First Quarter 2018 and Recent

Highlights

- Continued development at Newhall Ranch.

On track for land deliveries at the end of 2019.

- Milestone approvals secured for

additional commercial entitlements in San Francisco while moving

forward with infrastructure at Candlestick.

- Sale of 33 acres for $166 million with

approval to build 536 homes in the Great Park Neighborhoods.

- Company maintains strong credit

profile, including total liquidity of $902 million and debt to

total capitalization of 24.1% at March 31, 2018.

Five Point Holdings, LLC (“Five Point” or the “Company”)

(NYSE:FPH), an owner and developer of large mixed-use,

master-planned communities in California, today reported financial

results for the first quarter of 2018. Emile Haddad, Chairman and

CEO, commented that “Five Point has benefited from a strong start

to the year driven by continued operational progress. Economic

tailwinds in the form of sustained job growth and limited housing

supply in our core markets suggest that the value of our land

portfolio will steadily appreciate. Our ongoing efforts to develop

Newhall Ranch have continued. As a result, we believe that we are

positioned to generate revenues in that community sometime toward

the end of 2019. In San Francisco, the receipt of certain milestone

approvals leaves us on track to acquire another two million square

feet of commercial entitlements before the end of 2018. We continue

moving forward with infrastructure at Candlestick Point. At the

Shipyard, we are having discussions with the City of San Francisco

as it relates to the timing of land conveyance. In the Great Park

Neighborhoods, buyer demand at Cadence Park, which opened its first

phase in March, has been brisk. We have also been active since the

end of the quarter. In April, the Great Park Venture made a cash

distribution of $235 million to holders of legacy interests. In

May, the Great Park Venture completed the sale of 33 acres for $166

million, or $5 million per acre, in the Great Park Neighborhoods.

This transaction further validates our view of the residual value

of our assets. We remain firmly committed to maximizing the value

of our assets while maintaining a strong financial position.”

First Quarter 2018 Consolidated

Results

Liquidity and Capital Resources

As of March 31, 2018, total liquidity of $902 million was

comprised of cash and cash equivalents totaling $778 million and

borrowing availability of $124 million under our $125 million

unsecured revolving credit facility. Total capital was $1.9

billion, reflecting $3.0 billion in assets and $1.1 billion in

liabilities.

Results of Operations

Revenues. Revenues of $15.0 million for the three months

ended March 31, 2018 were primarily generated from management

services. Our adoption of new revenue accounting guidance on

January 1, 2018 has resulted in accelerated recognition of revenue

that reflects the impact of variable incentive compensation in our

development management agreement with the Great Park Venture.

Historically, revenue was not recognized until contingencies

related to the amount and timing of the consideration were

resolved. Under new revenue guidance, however, we will recognize

the revenue that we expect to receive over the projected contract

term and as to which a significant reversal is unlikely to

occur.

Other income. Other income for the three months ended

March 31, 2018 consisted primarily of a $6.7 million gain on

the sale of the Tournament Players Club at Valencia golf course in

our Newhall segment, in addition to interest income earned on our

cash and cash equivalents during the three-month period.

Equity in loss from unconsolidated entities. Equity in

loss from unconsolidated entities was $3.6 million for the three

months ended March 31, 2018. The loss was primarily due to our

proportionate share of the Great Park Venture's net loss during the

quarter of $14.7 million. After adjusting for amortization and

accretion of the basis difference, our equity in loss from our

37.5% percentage interest in the Great Park Venture was $4.1

million. Equity in earnings from our 75% interest in the Gateway

Commercial Venture was $0.4 million for the three months ended

March 31, 2018.

Selling, general, and administrative. Selling, general,

and administrative expenses were $28.6 million for the three months

ended March 31, 2018 and were largely comprised of employee

related costs, including $3.4 million in share based compensation

expense.

Net loss. Consolidated net loss for the quarter was $14.3

million. The net loss attributable to noncontrolling interests

totaled $9.1 million, resulting in a net loss attributable to the

Company of $5.2 million.

Segment Results

Newhall Segment. We are continuing our land development

activities with a focus on Mission Village and expect to start

delivering homesites to builders in late 2019. Mission Village is

approved for up to 4,055 homesites and approximately 1.6 million

square feet of commercial development.

Total segment revenues were $2.8 million for the first quarter

of 2018 and were derived from agricultural leasing and the sale of

citrus crops. Selling, general, and administrative expenses were

$4.1 million for the three months ended March 31, 2018.

San Francisco Segment. We are continuing our land

development activities at Candlestick Point. We are also working

with the City of San Francisco to increase the total amount of

commercial entitlements at The San Francisco Shipyard and

Candlestick Point by over two million square feet. We recently

received milestone approvals for these new entitlements from

several agencies, including the Planning Commission, the

Metropolitan Transportation Authority, and the Office of Community

Investment and Infrastructure. As a result, we anticipate receiving

final approval for increased commercial square footage sometime

before the end of 2018.

Total segment revenues were $2.0 million for the first quarter

of 2018. Revenues during the quarter were mostly attributable to

fees generated from management agreements. Selling, general, and

administrative expenses were $6.4 million for the first

quarter.

Great Park Segment. A favorable operating environment has

resulted in solid sales performance at the Great Park

Neighborhoods. Parasol Park is substantially sold out, and sales at

Cadence Park, the Great Park Venture's newest neighborhood, which

opened its first phase in March, are off to a good start.

Total segment revenues were $10.5 million for the first of

quarter 2018. Revenues were mainly attributable to management

services that we provided to the Great Park Venture. The Great Park

Segment's net loss for the quarter was $11.4 million, which

included a net loss of $14.7 million attributed to the Great Park

Venture that is not consolidated in our financial statements. After

making adjustments to account for a difference in investment basis,

the Company’s equity in loss from the Great Park Venture was $4.1

million for the three months ended March 31, 2018.

Commercial Segment. For the three months ended

March 31, 2018, the commercial segment recognized $6.8 million

in revenues from a triple net lease with Broadcom and property

management services provided by us. Segment expenses were mostly

comprised of depreciation, amortization and interest expense

totaling $5.1 million. Segment net income was $0.7 million. Our

share of equity in income from the Gateway Commercial Venture

totaled $0.4 million for the three months ended March 31,

2018.

Conference Call

Information

In conjunction with this release, Five Point will host a

conference call today, Monday, May 14, 2018 at 5:00 pm Eastern

Time. Emile Haddad, Chairman, President and Chief Executive

Officer, and Erik Higgins, Vice President and Chief Financial

Officer, will host the call. Interested investors and other parties

can listen to a live Internet audio webcast of the conference call

that will be available on the Five Point website at

ir.fivepoint.com. The conference call can also be accessed by

dialing (877) 425-9470 (domestic) or (201) 389-0878

(international). A telephonic replay will be available

approximately two hours after the call by dialing (844) 512-2921,

or for international callers, (412) 317-6671. The passcode for the

live call and the replay is 13680073. The telephonic replay will be

available until 11:59 p.m. Eastern Time on May 28, 2018.

About Five Point

Five Point, headquartered in Aliso Viejo, California,

designs and develops large mixed-use, master-planned communities in

Orange County, Los Angeles County, and San Francisco

County that combine residential, commercial, retail,

educational, and recreational elements with public amenities,

including civic areas for parks and open space. Five Point’s

communities include the Great Park Neighborhoods® in Irvine,

Newhall Ranch® near Valencia, and The San Francisco

Shipyard/Candlestick Point in the City of San Francisco. These

communities are designed to include approximately 40,000

residential homes and approximately 21 million square feet of

commercial space.

Forward-Looking

Statements

This press release contains forward-looking statements that are

subject to risks and uncertainties. These statements concern

expectations, beliefs, projections, plans and strategies,

anticipated events or trends and similar expressions concerning

matters that are not historical facts. When used, the words

“anticipate,” “believe,” “expect,” “intend,” “may,” “might,”

“plan,” “estimate,” “project,” “should,” “will,” “would,” “result”

and similar expressions that do not relate solely to historical

matters are intended to identify forward-looking statements. This

press release may contain forward-looking statements regarding: our

expectations of our future revenues, costs and financial

performance; future demographics and market conditions in the areas

where our communities are located; the outcome of pending

litigation and its effect on our operations; the timing of our

development activities; and the timing of future real estate

purchases or sales. We caution you that any forward-looking

statements included in this press release are based on our current

views and information currently available to us. Forward-looking

statements are subject to risks, trends, uncertainties and factors

that are beyond our control. Some of these risks and uncertainties

are described in more detail in our filings with the SEC, including

our Annual Report on Form 10-K, under the heading “Risk Factors.”

Should one or more of these risks or uncertainties materialize, or

should underlying assumptions prove incorrect, actual results may

vary materially from those anticipated, estimated or projected. We

caution you therefore against relying on any of these

forward-looking statements. While forward-looking statements

reflect our good faith beliefs, they are not guarantees of future

performance. They are based on estimates and assumptions only as of

the date hereof. We undertake no obligation to update or revise any

forward-looking statement to reflect changes in underlying

assumptions or factors, new information, data or methods, future

events or other changes, except as required by applicable law.

FIVE POINT HOLDINGS, LLC

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(In thousands)

(Unaudited)

Three Months EndedMarch 31, 2018

2017 REVENUES: Land sales $ 49 $ 465 Land sales—related

party 221 84,271 Management services—related party 11,767 5,470

Operating properties 2,930 2,097 Total revenues

14,967 92,303 COSTS AND EXPENSES: Land sales 38

80,447 Management services 7,089 2,649 Operating properties 2,390

2,280 Selling, general, and administrative 28,596 27,198

Total costs and expenses 38,113 112,574 OTHER

INCOME: Adjustment to payable pursuant to tax receivable agreement

1,928 — Interest income 2,747 — Miscellaneous 7,781 23

Total other income 12,456 23 EQUITY IN LOSS

FROM UNCONSOLIDATED ENTITIES (3,607 ) (2,876 ) LOSS BEFORE INCOME

TAX BENEFIT (14,297 ) (23,124 ) INCOME TAX BENEFIT — —

NET LOSS (14,297 ) (23,124 ) LESS NET LOSS ATTRIBUTABLE TO

NONCONTROLLING INTERESTS (9,065 ) (15,282 ) NET LOSS ATTRIBUTABLE

TO THE COMPANY $ (5,232 ) $ (7,842 )

FIVE POINT HOLDINGS, LLC

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands, except shares)

(Unaudited)

March 31, 2018 December 31, 2017

ASSETS INVENTORIES $ 1,471,615 $ 1,425,892 INVESTMENT IN

UNCONSOLIDATED ENTITIES 529,467 530,007 PROPERTIES AND EQUIPMENT,

NET 29,417 29,656 ASSETS HELD FOR SALE, NET — 4,519 INTANGIBLE

ASSET, NET—RELATED PARTY 104,653 127,593 CASH AND CASH EQUIVALENTS

778,242 848,478 RESTRICTED CASH AND CERTIFICATES OF DEPOSIT 1,467

1,467 RELATED PARTY ASSETS 44,836 3,158 OTHER ASSETS 8,247

7,585 TOTAL $ 2,967,944 $ 2,978,355

LIABILITIES AND CAPITAL LIABILITIES: Notes payable, net $

561,062 $ 560,618 Accounts payable and other liabilities 164,879

167,620 Liabilities related to assets held for sale — 5,363 Related

party liabilities 177,209 186,670 Payable pursuant to tax

receivable agreement 152,855 152,475 Total

liabilities 1,056,005 1,072,746 CAPITAL: Class A

common shares; No par value; Issued and outstanding:

2018—64,268,027 shares; 2017—62,314,850 shares Class B common

shares; No par value; Issued and outstanding: 2018—81,418,003

shares; 2017—81,463,433 shares Contributed capital 535,900 530,015

Retained earnings 63,293 57,841 Accumulated other comprehensive

loss (2,474 ) (2,455 ) Total members’ capital 596,719 585,401

Noncontrolling interests 1,315,220 1,320,208 Total

capital 1,911,939 1,905,609 TOTAL $ 2,967,944

$ 2,978,355

FIVE POINT HOLDINGS, LLC

SUPPLEMENTAL DATA

(In thousands)

(Unaudited)

March 31, 2018 Cash and cash equivalents $ 778,242 Borrowing

capacity (1) 124,000 Total liquidity $ 902,242

(1) As of March 31, 2018, no funds have been drawn on the

Company's $125.0 million revolving credit facility; however,

letters of credit of $1.0 million are issued and outstanding under

the revolving credit facility, thus reducing the available capacity

by the outstanding letters of credit amount.

March 31, 2018 Debt (1) $ 607,692 Total capital

1,911,939 Total capitalization $ 2,519,631 Debt to

total capitalization 24.1 %

(1) For purposes of this calculation, debt consists of

(i) the outstanding principal on the Company’s 7.875% senior

notes due 2025 of $500.0 million, (ii) a settlement note

with an outstanding principal of $5.0 million, and

(iii) the Company’s related party EB-5 reimbursement

obligation of $102.7 million.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180514006318/en/

Five Point Holdings, LLCInvestor Relations:Bob Wetenhall,

949-349-1087bob.wetenhall@fivepoint.comorMedia:Steve Churm,

949-349-1034steve.churm@fivepoint.com

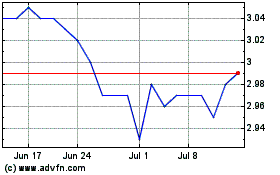

Five Point (NYSE:FPH)

Historical Stock Chart

From Jun 2024 to Jul 2024

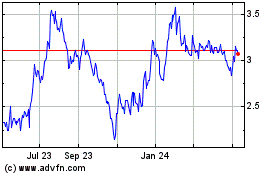

Five Point (NYSE:FPH)

Historical Stock Chart

From Jul 2023 to Jul 2024