Monster Beverage Results Disappoint

November 03 2016 - 5:50PM

Dow Jones News

Monster Beverage Corp. posted disappointing results in the

latest quarter as the stronger U.S. dollar and distribution

transitions continue to weigh on the energy-drink maker.

Shares, down 5.9% this year, fell another 5.9% to $131.88 in

after-hours trading.

In June 2015, Coca-Cola Co. paid $2.15 billion to buy a 16.7%

stake in Monster as part of an asset swap in which it also became

Monster's preferred distributor. Issues related to the distribution

transition have weighed on Monster's results since then.

On Thursday, Monster Chief Executive Rodney Sacks said the

alignment continued to progress, with transitions to Coca-Cola

bottlers in Chile, Colombia, Mexico, South Africa and other

countries in Africa during the quarter.

He also said the company is continuing to see improvements in

the quality of distribution in the U.S., but that the continued

strength of the U.S. dollar and distributor transitions affected

results.

For the September quarter, the company earned $191.6 million, or

99 cents a share, up from $174.6 million, or 84 cents a share, a

year earlier.

Revenue climbed 4.1% to $788 million. The company said

unfavorable currency exchange rates hit sales by about $2.6 million

during the quarter.

Analysts polled by Thomson Reuters had projected adjusted profit

of $1.12 a share on $818.8 million in revenue.

Gross margin improved to 63.8% from 61.5% a year ago.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

November 03, 2016 17:35 ET (21:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

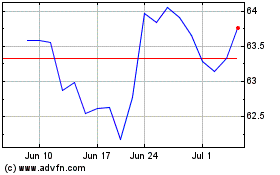

Coca Cola (NYSE:KO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Coca Cola (NYSE:KO)

Historical Stock Chart

From Apr 2023 to Apr 2024