Current Report Filing (8-k)

February 16 2021 - 7:59AM

Edgar (US Regulatory)

0000028823False00000288232021-02-122021-02-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): February 12, 2021

Diebold Nixdorf, Incorporated

(Exact name of registrant as specified in its charter)

_________________________________________________

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ohio

|

|

1-4879

|

|

34-0183970

|

|

|

|

|

|

|

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

|

|

5995 Mayfair Road, P.O. Box 3077,

|

|

|

|

|

|

North Canton,

|

Ohio

|

|

|

|

44720-8077

|

|

|

|

|

|

|

|

|

(Address of principal executive offices)

|

|

|

|

(Zip Code)

|

Registrant's telephone number, including area code: (330) 490-4000

Not Applicable

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol

|

|

Name of each exchange on which registered

|

|

Common shares, $1.25 par value per share

|

|

DBD

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On February 12, 2021, the Board of Directors of Diebold Nixdorf, Incorporated (the "Company"), upon approval by and recommendation of its People and Compensation Committee, granted a performance-based, multi-year equity incentive award to President and Chief Executive Officer Gerrard Schmid under the Company's shareholder-approved 2017 Equity and Performance Incentive Plan. This grant of 1,142,422 performance units has a four-year performance period, with potential vesting in annual increments based on achievement of performance metrics designed to increase shareholder value during such annual period. This award is an integral component of the Company's strategy to retain Mr. Schmid while incentivizing achievement of mission critical advances in talent, revenue growth, sustainability, and the return on invested capital (ROIC).

The performance units can be earned, if at all, upon achievement of specified performance objectives during the 2021 to 2024 performance period. The People and Compensation Committee set performance metrics and targets for each year of the four-year performance period that support three of the Company's strategic initiatives for the future: talent, revenue growth and sustainability. Each annual performance period includes performance metrics related to all three of these strategic initiatives. For example, the growth component includes focus on growing software and services revenue to specified metrics each of the four years, among other metrics. The sustainability component includes a goal of reducing carbon emissions over the four-year performance period as well as a specified increase in executive diversity, among other metrics. The talent component will require enhancement of emerging debit payment capabilities including the addition of expert sales personnel, as well as other goals. In the fourth and final annual performance period, an additional and fourth component focuses on increasing ROIC.

Subject to achievement at target on each of the goals, a proportionate number of performance units will vest annually in 20% tranches following the first three years, with 40% vesting following the fourth year of the performance period. No additional performance units will be earned for results in excess of target level.

The performance objectives that were established for this incentive award complement the metrics selected by the People and Compensation Committee for both the executive's 2021 Annual Cash Bonus Plan award and his 2021 performance-based equity award under the Company's long-term incentive compensation program. The 2021 Annual Cash Bonus Plan will be funded based on performance against pre-established targets for unlevered free cash flow and operating profit. The 2021-2023 performance-based equity incentive awards will be earned based on targets for levered free cash flow and revenue over the three-year performance period. The People and Compensation Committee believes that, collectively, these two programs and the special performance-based equity award granted on February 12, 2021 align the interests of the Company's CEO with the long-term interests of shareholders.

The foregoing description is qualified by reference to the full text of the award agreement, a copy of which is attached hereto as Exhibit 10.1 and incorporated herein by reference.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 9.01 Financial Statements and Exhibits

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(d) Exhibits.

|

|

|

|

|

|

|

|

Exhibit

|

|

|

|

Number

|

|

Description

|

|

|

|

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diebold Nixdorf, Incorporated

|

|

February 16, 2021

|

By:

|

/s/ Jonathan B. Leiken

|

|

|

|

Name:

|

Jonathan B. Leiken

|

|

|

|

Title:

|

Senior Vice President, Chief Legal Officer and

Secretary

|

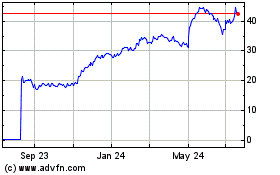

Diebold Nixdorf (NYSE:DBD)

Historical Stock Chart

From Aug 2024 to Sep 2024

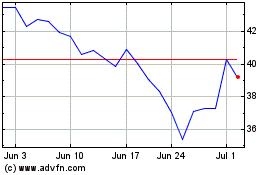

Diebold Nixdorf (NYSE:DBD)

Historical Stock Chart

From Sep 2023 to Sep 2024