Equus Announces Third Quarter Net Asset Value

November 11 2010 - 7:00AM

Business Wire

Equus Total Return, Inc. (NYSE: EQS) (the “Fund” or

“Equus”) reports net assets as of September 30, 2010, of $31.5

million, a decrease of $6.4 million since June 30, 2010. Net assets

per share declined to $3.55 as of September 30, 2010 from $4.28 as

of June 30, 2010. Comparative data is summarized below (in

thousands, except per share amounts):

For the Quarter Ended

9/30/2010 6/30/2010

3/31/2010 12/31/2009

9/30/2009 Net assets $31,474 $37,888 $50,151

$50,901 $65,632 Shares outstanding 8,862 8,862 8,862 8,862 8,862

Net assets per share $3.55 $4.28 $5.66 $5.74 $7.41

The overall decline in net asset value during the third quarter

2010 resulted principally from the decrease in the fair values of

the following portfolio holdings:

- 1848 Capital Partners, LLC

(“1848”). The Fund wrote down the fair value of its loan to

1848 from $1.3 million to $0.3 million due to uncertainty

concerning the recoverability of the loan and the value reflects

the estimated net liquidation value of certain of 1848’s assets and

holdings.

- Big Apple Entertainment Partners,

LLC (“Big Apple”). The Fund wrote down the fair value of its

loan to Big Apple from $3.2 million to $2.3 million due to a

decrease in operating results and a default in the loan which

matured in October 2010.

- ConGlobal Industries Holding, Inc.

(“ConGlobal”). The Fund wrote down the fair value of its

holding in ConGlobal from $7.3 million to $6.0 million due to a

decrease in trailing 12 month operating results.

- Equus Media Development Company, LLC

(“EMDC”). The Fund wrote down the fair value of its holding in

EMDC from $1.7 million to $1.2 million. The value of individual

properties held by EMDC, a wholly-owned subsidiary of the Fund, has

been discounted to reflect the current status and holding period of

these properties which, in some cases, exceeds three years.

- Riptide Entertainment, LLC

(“Riptide”). The Fund wrote down the fair value of its holdings

in Riptide from $0.2 million to $0 due to the underperformance and

non-performance of Riptide’s holdings in various entertainment

properties, including its equity holding in Big Apple.

- Spectrum Management, LLC

(“Spectrum”). The Fund wrote down the fair value of its

investment in Spectrum from $4.6 million to $2.3 million due to a

decrease in trailing 12 month operating results.

Significant events subsequent to the end of the quarter were as

follows:

- Collection of Funds from London

Bridge Entertainment Partners, LLC (“London Bridge”). On July

1, 2010, the Fund made a short-term loan of $0.6 million to London

Bridge which was repaid in full, together with all interest as

accrued, on October 1, 2010.

- Approval of Rights Offering. On

November 1, 2010, the Fund announced that its Board of Directors

had approved the terms of a non-transferable rights offering to the

Fund’s shareholders to purchase shares of its common stock. The

Fund intends to issue 1,772,329 new shares of its common stock

pursuant to the exercise of rights, such that each record date

holder shall be entitled to purchase one share of common stock for

every five shares held on such date. The Fund has filed a

registration statement with the Securities and Exchange Commission

in connection with the offering, which also includes a prospectus

describing the offering and containing additional information about

the Fund. A copy of the registration statement can be obtained on

the Fund’s website at www.equuscap.com.

About Equus

The Fund is a business development company that trades as a

closed-end fund on the New York Stock Exchange, under the symbol

"EQS". Additional information on the Fund may be obtained from the

Fund’s website.

This press release may contain certain forward-looking

statements regarding future circumstances. These forward-looking

statements are based upon the Fund’s current expectations and

assumptions and are subject to various risks and uncertainties that

could cause actual results to differ materially from those

contemplated in such forward-looking statements including, in

particular, the risks and uncertainties described in the Fund’s

filings with the SEC. Actual results, events, and performance may

differ. Readers are cautioned not to place undue reliance on these

forward-looking statements, which speak only as to the date hereof.

The Fund undertakes no obligation to release publicly any revisions

to these forward-looking statements that may be made to reflect

events or circumstances after the date hereof or to reflect the

occurrence of unanticipated events. The inclusion of any statement

in this release does not constitute an admission by the Fund or any

other person that the events or circumstances described in such

statements are material.

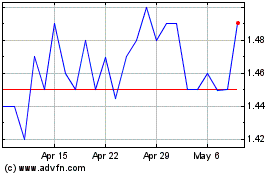

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Jun 2024 to Jul 2024

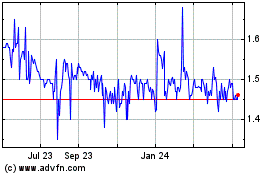

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Jul 2023 to Jul 2024