Equity Residential Provides Operating Update

September 04 2024 - 4:15PM

Business Wire

Equity Residential (NYSE: EQR) today provided an update on

certain same store operating trends in its business. Same store

revenue growth remains on track within the Company’s guidance range

as described in its second quarter 2024 earnings release published

on July 29, 2024. The Company is finishing its primary leasing

season with healthy demand and pricing for its apartment units. The

Company continues to expect to produce Blended Rate growth of 2.0%

to 3.0% for the third quarter of 2024 and Physical Occupancy of

96.2% for the full year 2024.

About Equity Residential

Equity Residential is committed to creating communities where

people thrive. The Company, a member of the S&P 500, is focused

on the acquisition, development and management of residential

properties located in and around dynamic cities that attract

affluent long-term renters. Equity Residential owns or has

investments in 309 properties consisting of 83,040 apartment units,

with an established presence in Boston, New York, Washington, D.C.,

Seattle, San Francisco and Southern California, and an expanding

presence in Denver, Atlanta, Dallas/Ft. Worth and Austin. For more

information on Equity Residential, please visit our website at

www.equityapartments.com.

Forward-Looking Statements

In addition to historical information, this press release

contains forward-looking statements and information within the

meaning of the federal securities laws. These statements are based

on current expectations, estimates, projections and assumptions

made by management. While Equity Residential’s management believes

the assumptions underlying its forward-looking statements are

reasonable, such information is inherently subject to uncertainties

and may involve certain risks, including, without limitation,

changes in general market conditions, including the rate of job

growth and cost of labor and construction material, the level of

new multifamily construction and development, government

regulations and competition. These and other risks and

uncertainties are described under the heading “Risk Factors” in our

Annual Report on Form 10-K and subsequent periodic reports filed

with the Securities and Exchange Commission (SEC) and available on

our website, www.equityapartments.com.

Many of these uncertainties and risks are difficult to predict and

beyond management’s control. Forward-looking statements are not

guarantees of future performance, results or events. Equity

Residential assumes no obligation to update or supplement

forward-looking statements that become untrue because of subsequent

events.

Terms and Definitions:

Blended Rate – The weighted average of New Lease Change

and Renewal Rate Achieved.

New Lease Change – The net effective change in rent

(inclusive of Leasing Concessions) for a lease with a new or

transferring resident compared to the rent for the prior lease of

the identical apartment unit, regardless of lease term.

Physical Occupancy – The weighted average occupied

apartment units for the reporting period divided by the average of

total apartment units available for rent for the reporting

period.

Renewal Rate Achieved – The net effective change in rent

(inclusive of Leasing Concessions) for a new lease on an apartment

unit where the lease has been renewed as compared to the rent for

the prior lease of the identical apartment unit, regardless of

lease term.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240904915223/en/

Marty McKenna (312) 928-1901

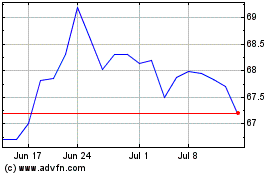

Equity Residential (NYSE:EQR)

Historical Stock Chart

From Dec 2024 to Jan 2025

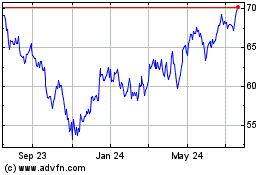

Equity Residential (NYSE:EQR)

Historical Stock Chart

From Jan 2024 to Jan 2025