key precursors to anticipated customer offtake conversions and unlocking potential project-level equity and debt financing, including through the DOE Title 17 program, for GIga America.

•Completing the DOE Title 17 application process and securing a conditional commitment from the Loan Programs Office before year-end 2024.

•Formalizing and announcing an agreement with a conventional battery technology solutions provider potentially in H1 2024.

•Targeting the formalization of commercial relationships to trigger development of the project options that are included in the FREYR 2.0 growth initiative.

•Maintaining the Company’s strong balance sheet and liquidity profile while making selected investments to advance FREYR’s strategic development.

.Presentation of Fourth Quarter and Full Year 2023 Results

A presentation will be held today, February 29, 2024, at 8:30 am Eastern Standard Time (2:30 pm Central European Time) to discuss financial results for the fourth quarter and full year 2023. The results and presentation material will be available for download at https://ir.freyrbattery.com.

To access the conference call, listeners should contact the conference call operator at the appropriate number listed below approximately 10 minutes prior to the start of the call.

Participant conference call dial-in numbers:

United States: 1 (646) 307-1963

United Kingdom: +44 20 3481 4247

Norway: +47 57 98 94 30

Denmark: +45 32 74 07 10

Spain: +34 910 489 958

Germany: +49 69 589964217

Sweden: +46 8 505 246 90

The participant passcode for the call is: 6712391

A webcast of the conference call will be broadcast simultaneously at https://app.webinar.net/bP012wvryqm on a listen-only basis. Please log in at least 10 minutes in advance to register and download any necessary software.

A replay of the webcast will be available at https://ir.freyrbattery.com/events-and-presentations/Events-Calendar/default.aspx.

***

3 | News Release | FREYR Battery, Inc. | www.freyrbattery.com/news

About FREYR Battery

FREYR Battery is a developer of clean, next-generation battery cell production capacity. The Company’s mission is to accelerate the decarbonization of global energy and transportation systems by producing clean, cost-competitive batteries. FREYR seeks to serve the primary markets of energy storage systems (“ESS”) and commercial mobility, and the Company maintains an ambition to serve the passenger electric vehicles market (“EV”). FREYR is commissioning and operating its Customer Qualification Plant (“CQP”) for technology development in Mo i Rana, Norway, and the company is commencing development of the Giga America battery manufacturing project in Coweta County, Georgia, in the U.S. To learn more about FREYR, please visit www.freyrbattery.com.

Investor contact:

Jeffrey Spittel

Head of Investor Relations

jeffrey.spittel@freyrbattery.com

Tel: (+1) 409-599-5706

Media contact:

Amy Jaick

Global Head of Communications

amy.jaick@freyrbattery.com

Tel: (+1) 973 713-5585

Cautionary Statement Concerning Forward-Looking Statements

All statements, other than statements of present or historical fact included in this presentation, including, without limitation, FREYR Battery’s (“FREYR”) ability to achieve automated, functional, customer-testable battery sample cells in H1 2024; scaling the SemiSolid platform as a path to sustainable competitive differentiation; FREYR’S cost and capital efficiency; FREYR’s plan to expand on the battery value chain into high value adjacencies and cultivate partnerships across the cell production technology spectrum; FREYR’s efforts to accelerate the path to commercialization; the pursuit of five major project opportunities in accordance with the FREYR 2.0 growth strategy; potential inorganic growth opportunities and the ability to generate revenue in the near-term through possible acquisitions; approaching milestones at FREYR’s CQP; customer acceptance and validation of the 24M SemiSolid process and product technology; securing a conditional commitment from the U.S. Department of Energy (“DOE”) through the Title 17 application under the Loan Programs Office; the development, financing, construction, timeline, capacity, and other usefulness of FREYR’s CQP, Giga Arctic, Giga America, and other planned or future production facilities or Gigafactories; any potential project equity raise for the development of Giga America; any potential benefits of the U.S. Inflation Reduction Act; establishing and/or announcing a conventional technology agreement; FREYR’s ability to reduce spending; any potential benefits of redomiciling to the U.S.; the giga-scalability of the 24M platform; and the implementation and effectiveness of FREYR’s overall business, technology, capital-raising and liquidity strategies are forward-looking statements.

These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside FREYR’s control and are difficult to predict. Additional information about factors that could materially affect FREYR is set forth under the “Risk Factors” section in (i) FREYR’s Registration Statement on Form S-3 filed with the Securities and Exchange Commission (the “SEC”) on September 1, 2022 and subsequent post-effective amendment thereto filed on January 5, 2024, (ii) FREYR Battery, Inc.’s Registration Statement on Form S-4 filed with the SEC on September 8, 2023 and subsequent amendments thereto filed on October 13, 2023, October 19, 2023 and October 31, 2023, (iii) FREYR’s annual report on Form 10-K filed with the SEC on February 27, 2023, and (iv) FREYR’s quarterly reports on Form 10-Q filed with the SEC on May 15, 2023, August 10, 2023, and November 9, 2023 and available on the SEC’s website at www.sec.gov. Except as otherwise required by applicable law, FREYR disclaims any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this presentation. Should underlying assumptions prove incorrect, actual results and projections could differ materially from those expressed in any forward-looking statements.

FREYR intends to use its website as a channel of distribution to disclose information which may be of interest or material to investors and to communicate with investors and the public. Such disclosures will be included on FREYR’s website in the ‘Investor Relations’ sections. FREYR also intends to use certain social media channels, including, but not limited to, Twitter and LinkedIn, as means of communicating with the public and investors about

4 | News Release | FREYR Battery, Inc. | www.freyrbattery.com/news

FREYR, its progress, products, and other matters. While not all the information that FREYR posts to its digital platforms may be deemed to be of a material nature, some information may be. As a result, FREYR encourages investors and others interested to review the information that it posts and to monitor such portions of FREYR’s website and social media channels on a regular basis, in addition to following FREYR’s press releases, SEC filings, and public conference calls and webcasts. The contents of FREYR’s website and other social media channels shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended.FREYR Battery is a developer of clean, next-generation battery cell production capacity. The company’s mission is to accelerate the decarbonization of global energy and transportation systems by producing clean, cost-competitive batteries. FREYR seeks to serve the primary markets of energy storage systems (“ESS”) and commercial mobility, and the company maintains an ambition to serve the passenger electric vehicles market (“EV”). FREYR’s Customer Qualification Plant (“CQP”) for technology development is in service in Mo I Rana, Norway, and the company is commencing development of the Giga America battery manufacturing project in Coweta County, Georgia, in the U.S. To learn more about FREYR, please visit www.freyrbattery.com.

5 | News Release | FREYR Battery, Inc. | www.freyrbattery.com/news

FREYR BATTERY, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In Thousands)

| | | | | | | | | | | | | | |

| | As of December 31, |

| | 2023 | | 2022 |

| ASSETS |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 253,339 | | | $ | 443,063 | |

| Restricted cash | | 22,403 | | | 119,982 | |

| Prepaid assets | | 2,168 | | | 8,293 | |

| Other current assets | | 34,044 | | | 8,117 | |

| Total current assets | | 311,954 | | | 579,455 | |

| | | | |

| Property and equipment, net | | 366,357 | | | 210,777 | |

| Intangible assets, net | | 2,813 | | | 2,963 | |

| Long-term investments | | 22,303 | | | — | |

| Convertible note | | — | | | 19,954 | |

| Right-of-use asset under operating leases | | 24,476 | | | 14,538 | |

| Other long-term assets | | 4,282 | | | 11 | |

| Total assets | | $ | 732,185 | | | $ | 827,698 | |

| | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

| Current liabilities: | | | | |

| Accounts payable | | $ | 18,113 | | | $ | 6,765 | |

| Accrued liabilities and other | | 30,790 | | | 51,446 | |

| | | | |

| | | | |

| | | | |

| Share-based compensation liability | | 281 | | | 4,367 | |

| | | | |

| Total current liabilities | | 49,184 | | | 62,578 | |

| | | | |

| Warrant liability | | 2,025 | | | 33,849 | |

| Operating lease liability | | 18,816 | | | 11,144 | |

| | | | |

| Other long-term liabilities | | 27,444 | | | — | |

| Total liabilities | | 97,469 | | | 107,571 | |

| | | | |

| Commitments and contingencies | | | | |

| | | | |

| Stockholders' equity | | | | |

| Preferred stock, $0.01 par value, 10,000 shares authorized, none issued and outstanding as of December 31, 2023 | | — | | | — | |

| Common stock, $0.01 par value, 355,000 shares authorized, and 139,705 issued and outstanding as of December 31, 2023 | | 1,397 | | | — | |

| Ordinary share capital, no par value shares, 245,000 authorized, 139,854 issued, and 139,705 outstanding as of December 31, 2022 | | — | | | 139,854 | |

| Additional paid-in capital | | 925,623 | | | 772,602 | |

| Treasury stock | | — | | | (1,041) | |

| Accumulated other comprehensive (loss) income | | (18,826) | | | 9,094 | |

| Accumulated deficit | | (274,999) | | | (203,054) | |

| Total stockholders' equity | | 633,195 | | | 717,455 | |

| | | | |

| Non-controlling interests | | 1,521 | | | 2,672 | |

| Total equity | | 634,716 | | | 720,127 | |

| | | | |

| Total liabilities and equity | | $ | 732,185 | | | $ | 827,698 | |

6 | News Release | FREYR Battery, Inc. | www.freyrbattery.com/news

FREYR BATTERY, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(In Thousands, Except per Share Amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended

December 31, | | Years ended

December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Operating expenses: | | | | | | | | |

| General and administrative | | $ | 22,728 | | | $ | 29,469 | | | $ | 108,133 | | | $ | 107,357 | |

| Research and development | | 10,162 | | | 4,380 | | | 28,457 | | | 13,574 | |

| Restructuring charge | | 6,016 | | | — | | | 6,016 | | | — | |

| Share of net loss of equity method investee | | 171 | | | 426 | | | 379 | | | 1,557 | |

| Total operating expenses | | 39,077 | | | 34,275 | | | 142,985 | | | 122,488 | |

| Loss from operations | | (39,077) | | | (34,275) | | | (142,985) | | | (122,488) | |

| | | | | | | | |

| Other income (expense): | | | | | | | | |

| Warrant liability fair value adjustment | | 8,515 | | | 59,771 | | | 31,763 | | | 14,183 | |

| Convertible note fair value adjustment | | — | | | (544) | | | 1,074 | | | (277) | |

| | | | | | | | |

| Interest income, net | | 3,907 | | | 1,691 | | | 9,949 | | | 1,780 | |

| | | | | | | | |

Foreign currency transaction gain (loss) | | 309 | | | (2,903) | | | 20,855 | | | 2,512 | |

| | | | | | | | |

| Other income, net | | 1,889 | | | 1,227 | | | 6,918 | | | 5,171 | |

| Total other income (expense) | | 14,620 | | | 59,242 | | | 70,559 | | | 23,369 | |

(Loss) income before income taxes | | (24,457) | | | 24,967 | | | (72,426) | | | (99,119) | |

| Income tax expense | | (329) | | | — | | | (670) | | | — | |

Net (loss) income | | (24,786) | | | 24,967 | | | (73,096) | | | (99,119) | |

| Net loss attributable to non-controlling interests | | 634 | | | 328 | | | 1,151 | | | 328 | |

Net (loss) income attributable to stockholders | | $ | (24,152) | | | $ | 25,295 | | | $ | (71,945) | | | $ | (98,791) | |

| | | | | | | | |

Weighted average shares outstanding: | | | | | | | | |

| Basic | | 139,705 | | | 123,455 | | | 139,705 | | | 118,474 | |

| Diluted | | 139,705 | | | 127,889 | | | 139,705 | | | 118,474 | |

| | | | | | | | |

| Net income (loss) per share: | | | | | | | | |

| Basic | | $ | (0.17) | | | $ | 0.20 | | | $ | (0.51) | | | $ | (0.83) | |

| Diluted | | $ | (0.17) | | | $ | 0.20 | | | $ | (0.51) | | | $ | (0.83) | |

| | | | | | | | |

| | | | | | | | |

| Other comprehensive income (loss): | | | | | | | | |

Net (loss) income | | $ | (24,786) | | | $ | 24,967 | | | $ | (73,096) | | | $ | (99,119) | |

| Foreign currency translation adjustments, net of tax | | 20,089 | | | 26,165 | | | (27,920) | | | 9,618 | |

Total comprehensive (loss) income | | (4,697) | | | 51,132 | | | (101,016) | | | (89,501) | |

| Comprehensive loss attributable to non-controlling interests | | 634 | | | 328 | | | 1,151 | | | 328 | |

Comprehensive (loss) income attributable to stockholders | | $ | (4,063) | | | $ | 51,460 | | | $ | (99,865) | | | $ | (89,173) | |

7 | News Release | FREYR Battery, Inc. | www.freyrbattery.com/news

FREYR BATTERY, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In Thousands)

| | | | | | | | | | | | | | |

| | For the years ended December 31, |

| | 2023 | | 2022 |

| Cash flows from operating activities: | | | | |

| Net loss | | $ | (73,096) | | | $ | (99,119) | |

| Adjustments to reconcile net loss to cash used in operating activities: | | | | |

| Share-based compensation expense | | 11,595 | | | 8,643 | |

| Depreciation and amortization | | 3,344 | | | 478 | |

| | | | |

| Loss on U.S. joint venture consolidation | | — | | | 1,619 | |

| Reduction in the carrying amount of right-of-use assets | | 1,351 | | | 1,458 | |

| Warrant liability fair value adjustment | | (31,763) | | | (14,183) | |

| | | | |

| Convertible note fair value adjustment | | (1,074) | | | 277 | |

| | | | |

| Share of net loss of equity method investee | | 379 | | | 1,557 | |

| Foreign currency transaction net unrealized gain | | (19,648) | | | (2,868) | |

| Other | | 469 | | | 2 | |

| Changes in assets and liabilities: | | | | |

| Prepaid assets and other current assets | | 4,487 | | | (3,664) | |

| | | | |

| Other long-term assets | | — | | | — | |

| Accounts payable, accrued liabilities and other | | 20,039 | | | 17,385 | |

| | | | |

| | | | |

| | | | |

| Operating lease liability | | (4,012) | | | (1,594) | |

| Net cash used in operating activities | | (87,929) | | | (90,009) | |

| | | | |

| Cash flows from investing activities: | | | | |

| Proceeds from property related grants | | 3,500 | | | 10,461 | |

| Purchases of property and equipment | | (187,823) | | | (180,787) | |

| Investments in equity method investee | | (1,655) | | | (3,000) | |

| Asset acquisition, cash acquired | | — | | | 300 | |

| | | | |

| Purchases of other long-term assets | | (1,000) | | | (2,000) | |

| Net cash used in investing activities | | (186,978) | | | (175,026) | |

| | | | |

| Cash flows from financing activities: | | | | |

| Proceeds from issuance of ordinary shares, net | | — | | | 251,124 | |

| Repurchase of treasury shares | | — | | | (1,052) | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Net cash provided by financing activities | | — | | | 250,072 | |

| | | | |

| Effect of changes in foreign exchange rates on cash, cash equivalents, and restricted cash | | (12,396) | | | 12,381 | |

Net decrease in cash, cash equivalents, and restricted cash | | (287,303) | | | (2,582) | |

| Cash, cash equivalents, and restricted cash at beginning of period | | 563,045 | | | 565,627 | |

| Cash, cash equivalents, and restricted cash at end of period | | $ | 275,742 | | | $ | 563,045 | |

| | | | |

| Reconciliation to consolidated balance sheets: | | | | |

| Cash and cash equivalents | | $ | 253,339 | | | $ | 443,063 | |

| Restricted cash | | 22,403 | | | 119,982 | |

| Cash, cash equivalents, and restricted cash | | $ | 275,742 | | | $ | 563,045 | |

8 | News Release | FREYR Battery, Inc. | www.freyrbattery.com/news

1 4Q AND FULL YEAR 2023 EARNINGS CALL # February 29, 2024 Photo: FREYR team member in dry room paraphernalia at CQP.

2 Forward Looking Statements IMPORTANT NOTICES All statements, other than statements of present or historical fact included in this presentation, including, without limitation, FREYR Battery’s (“FREYR”) ability to achieve automated, functional, customer-testable battery sample cells in H1 2024; scaling the SemiSolid platform as a path to sustainable competitive differentiation; FREYR’S cost and capital efficiency; FREYR’s plan to expand on the battery value chain into high value adjacencies and cultivate partnerships across the cell production technology spectrum; FREYR’s efforts to accelerate the path to commercialization; the pursuit of five major project opportunities in accordance with the FREYR 2.0 growth strategy; potential inorganic growth opportunities and the ability to generate revenue in the near-term through possible acquisitions; approaching milestones at FREYR’s CQP; customer acceptance and validation of the 24M SemiSolid process and product technology; securing a conditional commitment from the U.S. Department of Energy (“DOE”) through the Title 17 application under the Loan Programs Office; the development, financing, construction, timeline, capacity, and other usefulness of FREYR’s CQP, Giga Arctic, Giga America, and other planned or future production facilities or Gigafactories; any potential project equity raise for the development of Giga America; any potential benefits of the U.S. Inflation Reduction Act; establishing and/or announcing a conventional technology agreement; FREYR’s ability to reduce spending; any potential benefits of redomiciling to the U.S.; the giga-scalability of the 24M platform; and the implementation and effectiveness of FREYR’s overall business, technology, capital-raising and liquidity strategies are forward-looking statements. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside FREYR’s control and are difficult to predict. Additional information about factors that could materially affect FREYR is set forth under the “Risk Factors” section in (i) FREYR’s Registration Statement on Form S-3 filed with the Securities and Exchange Commission (the “SEC”) on September 1, 2022, (ii) FREYR Battery, Inc.’s Registration Statement on Form S-4 filed with the SEC on September 8, 2023 and subsequent amendments thereto filed on October 13, 2023, October 19, 2023 and October 31, 2023, (iii) FREYR’s annual report on Form 10-K filed with the SEC on February 27, 2023, and (iv) FREYR’s quarterly reports on Form 10-Q filed with the SEC on May 15, 2023 and August 10, 2023 and available on the SEC’s website at www.sec.gov. Except as otherwise required by applicable law, FREYR disclaims any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this presentation. Should underlying assumptions prove incorrect, actual results and projections could differ materially from those expressed in any forward-looking statements. FREYR intends to use its website as a channel of distribution to disclose information which may be of interest or material to investors and to communicate with investors and the public. Such disclosures will be included on FREYR’s website in the ‘Investor Relations’ sections. FREYR also intends to use certain social media channels, including, but not limited to, Twitter and LinkedIn, as means of communicating with the public and investors about FREYR, its progress, products and other matters. While not all the information that FREYR posts to its digital platforms may be deemed to be of a material nature, some information may be. As a result, FREYR encourages investors and others interested to review the information that it posts and to monitor such portions of FREYR’s website and social media channels on a regular basis, in addition to following FREYR’s press releases, SEC filings, and public conference calls and webcasts. The contents of FREYR’s website and other social media channels shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended.

# FREYR’S MISSION AND STRATEGY Decarbonize transportation and energy storage with the world’s most sustainable batteries Our mission Be the Western technology scaling and industrialization partner of choice Our strategy

FREYR TODAY 4 STREAMLINED, FOCUSED ORGANIZATION • Flattened organizational structure to promote speed, collaboration, and execution • Changes to operational management at CQP yielding tangible progress against timelines and milestones COST AND CAPITAL EFFICIENT • Optimizing balance sheet, cash spending, and capital discipline • Capital formation initiatives ongoing: • Advancing DOE Title 17 application and project-level equity raises • Targeting conditional commitment from DOE before year-end 2024 EVOLVED, PRODUCTION-FOCUSED MINDSET • Another key milestone achieved at CQP with successful anode casting trials with active electrolyte slurry • Producing fully automated cathodes and anodes after latest milestones • Start of dry room operations at CQP enabled shift in emphasis from installation/commissioning plant to producing cells • Producing functional sample cells for key customers using the full automation of the CQP in H1 2024 is priority #1 Focused on execution and delivering for our shareholders

FREYR’S TECHNOLOGY APPROACH 5 Scale differentiated Western tech and become an industrialization partner of choice in parallel SEMISOLIDTM PLATFORM • Scaling the 24M platform is a path to sustainable competitive differentiation • Significant value associated with scaling a new Western technology stack • Fit-for-purpose product targeting ESS market and commercial E-mobility • Technology is adaptable to advances in chemistries and evolving use cases • 24M batteries have been validated and deployed commercially at MWh scale • Recent milestones at CQP demonstrate tangible progress • Collaboration and support across SemiSolid vendor and partner ecosystem FREYR has a unique global leadership position to establish 24M at GWh scale CONVENTIONAL TECHNOLOGY • Mature technology already proven at GWh scale • Opportunity to accelerate FREYR’s commercial journey while participating in technical knowledge transfer and Western capability development • Production line equipment order lead times could be reduced by 12 months • Technology is bankable, reducing diligence lead time • Structures available to maximize public economic incentives • Similar strategy to the leading Tier 1 incumbents, all of which have conventional production pathways and disruptive new technology incubation programs • Potential to expand product portfolio into new end markets to cover higher C-rate applications, including passenger EVs FREYR’s fastest path to market while scaling Western tech

THE ROAD AHEAD: FREYR 2.0 GROWTH INITIATIVE 6 Pursuing commercial and project opportunities totaling more than 100 GWh REAL OPTIONS • Pursuing five major opportunities tied to specific projects in U.S. and Europe • Projects based on both 24M SemiSolid platform and potential conventional technology agreements • End markets include ESS and passenger EV applications • Possibility to produce both LFP and NMC cells BROADENING SET OF STRATEGIC PARTNERSHIP DISCUSSIONS • FREYR is an attractive partner • Strong competitive and financial positions generating interest from expanding network • Potential opportunities include M&A to accelerate path to market and first revenues

CQP UPDATE Progressing to anticipated start of fully automated cell production in H1 2024 ANOTHER KEY MILESTONE SURPASSED • Successfully conducted automated anode casting trials in February 2024 with active electrolyte slurry • Producing automated cathodes and anodes, working on improving process capability • Shift to production mindset – the installation/construction phase of the CQP is complete – moving past the point of making the CQP to making batteries CATALYSTS AHEAD • H1 2024: integrate the casting web across the cathode, anode, and merge systems of the Casting & Unit Assembly using the Multi-Carrier System (“MCS”) • H1 2024: commence automated production and make functional battery cells for customer samples • H2 2024: finalize digital twin – integration of over 50 video cameras and 5000 sensors recording data for every cell produced to drive continuous product improvement Active electrolyte slurry being prepared for casting Powder being processed under dry room conditions

8 FREYR’S planned U.S. flagship project to capitalize on the benefits of the Inflation Reduction Act GIGA AMERICA UPDATE THE GIGA AMERICA ASSET • FREYR owns the 368-acre Giga America project site in Coweta County, GA • Georgia is evolving into a regional U.S. clear energy and battery hub • Giga America site can accommodate multiple cell production facilities • Project to create hundreds of jobs in Coweta County and trigger multi-billion-dollar capital investment in Georgia CAPITAL FORMATION INITIATIVES PROGRESSING • Advancing DOE Title 17 process tied to the 24M SemiSolid technology track • Deep coordination with DOE Loan Programs Office (“LPO”) team to process application • Targeting conditional commitment from DOE before year-end 2024 • Project-level equity conversations apply to both SemiSolid and/or conventional technology tracks SemiSolid Technology Track • Achievements at CQP driving momentum with DOE application • Technical validation of CQP sample cells from key customers will dictate project development timeline and capital formation • Differentiated, next-generation, U.S.-based technology stack Conventional Technology Track • Deep diligence ongoing with multiple potential technology providers • Nearing technology selection and structure of relationship • Fastest path to market and first production

9 FREYR successfully redomiciled from Luxembourg to the U.S. effective December 31, 2023 REDOMICILE TO THE U.S. COMPLETED ✓ Simplifies corporate structure and streamlines reporting requirements ✓ Enhances FREYR's eligibility for inclusion in equity indexes and triggers associated benchmarking from actively managed funds ✓ Benefit from corporate governance under Delaware law, which is more closely aligned with the NYSE listing standards and U.S. SEC governance requirements ✓ Better long-term positioning for global tax developments and U.S. incentive programs for battery manufacturers TRANSACTION RATIONALE Founded: 2018 Incorporation: Delaware NYSE: FREY FREYR Battery, Inc. Primary Office: Newnan, GA

OPTIMIZING OUR SPENDING 10 • Ended Q4 2023 with $276 million of cash • $6 million restructuring charge (22% reduction in full time employees, and 26% reduction in contractors/project support by end of Q1) • Focus on core objectives also enables a significant reduction in CapEx and other costs for 2024, extending our liquidity to two years Operational and financial discipline remain in focus 4Q and Full-Year Financial Results ($ in millions, except per share data) Q4 2023 Q4 2022 2023 2022 G&A $23 $29 $108 $107 R&D 10 4 28 14 Restructuring & Other 6 0 6 2 Total Opex 39 34 143 122 Warrant Liab. FV Adjustment 9 60 32 14 Other income (exp.) 6 (0) 39 10 Net Income (Loss) (24) 25 (72) (99) Per Share ($0.17) $0.20 ($0.51) ($0.83) CFFO (34) (17) (88) (90) CF from Investing (19) (105) (187) (175) CF from Financing/FX 1 266 (12) 262 Net Change in Cash (52) 144 (287) (3) Ending Period Cash $276 $563 $276 $563 Years-ended December 31,

OPTIMIZING OUR BALANCE SHEET 11 • 2023 total cash uses were $287 million • 2024 cash use well below 2023; spend timing dependent on: • CQP & Test Center automation progress / cell production and testing ramp • Giga America development costs / DOE loan progress and diligence requirements • Costs to mature a potential conventional technology relationship • Other commercial and technology initiatives Prioritizing balance sheet strength by planning 2024 total cash uses well below 2023 FREYR Full-Year 2023 Cash Bridge ($ in millions) Note: Cash includes cash, cash equivalents and restricted cash: amounts may not reconcile due to rounding. Balance Sheet Summary ($ in millions) 2023 2022 Cash, equivalents, and restricted cash $276 $563 Other current assets 36 16 Net property, plant & equipment 366 211 Other assets 54 37 Total assets $732 $828 Current liabilities 49 63 Other liabilities 48 45 Shareholders' equity 635 720 Total liabilities and equity $732 $828 As of December 31,

FREYR 2024 OUTLOOK AND PRIORITIES 12 Near-term goals and commercialization road map H1 2024 CQP and 24M • On track for automated production of functional customer sample cells Conventional technology • Targeting finalization and announcement of agreement Capital formation • Engage with prospective project-level equity on both Giga America technology tracks • Continue to advance DOE LPO Title 17 application Project development: FREYR 2.0 • Targeting formalization of commercial relationships to trigger multiple project options • Five major opportunities totaling more than 100 GWh of capacity across ESS, E-mobility and passenger EV end markets H2 2024 CQP and 24M • Potential validation on initial sample cells and production process from Nidec • Digital twin established on product and key processes Capital formation • Targeting conditional DOE LPO commitment for Giga America based on SemiSolid technology platform Commercial • Potential conversion of conditional offtakes to firm sales agreements based on sample cell performance characteristics End of H1 2024Start of H1 2024 Year-end 2024

v3.24.0.1

Cover

|

Feb. 29, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 29, 2024

|

| Entity Registrant Name |

FREYR Battery, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

333-274434

|

| Entity Address, Address Line One |

6&8 East Court Square, Suite 300

|

| Entity Address, Postal Zip Code |

30263

|

| Entity Address, City or Town |

Newnan

|

| City Area Code |

(678)

|

| Local Phone Number |

632-3112

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Tax Identification Number |

93-3205861

|

| Entity Central Index Key |

0001992243

|

| Amendment Flag |

false

|

| Entity Address, State or Province |

GA

|

| OrdinarySharesWithoutNominalValueMember |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

FREY

|

| Security Exchange Name |

NYSE

|

| WarrantsEachWholeWarrantExercisableForOneOrdinaryShareAtAnExercisePriceOf1150Member |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50

|

| Trading Symbol |

FREY WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=fbinc_OrdinarySharesWithoutNominalValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=fbinc_WarrantsEachWholeWarrantExercisableForOneOrdinaryShareAtAnExercisePriceOf1150Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

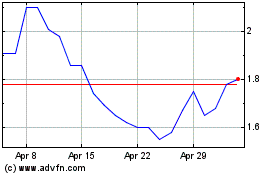

FREYR Battery (NYSE:FREY)

Historical Stock Chart

From Mar 2024 to Apr 2024

FREYR Battery (NYSE:FREY)

Historical Stock Chart

From Apr 2023 to Apr 2024