Buenaventura Announces First Quarter 2022 Production and Volume Sold per Metal Results

April 21 2022 - 5:13PM

Business Wire

Compañia de Minas Buenaventura S.A.A. (“Buenaventura” or

“the Company”) (NYSE: BVN; Lima Stock Exchange: BUE.LM), Peru’s

largest publicly-traded precious metals mining company, today

announced 1Q22 results for production and volume sold.

1Q22 Production per Metal

(100% basis)

1Q22 (Actual)

2022 Guidance (1) (2)

Gold (Oz.)

Orcopampa

19,031

57k - 65k

Tambomayo

13,867

45k - 50k

La Zanja

5,900

37k - 45k

Coimolache

19,512

75k - 80k

El Brocal

4,350

10k - 13k

Silver (Oz.)

Uchucchacua

0

0

El Brocal

1,059,666

4.2M - 4.8M

Tambomayo

419,396

1.8M - 2.4M

Julcani

661,132

2.2M - 2.5M

Lead (MT) El

Brocal

2,497

7.0k - 10.0k

Uchucchacua

0

0

Tambomayo

2,509

4.0k - 6.0k

Zinc (MT)

El Brocal

8,772

18.0k - 22.0k

Uchucchacua

0

0

Tambomayo

3,543

5.0k - 7.0k

Copper (MT)

El Brocal

10,159

40.0k - 45.0k

1.

2022 outlook projections shown

above are considered forward-looking statements and represent

management’s good faith estimates or expectations of future

production results as of April 2022.

2.

Please consider that this

guidance could potentially be adversely impacted due to further

effects related to COVID-19.

1Q22 Comments

Tambomayo:

- 1Q22 gold production exceeded first quarter 2022 projections

due to a.) gold grade which was higher than anticipated and b.)

production from a high-grade pillar which was carried forward from

the fourth quarter 2021 to the first quarter 2022.

- 1Q22 silver production was below projections, partially offset

by higher zinc and lead production for the quarter.

Orcopampa:

- 1Q22 gold production was above projections for the quarter due

to higher than anticipated tonnage and grade

Coimolache:

- 1Q22 gold production was above projections for the quarter

primarily due to favorable geological reconciliation of both

increased tonnage and grade

La Zanja:

- 1Q22 gold production was below projections for the quarter due

to lower than expected haulage fleet performance due to Peru’s

rainy season.

Julcani:

- 1Q22 silver production was above projections for the quarter

due to higher than anticipated grade.

Uchucchacua:

- Exploration tunneling and diamond drilling continues according

to plan with an emphasis on the Nora-Geraldine orebody.

- Yumpag mine development began ramp-up during 1Q22 with a new

contractor, also with exploration progressing as planned for the

Camila and Tomasa orebodies.

El Brocal:

- Copper, lead and zinc production was in line with expectations

for 1Q22.

- Silver production was below projections for the quarter due to

lower than expected open pit grades.

- A landslide within the mine’s open pit occurred on March 19,

2022 resulting in the death of 3 workers. The exact cause of the

landslide is under further investigation.

1Q22 Payable Volume Sold

1Q22 Volume Sold per Metal

(100% basis)

1Q22 (Actual)

Gold (Oz.) Orcopampa

19,307

Tambomayo

12,181

La Zanja

5,773

Coimolache

20,586

El Brocal

2,907

Silver (Oz.) Uchucchacua

18,730

El Brocal

852,933

Tambomayo

351,077

Julcani

636,303

Lead (MT)

El Brocal

2,239

Uchucchacua

0

Tambomayo

2,275

Zinc (MT) El Brocal

7,256

Uchucchacua

0

Tambomayo

2,922

Copper (MT) El Brocal

9,697

Realized Metal Prices*

1Q22 (Actual)

Gold (Oz)

1,896

Silver (Oz)

24.10

Lead (MT)

2,363

Zinc (MT)

4,105

Copper (MT)

9,950

*Buenaventura consolidated figures.

Appendix

1. 1Q22 Production per Metal

1Q22 (Actual)

Silver (Oz.)

Orcopampa

7,856

La Zanja

23,363

Coimolache

77,195

Lead (MT)

Julcani

99

2. 1Q22 Volume Sold per Metal

1Q22 (Actual)

Silver (Oz.)

Orcopampa

6,928

La Zanja

21,818

Coimolache

96,634

Lead (MT)

Julcani

76

Company Description Compañía de Minas Buenaventura S.A.A.

is Peru’s largest, publicly traded precious and base metals Company

and a major holder of mining rights in Peru. The Company is engaged

in the exploration, mining development, processing and trade of

gold, silver and other base metals via wholly-owned mines and

through its participation in joint venture projects. Buenaventura

currently operates several mines in Peru (Orcopampa*, Uchucchacua*,

Julcani*, Tambomayo*, La Zanja*, El Brocal and Coimolache).

The Company owns 19.58% of Sociedad Minera Cerro Verde, an

important Peruvian copper producer (a partnership with

Freeport-McMorRan Inc. and Sumitomo Corporation).

For a printed version of the Company’s 2019 Form 20-F, please

contact the persons indicated above, or download a PDF format file

from the Company’s web site.

(*) Operations wholly owned by Buenaventura

Note on Forward-Looking Statements This press release may

contain forward-looking information (as defined in the U.S. Private

Securities Litigation Reform Act of 1995) that involve risks and

uncertainties, including those concerning Cerro Verde’s costs and

expenses, results of exploration, the continued improving

efficiency of operations, prevailing market prices of gold, silver,

copper and other metals mined, the success of joint ventures,

estimates of future explorations, development and production,

subsidiaries’ plans for capital expenditures, estimates of reserves

and Peruvian political, economic, social and legal developments.

These forward-looking statements reflect the Company’s view with

respect to Cerro Verde’s future financial performance. Actual

results could differ materially from those projected in the

forward-looking statements as a result of a variety of factors

discussed elsewhere in this Press Release.

Company Website: www.buenaventura.com.pe/ir

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220421006028/en/

Contacts in Lima: Daniel Dominguez, Chief Financial Officer

(511) 419 2540

Gabriel Salas, Head of Investor Relations (511) 419 2591 /

Gabriel.salas@buenaventura.pe

Contacts in NY: Barbara Cano (646) 452 2334

barbara@inspirgroup.com

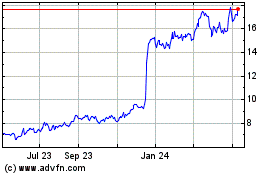

Compania De Minas Buenav... (NYSE:BVN)

Historical Stock Chart

From Dec 2024 to Jan 2025

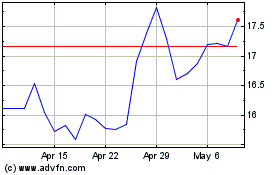

Compania De Minas Buenav... (NYSE:BVN)

Historical Stock Chart

From Jan 2024 to Jan 2025