UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☒

|

Definitive Proxy Statement

|

|

☐

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material Pursuant to §240.14a-12

|

Diamond Offshore Drilling, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

1)

|

Title of each class of securities to which transaction applies:

|

|

|

2)

|

Aggregate number of securities to which transaction applies:

|

|

|

3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

4)

|

Proposed maximum aggregate value of transaction:

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

1)

|

Amount Previously Paid:

|

|

|

2)

|

Form, Schedule or Registration Statement No.:

|

DIAMOND OFFSHORE DRILLING, INC.

15415 Katy Freeway

Houston, Texas 77094

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 13, 2020

To our Stockholders:

The 2020 annual meeting of stockholders of Diamond Offshore Drilling, Inc. will be held at the office of the company located at 15415 Katy Freeway, Houston, Texas, on Wednesday, May 13, 2020, at 8:30 a.m. local time1, for the following purposes:

|

|

(1)

|

To elect seven directors, each to serve until the next annual meeting of stockholders and until their respective successors are elected and qualified or until their earlier resignation or removal;

|

|

|

(2)

|

To hold an advisory vote on executive compensation;

|

|

|

(3)

|

To ratify the appointment of Deloitte & Touche LLP as the independent auditor for our company and its subsidiaries for fiscal year 2020; and

|

|

|

(4)

|

To transact such other business as may properly come before the annual meeting or any adjournments thereof.

|

Our stockholders of record at the close of business on March 18, 2020 are entitled to notice of, and to vote at, the annual meeting and any adjournments of the annual meeting. Additional information regarding the annual meeting is included in the attached proxy statement.

Your vote is important. Whether or not you plan to attend the meeting in person, please vote as promptly as possible using the internet or telephone, or, if you received a paper copy of the proxy materials, by signing, dating and returning the included proxy card.

By Order of the Board of Directors

Sincerely,

David L. Roland

Senior Vice President, General Counsel and Secretary

April 1, 2020

Important Notice Regarding the Availability of Proxy Materials

for the Annual Meeting of Stockholders to be Held on May 13, 2020.

Our proxy statement, proxy card and 2019 annual report to stockholders are available at www.proxydocs.com/DO

|

1

|

We are actively monitoring the public health and travel concerns relating to COVID-19 and the related recommendations and protocols issued by federal, state and local governments. In the event that it is not possible or advisable to hold our annual meeting in person as planned, we will announce alternative arrangements for the meeting as promptly as practicable, which may include holding the meeting solely by means of remote communication. Any such change, including details on how to participate and vote in a remote meeting, would be announced in advance, and details would be posted on our website at www.diamondoffshore.com and filed with the Securities and Exchange Commission. It is important that you retain a copy of your control number found on the proxy card, voting instruction form or notice, as such number will be required in order to gain access to any remote meeting. As always, we encourage you to vote your shares prior to the annual meeting.

|

Table of Contents

DIAMOND OFFSHORE DRILLING, INC.

15415 KATY FREEWAY

HOUSTON, TEXAS 77094

PROXY STATEMENT

For the 2020 Annual Meeting of Stockholders

to be held on May 13, 2020

ABOUT THE ANNUAL MEETING

Why am I receiving these materials, and when and where will the meeting be held?

The Board of Directors of Diamond Offshore Drilling, Inc. (which we refer to in this proxy statement as we, our, us, our company or the company) is providing you these proxy materials in connection with the Board’s solicitation of proxies from our stockholders for our 2020 annual meeting of stockholders (which we refer to as the Annual Meeting) and any adjournments and postponements of the Annual Meeting. The Annual Meeting will be held at the office of the company located at 15415 Katy Freeway, Houston, Texas, on Wednesday, May 13, 2020, commencing at 8:30 a.m. local time. On or before April 1, 2020, we expect to begin mailing to our stockholders proxy materials or an Important Notice Regarding the Availability of Proxy Materials (which we refer to as a Notice), containing instructions on how to access our proxy materials, including this proxy statement and our Annual Report, by the Internet and how to vote your shares. If you receive a Notice by mail, you will not receive a printed copy of the proxy materials unless you specifically request it. Whether or not you plan to attend the Annual Meeting, you may submit a proxy to vote your shares by the Internet, telephone or mail as more fully described below.

We are actively monitoring the public health and travel concerns relating to COVID-19 and the related recommendations and protocols issued by federal, state and local governments. In the event that it is not possible or advisable to hold the Annual Meeting in person as planned, we will announce alternative arrangements for the meeting as promptly as practicable, which may include holding the Annual Meeting solely by means of remote communication. Any such change, including details on how to participate and vote in a remote Annual Meeting, would be announced in advance, and details would be posted on our website at www.diamondoffshore.com and filed with the Securities and Exchange Commission (which we refer to as the SEC). It is important that you retain a copy of your control number found on the proxy card, voting instruction form or notice, as such number will be required in order to gain access to any remote Annual Meeting. As always, we encourage you to vote your shares prior to the Annual Meeting.

What is the purpose of the Annual Meeting?

At the Annual Meeting, you and our other stockholders entitled to vote at the Annual Meeting are requested to vote on proposals to elect seven members of our Board of Directors to serve until our 2021 annual meeting of stockholders, to approve executive compensation by advisory vote and to ratify the appointment of Deloitte & Touche LLP as our independent auditor for fiscal year 2020.

Who is entitled to attend and vote at the Annual Meeting?

Only stockholders of record as of the close of business on March 18, 2020, the record date for the Annual Meeting, or the holders of their valid proxies may attend the Annual Meeting. A list of our stockholders will be available for review at our executive offices in Houston, Texas during ordinary business hours for a period of 10 days prior to the meeting. Each person attending the Annual Meeting may be asked to present a photo ID before being admitted to the meeting. In addition, stockholders who hold their shares through a broker or nominee (i.e., in street name) should provide proof of their beneficial ownership, such as a

1

brokerage statement showing their ownership of shares as of March 18, 2020. Cameras, recording devices and other electronic devices will not be permitted at the Annual Meeting, and attendees will be subject to security inspections.

Only holders of record of our common stock at the close of business on March 18, 2020 are entitled to notice of and to vote at the Annual Meeting. Each stockholder is entitled to one vote for each share of common stock held. Shares of our common stock represented in person or by a properly submitted proxy will be voted at the Annual Meeting. On the record date, 137,944,059 shares of our common stock were outstanding and entitled to vote.

What constitutes a quorum?

The presence at the Annual Meeting in person or by proxy of the holders of a majority of the outstanding shares of our common stock entitled to vote at the Annual Meeting is required to constitute a quorum for the transaction of business.

What vote is required to approve each item to be voted on at the Annual Meeting?

Election of Directors. A nominee for director will be elected to the Board if all votes cast for that nominee’s election exceed the votes cast against his or her election. Under our Bylaws, any incumbent director nominee who does not receive a majority of the votes cast for election shall tender his or her resignation. For a more complete explanation of this requirement and process, please see “Election of Directors — Majority Vote Standard for Election of Directors” below.

Votes Required to Adopt Other Proposals. The affirmative vote of the holders of a majority of the shares of common stock present in person or represented by proxy and entitled to vote at the Annual Meeting is required for approval of all other items being submitted to stockholders for consideration.

How are abstentions and broker non-votes counted?

Abstentions and broker non-votes (i.e., shares with respect to which a broker indicates that it does not have authority to vote on a matter) will be counted for purposes of determining whether a quorum is present at the Annual Meeting. Abstentions will not affect the outcome of the election of directors. Abstentions will have the same effect as votes against any matter other than the election of directors. Broker non-votes will not affect the outcome of the election of directors or any other proposal to be voted on at the Annual Meeting.

How does the Board recommend that I vote?

Our Board of Directors recommends that you vote:

|

|

•

|

FOR each of the nominees for director named in this proxy statement;

|

|

|

•

|

FOR the resolution approving executive compensation; and

|

|

|

•

|

FOR the ratification of the appointment of Deloitte & Touche LLP as our independent auditor for fiscal year 2020.

|

How do I vote and can I change my vote after I return my proxy card?

You may vote in person at the Annual Meeting or you may give us your proxy. We recommend that you vote by proxy even if you plan to attend the Annual Meeting. As described below, you can change your vote at the Annual Meeting. You can vote by proxy over the telephone by calling a toll-free number, electronically by using the Internet or through the mail as described below. If you would like to vote by telephone or by using the Internet, please refer to the specific instructions set forth on the Notice or proxy card. If you are a holder of record and received your proxy statement and Annual Report by mail, you can vote by signing, dating and completing the enclosed proxy card and returning it by mail in the enclosed postpaid envelope. If you received a Notice and wish to vote by traditional proxy card, you may receive a full printed set of the proxy materials for the Annual Meeting at no charge through one of the following methods:

|

|

•

|

by the Internet at www.investorelections.com/DO;

|

|

|

•

|

by telephone at 1-866-648-8133; or

|

2

|

|

•

|

by sending a blank e-mail to paper@investorelections.com with the 12 digit control number (located in the Notice) in the subject line. No other requests, instructions or other inquiries should be included with your e-mail requesting material.

|

Once you receive the proxy statement, Annual Report and proxy card, please sign, date and complete the proxy card and return it in the enclosed postpaid envelope. No postage is necessary if the proxy card is mailed in the United States. If you hold your shares through a bank, broker or other nominee, it will provide you separate instructions for voting your shares.

Your proxy may be revoked at any time before its exercise by sending written notice of revocation to David L. Roland, Corporate Secretary, Diamond Offshore, 15415 Katy Freeway, Suite 100, Houston, Texas 77094, or by submitting a valid proxy that is dated later, or, if you attend the Annual Meeting in person, by giving notice of revocation to the Inspector of Election referred to below at the Annual Meeting.

Unless you revoke your proxy, your shares of common stock represented by your proxy will be voted at the Annual Meeting in accordance with the directions given in your proxy. If you do not specify a choice on your proxy, your proxy will be voted consistent with the above recommendations of the Board.

How will votes be recorded and where can I find the voting results of the Annual Meeting?

Votes will be tabulated by Mediant Communications Inc., and the results will be certified by our Inspector of Election. In tabulating votes, the Inspector of Election will make a record of the number of shares voted for or against each nominee and each other matter voted upon, the number of shares abstaining with respect to each nominee or other matter, and the number of shares held of record by broker-dealers that are present at the Annual Meeting but not voting. We plan to announce preliminary voting results at the Annual Meeting and to publish the final results in a current report on Form 8-K following the Annual Meeting.

STOCK OWNERSHIP OF PRINCIPAL STOCKHOLDERS

The following table shows certain information as of March 18, 2020 (unless otherwise indicated) as to all persons who, to our knowledge, were the beneficial owners of 5% or more of our common stock, which is our only outstanding class of voting securities. All shares reported were owned beneficially by the persons indicated unless otherwise indicated below.

|

|

|

|

|

|

|

|

|

Title of Class

|

|

Name and Address

of Beneficial Owner

|

|

Amount and Nature of

Beneficial Ownership

|

|

Percent

of Class

|

|

Common Stock

|

|

Loews Corporation

|

|

73,119,047 (1)

|

|

53.1%

|

|

|

|

667 Madison Avenue

|

|

|

|

|

|

|

|

New York, NY 10065-8087

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock

|

|

Contrarius Investment

Management Limited

|

|

13,271,845 (2)

|

|

9.6%

|

|

|

|

2 Bond Street

|

|

|

|

|

|

|

|

St. Helier, Jersey JE2 3NP

|

|

|

|

|

|

|

|

Channel Islands

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock

|

|

BlackRock, Inc.

|

|

10,190,825 (3)

|

|

7.4%

|

|

|

|

55 East 52nd Street

|

|

|

|

|

|

|

|

New York, NY 10055

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock

|

|

FMR LLC

|

|

7,499,848 (4)

|

|

5.4%

|

|

|

|

245 Summer Street

|

|

|

|

|

|

|

|

Boston, MA 02210

|

|

|

|

|

____________

|

(1)

|

Loews Corporation (which we refer to as Loews) has sole investment power and sole voting power over the shares.

|

|

(2)

|

This information is based on a Schedule 13G filed with the SEC on February 6, 2020 by Contrarius Investment Management Limited and Contrarius Investment Management (Bermuda) Limited, which reported that Contrarius Investment Management Limited has shared voting power over 13,271,845 shares and shared dispositive power over 13,271,845 shares, and Contrarius Investment Management (Bermuda)

|

3

|

|

Limited has shared voting power over 13,271,845 shares and shared dispositive power over 13,271,845 shares. The address for Contrarius Investment Management (Bermuda) Limited is Waterloo House, 100 Pitts Bay Road, Pembroke HM 08, Bermuda.

|

|

(3)

|

This information is based on a Schedule 13G/A (Amendment No. 3) filed with the SEC on February 5, 2020 by BlackRock, Inc., a parent holding company for a number of investment management subsidiaries, which indicates that BlackRock, Inc. has sole voting power over 9,989,553 shares and sole dispositive power over 10,190,825 shares.

|

|

(4)

|

This information is based on a Schedule 13G/A (Amendment No. 1) filed with the SEC on February 7, 2020 by FMR LLC and Abigail P. Johnson, which reported that FMR LLC has sole voting power with respect to 901,814 shares and sole dispositive power with respect to 7,499,848 shares, and Abigail P. Johnson has sole voting power with respect to none of such shares and sole dispositive power with respect to 7,499,848 shares. The Schedule 13G/A further states that members of the Johnson family, including Abigail P. Johnson, are the predominant owners, directly or through trusts, of Series B voting common shares of FMR LLC, representing 49% of the voting power of FMR LLC. The Johnson family group and all other Series B shareholders have entered into a shareholders’ voting agreement under which all Series B voting common shares will be voted in accordance with the majority vote of Series B voting common shares. Accordingly, through their ownership of voting common shares and the execution of the shareholders’ voting agreement, members of the Johnson family may be deemed, under the Investment Company Act of 1940, to form a controlling group with respect to FMR LLC. Neither FMR LLC nor Abigail P. Johnson has the sole power to vote or direct the voting of the shares owned directly by the various investment companies registered under the Investment Company Act, or Fidelity Funds, advised by Fidelity Management & Research Company, or FMR Co, a wholly owned subsidiary of FMR LLC, which power resides with the Fidelity Funds’ Boards of Trustees. FMR Co carries out the voting of the shares under written guidelines established by the Fidelity Funds’ Boards of Trustees.

|

Loews is a holding company, with principal subsidiaries (in addition to us) consisting of CNA Financial Corporation, an 89%-owned subsidiary engaged in commercial property and casualty insurance; Boardwalk Pipeline Partners, LP, a wholly-owned subsidiary engaged in the transportation and storage of natural gas and natural gas liquids; Loews Hotels Holding Corporation, a wholly-owned subsidiary engaged in the operation of a chain of hotels; and Altium Packaging LLC, a 99%-owned subsidiary engaged in the manufacture of rigid plastic packaging solutions.

Because as of the record date Loews owned a majority of the outstanding shares of our common stock, Loews has the power to approve matters submitted for consideration at the Annual Meeting without regard to the votes of the other stockholders. We understand that Loews intends to vote consistent with the above recommendations of the Board of Directors. There are no agreements between us and Loews with respect to the election of our directors or officers or with respect to the other matters that may come before the Annual Meeting.

4

STOCK OWNERSHIP OF MANAGEMENT AND DIRECTORS

The following table shows the shares of our common stock and common stock of Loews (which we refer to as Loews Common Stock) beneficially owned by each of our directors, each of our executive officers named in the 2019 Summary Compensation Table below, and all our current directors and executive officers as a group, as of March 1, 2020. Our directors and executive officers individually and as a group own less than 1% of our common stock. Except as otherwise noted, the named beneficial owner has sole voting power and sole investment power with respect to the number(s) of shares shown below. The table does not include any shares with respect to stock appreciation rights (SARs) granted under our Equity Incentive Compensation Plan (which we refer to as our Equity Plan) because the exercise prices of all outstanding SARs were higher than the fair market value per share ($2.93) of our common stock, determined in accordance with the terms of our Equity Plan, on March 1, 2020.

|

|

|

|

|

|

|

|

|

Name of Beneficial Owner

|

|

Shares of Our

Common Stock

|

|

Shares of Loews

Common Stock

|

|

% of Loews

Common Stock

|

|

James S. Tisch (1)

|

|

5,000

|

|

17,214,017

|

|

6.0%

|

|

Marc Edwards (2)

|

|

261,264

|

|

--

|

|

*

|

|

Anatol Feygin

|

|

--

|

|

--

|

|

*

|

|

Paul G. Gaffney II (3)

|

|

9,000

|

|

--

|

|

*

|

|

Edward Grebow

|

|

7,000

|

|

1,500

|

|

*

|

|

Alan H. Howard

|

|

--

|

|

--

|

|

*

|

|

Peter McTeague

|

|

--

|

|

--

|

|

*

|

|

Kenneth I. Siegel (4)

|

|

--

|

|

104,693

|

|

*

|

|

Clifford M. Sobel

|

|

--

|

|

--

|

|

*

|

|

Andrew H. Tisch (5)

|

|

--

|

|

16,223,921

|

|

5.7%

|

|

Ronald Woll (6)

|

|

50,389

|

|

--

|

|

*

|

|

Scott L. Kornblau (6)

|

|

2,661

|

|

--

|

|

*

|

|

David L. Roland (7)

|

|

30,050

|

|

--

|

|

*

|

|

Thomas M. Roth

|

|

18,572

|

|

--

|

|

*

|

|

All Directors and Executive Officers as a Group (15

persons, including those listed above)

|

|

393,522

|

|

33,544,131

|

|

11.7%

|

__________

*Less than 1% of the Loews Common Stock.

|

(1)

|

The number of shares of Loews Common Stock includes 324,737 shares of Loews Common Stock issuable upon the exercise of awards granted under the Loews Corporation Stock Option Plan that are currently exercisable. The number of shares of Loews Common Stock also includes 16,889,280 shares held by trusts of which Mr. Tisch is the managing trustee (includes 15,829,280 shares held in trust for his benefit and 1,060,000 shares held by a charitable foundation as to which Mr. Tisch has shared voting and investment power).

|

|

(2)

|

The number of shares of our common stock represents shares issued in connection with restricted stock units, or RSUs.

|

|

(3)

|

The number of shares of our common stock includes 7,000 shares held by a trust of which Mr. Gaffney is the trustee and 2,000 shares held by a trust of which his spouse is the trustee. Mr. Gaffney has shared voting and investment power with respect to the 2,000 shares held in trust.

|

|

(4)

|

The number of shares of Loews Common Stock represents 104,693 shares of Loews Common Stock issuable upon the exercise of stock awards granted under the Loews Corporation Stock Option Plan that are currently exercisable.

|

|

(5)

|

The number of shares of Loews Common Stock includes 324,737 shares of Loews Common Stock issuable upon the exercise of stock awards granted under the Loews Corporation Stock Option Plan that are currently exercisable. The number of shares of Loews Common Stock also includes 15,899,184 shares held by trusts of which Mr. Tisch is the managing trustee (including 14,809,184 shares held in trust for his benefit and 1,090,000 shares held by a charitable foundation as to which Mr. Tisch has shared voting and investment power).

|

|

(6)

|

The number of shares of our common stock represents shares issued in connection with RSUs, as to which the executive officer shares voting and investment power with his spouse.

|

|

(7)

|

The number of shares of our common stock represents 29,240 shares issued in connection with RSUs, as to which Mr. Roland shares voting and investment power with his spouse, and 810 shares held by virtue of Mr. Roland’s investment in our common stock pursuant to our Retirement Plan (as defined below).

|

5

ELECTION OF DIRECTORS

(Proposal No. 1)

Our Board of Directors currently consists of 10 directors. Three of our current directors, Edward Grebow, Clifford M. Sobel and Andrew H. Tisch, are not nominated for re-election at the Annual Meeting. Effective at the Annual Meeting, our Board will decrease the number of directors that comprise the entire Board to seven directors. Our Board has nominated the seven remaining directors for re-election at the Annual Meeting, and accordingly, proxies cannot be voted for a greater number of persons than the seven nominees named in this proxy statement. All directors are elected annually to serve until their respective successors are duly elected and qualified at the next annual meeting of stockholders or until their earlier resignation or removal. The names and information regarding our nominees, including their business experience during the past five years and other background information and individual qualifications, attributes and skills, are described below. Each of the seven directors to be elected at the Annual Meeting will serve a term of one year to expire at our 2021 annual meeting of stockholders.

In the absence of contrary instructions, the proxies received from holders of our common stock will be voted at the Annual Meeting for the election of each of the below nominees. Although we do not contemplate that any of the nominees will be unable to serve, decline to serve or otherwise be unavailable as a nominee at the time of the Annual Meeting, if that occurs we expect that the proxies will be voted for such other candidate(s) as our Board of Directors may nominate or our Board may adopt a resolution reducing the number of directors constituting our entire Board.

|

|

|

|

|

|

|

|

|

Name

|

|

Position

|

|

Age as of

January 31, 2020

|

|

Director Since

|

|

James S. Tisch

|

|

Chairman of the Board

|

|

67

|

|

1989

|

|

Marc Edwards

|

|

Director, President and CEO

|

|

59

|

|

2014

|

|

Anatol Feygin

|

|

Director

|

|

51

|

|

2019

|

|

Paul G. Gaffney II

|

|

Director

|

|

73

|

|

2004

|

|

Alan H. Howard

|

|

Director

|

|

60

|

|

2020

|

|

Peter McTeague

|

|

Director

|

|

54

|

|

2020

|

|

Kenneth I. Siegel

|

|

Director

|

|

63

|

|

2014

|

James S. Tisch has served as our Chairman of the Board since 1995. He served as our Chief Executive Officer (which we refer to as CEO) from 1998 to 2008. Mr. Tisch is the President and CEO and a member of the Office of the President of Loews and has been a director of Loews since 1986. Mr. Tisch also serves as a director of General Electric Company and CNA Financial Corporation, a subsidiary of Loews. Mr. Tisch has notified us of his resignation as our Chairman effective at the Annual Meeting, and Mr. Edwards has been elected to serve as our successor Chairman.

Mr. Tisch’s extensive background with our company provides him with unique knowledge of and insight into our business and operations, and enables him to more effectively provide us and our Board with strategic direction and operational oversight. In addition, Mr. Tisch’s status as the President and CEO of Loews, a significant stockholder of our company, enables our Board to have direct access to the perspective of our stockholders and ensures that the Board will take into consideration the interests of our stockholders in all Board decisions.

6

Marc Edwards has served as our President and CEO and as a director since March 2014. Mr. Edwards has been elected to serve as our Chairman of the Board after Mr. Tisch’s resignation as Chairman becomes effective at our Annual Meeting. Prior to joining our company, Mr. Edwards served as a member of Halliburton Company’s Executive Committee and as its Senior Vice President responsible for its Completion and Production Division from 2010 to 2014. He served as Vice President for Production Enhancement of Halliburton Company from 2008 through 2009. Since September 2016, Mr. Edwards has also served as the Lead Director, Chairman of the Compliance Committee and a member of the Audit and Risk, Compensation and Nominating and Corporate Governance Committees of NextTier Oilfield Solutions, Inc. (formerly Keane Group, Inc.), a NYSE-listed integrated well completion service company.

Mr. Edwards developed an extensive background in the global energy industry during his tenure at Halliburton that enables him to provide valuable contributions and perspective to our Board. His broad experience and understanding of the worldwide energy services industry provides valuable insight to our Board’s strategic and other deliberations. In addition, Mr. Edwards’ day-to-day leadership and involvement with our company as our President and CEO provides him with personal knowledge and insight regarding our operations.

Anatol Feygin has served as Executive Vice President and Chief Commercial Officer of Cheniere Energy, Inc., a NYSE-listed international energy company, since September 2016. Mr. Feygin joined Cheniere in March 2014 as Senior Vice President, Strategy and Corporate Development. Prior to joining Cheniere, Mr. Feygin worked with Loews from November 2007 to March 2014, most recently as its Vice President, Energy Strategist and Senior Portfolio Manager. Prior to joining Loews, Mr. Feygin spent three years at Bank of America, most recently as Head of Global Commodity Strategy. Mr. Feygin began his banking career at J.P. Morgan Securities Inc. as Senior Analyst, Natural Gas Pipelines and Distributors.

Mr. Feygin’s experience in the global energy industry enables him to advise our Board on industry issues and perspectives. As a result of his extensive experience in oil and gas executive, corporate development and financial matters, Mr. Feygin is able to provide the Board with expertise in industry corporate leadership, financial management, corporate planning and strategic development.

Paul G. Gaffney II is a retired Navy Vice Admiral and President Emeritus of Monmouth University, having served as President from 2003 to 2013. He was President of the National Defense University from 2000 to 2003. Prior to assuming those duties, Mr. Gaffney was the chief of naval research with responsibility for the Department of the Navy’s science and technology investment and commanded the Navy’s Meteorology and Oceanography program. He was also the commanding officer of the Naval Research Laboratory. Mr. Gaffney was appointed to the U.S. Ocean Policy Commission in 2001 and served during its full tenure from 2001 to 2004. He is a member of the National Academy of Engineering, a private nonprofit institution that advises the federal government and conducts independent studies to examine important topics in engineering and technology, and also served as Chair of the federal Ocean Research/Resources Advisory Panel (ORRAP) and the federal Ocean Exploration Advisory Board. Mr. Gaffney is a fellow in the Urban Coast Institute at Monmouth University and serves as the Counselor to the Dean of Engineering and Computing of the University of South Carolina.

Mr. Gaffney’s military experience, leadership in academia and expertise in ocean policy have provided him with valuable knowledge of the complex management and oversight issues faced by large institutions as well as policy and operational issues affecting the offshore drilling industry. As a result of this knowledge and experience, Mr. Gaffney provides our Board meaningful insights and a unique perspective to benefit the Board’s decision-making processes.

Alan H. Howard is the Managing Partner of Heathcote Advisors, LLC, a financial advisory and investing firm that he formed in 2008. Mr. Howard has also served as a senior advisor at Rossoff & Co., an investment banking and advisory firm, since 2013. From 2012 to 2019, he served as President of Dynatech International/MPX Holdings LLC, a global parts supplier and service provider of U.S. military aircraft and engines, and served as Dynatech International LLC’s Chief Executive Officer from 2015 to 2019 and Vice Chairman in 2019. From 2008 to 2010, Mr. Howard was Managing Partner of S3 Strategic Advisors LLC, a hedge fund advisory business, assisting asset managers with liquidity and capital structure issues through the financial crisis. He currently serves as Lead Director, Chairman of the Compensation Committee and member of the Audit Committee of Movado Group, Inc., a NYSE-listed company where he has served as a director since 1997. Since 2018, Mr. Howard has also served as a director of the BNY Mellon Family of Funds (formerly The Dreyfus Family of Funds), a number of equity, fixed income and money market funds managed by BNY Mellon Investments, an investment advisor.

7

Mr. Howard’s background as a chief executive officer and his experience in the financial sector provide him the necessary skills to lead our Audit Committee. His extensive experience in corporate development, financial services, investment banking and in assisting companies navigate difficult financial times provides our Board with valuable insight and expertise. This experience and knowledge also qualifies him to serve as the financial expert on our Audit Committee.

Peter McTeague is the founder of McMacro Solutions LLC, a consulting firm assisting institutional investors to assess the global macro landscape and interest rate and currency risks. Prior to founding McMacro Solutions LLC in 2018, Mr. McTeague was Head of Global Macro Strategy at Nomura Securities from 2016 to 2017, working closely with global business heads in assessing macro risks and opportunities, and also advising key clients. Prior to joining Nomura, Mr. McTeague was a Managing Director and Rates/Portfolio strategist for the Fortress Macro Fund at Fortress Investment Group LLC from 2008 to 2015, where he played a key role in driving discussion and portfolio construction across a range of firm strategies and was also a member of the Management Committee.

Mr. McTeague has proven experience in G10 markets in assessing the global macro landscape developing actionable strategies in his positions at McMacro Solutions, LLC, Nomura Securities and Fortress Investment Group. His experience in the global markets provides valuable insight and perspective to our Board, including with respect to our international operations.

Kenneth I. Siegel has served as a Senior Vice President of Loews since 2009. He has also served as a director of CNA Financial Corporation, a subsidiary of Loews, since 2019 and as a director of the general partner of Boardwalk Pipeline Partners, LP, a subsidiary of Loews, since 2009 and as its Chairman of the Board since 2011. Mr. Siegel served as a senior investment banker at Barclay’s Capital from 2008 to 2009, and he served in a similar capacity at Lehman Brothers from 2000 to 2008.

Mr. Siegel has extensive experience with capital markets and merger and acquisition transactions as a result of his positions at Loews, Barclay’s Capital and Lehman Brothers. Mr. Siegel’s experience in his position at Loews also provides him with knowledge of the energy industry and broad knowledge of and insight into the operations of Loews and the businesses in which it is engaged, including our company. This experience, combined with his financial and transactional expertise, enables Mr. Siegel to provide effective insight for our Board.

Director Independence

Because more than 50% of our outstanding common stock is currently held by Loews, we are a “controlled company” under the corporate governance listing standards (which we refer to as the NYSE Listing Standards) of the New York Stock Exchange (which we refer to as the NYSE). The NYSE Listing Standards do not require controlled companies to have a majority of independent directors. However, a majority of our Board of Directors is currently comprised of independent directors.

In determining independence, each year our Board determines whether directors have any “material relationship” with our company or with any members of our senior management. On an annual basis, and more frequently as necessary, each director and each executive officer discloses any transactions with our company in which the director or executive officer, or any member of his or her immediate family, has a direct or indirect material interest. When assessing the materiality of a director’s relationship with us, the Board considers all relevant facts and circumstances known to it, not merely from the director’s standpoint, but from that of the persons or organizations with which the director has an affiliation, and the frequency or regularity of the services provided by the director or such other persons or organizations to us or our affiliates, whether the services are being carried out at arm’s length in the ordinary course of business and whether the services are being provided substantially on the same terms to us as those prevailing at the time from unrelated parties for comparable transactions.

The Board has established guidelines to assist it in determining director independence. Under these guidelines, a director would not be considered independent if:

|

|

(1)

|

any of the following relationships existed during the past three years:

|

|

|

(i)

|

the director is our employee or the employee of any of our subsidiaries or has received more than $120,000 per year in direct compensation from us or any of our subsidiaries, other than director and committee fees and pension or certain other forms of deferred compensation for prior service;

|

|

|

(ii)

|

the director provided significant advisory or consultancy services to us or any of our subsidiaries or is affiliated with

|

8

|

|

|

a company or a firm that has provided significant advisory or consultancy services to us or any of our subsidiaries (annual revenue of the greater of 2% of the other company’s consolidated gross revenues or $1 million is considered significant);

|

|

|

(iii)

|

the director has been a significant customer or supplier of ours or any of our subsidiaries or has been affiliated with a company or firm that is a significant customer or supplier of ours or any of our subsidiaries (annual revenue of the greater of 2% of the other company’s consolidated gross revenues or $1 million is considered significant);

|

|

|

(iv)

|

the director has been employed by or affiliated with an internal or external auditor that within the past three years provided services to us or any of our subsidiaries; or

|

|

|

(v)

|

the director has been employed by another company where any of our current executives serve on that company’s compensation committee;

|

|

|

(2)

|

the director’s spouse, parent, sibling, child, mother- or father-in-law, son- or daughter-in-law or brother- or sister-in-law, or any other person sharing the director’s home (other than a domestic employee), has a relationship described in (1) above; or

|

|

|

(3)

|

the director has any other relationships with us or any of our subsidiaries or with any member of our senior management that our Board of Directors determines to be material.

|

After considering all known relevant facts and circumstances and applying the independence guidelines described above, our Board has determined that Messrs. Feygin, Gaffney, Grebow, Howard, McTeague and Sobel (whom we refer to as our Independent Directors) are independent under the NYSE Listing Standards and our independence guidelines.

Board Committees

Our Board of Directors has the following standing committees: the Executive Committee, Audit Committee and Compensation Committee. The current members of these standing Board committees are identified below:

|

|

|

|

|

|

|

|

|

Director

|

|

Executive

Committee

|

|

Audit

Committee

|

|

Compensation

Committee

|

|

James S. Tisch

|

|

*

|

|

|

|

|

|

Marc Edwards

|

|

*

|

|

|

|

|

|

Anatol Feygin

|

|

|

|

*

|

|

*

|

|

Paul G. Gaffney II

|

|

|

|

*

|

|

Chair

|

|

Alan H. Howard

|

|

*

|

|

Chair

|

|

|

|

Peter McTeague

|

|

|

|

|

|

*

|

As a “controlled company” under the NYSE Listing Standards, our Board has not been required to have a nominating committee. Our Board has determined that, because the full Board can perform the same functions that would normally be performed by a nominating committee and because a majority of our Board consists of independent directors, there was no meaningful benefit to having a separate nominating committee. In lieu of a separate nominating committee, our entire Board has performed the usual nominating committee functions, including participation in the consideration of director nominees.

Our Audit and Compensation Committees operate under written charters that describe the functions and responsibilities of each committee. Each charter can be viewed on our website at www.diamondoffshore.com in the “Investor Relations” section under “Corporate Governance.” A copy of each charter can also be obtained by writing to us at Diamond Offshore, Attention: Corporate Secretary, 15415 Katy Freeway, Suite 100, Houston, Texas 77094.

Please note that the preceding Internet address and all other Internet addresses referenced in this proxy statement are for information purposes only and are not intended to be a hyperlink. Accordingly, no information found or provided at such Internet addresses or at our website in general is intended or deemed to be incorporated by reference in this proxy statement.

9

Executive Committee

Our Bylaws describe the functions and responsibilities of the Executive Committee of our Board of Directors. Our Executive Committee is authorized to exercise all of the powers of the Board in the management of our business that may lawfully be delegated to it by the Board.

Audit Committee

The primary function of the Audit Committee is to assist our Board of Directors with its responsibility of overseeing the integrity of our financial statements, our compliance with legal and regulatory requirements, the qualifications and independence of our independent auditor, the performance of our internal audit function and independent auditor and our systems of disclosure controls and procedures, internal control over financial reporting and compliance with our adopted ethical standards. Our internal audit controls function maintains critical oversight over the key areas of our business and financial processes and controls, and provides reports directly to the Audit Committee. The committee has sole authority to directly appoint, retain, compensate, evaluate and terminate the independent auditor and to approve all engagement fees and terms for the independent auditor. The members of the committee meet regularly with representatives of our independent auditor firm and with our manager of internal audit without the presence of management.

Our Board has determined that each member of the Audit Committee is an Independent Director and satisfies the additional independence and other requirements for Audit Committee members provided for in the NYSE Listing Standards and SEC rules. The Board has also determined that Alan H. Howard qualifies as an “audit committee financial expert” under SEC rules.

Compensation Committee

The primary function of the Compensation Committee is to assist our Board of Directors in discharging its responsibilities relating to compensation of our executive officers. The Compensation Committee determines and approves compensation for our executive officers and directors and administers our Incentive Compensation Plan and our Equity Plan. In accordance with its charter, the committee may form and delegate authority to sub-committees consisting of one or more of its members when appropriate. The committee does not delegate to management any of its functions in setting executive compensation under its charter. The committee has authority to retain or obtain advice of outside legal counsel, compensation consultants or other advisors to assist in the evaluation of director, CEO or executive officer compensation, including responsibility for the appointment, compensation and oversight of any such advisor retained by the committee. During 2019, the committee did not engage a compensation advisor in determining or recommending amounts or forms of executive or director compensation. In January 2020, the committee engaged Frederic W. Cook & Co., Inc., a compensation consulting firm (which we refer to as FW Cook), to review and provide advice to the committee regarding our executive and non-employee director compensation programs. In connection with the firm’s engagement, the committee considered the independence of FW Cook in light of SEC rules and the NYSE Listing Standards and concluded that the work of the firm would not raise any conflict of interest. Among the factors considered by the committee in determining the firm’s independence were the following:

|

|

•

|

other services provided to our company by the firm;

|

|

|

•

|

the amount of fees to be paid by us as a percentage of the firm’s total revenues;

|

|

|

•

|

policies or procedures maintained by the firm designed to prevent a conflict of interest;

|

|

|

•

|

business or personal relationships between the individual consultants involved in the engagement and any committee member;

|

|

|

•

|

our common stock owned by the individual consultants involved in the engagement; and

|

|

|

•

|

business or personal relationships between our executive officers and the firm or the individual consultants involved in the engagement.

|

The Compensation Committee completes a review of all elements of compensation at least annually. All compensation decisions with respect to executive officers other than our CEO are determined in discussion with, and frequently based in part upon the recommendation of, our CEO. The committee makes all determinations with respect to the compensation of our CEO, including establishing performance objectives and criteria related to the payment of his compensation, and determining the extent to which such objectives have been achieved. See “Compensation Discussion and Analysis” for more information about the responsibilities of the Compensation Committee and the role of management with respect to compensation matters.

10

Compensation Committee Interlocks and Insider Participation. The members of the Compensation Committee are Paul G. Gaffney II, Anatol Feygin and Peter McTeague. Charles L. Fabrikant was a member of the Compensation Committee in 2019 until his resignation from our Board of Directors as of our 2019 annual meeting of stockholders. Edward Grebow was a member of the Compensation Committee until Mr. McTeague was added to the committee in March 2020. Our Board has determined that each member of the Compensation Committee is independent and satisfies the additional independence requirements for compensation committee members provided for in the NYSE Listing Standards and the SEC rules. No member of the Compensation Committee is, or was during 2019, an officer or employee of the company. During 2019:

|

|

•

|

None of our executive officers served as a member of the compensation committee (or other board committee performing equivalent functions or, in the absence of any such committee, the entire board of directors) of another entity, one of whose executive officers served on our Compensation Committee;

|

|

|

•

|

None of our executive officers served as a director of another entity, one of whose executive officers served on our Compensation Committee; and

|

|

|

•

|

None of our executive officers served as a member of the compensation committee (or other board committee performing equivalent functions or, in the absence of any such committee, the entire board of directors) of another entity, one of whose executive officers served on our Board of Directors.

|

Board Diversity and Director Nominating Process

Our Board of Directors recognizes the benefits of diversity throughout our company and the merits of achieving diversity. In identifying, evaluating and nominating individuals to serve as our directors, including those identified by stockholders, our Board does not have formal diversity requirements or rules. Rather, the Board believes that our company is best served by directors with a wide range of perspectives, professional experience, skills and other individual qualities and attributes. Our Board considers diversity broadly to include diversity of race, ethnicity and gender, as well as diversity of viewpoint, professional experience and individual characteristics, qualities and skills, resulting in the inclusion of naturally varying perspectives among the directors. Our Board also considers whether these capabilities and characteristics will enhance and complement the full Board so that, as a unit, the Board possesses the appropriate skills and experience to oversee the company’s business, ensure consideration of a wide range of perspectives and serve the long-term interests of our stockholders.

Our Board nominees vary in age from 51 to 73 and range in Board tenure from less than one year to 31 years. As described above under our director biographies, the current composition of our Board also reflects a variety of expertise, skills, experience and professional and personal backgrounds, including in the following areas:

|

|

|

|

Company history

|

Offshore oil and gas and oilfield services

|

|

Strategy, leadership and core business skills

|

Public company boards

|

|

Finance and risk management

|

Investment and M&A

|

|

Global energy, business and technology

|

Public policy and government

|

Our Board of Directors will, subject to the terms of our Certificate of Incorporation and Bylaws, review any candidates recommended by stockholders for positions on the Board. Our Bylaws provide that any stockholder entitled to vote generally in the election of directors at a meeting of stockholders who complies with the procedures specified in the Bylaws may nominate persons for election to the Board, subject to any conditions, restrictions and limitations imposed by our Certificate of Incorporation or Bylaws. These procedures include a requirement that our Corporate Secretary receive timely written notice of the nomination, which, for the 2021 annual meeting of stockholders, means that the nomination must be received no later than February 12, 2021. Any notice of nomination must be addressed to Diamond Offshore, 15415 Katy Freeway, Suite 100, Houston, Texas 77094, Attention: Corporate Secretary, and must include, in addition to any other information or matters required by our Certificate of Incorporation or Bylaws:

|

|

•

|

the name and address of the stockholder submitting the nomination and of the person or persons to be nominated;

|

|

|

•

|

a representation that the stockholder is a holder of our capital stock entitled to vote at the meeting and intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice;

|

|

|

•

|

a description of all contracts, arrangements or understandings between the stockholder and each nominee and any other person or persons (naming such person or persons) pursuant to which the nomination or nominations

|

11

|

|

|

are to be made by the stockholder;

|

|

|

•

|

such other information regarding each nominee proposed by the stockholder as would be required to be included in a proxy or information statement filed pursuant to the Exchange Act and the rules and regulations under it; and

|

|

|

•

|

the consent of each nominee to serve as our director if so elected.

|

Nominations of directors may also be made by our Board of Directors or as otherwise provided in our Certificate of Incorporation or Bylaws. In determining whether it will nominate a candidate for a position on our Board, the Board considers those matters it deems relevant, which may include the candidate’s integrity; business specialization; career achievements; breadth of experience; soundness of judgment; ability to make independent analytical inquiries; independence and potential conflicts of interest; potential to meet the present needs of the Board in light of the current mix of director skills and attributes; ability to represent the total corporate interests of our company and our stockholders; and diversity of race, ethnicity and gender. While our Board believes that its current membership comprises a variety of perspectives, professional experience, skills and other qualities and attributes, the Board is committed to efforts to increase diversity and will continue to consider diversity of race, ethnicity and gender among other relevant factors when assessing individual candidates and nominees to fill Board vacancies that occur in the future.

Majority Vote Standard for Election of Directors

Our Bylaws require a mandatory majority voting, director resignation procedure. A nominee for director in an uncontested election (such as this one) will be elected to the Board if all votes cast for that nominee’s election exceed the votes cast against his or her election. In the event that an incumbent director nominee does not receive a majority of the votes cast, the Board will require that director to tender his or her resignation and will establish a committee to consider whether to accept or reject the resignation. The Board will act on the committee’s recommendation and publicly disclose its decision.

Executive Sessions of Non-Management Directors

Our non-management directors, our Independent Directors and each of the Audit Committee and the Compensation Committee meet regularly in executive sessions without the presence of management. Upon the recommendation of the non-management directors and Independent Directors, our Board of Directors has selected Alan H. Howard to act as the Lead Director and to serve as the presiding director at meetings of our non‐management directors and our Independent Directors.

Board Leadership Structure

Our Board’s leadership structure consists of a Chairman of the Board, a Lead Director and independent Audit Committee and Compensation Committee chairs. James S. Tisch currently serves as our Chairman of the Board. Mr. Tisch has resigned as Chairman effective at our Annual Meeting, and Marc Edwards, our President and Chief Executive Officer, has been elected to serve as our successor Chairman of the Board. Alan H. Howard is our Lead Director, whose role is to chair meetings of the non-management directors, facilitate the ability of the non-management directors to fulfill their responsibilities and provide a structure for communicating any concerns of the non-management directors to the full Board and to our executive management. The Board believes this structure provides independent Board leadership and engagement and strong oversight of management while providing the benefit of having the Chairman lead regular Board meetings as we discuss key business and strategic issues and set the agenda for Board meetings. Although in the recent past prior to the Annual Meeting, our Board has separated the roles of CEO and Chairman of the Board, our Board has elected to combine those roles effective at the Annual Meeting. Our Board believes this leadership structure is appropriate because our CEO is closely involved in the day-to-day operations of our company and is well positioned to elevate critical business issues for consideration by the Board, and combining these positions allows him to more effectively execute our strategic initiatives and business plans and confront the challenges facing our company during these depressed market conditions. The Board has no fixed policy with respect to combining or separating the positions. The Board has exercised its discretion in combining or separating the positions as it has deemed appropriate in light of prevailing circumstances, and the Board may in the future reevaluate this determination.

Board Oversight of Risk Management

Our Board recognizes the importance of understanding, evaluating and managing risk and its impact on the financial health of our company. Our management periodically has discussions with our Board, Audit Committee and Compensation Committee to,

12

among other things, assist in identifying the principal risks facing our company, identifying and evaluating policies and practices that promote a culture designed to appropriately balance risk and reward, and evaluating risk management practices. These opportunities to interact enable the non-management directors to conduct meaningful discussions concerning these issues with senior management during Board, Audit Committee and Compensation Committee meetings.

Our Board oversees an enterprise-wide approach to risk management, designed to support the achievement of organizational objectives, including strategic objectives, long-term organizational performance and enhanced stockholder value. A fundamental component of risk management is not only understanding the risks and the measures management is taking to manage the risks, but also understanding what level of risk is appropriate for the company. The involvement of the full Board in setting our business strategy is a key part of the Board’s assessment of the company’s tolerance for risk. The Board also regularly reviews information regarding the company’s credit, liquidity and operations, as well as the associated risks. While the Board has the ultimate oversight responsibility for the risk management process, committees of the Board and the company’s management also share responsibility for risk management. In particular, the Audit Committee focuses on financial risk, including internal controls, and discusses risk assessment with management and our internal and external auditors. In addition, in setting compensation, the Compensation Committee endeavors to create incentives that encourage a level of risk-taking behavior consistent with the company’s business strategies and long-term stockholder value. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board is regularly informed about such risks.

Director Attendance at Meetings

During 2019, our Board of Directors held four meetings, our Audit Committee held eight meetings and our Compensation Committee held three meetings. Our Executive Committee did not meet during 2019. The rate of attendance by our directors at Board and committee meetings during 2019 was 100%, and all of our directors attended all meetings of the Board and committees on which they served. We do not require our Board members to attend our annual meeting of stockholders; however, all directors then in office were present at our annual meeting held in May 2019.

Director Compensation

Our Board of Directors has delegated to our Compensation Committee, which is comprised solely of independent directors, the primary responsibility for reviewing and considering revisions to our director compensation program. In setting director compensation, the committee considers the amount of time our directors expend in fulfilling their duties as well as the skill level required of members of our Board. The committee’s goal is to compensate our non-employee directors in a way that is competitive and attracts and retains directors of a high caliber.

During 2019, we compensated our non-employee directors with a combination of cash and SARs awards. Mr. Edwards, our President and CEO, did not receive any cash or equity fee or other remuneration for his service as a director. In addition, during 2019 employees of Loews who are also directors did not receive any cash fee for services as members of our Board. During 2019, we paid each of our eligible non-employee directors a cash retainer of $50,000 per year, paid in quarterly installments. In addition, the Chairman of the Audit Committee received an annual cash retainer of $15,000, the Chairman of the Compensation Committee received an annual cash retainer of $10,000 and the Lead Director received an annual cash retainer of $10,000. We also paid each of our qualified non-employee directors a cash fee of $1,500 for each Board meeting attended and $1,000 for each meeting of the Audit or Compensation Committees attended, and we reimbursed all reasonable out-of-pocket expenses that each director incurred attending Board meetings. During 2019, each member of our Board who was not also employed by our company received an award of 1,000 SARs each quarter. The SARs awarded to non-employee directors during 2019 vested immediately upon grant and have a term of 10 years from the date of grant.

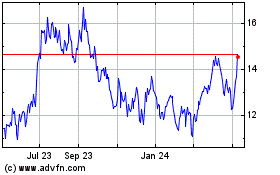

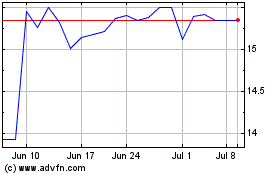

Beginning in 2014, oil prices declined significantly and have remained volatile, and the offshore drilling market has remained oversupplied with available offshore drilling rigs. These market factors resulted in a sharp decline in the demand for offshore drilling services, including services that we provide, as well as a significant decline in dayrates for contract drilling services. The decline in demand for contract drilling services and the dayrates for those services has adversely affected our financial condition, results of operations and cash flows and has resulted in a substantial and protracted decline in our stock price. As a result, our equity-based compensation programs have become ineffective in achieving their intended reward, retention and incentive goals.

13

In January 2020, the Compensation Committee engaged FW Cook to provide advice to the committee regarding our executive and non-employee director compensation programs, particularly focusing on ways to restructure the programs to render them more effective in a period of prolonged market duress. As part of its analysis and evaluation, the committee considered the results of the independent analysis completed by FW Cook, which included a review of non-employee director compensation trends and data from comparable oilfield services companies and controlled companies and also included advice and recommendations for restructuring our compensation programs to more effectively compensate and promote retention and incentives in our protracted depressed market environment.

In 2020, FW Cook determined that the value of our compensation program for non-employee directors was low compared to other comparable companies and that our declining market environment had rendered our use of SARs for director compensation to be ineffective. Pursuant to this compensation review process, and after considering FW Cook’s advice and recommendations for changes to make our compensation program more effective, the committee made the following changes to our non-employee director compensation commencing on April 1, 2020:

|

|

•

|

the annual cash retainer for non-employee directors was increased to $150,000, paid in quarterly installments;

|

|

|

•

|

the annual cash retainer for the Chairman of the Audit Committee was increased to $25,000;

|

|

|

•

|

the annual cash retainers for the Chairman of the Compensation Committee and the Lead Director remained at $10,000;

|

|

|

•

|

fees for Board meeting attendance were eliminated; and

|

|

|

•

|

non-employee directors will receive a grant of immediately-vested RSUs each quarter with a grant date value of $12,500.

|

Director Compensation for 2019

The following table summarizes the compensation earned by our non-employee directors in 2019:

|

Name(1)

|

|

Fees Earned or

Paid in Cash ($)

|

|

Option Awards

($)(2)

|

|

All Other

Compensation ($)

|

|

Total ($)

|

|

James S. Tisch

|

|

--

|

|

15,000

|

|

--

|

|

15,000

|

|

Charles L. Fabrikant

|

|

21,500

|

|

7,757

|

|

--

|

|

29,257

|

|

Anatol Feygin

|

|

33,000

|

|

7,244

|

|

--

|

|

40,244

|

|

Paul G. Gaffney II

|

|

77,000

|

|

15,000

|

|

--

|

|

92,000

|

|

Edward Grebow

|

|

92,000

|

|

15,000

|

|

--

|

|

107,000

|

|

Kenneth I. Siegel

|

|

--

|

|

15,000

|

|

--

|

|

15,000

|

|

Clifford M. Sobe

|

|

56,000

|

|

15,000

|

|

--

|

|

71,000

|

|

Andrew H. Tisch

|

|

--

|

|

15,000

|

|

--

|

|

15,000

|

_____________

|

|

(1)

|

Mr. Fabrikant served as a director until our 2019 annual meeting held in May 2019. Mr. Feygin was initially elected as a director at our 2019 annual meeting held in May 2019. Messrs. Howard and McTeague were elected to the Board in March 2020 and therefore are not included in this table. Marc Edwards, our President and CEO, is not included in this table because he was an employee of our company during 2019, and therefore received no compensation for his services as director. The compensation received by Mr. Edwards as an employee of the company during 2019 is shown in the 2019 Summary Compensation Table below.

|

|

|

(2)

|

These amounts represent the aggregate grant date fair value of awards of SARs granted pursuant to our Equity Plan for the year ended December 31, 2019, computed in accordance with the Financial Accounting Standards Board’s Accounting Standards Codification Topic 718 (which we refer to as FASB ASC Topic 718). Assumptions used in the calculation of dollar amounts of these awards are included in Note 5, Stock-Based Compensation, to our audited consolidated financial statements for the fiscal year ended December 31, 2019 included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, which has been filed with the SEC.

|

14

As of December 31, 2019, these non-employee directors held the following outstanding company equity awards:

|

|

|

|

|

|

|

Name

|

|

Unexercised

Option Awards(#)

|

|

|

James S. Tisch

|

|

254,500

|

|

|

|

Charles L. Fabrikant

|

|

24,000

|

|

|

|

Anatol Feygin

|

|

2,000

|

|

|

|

Paul G. Gaffney II

|

|

36,000

|

|

|

|

Edward Grebow

|

|

36,000

|

|

|

|

Kenneth I. Siegel

|

|

23,000

|

|

|

|

Clifford M. Sobel

|

|

32,500

|

|

|

|

Andrew H. Tisch

|

|

33,000

|

|

|

Code of Ethics and Corporate Governance Guidelines

We have a Code of Business Conduct and Ethics that applies to all of our directors, officers and employees, including our principal executive officer, principal financial officer and principal accounting officer. Our code can be found on our website at www.diamondoffshore.com in the “Investor Relations” section under “Corporate Governance” and is available in print to any stockholder who requests a copy by writing to our Corporate Secretary. We intend to post any changes to or waivers of our code for our principal executive officer, principal financial officer and principal accounting officer on our website.

In addition, our Board of Directors has adopted written Corporate Governance Guidelines to assist our directors in fulfilling their responsibilities. The guidelines are on our website at www.diamondoffshore.com in the “Investor Relations” section under “Corporate Governance” and are available in print to any stockholder who requests a copy from our Corporate Secretary.

Environmental, Social and Governance (ESG) Issues

We recognize the importance of identifying, assessing and promoting ESG issues as a fundamental part of conducting business. Our Purpose–Mission–Vision–Values & Behaviors stated on our website at www.diamondoffshore.com in the “About Us” section stresses the importance of these elements. Our company’s Purpose is “To responsibly unlock energy.” Our Mission (“With respect for the lives we touch and the impact we make, we deliver fresh perspectives to anticipating and solving complex deepwater challenges”) and Vision (“We see a world in which affordable and plentiful energy is delivered safely from the deepest waters”) expressly acknowledge the impact we have on the world around us. This recognition and commitment is the foundation for our company’s global culture, which is shaped by our Values & Behaviors – Take Ownership, Go Beyond, Have Courage, Exercise Care and Win Together. This approach helps strengthen the ties between our success and the well-being of our employees, stockholders and other stakeholders and the communities where we live and work.

We believe that diverse ecosystems and healthy natural resources – fresh water, oceans and air – are critical components of our society and economy. We continually seek opportunities to improve our operational sustainability. We have a long history and tradition of acting in a responsible and ethical manner and being actively and positively present in the communities where we operate. We do not tolerate discrimination or harassment. We foster an environment where all employees are given the tools to succeed and to contribute to the community through meaningful community and volunteer activities. We are committed to high standards of corporate governance, including a strong Board of Directors, a robust ethics and compliance program and a compensation framework that incentivizes our long-term financial success and does not motivate taking unreasonable risks.

Additional details regarding some of our ESG programs and efforts can be found on our website at www.diamondoffshore.com in the “HSE Excellence” section. Our UK Gender Pay Gap Report and Slavery and Human Trafficking Statement can be found on our website at www.diamondoffshore.com in the “Investor Relations” section under “Corporate Governance.” Maintaining an open dialogue with stakeholders is a key part of improving our understanding and promotion of ESG principles in our business, and we welcome further engagement.

Loans to Directors and Executive Officers

We comply and operate in a manner consistent with regulations prohibiting loans to our directors and executive officers.

15

Prohibitions Against Hedging and Pledging

We have a policy that prohibits our directors and employees (including our executive officers) from engaging in any hedging or short sale transactions related to our stock or other equity securities, thereby preventing our directors, executives and other employees from insulating themselves from the effects of poor stock performance. This policy does not apply to stock or other equity securities of Loews or any of its other subsidiaries. We also have a policy that prohibits our directors and employees (including our executive officers) from pledging our stock or other securities as collateral for a loan.

Reporting of Ethics and Compliance Concerns

We have a dedicated hotline and website available to all employees to report ethics and compliance concerns, anonymously if preferred, including concerns related to accounting, accounting controls, financial reporting and auditing matters. The hotline and website are administered and monitored by an independent monitoring company. A description of our procedures for confidential anonymous complaints regarding accounting, internal accounting controls and auditing matters can be found on our website at www.diamondoffshore.com in the “Investor Relations” section under “Corporate Governance - Confidential Reporting” and is available in print to any stockholder who requests a copy from our Corporate Secretary.

Public Policy Engagement and Political Activities

In recent years, we have not engaged in public policy or political activities, and we have not made corporate political contributions. Our company and some of our employees participate in industry and business trade groups that may engage in their own lobbying or other advocacy activities.

Transactions with Related Persons

We have a written policy requiring that any transaction, regardless of the size or amount, involving us or any of our subsidiaries in which any of our directors, director nominees, executive officers, principal stockholders or any of their immediate family members has had or will have a direct or indirect material interest, be reviewed and approved or ratified by our Audit Committee. All such transactions must be submitted to our General Counsel for review and reported to our Audit Committee for its consideration. In each case, the Audit Committee will consider, in light of all of the facts and circumstances known to it that it deems relevant, whether the transaction is fair and reasonable to our company.