0000895728

false

Z4

AB

CA

0000895728

2023-09-05

2023-09-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event

reported): September 5, 2023

ENBRIDGE INC.

(Exact Name of Registrant as Specified

in Charter)

| CANADA |

001-15254 |

98-0377957 |

|

(State or Other Jurisdiction

of Incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

200, 425 - 1ST STREET S.W.

CALGARY, ALBERTA, CANADA T2P 3L8

(Address of Principal Executive Offices)

(Zip Code)

1 (403) 231-3900

(Registrant’s telephone number,

including area code)

Not Applicable

(Former Name or Former Address, if Changed

Since Last Report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common Shares |

|

ENB |

|

New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into a Material Definitive

Agreement.

On September 5, 2023, subsidiaries of Enbridge

Inc., a Canadian corporation (“Enbridge”), entered into three separate purchase and sale agreements with Dominion Energy, Inc.,

a Virginia corporation (“Dominion”), to acquire all of the outstanding equity interests in (i) Dominion Energy Questar

Corporation, Dominion Energy Gas Distribution, LLC, The East Ohio Gas Company and DEO Alternative Fuel, LLC (collectively, “EOG”),

(ii) Questar Gas Company (“Questar Gas”), Wexpro Company, Wexpro II Company, Wexpro Development Co. and Dominion Energy

Wexpro Services Co. (collectively, the “Wexpro Companies”), and each of Dominion Gas Projects Co., LLC and Questar InfoComm

Inc. (collectively with Questar Gas and the Wexpro Companies, “Questar”), and (iii) Public Service Company of North Carolina, Incorporated

(“PSNC”). The acquisitions are not cross-conditioned on one another. The material terms of each of the agreements are summarized

below.

EOG Purchase and Sale Agreement

On September 5, 2023, a wholly owned subsidiary

of Enbridge (“EOG Buyer”) entered into a purchase and sale agreement (the “EOG Purchase Agreement”) with Dominion

to acquire all of the outstanding equity interests in EOG for approximately US$6.6 billion, consisting of cash consideration of approximately

US$4.3 billion and assumed debt of approximately US$2.3 billion, subject to customary purchase price adjustments. Enbridge has agreed

to guarantee the obligations of EOG Buyer under the EOG Purchase Agreement.

EOG Buyer’s acquisition of EOG (the “EOG

Acquisition”) is subject to the satisfaction of customary conditions, including (i) the absence of any governmental order prohibiting

the consummation of the EOG Acquisition, (ii) the expiration of the waiting period under the Hart-Scott-Rodino Antitrust Improvements

Act of 1976 (the “HSR Act”), (iii) Federal Communications Commission (“FCC”) approval of the change of control

of FCC licenses, (iv) clearance by the Committee on Foreign Investment in the United States (“CFIUS”) and (v) a

notice to the Public Utility Commission of Ohio. Subject to the satisfaction or waiver of the foregoing conditions and the other terms

and conditions of the EOG Purchase Agreement, the EOG Acquisition is expected to close in 2024.

The EOG Purchase Agreement contains customary

representations, warranties and covenants of EOG Buyer and Dominion, including covenants by Dominion to conduct the business of EOG in

the ordinary course during the interim period between the execution of the EOG Purchase Agreement and the consummation of the EOG Acquisition.

The EOG Purchase Agreement contains customary

termination rights, including if the closing of the EOG Acquisition has not occurred by September 5, 2024, subject to an extension

by either party to December 4, 2024 if the required regulatory approvals have not yet been obtained. If the EOG Purchase Agreement

is terminated under certain circumstances relating to failure to obtain required regulatory approvals, Enbridge may be required to pay

Dominion a termination fee of approximately US$154.8 million.

At the closing of the EOG Acquisition, Dominion

and EOG will enter into a transition services agreement, pursuant to which Dominion will provide certain transition services to EOG, subject

to the terms and conditions set forth therein.

A copy of the EOG Purchase Agreement will be filed

as an exhibit to Enbridge’s Quarterly Report on Form 10-Q for the fiscal quarter ending September 30, 2023.

Questar Purchase and Sale Agreement

On September 5, 2023, a wholly owned subsidiary

of Enbridge (“Questar Buyer”) entered into a purchase and sale agreement (the “Questar Purchase Agreement”) with

Dominion to acquire all of the outstanding equity interests in Questar for approximately US$4.3 billion, consisting of cash consideration

of approximately US$3.0 billion and assumed debt of approximately US$1.3 billion, subject to customary purchase price adjustments. Enbridge

has agreed to guarantee the obligations of Questar Buyer under the Questar Purchase Agreement.

Questar Buyer’s acquisition of Questar (the

“Questar Acquisition”) is subject to the satisfaction of customary conditions, including (i) the absence of any governmental

order prohibiting the consummation of the Questar Acquisition, (ii) the expiration of the waiting period under the HSR Act, (iii) FCC

approval of the change of control of FCC licenses, (iv) clearance by CFIUS and (v) the approval of the Utah Public Services

Commission and the Wyoming Public Services Commission (and notice to the Idaho Public Utilities Commission). Subject to the satisfaction

or waiver of the foregoing conditions and the other terms and conditions of the Questar Purchase Agreement, the Questar Acquisition is

expected to close in 2024.

The Questar Purchase Agreement contains customary

representations, warranties and covenants of Questar Buyer and Dominion, including covenants by Dominion to conduct the business of Questar

in the ordinary course during the interim period between the execution of the Questar Purchase Agreement and the consummation of the Questar

Acquisition.

The Questar Purchase Agreement contains customary

termination rights, including if the closing of the Questar Acquisition has not occurred by September 5, 2024, subject to an extension

by either party to December 4, 2024 if the required regulatory approvals have not yet been obtained. If the Questar Purchase Agreement

is terminated under certain circumstances relating to failure to obtain required regulatory approvals, Enbridge may be required to pay

Dominion a termination fee of approximately US$106.9 million.

At the closing of the Questar Acquisition, Dominion

and Questar will enter into a transition services agreement, pursuant to which Dominion will provide certain transition services to Questar,

subject to the terms and conditions set forth therein.

A copy of the Questar Purchase Agreement will

be filed as an exhibit to Enbridge’s Quarterly Report on Form 10-Q for the fiscal quarter ending September 30, 2023.

PSNC Purchase and Sale Agreement

On September 5, 2023, a wholly owned subsidiary

of Enbridge (“PSNC Buyer”) entered into a purchase and sale agreement (the “PSNC Purchase Agreement”) with Dominion

to acquire all of the outstanding equity interests in PSNC for approximately US$3.1 billion, consisting of cash consideration of approximately

US$2.2 billion and assumed debt of approximately US$1.0 billion, subject to customary purchase price adjustments. Enbridge has agreed

to guarantee the obligations of PSNC Buyer under the PSNC Purchase Agreement.

PSNC Buyer’s acquisition of PSNC (the “PSNC

Acquisition”) is subject to the satisfaction of customary conditions, including (i) the absence of any governmental order prohibiting

the consummation of the PSNC Acquisition, (ii) the expiration of the waiting period under the HSR Act, (iii) FCC approval of

the change of control of FCC licenses, (iv) clearance by CFIUS and (v) the approval of the North Carolina Utilities Commission.

Subject to the satisfaction or waiver of the foregoing conditions and the other terms and conditions of the PSNC Purchase Agreement, the

PSNC Acquisition is expected to close in 2024.

The PSNC Purchase Agreement contains customary

representations, warranties and covenants of PSNC Buyer and Dominion, including covenants by Dominion to conduct the business of PNSC

in the ordinary course during the interim period between the execution of the PSNC Purchase Agreement and the consummation of the PSNC

Acquisition.

The PSNC Purchase Agreement contains customary

termination rights, including if the closing of the PSNC Acquisition has not occurred by September 5, 2024, subject to an extension

by either party to December 4, 2024 if the required regulatory approvals have not yet been obtained. If the PSNC Purchase Agreement

is terminated under certain circumstances relating to failure to obtain required regulatory approvals, Enbridge may be required to pay

Dominion a termination fee of approximately US$78.3 million.

At the closing of the PSNC Acquisition, Dominion

and PSNC will enter into a transition services agreement, pursuant to which Dominion will provide certain transition services to PSNC,

subject to the terms and conditions set forth therein.

A copy of the PSNC Purchase Agreement will be

filed as an exhibit to Enbridge’s Quarterly Report on Form 10-Q for the fiscal quarter ending September 30, 2023.

Bridge Facility Commitment Letter

On

September 5, 2023, Enbridge, Morgan Stanley Senior Funding, Inc. and Royal Bank of Canada (together, the “Commitment Parties”)

entered into a financing commitment letter (the “Commitment Letter”) for a 364-day senior unsecured bridge facility (the “Bridge

Facility”) in an aggregate initial principal amount of US$9.4 billion, which may be borrowed as three separate loans on each applicable

closing date for each of the EOG Acquisition, the Questar Acquisition and the PSNC Acquisition (together, the “Acquisitions”).

The commitments under the Bridge Facility will be reduced by the net proceeds received by Enbridge from the Offering (as defined under

Item 7.01) and are expected to be further reduced by the net proceeds received from other sources, including, but not limited to, issuances

of hybrid notes and/or senior unsecured notes, asset sales, the potential reinstatement of our dividend reinvestment and share purchase

plan and/or at-the-market offerings of Enbridge common shares, prior to the expected closings of the Acquisitions. However, these sources

are subject to change, based on market conditions and other factors. Enbridge expects to reduce the commitments under the Bridge Facility

to zero from these other sources before any funding under the Bridge Facility would be required; however, to the extent Enbridge does

not finance any part of the purchase price through the other means described above, Enbridge may borrow under the Bridge Facility.

The commitments under the Commitment Letter are

subject to customary conditions, including the execution and delivery of definitive documentation with respect to the Bridge Facility

in accordance with the terms set forth in the Commitment Letter.

If Enbridge draws on the Bridge Facility to fund

any part of the cash portion of the aggregate purchase price for the Acquisitions, Enbridge will seek to repay the Bridge Facility following

completion of the Acquisitions with various sources, including the permanent financing solutions mentioned above.

Item 7.01 Regulation FD Disclosure.

On September 5, 2023, Enbridge issued press

releases announcing (1) the Acquisitions described in Item 1.01 above and (2) a “bought-deal” offering of Enbridge

common shares (the “Offering”). Copies of the press releases are attached hereto as Exhibits 99.1 and 99.2 and are incorporated

herein by reference.

In connection with the “bought-deal”

equity offering, Enbridge is making investor presentations to certain existing and potential investors. The investor presentation is attached

hereto as Exhibit 99.3.

The information contained under this Item 7.01

in this Current Report on Form 8-K, including Exhibits 99.1, 99.2 and 99.3, is being furnished and shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities

under that Section and shall not be deemed to be incorporated by reference into any filing of Enbridge under the Securities Act of

1933 or the Exchange Act.

This Current Report on Form 8-K does not

constitute an offer to sell or the solicitation of an offer to buy any security and shall not constitute an offer, solicitation or sale

of any security in any jurisdiction in which such offering, solicitation or sale would be unlawful.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

* Furnished herewith.

Forward-Looking Information

This communication contains both historical and

forward-looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E

of the U.S. Securities Exchange Act of 1934, as amended, and forward-looking information within the meaning of Canadian securities laws

(collectively, “forward-looking statements”). Forward-looking statements have been included to provide potential investors

with information about Enbridge. This information may not be appropriate for other purposes. Forward-looking statements are typically

identified by words such as “anticipate”, “believe”, “estimate”, “expect”, “forecast”,

“intend”, “likely”, “plan”, “project”, “target” and similar words suggesting

future outcomes or statements regarding an outlook. Forward-looking statements included in this Current Report on Form 8-K, including

the exhibits hereto, include, but are not limited to, statements with respect to the following: anticipated benefits of the Acquisitions,

timing of closing of the Acquisitions, management expectations, strategic objectives, strategic opportunities, growth opportunities, business

prospects, regulatory proceedings and other similar matters.

Although Enbridge believes these forward-looking

statements are reasonable based on the information available on the date such statements are made and processes used to prepare the information,

such statements are not guarantees of future events and readers are cautioned against placing undue reliance on forward-looking statements.

By their nature, these statements involve a variety of assumptions, known and unknown risks and uncertainties and other factors, which

may cause actual events to differ materially from those expressed or implied by such statements. Enbridge cautions readers not to place

undue reliance on these statements, as a number of important factors could cause actual results to differ materially from the expectations

expressed in such forward-looking statements.

Enbridge’s forward-looking statements are

subject to risks and uncertainties, including, but not limited to the possibility that the Acquisitions do not close when expected, or

at all, because required regulatory approvals and other conditions to closing are not received or satisfied on a timely basis; that the

anticipated benefits of the Acquisitions are not realized or will not be realized within the expected time period; general business and

economic conditions in Canada and the U.S.; the impact of the movement of the Canadian dollar relative to other currencies, particularly

the U.S. dollar; the effects of competition in the markets in which Enbridge operates; the impact of changes in the laws and regulations

regulating the oil and gas or natural gas utilities industries or affecting domestic and foreign operations; judicial or regulatory judgments

and legal proceedings; reputational risks; the outcome of various litigation and proceedings in which Enbridge is involved and the adequacy

of reserves maintained therefor; other factors that may affect future results of Enbridge, including changes in trade policies, timely

development and introduction of new products and services, changes in tax laws, technological and regulatory changes, and adverse developments

in general market, business, economic, labor, regulatory and political conditions; and those other risks and uncertainties disclosed in

Enbridge’s other filings with Canadian and United States securities regulators. The impact of any one risk, uncertainty or factor

on a particular forward-looking statement is not determinable with certainty as these are interdependent and Enbridge’s future course

of action depends on management’s assessment of all information available at the relevant time. Except to the extent required by

applicable law, Enbridge assumes no obligation to publicly update or revise any forward-looking statements made in this Current Report

on Form 8-K or the exhibits hereto or otherwise, whether as a result of new information, future events or otherwise. All subsequent

forward-looking statements, whether written or oral, attributable to Enbridge or persons acting on its behalf, are expressly qualified

in their entirety by these cautionary statements.

Enbridge cautions that the foregoing list of important

factors is not exhaustive and other factors could also adversely affect the closing of the financial sources, the use of proceeds of the

financial sources, the Acquisitions and the future results of Enbridge. The forward-looking statements speak only as of the date of this

Current Report on Form 8-K,. When relying on Enbridge’s forward-looking statements to make decisions with respect to Enbridge,

investors and others should carefully consider the foregoing factors and other uncertainties and potential events.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

ENBRIDGE INC. (Registrant) |

| |

|

|

| Date: September 5, 2023 |

By: |

/s/ Karen K.L. Uehara |

| |

|

Karen K.L. Uehara

Vice President, Corporate & Corporate Secretary (Duly Authorized Officer) |

Exhibit 99.1

Enbridge Announces

Strategic Acquisition of Three U.S. Based Utilities to Create Largest Natural Gas Utility Franchise in North America

September 5, 2023

HIGHLIGHTS:

| · | Enbridge

has entered into definitive agreements with Dominion Energy, Inc. to acquire The East

Ohio Gas Company (“EOG”), Questar Gas Company (“Questar Gas”), and

its related Wexpro companies (“Wexpro” and collectively with Questar Gas, “Questar”),

and Public Service Company of North Carolina, Incorporated (“PSNC”) (collectively

the “Gas utilities”) for an aggregate purchase price of US$14.0 billion

(CDN$19 billion1), comprised of US$9.4 billion of cash consideration and

US$4.6 billion of assumed debt (the “Acquisitions”). |

| · | Creates

North America’s largest natural gas utility platform delivering ~9.3 bcf/d to ~7 million

customers across multiple regulatory jurisdictions. |

| · | Historically

attractive acquisition multiples, based on 2024 estimate of ~1.3x Enterprise Value-to-Rate

Base and 2023 estimate of ~16.5x Price-to-Earnings. |

| · | Compounded

annual growth rate of approximately 8% on the consolidated rate base is expected to deliver

long-term value for Enbridge shareholders. |

| · | Expected

to be accretive to distributable cash flow per share (“DCFPS”) and adjusted earnings

per share (“EPS”) in the first full year of ownership, increasing over time driven

by the addition of approximately CDN$1.7 billion of annual, low-risk, quick-cycle rate base

investments to Enbridge’s secured growth backlog. |

| · | Financial

guidance in 2023, and near-term and medium-term outlook is maintained; long-term dividend

growth profile is strengthened. |

| · | High-quality,

utility cash flows from the Gas utilities further reduces Enbridge’s already industry

leading business risk and balances Enbridge’s earnings mix to approximately 50% Natural

Gas and Renewables and 50% Liquids upon closing, expected in 2024. |

| · | Funding

plan preserves financial flexibility as Enbridge expects to maintain leverage within its

target range of 4.5x to 5.0x Debt-to-Adjusted EBITDA. |

| · | Enbridge

is looking forward to welcoming the Gas utilities’ employees to the Enbridge family

and expects to maintain strong relationships with existing local unions and communities. |

CALGARY, AB Sept. 5, 2023 /CNW/

- Enbridge Inc. (“Enbridge” or the “Company”) (TSX: ENB) (NYSE: ENB) today announced that it has entered into

three separate definitive agreements with Dominion Energy, Inc. to acquire EOG, Questar and PSNC for an aggregate purchase price

of US$14.0 billion (CDN$19 billion), comprised of $US9.4 billion of cash consideration and US$4.6 billion of assumed debt,

subject to customary closing adjustments.

1 Translated at USD/CAD $1.36 (the exchange rate as of

September 1, 2023).

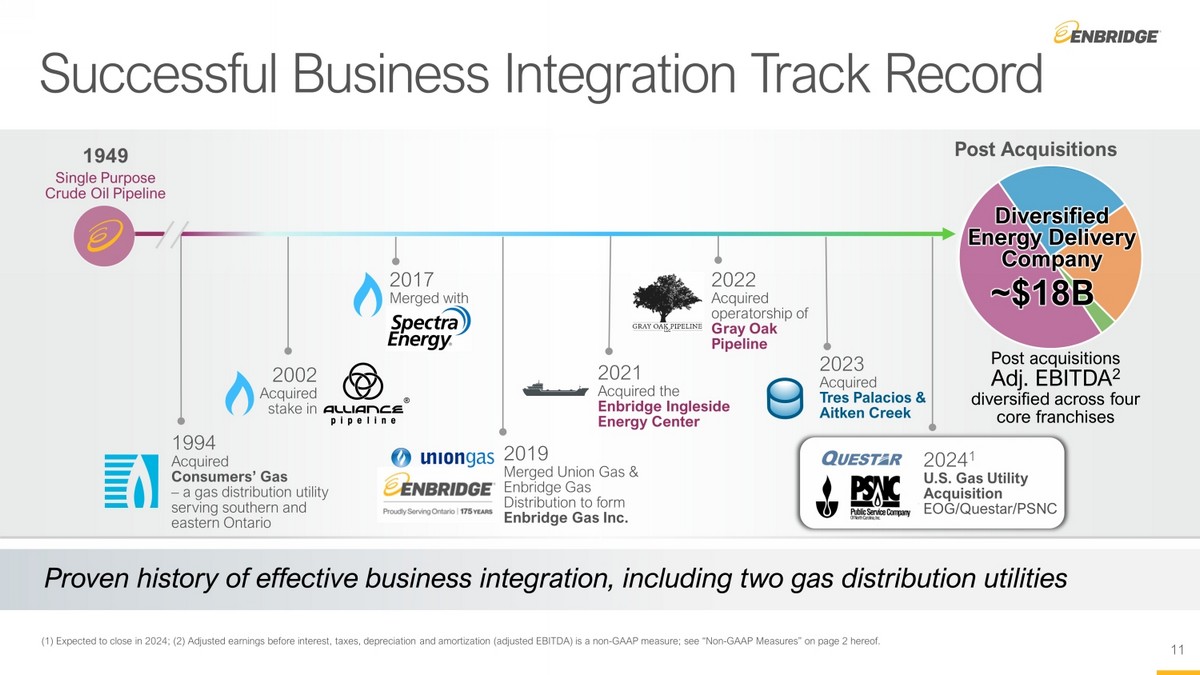

Upon the closings of the

three transactions, Enbridge will add gas utility operations in Ohio, North Carolina, Utah, Idaho and Wyoming, representing a significant

presence in the U.S. utility sector. The Gas utilities fit Enbridge’s long held investor proposition of low-risk businesses with

predictable cash flow growth and strong overall returns. Following the closings, the Acquisitions will double the scale of the Company’s

gas utility business to approximately 22% of Enbridge’s total adjusted EBITDA and balance the Company’s asset mix evenly

between natural gas and renewables, and liquids. The Acquisitions will lower Enbridge’s already industry-leading business risk

and secure visible, low-risk, long-term rate base growth. Increased utility earnings enhance Enbridge’s overall cash flow quality

and further underpin the longevity of Enbridge’s growing dividend profile.

Following the closings of

the Acquisitions, Enbridge’s gas utility business will be the largest, by volume, in North America with a combined rate base of

over CDN$27 billion and about 7,000 employees delivering over 9 Bcf/d of gas to approximately 7 million customers.

The Company estimates its

purchase price for the Acquisitions at ~1.3x Enterprise Value-to-Rate Base (based on 2024 estimates) and ~16.5x Price-to-Earnings (based

on 2023 estimates) and expects the Acquisitions to be accretive to Enbridge's financial DCFPS and adjusted EPS outlook in the first full

year of ownership adding shareholder value.

“Adding natural gas

utilities of this scale and quality, at a historically attractive multiple, is a once in a generation opportunity. The transaction is

expected to be accretive to DCFPS and adjusted EPS in the first full year of ownership, increasing over time due to the strong growth

profile,” said Greg Ebel, Enbridge President and CEO. “Following the closings of the Acquisitions, our Gas Distribution and

Storage (“GDS”) business will be North America’s largest gas utility franchise. These Acquisitions further diversify

our business, enhance the stable cash flow profile of our assets, and strengthen our long-term dividend growth profile. The transaction

also reinforces our position as the first-choice energy delivery company in North America.

“The assets we are acquiring have long

useful lives and natural gas utilities are ‘must-have’ infrastructure for providing safe, reliable and affordable energy.

In addition, these gas utilities have each committed to achieving net-zero greenhouse gas emissions by 2050 and are expected to play

a critical role in enabling a sustainable energy transition. We are very excited by today’s announcement as these businesses align

with Enbridge’s business risk model and long-term growth targets. The entire Enbridge team is committed to working with the EOG,

Questar and PSNC teams and to investing in the communities they serve. We look forward to serving our customers with dedication and to

providing them with safe, reliable, and affordable energy service for years to come.”

The Gas utilities are domiciled

in premier U.S. jurisdictions with transparent and constructive regulatory regimes that preserve customer choice to consume natural gas

and have attractive capital growth programs. EOG, Questar and PSNC each have lower-carbon initiatives that are similarly aligned with

Enbridge’s ESG goals.

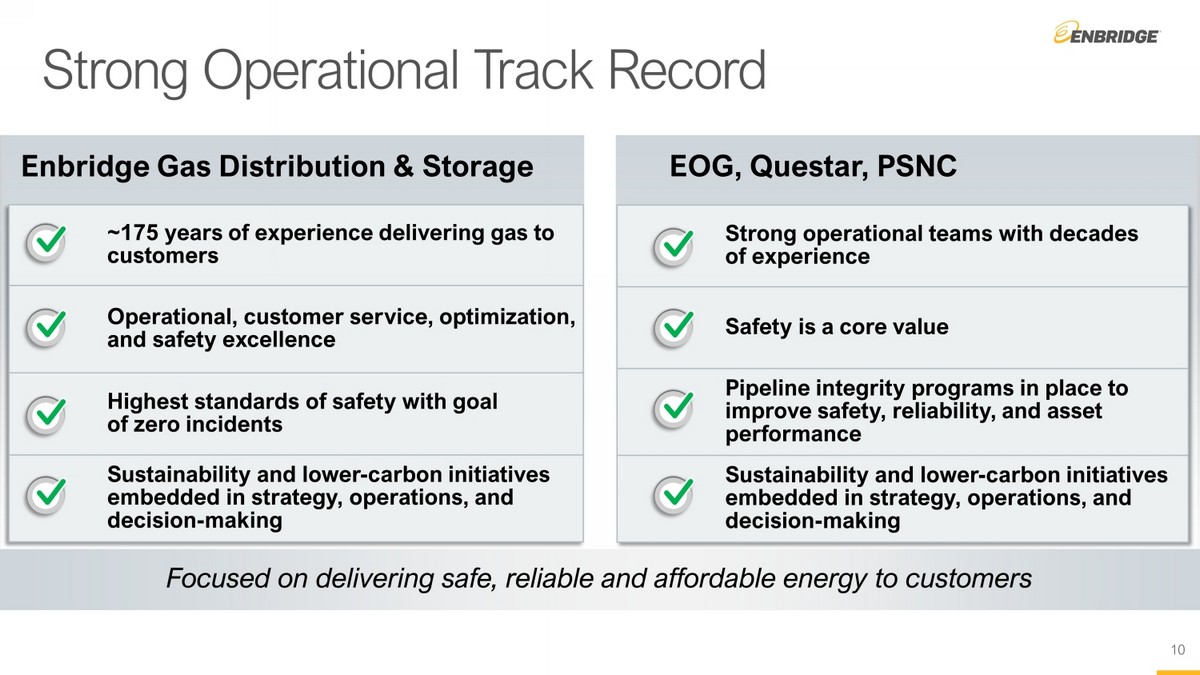

Each of the Gas utilities

have an excellent operating and safety track record. The experienced operating teams of each business will be joining the Enbridge team.

Keeping with Enbridge’s history of successfully integrating acquired businesses, we expect to be able to integrate the Gas utilities’

businesses smoothly while continuing to deliver the service our customers expect.

“Today and for the

long-term, natural gas will remain essential for achieving North America’s energy security, affordability and sustainability goals. Individually

and collectively, the Gas utilities are perfectly complementary to our gas distribution business unit’s current operations and

strategy. These utilities operate in regions with very attractive regulatory regimes, offer diverse, low-risk growth opportunities,

and are capital efficient with short cycles between capital deployments and earnings generation,” said Michele Harradence, President

of GDS and Executive Vice President at Enbridge. “We are excited to be welcoming over 3,000 new employees into the Enbridge family.

In addition, we intend to continue the robust social, community and diversity, equity and inclusion initiatives that each Gas utility

has committed to.”

COMMITMENT TO EOG, PSNC

AND QUESTAR COMMUNITIES, CUSTOMERS, AND EMPLOYEES

Following the closings of

the Acquisitions, EOG, PSNC and Questar each will continue to be regulated by the Public Utility Commission of Ohio, the North Carolina

Utilities Commission, and the Public Service Commissions of Utah, Wyoming and Idaho, respectively. Enbridge looks forward to establishing

a collaborative and mutually beneficial relationship with each of these regulatory bodies.

Enbridge’s existing

natural gas utility has proudly served its customers for 175 years and has built its business on the key pillars of safety, reliability,

affordability and customer service. Enbridge actively invests in the communities it serves and looks forward to continuing the community

service legacies of EOG, PSNC and Questar in their respective states. In addition, Enbridge offers a competitive and flexible Total Compensation

package to its staff and seeks to maintain strong relationships with local unions and the local workforce.

FINANCIAL CONSIDERATIONS

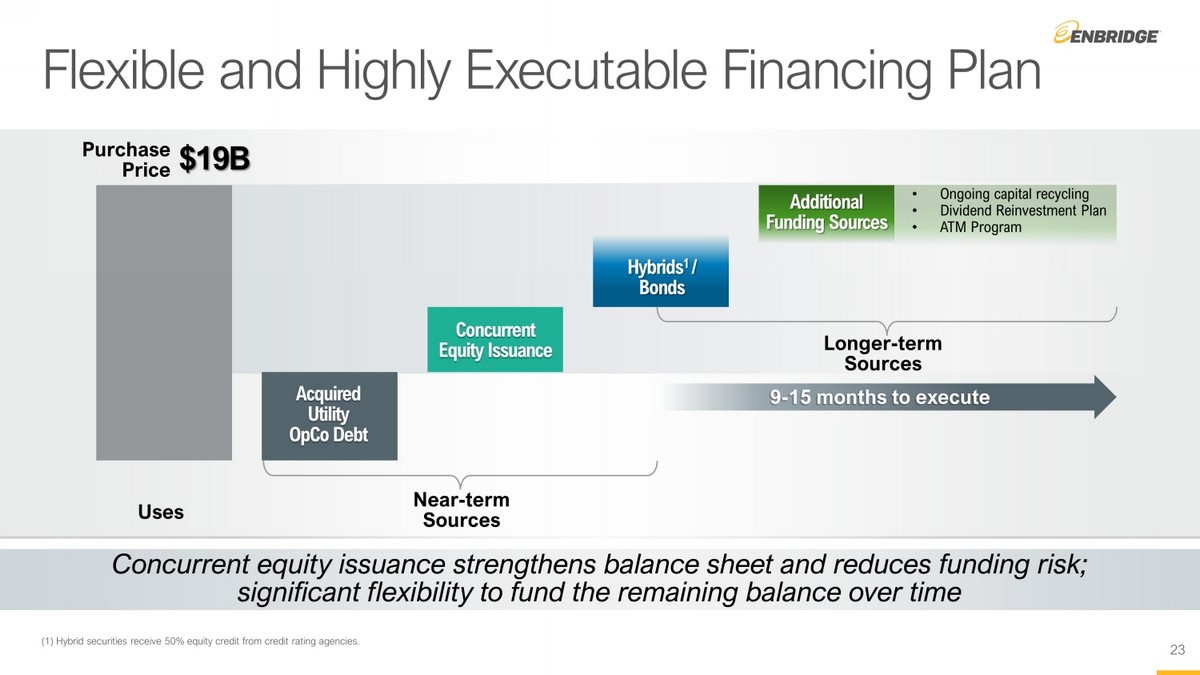

Today's equity offering,

announced separately, is expected to fully address the Company’s planned discrete common equity issuance needs to finance this

transaction. It ensures the remaining funding requirements can be readily satisfied through a variety of alternate sources including

hybrid debt securities and senior unsecured notes, continuing the Company’s ongoing capital recycling program, potential reinstatement

of Enbridge’s Dividend Reinvestment and Share Purchase Plan, or At-The-Market equity issuances. The acquisition of each Gas utility

is expected to close in 2024, upon receipt of the applicable required federal and state regulatory approvals, which allows Enbridge flexibility

to optimally balance the mix of financing alternatives prior to each closing. These sources may change, subject to market conditions

and other factors.

Enbridge has obtained debt

financing commitments totaling US$9.4 billion from Morgan Stanley and Royal Bank of Canada for the cash consideration component of the

Acquisitions in order to further demonstrate liquidity and the financing capacity to close the transactions.

The Company is committed

to maintaining its financial strength. The funding program for the Acquisitions is designed to maintain the Company’s balance sheet

within its previously communicated target leverage range of 4.5x to 5.0x Debt-to-Adjusted EBITDA with the objective of retaining its

strong investment grade credit ratings.

"Acquiring these natural

gas utilities makes strong strategic and financial sense. Enbridge is currently the only major pipeline and midstream company that owns

a regulated gas utility and we’ve further strengthened that position today by doubling the size of our GDS business. After closings,

the Acquisitions will extend and diversify our natural gas footprint and importantly add low-risk, ratable investments to our growth

portfolio” said Patrick Murray, Executive Vice President and Chief Financial Officer, Enbridge. “The financing plan for the

transaction includes significant equity pre-funding and a suite of financing options that will be optimized to maximize accretion and

protect our strong investment grade ratings.”

FINANCIAL OUTLOOK

The Company reaffirms its

2023 financial guidance, while planning to raise a significant portion of the financing required for the Acquisitions this year. After

the closings, the Acquisitions are expected to provide immediate high-quality cash flow and deliver significant EBITDA growth in their

first full fiscal year of Enbridge’s ownership. The Gas utilities have attractive embedded DCF and earnings growth, strengthening

Enbridge’s near-term and medium-term financial outlook. Sustainably returning capital to shareholders remains a key priority and

Enbridge plans to continue to grow its dividend up to its level of medium-term distributable cash flow growth.

Collectively, the Company

expects the Gas utilities to add CDN$1.7 billion of average annual low-risk, long-term capital investment opportunities, with significant

built-in rate rider mechanisms, enabling timely recovery of capital investments.

TIMING AND APPROVALS

The Acquisitions are expected

to close in 2024, subject to the satisfaction of customary closing conditions, including the receipt of certain required U.S. federal

and state regulatory approvals. These include clearance from the Federal Trade Commission under Hart-Scott-Rodino Antitrust Improvements

Act of 1976, approval from the Federal Communications Committee, and approval from the Committee on Foreign Investment in the United

States as well as approvals from state public utility commissions that regulate EOG, Questar, and PSNC. Closing of the purchase of each

Gas utility acquisition is expected to occur following receipt of each regulatory approvals applicable to each utility, and are not cross-conditioned

across all three Gas utilities.

ADVISORS

Morgan Stanley &

Co. LLC and RBC Capital Markets acted as co-lead Financial Advisors. Sullivan & Cromwell LLP and McCarthy Tétrault LLP

were legal advisors to Enbridge.

CONFERENCE CALL DETAILS

Enbridge will host a conference call

on September 5, 2023, at 4:30 p.m. Eastern Time (2:30 p.m. Mountain Time) to provide an overview of the Acquisitions. Analysts,

members of the media and other interested parties can access the call toll free at 1-800-606-3040. The call will be webcast live

at https://app.webinar.net/2vM5REDQKoe. A webcast replay will be available soon after the conclusion of the event and a

transcript will be posted to the website (conference

ID: 9581867).

The webcast

will include prepared remarks from the executive team. Enbridge's media and investor relations teams will be available after the call

for any additional questions.

FORWARD-LOOKING INFORMATION

This news release contains both historical and forward-looking

statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities

Exchange Act of 1934, as amended, and forward-looking information, future oriented financial information and financial outlook within

the meaning of Canadian securities laws (collectively, “forward-looking statements”). Forward-looking statements have been

included to provide readers with information about the Company and its subsidiaries and affiliates, including management’s assessment

of the Company’s and its subsidiaries’ future plans and operations. This information may not be appropriate for other purposes.

Forward-looking statements are typically identified by words such as “anticipate”, “believe”, “estimate”,

“expect”, “forecast”, “intend”, “likely”, “plan”, “project”,

“target” and similar words suggesting future outcomes or statements regarding an outlook. Forward-looking information or

statements included in this news release include, but are not limited to, statements with respect to the following: the Acquisitions,

including the characteristics, value drivers and anticipated benefits thereof on a standalone and combined post-Acquisitions basis; the

Company’s strategic plans, priorities, enablers and outlook; financial guidance and near and medium term outlooks, including expected

distributable cash flow (“DCF”) per share, adjusted earnings per share (“EPS”) and adjusted earnings before interest,

taxes, depreciation and amortization (“Adjusted EBITDA”), and expected growth thereof; expected debt to Adjusted EBITDA outlook

and target range; expected supply of, demand for, exports of and prices of crude oil, natural gas, natural gas liquids (“NGL”),

liquified natural gas (“LNG”) and renewable energy; energy transition and lower-carbon energy, and our approach thereto;

environmental, social and governance goals, practices and performance; industry and market conditions; anticipated utilization of the

Company’s assets; dividend growth and payout policy; expected future cash flows; expected shareholder returns and returns on equity;

expected performance of the Company’s businesses after the closings of the Acquisitions, including customer growth, system modernization

and organic growth opportunities; financial strength and flexibility; expectations on sources of liquidity and sufficiency of financial

resources; expected strategic priorities and performance of the Liquids Pipelines, Gas Transmission and Midstream, Gas Distribution and

Storage, Renewable Power Generation and Energy Services businesses; expected costs, benefits and in-service dates related to announced

projects and projects under construction; expected capital expenditures; investable capacity and capital allocation priorities; share

repurchases under our normal course issuer bid; expected equity funding requirements for the Company’s commercially secured growth

program; expected future growth, diversification, development and expansion opportunities, including with respect to the Company’s

post-Acquisitions commercially secured growth program and low carbon and new energies opportunities and strategy; expected optimization

and efficiency opportunities; expectations about the Company’s joint venture partners’ ability to complete and finance projects

under construction; our ability to complete the Acquisitions and successfully integrate the gas utilities without material delay, material

changes in terms, higher than anticipated costs or difficulty or loss of key personnel; expected closing of other acquisitions and dispositions

and the timing thereof; expected benefits of transactions, including the Acquisitions; expected future actions of regulators and courts,

and the timing and impact thereof; toll and rate cases discussions and proceedings and anticipated timeline and impact therefrom, including

Mainline System Tolling and those relating to the Gas Transmission and Midstream and Gas Distribution and Storage businesses; operational,

industry, regulatory, climate change and other risks associated with our businesses; the financing of the Acquisitions, including the

expected sources, timing and use of proceeds; and our ability to maintain strong investment grade credit metrics.

Although the Company believes these forward-looking statements

are reasonable based on the information available on the date such statements are made and processes used to prepare the

information, such statements are not guarantees of future performance and readers are cautioned against placing undue reliance on

forward-looking statements. By their nature, these statements involve a variety of assumptions, known and unknown risks and

uncertainties and other factors, which may cause actual results, levels of activity and achievements to differ materially from those

expressed or implied by such statements. Material assumptions include assumptions about the following: the expected supply of,

demand for, export of and prices of crude oil, natural gas, NGL, LNG and renewable energy; energy transition, including the drivers

and pace thereof; anticipated utilization of assets; exchange rates; inflation; interest rates; availability and price of labor and

construction materials; the stability of the Company’s supply chain; operational reliability; maintenance of support and

regulatory approvals for the Company’s projects; anticipated in-service dates; weather; the timing, terms and closing of

acquisitions and dispositions, including the Acquisitions, and of the financing of the Acquisitions; the realization of anticipated

benefits of transactions, including the Acquisitions; governmental legislation; litigation; estimated future dividends and impact of

the Company’s dividend policy on its future cash flows; the Company’s credit ratings; capital project funding; hedging

program; expected EBITDA and Adjusted EBITDA; expected earnings/(loss) and adjusted earnings/(loss); expected future cash flows;

expected future EPS; expected DCF and DCF per share; debt and equity market conditions; and the ability of management to execute key

priorities, including with respect to the Acquisitions. Assumptions regarding the expected supply of and demand for crude oil,

natural gas, NGL, LNG and renewable energy, and the prices of these commodities, are material to and underlie all forward-looking

statements, as they may impact current and future levels of demand for the Company’s services. Similarly, exchange rates,

inflation and interest rates impact the economies and business environments in which the Company operates and may impact levels of

demand for the Company’s services and cost of inputs, and are therefore inherent in all forward-looking statements. The most

relevant assumptions associated with forward-looking statements regarding announced projects and projects under construction,

including estimated completion dates and expected capital expenditures, include the following: the availability and price of labor

and construction materials; the stability of our supply chain; the effects of inflation and foreign exchange rates on labor and

material costs; the effects of interest rates on borrowing costs; and the impact of weather and customer, government, court and

regulatory approvals on construction and in-service schedules and cost recovery regimes.

The Company’s forward-looking statements are subject to risks

and uncertainties pertaining to the successful execution of the Company’s strategic priorities, operating performance, legislative

and regulatory parameters; litigation; acquisitions (including the Acquisitions), dispositions and other transactions and the realization

of anticipated benefits therefrom; the financing of the Acquisitions; operational dependence on third parties; dividend policy; project

approval and support; renewals of rights-of-way; weather; economic and competitive conditions; public opinion; changes in tax laws and

tax rates; exchange rates; inflation; interest rates; commodity prices; access to and cost of capital; political decisions; global geopolitical

conditions; and the supply of, demand for and prices of commodities and other alternative energy, including but not limited to those

risks and uncertainties discussed in our filings with Canadian and United States securities regulators. The impact of any one assumption,

risk, uncertainty or factor on a particular forward-looking statement is not determinable with certainty as these are interdependent

and the Company’s future course of action depends on management’s assessment of all information available at the relevant

time.

Financial outlook and future oriented financial information contained

in this news release about prospective financial performance, financial position or cash flows is based on assumptions about future events,

including economic conditions and proposed courses of action, based on management’s assessment of the relevant information currently

available and is subject to the same risk factors, limitations and qualifications as set forth above. The financial information included

in this news release, has been prepared by, and is the responsibility of, management . The purpose of the financial outlook and future

oriented financial information provided in this news release is to assist readers in understanding the Company’s expected financial

results following completion of the Acquisitions and the associated financings, and may not be appropriate for other purposes. The Company

and its management believe that such financial information has been prepared on a reasonable basis, reflecting the best estimates and

judgments, and that prospective financial information represents, to the best of management’s knowledge and opinion, the Company’s

expected course of action. However, because this prospective information is highly subjective, it should not be relied on as necessarily

indicative of past or future results, as the actual results may differ materially from those set forth in this news release.

Except to the extent required by applicable law, the Company assumes

no obligation to publicly update or revise any forward-looking statement made in this news release or otherwise, whether as a result

of new information, future events or otherwise. All forward-looking statements, whether written or oral, attributable to the Company

or persons acting on the Company’s behalf, are expressly qualified in their entirety by these cautionary statements.

NON-GAAP MEASURES

This news release makes reference to

non-GAAP and other financial measures, including earnings before interest, income taxes, depreciation and amortization (EBITDA),

adjusted EBITDA, distributable cash flow (DCF), adjusted earnings per share (EPS) and DCF per share and debt to adjusted EBITDA.

Management believes the presentation of these metrics gives useful information to investors and shareholders as they provide

increased transparency and insight into the performance of the Company. Adjusted EBITDA represents EBITDA adjusted for unusual,

infrequent or other non-operating factors on both a consolidated and segmented basis. Management uses EBITDA and adjusted EBITDA to

set targets and to assess the performance of the Company and its business units. Adjusted earnings represent earnings attributable

to common shareholders adjusted for unusual, infrequent or other non-operating factors included in adjusted EBITDA, as well as

adjustments for unusual, infrequent or other non-operating factors in respect of depreciation and amortization expense, interest

expense, income taxes and non-controlling interests on a consolidated basis. Management uses adjusted earnings as another measure of

the Company’s ability to generate earnings and EPS to assess the performance of the Company. DCF is defined as cash flow provided by operating activities before the impact of

changes in operating assets and liabilities (including changes in environmental liabilities) less distributions to non-controlling

interests, preference share dividends and maintenance capital expenditures, and further adjusted for unusual, infrequent or other

non-operating factors. Management also uses DCF to assess the performance of the Company and to set its dividend payout

target. Debt to adjusted EBITDA is used as a liquidity measure to indicate the amount of adjusted earnings available to pay

debt (as calculated on a GAAP basis) before covering interest, tax, depreciation and amortization.

Reconciliations of forward-looking non-GAAP

and other financial measures to comparable GAAP measures are not available due to the challenges and impracticability of estimating certain

items, particularly certain contingent liabilities and non-cash unrealized derivative fair value losses and gains which are subject to

market variability. Because of those challenges, reconciliations of forward-looking non-GAAP and other financial measures are not available

without unreasonable effort.

The non-GAAP measures described above

are not measures that have standardized meaning prescribed by generally accepted accounting principles in the United States of America

(U.S. GAAP) and are not U.S. GAAP measures. Therefore, these measures may not be comparable with similar measures presented by other

issuers. Additional information on non-GAAP and other financial measures may be found in the Company’s earnings news releases or

in additional information on the Company’s website, www.sedarplus.com or www.sec.gov.

Unless otherwise specified, all dollar

amounts in this news release are expressed in Canadian dollars, all references to “CDN,” “dollars” or “$”

are to Canadian dollars and all references to “US$” are to US dollars.

ABOUT ENBRIDGE INC.

At

Enbridge, we safely connect millions of people to the energy they rely on every day, fueling quality of life through our North American

natural gas, oil or renewable power networks and our growing European offshore wind portfolio. We're investing in modern energy delivery

infrastructure to sustain access to secure, affordable energy and building on two decades of experience in renewable energy to advance

new technologies including wind and solar power, hydrogen, renewable natural gas and carbon capture and storage. We're committed to reducing

the carbon footprint of the energy we deliver, and to achieving net zero greenhouse gas emissions by 2050. Headquartered in Calgary,

Alberta, Enbridge's common shares trade under the symbol ENB on the Toronto (TSX) and New York (NYSE) stock exchanges.

To learn more, visit us at enbridge.com

| FOR FURTHER

INFORMATION PLEASE CONTACT: |

|

|

| Enbridge Inc. –

Media |

|

Enbridge Inc. –

Investment Community |

| Jesse Semko |

|

Rebecca Morley |

| Toll Free: (888) 992-0997 |

|

Toll Free: (800) 481-2804 |

| Email: media@enbridge.com |

|

Email: investor.relations@enbridge.com |

Exhibit 99.2

Enbridge Announces CDN$4.0

Billion Bought-Deal Offering of Common Shares

CALGARY, ALBERTA–

(September 5, 2023) - Enbridge Inc. (TSX:ENB) (NYSE:ENB) (“Enbridge” or the “Company”) today announced

that it has entered into an agreement with a syndicate of underwriters led by RBC Capital Markets and Morgan Stanley, and including BMO

Capital Markets, CIBC Capital Markets, National Bank Financial Markets, Scotiabank, and TD Securities (the “Underwriters”)

under which the Underwriters have agreed to purchase, on a bought deal basis, 89,490,000 common shares of the Company (“Common

Shares”) for aggregate gross proceeds of CDN$4 billion at an offering price of CDN$44.70 per Common Share (the “Offering”).

Enbridge intends to use the

net proceeds from the Offering to finance a portion of the cash consideration payable by it for the purchase of local distribution company

gas utilities in the United States from Dominion Energy, Inc., the details of which were announced today in a separate news release

issued by Enbridge (the “Acquisitions”).

The Common Shares will be

offered to the public in all of the provinces of Canada through the Underwriters and their affiliates by way of a Canadian prospectus

supplement (the “Canadian Prospectus Supplement”) to Enbridge’s short form base shelf prospectus dated September 5,

2023 (the “Canadian Prospectus”). The Common Shares will be offered to the public in the United States pursuant to Enbridge’s

registration statement, including a prospectus (the “U.S. Prospectus”), filed with the U.S. Securities and Exchange Commission

(the “SEC”), and a prospectus supplement (the “U.S. Prospectus Supplement”) to the U.S. Prospectus. Before investing,

prospective purchasers in Canada should read the Canadian Prospectus Supplement, the Canadian Prospectus and the documents incorporated

by reference therein, and prospective purchasers in the United States should read the U.S. Prospectus, the U.S. Prospectus Supplement

and the documents incorporated by reference therein for more complete information about Enbridge and the Offering in Canada and the United

States, respectively. Common Shares may also be offered on a private placement basis in other international jurisdictions in reliance

on applicable private placement exemptions.

The Offering is expected to

close on or about September 8, 2023. Pursuant to the agreement, the Underwriters have an option to purchase up to 15% in additional

Common Shares by providing notice to Enbridge at any time until the date that is 30 days after the closing of the Offering, to cover over-allotments,

if any. If the over-allotment option is exercised in full, the aggregate gross proceeds from the Offering will be approximately CDN$4.6

billion.

A

copy of the Canadian Prospectus for the Offering is, and a copy of the Canadian Prospectus Supplement will be, available on SEDAR+ (http://www.sedarplus.ca)

and a copy of the U.S. Prospectus is, and a copy of the U.S. Prospectus Supplement will be, available on the SEC website (http://www.sec.gov).

Potential investors can request copies of the Canadian Prospectus and Canadian Prospectus Supplement from RBC Dominion Securities Inc.,

180 Wellington Street West, 8th Floor, Toronto, ON M5J 0C2, Attention: Distribution Centre, or via telephone: 1-416-842-5349, or via e-

mail at Distribution.RBCDS@rbccm.com and the U.S. Prospectus and U.S. Prospectus Supplement from RBC Capital Markets, LLC, 200 Vesey Street,

8th Floor, New York, NY 10281-8098, Attention: Equity Syndicate, phone: 877-822-4089, Email: equityprospectus@rbccm.com or Morgan Stanley &

Co. LLC - Attn: Prospectus Department - 180 Varick Street, 2nd Floor - New York, NY 10014.

The closing of the Offering

is not conditional upon the completion of the Acquisitions. In the event that any or all of the Acquisitions are not completed, Enbridge

may use the net proceeds from the Offering to reduce its outstanding indebtedness, finance future growth opportunities including acquisitions,

finance its capital expenditures, or for other general corporate purposes.

This press release shall not

constitute an offer to sell or the solicitation of an offer to buy any securities, nor will there be any sale of these securities, in

any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities

laws of any such jurisdiction.

FORWARD-LOOKING INFORMATION

This news release contains both historical and forward-looking statements

within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange

Act of 1934, as amended, and forward-looking information within the meaning of Canadian securities laws (collectively, forward-looking

statements). Forward-looking statements have been included to provide potential investors with information about Enbridge. This information

may not be appropriate for other purposes. Forward-looking statements are typically identified by words such as “anticipate”,

“believe”, “estimate”, “expect”, “forecast”, “intend”, “likely”,

“plan”, “project”, “target” and similar words suggesting future outcomes or statements regarding an

outlook. Forward-looking statements included in this news release include, but are not limited to, statements with respect to the following:

the closing of the Offering, the use of proceeds of the Offering and the Acquisitions.

Although Enbridge believes these forward-looking statements are

reasonable based on the information available on the date such statements are made and processes used to prepare the information, such

statements are not guarantees of future events and readers are cautioned against placing undue reliance on forward-looking statements.

By their nature, these statements involve a variety of assumptions, known and unknown risks and uncertainties and other factors, which

may cause actual events to differ materially from those expressed or implied by such statements.

Enbridge's forward-looking statements are subject to risks and uncertainties,

including, but not limited to the possibility that the Offering does not close when expected, or at all, because conditions to closing

are not satisfied on a timely basis, or at all, the possibility that the Acquisitions do not close when expected, or at all, because required

regulatory approvals and other conditions to closing are not received or satisfied on a timely basis, and those other risks and uncertainties

disclosed in Enbridge’s other filings with Canadian and United States securities regulators. The impact of any one risk, uncertainty

or factor on a particular forward-looking statement is not determinable with certainty as these are interdependent and Enbridge's future

course of action depends on management's assessment of all information available at the relevant time. Except to the extent required by

applicable law, Enbridge assumes no obligation to publicly update or revise any forward-looking statements made in this news release or

otherwise, whether as a result of new information, future events or otherwise. All subsequent forward-looking statements, whether written

or oral, attributable to Enbridge or persons acting on its behalf, are expressly qualified in their entirety by these cautionary statements.

ABOUT ENBRIDGE INC.

At

Enbridge, we safely connect millions of people to the energy they rely on every day, fueling quality of life through our North American

natural gas, oil or renewable power networks and our growing European offshore wind portfolio. We're investing in modern energy delivery

infrastructure to sustain access to secure, affordable energy and building on two decades of experience in renewable energy to advance

new technologies including wind and solar power, hydrogen, renewable natural gas and carbon capture and storage. We're committed to reducing

the carbon footprint of the energy we deliver, and to achieving net zero greenhouse gas emissions by 2050. Headquartered in Calgary,

Alberta, Enbridge's common shares trade under the symbol ENB on the Toronto (TSX) and New York (NYSE) stock exchanges.

| FOR FURTHER INFORMATION PLEASE CONTACT: |

|

|

| Enbridge Inc. – Media |

|

Enbridge Inc. – Investment Community |

| Jesse Semko |

|

Rebecca Morley |

| Toll Free: (888) 992-0997 |

|

Toll Free: (800) 481-2804 |

| Email: media@enbridge.com |

|

Email: investor.relations@enbridge.com |

Exhibit

99.3

Greg Ebel President & CEO September 5, 2023 Pat Murray EVP & CFO U.S. Gas Utilities Acquisition

Legal notice 2 Prospectus A final base shelf prospectus of Enbridge Inc. dated September 5 , 2023 containing important information relating to the securities described in this document has been filed with the securit ies regulatory authorities in each of the provinces of Canada. A copy of the final base shelf prospectus, any amendment to the fi na l base shelf base shelf prospectus, any amendment to the final base shelf prospectus and any applicable shelf prospectus supplement that h as been filed, is required to be delivered with this document. This document does not provide full disclosure of all material facts relating to the securities offered. Investors should rea d t he final base shelf prospectus, any amendment and any applicable shelf prospectus supplement for disclosure of those facts, e spe cially risk factors relating to the securities described in this document, before factors relating to the securities described in this document, before making an investment decision. This presentation shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor wil l there be any sale of these securities, in any jurisdiction in which such offer, solicitation or sale would be unlawful prio r t o which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Forward Looking Information This presentation contains both historical and forward - looking statements within the meaning of Section 27A of the U.S. Securiti es Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended, and forward - looking informa tion, future oriented financial information and financial outlook within the future oriented financial information and financial outlook within the meaning of Canadian securities laws (collectively, “fo rwa rd - looking statements”). Forward - looking statements been included to provide investors with information about Enbridge and its s ubsidiaries and affiliates, including management’s assessment of their future affiliates, including management’s assessment of their future plans and operations. This information may not be appropriate f or other purposes. Forward - looking statements are typically identified by words such as “anticipate”, “believe”, “estimate”, “expec t”, “forecast”, “intend”, “likely”, “plan”, “project”, “target” and similar words “intend”, “likely”, “plan”, “project”, “target” and similar words suggesting future outcomes or statements regarding an outlo ok. Forward - looking information or statements included in this presentation include, but are not limited to, statements with respec t to the following: Enbridge’s proposed acquisitions of three natural gas utilities and Enbridge’s proposed acquisitions of three natural gas utilities and related matters (the Acquisitions), including the charact eri stics, value drivers and anticipated benefits (including expected accretion to our non - GAAP distributable cash flow (DCF) per share and non - GAAP earnings per share ( EPS)) thereof on a standalone and combined GAAP earnings per share (EPS)) thereof on a standalone and combined post - Acquisitions basis; Enbridge’s strategic plans, priorities, enablers and outlook; financial gu idance and near and medium term outlooks, including expected DCF per share and adjusted earnings before interest, taxes, depr eci ation and amortization (EBITDA), earnings before interest, taxes, depreciation and amortization (EBITDA), and expected growth thereof; expected debt to adjust ed EBITDA outlook and target range; expected supply of, demand for, exports of and prices of crude oil, natural gas, natural gas li quids (NGL), liquified natural gas (LNG) and renewable energy; energy transition (NGL), liquified natural gas (LNG) and renewable energy; energy transition and lower - carbon energy, and our approach thereto; en vironmental, social and governance goals, practices and performance; industry and market conditions; anticipated utilization of Enbridge’s assets; dividend growth and payout policy; expected future cash and payout policy; expected future cash flows; expected shareholder returns and returns on equity; expected performance of th e C ompany’s businesses after the closings of the Acquisitions, including customer growth, system modernization and organic growt h o pportunities; financial strength and flexibility; expectations on sources of liquidity and sufficiency of financial resources; expected strategic priorities and performance of the Liquids Pipelines, Gas Tr ansmission and Midstream, Gas Distribution and Storage, Renewable Power Generation and Energy Services businesses; expected c ost s, benefits and in - service dates related to announced projects and projects under construction; expected capital expenditures; investable capacity and capital allocation priorities; share repurchases u nde r our normal course issuer bid; expected equity funding requirements for Enbridge’s commercially secured growth program; expe cte d future growth, diversification, development and expansion opportunities, including with respect to Enbridge’s post - Acquisitions commercially secured growth program and low carbon and new energies oppor tunities and strategy; expected optimization and efficiency opportunities; expectations about the Enbridge’s joint venture pa rtn ers’ ability to complete and finance projects under construction; our ability to complete the Acquisitions and successfully integrate the gas utilities without material delay, material changes in terms, hig her than anticipated costs or difficulty or loss of key personnel; expected closing of other acquisitions and dispositions and th e timing thereof; expected benefits of transactions, including the Acquisitions; expected future actions of regulators and courts, and the timing and impact thereof; toll and rate cases discussions and proceedings a nd anticipated timeline and impact therefrom, including Mainline System Tolling and those relating to the Gas Transmission and M ids tream and Gas Distribution and Storage businesses; operational, industry, regulatory, climate change and other risks associated with our businesses; the financing of the Acquisitions, including the e xpe cted sources, timing and use of proceeds; and our ability to maintain strong investment grade credit metrics. Although we believe these forward - looking statements are reasonable based on the information available on the date such statemen ts are made and processes used to prepare the information, such statements are not guarantees of future performance and reade rs are cautioned against placing undue reliance on forward - looking statements. By their nature, these statements involve a variety of assumptions, known and unknown risks and uncertainties and ot her factors, which may cause actual results, levels of activity and achievements to differ materially from those expressed or im plied by such statements. Material assumptions include assumptions about the following: the expected supply of, demand for, export of and prices of crude oil, natural gas, NGL, LNG and renewable energy; en ergy transition, including the drivers and pace thereof; anticipated utilization of assets; exchange rates; inflation; intere st rates; availability and price of labor and construction materials; the stability of the our supply chain; operational reliability; maintenance of support and regulatory approvals for the Enbridge’s projects; anticipat ed in - service dates; weather; the timing, terms and closing of acquisitions and dispositions, including the Acquisitions, and of th e financing of the Acquisitions; the realization of anticipated benefits of transactions, including the Acquisitions; governmental legislation; litigation; estimated future dividends and impact of Enbridge’s dividen d p olicy on its future cash flows; our credit ratings; capital project funding; hedging program; expected EBITDA and adjusted EB ITD A; expected earnings/(loss) and adjusted earnings/(loss); expected future cash flows; expected future EPS; expected DCF and DCF per share; debt and equity market conditions; and the ability of management to execute key priorities, including with respect to the Acquisitions. Assumptions regarding the expected supply of and demand f or crude oil, natural gas, NGL, LNG and renewable energy, and the prices of these commodities, are material to and underlie all forward - looking statements, as they may impact current and future levels of demand for the Enbridge’s services. Similarly, exchange rates, inflation and interest rates impact the economies and business en vironments in which Enbridge operates and may impact levels of demand for our services and cost of inputs, and are therefore inherent in all forward - looking statements. The most relevant assumptions ass ociated with forward - looking statements regarding announced projects and projects under construction, including estimated comple tion dates and expected capital expenditures, include the following: the availability and price of labor and construction materials; the stability of our supply chain; the effects of inflation and f ore ign exchange rates on labor and material costs; the effects of interest rates on borrowing costs; and the impact of weather a nd customer, government, court and regulatory approvals on construction and in - service schedules and cost recovery regimes. Our forward - looking statements are subject to risks and uncertainties pertaining to the successful execution of our strategic pr iorities, operating performance, legislative and regulatory parameters; litigation; acquisitions (including the Acquisitions) , d ispositions and other transactions and the realization of anticipated benefits therefrom; the financing of the Acquisitions; operational dependence on third parties; dividend policy; project approval and support; re new als of rights - of - way; weather; economic and competitive conditions; public opinion; changes in tax laws and tax rates; exchange rates; inflation; interest rates; commodity prices; access to and cost of capital; political decisions; global geopolitical conditions; and the supply of, demand for and prices of commodities and other altern ati ve energy, including but not limited to those risks and uncertainties discussed in our filings with Canadian and United State s s ecurities regulators. The impact of any one assumption, risk, uncertainty or factor on a particular forward - looking statement is not determinable with certainty as these are interdependent and the our future cour se of action depends on management’s assessment of all information available at the relevant time. Financial outlook and future oriented financial information contained in this presentation about prospective financial perfor man ce, financial position or cash flows is based on assumptions about future events, including economic conditions and proposed cou rses of action, based on management’s assessment of the relevant information currently available and is subject to the same risk factors, limitations and qualifications as set forth above. The financial in formation included in this presentation, has been prepared by, and is the responsibility of, management . The purpose of the fin ancial outlook and future oriented financial information provided in this presentation is to assist readers in understanding the Enbridge’s expected financial results following completion of the Acquisitions and the as sociated financings, and may not be appropriate for other purposes. Enbridge and its management believe that such financial i nfo rmation has been prepared on a reasonable basis, reflecting the best estimates and judgments, and that prospective financial information represents, to the best of management’s knowledge and opinion, Enbr idg e’s expected course of action. However, because this prospective information is highly subjective, it should not be relied on as necessarily indicative of past or future results, as the actual results may differ materially from those set forth in this presentation. Except to the extent required by applicable law, Enbridge assumes no obligation to publicly update or revise any forward - looking statement made in this presentation or otherwise, whether as a result of new information, future events or otherwise. All for wa rd - looking statements, whether written or oral, attributable to Enbridge or persons acting on its behalf, are expressly qualified in their entirety by these cautionary statements. Non - GAAP Measures This presentation makes reference to non - GAAP and other financial measures, including earnings before interest, income taxes, de preciation and amortization (EBITDA), adjusted EBITDA, adjusted earnings and adjusted earnings per share (EPS), distributable ca sh flow (DCF) and DCF per share and debt to EBITDA. Management believes the presentation of these metrics gives useful information to investors and shareholders as they provide increased t ran sparency and insight into the performance of the Company. Adjusted EBITDA represents EBITDA adjusted for unusual, infrequent or other non - operating factors on both a consolidated and segmented basis. Management uses EBITDA and adjusted EBITDA to set targets and to assess the performance of the Company and its business units . A djusted earnings represent earnings attributable to common shareholders adjusted for unusual, infrequent or other non - operating factors included in adjusted EBITDA, as well as adjustments for unusual, infrequent or other non - operating factors in respect of depreciation and amortization expense, interest expense, income taxes and non - controlling interests on a consolidated basis. Management uses adjusted earnings as another measure of the Compan y’s ability to generate earnings and uses EPS to assess the performance of the Company. DCF is defined as cash flow provided by operating activities before the impact of changes in operating assets an d liabilities (including changes in environmental liabilities) less distributions to non - controlling interests, preference share dividends and maintenance capital expenditures, and further adjusted for unusual, infrequent or other non - operating factors. Management also uses DCF to assess the performance of the Company and to set its divi dend payout target. Debt to EBITDA is used as a liquidity measure to indicate the amount of adjusted earnings available to pay debt (as calculated on a GAAP basis) before covering interest, tax, depreciation and amortization. Reconciliations of forward - looking non - GAAP and other financial measures to comparable GAAP measures are not available due to th e challenges and impracticability of estimating certain items, particularly certain contingent liabilities and non - cash unrealiz ed derivative fair value losses and gains which are subject to market variability. Because of those challenges, reconciliations of forward - looking non - GAAP and other financial measures are not available without unreasonable effort. The non - GAAP measures described above are not measures that have standardized meaning prescribed by generally accepted accountin g principles in the United States of America (U.S. GAAP) and are not U.S. GAAP measures. Therefore, these measures may not be co mparable with similar measures presented by other issuers. Additional information on non - GAAP and other financial measures may be found in the Company’s earnings news releases or in addit ional information on the Company’s website, www.sedarplus.com or www.sec.gov. Unless otherwise specified, all dollar amounts in this presentation are expressed in Canadian dollars, all references to “CAD $”, “dollars” or “$” are to Canadian dollars and all references to “US$” are to US dollars.

Generational acquisition furthers ENB’s utility - like model at an attractive and accretive purchase price Transaction Overview 3 (1) US$14.0B Converted at 1.36 USD/CAD • Enbridge to acquire three premier Gas Utilities from Dominion Energy • Creates North America’s largest gas utility platform; delivering ~9.3 bcf/d to ~7 million customers • All cash transaction for aggregated purchase price of CAD$19B 1 (i ncludes ~CAD$6B of assumed regulated Op Co debt) • Concurrent CAD$4B equity offering de - risks funding plan • Acquisitions expected to close in 2024, subsequent to regulatory approvals (not cross conditional)

Agenda 4 • Value Proposition • Unique Asset Acquisition • Enhances Diversification • Growth Outlook • Financing Plan Strong Total Return Predictable Cash Flow Growth Low - Risk Business First - choice Energy Provider

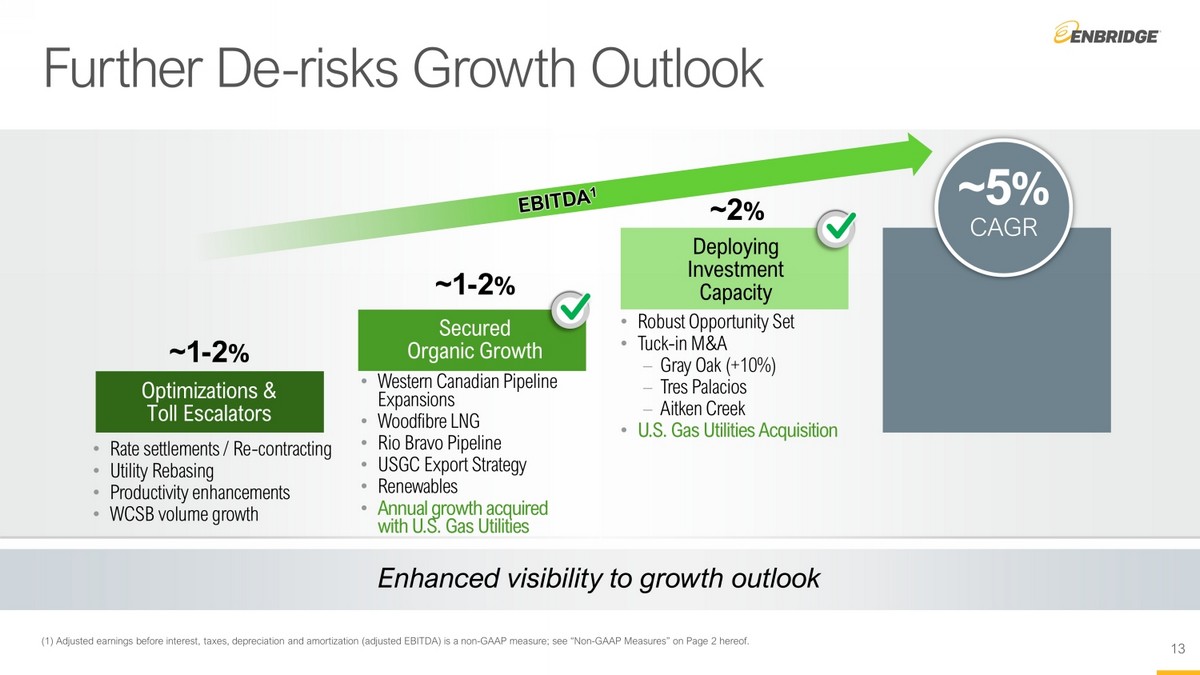

Accretive to Enbridge’s Value Proposition 5 Stability Strength Consistency Growth Optionality Accelerates Scale & Breadth of Existing Low - risk Utility Model Improves Cash Flow Quality and Maintains Balance Sheet Strength Supports Long - term Dividend Growth Profile Further De - risks Growth Outlook Embedded Lower - carbon Opportunities Diversified Low - Risk Pipeline / Utility Model Reliable Cash Flows & Strong Balance Sheet 28 Years of Annual Dividend Increases ~5% Medium - term Growth Outlook Lower - carbon Optionality Throughout the Business Enbridge’s Value Drivers U.S. Gas Utilities Acquisition

Questar 5 NEXUS Texas Eastern In states that preserve customer choice with legislation that “Bans the Ban on Natural Gas” East Tennessee EOG 6 PSNC 7 Unique opportunity to acquire large - scale gas utilities at historically attractive value Unique Asset Acquisition • Rare opportunity to acquire high - quality, growing natural gas utilities of scale for CAD$19B 1 • Creates North America’s largest natural gas utility platform delivering ~9.3 Bcf/d to ~7.0 million customers • Historically attractive acquisition multiple of ~1.3x 2 EV/Rate Base and ~16.5x 3 P/E delivers long - term shareholder value • Expected to be accretive to DCF PS 4 and adjusted EPS 4 in first full year of ownership and increases over time driven by strong utility growth profile • Natural gas utilities recognized as long - term assets as they remain “must - have” infrastructure for providing safe, reliable, and affordable energy • Diversifies utility business and doubles size further enhancing stable cash flow generation; strengthens long - term dividend growth profile (1) Enterprise Value; (2) Based on 2024e; (3) Based on 2023e; (4) Distributable Cash Flow Per Share (DCFPS) and adjusted earnings per share (EPS) a re non - GAAP measures; see “Non - GAAP Measures” on Page 2 hereof; (5) Questar Gas Company; (6) The East Ohio Gas Company; (7) Public Service Company of North Carolina 6

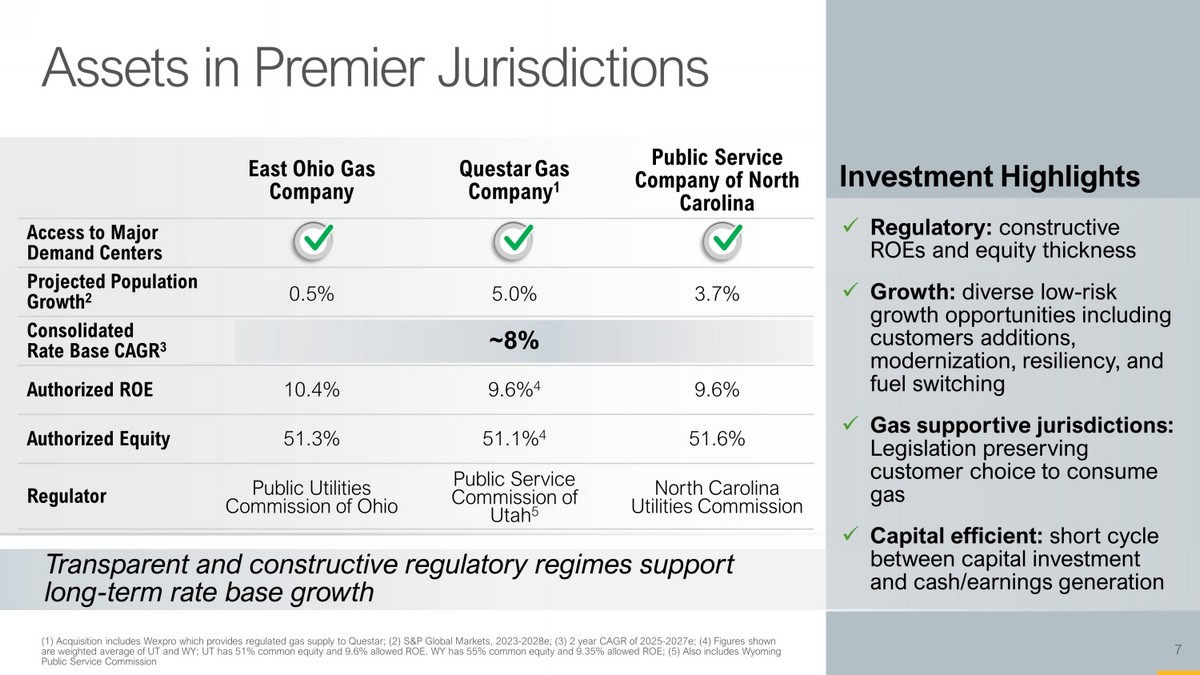

East Ohio Gas Company Questar Gas Company 1 Public Service Company of North Carolina Access to Major Demand Centers Projected Population Growth 2 0.5% 5.0% 3.7% Consolidated Rate Base CAGR 3 ~8% Authorized ROE 10.4% 9.6% 4 9.6% Authorized Equity 51.3% 51.1% 4 51.6% Regulator Public Utilities Commission of Ohio Public Service Commission of Utah 5 North Carolina Utilities Commission Assets in Premier Jurisdictions 7 (1) Acquisition includes Wexpro which provides regulated gas supply to Questar; (2) S&P Global Markets, 2023 - 2028e; (3) 2 year C AGR of 2025 - 2027e; (4) Figures shown are weighted average of UT and WY; UT has 51% common equity and 9.6% allowed ROE. WY has 55% common equity and 9.35% allowed ROE ; (5) Also includes Wyoming Public Service Commission Transparent and constructive regulatory regimes support long - term rate base growth Investment Highlights x Regulatory: constructive ROEs and equity thickness x Growth: diverse low - risk growth opportunities including customers additions, modernization, resiliency, and fuel switching x Gas supportive jurisdictions: Legislation preserving customer choice to consume gas x Capital efficient: short cycle between capital investment and cash/earnings generation