Coeur d’Alene Mines Corporation (NYSE:CDE) (TSX:CDM) sold 6.2

million ounces of silver and 67,391 ounces of gold, leading to

$343.6 million in sales and $151.0 million in operating cash flow1

during the third quarter of 2011.

Third Quarter Highlights:

- Record net metal sales of $343.6

million were 49% higher over the prior quarter and 190% higher than

last year’s third quarter

- Record $151.0 million of operating cash

flow1 represented a 30% jump over prior quarter and almost

five-times higher than last year’s third quarter

- Adjusted earnings2 totaled a record

$93.8 million, or $1.05 per share, versus an adjusted loss of

($4.5) million, or ($0.05) per share, during last year’s third

quarter

- Net income reached $31.1 million, or

$0.35 per share, compared to a net loss of ($22.6) million, or

($0.25) per share, during last year’s third quarter

- Silver production totaled 4.9 million

ounces, which was 3% higher than the prior quarter and 13% higher

than last year’s third quarter

- Gold production totaled 57,052 ounces,

down slightly from the prior quarter and 20% higher compared to

last year’s third quarter

- Average realized prices were $38.28 per

ounce for silver and $1,681.42 per ounce for gold

- Cash and cash equivalents increased to

$207.9 million at September 30, 2011, up from $106.8 million at

June 30, 2011 and 214% higher than year-end 2010

First Nine Months 2011 Highlights:

- Record net metal sales of $774.3

million represented a 152% increase over first nine months of

2010

- Record operating cash flow1 of $356.9

million jumped 322% compared to first nine months of 2010

- Adjusted earnings2 totaled $189.3

million, or $2.12 per share, compared to an adjusted loss of

($11.7) million, or ($0.13) per share, during the first nine months

of 2010

- Silver production totaled 13.8 million

ounces, up 15% compared to the first nine months of 2010

- Gold production totaled 170,838 ounces,

up 77% over the first nine months of 2010

- Average realized prices were $36.69 per

ounce of silver and $1,522.65 per ounce of gold, increases of 103%

and 29%, respectively, compared to the first nine months of

2010

1 Operating cash flow is a non-U.S. GAAP measure defined as

net income plus depreciation, depletion and amortization and other

non-cash items prior to changes in operating assets and

liabilities. On a U.S. GAAP basis, the Company generated cash flow

from operations of $181.8 million in the third quarter of 2011 and

$328.6 million in the first nine months of 2011. See the

reconciliation from non-U.S. GAAP to U.S. GAAP at the end of this

news release. 2 Adjusted earnings is a non-U.S. GAAP measure

defined as operating income plus interest and other income less

interest expense and current taxes. Adjusted earnings exclude

non-cash fair value adjustments, other non-cash adjustments,

deferred taxes and discontinued operations. The Company realized

net income of $31.8 million in the third quarter of 2011 and $82.8

million during the first nine months of 2011. See reconciliation

between non-U.S. GAAP adjusted earnings and U.S. GAAP at the end of

this news release.

“We are pleased to report all-time record sales and operating

cash flow for both the quarter and the first nine months,”

commented Mitchell J. Krebs, Coeur’s President and Chief Executive

Officer. “In conjunction with strong prices, our rising production

levels and growing cash flow offer investors a unique investment

opportunity.

“The San Bartolomé and Palmarejo mines are performing

consistently, and the Rochester operation is now seeing production

from its recently-completed leach pad. We remain on track to

produce approximately 19.5 million ounces of silver at unchanged

cash operating costs5 of $5.75 per ounce and expect to achieve our

financial targets of $1.0 billion in total sales and over $500

million in operating cash flow1. We are revising our gold

production forecast for 2011 to approximately 220,000 ounces.”

Mr. Krebs continued, “One of our most critical objectives is to

deliver consistent results for our shareholders. While we are now

achieving consistency at San Bartolomé and Palmarejo, we still have

work to do at Kensington, which is the newest of our three,

long-life mines. We plan to temporarily reduce processing rates by

50% at Kensington over the next six months to allow time for the

operation to complete several key initiatives, which we expect to

better position the mine for long-term, sustainable and consistent

performance.

“Finally, our cash balance grew to $207.9 million at quarter

end. We are evaluating potential alternatives for returning capital

to shareholders. As we continue generating significant free cash

flow and achieve consistent performance from our operations, we

believe we will be well-positioned to invest in high-return

internal and external growth opportunities while also returning

capital to our shareholders.”

Financial

Highlights

US$ in millions (except price of

silver and gold)

First Nine First Nine

Year over Quarter

Months Months Year

3Q

2011 3Q 2010 Variance

2011

2010 Variance

Sales of Metal $

343.6 $ 118.6 190 %

$

774.3 $ 307.9 151 %

Production

Costs $ 141.3 $ 60.4

134 %

$ 310.8 $ 170.8 82

%

EBITDA (3) $ 186.0 $

48.3 285 %

$ 411.6 $

107.0 285 %

Adjusted Earnings (2)

$ 93.8 ($4.5 ) n.a.

$ 189.3 ($11.7 ) n.a.

Adjusted Earnings Per Share (2) $

1.05 ($0.05 ) n.a.

$

2.12 ($0.13 ) n.a.

Net

Income/(Loss) $ 31.1 ($22.6

) 237 %

$ 82.1 ($86.2 )

195 %

EPS $ 0.35

($0.25 ) 239 %

$ 0.92

($1.00 ) 192 %

Operating Cash Flow (1)

$ 151.0 $ 34.7 335 %

$ 356.9 $ 84.5 322 %

Capital

Expenditures $ 38.1 $ 36.8

4 %

$ 79.8 $ 129.4

-38 %

Cash and Equivalents $ 207.9

$ 27.8 648 %

$ 207.9

$ 27.8 648 %

Total Debt (4)

$ 146.7 $ 180.1 -21 %

$ 146.7 $ 180.1 -21 %

Shares Issued & Outstanding 89.7

89.3 0 %

89.7 89.3 0 %

Avg.

Realized Price - Silver $ 38.28 $

18.87 103 %

$ 36.69 $

18.12 103 %

Avg. Realized Price - Gold

$ 1,681 $ 1,229 37 %

$ 1,523 $ 1,177 29 % 1

Operating cash flow is a non-U.S. GAAP measure defined as

net income plus depreciation, depletion and amortization and other

non-cash items prior to changes in operating assets and

liabilities. On a U.S. GAAP basis, the Company generated cash flow

from operations of $181.9 million in the third quarter of 2011 and

$328.8 million in the first nine months of 2011. See the

reconciliation from non-U.S. GAAP to U.S. GAAP at the end of this

news release. 2 Adjusted earnings is a non-U.S. GAAP measure

defined as operating income plus interest and other income less

interest expense and current taxes. Adjusted earnings exclude

non-cash fair value adjustments, other non-cash adjustments,

deferred taxes and discontinued operations. The Company realized

net income of $31.1 million in the third quarter of 2011 and $82.1

million during the first nine months of 2011. See reconciliation

between non-U.S. GAAP adjusted earnings and U.S. GAAP at the end of

this news release. Adjusted earnings per share represent the

adjusted earnings divided by the number of shares outstanding at

the end of the quarter. 3 EBITDA is a non-U.S. GAAP measure defined

as earnings before interest, taxes, depreciation and amortization.

A reconciliation of this measure to U.S. GAAP is provided at the

end of this news release. 4 Includes short and long-term

indebtedness; excludes capital leases, royalty obligations and

Mitsubishi gold lease facility. 5 Cash operating costs is a

non-U.S. GAAP measure defined as cash costs less production taxes

and royalties if applicable. See the reconciliation between

non-U.S. GAAP at the end of this news release. Consolidated cash

operating costs per silver ounce are net of gold by-product and

represent the consolidation of all Coeur’s mines except for

Kensington, which is a primary gold mine and reports cash operating

costs per gold ounce.

Net metal sales increased 190% to $343.6 million in the third

quarter compared to $118.6 million during last year’s third

quarter, primarily due to increased gold production from the

Kensington mine and higher silver production from the Palmarejo

mine as well as substantially higher average realized silver and

gold prices.

Silver production contributed 68% of the Company’s total metal

sales during the quarter compared to 62% during the third quarter

of 2010. Silver and gold ounces sold were higher than production

during the quarter due to several factors, including a carryover of

sales from the ounces produced but not sold during the prior

quarter.

Coeur reports a non-U.S. GAAP metric of adjusted earnings2 as a

measure of operating income and which excludes non-cash fair value

adjustments, other non-cash adjustments, deferred taxes and

discontinued operations. Third quarter adjusted earnings were $93.8

million or $1.05 per share, compared to an adjusted loss of ($4.5)

million or ($0.05) per share during last year’s third quarter.

The Company realized net income of $31.1 million or $0.35 per

share in the third quarter compared to a net loss of ($22.6)

million or ($0.25) per share in last year’s third quarter. The

earnings reflected fair value adjustments that decreased net income

by $53.4 million and $19.1 million in the three months ended

September 30, 2011 and 2010, respectively. These fair value

adjustments are driven primarily by higher gold prices which

increased the estimated future liabilities related to a gold

royalty obligation at Palmarejo and a small amount of gold collar

option positions related to a term credit facility secured by the

Company’s Alaskan subsidiary.

On a U.S. GAAP basis, the Company generated cash flow from

operations of $181.9 million during the third quarter compared to

$12.9 million during the third quarter of 2010. Prior to changes in

working capital, Coeur generated operating cash flow1 of $151.0

million during the third quarter, almost five times higher than a

year ago.

Coeur reduced its total debt by 23% from $180.1 million a year

ago to $146.7 million, including principal repayments of $6.9

million on the Kensington term facility ($82.8 million remaining)

and $3.8 million in senior notes ($18.8 million remaining). As a

result, interest expense for the third quarter declined by $2.0

million from a year ago to $8.0 million. Subsequent to the end of

the third quarter, the Company eliminated the remaining senior

notes, resulting in a further 13% reduction in remaining debt to

$128 million.

Capital expenditures totaled $38.1 million during the third

quarter, which was slightly higher than during last year’s third

quarter. Most of the capital expenditures were at Rochester for

construction of the new leach pad, at Palmarejo related to

activities at the tailings facility and at Kensington for the

construction of the underground paste fill plant and for

underground development.

Cash and cash equivalents totaled $207.9 million at September

30, 2011, almost double from June 30, 2011 and 214% higher than

year-end 2010.

Operational Highlights:

Production

(silver ounces in thousands)

3Q 2011 3Q 2010

Quarter Variance

First Nine Months 2011

First Nine Months 2010 Year over Year Variance

Silver Gold Silver Gold

Silver Gold

Silver Gold

Silver Gold Silver Gold

Palmarejo

2,251 29,815 1,507 29,823

49 % 0 %

6,351 90,963

3,878 72,350 64 % 26 %

San

Bartolomé 2,051 - 1,795

- 14 % n.a.

5,504

- 4,697 - 17 % n.a.

Rochester 352 1,435 419

1,935 -16 % -26 %

1,018

4,283 1,475 7,241 -31 % -41 %

Martha 118 115 511

601 -77 % -81 %

400 471

1,426 1,675 -72 % -72 %

Kensington - 25,687 -

15,155 n.a. 69 %

-

75,121 - 15,155 n.a. 396 %

Endeavor 138 - 102

- 35 % n.a.

502 -

446 - 13 % n.a.

Total

4,910 57,052 4,334 47,514

13 % 20 %

13,775 170,838

11,922 96,421 16 % 77 %

Table reflects continuing operations. Additional operating

statistics are in the tables in the Appendix.

Operational Highlights: Cash Operating

Costs (5)

First Year

Nine

First Nine

over Quarter

Months

Months

Year

3Q 2011 3Q 2010 Variance

2011

2010

Variance

Palmarejo $ (1.16

) $ 0.15 -873 %

$ (0.47

) $ 4.85 -110 %

San Bartolomé

$ 9.32 $ 7.05 32 %

$ 9.07 $ 7.99 14 %

Rochester $ 36.71 $ 5.10

620 %

$ 17.46 $ 2.93

496 %

Martha $ 39.31

$ 9.86 299 %

$ 32.48

$ 10.96 196 %

Endeavor $

22.26 $ 10.32 116 %

$

19.79 $ 8.56 131 %

Total

$ 7.57 $ 4.87 55 %

$ 6.36 $ 6.72 -5 %

Kensington $ 973.28 $

1,199.20 -19 %

$ 961.10 $

1,199.20 -20 %

Table reflects continuing operations. Additional operating

statistics are in the tables in the Appendix.

5 Cash operating costs is a non-U.S. GAAP measure defined as

cash costs less production taxes and royalties if applicable. See

the reconciliation between non-U.S. GAAP at the end of this news

release. Consolidated cash operating costs per silver ounce are net

of gold by-product and represent the consolidation of all Coeur’s

mines except for Kensington, which is a primary gold mine and

reports cash operating costs per gold ounce.

During the third quarter, silver production reached 4.9 million

ounces while gold production totaled 57,052 ounces. Kensington

contributed 45% of the Company’s total gold production.

Consolidated cash operating costs were $7.57 per silver ounce in

the third quarter, higher than the third quarter of 2010 due to

short-term higher production costs at Palmarejo, San Bartolomé and

Rochester, which are expected to improve in the fourth quarter. In

general, the Company has seen cost increases in power, diesel,

other inputs and labor during the quarter.

Palmarejo, Mexico – Generating Strong Cash Flow

- Third quarter silver production

increased 49% to 2.3 million ounces compared to the third quarter

of 2010 and was slightly lower than the prior quarter. Third

quarter gold production totaled 29,815 ounces, which was equivalent

to gold production during last year’s third quarter and 11% lower

than the prior quarter.

- Tons milled declined during the third

quarter due to mill maintenance and repair work that took place

during July, which slightly affected quarterly production

levels.

- Third quarter cash operating costs per

ounce were higher than the prior quarter due to increased

maintenance and operational costs in the open pit and increased

process costs in the areas of grinding and leaching.

- Palmarejo is the Company’s largest

contributor of sales and operating cash flow1, reaching $166.9

million and $91.2 million respectively, in the third quarter.

Capital expenditures were $9.5 million.

San Bartolomé, Bolivia – Another Consistent Quarter

- Silver production increased 14% over

last year’s third quarter and 18% from the prior quarter, while

cash operating costs increased 32% and 7% respectively. Increased

production was driven by 13% higher mill throughput as well as

slightly higher ore grade and recovery rate.

- Third quarter production costs

increased from last year’s third quarter due to higher project

development, open pit haulage and maintenance costs.

- San Bartolomé contributed $102.8

million in sales and $49.6 million in operating cash flow1 in the

third quarter. Capital expenditures were $4.4 million.

Kensington, Alaska – Short-Term Reduction Expected to Lead to

Long-Term Consistency

- Kensington is expected to enter a six

month period where processing levels will be reduced by 50% to

approximately 700 tons per day. This is intended to allow the mine

to implement and complete several key initiatives, including:

- Accelerated underground development,

resulting in more working faces and greater operational

flexibility

- Aggressive in-fill drilling program to

better define the high-grade ore zones and convert existing

resources into proven and probable reserves

- Completion and commissioning of the

underground paste backfill plant and related distribution system,

providing access to stopes located in previously mined areas

- Upgrading and completing construction

of several underground and surface facilities

- Improving overall safety of the

operation

- Expected operational effects of this

strategy:

- 2011 production of approximately 85,000

ounces at costs of approximately $990 per ounce

- 2012 production expected to be similar

to 2011, with costs declining in the second half of the year as

production levels increase

- Production levels in 2013 and beyond

are expected to rise to approximately 125,000 – 135,000 ounces at

substantially lower operating costs than the current levels

- The mine contributed $44.2 million in

sales and $14.5 million in operating cash flow1 in the third

quarter. Capital expenditures were $9.2 million.

K. Leon Hardy, Coeur’s Chief Operating Officer, said, “2012 is

expected to represent a transition year at Kensington as these

projects are completed and operating activities resume at increased

levels. We recognize that we need to take a step back in the ore

production profile in order to advance these initiatives that we

expect to ultimately reduce costs and ensure higher, more

consistent production levels. Kensington is an underground

operation with one primary portal, which means we will need to

curtail some ore production in order to advance installations and

other work in the mine.”

Rochester, Nevada – Resurgence in Production in the Fourth

Quarter

- Third quarter silver production was

lower by 16% from last year’s third quarter and slightly higher

than the prior quarter, while cash operating costs were

significantly higher.

- Per ounce costs were temporarily higher

during the quarter as a result of increased costs associated with

ore placement on the new leach pad while ounces produced during the

quarter consisted solely of residual production of silver and gold

from existing leach pads. The new leach pad is expected to begin

producing new silver and gold ounces during the fourth quarter of

2011, which are expected to reduce cash operating costs.

- During the third quarter and through

the end of October, the Company placed ore containing over 5,000

ounces of gold and 418,000 ounces of silver on the new leach pad.

These levels are expected to double by year end. The Company

expects an initial 50% recovery rate within 30 to 60 days from the

placement of this ore.

- The mine contributed $17.5 million in

sales and $2.7 million in operating cash flow1 in the third

quarter. Capital expenditures were $13.6 million.

Exploration Highlights

Donald J. Birak, Senior Vice President of Exploration,

commented, “Our accelerated exploration program is yielding

excellent results, particularly at Palmarejo and Rochester. Along

with the Joaquin silver project in southern Argentina, we expect

this work, continuing into 2012, to result in mine life extensions

and mineral resource additions at all of these properties. We

anticipate dramatically increasing our investment in exploration in

2012.”

During the three months ending September 30, 2011, the Company

completed over 39,600 meters (130,000 feet) of new core and reverse

circulation drilling in its global exploration program. The

majority of this drilling was devoted to the Company’s Palmarejo

property followed by Rochester, Joaquin and Kensington.

Palmarejo, Mexico

The Company completed over 21,500 meters (70,550 feet) in the

third quarter in the Palmarejo District. This exploration drilling

was split between targets around the current Palmarejo mine from

both surface and underground drill platforms, specifically the

Rosario, Tucson and Chapotillo zones, and at the Guadalupe and La

Patria deposits. This past quarter’s drilling at La Patria remained

focused on exploration drilling and definition of the northern

zone.

The Company is very encouraged by its initial drilling results

from La Patria and has commenced a program of surface trenching to

help define the continuity of the known vein structures in support

of continued drilling.

Rochester, Nevada

Drilling at Rochester nearly doubled compared to the prior

quarter. A total of 12,800 meters (42,000 feet) of reverse

circulation drilling were completed at the Nevada Packard and

Rochester silver and gold deposits. Drilling at Nevada Packard,

situated approximately 2.3 kilometers (1.4 miles) south of the

current Rochester mine, focused on expanding the deposit to the

west. At Rochester, drilling was focused on the Northwest Rochester

zone at the north side of the mine.

Both deposits remain open for expansion. Drilling is expected to

continue at Rochester into the fourth quarter and into 2012.

Martha and Joaquin, Argentina

Over 3,600 meters (12,200 feet) of core drilling was completed

on all targets in the Santa Cruz Province of southern Argentina in

the third quarter of 2011. At Joaquin, drilling recommenced late in

the quarter at the La Negra zone. The Company plans to continue to

drill to define the mineral resources at Joaquin and advance the

project towards completion of a feasibility study, which would

increase the Company’s managing interest in the Joaquin project

from 51% to 61%. Subject to certain conditions the Company has an

option to increase its interest to 71%. The Joaquin project is

located approximately 100 kilometers (62 miles) north of the Martha

mine by road. Other targets drilled in the quarter were Betty and

Wendy at Martha and Satélite, an early-stage prospect in eastern

Santa Cruz.

Kensington, Alaska

Exploration at Kensington in the quarter consisted of just over

1,000 meters (3,300 feet) of core drilling nearly all of which was

devoted to the Raven zone, which is located approximately 685

meters (2,250 feet) due west of the Kensington ore body. This

drilling and ongoing drilling is expected to define a new mineral

resource estimate on this zone. Raven is one of several

gold-bearing vein structures occurring within a 300- to 450-meter

wide (1,000 to 1,500 feet) corridor, extending over 3,000 meters

(9,800 feet) southward to the Jualin deposit, which is located near

the mill facility. Drilling commenced late in the quarter on a new

target, Kensington South.

San Bartolomé, Bolivia

The ongoing program of trenching and sampling continued into the

third quarter of 2011 at San Bartolomé. A total of 51 new backhoe

trenches were completed and sampled, resulting in 339 new samples

collected from one-meter vertical intervals. All of this work was

centered on the Santa Rita and Diablo areas. Through the first nine

months of 2011, 1,010 new samples have been collected from 164

trenches intended to expand and upgrade mineral resources.

Conference Call Information

Coeur will hold a conference call to discuss the Company’s third

quarter 2011 results at 1:00 p.m. Eastern time on November 7, 2011.

To listen live via telephone, call (877) 464-2820 (US and Canada)

or (660) 422-4718 (International). The conference ID number is

18886296. The conference call and presentation will also be webcast

on the Company's web site at www.coeur.com. A replay of the call

will be available through November 15, 2011. The replay dial-in

numbers are (855) 859-2056 (US and Canada) and (404) 537-3406

(International) and the access code is 18886296. In addition, the

call will be archived for a limited time on the Company’s web

site.

Cautionary Statement

This news release contains forward-looking statements within the

meaning of securities legislation in the United States and Canada,

including statements regarding anticipated operating results. Such

statements are subject to numerous assumptions and uncertainties,

many of which are outside the control of Coeur. Operating,

exploration and financial data, and other statements in this

presentation are based on information that Coeur believes is

reasonable, but involve significant uncertainties affecting the

business of Coeur, including, but not limited to, future gold and

silver prices, costs, ore grades, estimation of gold and silver

reserves, mining and processing conditions, construction delays and

related disruptions in production, currency exchange rates, costs

of capital expenditures and the completion and/or updating of

mining feasibility studies, changes that could result from future

acquisitions of new mining properties or businesses, risks and

hazards inherent in the mining business (including environmental

hazards, industrial accidents, weather and geologically related

conditions), permitting and regulatory matters (including

penalties, fines, sanctions, and shutdowns), risks inherent in the

ownership and operation of, or investment in, mining properties or

businesses in foreign countries, as well as other uncertainties and

risk factors set out in filings made from time to time with the

United States Securities and Exchange Commission, and the Canadian

securities regulators, including, without limitation, Coeur’s

reports on Form 10-K and Form 10-Q. Actual results, developments

and timetables could vary significantly from the estimates

presented. Readers are cautioned not to put undue reliance on

forward-looking statements. Coeur disclaims any intent or

obligation to update publicly such forward-looking statements,

whether as a result of new information, future events or otherwise.

Additionally, Coeur undertakes no obligation to comment on

analyses, expectations or statements made by third parties in

respect of Coeur, its financial or operating results or its

securities.

Donald J. Birak, Coeur's Senior Vice President of Exploration

and a qualified person under Canadian NI 43-101, supervised the

preparation of the scientific and technical information concerning

Coeur's mineral projects in this news release. For a description of

the key assumptions, parameters and methods used to estimate

mineral reserves and resources, as well as data verification

procedures and a general discussion of the extent to which the

estimates may be affected by any known environmental, permitting,

legal, title, taxation, socio-political, marketing or other

relevant factors, please see the Technical Reports for each of

Coeur's properties as filed on SEDAR at www.sedar.com.

Cautionary Note to U.S. Investors – The United States Securities

and Exchange Commission permits U.S. mining companies, in their

filings with the SEC, to disclose only those mineral deposits that

a company can economically and legally extract or produce. We use

certain terms in this presentation, such as “measured,”

“indicated,” and “inferred resources,” that are recognized by

Canadian regulations, but that SEC guidelines generally prohibit

U.S. registered companies from including in their filings with the

SEC. U.S. investors are urged to consider closely the disclosure in

our Form 10-K which may be secured from us, or from the SEC’s

website at http://www.sec.gov.

Non-U.S. GAAP Measures

We supplement the reporting of our financial information

determined under United States generally accepted accounting

principles (U.S. GAAP) with certain non-U.S. GAAP financial

measures, including cash operating costs, operating cash flow,

adjusted earnings, and EBITDA. We believe that these adjusted

measures provide meaningful information to assist management,

investors and analysts in understanding our financial results and

assessing our prospects for future performance. We believe these

adjusted financial measures are important indicators of our

recurring operations because they exclude items that may not be

indicative of, or are unrelated to our core operating results, and

provide a better baseline for analyzing trends in our underlying

businesses. We believe cash operating costs, operating cash flow,

adjusted earnings and EBITDA are important measures in assessing

the Company's overall financial performance.

About Coeur

Coeur d’Alene Mines Corporation is the largest U.S.-based

primary silver producer and a growing gold producer. The Company

has several core silver and gold mines generating higher

production, sales and cash flow in continued strong precious metals

markets. This growth is derived from wholly-owned mines that were

constructed and began producing between 2008 and 2010: the San

Bartolomé silver mine in Bolivia; the Palmarejo silver-gold mine in

Mexico, and the Kensington gold mine in Alaska. In addition, the

Company is expecting additional production from its long-time

Rochester silver-gold mine in Nevada, and also owns and operates

the Martha silver-gold mine in Argentina. The Company also owns a

non-operating interest in a silver-base metal mine in Australia,

and conducts ongoing exploration activities near and within its

operating properties in Argentina, Mexico, Nevada and Alaska.

APPENDIX:

Operating Statistics from Continuing Operations

Three months ended Nine months ended

September 30, September 30, 2011

2010 2011 2010

Silver

Operations:

Palmarejo Tons milled 403,978 405,742 1,217,437 1,321,017

Ore grade/Ag oz 7.34 5.33 6.88 4.11 Ore grade/Au oz 0.08 0.08 0.08

0.06 Recovery/Ag oz 75.9 % 69.6 % 75.8 % 71.4 % Recovery/Au oz 93.6

% 94.4 % 92.2 % 91.4 % Silver production ounces 2,250,818 1,506,742

6,351,120 3,877,972 Gold production ounces 29,815 29,823 90,963

72,350 Cash operating cost/oz $ (1.16 ) $ 0.15 $ (0.47 ) $ 4.85

Cash cost/oz $ (1.16 ) $ 0.15 $ (0.47 ) $ 4.85 Total production

cost/oz $ 17.33 $ 15.08 $ 18.07 $ 21.24

San Bartolomé Tons

milled 428,978 360,605 1,195,286 1,100,619 Ore grade/Ag oz 5.40

5.70 5.21 4.89 Recovery/Ag oz 88.6 % 87.2 % 88.3 % 87.2 % Silver

production ounces 2,051,426 1,794,617 5,503,951 4,697,685 Cash

operating cost/oz $ 9.32 $ 7.05 $ 9.07 $ 7.99 Cash cost/oz $ 10.89

$ 7.83 $ 10.58 $ 8.69 Total production cost/oz $ 13.90 $ 10.58 $

13.61 $ 11.70

Martha Tons milled 24,086 12,790 64,025 42,786

Ore grade/Ag oz 5.33 42.42 7.24 37.36 Ore grade/Au oz 0.01 0.05

0.01 0.04 Recovery/Ag oz 92.3 % 96.3 % 86.2 % 89.9 % Recovery/Au oz

72.9 % 93.6 % 74.0 % 88.0 % Silver production ounces 118,523

510,685 399,630 1,425,796 Gold production ounces 115 601 471 1,675

Cash operating cost/oz $ 39.31 $ 9.86 $ 32.48 $ 10.96 Cash cost/oz

$ 41.29 $ 11.04 $ 33.95 $ 11.74 Total production cost/oz $ 45.73 $

16.98 $ 35.31 $ 17.24

Rochester (A) Tons milled 607,031 -

607,031 - Silver production ounces 351,717 419,433 1,018,844

1,474,686 Gold production ounces 1,435 1,935 4,283 7,241 Cash

operating cost/oz $ 36.71 $ 5.10 $ 17.46 $ 2.93 Cash cost/oz $

39.80 $ 5.82 $ 19.87 $ 3.55 Total production cost/oz $ 41.72 $ 7.01

$ 21.75 $ 4.62

Endeavor Tons milled 182,226 188,198 556,901

464,379 Ore grade/Ag oz 1.43 1.45 1.97 2.14 Recovery/Ag oz 53.0 %

37.3 % 45.8 % 44.9 % Silver production ounces 137,843 102,053

501,638 445,752 Cash operating cost/oz $ 22.26 $ 10.32 $ 19.79 $

8.56 Cash cost/oz $ 22.26 $ 10.32 $ 19.79 $ 8.56 Total production

cost/oz $ 28.88 $ 13.55 $ 24.57 $ 11.79

Three

months ended Nine months ended September

30, September 30, 2011 2010

2011 2010

Gold

Operation:

Kensington(B) Tons milled 116,255 90,254 343,640 90,254 Ore

grade/Au oz 0.24 0.19 0.24 0.19 Recovery/Au oz 91.7 % 87.7 % 92.3 %

87.7 % Gold production ounces 25,687 15,155 75,121 15,155 Cash

operating cost/oz $ 973.28 $ 1,199.20 $ 961.10 $ 1,199.20 Cash

cost/oz $ 973.28 $ 1,199.20 $ 961.10 $ 1,199.20 Total production

cost/oz $ 1,345.76 $ 1,675.56 $ 1,345.04 $ 1,675.56

CONSOLIDATED PRODUCTION TOTALS(C) Total silver ounces

4,910,326 4,333,530 13,755,183 11,921,891 Total gold ounces 57,052

47,514 170,838 96,421

Silver

Operations:(D)

Cash operating cost per oz - silver $ 7.57 $ 4.87 $ 6.36 $ 6.72

Cash cost per oz - silver $ 8.49 $ 5.40 $ 7.18 $ 7.17 Total

production cost oz - silver $ 18.65 $ 12.62 $ 17.30 $ 14.59

Gold

Operation:(E)

Cash operating cost per oz - gold $ 973.28 $ 1,199.20 $ 961.10 $

1,199.20 Cash cost per oz - gold $ 973.28 $ 1,199.20 $ 961.10 $

1,199.20 Total production cost per oz - gold $ 1,345.76 $ 1,675.56

$ 1,345.04 $ 1,675.56

CONSOLIDATED SALES TOTALS (F) Silver

ounces sold 6,189,897 3,861,696 13,982,233 11,547,775 Gold ounces

sold 67,391 37,507 183,243 86,890 Realized price per silver ounce $

38.28 $ 18.87 $ 36.69 $ 18.12 Realized price per gold ounce $

1,681.42 $ 1,228.51 $ 1,522.65 $ 1,177.31 (A) The

Rochester mine has commenced to place ore on the new leach pad and

production is expected in the fourth quarter of 2011. The leach

cycle at Rochester requires five to ten years to recover gold and

silver contained in the ore. The Company estimates the ultimate

recovery to be approximately 61% for silver and 92% for gold.

However, ultimate recoveries will not be known until leaching

operations cease, which is currently estimated for 2014 for the

current leach pad. Current recovery may vary significantly from

ultimate recovery. See Critical Accounting Policies and Estimates –

Ore on Leach Pad in the Company’s Form 10-K for the year ended

December 31, 2010. (B) Kensington achieved commercial production on

July 3, 2010. (C) Current production ounces and recoveries reflect

final metal settlements of previously reported production ounces.

(D) Amount includes by-product gold credits deducted in computing

cash costs per ounce. (E) Amounts reflect Kensington per ounce

statistics only. (F) Units sold at realized metal prices will not

match reported metal sales due primarily to the effects on revenues

of mark-to-market adjustments on embedded derivatives in the

Company’s provisionally priced sales contracts.

“Operating Costs per Ounce” and “Cash Costs per Ounce” are

calculated by dividing the operating cash costs and cash costs

computed for each of the Company’s mining properties for a

specified period by the amount of gold ounces or silver ounces

produced by that property during that same period. Management uses

cash operating costs per ounce and cash costs per ounce as key

indicators of the profitability of each of its mining properties.

Gold and silver are sold and priced in the world financial markets

on a U.S. dollar per ounce basis.

“Cash Operating Costs” and “Cash Costs” are costs directly

related to the physical activities of producing silver and gold,

and include mining, processing and other plant costs, third-party

refining and smelting costs, marketing expenses, on-site general

and administrative costs, royalties, in-mine drilling expenditures

related to production and other direct costs. Sales of by-product

metals are deducted from the above in computing cash costs. Cash

costs exclude depreciation, depletion and amortization, accretion,

corporate general and administrative expenses, exploration,

interest, and pre-feasibility costs. Cash operating costs include

all cash costs except production taxes and royalties, if

applicable. Cash costs are calculated and presented using the “Gold

Institute Production Cost Standard” applied consistently for all

periods presented.

Total operating costs and cash costs per ounce are non-U.S. GAAP

measures and investors are cautioned not to place undue reliance on

them and are urged to read all U.S. GAAP accounting disclosures

presented in the consolidated financial statements and accompanying

footnotes. In addition, see the reconciliation of “cash costs” to

production costs under “Reconciliation of Non-U.S. GAAP Cash Costs

to U.S. GAAP Production Costs” set forth below.

COEUR D’ALENE MINES CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited)

September 30, December 31, 2011

2010 ASSETS (In thousands, except share data)

CURRENT ASSETS Cash and cash equivalents $ 207,882 $ 66,118 Short

term investments 1,160 - Receivables 84,153 58,880 Ore on leach pad

12,198 7,959 Metal and other inventory 126,155 118,340 Prepaid

expenses and other 22,494 14,914

454,042 266,211 NON-CURRENT ASSETS Property, plant and equipment,

net 674,647 668,101 Mining properties, net 2,031,143 2,122,216 Ore

on leach pad, non-current portion 10,785 10,005 Restricted assets

29,513 29,028 Marketable securities 13,884 - Receivables,

non-current portion 41,329 42,866 Debt issuance costs, net 2,663

4,333 Deferred tax assets 384 804 Other 12,829

13,963 TOTAL ASSETS $ 3,271,219 $ 3,157,527

LIABILITIES AND SHAREHOLDERS' EQUITY CURRENT

LIABILITIES Accounts payable $ 74,800 $ 67,209 Accrued liabilities

and other 16,767 39,720 Accrued income taxes 53,174 28,155 Accrued

payroll and related benefits 14,882 17,953 Accrued interest payable

168 834 Current portion of capital leases and other debt

obligations 51,639 63,317 Current portion of royalty obligation

63,616 51,981 Current portion of reclamation and mine closure 1,309

1,306 Deferred tax liabilities - 242

276,355 270,717 NON-CURRENT LIABILITIES Long-term debt and capital

leases 124,491 130,067 Non-current portion of royalty obligation

190,011 190,334 Reclamation and mine closure 28,815 27,779 Deferred

tax liabilities 487,336 474,264 Other long-term liabilities

39,237 23,599 869,890 846,043 COMMITMENTS AND

CONTINGENCIES SHAREHOLDERS' EQUITY

Common stock, par value $0.01 per share;

authorized 150,000,000 shares, 89,652,578 issued at September 30,

2011 and 89,315,767 issued at December 31, 2010

897 893 Additional paid-in capital 2,584,450 2,578,206 Accumulated

deficit (456,197 ) (538,332 ) Accumulated other comprehensive loss

(4,176 ) - 2,124,974

2,040,767 TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY $

3,271,219 $ 3,157,527

COEUR D’ALENE MINES

CORPORATION AND SUBSIDIARIES CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

(Unaudited) Three months ended Nine months

ended September 30, September 30, 2011

2010 2011 2010 (In thousands,

except per share data) Sales of metal $ 343,575 $

118,564 $ 774,289 $ 307,871 Production costs applicable to sales

(141,253 ) (60,402 ) (310,829 ) (170,795 ) Depreciation, depletion

and amortization (58,652 ) (37,801 ) (166,334

) (95,503 ) Gross profit 143,670 20,361 297,126 41,573 COSTS

AND EXPENSES Administrative and general 8,236 5,963 22,294 19,758

Exploration 4,772 3,840 11,611 9,521 Pre-development, care,

maintenance and other 3,271 82

17,949 814 Total cost and expenses

16,279 9,885 51,854

30,093 OPERATING INCOME 127,391 10,476 245,272 11,480 OTHER

INCOME AND EXPENSE Loss on debt extinguishments (784 ) (806 )

(1,640 ) (12,714 ) Fair value adjustments, net (53,351 ) (19,107 )

(71,051 ) (65,881 ) Interest income and other (6,610 ) (638 )

(1,946 ) (2,725 ) Interest expense, net of capitalized interest

(7,980 ) (9,951 ) (26,553 ) (21,402 )

Total other income and expense (68,725 ) (30,502 )

(101,190 ) (102,722 ) Income (loss) from continuing

operations before income taxes 58,666 (20,026 ) 144,082 (91,242 )

Income tax benefit (provision) (27,606 ) (3,233 )

(61,947 ) 13,137 Income (loss) from continuing

operations 31,060 (23,259 ) 82,135 (78,105 ) Loss from discontinued

operations, net of income taxes - (251 ) - (6,029 ) Gain (loss) on

sale of net assets of discontinued operations, net of income taxes

- 882 - (2,095 )

NET INCOME (LOSS) 31,060 (22,628 ) 82,135 (86,229 ) Other

comprehensive income (loss), net of income taxes (2,789 )

164 (4,176 ) 159 COMPREHENSIVE

INCOME (LOSS) $ 28,271 $ (22,464 ) $ 77,959 $ (86,070

) BASIC AND DILUTED INCOME PER SHARE Basic income (loss) per

share: Income (loss) from continuing operations $ 0.35 $ (0.26 ) $

0.92 $ (0.90 ) Income (loss) from discontinued operations -

0.01 - (0.10 ) Net income

(loss) $ 0.35 $ (0.25 ) $ 0.92 $ (1.00 )

Diluted income (loss) per share: Income (loss) from continuing

operations $ 0.35 $ (0.26 ) $ 0.92 $ (0.90 ) Income (loss) from

discontinued operations - 0.01 -

(0.10 ) Net income (loss) $ 0.35 $ (0.25 ) $

0.92 $ (1.00 ) Weighted average number of shares of

common stock Basic 89,449 89,236 89,350 86,489 Diluted 89,739

89,236 89,702 86,489

COEUR D’ALENE MINES CORPORATION AND

SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN

SHAREHOLDERS’ EQUITY Nine Months Ended September 30,

2011 (Unaudited)

Accumulated Common Common

Additional Other Stock Stock Par

Paid-In Accumulated Comprehensive (In

thousands) Shares Value Capital

(Deficit) Loss Total Balances at December

31, 2010 89,316 $ 893 $ 2,578,206 $ (538,332 ) $ - $ 2,040,767

Net income - - - 82,135 - 82,135 Unrealized loss on marketable

securities, net of tax - - - - (4,176 ) (4,176 ) Common stock

issued/cancelled under long-term incentive plans, net 337 4

6,244 - - 6,248

Balances at September 30, 2011 89,653 $ 897 $ 2,584,450 $

(456,197 ) $ (4,176 ) $ 2,124,974

COEUR D’ALENE

MINES CORPORATION AND SUBSIDIARIES CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS (Unaudited)

Three months ended Nine months ended September

30, September 30, 2011 2010

2011 2010 (In thousands)

(In thousands)

CASH FLOWS FROM OPERATING ACTIVITIES: Net income (loss) $

31,060 $ (22,628 ) $ 82,135 $ (86,229 ) Add (deduct) non-cash items

Depreciation, depletion and amortization 58,652 37,913 166,334

97,697 Accretion of discount on debt and other assets, net 516 537

1,460 537 Accretion of royalty obligation 4,990 4,778 16,027 14,407

Deferred income taxes 3,084 (7,879 ) 13,177 (29,269 ) Loss on debt

extinguishment 784 806 1,640 12,714 Fair value adjustments, net

50,767 17,436 71,360 64,159 (Gain) loss on foreign currency

transactions 137 2,144 (600 ) 3,966 Share-based compensation 457

1,960 5,261 3,969 (Gain) loss on sale of assets 4 (970 ) (1,220 )

1,835 Other non-cash charges 506 629 1,337 702 Changes in operating

assets and liabilities: Receivables and other current assets

(19,210 ) (4,511 ) (30,854 ) (12,136 ) Inventories 23,234 (22,980 )

(12,834 ) (27,888 ) Accounts payable and accrued liabilities

26,930 5,704 15,538

(8,298 ) CASH PROVIDED BY OPERATING ACTIVITIES 181,911

12,939 328,761 36,166

CASH FLOWS FROM INVESTING ACTIVITIES Purchase of

investments (8,804 ) (15 ) (21,914 ) (672 ) Proceeds from sales and

maturities of investments 495 12,477 3,855 13,134 Capital

expenditures (38,099 ) (36,783 ) (79,780 ) (129,439 ) Other

1,397 5,902 1,670 5,977

CASH USED IN INVESTING ACTIVITIES (45,011 )

(18,419 ) (96,169 ) (111,000 ) CASH FLOWS FROM

FINANCING ACTIVITIES: Proceeds from issuance of notes and bank

borrowings - 10,755 27,500 145,565 Payments on long-term debt,

capital leases, and associated costs (16,405 ) (19,196 ) (51,640 )

(38,439 ) Payments on gold production royalty (19,510 ) (11,302 )

(51,569 ) (29,836 ) Proceeds from gold lease facility - 11,915 -

16,432 Payments on gold lease facility - - (13,800 ) (17,101 )

Proceeds from sale-leaseback transactions - - - 4,853 Additions to

restricted asses associated with the Kensington Term Facility -

(297 ) (1,325 ) (1,880 ) Other 67 210

6 250 CASH PROVIDED (USED IN) BY

FINANCING ACTIVITIES: (35,848 ) (7,915 )

(90,828 ) 79,844 INCREASE (DECREASE) IN CASH

AND CASH EQUIVALENTS 101,052 (13,395 ) 141,764 5,010 Cash

and cash equivalents at beginning of period 106,830

41,187 66,118 22,782 Cash

and cash equivalents at end of period $ 207,882 $ 27,792

$ 207,882 $ 27,792

OPERATING CASH

FLOW RECONCILIATION 3Q 2011 2Q 2011

1Q 2011 4Q 2010 3Q 2010

Cash provided by operating activities $ 181,911 $ 111,065 $ 35,785

$ 129,397 $ 12,939 Changes in operating assets and liabilities:

Receivables and other current assets 19,210 6,784 4,860 (11,779 )

4,511 Inventories (23,234 ) 23,575 12,493 19,999 22,980 Accounts

payable and accrued liabilities (26,930 ) (25,585 )

36,977 (38,186 ) (5,704 )

OPERATING CASH

FLOW $ 150,957 $ 115,839 $ 90,115 $ 99,431

$ 34,726

OPERATING CASH FLOW RECONCILIATION

First Nine First Nine Months 2011

Months 2010 Cash provided by operating activities $

328,761 $ 36,165 Changes in operating assets and liabilities:

Receivables and other current assets 30,854 12,136 Inventories

12,834 27,888 Accounts payable and accrued liabilities

(15,538 ) 8,298

OPERATING CASH FLOW $ 356,911

$ 84,487

EBITDA RECONCILIATION 3Q 2011

2Q 2011 1Q 2011 4Q 2010

3Q 2010 Net income (loss) $ 31,060 $ 38,611 $ 12,464

($5,078 ) ($22,628 ) Loss on sale of net assets of discontinued

operations, net of income taxes - - - 1 (883 ) Loss from

discontinued operations, net of income taxes - - - - 251 Income tax

provision (benefit) 27,606 21,402 12,939 3,655 3,233 Interest

expense, net of capitalized interest 7,980 9,268 9,304 9,539 9,951

Interest and other income 6,610 (2,763 ) (1,934 ) (3,495 ) 638 Fair

value adjustments, net 53,351 12,432 5,302 51,213 19,107 Loss on

debt extinguishments 784 389 467 7,586 806 Depreciation and

depletion 58,652 57,641 50,041

46,116 37,801

EBITDA $ 186,043 $

136,980 $ 88,583 $ 109,537 $ 48,276

EBITDA RECONCILIATION First Nine Months

2011 First Nine Months 2010 Net income (loss) $

82,135 ($86,230 ) Loss on sale of net assets of discontinued

operations, net of income taxes - 2,094 Loss from discontinued

operations, net of income taxes - 6,029 Income tax provision

(benefit) 61,947 (13,136 ) Interest expense, net of capitalized

interest 26,552 21,403 Interest and other income 1,913 2,724 Fair

value adjustments, net 71,085 65,881 Loss on debt extinguishments

1,640 12,714 Depreciation and depletion 166,334

95,503

EBITDA $ 411,606 $

106,982 ADJUSTED EARNINGS

RECONCILIATION 3Q 2011 2Q 2011

1Q 2011 4Q 2010 3Q 2010

Net income (loss) $ 31,060 $ 38,611 $ 12,464 ($5,078 ) ($22,628 )

Loss on sale of net assets of discontinued operations, net of

income taxes - - - 1 (883 ) Share Based Compensation 457 (3,351 )

8,155 3,248 1,960 Loss from discontinued operations, net of income

taxes - - - - 251 Deferred income tax provision 3,110 4,198 5,870

(8,386 ) (7,860 ) Interest expense, accretion of royalty obligation

4,990 5,770 5,267 4,611 4,778 Fair value adjustments, net 53,351

12,432 5,302 51,213 19,107 Loss on debt extinguishments 784

389 467 7,586 806

ADJUSTED EARNINGS (LOSS) $ 93,752 $

58,049 $ 37,525 $ 53,195

($4,469 ) ADJUSTED EARNINGS

RECONCILIATION First Nine Months 2011

First Nine Months 2010 Net income (loss) $ 82,135 ($86,230 )

Loss on sale of net assets of discontinued operations, net of

income taxes - 2,094 Share Based Compensation 5,261 3,969 Loss from

discontinued operations, net of income taxes - 6,029 Deferred

income tax provision 13,178 (30,515 ) Interest expense, accretion

of royalty obligation 16,027 14,407 Fair value adjustments, net

71,085 65,881 Loss on debt extinguishments 1,640 12,714

ADJUSTED EARNINGS (LOSS) $ 189,326

($11,651 )

Results of Operations by

Mine:

PALMAREJO

in millions of US$ 3Q 2011 2Q 2011

1Q 2011 4Q 2010 3Q 2010

Sales of Metal $ 166.9 $ 123.7 $

88.2 $ 78.1 $ 61.5

Production

Costs 64.1 37.7

37.4 35.6 31.3

EBITDA 100.4 84.6

50.2 41.0

28.9

Operating Income 61.6

43.0 16.5 13.0

6.4

Operating Cash Flow

(1) 91.2 81.8

48.4 38.7 26.6

Capital Expenditures 9.5

10.3 5.1 11.1

15.8

in millions of US$ 3Q

2011 2Q 2011 1Q 2011 4Q

2010 3Q 2010 Gross Profit $ 102.8

$ 86.0 $ 50.8 $ 42.5

$ 30.2

Gross Margin 61.6 %

69.5 % 57.6 % 54.4 %

49.1 %

Ounces unless otherwise noted 3Q

2011 2Q 2011 1Q 2011 4Q

2010 3Q 2010 Underground Operations:

Tons Mined 143,010 144,614

143,800 151,032

146,682

Average Silver Grade (oz/t)

9.36 10.08 8.30

6.30 5.63

Average Gold Grade (oz/t) 0.13

0.14 0.14 0.10

0.10

Surface Operations:

Tons Mined

260,618 276,699

246,879 281,177 256,927

Average Silver Grade (oz/t) 6.56

5.85 4.60 7.33

5.20

Average Gold Grade (oz/t)

0.05 0.06 0.05

0.07 0.07

Processing:

Total Tons Milled 403,978

414,719 398,740

514,391 405,742

Average Recovery

Rate – Ag 75.90 % 78.30 %

72.70 % 66.72 % 69.60 %

Average

Recovery Rate – Au 93.60 % 95.20 %

87.40 % 90.32 % 94.30 %

Silver Production - oz (in thousands) 2,251

2,371 1,730

2,010 1,507

Gold Production -

oz (in thousands) 30 33

28 30

30

Cash Operating Costs/Ag Oz ($1.16 )

($3.68 ) $ 4.80 $ 2.68

$ 0.15

Reconciliation of EBITDA for

Palmarejo 3Q 2011 2Q 2011

1Q 2011 4Q 2010 3Q 2010 Sales of

metal $ 166.9 $ 123.7 $ 88.2 $ 78.1

$ 61.5 Production costs applicable to sales (64.1 ) (37.8 )

(37.4 ) (35.6 ) (31.3 ) Administrative and general 0.0 0.0 0.0 0.0

Exploration (2.2 ) (1.3 ) (0.6 ) (1.5 ) (1.3 ) Care and maintenance

and other (0.2 ) 0.0 0.0 0.0 0.0 Pre-development 0.0

0.0 0.0

0.0 0.0

EBITDA

$ 100.4 $ 84.6

$ 50.2 $ 41.0

$ 28.9 Operating Cash

Flow for Palmarejo 3Q 2011 2Q 2011

1Q 2011 4Q 2010 3Q 2010

Cash provided by operating activities $ 104.7 $ 62.9

$ 10.1 $ 63.5 $ 14.0 Changes in operating

assets and liabilities: Receivables and other current assets (0.8 )

8.9 (0.4 ) (14.5 ) (2.6 ) Prepaid expenses and other 3.4 (0.4 ) 1.0

(1.7 ) 0.6 Inventories (16.2 ) 12.0 16.1 16.4 7.4 Accounts payable

and accrued liabilities 0.1 (1.6

) 21.6 (25.0 ) 7.2

OPERATING CASH FLOW $ 91.2

$ 81.8 $

48.4 $ 38.7

$ 26.6 SAN BARTOLOME

in millions of US$

3Q 2011 2Q 2011 1Q 2011

4Q 2010 3Q 2010 Sales of Metal $ 102.8

$ 55.6 $ 46.3 $ 67.1

$ 30.0

Production Costs 30.1

14.1 14.1

22.4 12.9

EBITDA

72.5 41.4 32.1

44.7 17.1

Operating

Income/(Loss) 66.7 36.2

27.0 39.2

12.2

Operating Cash Flow (1) 49.6

25.7 23.6

23.3 27.8

Capital

Expenditures 4.4 3.3

3.5 3.5 0.8

in millions of US$ 3Q 2011 2Q

2011 1Q 2011 4Q 2010 3Q

2010 Gross Profit $ 72.7 $ 41.5

$ 32.2 $ 44.7 $ 17.1

Gross Margin 70.7 % 74.6 %

69.5 % 66.6 % 57.0 %

Ounces unless otherwise noted 3Q 2011 2Q

2011 1Q 2011 4Q 2010 3Q

2010 Tons Milled 428,978

378,640 387,668 404,160

360,605

Average Silver Grade

(oz/t) 5.4 5.2

5.6 5.4 5.7

Average Recovery Rate 88.6 % 87.7 %

88.6 % 92.0 % 87.2 %

Silver Production 2,051 1,742

1,711 2,011

1,795

Gold Production 0

0 0 0

0

Cash Operating Costs/Ag Oz $ 9.32

$ 8.73 $ 9.13 $ 7.53

$ 7.05

Reconciliation of EBITDA for

San Bartolome 3Q 2011 2Q 2011

1Q 2011 4Q 2010 3Q 2010

Sales of metal $ 102.8 $ 55.6 $ 46.3 $

67.1 $ 30.0 Production costs applicable to sales (30.1 )

(14.1 ) (14.1 ) (22.4 ) (12.9 ) Administrative and general 0.0 0.0

0.0 0.0 Exploration (0.1 ) (0.1 ) (0.1 ) 0.0 0.0 Care and

maintenance and other (0.1 ) 0.0 0.0 0.0 Pre-development

0.0 0.0

0.0 0.0

EBITDA

$ 72.5 $ 41.4

$ 32.1 $ 44.7

$ 17.1 Operating Cash

Flow for San Bartolome 3Q 2011 2Q

2011 1Q 2011 4Q 2010 3Q

2010 Cash provided by operating activities $ 78.1

$ 38.2 $ 10.5 $ 28.8 $ 15.3 Changes in

operating assets and liabilities: Receivables and other current

assets 5.0 1.5 1.7 1.3 0.4 Prepaid expenses and other 0.2 (0.6 )

(0.5 ) (0.6 ) 0.6 Inventories (7.2 ) 4.0 4.9 4.2 2.8 Accounts

payable and accrued liabilities (26.5 )

(17.4 ) 7.0 (10.4 )

8.7

OPERATING CASH FLOW $ 49.6

$ 25.7 $

23.6 $ 23.3

$ 27.8 KENSINGTON

in millions of US$ 3Q

2011 2Q 2011 1Q 2011 4Q

2010 3Q 2010 Sales of Metal $ 44.2

$ 26.0 $ 48.1 $ 15.1

$ 8.5

Production Costs 24.3

12.8 32.9

6.6 7.4

EBITDA 19.6

12.8 15.2

8.5 0.5

Operating

Income/(Loss) 10.3 2.8

5.8 (1.8 ) (6.7 )

Operating Cash Flow (1) 14.5

11.7 14.0 8.0

(0.3 )

Capital Expenditures 9.2

7.4 5.4

9.6 20.0

in millions of

US$ 3Q 2011 2Q 2011 1Q 2011

4Q 2010 3Q 2010 Gross Profit $

19.9 $ 13.2 $ 15.2 $ 8.5

$ 1.1

Gross Margin 45.0 %

50.8 % 31.6 % 56.3 %

13.1 %

Ounces unless otherwise noted 3Q

2011 2Q 2011 1Q 2011 4Q

2010 3Q 2010 Tons Milled 116,255

121,565 105,820

83,774 90,254

Average

Gold Grade (oz/t) 0.2 0.2

0.2 0.4 0.2

Average Recovery Rate 91.7 %

93.0 % 92.4 % 91.0 % 87.7

%

Gold Production 26 26

24 28 15

Cash Operating Costs/Ag Oz $ 973.28 $

923.56 $ 988.75 $ 874.60

$ 1,199.20

Reconciliation of EBITDA for

Kensington 3Q 2011 2Q 2011

1Q 2011 4Q 2010 3Q 2010 Sales of

metal 44.2 26.0 48.1 15.1 8.5

Production costs applicable to sales (24.3 ) (12.8 ) (32.9 ) (6.6 )

(7.4 ) Administrative and general 0.0 0.0 0.0 0.0 0.0 Exploration

(0.3 ) (0.3 ) 0.0 0.0 (0.4 ) Care and maintenance and other (0.1 )

0.0 0.0 (0.2 ) Pre-development 0.0

0.0 0.0 0.0

0.0

EBITDA $ 19.6

$ 12.8 $

15.2 $ 8.5

$ 0.5 Operating Cash Flow for

Kensington 3Q 2011 2Q 2011

1Q 2011 4Q 2010 3Q 2010 Cash

provided by operating activities $ 8.6 $ 7.6 $

17.0 $ (5.6 ) $ (14.9 ) Changes in operating assets

and liabilities: Receivables and other current assets 5.0 (1.0 )

8.4 (2.2 ) 7.3 Prepaid expenses and other 1.3 0.2 (0.1 ) 0.1 1.9

Inventories (1.3 ) 8.0 (12.2 ) 15.3 10.1 Accounts payable and

accrued liabilities 0.9 (3.1 )

0.9 0.4

(4.7 )

OPERATING CASH FLOW $ 14.5

$ 11.7 $

14.0 $ 8.0

$ (0.3 ) ROCHESTER

in millions of US$ 3Q

2011 2Q 2011 1Q 2011 4Q

2010 3Q 2010 Sales of Metal $ 17.5

$ 14.4 $ 14.3 $ 25.3

$ 5.8

Production Costs 11.4

5.3 7.4

10.6 2.8

EBITDA 2.7

(2.2 ) 3.4

14.1 2.8

Operating Income/(Loss)

2.1 (2.9 ) 2.9

15.2 2.3

Operating

Cash Flow (1) 2.7 (3.8 )

0.9 9.0 4.6

Capital Expenditures 13.6

4.2 1.7 2.1

0.1

in millions of US$ 3Q 2011

2Q 2011 1Q 2011 4Q 2010

3Q 2010 Gross Profit $ 6.1 $ 9.1

$ 6.9 $ 14.7 $ 3.1

Gross Margin 34.9 % 63.2 %

48.3 % 58.1 % 52.5 %

Ounces unless otherwise noted 3Q 2011 2Q

2011 1Q 2011 4Q 2010 3Q

2010 Silver Production (in thousands) 352

333 334 549

419

Gold Production (in

thousands) 1 1

2 2 2

Cash

Operating Costs/Ag Oz $ 36.71 $ 4.34

$ 10.28 $ 2.94 $ 5.10

Reconciliation of EBITDA for Rochester 3Q

2011 2Q 2011 1Q 2011 4Q

2010 3Q 2010 Sales of metal 17.5

14.4 14.3 25.3 5.8 Production costs applicable

to sales (11.4 ) (5.3 ) (7.4 ) (10.6 ) (2.8 ) Administrative and

general 0.0 0.0 0.0 0.0 0.0 Exploration (0.2 ) (0.3 ) 0.0 0.0 (0.1

) Care and maintenance and other (3.2 ) (11.0 ) (3.5 ) (0.6 ) (0.1

) Pre-development 0.0 0.0

0.0 0.0 0.0

EBITDA $ 2.7

$ (2.2 ) $ 3.4

$ 14.1 $ 2.8

Operating Cash Flow for Rochester 3Q

2011 2Q 2011 1Q 2011 4Q

2010 3Q 2010 Cash provided by operating

activities $ 0.9 $ (2.0 ) $ 1.4 $ 11.8

$ 6.2 Changes in operating assets and liabilities:

Receivables and other current assets 0.2 - (0.3 ) 0.3 - Prepaid

expenses and other 0.7 0.4 (0.1 ) 0.1 (0.1 ) Inventories 5.9 0.6

1.0 (1.8 ) (1.7 ) Accounts payable and accrued liabilities

(5.0 ) (2.8 ) (1.1 )

(1.4 ) 0.2

OPERATING CASH FLOW

$ 2.7 $ (3.8

) $ 0.9 $

9.0 $ 4.6

MARTHA

in

millions of US$ 3Q 2011 2Q 2011

1Q 2011 4Q 2010 3Q 2010 Sales

of Metal $ 6.0 $ 4.8 ($0.3 )

$ 18.6 $ 11.0

Production Costs

8.1 3.9 -0.4

10.3 5.3

EBITDA (3.8 ) (0.5 ) (1.2

) 6.5 4.3

Operating

Income/(Loss) (4.0 ) (0.4 )

(1.8 ) 5.2 2.1

Operating Cash Flow (1) (1.7 )

(0.9 ) 2.9 3.8

(1.2 )

Capital Expenditures 1.1

0.6 0.3 0.1

0.0

in millions of US$ 3Q

2011 2Q 2011 1Q 2011 4Q

2010 3Q 2010 Gross Profit ($2.1 )

$ 0.9 $ 0.1 $ 8.3

$ 5.7

Gross Margin -34.9 % 18.8

% na 44.6 % 52.1 %

Ounces

unless otherwise noted 3Q 2011 2Q 2011

1Q 2011 4Q 2010 3Q 2010

Total Tons Milled 24,086 22,122

17,818 13,616

12,790

Average Silver Grade (oz/t)

5.33 5.44 12.06

14.53 42.42

Average Gold Grade (oz/t) 0.01

0.01 0.02 0.02

0.05

Average Recovery Rate – Ag

92.30 % 84.00 % 83.70 %

75.85 % 96.30 %

Average Recovery Rate – Au

72.90 % 72.40 % 75.30 %

57.68 % 93.60 %

Silver Production (in

thousands) 119 101

180 150 511

Gold Production (in thousands) 0

0 0 0

1

Cash Operating Costs/Ag Oz $ 39.31

$ 38.79 $ 24.44 $ 33.99

$ 9.86

Reconciliation of EBITDA for

Martha 3Q 2011 2Q 2011 1Q

2011 4Q 2010 3Q 2010 Sales of metal

6.0 4.8 (0.3 ) 18.7 11.0

Production costs applicable to sales (8.2 ) (3.8 ) 0.4 (10.3 ) (5.3

) Administrative and general 0.0 0.0 0.0 0.0 0.0 Exploration (1.5 )

(1.5 ) (1.3 ) (1.9 ) (1.4 ) Care and maintenance and other (0.1 )

0.0 0.0 0.0 0.0 Pre-development 0.0

0.0 0.0 0.0

0.0

EBITDA $ (3.8

) $ (0.5 ) $

(1.2 ) $ 6.5

$ 4.3 Operating Cash Flow for

Martha 3Q 2011 2Q 2011 1Q

2011 4Q 2010 3Q 2010 Cash provided

by operating activities $ 0.2 $ (3.2) $ (3.1)

$ 4.6 $ 1.9 Changes in operating assets and

liabilities: Receivables and other current assets 2.3 0.2 (5.8) 5.4

(3.7) Prepaid expenses and other 0.4 0.1 - - - Inventories (3.3)

0.1 4.1 (4.8) 0.8 Accounts payable and accrued liabilities

(1.3) 1.9 4.7 (1.4) (0.2)

OPERATING

CASH FLOW $ (1.7) $ (0.9)

$ (0.1) $ 3.8 $ (1.2)

ENDEAVOR

in millions of US$ 3Q 2011 2Q 2011

1Q 2011 4Q 2010 3Q 2010

Sales of Metal $ 6.2 $ 6.6 $ 3.1

$ 3.3 $ 1.7

Production

Costs 3.2 3.3

1.1 1.4 0.7

EBITDA 3.0 3.3

2.0 1.9 1.0

Operating Income/(Loss) 2.1 2.4

1.4 1.3

0.7

Operating Cash Flow (1) 1.3

3.6 2.0

1.8 1.3

Capital

Expenditures 0.0 0.0

0.0 0.0 0.0

in millions of US$ 3Q 2011 2Q

2011 1Q 2011 4Q 2010 3Q

2010 Gross Profit $ 3.0 $ 3.3

$ 2.0 $ 1.9 $ 1.0

Gross Margin 48.4 % 50.0 %

64.5 % 57.6 % 60.2 %

Ounces unless otherwise noted 3Q 2011 2Q

2011 1Q 2011 4Q 2010 3Q

2010 Silver Production (in thousands) 138

215 149 120

102

Gold Production (in

thousands) 0 0

0 0 0

Cash

Operating Costs/Ag Oz $ 22.26 $ 20.04

$ 17.15 $ 16.03 $ 10.32

Reconciliation of EBITDA for Endeavor 3Q

2011 2Q 2011 1Q 2011 4Q

2010 3Q 2010 Sales of metal 6.2 6.6

3.1 3.3 1.7 Production costs applicable to

sales (3.2 ) (3.3 ) (1.1 ) (1.4 ) (0.7 ) Administrative and general

0.0 0.0 0.0 0.0 0.0 Exploration 0.0 0.0 0.0 0.0 0.0 Care and

maintenance and other 0.0 0.0 0.0 0.0 0.0 Pre-development

0.0 0.0 0.0

0.0 0.0

EBITDA

$ 3.0 $ 3.3

$ 2.0 $ 1.9

$ 1.0 Operating Cash Flow for

Endeavor 3Q 2011 2Q 2011

1Q 2011 4Q 2010 3Q 2010 Cash

provided by operating activities $ 2.4 $ 2.5 $

2.1 $ 2.7 $ 0.3 Changes in operating assets and

liabilities: Receivables and other current assets (1.4 ) 2.7 (1.0 )

(0.4 ) 1.2 Prepaid expenses and other - - - - - Inventories (0.9 )

- 0.9 - - Accounts payable and accrued liabilities

1.2 (1.6 ) -

(0.5 ) (0.2 )

OPERATING CASH FLOW

$ 1.3 $ 3.6

$ 2.0 $ 1.8

$ 1.3 Reconciliation of

Non-U.S. GAAP Cash Costs to U.S. GAAP Production Costs Three

months ended September 30, 2011 (In thousands except ounces and per

ounce costs) Palmarejo San

Bartolomé Kensington Rochester

Martha Endeavor Total

Production of silver (ounces) 2,250,818 2,051,426 - 351,717 118,523

137,843 4,910,327 Production of gold (ounces) - - 25,687 - - -

25,687 Cash operating cost per Ag ounce $ (1.16 ) $ 9.32 $ - $

36.71 $ 39.31 $ 22.26 $ 7.57 Cash costs per Ag ounce $ (1.16 ) $

10.89 $ - $ 39.80 $ 41.29 $ 22.26 $ 8.49 Cash operating cost per Au

ounce $ - $ - $ 973.28 $ - $ - $ - $ 973.28 Cash cost per Au ounce

$ - $ - $ 973.28 $ - $ - $ - $

973.28 Total Cash Operating Cost (Non-U.S. GAAP) $

(2,607 ) $ 19,120 $ 25,000 $ 12,912 $ 4,660 $ 3,068 $ 62,153

Royalties - 3,217 - 827 234 - 4,278 Production taxes -

- - 260 -

- 260 Total Cash Costs (Non-U.S.

GAAP) (2,607 ) 22,337 25,000 13,999 4,893 3,068 66,691

Add/Subtract: Third party smelting costs - - (3,096 ) - (566 ) (808

) (4,470 ) By-product credit 51,185 - - 2,433 198 - 53,816 Other

adjustments 435 111 - 117 290 - 953 Change in inventory 15,099

7,637 2,443 (5,193 ) 3,328 949 24,263 Depreciation, depletion and

amortization 41,174 6,062 9,568

556 237 914 58,511

Production costs applicable to sales,

including depreciation, depletion and amortization (U.S. GAAP)

$ 105,286 $ 36,147 $ 33,915 $ 11,912 $ 8,380

$ 4,123 $ 199,764

Reconciliation of

Non-U.S. GAAP Cash Costs to U.S. GAAP Production Costs Nine

months ended September 30, 2011 (In thousands except ounces and per

ounce costs) Palmarejo San

Bartolomé Kensington Rochester

Martha Endeavor Total

Production of silver (ounces) 6,351,120 5,503,951 - 1,018,844

399,630 501,638 13,775,183 Production of gold (ounces) - - 75,121 -

- - 75,121 Cash operating cost per Ag ounce $ (0.47 ) $ 9.07 $ - $

17.46 $ 32.48 $ 19.79 $ 6.36 Cash costs per Ag ounce $ (0.47 ) $

10.58 $ - $ 19.87 $ 33.95 $ 19.79 $ 7.18 Cash operating cost per Au

ounce $ - $ - $ 961.10 $ - $ - $ - $ 961.10 Cash cost per Au ounce

$ - $ - $ 961.10 $ - $ - $ -

$ 961.10 Total Cash Operating Cost (Non-U.S.

GAAP) $ (3,014 ) $ 49,946 $ 72,199 $ 17,787 $ 12,981 $ 9,926 $

159,825 Royalties - 8,281 - 1,734 587 - 10,602 Production taxes

- - - 728

- - 728 Total Cash

Costs (Non-U.S. GAAP) (3,014 ) 58,227 72,199 20,249 13,568 9,926

171,155 Add/Subtract: Third party smelting costs - - (9,122 ) -

(2,366 ) (2,390 ) (13,878 ) By-product credit 139,842 - - 6,554 706

- 147,102 Other adjustments 1,208 298 19 256 462 - 2,243 Change in

inventory 1,216 (196 ) 7,015 (3,005 ) (869 ) 45 4,206 Depreciation,

depletion and amortization 116,584 16,387

28,823 1,655 81

2,398 165,928

Production costs applicable to sales,

including depreciation, depletion and amortization (U.S. GAAP)

$ 255,836 $ 74,716 $ 98,934 $ 25,709 $

11,582 $ 9,979 $ 476,756

Reconciliation of Non-U.S. GAAP Cash Costs to U.S. GAAP

Production Costs Three months ended September 30, 2010 (In

thousands except ounces and per ounce costs)

Palmarejo San Bartolomé

Kensington Rochester Martha

Endeavor Total Production of silver

(ounces) 1,506,742 1,794,617 - 419,433 510,685 102,053 4,333,530

Production of gold (ounces) - - 15,155 - - - 15,155 Cash operating

cost per Ag ounce $ 0.15 $ 7.05 $ - $ 5.10 $ 9.86 $ 10.32 $ 4.87

Cash costs per Ag ounce $ 0.15 $ 7.83 $ - $ 5.82 $ 11.04 $ 10.32 $

5.40 Cash operating cost per Au ounce $ - $ - $ 1,199.20 $ - $ - $

- $ 1,199.20 Cash costs per Au ounce $ - $ - $

1,199.20 $ - $ - $ - $ 1,199.20

Total Operating Cost (Non-U.S. GAAP) $ 227 $ 12,651 $ 18,174

$ 2,140 $ 5,039 $ 1,053 $ 39,284 Royalties - 1,396 - - 601 - 1,997

Production taxes - - -

304 - - 304

Total Cash Costs (Non-U.S. GAAP) 227 14,047 18,174 2,444

5,640 1,053 41,585 Add/Subtract: Third party smelting costs - -

(1,618 ) - (995 ) (354 ) (2,967 ) By-product credit 36,538 - -

2,361 734 - 39,633 Other adjustments - - - 53 914 - 967 Change in

inventory (5,423 ) (1,146 ) (9,135 ) (2,088 ) (1,009 ) (15 )

(18,816 ) Depreciation, depletion and amortization 22,491

4,943 7,219 446

2,119 330 37,548

Production costs applicable to sales,

including depreciation, depletion and amortization (U.S. GAAP)

$ 53,833 $ 17,844 $ 14,640 $ 3,216 $

7,403 $ 1,014 $ 97,950

Reconciliation of Non-U.S. GAAP Cash Costs to U.S. GAAP

Production Costs Nine months ended September 30, 2010 (In

thousands except ounces and per ounce costs)

Palmarejo San Bartolomé

Kensington Rochester Martha

Endeavor Total Production of silver

(ounces) 3,877,972 4,697,685 - 1,474,686 1,425,796 445,752

11,921,891 Production of gold (ounces) - - $ 15,155 - - - 15,155

Cash operating cost per Ag ounce $ 4.85 $ 7.99 $ - $ 2.93 $ 10.96 $

8.56 $ 6.72 Cash costs per Ag ounce $ 4.85 $ 8.69 $ - $ 3.55 $

11.74 $ 8.56 $ 7.17 Cash operating cost per Au ounce $ - $ - $

1,199.20 $ - $ - $ - $ 1,199.20 Cash costs per Au ounce $ -

$ - $ 1,199.20 $ - $ - $ - $ 1,199.20

Total Operating Cost (Non-U.S. GAAP) $ 18,799 $

37,520 18,174 $ 4,315 $ 15,624 $ 3,817 $ 98,249 Royalties - 3,287 -

- 1,107 - 4,394 Production taxes - -

- 912 - -

912 Total Cash Costs (Non-U.S. GAAP) 18,799 40,807

18,174 5,227 16,731 3,817 103,555 Add/Subtract: Third party

smelting costs - - (1,618 ) - (2,821 ) (964 ) (5,403 ) By-product

credit 85,429 - - 8,480 1,971 - 95,880 Other adjustments - - - 216

1,173 - 1,389 Change in inventory (12,120 ) (3,162 ) (9,135 ) 230

(312 ) (127 ) (24,626 ) Depreciation, depletion and amortization

63,574 14,152 7,219

1,368 6,673 1,440 94,426

Production costs applicable to sales,

including depreciation, depletion and amortization (U.S. GAAP)

$ 155,682 $ 51,797 $ 14,640 $ 15,521 $ 23,415

$ 4,166 $ 265,221

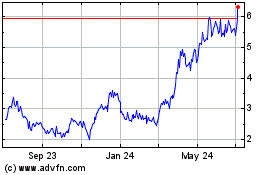

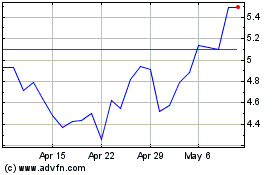

Coeur Mining (NYSE:CDE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Coeur Mining (NYSE:CDE)

Historical Stock Chart

From Jul 2023 to Jul 2024