UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of

July

, 2019

EMPRESA DISTRIBUIDORA Y COMERCIALIZADORA NORTE S.A. (EDENOR)

(DISTRIBUTION AND MARKETING COMPANY OF THE NORTH )

(Translation of Registrant's Name Into English)

Argentina

(Jurisdiction of incorporation or organization)

Av. del Libertador 6363,

12th Floor,

City of Buenos Aires (A1428ARG),

Tel: 54-11-4346-5000

(Address of principal executive offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F

X

Form 40-F

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes

No

X

(If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

.)

MINUTES OF GENERAL EXTRAORDINARY SHAREHOLDERS’ MEETING No. 69

:

In the Autonomous City of Buenos Aires, on this 10th day of the month of June of the year 2019, at 11:00 a.m., at Avenida del Libertador 6363, there appear the shareholders of Empresa Distribuidora y Comercializadora Norte S.A. (Edenor S.A.) registered on folio No. 26 of Company’s Share Deposit and Attendance to Shareholders’ Meeting Book No. 2. It is expressly stated that Ms. Cristina Luis, acting on behalf of Bolsas y Mercados Argentinos (“BYMA”), and Directors Ricardo Torres, María Carolina Sigwald, María José Wuille-Bille, Gustavo Capatti, Carlos Iglesias, Diego Salaverri, Mariano Garcia Mithieux and Lucas Amado also attend the meeting. Acting on behalf of the Supervisory Board, Supervisory Board Members Jorge Pardo, Daniel Abelovich and Germán Wetzler Malbrán are also present. The Shareholders’ Meeting is presided over by the Board of Directors’ Chairman, Mr. Ricardo Torres, with the assistance of the Board’s Secretary to facilitate its development. The Secretary informs that three (3) shareholders are attending the Meeting, all of them appointed as proxy holders, holding a total 825,291,664 shares, which are made up as follows: 462,292,111 Series A shares, representing a capital stock of $462,292,111, equivalent to 100% of Series A capital stock; and 362,999,553 Series B shares, representing a capital stock of $362,999,553, equivalent to 87.94% of Series B and Series C capital stock considered jointly, all of them equivalent to 94.31% of the total capital stock, after discounting the 31,358,527 Series B shares the Company holds in treasury, pursuant to Section 221, second paragraph, of General Business Organizations Act No. 19,550, which should be excluded for the purposes of determining the quorum or majorities at the time of adopting resolutions at shareholders’ meetings. Additionally, it is informed that this General Shareholders’ Meeting will discuss the Agenda announced in the call notice prepared by the Board of Directors in its meeting held on May 13, 2019, which was published on the Official Gazette of the Republic of Argentina on May 14, 15, 16, 17 and 20, 2019, and in the “La Prensa” newspaper on May 15, 16, 17, 18 and 19, 2019. Thereupon, the Chairman informs that, with quorum duly established under the legal and statutory provisions in force, this General Extraordinary Shareholders’ Meeting is declared validly held on first call, and submits the FIRST ITEM of the agenda for consideration

:

1)

Appointment of two shareholders to approve and sign the minutes

.

The Secretary expressly states that the Board of Directors, in its meeting held on May 13, 2019, resolved to propose to the Shareholders’ Meeting that the Minutes be executed by the proxy holders of Pampa Energía S.A. (“PESA”), the National Social Security Administration (“ANSES”,

Administración Nacional de Seguridad Social

) on behalf of the Sustainability Guarantee Fund pursuant to Act No. 26,425, and The Bank of New York Mellon (“BONY”). Shareholder PESA’s proxy holder takes the floor and proposes that the motion submitted by the Board of Directors be approved. The motion is submitted for consideration, and shareholder BONY’s proxy holder states that it votes in favor of adopting it with 54,744,520 votes, abstains from voting with 65,247,480 votes and votes against its adoption with 8,000 votes; whereas shareholder ANSES-FGS’s proxy holder votes in favor of the motion. Therefore,

THE MEETING RESOLVES

to approve the motion filed by shareholder PESA by a majority of computable votes, with the above-mentioned abstentions and negative votes. Thereupon, the SECOND ITEM of the Agenda is submitted for consideration:

2)

RATIFICATION OF ALL BOARD OF DIRECTORS’ ACTS AND PROCEEDINGS ASSOCIATED WITH THE NEGOTIATION AND EXECUTION OF THE AGREEMENT FOR THE IMPLEMENTATION OF THE TRANSFER OF JURISDICTION AND THE LIABILITIES REGULARIZATION AGREEMENT

.

The Secretary states, that, in this respect, in its meeting held on May 13, 2019 the Board of Directors resolved to propose to the Shareholders’ Meeting that it should ratify all the Board of Directors’ acts and proceedings associated with the negotiation and execution of the “AGREEMENT FOR THE IMPLEMENTATION OF THE TRANSFER OF

JURISDICTION

OF THE ELECTRICITY DISTRIBUTION UTILITY SERVICE TO THE PROVINCE OF BUENOS AIRES

AND THE AUTONOMOUS CITY OF BUENOS AIRES” AND THE “LIABILITIES REGULARIZATION

AGREEMENT FOR THE TRANSFER OF CONCESSIONAIRES TO LOCAL JURISDICTIONS”. In this

respect, the Chairman informs the attendees that, pursuant to 2018 Fiscal

Consensus Act No. 27,469, The National Administration’s General Budget of

Income and Expenditures for Fiscal Year 2019 Act No. 27,467, and Executive

Order No. 162/2019, which required the Ministry of Finance to take the

necessary steps to comply with the instruction provided for by Section 124 of

Act No. 27,467, on February 28 of this year the Federal Government, the

Province of Buenos Aires and the Autonomous City of Buenos Aires executed the

AGREEMENT FOR THE TRANSFER OF JURISDICTION OF THE ELECTRICITY DISTRIBUTION

UTILITY SERVICE TO THE PROVINCE OF BUENOS AIRES AND THE AUTONOMOUS CITY OF

BUENOS AIRES (the “TRANSFER AGREEMENT”), whereby the Federal Government —which

originally granted the electricity distribution utility service within its

geographical concession area to Edenor— started, as from March 1, 2019, the

process for transferring the Company to the jurisdictions of the Province of

Buenos Aires and the Autonomous City of Buenos Aires, which, after the

implementation of the transfer, would be vested with enforcement powers over

the utility service provided by Edenor, both of them undertaking to create a

bipartite monitoring and regulatory body for the electricity distribution

utility service. To such effect, on May 10, 2019 the Federal, Provincial and

City Governments entered into, conditional upon its ratification by the

Provincial Executive Branch and the City’s Legislative Body, the AGREEMENT FOR

THE IMPLEMENTATION OF THE TRANSFER OF JURISDICTION OF THE ELECTRICITY

DISTRIBUTION UTILITY SERVICE TO THE PROVINCE OF BUENOS AIRES AND THE AUTONOMOUS

CITY OF BUENOS AIRES (the “IMPLEMENTATION AGREEMENT”) with the purpose of

implementing the transfer of the utility service under concession to Edenor,

whereby the Company was required to become acquainted with the stipulations by

the Federal, Provincial and Autonomous City’s Governments under the TRANSFER

AGREEMENT and the IMPLEMENTATION AGREEMENT itself; to expressly state its

consent to the transfer of its Concession Agreement and other provisions of the

IMPLEMENTATION AGREEMENT involving its rights and obligations, and to undertake

to hold the Federal Government, the Province of Buenos Aires and the City of

Buenos Aires harmless from and against all and any administrative, judicial,

extrajudicial or arbitration claims, whether in the Republic of Argentina,

abroad or at the international level, by its controlling, controlled or

affiliated companies or shareholders regarding the provisions stipulated in the

TRANSFER AGREEMENT and the IMPLEMENTATION AGREEMENT. Lastly, as the TRANSFER

AGREEMENT provides that the Federal Government is solely responsible for all

receivables and payables arising from any cause or under any title prior to

February 28, 2019 associated with the electricity distribution utility service

provided by Edenor or the execution of its Concession Agreement, the Federal

Government undertook to hold the Province of Buenos Aires and/or the City of

Buenos Aires harmless from and against any liability which may be attributed to

them for issues arising before February 28, 2019. To such effect,

simultaneously with the IMPLEMENTATION AGREEMENT, the LIABILITIES

REGULARIZATION AGREEMENT FOR THE TRANSFER OF CONCESSIONAIRES TO LOCAL

JURISDICTIONS (the “REGULARIZATION AGREEMENT”) was entered into, which provides

a solution to the so-called regulatory assets and liabilities. In this sense,

the Chairman expresses that in September 2016 the Secretariat of Electric

Energy had provided that any receivables and other issues existing between the

Federal Government and Edenor resulting from the Transition Tariff Regime under

the Contract Renegotiation Memorandum of Understanding should be dealt with and

resolved independently from the Full Tariff Review

(RTI).

He also points out that, in its meeting held on April 16, 2018, the Board of

Directors unanimously authorized the Chairman, acting in the name and on behalf

of the Company, to negotiate and execute an agreement with the Federal

Government under terms and conditions substantially similar to those informed

in that meeting, and authorized the voluntary dismissal of the claim and the

right invoked in the proceeding “

Edenor c/ Estado Nacional – MPIPS s/

Proceso de conocimiento

(Edenor vs. the Federal Government - MPIPS on

Declaratory Judgment)”, File No. 27519/2013 and the corresponding Motion for

Waiver of Court Fees, File No. 27520/2013. This agreement did not succeed due

to reasons beyond the Company’s control. Since then and to this same effect,

the Company has held several meetings with different representatives of the

National Executive Branch seeking to reach an agreement on receivables

resulting from acts and omissions occurring during the Tariff Transition Period

and until the entry into effect of the RTI approved in February 2017. In this

sense, in late April 2019, a draft REGULARIZATION AGREEMENT was drawn up with

the Federal Government, which was submitted to the consideration of the

Company’s Board of Directors and approved in Board Meeting No. 435 held on May

6, 2019, when its content was disclosed and approved, and the Chairman and

Vice-Chairman were indistinctly authorized to execute both the IMPLEMENTATION

AGREEMENT and the REGULARIZATION AGREEMENT, thus validating the compromises and

waivers stipulated in both agreements. The Chairman points out that the

execution of the REGULARIZATION AGREEMENT will put an end to reciprocal claims

between the Company and the Federal Government arising from regulatory assets

and liabilities, and briefly explained the different issues involved, which

ones would be resolved favorably or unfavorably to the Company, which ones

would result in a contingent liability and for which amounts, and the treatment

to be given to each of them. The Chairman states that the execution of the

REGULARIZATION AGREEMENT also required the Company —and its controlling

shareholder— to waive all and any administrative, judicial, extrajudicial or

arbitration rights, actions or claims in the Republic of Argentina, abroad or

at the international level, regarding: (i) tariff issues associated with the

Transition Period resulting from the concession agreement and/or the

Memorandums of Understanding; (ii) any income difference during such period,

and any fact, act or omission occurring during the Transition Period; (iii)

differences resulting from the application of the bill cap for users benefiting

from the Social Tariff; and (iv) claims associated with the payment of

consumptions by low-income neighborhoods with community meters generated as

from October 2017, 2017, in the proportion committed by the Federal Government

under the New Master Agreement and its successive extensions. Furthermore, the

Company undertakes to hold the Federal Government harmless from and against all

and any administrative, judicial, extrajudicial or arbitration claims, in the

Republic of Argentina, abroad or at the international level, by its

controlling, controlled or affiliated companies or shareholders regarding the

previously mentioned issues; and to waive, within a term of 30 days as from the

execution of the Regularization Agreement, the judicial proceeding and the

right originating the proceeding “

Edenor S.A. c/ Estado Nacional –Ministerio

de Planificación Federal, Inversión Pública y Servicios s/ process de

conocimiento

(Edenor vs. the Federal Government - Ministry of Federal

Planning, Public Investment and Services on Declaratory Judgment)” (File No.

27,519/2013) pending before Federal First Instance Court in Administrative

Litigation No. 11, providing that each party will bear its own litigation costs

under this proceeding and any other proceeding to be waived under the

Regularization Agreement, the Government Secretariat of Energy undertaking to

provide its consent and to grant the instruments necessary so that this

proceeding may be terminated and each party may bear its own costs. The

voluntary dismissal of rights and proceedings was approved by the Company’s

Board of Directors in the above-mentioned meeting held on May 6, 2019, and by

the Board of Directors of its controlling company, Pampa Energía S.A., in Board

Meeting No. 2190, also held on May 6, 2019.

Shareholder

PESA’s proxy holder takes the floor and makes a motion to ratify the Company’s

Board of Directors acts and proceedings regarding the negotiation and execution

of the AGREEMENT FOR THE IMPLEMENTATION OF THE TRANSFER OF JURISDICTION and the

LIABILITIES REGULARIZATION AGREEMENT. The motion is submitted for

consideration, and shareholder BONY’s proxy holder states that it votes in

favor of the motion with 53,613,580 votes, abstains from voting with 66,346,820

votes, and votes against the motion with 39,600 votes; whereas shareholder

ANSES-FGS’ proxy holder votes in favor of the motion. Consequently,

THE

MEETING RESOLVES

to approve the motion by a majority of computable votes,

with the above-mentioned abstentions and negative votes. Next, the THIRD ITEM

of the Agenda is submitted for consideration:

3°)

Consideration of waivers and dismissals of actions and rights

arising from such agreements and indemnity

.

The Secretary expresses that, in this

respect, in its meeting held on May 13, 2019, the Board of Directors resolved

to propose to the Shareholders’ Meeting that it should approve

:

(

i

) the waiver and voluntary

dismissal of all and any administrative, judicial, extrajudicial or arbitration

claims, in the Republic of Argentina, abroad or at the international level, of

tariff issues associated with the transition period resulting from the

concession agreements and/or the memorandums of understanding, together with

any income difference during such period, and any fact, act or omission

occurring during the transition period; (

ii

) the waiver and voluntary

dismissal of all and any administrative, judicial, extrajudicial or arbitration

claims, in the Republic of Argentina, abroad or at the international level,

regarding differences resulting from the application of the bill cap for users

benefiting from the Social Tariff and the payment of consumptions by low-income

neighborhoods with community meters generated as from October 2017, in the

proportion committed by the Federal Government under the New Master Agreement

and its successive extensions; (

iii

) the voluntary dismissal of the

claim and the right invoked in the proceedings “

Edenor S.A. c/ Federal

Government - M° de Planificación Federal Inv.

Pública y Servicios s/

Proceso de Conocimiento

(Edenor vs. the Federal Government - Ministry of

Federal Planning, Public Investment and Services on Declaratory Judgment)”

(File No. 27,519/2013) and “

Edenor S.A. c/ Estado Nacional - M° de

Planificación Federal Inv.

Pública y Servicios s/ Beneficio de litigar

sin gastos

(Edenor S.A. vs. the Federal Government - Ministry of Federal

Planning, Public Investment and Services, Motion for Waiver of Court Fees)”

(File No. 27,520/2013); y (

iv

) to hold the Federal Government harmless

from and against all and any administrative, judicial, extrajudicial or

arbitration claims, in the Republic of Argentina, abroad or at the

international level, by its controlling, controlled or affiliated companies or

shareholders regarding the issues mentioned in (ii) through (iii) above.

Shareholder PESA’s proxy holder takes the floor and files a motion to approve

the above-stated proposal made by the Board of Directors to the Company

shareholders last May 13, 2019 in its Meeting No. 437, including the approval

in whole of the LIABILITIES REGULARIZATION AGREEMENT executed by the Company’s

legal representative, specifically its SECTION 8 which is transcribed below:

“

SECTION

8.

Waiver of all Claims by Concessionaires regarding the Transition Period

.

Concessionaires do hereby waive all and any administrative, judicial,

extrajudicial or arbitration claims, in the Republic of Argentina, abroad or at

the international level, regarding tariff issues associated with the Transition

Period resulting from the concession agreements and/or the Memorandums of

Understanding, together with any income difference during such period, and any

fact, act or omission occurring during the Transition Period.

Concessionaires

do hereby waive all and any administrative, judicial, extrajudicial or

arbitration claims, in the Republic of Argentina, abroad or at the

international level, regarding differences resulting from the application of

the bill cap for users benefiting from the Social Tariff and the payment of

consumptions by

low-income neighborhoods with community

meters generated as from October 2017, in the proportion committed by the

Federal Government under the New Master Agreement and its successive

extensions.

These

waivers do not cover discounts granted by Edenor to users associated with the

penalties mentioned in sections 9.2.1 and 9.2.2 of Edenor’s Memorandum of

Understanding, which status as settlement payment has been challenged by the

ENRE.

Concessionaires

do hereby provide evidence, pursuant to Schedule VI’s documentation, of the

waivers and voluntary dismissals by its shareholders of all administrative,

judicial, extrajudicial or arbitration claims, in the Republic of Argentina,

abroad or at the international level, regarding issues mentioned in the first

and second paragraph of this clause, and undertake to submit the applicable

Minutes of Shareholders’ Meeting within 45 calendar days from the execution

hereof.

They

also undertake to hold the Federal Government harmless from and against all and

any administrative, judicial, extrajudicial or arbitration claims, in the

Republic of Argentina, abroad or at the international level, by its

controlling, controlled or affiliated companies or shareholders regarding the

issues mentioned in the first and second paragraph of this clause. Edenor

undertakes to waive, within 30 days as from the execution hereof, the judicial

proceeding and the right originating the proceeding “Edenor S.A. c/ Federal

Government –Ministerio de Planificación Federal, Inversión Pública y Servicios

s/proceso de conocimiento (Edenor vs. the Federal Government - Ministry of

Federal Planning, Public Investment and Services on Declaratory Judgment)”

(File No. 27,519/2013) pending before Federal First Instance Court in

Administrative Litigation No. 11. Each party will bear its own litigation costs

under this proceeding and any other proceeding to be waived under this

Agreement. The Government Secretariat of Energy (SGE) undertakes to provide its

consent and grant the instruments necessary so that this proceeding may be

terminated and each party may bear its own costs.

Waivers,

dismissals and consents by the Concessionaires hereunder are made taking into

consideration the commitments made by the Federal Government herein and in

order to put an end to the situation existing as a result of the facts

described in the Recitals hereof, and do not imply an acknowledgment of facts

or rights. Specifically, the consent regarding the penalties set forth in item

(ii) of Section 1 hereof is provided to the sole effect of putting an end to

the claims, without this implying an acknowledgment by the Concessionaires of

the negligence attributed by the ENRE.

The

Parties acknowledge and declare that the considerations and provisions hereof

are applicable solely and on a one-off basis to the rights and obligations

corresponding to the Transition Period regarding the differences resulting from

the application of the bill cap for users benefiting from the Social Tariff and

the payment of consumptions by low-income neighborhoods with community meters

generated as from October 2017, in the proportion committed by the Federal

Government. Consequently, Concessionaires acknowledge and declare that factual

or legal circumstances stipulated in this Agreement will in no case constitute

or be deemed an acknowledgment of facts or rights or be invoked, also waiving

to do so in the future, so as to exempt, mitigate or release any liability by

the Concessionaires in case of breach of any obligation not associated with the

Transition Period, including, but not limited to, service quality levels and

other requirements established by the ENRE under the RTI and/or any other

obligation by the Concessionaires under the Regulatory Framework and

supplementary provisions applicable to the Concessionaires and/or the service

they provide.

”

The motion

is submitted for consideration, and shareholder BONY’s proxy holder states that

it votes in favor of the motion with 53,613,580 votes, abstains from voting

with 66,346,820 votes, and votes against the motion with 39,600 votes; whereas

shareholder ANSES-FGS’ proxy holder votes in favor of the motion.

Consequently,

THE MEETING RESOLVES

to approve all motions by a majority of computable votes, with the above-mentioned abstentions and negative votes.

There being no further business to transact, and after responding to some queries on the Company’s ordinary course of business, the Chairman thanks the shareholders for attending the meeting, which is adjourned at 11:30 a.m., after reading and ratifying these Minutes, which are signed by the persons stated in the First Item.-

|

Ricardo Torres

Edenor S.A.’s Chairman

|

Juan Manuel Recio

Pampa Energía S.A.’s Proxy Holder

|

|

Marianela Lago

ANSES-FGS’ Proxy Holder.

|

Magalí Aumasque

The Bank of New York’s Proxy Holder

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Empresa Distribuidora y Comercializadora Norte S.A.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Leandro Montero

|

|

|

Leandro Montero

|

|

|

Chief Financial Officer

|

Date:

July

3

1

, 2019

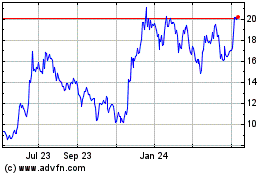

Empresa Distribuidora Y ... (NYSE:EDN)

Historical Stock Chart

From Jun 2024 to Jul 2024

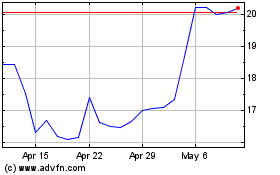

Empresa Distribuidora Y ... (NYSE:EDN)

Historical Stock Chart

From Jul 2023 to Jul 2024