0001559865false00015598652024-03-042024-03-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): March 4, 2024

EVERTEC, Inc.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

| | | | | | | | | | | |

| Puerto Rico | | 66-0783622 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. employer

identification number) |

| | |

| Cupey Center Building, | Road 176, Kilometer 1.3, | | |

| San Juan, | Puerto Rico | | 00926 |

| (Address of principal executive offices) | | (Zip Code) |

(787) 759-9999

(Registrant’s telephone number, including area code)

Not applicable

(Former name, former address and former fiscal year, if changed since last report)

COMMISSION FILE NUMBER 001-35872

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | EVTC | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events

On March 4, 2024 the Board of Directors of Evertec, Inc. (the “Company” or “Evertec”) approved an increase to Evertec’s existing share repurchase authorization to permit future repurchases of up to an aggregate of $220 million worth of shares of the Company’s common stock, par value $0.01 per share (the “Common Stock”) by December 31, 2025. Prior to this increase, the Company’s share repurchase program authorization had approximately $137 million remaining. Under the repurchase program, the Company may repurchase shares in the open market, through accelerated share repurchase programs, Rule 10b5-1 plans, or in privately negotiated transactions, subject to business opportunities and other factors.

On March 6, 2024, Evertec entered into an accelerated share repurchase agreement (the “ASR Agreement”) with Bank of America, N.A. (the “ASR Counterparty”) to repurchase an aggregate of $70 million of the Company’s common stock, par value $0.01 per share (the “Common Stock”). The Company is funding the share repurchases under the ASR Agreement which are being made pursuant to the Company’s $220 million share repurchase program. After giving effect to the ASR Agreement, $150 million will remain available for share repurchases under the Company’s share repurchase program.

Under the terms of the ASR Agreement, the Company will make a payment of $70 million to the ASR Counterparty on March 8, 2024, and expects to receive on the same day an initial delivery of approximately 1.5 million shares of Common Stock from the ASR Counterparty. The final number of shares to be repurchased by the Company will be based on the average of the daily volume-weighted average price of the Company’s Common Stock during the term of the ASR Agreement, less a discount and subject to adjustments pursuant to the terms and conditions of the ASR Agreement. The resulting adjustments may affect the total amount expended by the Company or the aggregate number of shares it repurchases. The ASR Agreement contains customary terms for these types of transactions, including, but not limited to, the mechanisms to determine the number of shares of Common Stock or the amount of cash that will be delivered at settlement, the required timing of delivery of the shares of Common Stock, the specific circumstances under which adjustments may be made to the transaction, the specific circumstances under which the transaction may be terminated prior to its scheduled maturity and various acknowledgments, representations and warranties made by the Company and the ASR Counterparty to one another. At settlement, the ASR Counterparty may be required to deliver additional shares of Common Stock to the Company, or under certain circumstances, the Company may be required to deliver shares of Common Stock or to make a cash payment, at its election, to the ASR Counterparty. The final settlement of the transactions under the ASR Agreement is scheduled to occur by September 5, 2024, subject to earlier termination, as set forth in the ASR Agreement.

Item 7.01 Regulation FD Disclosure.

On March 6, 2024, the Company issued a press release regarding the foregoing announcements. A copy of the press release announcing the discussed above is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

Note: The information contained in this Item 7.01 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| EVERTEC, Inc. |

| (Registrant) |

| | |

| Date: March 6, 2024 | By: | /s/ Joaquin A. Castrillo-Salgado |

| | Name: Joaquin A. Castrillo-Salgado |

| | Title: Chief Financial Officer |

EXHIBIT INDEX

| | | | | | | | |

| Number | | Exhibit |

| 99.1 | | |

| 104 |

| Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) |

Exhibit 99.1

EVERTEC ENTERS INTO ACCELERATED SHARE REPURCHASE AGREEMENT

INCREASES SHARE REPURCHASE AUTHORIZATION

SAN JUAN, PUERTO RICO - March 6, 2024 – EVERTEC, Inc. (NYSE: EVTC) (“Evertec” or the “Company”) today announced that it has entered into an Accelerated Share Repurchase (ASR) agreement with Bank of America, N.A. by which the Company will repurchase $70 million of its common stock. The ASR is expected to be completed by the third quarter of 2024.

Additionally, the Company's Board of Directors approved an increase to the share repurchase authorization to an aggregate $220 million and an extension to the expiration date to December 31, 2025. The ASR was executed under this increase. Prior to this amendment, the share repurchase program had approximately $137 million remaining. The Company may repurchase shares in the open market, through accelerated share repurchase programs, 10b5-1 plans, or in privately negotiated transactions, subject to business opportunities and other factors.

About EVERTEC

EVERTEC, Inc. (NYSE: EVTC) is a leading full-service transaction processor and financial technology provider in Latin America, Puerto Rico and the Caribbean, providing a broad range of merchant acquiring, payment services and business process management services. Evertec owns and operates the ATH® network, one of the leading personal identification number (“PIN”) debit networks in Latin America. In addition, the Company manages a system of electronic payment networks and offers a comprehensive suite of services for core banking, cash processing and fulfillment in Puerto Rico, that process approximately six billion transactions annually. The Company also offers financial technology outsourcing in all the regions it serves. Based in Puerto Rico, the Company operates in 26 Latin American countries and serves a diversified customer base of leading financial institutions, merchants, corporations and government agencies with “mission-critical” technology solutions. For more information, visit www.evertecinc.com.

Investor Contact

Beatriz Brown-Sáenz

(787) 773-5442

IR@evertecinc.com

v3.24.0.1

Document and Entity Information Document

|

Mar. 04, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Mar. 04, 2024

|

| Entity Registrant Name |

EVERTEC, Inc.

|

| Entity Incorporation, State or Country Code |

PR

|

| Entity File Number |

001-35872

|

| Entity Central Index Key |

0001559865

|

| Amendment Flag |

false

|

| Entity Tax Identification Number |

66-0783622

|

| Entity Address, Address Line One |

Cupey Center Building,

|

| Entity Address, Address Line Two |

Road 176, Kilometer 1.3,

|

| Entity Address, City or Town |

San Juan,

|

| Entity Address, Country |

PR

|

| Entity Address, Postal Zip Code |

00926

|

| City Area Code |

787

|

| Local Phone Number |

759-9999

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value per share

|

| Trading Symbol |

EVTC

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

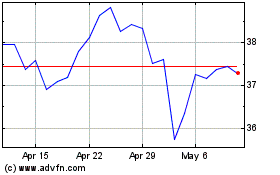

Evertec (NYSE:EVTC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Evertec (NYSE:EVTC)

Historical Stock Chart

From Apr 2023 to Apr 2024