Essent Group Ltd. (NYSE: ESNT) today reported net income for the

quarter ended December 31, 2021 of $181.0 million or $1.64 per

diluted share, compared to $123.6 million or $1.10 per diluted

share for the quarter ended December 31, 2020. For the full year

2021, net income was $681.8 million or $6.11 per diluted share,

compared to $413.0 million or $3.88 per diluted share for 2020.

Essent also announced today that its Board of Directors has

declared a quarterly cash dividend of $0.20 per common share. The

dividend is payable on March 21, 2022, to shareholders of record on

March 10, 2022.

“We are pleased with our fourth quarter and full year 2021

financial results, which reflect our continued focus on optimizing

our unit economics in generating high-quality earnings and strong

returns,” said Mark A. Casale, Chairman and Chief Executive

Officer. “Our strong operating performance also generated excess

capital, which we continued to deploy in a balanced manner between

reinvestment in our franchise and distribution to shareholders. In

connection with this, we are pleased to announce that our Board has

approved an increase in our quarterly dividend to $0.20 per

share.”

Fourth Quarter & Full Year 2021 Financial

Highlights:

- Insurance in force as of December 31, 2021 was $207.2 billion,

compared to $208.2 billion as of September 30, 2021 and $198.9

billion as of December 31, 2020.

- New insurance written for the fourth quarter was $16.4 billion,

compared to $23.6 billion in the third quarter of 2021 and $29.6

billion in the fourth quarter of 2020.

- Net premiums earned for the fourth quarter were $217.3 million,

compared to $218.7 million in the third quarter of 2021 and $222.3

million in the fourth quarter of 2020.

- Income from other invested assets for the fourth quarter

included $12.0 million, or $0.09 per diluted share on an after-tax

basis, pertaining to net unrealized gains associated with strategic

investments in limited partnerships.

- The expense ratio for the fourth quarter was 19.0%, compared to

19.3% in the third quarter of 2021 and 16.6% in the fourth quarter

of 2020.

- The provision for losses and LAE for the fourth quarter was a

benefit of $3.4 million, compared to a benefit of $7.5 million in

the third quarter of 2021 and a provision of $62.1 million in the

fourth quarter of 2020.

- The percentage of loans in default as of December 31, 2021 was

2.16%, compared to 2.47% as of September 30, 2021 and 3.93% as of

December 31, 2020.

- The combined ratio for the fourth quarter was 17.4%, compared

to 15.9% in the third quarter of 2021 and 44.5% in the fourth

quarter of 2020.

- The consolidated balance of cash and investments at December

31, 2021 was $5.2 billion, which includes holding company net cash

and investments available for sale of $618.3 million.

- The combined risk-to-capital ratio of the U.S. mortgage

insurance business, which includes statutory capital for both

Essent Guaranty, Inc. and Essent Guaranty of PA, Inc., was 10.4:1

as of December 31, 2021.

- On November 10, 2021, Essent Guaranty, Inc. obtained $439.4

million of fully collateralized excess of loss reinsurance coverage

on mortgage insurance policies written by Essent in April 1, 2021

through September 30, 2021 from Radnor Re 2021-2 Ltd., a newly

formed Bermuda special purpose insurer. Radnor Re 2021-2 Ltd. is

not a subsidiary or an affiliate of Essent Group Ltd.

- On December 10, 2021, Essent Group Ltd. entered into an amended

and restated credit facility, increasing to $825 million the

committed capacity and extending the contractual maturity to

December 10, 2026.

Conference Call:

Essent management will hold a conference call at 10:00 AM

Eastern time today to discuss its results. The conference call will

be broadcast live over the Internet at

http://ir.essentgroup.com/events-and-presentations/events/default.aspx.

The call may also be accessed by dialing 888-510-2507 inside the

U.S., or 646-960-0351 for international callers, using passcode

9824537 or by referencing Essent.

A replay of the webcast will be available on the Essent website

approximately two hours after the live broadcast ends for a period

of one year. A replay of the conference call will be available

approximately two hours after the call ends for a period of two

weeks, using the following dial-in numbers and passcode:

800-770-2030 inside the U.S., or 647-362-9199 for international

callers, passcode 9824537.

In addition to the information provided in the Company's

earnings news release, other statistical and financial information,

which may be referred to during the conference call, will be

available on Essent's website at

http://ir.essentgroup.com/financials/quarterly-results/default.aspx.

Forward-Looking Statements:

This press release may include “forward-looking statements”

which are subject to known and unknown risks and uncertainties,

many of which may be beyond our control. Forward-looking statements

generally can be identified by the use of forward-looking

terminology such as "may," "will," “should,” “expect,” "plan,"

"anticipate," "believe," “estimate,” “predict,” or "potential" or

the negative thereof or variations thereon or similar terminology.

Actual events, results and outcomes may differ materially from our

expectations due to a variety of known and unknown risks,

uncertainties and other factors. Although it is not possible to

identify all of these risks and factors, they include, among

others, the following: the impact of COVID-19 and related economic

conditions; changes in or to Fannie Mae and Freddie Mac (the

“GSEs”), whether through Federal legislation, restructurings or a

shift in business practices; failure to continue to meet the

mortgage insurer eligibility requirements of the GSEs; competition

for customers; lenders or investors seeking alternatives to private

mortgage insurance; an increase in the number of loans insured

through Federal government mortgage insurance programs, including

those offered by the Federal Housing Administration; decline in new

insurance written and franchise value due to loss of a significant

customer; decline in the volume of low down payment mortgage

originations; the definition of "Qualified Mortgage" reducing the

size of the mortgage origination market or creating incentives to

use government mortgage insurance programs; the definition of

"Qualified Residential Mortgage" reducing the number of low down

payment loans or lenders and investors seeking alternatives to

private mortgage insurance; the implementation of the Basel III

Capital Accord discouraging the use of private mortgage insurance;

a decrease in the length of time that insurance policies are in

force; uncertainty of loss reserve estimates; deteriorating

economic conditions; our non-U.S. operations becoming subject to

U.S. Federal income taxation; becoming considered a passive foreign

investment company for U.S. Federal income tax purposes; and other

risks and factors described in Part I, Item 1A “Risk Factors” of

our Annual Report on Form 10-K for the year ended December 31, 2020

filed with the Securities and Exchange Commission on February 26,

2021, as subsequently updated through other reports we file with

the Securities and Exchange Commission. Any forward-looking

information presented herein is made only as of the date of this

press release, and we do not undertake any obligation to update or

revise any forward-looking information to reflect changes in

assumptions, the occurrence of unanticipated events, or

otherwise.

About the Company:

Essent Group Ltd. (NYSE: ESNT) is a Bermuda-based holding

company (collectively with its subsidiaries, “Essent”) which,

through its wholly-owned subsidiary, Essent Guaranty, Inc., offers

private mortgage insurance for single-family mortgage loans in the

United States. Essent provides private capital to mitigate mortgage

credit risk, allowing lenders to make additional mortgage financing

available to prospective homeowners. Headquartered in Radnor,

Pennsylvania, Essent Guaranty, Inc. is licensed to write mortgage

insurance in all 50 states and the District of Columbia, and is

approved by Fannie Mae and Freddie Mac. Essent also offers

mortgage-related insurance, reinsurance and advisory services

through its Bermuda-based subsidiary, Essent Reinsurance Ltd.

Essent is committed to supporting environmental, social and

governance (“ESG”) initiatives that are relevant to the company and

align with the companywide dedication to responsible corporate

citizenship that positively impacts the community and people

served. Additional information regarding Essent may be found at

www.essentgroup.com and www.essent.us.

Source: Essent Group Ltd.

Essent Group Ltd. and

Subsidiaries

Financial Results and

Supplemental Information (Unaudited)

Quarter and Year Ended

December 31, 2021

Exhibit A

Condensed Consolidated Statements of

Comprehensive Income (Unaudited)

Exhibit B

Condensed Consolidated Balance Sheets

(Unaudited)

Exhibit C

Historical Quarterly Data

Exhibit D

New Insurance Written

Exhibit E

Insurance in Force and Risk in Force

Exhibit F

Other Risk in Force

Exhibit G

Portfolio Vintage Data

Exhibit H

Reinsurance Vintage Data

Exhibit I

Portfolio Geographic Data

Exhibit J

Rollforward of Defaults and Reserve for

Losses and LAE

Exhibit K

Detail of Reserves by Default

Delinquency

Exhibit L

Investments Available for Sale

Exhibit M

Insurance Company Capital

Exhibit A

Essent Group Ltd. and

Subsidiaries

Condensed Consolidated

Statements of Comprehensive Income (Unaudited)

Three Months Ended December

31,

Year Ended December

31,

(In thousands,

except per share amounts)

2021

2020

2021

2020

Revenues:

Direct premiums written

$

224,972

$

245,437

$

918,406

$

922,851

Ceded premiums

(26,476

)

(31,194

)

(110,914

)

(88,738

)

Net premiums written

198,496

214,243

807,492

834,113

Decrease in unearned premiums

18,825

8,096

65,051

28,451

Net premiums earned

217,321

222,339

872,543

862,564

Net investment income

23,661

20,949

88,765

80,087

Realized investment (losses) gains,

net

(191

)

564

418

2,697

Income (loss) from other invested

assets

14,997

2

56,386

(215

)

Other income

1,128

3,345

10,398

10,021

Total revenues

256,916

247,199

1,028,510

955,154

Losses and expenses:

(Benefit) provision for losses and LAE

(3,433

)

62,073

31,057

301,293

Other underwriting and operating

expenses

41,232

36,825

166,857

154,691

Interest expense

2,095

2,149

8,282

9,074

Total losses and expenses

39,894

101,047

206,196

465,058

Income before income taxes

217,022

146,152

822,314

490,096

Income tax expense

36,035

22,550

140,531

77,055

Net income

$

180,987

$

123,602

$

681,783

$

413,041

Earnings per share:

Basic

$

1.65

$

1.10

$

6.13

$

3.89

Diluted

1.64

1.10

6.11

3.88

Weighted average shares

outstanding:

Basic

109,550

111,908

111,164

106,098

Diluted

110,028

112,310

111,555

106,376

Net income

$

180,987

$

123,602

$

681,783

$

413,041

Other comprehensive income

(loss):

Change in unrealized (depreciation)

appreciation of investments

(27,807

)

5,840

(87,567

)

82,087

Total other comprehensive (loss)

income

(27,807

)

5,840

(87,567

)

82,087

Comprehensive income

$

153,180

$

129,442

$

594,216

$

495,128

Loss ratio

(1.6

%)

27.9

%

3.6

%

34.9

%

Expense ratio

19.0

16.6

19.1

17.9

Combined ratio

17.4

%

44.5

%

22.7

%

52.9

%

Exhibit B

Essent Group Ltd. and

Subsidiaries

Condensed Consolidated Balance

Sheets (Unaudited)

December 31,

December 31,

(In thousands,

except per share amounts)

2021

2020

Assets

Investments

Fixed maturities available for sale, at

fair value

$

4,649,800

$

3,838,513

Short-term investments available for sale,

at fair value

313,087

726,860

Total investments available for sale

4,962,887

4,565,373

Other invested assets

170,472

88,904

Total investments

5,133,359

4,654,277

Cash

81,491

102,830

Accrued investment income

26,546

19,948

Accounts receivable

46,157

50,140

Deferred policy acquisition costs

12,178

17,005

Property and equipment

11,921

15,095

Prepaid federal income tax

360,810

302,636

Other assets

49,712

40,793

Total assets

$

5,722,174

$

5,202,724

Liabilities and Stockholders'

Equity

Liabilities

Reserve for losses and LAE

$

407,445

$

374,941

Unearned premium reserve

185,385

250,436

Net deferred tax liability

373,654

305,109

Credit facility borrowings, net of

deferred costs

419,823

321,720

Other accrued liabilities

99,753

87,885

Total liabilities

1,486,060

1,340,091

Commitments and contingencies

Stockholders' Equity

Common shares, $0.015 par value:

Authorized - 233,333; issued and

outstanding - 109,377 shares in 2021 and 112,423 shares in 2020

1,641

1,686

Additional paid-in capital

1,428,952

1,571,163

Accumulated other comprehensive income

50,707

138,274

Retained earnings

2,754,814

2,151,510

Total stockholders' equity

4,236,114

3,862,633

Total liabilities and stockholders'

equity

$

5,722,174

$

5,202,724

Return on average equity

16.8

%

12.1

%

Exhibit C

Essent Group Ltd. and

Subsidiaries

Supplemental

Information

Historical Quarterly

Data

2021

2020

Selected Income Statement Data

December 31

September 30

June 30

March 31

December 31

(In thousands,

except per share amounts)

Revenues:

Net premiums earned:

U.S. Mortgage Insurance Portfolio

$

205,877

$

207,127

$

204,149

$

207,840

$

208,715

GSE and other risk share

11,444

11,591

13,288

11,227

13,624

Net premiums earned

217,321

218,718

217,437

219,067

222,339

Income from other invested assets

(1)

14,997

40,741

122

526

2

Other revenues (2)

24,598

24,077

25,702

25,204

24,858

Total revenues

256,916

283,536

243,261

244,797

247,199

Losses and expenses:

(Benefit) provision for losses and LAE

(3,433

)

(7,483

)

9,651

32,322

62,073

Other underwriting and operating

expenses

41,232

42,272

41,114

42,239

36,825

Interest expense

2,095

2,063

2,073

2,051

2,149

Total losses and expenses

39,894

36,852

52,838

76,612

101,047

Income before income taxes

217,022

246,684

190,423

168,185

146,152

Income tax expense (3)

36,035

41,331

30,628

32,537

22,550

Net income

$

180,987

$

205,353

$

159,795

$

135,648

$

123,602

Earnings per share:

Basic

$

1.65

$

1.85

$

1.43

$

1.21

$

1.10

Diluted

1.64

1.84

1.42

1.21

1.10

Weighted average shares

outstanding:

Basic

109,550

111,001

112,118

112,016

111,908

Diluted

110,028

111,387

112,454

112,378

112,310

Book value per share

$

38.73

$

37.58

$

36.32

$

34.75

$

34.36

Return on average equity

(annualized)

17.2

%

19.9

%

16.0

%

13.9

%

13.0

%

Other Data:

Loss ratio (4)

(1.6

%)

(3.4

%)

4.4

%

14.8

%

27.9

%

Expense ratio (5)

19.0

19.3

18.9

19.3

16.6

Combined ratio

17.4

%

15.9

%

23.3

%

34.0

%

44.5

%

Credit Facility

Borrowings outstanding

$

425,000

$

325,000

$

325,000

$

325,000

$

325,000

Undrawn committed capacity

$

400,000

$

300,000

$

300,000

$

300,000

$

300,000

Weighted average interest rate (end of

period)

1.79

%

2.13

%

2.13

%

2.13

%

2.19

%

Debt-to-capital

9.12

%

7.23

%

7.37

%

7.65

%

7.76

%

(1) Income from other invested

assets for the three months ended September 30, 2021 includes $39.5

million of net unrealized gains, which includes $21.1 million of

net unrealized gains that were accumulated in other comprehensive

income at June 30, 2021 and prior periods.

(2) Certain of our third-party

reinsurance agreements contain an embedded derivative as the

premium ceded under those agreements will vary based on changes in

interest rates. For each of the three month periods noted, Other

revenues include net favorable (unfavorable) changes in the fair

value of these embedded derivatives as follows: December 31, 2021:

($2,931); September 30, 2021: ($1,493); June 30, 2021: $950; March

31, 2021: ($606); December 31, 2020: ($209).

(3) Income tax expense for the

quarters ended December 31, 2021 and March 31, 2021 includes $2,473

and $5,718, respectively, of discrete tax expense associated with

an increase in the estimate of our beginning of the year deferred

state income tax liability. Income tax expense for the quarters

ended December 31, 2021 and September 30, 2021 includes $1,759 and

$8,271, respectively, of discrete tax expense associated with

realized and unrealized gains and losses.

(4) Loss ratio is calculated by

dividing the provision for losses and LAE by net premiums

earned.

(5) Expense ratio is calculated by

dividing other underwriting and operating expenses by net premiums

earned.

Exhibit C, continued

Essent Group Ltd. and

Subsidiaries

Supplemental

Information

Historical Quarterly

Data

2021

2020

Other Data, continued:

December 31

September 30

June 30

March 31

December 31

($ in

thousands)

U.S. Mortgage Insurance

Portfolio

Flow:

New insurance written

$

16,379,082

$

23,579,884

$

25,004,854

$

19,254,014

$

29,566,820

New risk written

4,331,531

6,273,735

6,445,864

4,616,450

7,051,173

Bulk:

New insurance written

$

416

$

—

$

—

$

—

$

—

New risk written

41

—

—

—

—

Total:

New insurance written

$

16,379,498

$

23,579,884

$

25,004,854

$

19,254,014

$

29,566,820

New risk written

$

4,331,572

$

6,273,735

$

6,445,864

$

4,616,450

$

7,051,173

Average insurance in force

$

207,388,906

$

206,732,478

$

199,739,297

$

197,749,668

$

195,670,925

Insurance in force (end of period)

$

207,190,544

$

208,216,549

$

203,559,859

$

197,091,191

$

198,882,352

Gross risk in force (end of period)

(6)

$

52,554,246

$

52,457,020

$

50,835,835

$

48,951,602

$

49,565,150

Risk in force (end of period)

$

45,273,383

$

45,074,159

$

42,906,519

$

41,135,978

$

41,339,262

Policies in force

785,119

798,877

794,743

785,382

799,893

Weighted average coverage (7)

25.4

%

25.2

%

25.0

%

24.8

%

24.9

%

Annual persistency

65.4

%

62.2

%

58.3

%

56.1

%

60.1

%

Loans in default (count)

16,963

19,721

23,504

29,080

31,469

Percentage of loans in default

2.16

%

2.47

%

2.96

%

3.70

%

3.93

%

U.S. Mortgage Insurance Portfolio

premium rate:

Base average premium rate (8)

0.42

%

0.42

%

0.43

%

0.44

%

0.44

%

Single premium cancellations

(9)

0.03

%

0.03

%

0.03

%

0.04

%

0.05

%

Gross average premium rate

0.45

%

0.45

%

0.46

%

0.48

%

0.49

%

Ceded premiums

(0.05

%)

(0.05

%)

(0.05

%)

(0.06

%)

(0.06

%)

Net average premium rate

0.40

%

0.40

%

0.41

%

0.42

%

0.43

%

(6) Gross risk in force includes

risk ceded under third-party reinsurance.

(7) Weighted average coverage is

calculated by dividing end of period gross risk in force by end of

period insurance in force.

(8) Base average premium rate is

calculated by dividing annualized base premiums earned by average

insurance in force for the period.

(9) Single premium cancellations is

calculated by dividing annualized premiums on the cancellation of

non-refundable single premium policies by average insurance in

force for the period.

Exhibit D

Essent Group Ltd. and

Subsidiaries

Supplemental

Information

New Insurance Written:

Flow

NIW by Credit Score

Three Months Ended

Year Ended

December 31, 2021

December 31, 2020

December 31, 2021

December 31, 2020

($ in

thousands)

>=760

$

6,643,740

40.6

%

$

13,330,379

45.1

%

$

34,422,627

40.9

%

$

48,037,084

44.5

%

740-759

2,833,379

17.3

5,069,530

17.1

13,691,394

16.3

19,385,541

17.9

720-739

2,472,738

15.1

4,134,782

14.0

12,789,715

15.2

15,744,485

14.6

700-719

2,170,829

13.2

3,385,670

11.5

11,499,406

13.6

12,409,936

11.5

680-699

1,504,268

9.2

1,743,694

5.9

7,359,569

8.7

6,871,511

6.4

<=679

754,128

4.6

1,902,765

6.4

4,455,123

5.3

5,495,357

5.1

Total

$

16,379,082

100.0

%

$

29,566,820

100.0

%

$

84,217,834

100.0

%

$

107,943,914

100.0

%

Weighted average credit score

745

748

745

749

NIW by LTV

Three Months Ended

Year Ended

December 31, 2021

December 31, 2020

December 31, 2021

December 31, 2020

($ in

thousands)

85.00% and below

$

1,799,336

11.0

%

$

6,317,550

21.4

%

$

11,460,273

13.6

%

$

20,124,987

18.6

%

85.01% to 90.00%

4,372,552

26.7

9,629,373

32.6

23,565,227

28.0

34,020,882

31.5

90.01% to 95.00%

7,722,842

47.1

11,134,923

37.6

37,813,167

44.9

42,517,221

39.4

95.01% and above

2,484,352

15.2

2,484,974

8.4

11,379,167

13.5

11,280,824

10.5

Total

$

16,379,082

100.0

%

$

29,566,820

100.0

%

$

84,217,834

100.0

%

$

107,943,914

100.0

%

Weighted average LTV

92

%

91

%

92

%

91

%

NIW by Product

Three Months Ended

Year Ended

December 31, 2021

December 31, 2020

December 31, 2021

December 31, 2020

Single Premium policies

2.7

%

7.7

%

3.8

%

9.0

%

Monthly Premium policies

97.3

92.3

96.2

91.0

100.0

%

100.0

%

100.0

%

100.0

%

NIW by Purchase vs.

Refinance

Three Months Ended

Year Ended

December 31, 2021

December 31, 2020

December 31, 2021

December 31, 2020

Purchase

92.1

%

61.6

%

82.1

%

60.4

%

Refinance

7.9

38.4

17.9

39.6

100.0

%

100.0

%

100.0

%

100.0

%

Exhibit E

Essent Group Ltd. and

Subsidiaries

Supplemental

Information

Insurance in Force and Risk in

Force

Portfolio by Credit

Score

IIF by FICO score

December 31, 2021

September 30, 2021

December 31, 2020

($ in

thousands)

>=760

$

85,501,113

41.3

%

$

85,833,588

41.2

%

$

82,452,139

41.5

%

740-759

35,111,019

17.0

35,234,863

16.9

34,538,761

17.3

720-739

31,158,325

15.0

31,291,415

15.1

29,599,646

14.9

700-719

26,105,790

12.6

26,136,910

12.6

23,807,982

12.0

680-699

16,819,629

8.1

16,758,439

8.0

15,538,235

7.8

<=679

12,494,668

6.0

12,961,334

6.2

12,945,589

6.5

Total

$

207,190,544

100.0

%

$

208,216,549

100.0

%

$

198,882,352

100.0

%

Weighted average credit score

745

745

745

Gross RIF by FICO score

December 31, 2021

September 30, 2021

December 31, 2020

($ in

thousands)

>=760

$

21,488,011

40.9

%

$

21,414,607

40.8

%

$

20,336,799

41.0

%

740-759

8,992,181

17.1

8,958,297

17.1

8,682,265

17.5

720-739

8,029,952

15.3

8,020,171

15.3

7,504,065

15.1

700-719

6,693,045

12.7

6,652,117

12.7

5,970,851

12.1

680-699

4,299,245

8.2

4,250,044

8.1

3,887,059

7.9

<=679

3,051,812

5.8

3,161,784

6.0

3,184,111

6.4

Total

$

52,554,246

100.0

%

$

52,457,020

100.0

%

$

49,565,150

100.0

%

Portfolio by LTV

IIF by LTV

December 31, 2021

September 30, 2021

December 31, 2020

($ in

thousands)

85.00% and below

$

27,362,267

13.2

%

$

28,452,535

13.7

%

$

27,308,296

13.7

%

85.01% to 90.00%

59,567,378

28.7

60,257,704

28.9

58,606,394

29.5

90.01% to 95.00%

91,350,909

44.1

90,957,363

43.7

86,169,485

43.3

95.01% and above

28,909,990

14.0

28,548,947

13.7

26,798,177

13.5

Total

$

207,190,544

100.0

%

$

208,216,549

100.0

%

$

198,882,352

100.0

%

Weighted average LTV

92

%

92

%

92

%

Gross RIF by LTV

December 31, 2021

September 30, 2021

December 31, 2020

($ in

thousands)

85.00% and below

$

3,200,124

6.1

%

$

3,311,106

6.3

%

$

3,142,034

6.3

%

85.01% to 90.00%

14,366,450

27.3

14,506,577

27.7

14,061,553

28.4

90.01% to 95.00%

26,592,162

50.6

26,410,513

50.3

24,895,471

50.2

95.01% and above

8,395,510

16.0

8,228,824

15.7

7,466,092

15.1

Total

$

52,554,246

100.0

%

$

52,457,020

100.0

%

$

49,565,150

100.0

%

Portfolio by Loan Amortization

Period

IIF by Loan Amortization Period

December 31, 2021

September 30, 2021

December 31, 2020

($ in

thousands)

FRM 30 years and higher

$

198,243,758

95.7

%

$

198,392,156

95.3

%

$

187,704,000

94.4

%

FRM 20-25 years

3,658,366

1.8

3,974,602

1.9

4,365,585

2.2

FRM 15 years

3,996,684

1.9

4,419,750

2.1

4,776,068

2.4

ARM 5 years and higher

1,291,736

0.6

1,430,041

0.7

2,036,699

1.0

Total

$

207,190,544

100.0

%

$

208,216,549

100.0

%

$

198,882,352

100.0

%

Exhibit F

Essent Group Ltd. and

Subsidiaries

Supplemental

Information

Other Risk in Force

2021

2020

($ in

thousands)

December 31

September 30

June 30

March 31

December 31

GSE and other risk share (1):

Risk in Force

$

1,788,918

$

1,568,800

$

1,496,247

$

1,534,174

$

1,416,719

Reserve for losses and LAE

$

1,349

$

1,389

$

1,390

$

1,312

$

1,073

Weighted average credit score

748

748

747

747

746

Weighted average LTV

84

%

84

%

84

%

84

%

84

%

(1) GSE and other risk share

includes GSE risk share and other reinsurance transactions. Essent

Reinsurance Ltd. ("Essent Re") provides insurance or reinsurance

relating to the risk in force on loans in reference pools acquired

by Freddie Mac and Fannie Mae.

Exhibit G

Essent Group Ltd. and

Subsidiaries

Supplemental

Information

Portfolio Vintage Data

December 31, 2021

Insurance in Force

Year

Original

Insurance

Written

($ in thousands)

Remaining

Insurance

in Force

($ in thousands)

% Remaining of

Original

Insurance

Number of Policies in

Force

Weighted

Average

Coupon

% Purchase

>90% LTV

>95% LTV

FICO < 700

FICO >= 760

Incurred Loss Ratio (Inception

to Date) (1)

Number of Loans in

Default

Percentage of Loans in

Default

2010 - 2014

$

60,668,851

$

3,122,498

5.1

%

19,269

4.32

%

80.6

%

71.7

%

5.2

%

15.3

%

42.4

%

3.3

%

900

4.67

%

2015

26,193,656

3,114,853

11.9

17,893

4.16

86.5

67.1

3.5

17.8

39.8

4.3

742

4.15

2016

34,949,319

6,326,129

18.1

33,941

3.86

88.1

65.3

8.9

15.2

43.9

5.3

1,327

3.91

2017

43,858,322

8,509,847

19.4

47,080

4.26

90.5

65.6

18.3

20.0

37.9

8.3

2,458

5.22

2018

47,508,525

9,482,084

20.0

49,923

4.77

93.7

66.9

23.5

21.2

33.3

13.7

3,096

6.20

2019

63,569,183

20,252,049

31.9

90,476

4.21

86.0

65.3

22.4

19.0

35.5

21.8

3,953

4.37

2020

107,944,065

76,550,717

70.9

276,407

3.18

63.0

51.7

11.3

11.1

44.8

13.6

3,490

1.26

2021

84,218,250

79,832,367

94.8

250,130

3.07

82.7

59.0

13.9

14.1

40.4

9.1

997

0.40

Total

$

468,910,171

$

207,190,544

44.2

785,119

3.41

76.8

58.0

14.0

14.1

41.3

8.9

16,963

2.16

(1) Incurred loss ratio is

calculated by dividing the sum of case reserves and cumulative

amount paid for claims by cumulative net premiums earned.

Exhibit H

Essent Group Ltd. and

Subsidiaries

Supplemental

Information

Reinsurance Vintage

Data

December 31, 2021

($ in

thousands)

Excess of Loss

Reinsurance

Original

Reinsurance in Force

Remaining

Reinsurance in Force

Earned Premiums Ceded

Year

Remaining

Insurance

in Force

Remaining

Risk

in Force

ILN (1)

Other Reinsurance (2)

Total

ILN

Other Reinsurance

Total

Losses

Ceded

to Date

Original

First Layer

Retention

Remaining

First Layer

Retention

Quarter-to-Date

Year-to-Date

Reduction in PMIERs Minimum

Required

Assets (8)

2015 & 2016

$

9,131,102

$

2,462,841

$

333,844

$

—

$

333,844

$

178,717

$

—

$

178,717

$

—

$

208,111

$

207,140

$

1,177

$

4,808

$

—

2017

8,286,495

2,143,551

424,412

165,167

589,579

242,123

165,167

407,290

—

224,689

217,409

2,679

10,655

—

2018

9,341,880

2,382,994

473,184

118,650

591,834

325,537

76,144

401,681

—

253,643

249,450

3,220

12,824

—

2019 (3)

11,238,898

2,874,767

495,889

55,102

550,991

495,889

55,102

550,991

—

215,605

215,115

2,778

11,068

43,674

2019 & 2020 (4)

31,050,401

7,848,926

399,159

—

399,159

153,530

—

153,530

—

465,690

465,690

3,174

17,573

78,211

2020 & 2021 (5)

50,143,288

12,263,000

557,911

—

557,911

557,911

—

557,911

—

278,956

278,956

3,695

7,675

534,049

2021 (6)

45,887,021

12,086,006

439,407

—

439,407

439,407

—

439,407

—

279,415

279,415

2,367

2,367

400,151

Total

$

165,079,085

$

42,062,085

$

3,123,806

$

338,919

$

3,462,725

$

2,393,114

$

296,413

$

2,689,527

$

—

$

1,926,109

$

1,913,175

$

19,090

$

66,970

$

1,056,085

Quota Share

Reinsurance

Losses Ceded

Ceding Commission

Earned Premiums Ceded

Year

Remaining Insurance

in Force

Remaining Risk

in Force

Remaining Ceded

Insurance in Force

Remaining Ceded Risk in

Force

Quarter-to-Date

Year-to-Date

Quarter-to-Date

Year-to-Date

Quarter-to-Date

Year-to-Date

Reduction in PMIERs Minimum

Required Assets (8)

2019 & 2020 (7)

$

85,045,135

$

21,077,760

$

18,703,480

$

4,591,336

$

(1,023

)

$

6,926

$

4,205

$

18,509

$

7,386

$

43,944

$

306,548

(1) Reinsurance provided by

unaffiliated special purpose insurers through the issuance of

mortgage insurance-linked notes ("ILNs").

(2) Reinsurance provided by panels

of reinsurers.

(3) Reinsurance coverage on new

insurance written from January 1, 2019 through August 31, 2019.

(4) Reinsurance coverage on new

insurance written from September 1, 2019 through July 31, 2020.

(5) Reinsurance coverage on new

insurance written from August 1, 2020 through March 31, 2021.

(6) Reinsurance coverage on new

insurance written from April 1, 2021 through September 30,

2021.

(7) Reinsurance coverage on 40% of

eligible single premium policies and 20% of all other eligible

policies written from September 1, 2019 through December 31,

2020.

(8) Represents the reduction in

Essent Guaranty, Inc.'s Minimum Required Assets based on our

interpretation of the PMIERs.

Exhibit I

Essent Group Ltd. and

Subsidiaries

Supplemental

Information

Portfolio Geographic

Data

IIF by State

December 31, 2021

September 30, 2021

December 31, 2020

CA

13.1

%

13.1

%

12.0

%

TX

9.9

9.8

9.7

FL

9.7

9.5

8.7

CO

4.1

4.1

4.1

WA

3.7

3.7

3.8

IL

3.3

3.4

3.4

AZ

3.3

3.4

3.6

NJ

3.1

3.1

3.3

VA

3.1

3.1

3.1

GA

3.1

3.1

3.0

All Others

43.6

43.7

45.3

Total

100.0

%

100.0

%

100.0

%

Gross RIF by State

December 31, 2021

September 30, 2021

December 31, 2020

CA

13.0

%

12.9

%

11.8

%

TX

10.2

10.1

10.0

FL

10.0

9.8

9.0

CO

4.0

4.1

4.1

WA

3.6

3.7

3.8

AZ

3.3

3.3

3.5

IL

3.2

3.3

3.3

GA

3.1

3.1

3.1

VA

3.0

3.1

3.1

NJ

3.0

3.0

3.2

All Others

43.6

43.6

45.1

Total

100.0

%

100.0

%

100.0

%

Exhibit J

Essent Group Ltd. and

Subsidiaries

Supplemental

Information

Rollforward of Defaults and

Reserve for Losses and LAE

U.S. Mortgage Insurance

Portfolio

Rollforward of Insured Loans

in Default

Three Months Ended

2021

2020

December 31

September 30

June 30

March 31

December 31

Beginning default inventory

19,721

23,504

29,080

31,469

35,464

Plus: new defaults (A)

5,809

5,132

4,934

7,422

8,745

Less: cures

(8,514

)

(8,862

)

(10,453

)

(9,737

)

(12,679

)

Less: claims paid

(47

)

(41

)

(46

)

(61

)

(49

)

Less: rescissions and denials, net

(6

)

(12

)

(11

)

(13

)

(12

)

Ending default inventory

16,963

19,721

23,504

29,080

31,469

(A) New defaults remaining as of

December 31, 2021

4,316

2,162

1,523

1,686

1,516

Cure rate (1)

26

%

58

%

69

%

77

%

83

%

Total amount paid for claims (in

thousands)

$

992

$

1,069

$

1,154

$

1,989

$

1,922

Average amount paid per claim (in

thousands)

$

21

$

26

$

25

$

33

$

39

Severity

45

%

60

%

57

%

70

%

62

%

Rollforward of Reserve for

Losses and LAE

Three Months Ended

2021

2020

($ in

thousands)

December 31

September 30

June 30

March 31

December 31

Reserve for losses and LAE at beginning of

period

$

411,567

$

420,482

$

409,811

$

373,868

$

307,019

Less: Reinsurance recoverables

26,970

27,286

24,907

19,061

11,898

Net reserve for losses and LAE at

beginning of period

384,597

393,196

384,904

354,807

295,121

Add provision for losses and LAE occurring

in:

Current period

13,231

11,371

24,534

47,763

63,597

Prior years

(16,624

)

(18,853

)

(14,961

)

(15,680

)

(1,879

)

Incurred losses and LAE during the

period

(3,393

)

(7,482

)

9,573

32,083

61,718

Deduct payments for losses and LAE

occurring in:

Current period

157

103

14

114

524

Prior years

891

1,014

1,267

1,872

1,508

Loss and LAE payments during the

period

1,048

1,117

1,281

1,986

2,032

Net reserve for losses and LAE at end of

period

380,156

384,597

393,196

384,904

354,807

Plus: Reinsurance recoverables

25,940

26,970

27,286

24,907

19,061

Reserve for losses and LAE at end of

period

$

406,096

$

411,567

$

420,482

$

409,811

$

373,868

(1) The cure rate is calculated by

dividing new defaults remaining as of the reporting date by the

original number of new defaults reported in the quarterly period

and subtracting that percentage from 100%.

Exhibit K

Essent Group Ltd. and

Subsidiaries

Supplemental

Information

Detail of Reserves by Default

Delinquency

U.S. Mortgage Insurance

Portfolio

December 31, 2021

Number of

Policies in

Default

Percentage of

Policies in

Default

Amount of

Reserves

Percentage of

Reserves

Defaulted RIF

Reserves as a

Percentage of

Defaulted RIF

($ in

thousands)

Missed Payments:

Three payments or less

4,113

24

%

$

20,712

5

%

$

243,511

9

%

Four to eleven payments

5,459

32

77,822

21

349,494

22

Twelve or more payments

7,331

43

274,465

73

470,859

58

Pending claims

60

1

2,397

1

2,852

84

Total case reserves

16,963

100

%

375,396

100

%

$

1,066,716

35

IBNR

28,155

LAE

2,545

Total reserves for losses and LAE

$

406,096

Average reserve per default:

Case

$

22.1

Total

$

23.9

Default Rate

2.16

%

December 31, 2020

Number of

Policies in

Default

Percentage of

Policies in

Default

Amount of

Reserves

Percentage of

Reserves

Defaulted RIF

Reserves as a

Percentage of

Defaulted RIF

($ in

thousands)

Missed Payments:

Three payments or less

6,631

21

%

$

47,905

14

%

$

384,668

12

%

Four to eleven payments

23,543

75

260,593

76

1,553,593

17

Twelve or more payments

1,243

4

32,593

9

67,501

48

Pending claims

52

—

2,199

1

2,843

77

Total case reserves

31,469

100

%

343,290

100

%

$

2,008,605

17

IBNR

25,747

LAE

4,831

Total reserves for losses and LAE

$

373,868

Average reserve per default:

Case

$

10.9

Total

$

11.9

Default Rate

3.93

%

Exhibit L

Essent Group Ltd. and

Subsidiaries

Supplemental

Information

Investments Available for

Sale

Investments Available for Sale

by Asset Class

Asset Class

December 31, 2021

December 31, 2020

($ in

thousands)

Fair Value

Percent

Fair Value

Percent

U.S. Treasury securities

$

448,793

9.1

%

$

268,444

5.9

%

U.S. agency securities

5,504

0.1

18,085

0.4

U.S. agency mortgage-backed securities

1,008,863

20.3

995,905

21.8

Municipal debt securities

627,599

12.7

551,517

12.1

Non-U.S. government securities

79,743

1.6

61,607

1.3

Corporate debt securities

1,455,247

29.3

1,126,512

24.7

Residential and commercial mortgage

securities

545,423

11.0

409,282

9.0

Asset-backed securities

581,703

11.7

454,717

9.9

Money market funds

210,012

4.2

679,304

14.9

Total investments available for sale

$

4,962,887

100.0

%

$

4,565,373

100.0

%

Investments Available for Sale

by Credit Rating

Rating (1)

December 31, 2021

December 31, 2020

($ in

thousands)

Fair Value

Percent

Fair Value

Percent

Aaa

$

2,412,273

48.6

%

$

2,564,746

56.2

%

Aa1

96,331

1.9

133,100

2.9

Aa2

354,951

7.2

260,462

5.7

Aa3

221,914

4.5

204,917

4.5

A1

263,820

5.3

249,710

5.5

A2

427,282

8.6

401,175

8.8

A3

274,525

5.5

229,882

5.0

Baa1

305,204

6.1

260,602

5.7

Baa2

274,011

5.5

178,926

3.9

Baa3

240,755

4.9

48,199

1.1

Below Baa3

91,821

1.9

33,654

0.7

Total investments available for sale

$

4,962,887

100.0

%

$

4,565,373

100.0

%

(1) Based on ratings issued by

Moody's, if available. S&P or Fitch rating utilized if Moody's

not available.

Investments Available for Sale

by Duration and Book Yield

Effective Duration

December 31, 2021

December 31, 2020

($ in

thousands)

Fair Value

Percent

Fair Value

Percent

< 1 Year

$

1,104,397

22.2

%

$

1,568,505

34.4

%

1 to < 2 Years

561,297

11.3

581,003

12.7

2 to < 3 Years

539,174

10.9

616,069

13.5

3 to < 4 Years

593,663

12.0

426,333

9.3

4 to < 5 Years

663,127

13.4

367,633

8.1

5 or more Years

1,501,229

30.2

1,005,830

22.0

Total investments available for sale

$

4,962,887

100.0

%

$

4,565,373

100.0

%

Pre-tax investment income yield:

Three months ended December 31, 2021

2.06

%

Year ended December 31, 2021

1.99

%

Holding company net cash and investments

available for sale:

($ in

thousands)

As of December 31, 2021

$

618,306

As of December 31, 2020

$

574,901

Exhibit M

Essent Group Ltd. and

Subsidiaries

Supplemental

Information

Insurance Company

Capital

2021

2020

December 31

September 30

June 30

March 31

December 31

($ in

thousands)

U.S. Mortgage Insurance

Subsidiaries:

Combined statutory capital (1)

$

2,950,107

$

2,916,802

$

2,809,087

$

2,778,131

$

2,659,161

Combined net risk in force (2)

$

30,660,272

$

30,766,379

$

29,646,042

$

29,358,191

$

29,493,572

Risk-to-capital ratios: (3)

Essent Guaranty, Inc.

10.8:1

10.9:1

10.9:1

11.0:1

11.5:1

Essent Guaranty of PA, Inc.

0.8:1

1.0:1

1.1:1

1.4:1

1.7:1

Combined (4)

10.4:1

10.5:1

10.6:1

10.6:1

11.1:1

Essent Guaranty, Inc. PMIERs Data

(5):

Available Assets

$

3,170,881

$

3,161,780

$

3,016,050

$

2,996,651

$

2,855,923

Minimum Required Assets

1,791,551

1,951,096

1,731,843

1,864,262

1,671,011

PMIERs excess Available Assets

$

1,379,330

$

1,210,684

$

1,284,207

$

1,132,389

$

1,184,912

PMIERs sufficiency ratio (6)

177

%

162

%

174

%

161

%

171

%

Essent Reinsurance Ltd.:

Stockholder's equity (GAAP basis)

$

1,301,937

$

1,249,996

$

1,192,077

$

1,136,504

$

1,101,003

Net risk in force (2)

$

15,997,129

$

15,466,651

$

14,338,567

$

12,905,289

$

12,892,300

(1) Combined statutory capital

equals the sum of statutory capital of Essent Guaranty, Inc. plus

Essent Guaranty of PA, Inc., after eliminating the impact of

intercompany transactions. Statutory capital is computed based on

accounting practices prescribed or permitted by the Pennsylvania

Insurance Department and the National Association of Insurance

Commissioners Accounting Practices and Procedures Manual.

(2) Net risk in force represents

total risk in force, net of reinsurance ceded and net of exposures

on policies for which loss reserves have been established.

(3) The risk-to-capital ratio is

calculated as the ratio of net risk in force to statutory

capital.

(4) The combined risk-to-capital

ratio equals the sum of the net risk in force of Essent Guaranty,

Inc. and Essent Guaranty of PA, Inc. divided by the combined

statutory capital.

(5) Data is based on our

interpretation of the PMIERs as of the dates indicated.

(6) PMIERs sufficiency ratio is

calculated by dividing Available Assets by Minimum Required

Assets.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220211005069/en/

Media Contact 610.230.0556 media@essentgroup.com

Investor Relations Contact Philip Stefano Vice President,

Investor Relations 855-809-ESNT ir@essentgroup.com

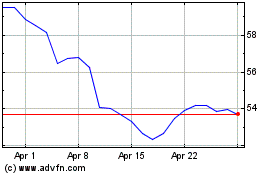

Essent (NYSE:ESNT)

Historical Stock Chart

From Apr 2024 to May 2024

Essent (NYSE:ESNT)

Historical Stock Chart

From May 2023 to May 2024