Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

October 07 2022 - 3:47PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Issuer

Pursuant To Rule 13a-16 Or 15d-16 of the

Securities Exchange Act of 1934

For the month of October 2022

Commission File Number: 333-251238

COSAN S.A.

(Exact name of registrant as specified in its charter)

N/A

(Translation of registrant’s name into English)

Av. Brigadeiro Faria Lima, 4100, – 16th floor

São Paulo, SP 04538-132 Brazil

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40‑F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ☐ No ☒

COSAN S.A.

CNPJ nº 50.746.577/0001-15

NIRE 35.300.177.045

Listed Company

MATERIAL FACT

Cosan S.A. (B3: CSAN3; NYSE: CSAN) ("Cosan" or "Company"), in compliance with the provisions of CVM Resolution No. 44 of August 23, 2021, informs its shareholders and the market in general that, through a subsidiary and a combination of direct investments (equity) and derivative operations, it has acquired a stake corresponding to approximately 4.90% of the total common shares (ex treasury) issued by Vale S.A. ("Vale").

The Company also informs that it intends to increase its interest above the percentage already acquired and will immediately seek approval from the Administrative Council for Economic Defense (CADE). Until CADE's decision, the Company will be exposed to an additional and exclusively financial position of 1.6% of Vale's equity through a derivative transaction that is different from the one used for the acquisition, which might be converted into direct acquisition with CADE’s approval.

This move is another step in the Company's portfolio diversification journey, investing in irreplicable assets in sectors that Brazil has a clear competitive advantage.

The operation was financed by a combination of credit lines, including the private issuance of commercial notes, and financing related to derivative instruments.

Cosan will host today at 7:00 p.m. (Brazilian Time) a public conference call with the market to present the transaction. Participants in the conference call must register through the link available on the Company's investor relations website (or click here).

Cosan will keep its shareholders and the market duly informed of any new information regarding the matter dealt with in this Material Fact.

Sao Paulo, October 7, 2022

Ricardo Lewin

Chief Financial and Investor Relations Officer

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: October 07, 2022

|

COSAN S.A.

|

|

| By: |

/s/ Ricardo Lewin |

|

Name: Ricardo Lewin |

|

Title: Chief Financial Officer |

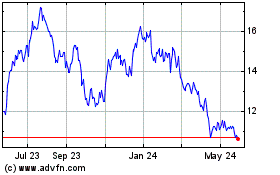

Cosan (NYSE:CSAN)

Historical Stock Chart

From Nov 2024 to Dec 2024

Cosan (NYSE:CSAN)

Historical Stock Chart

From Dec 2023 to Dec 2024