16% Increase in Silver Reserves and 12%

Increase in Gold Reserves Extends Coeur’s Operating Profile

Coeur Mining, Inc. (“Coeur” or the “Company”)

(NYSE:CDE)(TSX:CDM) announced contained ounces of proven and

probable mineral reserves totaling approximately 255.4 million

silver ounces and 2.2 million gold ounces, representing increases

of 15.9% and 12.3%, respectively, compared to year-end 2012. These

gains are net of the 17.0 million ounces of silver and 262,217

ounces of gold produced during 2013. In addition to these reserves,

Coeur announced measured and indicated mineral resources totaling

approximately 386.3 million silver ounces and 2.5 million gold

ounces, up 26.6% and 1.4%, respectively, compared to year-end

2012.

Highlights

(All comparisons below refer to year-end 2013 compared with

year-end 2012)

- Proven and probable silver reserves

increased 15.9% to 255.4 million ounces

- 26.6% increase in measured and

indicated silver resources to 386.3 million ounces

- Proven and probable gold reserves

increased 12.3% to 2.2 million ounces

- 1.4% increase in measured and indicated

gold resources to 2.5 million ounces

- Inferred silver resources increased

45.5% to 96.4 million ounces

- Inferred gold resources increased 36.5%

to 1.1 million ounces

Mitchell J. Krebs, Coeur’s President and Chief Executive

Officer, said, “For the past several years, our main focus has been

to get all four of our mines up and running consistently. 2012 was

the first year we devoted significant capital to exploration and we

are starting to see the fruits of these efforts. We have spent $74

million in exploration expenditures over the past two years and

will continue to fund exploration activities using a success-based

approach focused on resource conversion. We believe a robust

exploration program represents a high-return use of our capital

based on the results we have achieved.

“In 2014, we plan to invest $23 - $28 million in exploration,

including approximately $10 million in capitalized drilling, but

may increase this budget if we receive positive drill results that

warrant further exploration activity. We are continuing a targeted

focus on resource conversion at Palmarejo, which we believe holds

considerable opportunity for new sources of production.”

Please refer to the tables in the Appendix for tons and average

grades associated with references of contained ounces in each

category in this news release. All reserves and resources reported

herein comply with Canadian National Instrument 43-101 (“NI

43-101”).

About Coeur

Coeur Mining is the largest U.S.-based primary silver producer

and a significant gold producer. The Company has four precious

metals mines in the Americas generating strong production, sales

and cash flow in continued robust metals markets. Coeur produces

from its wholly owned operations: the Palmarejo silver-gold mine in

Mexico, the San Bartolomé silver mine in Bolivia, the Rochester

silver-gold mine in Nevada and the Kensington gold mine in Alaska.

The Company also has a non-operating interest in the Endeavor mine

in Australia in addition to net smelter royalties on the Cerro Bayo

mine in Chile, the El Gallo complex in Mexico, and the Zaruma mine

in Ecuador. In addition, the Company has two silver-gold

feasibility stage projects - the La Preciosa project in Mexico and

the Joaquin project in Argentina. The Company also conducts ongoing

exploration activities in Alaska, Argentina, Bolivia, Mexico, and

Nevada. The Company owns strategic investment positions in eight

silver and gold development companies with projects in North and

South America.

Cautionary Statement

This news release contains forward-looking statements within the

meaning of securities legislation in the United States and Canada,

including statements regarding mineral reserve and resource

estimates, exploration expenditures, exploration and development

efforts, and expectations regarding new sources of production. Such

forward-looking statements involve known and unknown risks,

uncertainties and other factors which may cause Coeur's actual

results, performance or achievements to be materially different

from any future results, performance or achievements expressed or

implied by the forward-looking statements. Such factors include,

among others, the risks and hazards inherent in the mining business

(including risks inherent in developing large-scale mining

projects, environmental hazards, industrial accidents, weather or

geologically related conditions), changes in the market prices of

gold and silver and a sustained lower price environment, the

uncertainties inherent in Coeur's production, exploratory and

developmental activities, including risks relating to permitting

and regulatory delays, ground conditions, grade variability, any

future labor disputes or work stoppages, the uncertainties inherent

in the estimation of gold and silver ore reserves, changes that

could result from Coeur's future acquisition of new mining

properties or businesses, reliance on third parties to operate

certain mines where Coeur owns silver production and reserves and

the absence of control over mining operations in which Coeur or its

subsidiaries hold royalty or streaming interests and risks related

to these mining operations including results of mining and

exploration activities, environmental, economic and political risks

of the jurisdiction in which the mining operations are located, the

loss of any third-party smelter to which Coeur markets silver and

gold, the effects of environmental and other governmental

regulations, the risks inherent in the ownership or operation of or

investment in mining properties or businesses in foreign countries,

Coeur's ability to raise additional financing necessary to conduct

its business, make payments or refinance its debt, as well as other

uncertainties and risk factors set out in filings made from time to

time with the United States Securities and Exchange Commission, and

the Canadian securities regulators, including, without limitation,

Coeur's most recent reports on Form 10-K and Form 10-Q. Actual

results, developments and timetables could vary significantly from

the estimates presented. Readers are cautioned not to put undue

reliance on forward-looking statements. Coeur disclaims any intent

or obligation to update publicly such forward-looking statements,

whether as a result of new information, future events or otherwise.

Additionally, Coeur undertakes no obligation to comment on

analyses, expectations or statements made by third parties in

respect of Coeur, its financial or operating results or its

securities.

W. David Tyler, Coeur's Vice President, Technical Services and a

qualified person under Canadian National Instrument 43-101,

supervised the preparation of the scientific and technical

information concerning Coeur's mineral projects in this news

release. For a description of the key assumptions, parameters and

methods used to estimate mineral reserves and resources, as well as

data verification procedures and a general discussion of the extent

to which the estimates may be affected by any known environmental,

permitting, legal, title, taxation, socio-political, marketing or

other relevant factors, please see the Technical Reports for each

of Coeur's properties as filed on SEDAR at www.sedar.com.

Cautionary Note to U.S. Investors - The United States Securities

and Exchange Commission permits U.S. mining companies, in their

filings with the SEC, to disclose only those mineral deposits that

a company can economically and legally extract or produce. We may

use certain terms in public disclosures, such as "measured,"

"indicated," "inferred” and “resources," that are recognized by

Canadian regulations, but that SEC guidelines generally prohibit

U.S. registered companies from including in their filings with the

SEC. U.S. investors are urged to consider closely the disclosure in

our Form 10-K which may be secured from us, or from the SEC's

website at http://www.sec.gov.

Table 1: 2013

Proven and Probable Reserves

GRADE (Oz/Ton) OUNCES

LOCATION SHORT TONS SILVER

GOLD SILVER GOLD PROVEN RESERVES

Rochester Nevada, USA 132,188,000 0.53 0.004 69,915,000 551,000

Martha Argentina — — — — — San Bartolomé Bolivia 1,206,000 2.87 —

3,456,000 — Kensington Alaska, USA 354,000 — 0.243 — 86,000

Endeavor Australia 2,646,000 2.58 — 6,820,000 — Palmarejo Mexico

5,100,000 3.68 0.050 18,762,000 256,000 Joaquin Argentina — — — — —

La Preciosa Mexico — — —

— —

Total 141,494,000

98,953,000 893,000

PROBABLE RESERVES Rochester Nevada, USA 55,046,000 0.57

0.002 31,454,000 130,000

Martha

Argentina — — — — — San Bartolomé Bolivia 39,700,000 2.52 —

100,072,000 — Kensington Alaska, USA 5,662,000 — 0.158 — 897,000

Endeavor Australia 1,433,000 1.41 — 2,026,000 — Palmarejo Mexico

6,135,000 3.73 0.051 22,891,000 313,000 Joaquin Argentina — — — — —

La Preciosa Mexico — — —

— —

Total 107,976,000

156,443,000

1,340,000 PROVEN AND PROBABLE RESERVES Rochester

Nevada, USA 187,234,000 0.54 0.004 101,369,000 681,000 Martha

Argentina — — — — — San Bartolomé Bolivia 40,906,000 2.53 —

103,528,000 — Kensington Alaska, USA 6,016,000 — 0.163 — 983,000

Endeavor Australia 4,079,000 2.17 — 8,846,000 — Palmarejo Mexico

11,235,000 3.71 0.051 41,653,000 569,000 Joaquin Argentina — — — —

— La Preciosa Mexico — — —

— —

Total Proven and Probable

249,470,000

255,396,000 2,233,000

Table 2: 2013

Measured and Indicated Resources (Excluding Proven and Probable

Reserves)

GRADE (Oz/Ton) OUNCES

LOCATION SHORT TONS SILVER

GOLD SILVER GOLD MEASURED RESOURCES

Rochester Nevada, USA 66,190,000 0.45 0.003 29,860,000 186,000

Martha Argentina — — — — — San Bartolomé Bolivia — — — — —

Kensington Alaska, USA 387,000 — 0.238 — 92,000 Endeavor Australia

6,724,000 2.33 — 15,690,000 — Palmarejo Mexico 4,507,000 6.27 0.095

28,238,000 429,000 Joaquin Argentina 5,865,000 4.62 0.003

27,106,000 19,000 La Preciosa Mexico 11,119,000

2.78 0.005 30,856,000 58,000

Total 94,792,000

131,750,000 784,000 INDICATED

RESOURCES Rochester Nevada, USA 75,532,000 0.42 0.004

31,893,000 268,000

Martha

Argentina 57,000 13.60 0.018 775,000 1,000 San Bartolomé Bolivia

17,015,000 2.17 — 36,869,000 — Kensington Alaska, USA 2,299,000 —

0.206 — 474,000 Endeavor Australia 8,267,000 2.51 — 20,737,000 —

Palmarejo Mexico 21,795,000 1.33 0.033 28,950,000 711,000 Joaquin

Argentina 11,098,000 3.39 0.004 37,670,000 41,000 Lejano Argentina

1,233,000 2.42 0.008 2,983,000 10,000 La Preciosa Mexico

38,231,000 2.48 0.004 94,670,000

172,000

Total 175,527,000

254,547,000

1,677,000 MEASURED AND INDICATED RESOURCES Rochester

Nevada, USA 141,722,000 0.44 0.003 61,753,000 454,000 Martha

Argentina 57,000 13.60 0.018 775,000 1,000 San Bartolomé Bolivia

17,015,000 2.17 — 36,869,000 — Kensington Alaska, USA 2,686,000 —

0.211 — 566,000 Endeavor Australia 14,991,000 2.43 — 36,427,000 —

Palmarejo Mexico 26,302,000 2.17 0.043 57,188,000 1,140,000 Joaquin

Argentina 16,963,000 3.82 0.004 64,776,000 60,000 Lejano Argentina

1,233,000 2.42 0.008 2,983,000 10,000 La Preciosa Mexico

49,350,000 2.54 0.005

125,526,000 230,000

Total Measured and Indicated

270,319,000

386,297,000 2,461,000

Table 3: 2013

Inferred Resources

GRADE (Oz/Ton) OUNCES

LOCATION SHORT TONS SILVER

GOLD SILVER GOLD INFERRED RESOURCES

Rochester Nevada, USA 37,365,000 0.62 0.003 23,295,000 101,000

Martha Argentina 204,000 4.75 0.005 969,000 1,000 San Bartolomé

Bolivia 3,683,000 1.26 — 4,638,000 — Kensington Alaska, USA

1,014,000 — 0.259 — 263,000 Endeavor Australia 1,653,000 2.86 —

4,726,000 — Palmarejo Mexico 11,611,000 1.91 0.053 22,188,000

621,000 Joaquin Argentina 1,022,000 3.02 0.004 3,084,000 4,000

Lejano Argentina 3,307,000 1.73 0.006 5,713,000 19,000 La Preciosa

Mexico 16,791,000 1.89 0.003

31,810,000 49,000

Total Inferred

76,650,000

96,423,000 1,058,000 Notes to the above

mineral reserves and resources: 1. Effective December 31,

2013 except Endeavor, effective June 30, 2013. 2. Metal prices used

for mineral reserves were $25.00 per ounce of silver and $1,450 per

ounce of gold, except Endeavor, at $2,300 per metric ton of lead,

$2,300 per metric ton of zinc, and $34.00 per ounce of silver.

Metal prices used for mineral resources were $29.00 per ounce of

silver and $1,600 per ounce of gold, except for Endeavor, at $2,300

per metric ton of lead, $2,300 per metric ton of zinc and $34.00

per ounce of silver. 3. Palmarejo mineral resources are the

addition of Palmarejo, Guadalupe, and La Patria (measured,

indicated, and inferred). 4. Mineral resources are in addition to

mineral reserves and have not demonstrated economic viability.

Inferred mineral resources are considered too speculative

geologically to have the economic considerations applied to them

that would enable them to be considered for estimation of mineral

reserves. 5. Rounding of tons and ounces, as required by reporting

guidelines, may result in apparent differences between tons, grade,

and contained metal content. 6.

For details on the estimation of mineral

resources and reserves for each property, please refer to the

relevant NI 43-101-compliant Technical Report on file at

www.sedar.com and the updated Technical Report for Rochester to be

filed within 45 days on www.sedar.com.

Coeur Mining, Inc.Bridget Freas, Director, Investor

Relations(312) 489-5819orDonna Mirandola, Director, Corporate

Communications(312) 489-5824www.coeur.com

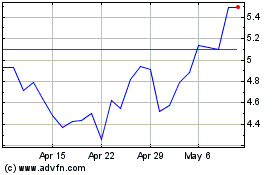

Coeur Mining (NYSE:CDE)

Historical Stock Chart

From Jun 2024 to Jul 2024

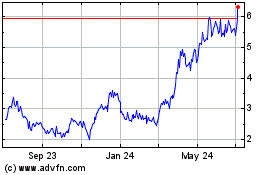

Coeur Mining (NYSE:CDE)

Historical Stock Chart

From Jul 2023 to Jul 2024