Net Revenues Growth of 13.0% YoY, Net Income of

$4.6 million, Net Income Margin of 3.4% and Adjusted EBITDA Margin

of 13.7%

FIGS, Inc. (NYSE: FIGS) (the “Company”), the direct-to-consumer

apparel and lifestyle brand dedicated to the healthcare community,

today released its second quarter 2023 financial results and

published a financial highlights presentation on its investor

relations website at

ir.wearfigs.com/financials/quarterly-results/.

Second Quarter 2023 Financial Highlights

- Net revenues were $138.1 million, an increase of 13.0%

year over year, driven by an increase in orders from existing and

new customers and an increase in average order value (“AOV”).

- Gross margin was 69.5%, a decrease of 110 basis points

year over year, primarily due to product mix shift and, to a lesser

extent, higher duties and an increased mix of promotional sales,

offset by lower air freight utilization and ocean freight

rates.

- Operating expenses were $89.5 million, an increase of

16.3% year over year. As a percentage of net revenues, operating

expenses increased to 64.7% from 62.8% in the prior year period due

to higher selling expenses associated with fulfillment costs, and

general and administrative expenses associated with investments in

people.

- Net income and net income, as adjusted(1) were

$4.6 million (or $0.02 in diluted earnings per share), a

decrease of $0.3 million year over year as compared to net income

in the same period last year, and a decrease of $1.7 million as

compared to net income, as adjusted(1) in the same period

last year.

- Net income margin(2) was 3.4%, as compared to 4.1% in

the same period last year.

- Adjusted EBITDA(1) was $18.9 million, a decrease of $2.6

million year over year.

- Adjusted EBITDA margin(1)(2) was 13.7%, as compared to

17.6% in the same period last year.

Key Operating Metrics

- Active customers(3) as of June 30, 2023 increased 21.0%

to 2.5 million.

- Net revenues per active customer(3) were $215, a

decrease of 5.3% year over year.

- AOV(3) was $115, an increase of 5.5% year over year,

primarily driven by higher average unit retail associated with

product mix and an increase in units per transaction.

“Our second quarter results demonstrate both the resilience of

our business model and strong execution against our strategic

priorities,” said Trina Spear, Chief Executive Officer and

Co-Founder. “As we look ahead, we see ample room to advance our

market leadership position in the U.S. and we are highly encouraged

by the growth opportunities within our international and TEAMS

businesses, as well as retail, where we are just getting started.

We believe that our solutions-based product innovation and brand

authenticity combined with our scale and strong balance sheet,

position us to execute these multiple growth levers and deliver

long term profitable growth.”

Financial Outlook

For Full-Year 2023, the Company now expects:

Net Revenues Growth as Compared to

2022

5.5% to 7.5%

Adjusted EBITDA Margin(2)(4)

12.5% to 13.5%

Daniella Turenshine, Chief Financial Officer, commented, “We

delivered better than expected results in the second quarter while

making progress in getting inventory back to normalized levels and

generating strong free cash flow. We plan to continue to leverage

our strong balance sheet and free cash flow generation to invest in

future growth.”

(1) “Net income, as adjusted,” “adjusted

EBITDA” and “adjusted EBITDA margin” are non-GAAP financial

measures. Please see the sections titled “Non-GAAP Financial

Measures and Key Operating Metrics” and “Reconciliations of GAAP to

Non-GAAP Measures” below for more information regarding the

Company’s use of non-GAAP financial measures and reconciliations to

the most directly comparable GAAP measures.

(2) “Net income margin” and “adjusted

EBITDA margin” are calculated by dividing net income and adjusted

EBITDA by net revenues, respectively.

(3) “Active customers,” “net revenues per

active customer” and “average order value” are key operational and

business metrics that are important to understanding the Company’s

performance. Please see the sections titled “Non-GAAP Financial

Measures and Key Operating Metrics” and “Key Operating Metrics”

below for information regarding how the Company calculates its key

operational and business metrics and for comparisons of active

customers, net revenues per active customer and average order value

to the prior year period.

(4) The Company has not provided a

quantitative reconciliation of its adjusted EBITDA margin outlook

to a GAAP net income margin outlook because it is unable, without

making unreasonable efforts, to project certain reconciling items.

These items include, but are not limited to, future stock-based

compensation expense, income taxes, expenses related to

non-ordinary course disputes and transaction costs. These items are

inherently variable and uncertain and depend on various factors,

some of which are outside of the Company’s control or ability to

predict. For more information regarding the Company’s use of

non-GAAP financial measures, please see the section titled

“Non-GAAP Financial Measures and Key Operating Metrics.”

Conference Call Details

FIGS management will host a conference call and webcast today at

2:00 p.m. PT / 5:00 p.m. ET to discuss the Company’s financial and

business results and outlook. To participate, please dial

1-833-470-1428 (US) or 1-404-975-4839 (International) and the

conference ID 145709. The call is also accessible via webcast at

ir.wearfigs.com. A recording will be available shortly after the

conclusion of the call until 11:59 p.m. ET on August 10, 2023. To

access the replay, please dial 1-866-813-9403 (US) or

+44-204-525-0658 (International) and the conference ID 689868. An

archive of the webcast will be available on FIGS’ investor

relations website at ir.wearfigs.com.

Non-GAAP Financial Measures and Key Operating Metrics

In addition to the GAAP financial measures set forth in this

press release, the Company has included non-GAAP financial measures

within the meaning of Regulation G and Item 10(e) of Regulation

S-K. The Company uses “net income, as adjusted,” “adjusted EBITDA”

and “adjusted EBITDA margin” to provide useful supplemental

measures that assist in evaluating its ability to generate

earnings, provide consistency and comparability with its past

financial performance and facilitate period-to-period comparisons

of its core operating results as well as the results of its peer

companies. The Company calculates “net income, as adjusted,” as net

income adjusted to exclude transaction costs, expenses related to

non-ordinary course disputes, other than temporary impairment of

held-to-maturity investments, stock-based compensation, including

expense related to award modifications, accelerated performance

awards and ambassador grants in connection with its initial public

offering, and expense resulting from the retirement of the

Company’s previous CFO, and the income tax impact of these

adjustments. The Company calculates “adjusted EBITDA” as net income

adjusted to exclude: other income (loss), net; gain/loss on

disposal of assets; provision for income taxes; depreciation and

amortization expense; stock-based compensation and related expense;

transaction costs; and expenses related to non-ordinary course

disputes. The Company calculates “adjusted EBITDA margin” by

dividing adjusted EBITDA by net revenues.

Reconciliations of non-GAAP financial measures to the most

directly comparable GAAP measures are included below under the

heading “Reconciliations of GAAP to Non-GAAP Measures.”

The Company has also included herein “active customers,” “net

revenues per active customer” and “average order value,” which are

key operational and business metrics that are important to

understanding Company performance. The number of active customers

is an important indicator of growth as it reflects the reach of the

Company’s digital platform, brand awareness and overall value

proposition. The Company defines an active customer as a unique

customer account that has made at least one purchase in the

preceding 12-month period. In any particular period, the Company

determines the number of active customers by counting the total

number of customers who have made at least one purchase in the

preceding 12-month period, measured from the last date of such

period. The Company believes measuring net revenues per active

customer is important to understanding engagement and retention of

customers, and as such, the value proposition for its customer

base. The Company defines net revenues per active customer as the

sum of total net revenues in the preceding 12-month period divided

by the current period active customers. The Company defines average

order value as the sum of the total net revenues in a given period

divided by the total orders placed in that period. Total orders are

the summation of all completed individual purchase transactions in

a given period. The Company believes its relatively high average

order value demonstrates the premium nature of its products. As the

Company expands into and increases its presence in additional

product categories, price points and international markets, average

order value may fluctuate.

Active customers as of June 30, 2023 and 2022, respectively, net

revenues per active customer as of June 30, 2023 and 2022,

respectively, and average order value for the three and six months

ended June 30, 2023 and 2022, respectively, are presented below

under the heading “Key Operating Metrics.”

About FIGS

FIGS is a founder-led, direct-to-consumer healthcare apparel and

lifestyle brand that seeks to celebrate, empower and serve current

and future generations of healthcare professionals. We create

technically advanced apparel and products for healthcare

professionals that feature an unmatched combination of comfort,

durability, function and style. We market and sell our products in

17 countries directly through our digital platform to provide a

seamless experience for healthcare professionals.

Forward Looking Statements

This press release contains various forward-looking statements

about the Company within the meaning of the Private Securities

Litigation Reform Act of 1995, as amended, that are based on

current management expectations, and which involve substantial

risks and uncertainties that could cause actual results to differ

materially from the results expressed in, or implied by, such

forward-looking statements. All statements contained in this press

release that do not relate to matters of historical fact should be

considered forward-looking. These forward-looking statements

generally are identified by the words “anticipate”, “believe”,

“contemplate”, “continue”, “could”, “estimate”, “expect”,

“forecast”, “future”, “intend”, “may”, “might”, “opportunity”,

“outlook”, “plan”, “possible”, “potential”, “predict”, “project,”

“should”, “strategy”, “strive”, “target”, “will” or “would”, the

negative of these words or other similar terms or expressions. The

absence of these words does not mean that a statement is not

forward-looking. These forward-looking statements address various

matters, including the Company’s belief that it has ample room to

advance its market leadership position in the U.S.; the growth

opportunities within the Company’s international, TEAMS and retail

businesses; the Company’s belief that its solutions-based product

innovation, brand authenticity, scale and strong balance sheet

position it to execute its multiple growth levers and deliver long

term profitable growth; the Company’s plan to continue to leverage

its strong balance sheet and free cash flow generation to invest in

future growth and the Company’s outlook as to net revenues growth

and adjusted EBITDA margin for the full year ending December 31,

2023; all of which reflect the Company’s expectations based upon

currently available information and data. Because such statements

are based on expectations as to future financial and operating

results and are not statements of fact, the Company’s actual

results, performance or achievements may differ materially from

those expressed or implied by the forward-looking statements, and

you are cautioned not to place undue reliance on these

forward-looking statements. The following important factors and

uncertainties, among others, could cause actual results,

performance or achievements to differ materially from those

described in these forward-looking statements: the Company’s

ability to maintain its recent rapid growth and effectively manage

its growth; the Company’s ability to maintain profitability; the

Company’s ability to maintain the value and reputation of its

brand; the Company’s ability to attract new customers, retain

existing customers, and to maintain or increase sales to those

customers; the success of the Company’s marketing efforts; the

Company’s ability to maintain a strong community of engaged

customers and Ambassadors; negative publicity related to the

Company’s marketing efforts or use of social media; the Company’s

ability to successfully develop and introduce new, innovative and

updated products; the competitiveness of the market for healthcare

apparel; the Company’s ability to maintain its key employees; the

Company’s ability to attract and retain highly skilled team

members; risks associated with expansion into, and conducting

business in, international markets; changes in, or disruptions to,

the Company’s shipping arrangements; the successful operation of

the Company’s distribution and warehouse management systems; the

Company’s ability to accurately forecast customer demand, manage

its inventory, and plan for future expenses; the impact of changes

in consumer confidence, shopping behavior and consumer spending on

demand for the Company’s products; the impact of COVID-19 and

macroeconomic trends on the Company’s operations; the Company’s

reliance on a limited number of third-party suppliers; the

fluctuating costs of raw materials; the Company’s failure to

protect its intellectual property rights; the fact that the

operations of many of the Company’s suppliers and vendors are

subject to additional risks that are beyond its control; and other

risks, uncertainties and factors discussed in the “Risk Factors”

section of the Company’s Quarterly Report on Form 10-Q for the

quarter ended June 30, 2023 to be filed with the Securities and

Exchange Commission (“SEC”), the Company’s Annual Report on Form

10-K for the year ended December 31, 2022 filed with the SEC on

February 28, 2023, and the Company’s other periodic filings with

the SEC. The forward-looking statements in this press release speak

only as of the time made and the Company does not undertake to

update or revise them to reflect future events or

circumstances.

FIGS, INC.

BALANCE SHEETS (In thousands, except

share and per share data)

As of

June 30, 2023

December 31,

2022

Assets

(Unaudited)

Current assets

Cash and cash equivalents

$

146,730

$

159,775

Short-term investments

38,595

—

Accounts receivable

6,269

6,866

Inventory, net

167,806

177,976

Prepaid expenses and other current

assets

9,849

11,883

Total current assets

369,249

356,500

Non-current assets

Property and equipment, net

11,399

11,024

Operating lease right-of-use assets

17,154

15,312

Deferred tax assets

11,955

10,971

Other assets

1,258

1,257

Total non-current assets

41,766

38,564

Total assets

$

411,015

$

395,064

Liabilities and stockholders’

equity

Current liabilities

Accounts payable

$

11,933

$

20,906

Operating lease liabilities

3,818

3,408

Accrued expenses

17,990

26,164

Accrued compensation and benefits

4,366

3,415

Sales tax payable

2,953

3,374

Gift card liability

8,390

7,882

Deferred revenue

777

2,786

Returns reserve

3,314

3,458

Income tax payable

3,290

—

Total current liabilities

56,831

71,393

Non-current liabilities

Operating lease liabilities,

non-current

17,086

15,756

Other non-current liabilities

176

176

Total liabilities

$

74,093

$

87,325

Commitments and contingencies

Stockholders’ equity

Class A Common stock — par value $0.0001

per share, 1,000,000,000 shares authorized as of June 30, 2023 and

December 31, 2022; 160,504,522 and 159,351,307 shares issued and

outstanding as of June 30, 2023 and December 31, 2022,

respectively

16

16

Class B Common stock — par value $0.0001

per share, 150,000,000 shares authorized as of June 30, 2023 and

December 31, 2022; 7,748,952 and 7,210,795 shares issued and

outstanding as of June 30, 2023 and December 31, 2022,

respectively

—

—

Preferred stock — par value $0.0001 per

share, 100,000,000 shares authorized as of June 30, 2023 and

December 31, 2022; zero shares issued and outstanding as of June

30, 2023 and December 31, 2022

—

—

Additional paid-in capital

291,306

268,606

Accumulated other comprehensive loss

(8

)

—

Retained earnings

45,608

39,117

Total stockholders’ equity

336,922

307,739

Total liabilities and stockholders’

equity

$

411,015

$

395,064

FIGS, INC.

STATEMENTS OF OPERATIONS (In

thousands, except share and per share data)

(Unaudited)

Three months ended June

30,

Six months ended June

30,

2023

2022

2023

2022

Net revenues

$

138,132

$

122,247

$

258,364

$

232,348

Cost of goods sold

42,098

35,899

76,654

67,569

Gross profit

96,034

86,348

181,710

164,779

Operating expenses

Selling

33,739

26,803

64,896

48,861

Marketing

20,889

20,824

37,953

36,232

General and administrative

34,840

29,270

68,997

56,490

Total operating expenses

89,468

76,897

171,846

141,583

Net income from operations

6,566

9,451

9,864

23,196

Other income, net

Interest income

1,521

70

2,593

79

Other expense

(4

)

—

(5

)

(1

)

Total other income, net

1,517

70

2,588

78

Net income before provision for income

taxes

8,083

9,521

12,452

23,274

Provision for income taxes

3,501

4,669

5,961

9,523

Net income

$

4,582

$

4,852

$

6,491

$

13,751

Earnings attributable to Class A and Class

B common stockholders

Basic earnings per share

$

0.03

$

0.03

$

0.04

$

0.08

Diluted earnings per share

$

0.02

$

0.03

$

0.04

$

0.07

Weighted-average shares

outstanding—basic

167,423,656

164,919,979

167,100,292

164,664,480

Weighted-average shares

outstanding—diluted

183,332,560

188,903,553

183,094,950

191,142,834

FIGS, INC.

STATEMENTS OF CASH FLOWS (In

thousands) (Unaudited)

Six months ended June

30,

2023

2022

Cash flows from operating

activities:

Net income

$

6,491

$

13,751

Adjustments to reconcile net income to net

cash (used in) provided by operating activities:

Depreciation and amortization expense

1,372

808

Deferred income taxes

(984

)

(315

)

Non-cash operating lease cost

1,364

1,061

Stock-based compensation

22,309

17,254

Other

(260

)

—

Changes in operating assets and

liabilities:

Accounts receivable

597

(2,637

)

Due from related party

—

(631

)

Inventory

10,170

(41,578

)

Prepaid expenses and other current

assets

2,034

(4,929

)

Other assets

(1

)

(687

)

Accounts payable

(9,100

)

(4,081

)

Accrued expenses

(8,181

)

2,970

Accrued compensation and benefits

951

(2,994

)

Sales tax payable

(421

)

58

Gift card liability

508

319

Deferred revenue

(2,009

)

448

Returns reserve

(144

)

(387

)

Income tax payable

3,290

(3,973

)

Operating lease liabilities

(1,466

)

(964

)

Other non-current liabilities

—

(28

)

Net cash (used in) provided by operating

activities

26,520

(26,535

)

Cash flows from investing

activities:

Purchases of property and equipment

(1,613

)

(1,727

)

Purchases of available-for-sale

securities

(38,343

)

—

Purchases of held-to-maturity

securities

—

(500

)

Net cash used in investing activities

(39,956

)

(2,227

)

Cash flows from financing

activities:

Proceeds from stock option exercises and

employee stock purchases

637

1,073

Tax payments related to net share

settlements on restricted stock units

(246

)

—

Capital contributions

—

479

Net cash provided by financing

activities

391

1,552

Net decrease in cash, cash equivalents,

and restricted cash

(13,045

)

(27,210

)

Cash, cash equivalents, and restricted

cash, beginning of period

159,775

197,430

Cash and cash equivalents, end of

period

$

146,730

$

170,220

FIGS, INC.

RECONCILIATIONS OF GAAP TO NON-GAAP

MEASURES (Unaudited)

The following table presents a reconciliation of net income, as

adjusted to net income, which is the most directly comparable

financial measure calculated in accordance with GAAP:

Three months ended June

30,

Six months ended June

30,

2023

2022

2023

2022

(in thousands)

Net income

$

4,581

$

4,852

$

6,490

$

13,751

Add (deduct):

Transaction costs

—

145

—

145

Expenses related to non-ordinary course

disputes(1)

—

2,787

1,256

5,204

Income tax impacts of items above

—

(1,438

)

(707

)

(2,291

)

Net income, as adjusted

$

4,581

$

6,346

$

7,039

$

16,809

(1) Exclusively represents attorney’s

fees, costs and expenses incurred by the Company in connection with

the Company’s now-concluded litigation against Strategic Partners,

Inc.

The following table presents a reconciliation of adjusted EBITDA

to net income, which is the most directly comparable financial

measure calculated in accordance with GAAP, and presents adjusted

EBITDA margin with net income margin, which is the most directly

comparable financial measure calculated in accordance with

GAAP:

Three months ended June

30,

Six months ended June

30,

2023

2022

2023

2022

(in thousands, except

percentages)

Net income

$

4,581

$

4,852

$

6,490

$

13,751

Add (deduct):

Other income, net

(1,517

)

(70

)

(2,588

)

(78

)

Provision for income taxes

3,501

4,669

5,961

9,523

Depreciation and amortization

expense(1)

713

433

1,372

808

Stock-based compensation and related

expense(2)

11,618

8,808

22,482

17,254

Expenses related to non-ordinary course

disputes(3)

—

2,787

1,256

5,204

Adjusted EBITDA

$

18,896

$

21,479

$

34,973

$

46,462

Net revenues

$

138,132

$

122,247

$

258,364

$

232,348

Net income margin(4)

3.4

%

4.1

%

2.5

%

5.9

%

Adjusted EBITDA margin

13.7

%

17.6

%

13.5

%

20.0

%

(1) Excludes amortization of debt issuance

costs included in “Other income, net.”

(2) Includes stock-based compensation

expense and payroll taxes related to equity award activity.

(3) Exclusively represents attorney’s

fees, costs and expenses incurred by the Company in connection with

the Company’s now-concluded litigation against Strategic Partners,

Inc.

(4) Net income margin represents net

income as a percentage of net revenues.

FIGS, INC.

KEY OPERATING METRICS

(Unaudited)

Active customers as of June 30, 2023 and 2022, respectively, net

revenues per active customer as of June 30, 2023 and 2022,

respectively, and average order value for the three and six months

ended June 30, 2023 and 2022, respectively, are presented in the

following tables:

As of June 30,

2023

2022

(in thousands)

Active customers

2,476

2,047

As of June 30,

2023

2022

Net revenues per active customer

$

215

$

227

Three months ended June

30,

Six months ended June

30,

2023

2022

2023

2022

Average order value

$

115

$

109

$

115

$

112

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230803192991/en/

Investors: Jean Fontana IR@wearfigs.com Media: Todd Maron

press@wearfigs.com

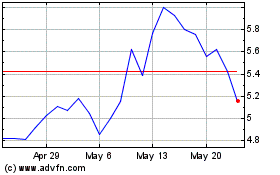

FIGS (NYSE:FIGS)

Historical Stock Chart

From Dec 2024 to Jan 2025

FIGS (NYSE:FIGS)

Historical Stock Chart

From Jan 2024 to Jan 2025