0001224608falsetrue00012246082024-10-312024-10-310001224608us-gaap:CommonStockMember2024-10-312024-10-310001224608cno:RightsToPurchaseSeriesFJuniorParticipatingPreferredStockMember2024-10-312024-10-310001224608cno:A5125SubordinatedDebenturesDue2060Member2024-10-312024-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 31, 2024

CNO Financial Group, Inc.

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | |

| Delaware | 001-31792 | 75-3108137 |

(State or Other

Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer

Identification No.) |

11299 Illinois Street

Carmel, Indiana 46032

(Address of Principal Executive Offices) (Zip Code)

(317) 817-6100

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

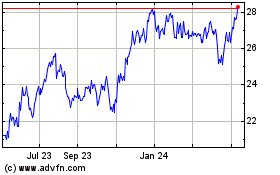

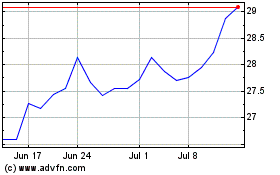

| Common Stock, par value $0.01 per share | | CNO | | New York Stock Exchange |

| Rights to purchase Series F Junior Participating Preferred Stock | | | | New York Stock Exchange |

| 5.125% Subordinated Debentures due 2060 | | CNOpA | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02. | Results of Operations and Financial Condition. |

On October 31, 2024, CNO Financial Group, Inc. ("CNO" or the "Company") issued: (i) a press release announcing its financial results for the quarter ended September 30, 2024, a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by reference; (ii) the Quarterly Financial Supplement for September 30, 2024, a copy of which is attached hereto as Exhibit 99.2 and is incorporated herein by reference; and (iii) additional financial information related to its financial and operating results for the quarter ended September 30, 2024, a copy of which is attached hereto as Exhibit 99.3 and is incorporated herein by reference.

The information contained under Item 2.02 in this Current Report on Form 8-K (including Exhibits 99.1, 99.2 and 99.3) is being furnished and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that Section. The information contained in this Current Report on Form 8-K shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in any such filing.

| | | | | |

| Item 9.01(d). | Financial Statements and Exhibits. |

The following materials are furnished as exhibits to this Current Report on Form 8-K:

| | | | | |

| 99.1 | |

| 99.2 | |

| 99.3 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| CNO Financial Group, Inc. |

| |

| Date: October 31, 2024 | |

| By: | /s/ Michellen A. Wildin | |

| | Michellen A. Wildin | |

| | Senior Vice President and Chief Accounting Officer | |

| | |

News

News

For Immediate Release

CNO Financial Group Reports Third Quarter 2024 Results

Strong third quarter production; Record annuity collected premiums

Carmel, Ind., October 31, 2024 - CNO Financial Group, Inc. (NYSE: CNO) today reported net income of $9.3 million, or $0.09 per diluted share, in 3Q24 compared to $167.3 million, or $1.46 per diluted share, in 3Q23. Non-economic accounting impacts due to market volatility affected both periods which reduced net income in 2024 and increased it in 2023. Net operating income,(1) which excludes these non-economic accounting impacts, was $119.2 million, or $1.11 per diluted share, in 3Q24 compared to $101.3 million, or $0.88 per diluted share, in 3Q23.

Significant items(6) positively impacted both net income and net operating income(1) by $18.8 million, or $0.17 per diluted share, in 3Q24 compared to $16.9 million, or $0.14 per diluted share, in 3Q23.

“CNO delivered another quarter of excellent net operating income and sales performance, reflecting continued agent force growth, and ongoing strength in our underwriting margins and net investment income,” said Gary C. Bhojwani, chief executive officer. “We posted our ninth consecutive quarter of sales growth, led by record annuity collected premiums and strong Medicare and long-term care sales.”

“Our sustained sales growth is translating into earnings growth, with operating earnings per share up 26%. All Growth Scorecard performance metrics are up once again. As we advance our growth strategy, we continue to optimize the balance between production, profitability and capital management.”

“CNO has a unique and differentiated position to serve the middle-income market through our products, distribution capabilities and proven track record of execution. We enter the fourth quarter with momentum, supported by favorable demographic trends, a supportive macroeconomic environment and our strong financial position.”

Third Quarter 2024 Highlights (as compared to the corresponding period in the prior year unless otherwise stated)

•Annuity collected premiums up 25%; Policyholder and client assets up 12%

•Medicare Supplement new annualized premiums ("NAP")(4) up 15%; Medicare Advantage sales up 26%

•Producing agent counts in the Consumer Division and Worksite Division up 5% and 17%, respectively

•Raising full-year guidance for earnings and cash flow

• Returned $106.8 million to shareholders

• Book value per share was $25.86; Book value per diluted share, excluding accumulated other comprehensive loss,(2) was $35.84

• Return on equity ("ROE") of 11.8%; Operating ROE, as adjusted,(5) of 11.7%

FINANCIAL SUMMARY

Quarter End

(Amounts in millions, except per share data)

(Unaudited)

Net operating income, a non-GAAP(a) financial measure, is used consistently by CNO’s management to evaluate the operating performance of the company and is a measure commonly used in the life insurance industry. It differs from net income primarily because it excludes certain non-operating items such as net realized investment gains (losses) from sales and change in the allowance for credit losses, changes in fair values of embedded derivatives and market risk benefits and the liability for a deferred compensation plan, and certain significant and unusual items included in net income. Management believes an analysis of net operating income is important in understanding the profitability and operating trends of the Company’s business. Net income is the most directly comparable GAAP measure.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Per diluted share | | | | | | | |

| Quarter ended | | Quarter ended |

| September 30, | | September 30, |

| 2024 | | | 2023 | | % change | | 2024 | | | 2023 | | % change |

| | | | | | | | | | | | | |

Income from insurance products (b) | 1.21 | | | | $ | 0.76 | | | 59 | | | $ | 129.2 | | | | $ | 86.8 | | | 49 | |

| Fee income | (0.03) | | | | (0.03) | | | — | | | (2.7) | | | | (2.9) | | | (7) | |

Investment income not allocated to product lines (c) | 0.42 | | | | 0.33 | | | 27 | | | 45.5 | | | | 38.4 | | | 18 | |

| Expenses not allocated to product lines | (0.17) | | | | 0.07 | | | n/m | | (18.5) | | | | 7.5 | | | n/m |

| Operating earnings before taxes | 1.43 | | | | 1.13 | | | | | 153.5 | | | | 129.8 | | | |

| Income tax expense on operating income | (0.32) | | | | (0.25) | | | 28 | | | (34.3) | | | | (28.5) | | | 20 | |

| Net operating income (1) | 1.11 | | | | 0.88 | | | 26 | | | 119.2 | | | | 101.3 | | | 18 | |

| Net realized investment losses from sales, impairments and change in allowance for credit losses | (0.10) | | | | (0.17) | | | | | (11.1) | | | | (20.1) | | | |

| Net change in market value of investments recognized in earnings | 0.11 | | | | (0.08) | | | | | 12.3 | | | | (9.2) | | | |

| Changes in fair value of embedded derivative liabilities and market risk benefits | (1.19) | | | | 0.95 | | | | | (127.1) | | | | 109.4 | | | |

| | | | | | | | | | | | | |

| Other | (0.15) | | | | 0.05 | | | | | (16.6) | | | | 5.7 | | | |

| Non-operating income (loss) before taxes | (1.33) | | | | 0.75 | | | | | (142.5) | | | | 85.8 | | | |

| Income tax benefit (expense) on non-operating income | 0.31 | | | | (0.17) | | | | | 32.6 | | | | (19.8) | | | |

| | | | | | | | | | | | | |

| Net non-operating income (loss) | (1.02) | | | | 0.58 | | | | | (109.9) | | | | 66.0 | | | |

| Net income | $ | 0.09 | | | | $ | 1.46 | | | | | $ | 9.3 | | | | $ | 167.3 | | | |

| | | | | | | | | | | | | |

| Weighted average diluted shares outstanding | 107.1 | | | | 114.5 | | | | | | | | | | |

n/m - not meaningful

____________________

(a) GAAP is defined as accounting principles generally accepted in the United States of America.

(b) Income from insurance products is the sum of the insurance margins of the annuity, health and life product lines, less expenses allocated to the insurance product lines. It excludes the income from our fee income business, investment income not allocated to product lines, net expenses not allocated to product lines (primarily holding company expenses) and income taxes. Insurance margin is management’s measure of the profitability of its annuity, health and life segments’ performance and consists of insurance policy income plus allocated investment income less insurance policy benefits, interest credited, commissions, advertising expense and amortization of acquisition costs.

(c) Investment income not allocated to product lines represents net investment income less: (i) equity returns credited to policyholder account balances; (ii) the investment income allocated to our product lines; (iii) interest expense on notes payable, investment borrowings and financing arrangements; (iv) expenses related to the funding agreement-backed notes ("FABN") program; and (v) certain expenses related to benefit plans that are offset by special-purpose investment income; plus (vi) the impact of annual option forfeitures related to fixed indexed annuity surrenders.

FINANCIAL SUMMARY (continued)

Management vs. GAAP Measures

(Dollars in millions, except per share data)

(Unaudited)

Shareholders’ equity, excluding accumulated other comprehensive income (loss), and book value per share, excluding accumulated other comprehensive income (loss), are non-GAAP measures that are utilized by management to view the business without the effect of accumulated other comprehensive income (loss) which is primarily attributable to fluctuations in interest rates associated with fixed maturities, available for sale. Management views the business in this manner because the Company has the ability and generally, the intent, to hold investments to maturity and meaningful trends can be more easily identified without the fluctuations. In addition, shareholders' equity excludes net operating loss carryforwards in our non-GAAP return on equity measures as such assets are not discounted and, accordingly, will not provide a return to shareholders until after it is realized as a reduction to taxes that would otherwise be paid. Management believes that excluding this value from the equity component of this measure enhances the understanding of the effect these non-discounted assets have on operating returns.

___________________________________________________________________________________________________

| | | | | | | | | | | |

| Quarter ended |

| September 30, |

| 2024 | | 2023 |

| | | |

Trailing twelve months return on equity (a) | 11.8 | % | | 14.5 | % |

Trailing twelve months operating return on equity as adjusted to exclude accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) (5) | 11.7 | % | | 8.5 | % |

Trailing twelve months operating return, excluding significant items, on equity as adjusted to exclude accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) (5) | 10.5 | % | | 8.0 | % |

| | | |

| | | |

| Shareholders’ equity | $ | 2,687.8 | | | $ | 1,890.1 | |

| Accumulated other comprehensive loss | 1,116.0 | | | 1,956.7 | |

| | | |

| Shareholders’ equity, excluding accumulated other comprehensive loss | 3,803.8 | | | 3,846.8 | |

| Net operating loss carryforwards | (273.9) | | | (102.6) | |

| Shareholders' equity, excluding accumulated other comprehensive loss and net operating loss carryforwards | $ | 3,529.9 | | | $ | 3,744.2 | |

| | | |

| Book value per diluted share | $ | 25.32 | | | $ | 16.58 | |

| Accumulated other comprehensive loss | 10.52 | | | 17.17 | |

| | | |

Book value per diluted share, excluding accumulated other comprehensive loss (a non-GAAP financial measure) (2) | $ | 35.84 | | | $ | 33.75 | |

____________________

(a) Calculated using average shareholders’ equity for the measurement period.

Non-Operating Items

Net investment losses in 3Q24 were $11.1 million, including the favorable change in the allowance for credit losses of $11.6 million. Net investment losses in 3Q23 were $20.1 million, including the unfavorable change in the allowance for credit losses of $2.3 million.

During 3Q24 and 3Q23, we recognized an increase (decrease) in earnings of $12.3 million and $(9.2) million, respectively, due to the net change in market value of investments.

During 3Q24 and 3Q23, we recognized an increase (decrease) in earnings of $(127.1) million and $109.4 million, respectively, resulting from changes in the estimated fair value of embedded derivative liabilities and market risk benefits related to our fixed indexed annuities. Such amounts include the impacts of changes in market interest rates and equity impacts used to determine the estimated fair values of the embedded derivatives and market risk benefits. In addition, 3Q24 includes the impacts to the fair value of the embedded derivative and market risk benefits resulting from our comprehensive annual actuarial review.

Other non-operating items in 3Q24 included a charge of $8.3 million primarily related to a 5% workforce reduction and transition costs for outsourcing certain operations activities. In addition, other non-operating items included an increase (decrease) in earnings of $(3.5) million and $6.8 million in 3Q24 and 3Q23, respectively, for the mark-to-market change in the agent deferred compensation plan liability which was impacted by changes in the underlying actuarial assumptions used to value the liability. We recognize the mark-to-market change in the estimated value of this liability through earnings as assumptions change.

INVESTMENT PORTFOLIO

(Dollars in millions)

Fixed maturities, available for sale, at amortized cost by asset class as of September 30, 2024 are as follows:

| | | | | | | | | | | | | | | | | |

| Investment grade | | Below investment grade | | Total |

| Corporate securities | $ | 13,083.3 | | | $ | 641.9 | | | $ | 13,725.2 | |

| Certificates of deposit | 470.0 | | | — | | | 470.0 | |

| United States Treasury securities and obligations of the United States government and agencies | 210.8 | | | — | | | 210.8 | |

| States and political subdivisions | 3,213.6 | | | 9.6 | | | 3,223.2 | |

| Foreign governments | 103.2 | | | — | | | 103.2 | |

| Asset-backed securities | 1,479.4 | | | 99.1 | | | 1,578.5 | |

| Agency residential mortgage-backed securities | 812.5 | | | — | | | 812.5 | |

| Non-agency residential mortgage-backed securities | 1,252.0 | | | 418.0 | | (a) | 1,670.0 | |

| Collateralized loan obligations | 1,083.2 | | | — | | | 1,083.2 | |

| Commercial mortgage-backed securities | 2,285.8 | | | 84.0 | | | 2,369.8 | |

| | | | | |

| Total | $ | 23,993.8 | | | $ | 1,252.6 | | | $ | 25,246.4 | |

____________________

(a) Certain structured securities rated below investment grade by Nationally Recognized Statistical Rating Organizations may be assigned a NAIC 1 or NAIC 2 designation based on the cost basis of the security relative to estimated recoverable amounts as determined by the National Association of Insurance Commissioners (NAIC).

The fair value of CNO’s available for sale fixed maturity portfolio was $23.7 billion compared with an amortized cost of $25.2 billion. Net unrealized losses were comprised of gross unrealized gains of $300.3 million and gross unrealized losses of $1,796.1 million. The allowance for credit losses was $25.9 million at September 30, 2024.

Statutory (based on non-GAAP measures) and GAAP Capital Information

The consolidated statutory risk-based capital ratio of our U.S. based insurance subsidiaries was estimated at 388% at September 30, 2024, reflecting estimated 3Q24 statutory operating earnings of $8.4 million (and $32.5 million in the first nine months of 2024) and the payment of insurance company dividends (net of capital contributions) to the holding company of $38.9 million during 3Q24 (and $111.9 million (net of capital contributions) in the first nine months of 2024).

During 3Q24, we repurchased $90.0 million of common stock under our securities repurchase program (including $1.4 million of repurchases settled in 4Q24). We repurchased 2.8 million common shares at an average cost of $32.03 per share. As of September 30, 2024, we had 103.9 million shares outstanding and had authority to repurchase up to an additional $331.8 million of our common stock. During 3Q24, dividends paid on common stock totaled $16.9 million.

Unrestricted cash and investments held by our holding company were $453 million at September 30, 2024 compared to $256.0 million at December 31, 2023. In addition, the holding company has invested $500 million of the proceeds from the previously announced May 2024 issuance of $700.0 million of 6.450% senior notes due 2034 (the "2034 Notes") primarily into certificates of deposit which are expected to be used for the repayment of $500.0 million of 5.250% senior notes due May 2025 (the "2025 Notes").

Book value per common share was $25.86 at September 30, 2024 compared to $20.26 at December 31, 2023. Book value per diluted share, excluding accumulated other comprehensive income (loss) (2), was $35.84 at September 30, 2024 compared to $33.94 at December 31, 2023.

The debt-to-capital ratio was 40.5% and 34.0% at September 30, 2024 and December 31, 2023, respectively. Our debt-to-total capital ratio, excluding accumulated other comprehensive income (loss)(3), was 32.5% and 23.1% at September 30, 2024 and December 31, 2023, respectively. Such ratios reflect the issuance of the 2034 Notes in May 2024. At September 30, 2024, adjusting for the expected repayment of the 2025 Notes, the debt-to-total capital ratio would have been 33.2% and the debt-to-total capital ratio, excluding accumulated other comprehensive income (loss), would have been 26.0%.

Return on equity for the trailing four quarters ended September 30, 2024 and 2023 was 11.8% and 14.5%, respectively. Operating return, excluding significant items, on equity as adjusted to exclude accumulated other comprehensive income (loss) and net operating loss carryforwards(5), for the trailing four quarters ended September 30, 2024 and 2023 was 10.5% and 8.0%, respectively.

In this news release, CNO includes non-GAAP measures to enhance investors’ understanding of management’s view of the business. The non-GAAP measures are not a substitute for GAAP, but rather a supplement to increase transparency by providing a broader perspective. CNO’s definitions of non-GAAP measures may differ from other companies’ definitions. More detailed information including various GAAP and non-GAAP measurements are located at CNOinc.com in the Investors section under SEC Filings.

CAUTION REGARDING FORWARD-LOOKING STATEMENTS:

This press release may contain forward-looking statements within the meaning of federal securities laws. These prospective statements reflect management’s current expectations, but are not guarantees of future performance. Accordingly, please refer to CNO’s cautionary statement regarding forward-looking statements, and the business environment in which the Company operates, contained in the Company’s Form 10-K for the year ended December 31, 2023 and any subsequent Form 10-Q or Form 10-K on file with the Securities and Exchange Commission and on the Company’s website at CNOinc.com in the Investors section. CNO specifically disclaims any obligation to update or revise any forward-looking statement because of new information, future developments or otherwise.

EARNINGS RELEASE CONFERENCE CALL WEBCAST:

The Company will host a conference call to discuss results on November 1, 2024 at 11:00 a.m. Eastern Time. During the call, we will be referring to a presentation that will be available at the Investors section of the company's website.

To participate by dial-in, please register at https://www.netroadshow.com/events/login?show=7b707407&confId=72581. Upon registering, you will be provided with call details and a registrant ID used to track attendance on the conference call. Reminders will also be sent to registered participants via email.

For those investors who prefer to listen to the call online, we will be broadcasting the call live via webcast. The event can be accessed through the Investors section of the company's website: ir.CNOinc.com. Participants should go to the website at least 15 minutes before the event to register and download any necessary audio software.

ABOUT CNO FINANCIAL GROUP

CNO Financial Group, Inc. (NYSE: CNO) secures the future of middle-income America. CNO provides life and health insurance, annuities, financial services, and workforce benefits solutions through our family of brands, including Bankers Life, Colonial Penn, Optavise and Washington National. Our customers work hard to save for the future, and we help protect their health, income, and retirement needs with 3.2 million policies and $38 billion in total assets. Our 3,500 associates, 4,800 exclusive agents and more than 5,000 independent partner agents guide individuals, families, and businesses through a lifetime of financial decisions. For more information, visit CNOinc.com.

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEET

(Dollars in millions)

(unaudited)

| | | | | | | | | | | |

| September 30,

2024 | | December 31,

2023 |

| ASSETS | | | |

| Investments: | | | |

Fixed maturities, available for sale, at fair value (net of allowance for credit losses: September 30, 2024 - $25.9 and December 31, 2023 - $42.9; amortized cost: September 30, 2024 - $25,246.4 and December 31, 2023 - $23,699.2) | $ | 23,724.7 | | | $ | 21,506.2 | |

| Equity securities at fair value | 120.5 | | | 96.9 | |

| Mortgage loans (net of allowance for credit losses: September 30, 2024 - $16.5 and December 31, 2023 - $15.4) | 2,372.7 | | | 2,064.1 | |

| Policy loans | 133.3 | | | 128.5 | |

| Trading securities | 217.4 | | | 222.7 | |

Investments held by variable interest entities (net of allowance for credit losses: September 30, 2024 - $1.8 and December 31, 2023 - $3.1; amortized cost: September 30, 2024 - $258.8 and December 31, 2023 - $787.6) | 250.1 | | | 768.6 | |

| Other invested assets | 1,595.5 | | | 1,353.4 | |

| Total investments | 28,414.2 | | | 26,140.4 | |

| Cash and cash equivalents - unrestricted | 1,164.7 | | | 774.5 | |

| Cash and cash equivalents held by variable interest entities | 80.6 | | | 114.5 | |

| Accrued investment income | 276.2 | | | 251.5 | |

| Present value of future profits | 165.7 | | | 180.7 | |

| Deferred acquisition costs | 2,100.9 | | | 1,944.4 | |

Reinsurance receivables (net of allowance for credit losses: September 30, 2024 - $3.0 and December 31, 2023 - $3.0) | 3,906.7 | | | 4,040.7 | |

| Market risk benefit asset | 96.4 | | | 75.4 | |

| Income tax assets, net | 788.7 | | | 936.2 | |

| Assets held in separate accounts | 3.3 | | | 3.1 | |

| Other assets | 648.0 | | | 641.1 | |

| Total assets | $ | 37,645.4 | | | $ | 35,102.5 | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | | | |

| Liabilities: | | | |

| Liabilities for insurance products: | | | |

| Policyholder account balances | $ | 17,240.5 | | | $ | 15,667.8 | |

| Future policy benefits | 12,179.6 | | | 11,928.2 | |

| Market risk benefit liability | 1.0 | | | 7.4 | |

| Liability for life insurance policy claims | 59.9 | | | 62.1 | |

| Unearned and advanced premiums | 217.4 | | | 218.9 | |

| Liabilities related to separate accounts | 3.3 | | | 3.1 | |

| Other liabilities | 951.0 | | | 848.8 | |

| Investment borrowings | 2,188.9 | | | 2,189.3 | |

| Borrowings related to variable interest entities | 283.1 | | | 820.8 | |

| Notes payable – direct corporate obligations | 1,832.9 | | | 1,140.5 | |

| Total liabilities | 34,957.6 | | | 32,886.9 | |

| Commitments and Contingencies | | | |

| Shareholders' equity: | | | |

Common stock ($0.01 par value, 8,000,000,000 shares authorized, shares issued and outstanding: September 30, 2024 – 103,922,954; December 31, 2023 – 109,357,540) | 1.0 | | | 1.1 | |

| Additional paid-in capital | 1,715.9 | | | 1,891.5 | |

| Accumulated other comprehensive loss | (1,116.0) | | | (1,576.8) | |

| Retained earnings | 2,086.9 | | | 1,899.8 | |

| Total shareholders' equity | 2,687.8 | | | 2,215.6 | |

| Total liabilities and shareholders' equity | $ | 37,645.4 | | | $ | 35,102.5 | |

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF OPERATIONS

(Dollars in millions, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | Nine months ended |

| September 30, | | September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Revenues: | | | | | | | |

| Insurance policy income | $ | 645.0 | | | $ | 626.0 | | | $ | 1,914.9 | | | $ | 1,879.8 | |

| Net investment income: | | | | | | | |

| General account assets | 366.3 | | | 324.8 | | | 1,019.9 | | | 925.1 | |

| Policyholder and other special-purpose portfolios | 87.6 | | | (33.0) | | | 312.3 | | | 109.4 | |

| Investment gains (losses): | | | | | | | |

| Realized investment losses | (13.1) | | | (21.6) | | | (49.4) | | | (58.0) | |

| Other investment gains (losses) | 14.3 | | | (7.7) | | | 41.2 | | | (21.2) | |

| | | | | | | |

| Total investment gains (losses) | 1.2 | | | (29.3) | | | (8.2) | | | (79.2) | |

| Fee revenue and other income | 29.5 | | | 59.0 | | | 113.4 | | | 141.2 | |

| Total revenues | 1,129.6 | | | 947.5 | | | 3,352.3 | | | 2,976.3 | |

| Benefits and expenses: | | | | | | | |

| Insurance policy benefits | 726.2 | | | 399.1 | | | 1,926.4 | | | 1,574.7 | |

| Liability for future policy benefits remeasurement (gain) loss | 7.3 | | | (0.1) | | | (29.1) | | | 8.8 | |

| Change in fair value of market risk benefits | (16.1) | | | (33.8) | | | (30.0) | | | (36.6) | |

| Interest expense | 68.0 | | | 62.6 | | | 192.4 | | | 174.9 | |

| Amortization of deferred acquisition costs and present value of future profits | 64.0 | | | 57.0 | | | 185.9 | | | 168.5 | |

| | | | | | | |

| | | | | | | |

| Other operating costs and expenses | 269.2 | | | 247.1 | | | 798.9 | | | 775.3 | |

| Total benefits and expenses | 1,118.6 | | | 731.9 | | | 3,044.5 | | | 2,665.6 | |

| Income before income taxes | 11.0 | | | 215.6 | | | 307.8 | | | 310.7 | |

| | | | | | | |

| Income tax expense | 1.7 | | | 48.3 | | | 69.9 | | | 70.5 | |

| | | | | | | |

| Net income | $ | 9.3 | | | $ | 167.3 | | | $ | 237.9 | | | $ | 240.2 | |

| Earnings per common share: | | | | | | | |

| Basic: | | | | | | | |

| Weighted average shares outstanding | 105,101,000 | | | 112,689,000 | | | 107,265,000 | | | 113,836,000 | |

| Net income | $ | .09 | | | $ | 1.48 | | | $ | 2.22 | | | $ | 2.11 | |

| Diluted: | | | | | | | |

| Weighted average shares outstanding | 107,131,000 | | | 114,462,000 | | | 109,078,000 | | | 115,613,000 | |

| Net income | $ | .09 | | | $ | 1.46 | | | $ | 2.18 | | | $ | 2.08 | |

NOTES

(1)Management believes that an analysis of net income applicable to common stock before: (i) net realized investment gains or losses from sales, impairments and the change in allowance for credit losses, net of taxes; (ii) net change in market value of investments recognized in earnings, net of taxes; (iii) changes in fair value of embedded derivative liabilities and market risk benefits related to our fixed indexed annuities, net of taxes; (iv) fair value changes related to the agent deferred compensation plan, net of taxes; (v) gains or losses related to material reinsurance transactions, net of taxes; (vi) loss on extinguishment of debt, net of taxes; (vii) changes in the valuation allowance for deferred tax assets and other tax items; and (viii) other non-operating items consisting primarily of earnings attributable to variable interest entities, net of taxes ("net operating income," a non-GAAP financial measure) is important to evaluate the financial performance of the company, and is a key measure commonly used in the life insurance industry. Management uses this measure to evaluate performance because the items excluded from net operating income can be affected by events that are unrelated to the company's underlying fundamentals. A reconciliation of net operating income to net income applicable to common stock is provided in the table on page 2. Additional information concerning this non-GAAP measure is included in our periodic filings with the Securities and Exchange Commission that are available in the "Investors - SEC Filings" section of CNO's website, CNOinc.com.

(2)Book value per diluted share reflects the potential dilution that could occur if outstanding stock options were exercised and restricted stock and performance units were vested. The dilution from options, restricted shares and performance units is calculated using the treasury stock method. Under this method, we assume the proceeds from the exercise of the options (or the unrecognized compensation expense with respect to restricted stock and performance units) will be used to purchase shares of our common stock at the closing market price on the last day of the period. In addition, the calculation of this non-GAAP measure differs from the corresponding GAAP measure because accumulated other comprehensive income (loss) has been excluded from the value of capital used to determine this measure. Management believes this non-GAAP measure is useful because it removes the volatility that arises from changes in the unrealized appreciation (depreciation) of our investments.

(3)The calculation of this non-GAAP measure differs from the corresponding GAAP measure because accumulated other comprehensive income (loss) has been excluded from the value of capital used to determine this measure. Management believes this non-GAAP measure is useful because it removes the volatility that arises from changes in the unrealized appreciation (depreciation) of our investments.

(4)Measured by new annualized premiums for life and health products, which includes 10% of single premium whole life deposits and 100% of all other premiums (excluding annuities). Sales of third-party products are excluded.

(5)The following summarizes the calculations of: (i) operating return on equity as adjusted to exclude accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure); (ii) operating return, excluding significant items, as adjusted to exclude accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure); and (iii) return on equity are as follows (dollars in millions):

| | | | | | | | | | | | | | | | | |

| | | Trailing twelve months ended |

| | | 3Q24 | | 3Q23 |

| Net operating income | $ | 425.2 | | | $ | 305.1 | |

| | | | | |

| Net operating income, excluding significant items | $ | 380.0 | | | $ | 287.7 | |

| | | | | |

| Net income | $ | 274.2 | | | $ | 278.2 | |

| | | | | |

| Average common equity, excluding accumulated other | | | |

| comprehensive income (loss) and net operating loss | | | |

| carryforwards (a non-GAAP financial measure) | $ | 3,620.8 | | | $ | 3,582.8 | |

| | | | | |

| Average common shareholders' equity | $ | 2,325.3 | | | $ | 1,918.3 | |

| | | | | |

| Operating return on equity as adjusted to exclude accumulated | | | |

| other comprehensive income (loss) and net operating loss | | | |

| carryforwards (a non-GAAP financial measure) | 11.7 | % | | 8.5 | % |

| | | | | |

| Operating return, excluding significant items, on equity as adjusted | | | |

| to exclude accumulated other comprehensive income (loss) and | | | |

| net operating loss carryforwards (a non-GAAP financial measure) | 10.5 | % | | 8.0 | % |

| | | | | |

| Return on equity | 11.8 | % | | 14.5 | % |

The following summarizes: (i) net operating income; (ii) significant items; (iii) net operating income, excluding significant items; and (iv) net income (loss) (dollars in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | Net operating | | | | |

| | | | | | Net operating | | income, | | | | |

| | | | | | income, | | excluding | | | | Net |

| | | | | | excluding | | significant | | | | income - |

| | Net operating | | Significant | | significant | | items - trailing | | Net | | trailing |

| | income | | items | | items (a) | | four quarters | | income (loss) | | four quarters |

| 4Q22 | | $ | 82.9 | | | $ | (0.5) | | (b) | $ | 82.4 | | | $ | 342.5 | | | $ | 38.0 | | | $ | 630.6 | |

| 1Q23 | | 58.6 | | | — | | | 58.6 | | | 336.6 | | | (0.8) | | | 446.4 | |

| 2Q23 | | 62.3 | | | — | | | 62.3 | | | 281.2 | | | 73.7 | | | 286.8 | |

| 3Q23 | | 101.3 | | | (16.9) | | (c) | 84.4 | | | 287.7 | | | 167.3 | | | 278.2 | |

| 4Q23 | | 133.9 | | | (26.4) | | (d) | 107.5 | | | 312.8 | | | 36.3 | | | 276.5 | |

| 1Q24 | | 57.5 | | | — | | | 57.5 | | | 311.7 | | | 112.3 | | | 389.6 | |

| 2Q24 | | 114.6 | | | — | | | 114.6 | | | 364.0 | | | 116.3 | | | 432.2 | |

| 3Q24 | | 119.2 | | | (18.8) | | (e) | 100.4 | | | 380.0 | | | 9.3 | | | 274.2 | |

| | | | | | | | | | | | |

| (a) See note (6) for additional information. |

| | | | | | | | | | | | |

| (b) Comprised of $.7 million of the net favorable impact arising from our comprehensive annual actuarial review, net of tax expense of $.2 million. |

| | | | | | | | | | | | |

| (c) Comprised of $21.7 million of legal recoveries, net of expenses and increased legal accruals, net of tax expense of $4.8 million. |

| | | | | | | | | | | | |

| (d) Comprised of $33.9 million of the net favorable impact arising from our comprehensive annual actuarial review, net of tax expense of $7.5 million. |

| | | | | | | | | | | | |

| (e) Comprised of $27.3 million of the net favorable impact arising from our comprehensive annual actuarial review and $2.9 million of the unfavorable impact related to a fixed asset impairment, net of tax expense of $5.6 million. |

A reconciliation of pre-tax operating earnings (a non-GAAP financial measure) to net income is as follows (dollars in millions):

| | | | | | | | | | | | | | | | | |

| | | Twelve months ended |

| | | 3Q24 | | 3Q23 |

| Pre-tax operating earnings (a non-GAAP financial measure) | $ | 549.0 | | | $ | 394.4 | |

| Income tax expense | (123.8) | | | (89.3) | |

| Net operating income | 425.2 | | | 305.1 | |

| Non-operating items: | | | |

| Net realized investment losses from sales, impairments and change in allowance for credit losses | (36.2) | | | (91.3) | |

| Net change in market value of investments recognized in earnings | 38.2 | | | (24.1) | |

| Changes in fair value of embedded derivative liabilities and market risk benefits | (170.9) | | | 78.3 | |

| Fair value changes related to the agent deferred compensation plan | (10.3) | | | 7.0 | |

| | | |

| Other | (15.9) | | | (5.1) | |

| Non-operating loss before taxes | (195.1) | | | (35.2) | |

| | | |

| Income tax benefit on non-operating loss | 44.1 | | | 8.3 | |

| | | |

| Net non-operating loss | (151.0) | | | (26.9) | |

| Net income | $ | 274.2 | | | $ | 278.2 | |

| | | | | |

A reconciliation of consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) to common shareholders’ equity, is as follows (dollars in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1Q22 | | 2Q22 | | 3Q22 | | 4Q22 |

| Consolidated capital, excluding accumulated other comprehensive | | | | | | | |

| income (loss) and net operating loss carryforwards | | | | | | | |

| (a non-GAAP financial measure) | $ | 3,141.7 | | | $ | 3,329.0 | | | $ | 3,510.3 | | | $ | 3,557.1 | |

| Net operating loss carryforwards | 238.2 | | | 214.7 | | | 190.9 | | | 169.0 | |

| Accumulated other comprehensive loss | (561.5) | | | (1,415.8) | | | (1,837.8) | | | (1,957.3) | |

| Common shareholders' equity | $ | 2,818.4 | | | $ | 2,127.9 | | | $ | 1,863.4 | | | $ | 1,768.8 | |

| | | | | | | | | |

| | | 1Q23 | | 2Q23 | | 3Q23 | | 4Q23 |

| Consolidated capital, excluding accumulated other comprehensive | | | | | | | |

| income (loss) and net operating loss carryforwards | | | | | | | |

| (a non-GAAP financial measure) | $ | 3,543.8 | | | $ | 3,603.0 | | | $ | 3,744.2 | | | $ | 3,712.8 | |

| Net operating loss carryforwards | 152.4 | | | 126.3 | | | 102.6 | | | 79.6 | |

| Accumulated other comprehensive loss | (1,664.4) | | | (1,733.5) | | | (1,956.7) | | | (1,576.8) | |

| Common shareholders' equity | $ | 2,031.8 | | | $ | 1,995.8 | | | $ | 1,890.1 | | | $ | 2,215.6 | |

| | | | | | | | | |

| | | 1Q24 | | 2Q24 | | 3Q24 | | |

| Consolidated capital, excluding accumulated other comprehensive | | | | | | | |

| income (loss) and net operating loss carryforwards | | | | | | | |

| (a non-GAAP financial measure) | $ | 3,536.8 | | | $ | 3,596.7 | | | $ | 3,529.9 | | | |

| Net operating loss carryforwards | 311.2 | | | 296.5 | | | 273.9 | | | |

| Accumulated other comprehensive loss | (1,480.3) | | | (1,464.3) | | | (1,116.0) | | | |

| Common shareholders' equity | $ | 2,367.7 | | | $ | 2,428.9 | | | $ | 2,687.8 | | | |

| | | | | | | | | |

A reconciliation of consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) to common shareholders’ equity, is as follows (dollars in millions):

| | | | | | | | | | | | | | | | | |

| | | Trailing four quarter average |

| | | 3Q24 | | 3Q23 |

| Consolidated capital, excluding accumulated other comprehensive | | | |

| income (loss) and net operating loss carryforwards | | | |

| (a non-GAAP financial measure) | $ | 3,620.8 | | | $ | 3,582.8 | |

| Net operating loss carryforwards | 218.9 | | | 148.6 | |

| Accumulated other comprehensive loss | (1,514.4) | | | (1,813.1) | |

| Common shareholders' equity | $ | 2,325.3 | | | $ | 1,918.3 | |

(6) The tables below summarize the financial impact of significant items on our net operating income. Management believes that identifying the impact of these items enhances the understanding of our operating results (dollars in millions, except per share data).

| | | | | | | | | | | | | | | | | | | | |

| | Three months ended |

| | September 30, 2024 |

| | Actual results | | Significant items | | Excluding significant

items |

| Insurance product margin | | | | | | |

| Annuity margin | | $ | 91.1 | | | $ | (36.2) | | (a) | $ | 54.9 | |

| Health margin | | 127.8 | | | 8.2 | | (a) | 136.0 | |

| Life margin | | 63.3 | | | 0.7 | | (a) | 64.0 | |

| Total insurance product margin | | 282.2 | | | (27.3) | | | 254.9 | |

| Allocated expenses | | (153.0) | | | — | | | (153.0) | |

| Income from insurance products | | 129.2 | | | (27.3) | | | 101.9 | |

| Fee income | | (2.7) | | | — | | | (2.7) | |

| Investment income not allocated to product lines | | 45.5 | | | — | | | 45.5 | |

| Expenses not allocated to product lines | | (18.5) | | | 2.9 | | (b) | (15.6) | |

| Operating earnings before taxes | | 153.5 | | | (24.4) | | | 129.1 | |

| Income tax (expense) benefit on operating income | | (34.3) | | | 5.6 | | | (28.7) | |

| Net operating income | | $ | 119.2 | | | $ | (18.8) | | | $ | 100.4 | |

| | | | | | |

| Net operating income per diluted share | | $ | 1.11 | | | $ | (0.17) | | | $ | 0.94 | |

___________

(a)Comprised of $27.3 million of the net favorable impact arising from our comprehensive annual actuarial review.

(b)Comprised of $2.9 million of the unfavorable impact related to a fixed asset impairment.

| | | | | | | | | | | | | | | | | | | | |

| | Three months ended |

| | December 31, 2023 |

| | Actual results | | Significant items | | Excluding significant

items |

| Insurance product margin | | | | | | |

| Annuity margin | | $ | 63.6 | | | $ | (12.9) | | (a) | $ | 50.7 | |

| Health margin | | 146.4 | | | (22.3) | | (a) | 124.1 | |

| Life margin | | 64.6 | | | 1.3 | | (a) | 65.9 | |

| Total insurance product margin | | 274.6 | | | (33.9) | | | 240.7 | |

| Allocated expenses | | (138.8) | | | — | | | (138.8) | |

| Income from insurance products | | 135.8 | | | (33.9) | | | 101.9 | |

| Fee income | | 17.8 | | | — | | | 17.8 | |

| Investment income not allocated to product lines | | 38.3 | | | — | | | 38.3 | |

| Expenses not allocated to product lines | | (19.8) | | | — | | | (19.8) | |

| Operating earnings before taxes | | 172.1 | | | (33.9) | | | 138.2 | |

| Income tax (expense) benefit on operating income | | (38.2) | | | 7.5 | | | (30.7) | |

| Net operating income | | $ | 133.9 | | | $ | (26.4) | | | $ | 107.5 | |

| | | | | | |

| Net operating income per diluted share | | $ | 1.18 | | | $ | (0.23) | | | $ | 0.95 | |

___________

(a)Comprised of $33.9 million of the net favorable impact arising from our comprehensive annual actuarial review.

| | | | | | | | | | | | | | | | | | | | |

| | Three months ended |

| | September 30, 2023 |

| | Actual results | | Significant items | | Excluding significant

items |

| Insurance product margin | | | | | | |

| Annuity margin | | $ | 57.0 | | | $ | — | | | $ | 57.0 | |

| Health margin | | 123.2 | | | — | | | 123.2 | |

| Life margin | | 59.8 | | | — | | | 59.8 | |

| Total insurance product margin | | 240.0 | | | — | | | 240.0 | |

| Allocated expenses | | (153.2) | | | — | | | (153.2) | |

| Income from insurance products | | 86.8 | | | — | | | 86.8 | |

| Fee income | | (2.9) | | | — | | | (2.9) | |

| Investment income not allocated to product lines | | 38.4 | | | — | | | 38.4 | |

| Expenses not allocated to product lines | | 7.5 | | | (21.7) | | (a) | (14.2) | |

| Operating earnings before taxes | | 129.8 | | | (21.7) | | | 108.1 | |

| Income tax (expense) benefit on operating income | | (28.5) | | | 4.8 | | | (23.7) | |

| Net operating income | | $ | 101.3 | | | $ | (16.9) | | | $ | 84.4 | |

| | | | | | |

| Net operating income per diluted share | | $ | 0.88 | | | $ | (0.14) | | | $ | 0.74 | |

___________

(a)Comprised of $21.7 million of legal recoveries, net of expenses and increased legal accruals.

| | | | | | | | | | | | | | | | | | | | |

| | Three months ended |

| | December 31, 2022 |

| | Actual results | | Significant items | | Excluding significant

items |

| Insurance product margin | | | | | | |

| Annuity margin | | $ | 50.8 | | | $ | 3.2 | | (a) | $ | 54.0 | |

| Health margin | | 140.4 | | | (18.3) | | (a) | 122.1 | |

| Life margin | | 43.3 | | | 14.4 | | (a) | 57.7 | |

| Total insurance product margin | | 234.5 | | | (0.7) | | | 233.8 | |

| Allocated expenses | | (149.1) | | | — | | | (149.1) | |

| Income from insurance products | | 85.4 | | | (0.7) | | | 84.7 | |

| Fee income | | 9.2 | | | — | | | 9.2 | |

| Investment income not allocated to product lines | | 25.2 | | | — | | | 25.2 | |

| Expenses not allocated to product lines | | (12.8) | | | — | | | (12.8) | |

| Operating earnings before taxes | | 107.0 | | | (0.7) | | | 106.3 | |

| Income tax (expense) benefit on operating income | | (24.1) | | | 0.2 | | | (23.9) | |

| Net operating income | | $ | 82.9 | | | $ | (0.5) | | | $ | 82.4 | |

| | | | | | |

| Net operating income per diluted share | | $ | 0.71 | | | $ | — | | | $ | 0.71 | |

___________

(a)Comprised of $0.7 million of the net favorable impact arising from our comprehensive annual actuarial review.

For further information:

CNO News Media

Valerie Dolenga

Valerie.Dolenga@CNOinc.com

CNO Investor Relations

Adam Auvil

Adam.Auvil@CNOinc.com

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | |

| Quarterly Financial Supplement - 3Q2024 | | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| October 31, 2024 | | | | | |

| | | | | |

| | | | | | | | | | | | | | |

| Table of Contents | | | | Page |

| | | | |

| Consolidated balance sheet | | | | 3 |

| Consolidated statement of operations | | | | 4 |

| Financial summary | | | | 5 |

| Insurance operations | | | | 6 |

| Margin from insurance products | | | | 7-9 |

| Collected premiums and insurance policy income | | | | 10 |

| Health and life new annualized premiums | | | | 11 |

| Computation of weighted average shares outstanding | | | | 12 |

| Annuities - account value rollforwards | | | | 13 |

| Consolidated statutory information of U.S. based insurance subsidiaries | | | | 14 |

| Investment income not allocated to product lines and investment income allocated to product lines | | | | 15-18 |

| Other investment data | | | | 18 |

| Significant items | | | | 19-20 |

| Notes | | | | 20-21 |

CNO FINANCIAL GROUP, INC.

CONSOLIDATED BALANCE SHEET

(Dollars in millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Mar-23 | | Jun-23 | | Sep-23 | | Dec-23 | | Mar-24 | | Jun-24 | | Sep-24 | | |

| Assets | | | | | | | | | | | | | | | |

| Investments: | | | | | | | | | | | | | | | |

| Fixed maturities, available for sale, at fair value | $ | 21,107.1 | | | $ | 20,959.7 | | | $ | 20,305.2 | | | $ | 21,506.2 | | | $ | 21,648.1 | | | $ | 22,617.9 | | | $ | 23,724.7 | | | |

| Equity securities at fair value | 106.1 | | | 96.4 | | | 95.5 | | | 96.9 | | | 118.4 | | | 117.7 | | | 120.5 | | | |

| Mortgage loans | 1,676.1 | | | 1,825.9 | | | 1,971.3 | | | 2,064.1 | | | 2,087.1 | | | 2,176.0 | | | 2,372.7 | | | |

| Policy loans | 123.0 | | | 124.2 | | | 126.4 | | | 128.5 | | | 130.3 | | | 131.3 | | | 133.3 | | | |

| Trading securities | 208.1 | | | 218.9 | | | 221.2 | | | 222.7 | | | 222.8 | | | 207.8 | | | 217.4 | | | |

| Investments held by variable interest entities | 1,017.9 | | | 948.2 | | | 858.1 | | | 768.6 | | | 533.4 | | | 425.5 | | | 250.1 | | | |

| Other invested assets | 1,097.1 | | | 1,176.7 | | | 1,119.9 | | | 1,353.4 | | | 1,471.3 | | | 1,554.0 | | | 1,595.5 | | | |

| Total investments | 25,335.4 | | | 25,350.0 | | | 24,697.6 | | | 26,140.4 | | | 26,211.4 | | | 27,230.2 | | | 28,414.2 | | | |

| Cash and cash equivalents - unrestricted | 425.0 | | | 457.7 | | | 460.8 | | | 774.5 | | | 566.3 | | | 878.8 | | | 1,164.7 | | | |

| Cash and cash equivalents held by variable interest entities | 97.1 | | | 104.2 | | | 122.0 | | | 114.5 | | | 83.5 | | | 113.3 | | | 80.6 | | | |

| Accrued investment income | 241.3 | | | 242.1 | | | 252.3 | | | 251.5 | | | 252.0 | | | 262.5 | | | 276.2 | | | |

| Present value of future profits | 197.6 | | | 191.8 | | | 186.2 | | | 180.7 | | | 175.5 | | | 170.4 | | | 165.7 | | | |

| Deferred acquisition costs | 1,811.3 | | | 1,857.7 | | | 1,897.5 | | | 1,944.4 | | | 1,992.3 | | | 2,047.2 | | | 2,100.9 | | | |

| Reinsurance receivables | 4,189.6 | | | 4,029.2 | | | 4,053.2 | | | 4,040.7 | | | 3,969.0 | | | 3,910.9 | | | 3,906.7 | | | |

| Market risk benefit asset | 57.8 | | | 66.0 | | | 89.3 | | | 75.4 | | | 84.1 | | | 84.5 | | | 96.4 | | | |

| Income tax assets, net | 988.1 | | | 1,007.1 | | | 1,039.8 | | | 936.2 | | | 886.1 | | | 882.8 | | | 788.7 | | | |

| Assets held in separate accounts | 2.8 | | | 3.0 | | | 2.9 | | | 3.1 | | | 3.3 | | | 3.2 | | | 3.3 | | | |

| Other assets | 669.0 | | | 745.1 | | | 705.8 | | | 641.1 | | | 716.2 | | | 706.4 | | | 648.0 | | | |

| Total assets | $ | 34,015.0 | | | $ | 34,053.9 | | | $ | 33,507.4 | | | $ | 35,102.5 | | | $ | 34,939.7 | | | $ | 36,290.2 | | | $ | 37,645.4 | | | |

| Liabilities | | | | | | | | | | | | | | | |

| Liabilities for insurance products: | | | | | | | | | | | | | | | |

| Policyholder account balances | $ | 15,302.9 | | | $ | 15,387.7 | | | $ | 15,481.8 | | | $ | 15,667.8 | | | $ | 15,736.7 | | | $ | 16,637.9 | | | $ | 17,240.5 | | | |

| Future policy benefits | 11,623.3 | | | 11,479.6 | | | 10,829.9 | | | 11,928.2 | | | 11,736.5 | | | 11,479.4 | | | 12,179.6 | | | |

| Market risk benefit liability | 17.6 | | | 10.5 | | | 3.1 | | | 7.4 | | | 3.8 | | | 3.2 | | | 1.0 | | | |

| Liability for life insurance policy claims | 67.6 | | | 64.6 | | | 60.8 | | | 62.1 | | | 65.1 | | | 59.6 | | | 59.9 | | | |

| Unearned and advanced premiums | 243.5 | | | 233.6 | | | 221.2 | | | 218.9 | | | 226.0 | | | 220.9 | | | 217.4 | | | |

| Liabilities related to separate accounts | 2.8 | | | 3.0 | | | 2.9 | | | 3.1 | | | 3.3 | | | 3.2 | | | 3.3 | | | |

| Other liabilities | 681.3 | | | 898.9 | | | 869.6 | | | 848.8 | | | 905.0 | | | 934.4 | | | 951.0 | | | |

| Investment borrowings | 1,839.6 | | | 1,839.5 | | | 2,089.4 | | | 2,189.3 | | | 2,189.1 | | | 2,189.0 | | | 2,188.9 | | | |

| Borrowings related to variable interest entities | 1,065.4 | | | 1,001.0 | | | 918.5 | | | 820.8 | | | 565.5 | | | 501.4 | | | 283.1 | | | |

| Notes payable - direct corporate obligations | 1,139.2 | | | 1,139.7 | | | 1,140.1 | | | 1,140.5 | | | 1,141.0 | | | 1,832.3 | | | 1,832.9 | | | |

| Total liabilities | 31,983.2 | | | 32,058.1 | | | 31,617.3 | | | 32,886.9 | | | 32,572.0 | | | 33,861.3 | | | 34,957.6 | | | |

| Shareholders' equity | | | | | | | | | | | | | | | |

| Common stock | 1.1 | | | 1.1 | | | 1.1 | | | 1.1 | | | 1.1 | | | 1.1 | | | 1.0 | | | |

| Additional paid-in capital | 2,021.1 | | | 1,997.9 | | | 1,965.3 | | | 1,891.5 | | | 1,851.2 | | | 1,797.6 | | | 1,715.9 | | | |

| Retained earnings | 1,674.0 | | | 1,730.3 | | | 1,880.4 | | | 1,899.8 | | | 1,995.7 | | | 2,094.5 | | | 2,086.9 | | | |

| Total shareholders' equity before accumulated other comprehensive loss | 3,696.2 | | | 3,729.3 | | | 3,846.8 | | | 3,792.4 | | | 3,848.0 | | | 3,893.2 | | | 3,803.8 | | | |

| Accumulated other comprehensive loss | (1,664.4) | | | (1,733.5) | | | (1,956.7) | | | (1,576.8) | | | (1,480.3) | | | (1,464.3) | | | (1,116.0) | | | |

| Total shareholders' equity | 2,031.8 | | | 1,995.8 | | | 1,890.1 | | | 2,215.6 | | | 2,367.7 | | | 2,428.9 | | | 2,687.8 | | | |

| Total liabilities and shareholders' equity | $ | 34,015.0 | | | $ | 34,053.9 | | | $ | 33,507.4 | | | $ | 35,102.5 | | | $ | 34,939.7 | | | $ | 36,290.2 | | | $ | 37,645.4 | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Mar-23 | | Jun-23 | | Sep-23 | | Dec-23 | | Mar-24 | | Jun-24 | | Sep-24 | | |

| | | | | | | | | | | | | | | |

| Book value per common share | $ | 17.68 | | | $ | 17.56 | | | $ | 16.85 | | | $ | 20.26 | | | $ | 21.81 | | | $ | 22.80 | | | $ | 25.86 | | | |

| | | | | | | | | | | | | | | |

| Book value per common share, excluding accumulated other comprehensive loss (1) (2) | $ | 32.17 | | | $ | 32.81 | | | $ | 34.30 | | | $ | 34.68 | | | $ | 35.44 | | | $ | 36.55 | | | $ | 36.60 | | | |

| | | | | | | | | | | | | | | |

| Book value per diluted share (1) (3) | $ | 31.82 | | | $ | 32.34 | | | $ | 33.75 | | | $ | 33.94 | | | $ | 34.97 | | | $ | 36.00 | | | $ | 35.84 | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

CNO FINANCIAL GROUP, INC.

CONSOLIDATED STATEMENT OF OPERATIONS

(Dollars in millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| 1Q | | 2Q | | 3Q | | 4Q | | YTD | | 1Q | | 2Q | | 3Q | | | | |

| 2023 | | 2023 | | 2023 | | 2023 | | 2023 | | 2024 | | 2024 | | 2024 | | | | |

| Revenues | | | | | | | | | | | | | | | | | | | |

| Insurance policy income | $ | 625.5 | | | $ | 628.3 | | | $ | 626.0 | | | $ | 625.7 | | | $ | 2,505.5 | | | $ | 628.4 | | | $ | 641.5 | | | $ | 645.0 | | | | | |

| Net investment income: | | | | | | | | | | | | | | | | | | | |

| General account assets | 292.2 | | | 308.1 | | | 324.8 | | | 325.1 | | | 1,250.2 | | | 301.9 | | | 351.7 | | | 366.3 | | | | | |

| Policyholder and other special-purpose portfolios | 50.8 | | | 91.6 | | | (33.0) | | | 140.1 | | | 249.5 | | | 167.3 | | | 57.4 | | | 87.6 | | | | | |

| Investment gains (losses): | | | | | | | | | | | | | | | | | | | |

| Realized investment losses | (14.6) | | | (21.8) | | | (21.6) | | | (11.3) | | | (69.3) | | | (10.0) | | | (26.3) | | | (13.1) | | | | | |

| Other investment gains (losses) | — | | | (13.5) | | | (7.7) | | | 21.5 | | | 0.3 | | | 17.8 | | | 9.1 | | | 14.3 | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Total investment gains (losses) | (14.6) | | | (35.3) | | | (29.3) | | | 10.2 | | | (69.0) | | | 7.8 | | | (17.2) | | | 1.2 | | | | | |

| Fee revenue and other income | 52.1 | | | 30.1 | | | 59.0 | | | 69.4 | | | 210.6 | | | 51.1 | | | 32.8 | | | 29.5 | | | | | |

| Total revenues | 1,006.0 | | | 1,022.8 | | | 947.5 | | | 1,170.5 | | | 4,146.8 | | | 1,156.5 | | | 1,066.2 | | | 1,129.6 | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Benefits and expenses | | | | | | | | | | | | | | | | | | | |

| Insurance policy benefits | 609.7 | | | 565.9 | | | 399.1 | | | 743.5 | | | 2,318.2 | | | 631.4 | | | 568.8 | | | 726.2 | | | | | |

| Liability for future policy benefits remeasurement (gain) loss | 0.6 | | | 8.3 | | | (0.1) | | | (30.0) | | | (21.2) | | | (6.4) | | | (30.0) | | | 7.3 | | | | | |

| Change in fair value of market risk benefits | 14.8 | | | (17.6) | | | (33.8) | | | 15.3 | | | (21.3) | | | (13.7) | | | (0.2) | | | (16.1) | | | | | |

| Interest expense | 54.7 | | | 57.6 | | | 62.6 | | | 63.7 | | | 238.6 | | | 60.2 | | | 64.2 | | | 68.0 | | | | | |

| Amortization of deferred acquisition costs and present value of future profits | 55.5 | | | 56.0 | | | 57.0 | | | 58.9 | | | 227.4 | | | 60.5 | | | 61.4 | | | 64.0 | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Other operating costs and expenses | 271.7 | | | 256.5 | | | 247.1 | | | 273.0 | | | 1,048.3 | | | 278.3 | | | 251.4 | | | 269.2 | | | | | |

| Total benefits and expenses | 1,007.0 | | | 926.7 | | | 731.9 | | | 1,124.4 | | | 3,790.0 | | | 1,010.3 | | | 915.6 | | | 1,118.6 | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Income (loss) before income taxes | (1.0) | | | 96.1 | | | 215.6 | | | 46.1 | | | 356.8 | | | 146.2 | | | 150.6 | | | 11.0 | | | | | |

| Income tax expense (benefit) on period income (loss) | (0.2) | | | 22.4 | | | 48.3 | | | 9.8 | | | 80.3 | | | 33.9 | | | 34.3 | | | 1.7 | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Net income (loss) | $ | (0.8) | | | $ | 73.7 | | | $ | 167.3 | | | $ | 36.3 | | | $ | 276.5 | | | $ | 112.3 | | | $ | 116.3 | | | $ | 9.3 | | | | | |

| | | | | | | | | | | | | | | | | | | |

CNO FINANCIAL GROUP, INC.

FINANCIAL SUMMARY

(Dollars in millions, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| 1Q | | 2Q | | 3Q | | 4Q | | YTD | | 1Q | | 2Q | | 3Q | | | | |

| 2023 | | 2023 | | 2023 | | 2023 | | 2023 | | 2024 | | 2024 | | 2024 | | | | |

| Insurance product margin (4) | | | | | | | | | | | | | | | | | | | |

| Annuity margin | $ | 57.3 | | | $ | 57.1 | | | $ | 57.0 | | | $ | 63.6 | | | $ | 235.0 | | | $ | 52.0 | | | $ | 76.1 | | | $ | 91.1 | | | | | |

| Health margin | 116.5 | | | 108.2 | | | 123.2 | | | 146.4 | | | 494.3 | | | 123.0 | | | 135.9 | | | 127.8 | | | | | |

| Life margin | 47.4 | | | 57.9 | | | 59.8 | | | 64.6 | | | 229.7 | | | 54.6 | | | 63.1 | | | 63.3 | | | | | |

| Total insurance product margin | 221.2 | | | 223.2 | | | 240.0 | | | 274.6 | | | 959.0 | | | 229.6 | | | 275.1 | | | 282.2 | | | | | |

| Allocated expenses | (157.5) | | | (149.5) | | | (153.2) | | | (138.8) | | | (599.0) | | | (161.6) | | | (154.6) | | | (153.0) | | | | | |

| Income from insurance products (8) | 63.7 | | | 73.7 | | | 86.8 | | | 135.8 | | | 360.0 | | | 68.0 | | | 120.5 | | | 129.2 | | | | | |

| Fee income | 15.5 | | | 0.6 | | | (2.9) | | | 17.8 | | | 31.0 | | | 11.3 | | | 0.8 | | | (2.7) | | | | | |

| Investment income not allocated to product lines (9) | 15.5 | | | 28.0 | | | 38.4 | | | 38.3 | | | 120.2 | | | 12.3 | | | 44.8 | | | 45.5 | | | | | |

| Expenses not allocated to product lines | (18.3) | | | (21.1) | | | 7.5 | | | (19.8) | | | (51.7) | | | (16.8) | | | (17.5) | | | (18.5) | | | | | |

| Operating earnings before taxes | 76.4 | | | 81.2 | | | 129.8 | | | 172.1 | | | 459.5 | | | 74.8 | | | 148.6 | | | 153.5 | | | | | |

| Income tax expense on operating income | (17.8) | | | (18.9) | | | (28.5) | | | (38.2) | | | (103.4) | | | (17.3) | | | (34.0) | | | (34.3) | | | | | |

| Net operating income (10) | 58.6 | | | 62.3 | | | 101.3 | | | 133.9 | | | 356.1 | | | 57.5 | | | 114.6 | | | 119.2 | | | | | |

| Net realized investment gains (losses) from sales, impairments and change in allowance for credit losses | (12.7) | | | (31.3) | | | (20.1) | | | 1.4 | | | (62.7) | | | (4.6) | | | (21.9) | | | (11.1) | | | | | |

| Net change in market value of investments recognized in earnings | (1.9) | | | (4.0) | | | (9.2) | | | 8.8 | | | (6.3) | | | 12.4 | | | 4.7 | | | 12.3 | | | | | |

| Fair value changes related to agent deferred compensation plan | — | | | — | | | 6.8 | | | (10.3) | | | (3.5) | | | — | | | 3.5 | | | (3.5) | | | | | |

| Changes in fair value of embedded derivative liabilities and market risk benefits | (65.1) | | | 50.4 | | | 109.4 | | | (124.6) | | | (29.9) | | | 64.0 | | | 16.8 | | | (127.1) | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Other | 2.3 | | | (0.2) | | | (1.1) | | | (1.3) | | | (0.3) | | | (0.4) | | | (1.1) | | | (13.1) | | | | | |

| Net non-operating income (loss) before taxes | (77.4) | | | 14.9 | | | 85.8 | | | (126.0) | | | (102.7) | | | 71.4 | | | 2.0 | | | (142.5) | | | | | |

| Income tax (expense) benefit on non-operating income (loss) | 18.0 | | | (3.5) | | | (19.8) | | | 28.4 | | | 23.1 | | | (16.6) | | | (0.3) | | | 32.6 | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Net non-operating income (loss) | (59.4) | | | 11.4 | | | 66.0 | | | (97.6) | | | (79.6) | | | 54.8 | | | 1.7 | | | (109.9) | | | | | |

| Net income (loss) | $ | (0.8) | | | $ | 73.7 | | | $ | 167.3 | | | $ | 36.3 | | | $ | 276.5 | | | $ | 112.3 | | | $ | 116.3 | | | $ | 9.3 | | | | | |

| Per diluted share | | | | | | | | | | | | | | | | | | | |

| Net operating income | $ | 0.51 | | | $ | 0.54 | | | $ | 0.88 | | | $ | 1.18 | | | $ | 3.09 | | | $ | 0.52 | | | $ | 1.05 | | | $ | 1.11 | | | | | |

| Net non-operating income (loss) | (0.52) | | | 0.10 | | | 0.58 | | | (0.86) | | | (0.69) | | | 0.49 | | | 0.01 | | | (1.02) | | | | | |

| Net income (loss) | $ | (0.01) | | | $ | 0.64 | | | $ | 1.46 | | | $ | 0.32 | | | $ | 2.40 | | | $ | 1.01 | | | $ | 1.06 | | | $ | 0.09 | | | | | |

| | | | | | | | | | | | | | | | | | | |

CNO FINANCIAL GROUP, INC.

Insurance Operations

(Dollars in millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| 1Q | | 2Q | | 3Q | | 4Q | | YTD | | 1Q | | 2Q | | 3Q | | | | |

| 2023 | | 2023 | | 2023 | | 2023 | | 2023 | | 2024 | | 2024 | | 2024 | | | | |

| Insurance product margin (4) | | | | | | | | | | | | | | | | | | | |

| Annuity: | | | | | | | | | | | | | | | | | | | |

| Insurance policy income | $ | 5.1 | | | $ | 8.1 | | | $ | 7.2 | | | $ | 8.0 | | | $ | 28.4 | | | $ | 7.3 | | | $ | 9.3 | | | $ | 11.2 | | | | | |

| Net investment income (5) (6) | 125.4 | | | 127.7 | | | 131.0 | | | 132.2 | | | 516.3 | | | 134.5 | | | 140.5 | | | 142.2 | | | | | |

| Insurance policy benefits | (8.7) | | | (10.6) | | | (9.8) | | | 0.1 | | | (29.0) | | | (11.3) | | | 8.4 | | | 25.9 | | | | | |

| Interest credited (6) | (48.1) | | | (50.6) | | | (53.4) | | | (57.3) | | | (209.4) | | | (58.3) | | | (61.2) | | | (65.2) | | | | | |

| Amortization and non-deferred commissions | (16.4) | | | (17.5) | | | (18.0) | | | (19.4) | | | (71.3) | | | (20.2) | | | (20.9) | | | (23.0) | | | | | |

| Annuity margin | 57.3 | | | 57.1 | | | 57.0 | | | 63.6 | | | 235.0 | | | 52.0 | | | 76.1 | | | 91.1 | | | | | |

| Health: | | | | | | | | | | | | | | | | | | | |

| Insurance policy income | 401.4 | | | 397.1 | | | 397.8 | | | 398.3 | | | 1,594.6 | | | 398.4 | | | 403.6 | | | 406.9 | | | | | |

| Net investment income (5) | 74.0 | | | 74.3 | | | 74.2 | | | 74.2 | | | 296.7 | | | 74.3 | | | 75.1 | | | 75.0 | | | | | |

| Insurance policy benefits | (318.1) | | | (322.7) | | | (308.5) | | | (285.6) | | | (1,234.9) | | | (308.5) | | | (302.3) | | | (314.1) | | | | | |

| Amortization and non-deferred commissions | (40.8) | | | (40.5) | | | (40.3) | | | (40.5) | | | (162.1) | | | (41.2) | | | (40.5) | | | (40.0) | | | | | |

| Health margin | 116.5 | | | 108.2 | | | 123.2 | | | 146.4 | | | 494.3 | | | 123.0 | | | 135.9 | | | 127.8 | | | | | |

| Life: | | | | | | | | | | | | | | | | | | | |

| Insurance policy income | 219.0 | | | 223.1 | | | 221.0 | | | 219.4 | | | 882.5 | | | 222.7 | | | 228.6 | | | 226.9 | | | | | |

| Net investment income (5) (7) | 36.3 | | | 36.1 | | | 36.3 | | | 36.1 | | | 144.8 | | | 36.5 | | | 36.7 | | | 36.8 | | | | | |

| Insurance policy benefits | (147.2) | | | (142.8) | | | (140.7) | | | (139.3) | | | (570.0) | | | (144.0) | | | (144.6) | | | (143.5) | | | | | |

| Interest credited (7) | (12.1) | | | (12.2) | | | (12.1) | | | (12.9) | | | (49.3) | | | (12.5) | | | (12.4) | | | (13.3) | | | | | |

| Amortization and non-deferred commissions | (19.9) | | | (20.8) | | | (22.1) | | | (23.0) | | | (85.8) | | | (23.5) | | | (24.3) | | | (25.1) | | | | | |

| Advertising expense | (28.7) | | | (25.5) | | | (22.6) | | | (15.7) | | | (92.5) | | | (24.6) | | | (20.9) | | | (18.5) | | | | | |

| Life margin | 47.4 | | | 57.9 | | | 59.8 | | | 64.6 | | | 229.7 | | | 54.6 | | | 63.1 | | | 63.3 | | | | | |

| Total insurance product margin | 221.2 | | | 223.2 | | | 240.0 | | | 274.6 | | | 959.0 | | | 229.6 | | | 275.1 | | | 282.2 | | | | | |

| Allocated expenses: | | | | | | | | | | | | | | | | | | | |

| Branch office expenses | (19.8) | | | (15.9) | | | (16.3) | | | (12.9) | | | (64.9) | | | (19.8) | | | (16.2) | | | (16.7) | | | | | |

| Other allocated expenses | (137.7) | | | (133.6) | | | (136.9) | | | (125.9) | | | (534.1) | | | (141.8) | | | (138.4) | | | (136.3) | | | | | |

| Income from insurance products (8) | 63.7 | | | 73.7 | | | 86.8 | | | 135.8 | | | 360.0 | | | 68.0 | | | 120.5 | | | 129.2 | | | | | |

| Fee income | 15.5 | | | 0.6 | | | (2.9) | | | 17.8 | | | 31.0 | | | 11.3 | | | 0.8 | | | (2.7) | | | | | |

| Investment income not allocated to product lines (9) | 15.5 | | | 28.0 | | | 38.4 | | | 38.3 | | | 120.2 | | | 12.3 | | | 44.8 | | | 45.5 | | | | | |

| Expenses not allocated to product lines | (18.3) | | | (21.1) | | | 7.5 | | | (19.8) | | | (51.7) | | | (16.8) | | | (17.5) | | | (18.5) | | | | | |

| Operating earnings before taxes | 76.4 | | | 81.2 | | | 129.8 | | | 172.1 | | | 459.5 | | | 74.8 | | | 148.6 | | | 153.5 | | | | | |

| Income tax expense on operating income | (17.8) | | | (18.9) | | | (28.5) | | | (38.2) | | | (103.4) | | | (17.3) | | | (34.0) | | | (34.3) | | | | | |

| Net operating income (10) | $ | 58.6 | | | $ | 62.3 | | | $ | 101.3 | | | $ | 133.9 | | | $ | 356.1 | | | $ | 57.5 | | | $ | 114.6 | | | $ | 119.2 | | | | | |

| | | | | | | | | | | | | | | | | | | |

CNO FINANCIAL GROUP, INC.

Margin from Annuity Products

(Dollars in millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| 1Q | | 2Q | | 3Q | | 4Q | | YTD | | 1Q | | 2Q | | 3Q | | | | |

| 2023 | | 2023 | | 2023 | | 2023 | | 2023 | | 2024 | | 2024 | | 2024 | | | | |

| Annuity margin (4): | | | | | | | | | | | | | | | | | | | |

| Fixed indexed annuities | | | | | | | | | | | | | | | | | | | |

| Insurance policy income | $ | 3.6 | | | $ | 5.5 | | | $ | 5.1 | | | $ | 5.5 | | | $ | 19.7 | | | $ | 6.0 | | | $ | 7.2 | | | $ | 8.7 | | | | | |

| Net investment income (5) (6) | 98.8 | | | 101.2 | | | 104.4 | | | 105.9 | | | 410.3 | | | 108.4 | | | 113.8 | | | 115.9 | | | | | |

| Insurance policy benefits | (4.1) | | | (4.2) | | | (4.3) | | | 2.5 | | | (10.1) | | | (5.8) | | | (2.6) | | | 28.7 | | | | | |

| Interest credited (6) | (36.4) | | | (38.9) | | | (41.5) | | | (45.1) | | | (161.9) | | | (46.7) | | | (49.4) | | | (53.3) | | | | | |

| Amortization and non-deferred commissions | (15.4) | | | (16.0) | | | (16.5) | | | (17.9) | | | (65.8) | | | (18.5) | | | (19.1) | | | (21.0) | | | | | |

| Margin from fixed indexed annuities | $ | 46.5 | | | $ | 47.6 | | | $ | 47.2 | | | $ | 50.9 | | | $ | 192.2 | | | $ | 43.4 | | | $ | 49.9 | | | $ | 79.0 | | | | | |

| Average net insurance liabilities (11) | $ | 9,183.8 | | | $ | 9,276.0 | | | $ | 9,381.0 | | | $ | 9,508.7 | | | $ | 9,337.3 | | | $ | 9,636.3 | | | $ | 9,758.1 | | | $ | 9,899.4 | | | | | |

| Margin/average net insurance liabilities (12) | 2.03 | % | | 2.05 | % | | 2.01 | % | | 2.14 | % | | 2.06 | % | | 1.80 | % | | 2.05 | % | | 3.19 | % | | | | |

| Fixed interest annuities | | | | | | | | | | | | | | | | | | | |

| Insurance policy income | $ | 0.3 | | | $ | 0.2 | | | $ | 0.3 | | | $ | 0.2 | | | $ | 1.0 | | | $ | 0.1 | | | $ | 0.4 | | | $ | 0.1 | | | | | |

| Net investment income (5) | 20.9 | | | 20.9 | | | 21.0 | | | 20.8 | | | 83.6 | | | 20.6 | | | 21.1 | | | 20.8 | | | | | |

| Insurance policy benefits | (0.1) | | | — | | | (0.1) | | | (0.3) | | | (0.5) | | | (0.4) | | | 0.1 | | | (0.4) | | | | | |

| Interest credited | (11.1) | | | (11.1) | | | (11.4) | | | (11.6) | | | (45.2) | | | (11.1) | | | (11.3) | | | (11.3) | | | | | |

| Amortization and non-deferred commissions | (0.9) | | | (1.3) | | | (1.4) | | | (1.4) | | | (5.0) | | | (1.6) | | | (1.6) | | | (1.9) | | | | | |

| Margin from fixed interest annuities | $ | 9.1 | | | $ | 8.7 | | | $ | 8.4 | | | $ | 7.7 | | | $ | 33.9 | | | $ | 7.6 | | | $ | 8.7 | | | $ | 7.3 | | | | | |

| Average net insurance liabilities (11) | $ | 1,630.9 | | | $ | 1,613.1 | | | $ | 1,603.0 | | | $ | 1,600.9 | | | $ | 1,612.0 | | | $ | 1,588.0 | | | $ | 1,569.4 | | | $ | 1,568.2 | | | | | |

| Margin/average net insurance liabilities (12) | 2.23 | % | | 2.16 | % | | 2.10 | % | | 1.92 | % | | 2.10 | % | | 1.91 | % | | 2.22 | % | | 1.86 | % | | | | |

| Other annuities | | | | | | | | | | | | | | | | | | | |

| Insurance policy income | $ | 1.2 | | | $ | 2.4 | | | $ | 1.8 | | | $ | 2.3 | | | $ | 7.7 | | | $ | 1.2 | | | $ | 1.7 | | | $ | 2.4 | | | | | |

| Net investment income (5) | 5.7 | | | 5.6 | | | 5.6 | | | 5.5 | | | 22.4 | | | 5.5 | | | 5.6 | | | 5.5 | | | | | |

| Insurance policy benefits | (4.5) | | | (6.4) | | | (5.4) | | | (2.1) | | | (18.4) | | | (5.1) | | | 10.9 | | | (2.4) | | | | | |

| Interest credited | (0.6) | | | (0.6) | | | (0.5) | | | (0.6) | | | (2.3) | | | (0.5) | | | (0.5) | | | (0.6) | | | | | |

| Amortization and non-deferred commissions | (0.1) | | | (0.2) | | | (0.1) | | | (0.1) | | | (0.5) | | | (0.1) | | | (0.2) | | | (0.1) | | | | | |

| Margin from other annuities | $ | 1.7 | | | $ | 0.8 | | | $ | 1.4 | | | $ | 5.0 | | | $ | 8.9 | | | $ | 1.0 | | | $ | 17.5 | | | $ | 4.8 | | | | | |

| Average net insurance liabilities (11) | $ | 469.5 | | | $ | 462.5 | | | $ | 455.6 | | | $ | 447.5 | | | $ | 458.8 | | | $ | 439.9 | | | $ | 426.4 | | | $ | 414.4 | | | | | |

| Margin/average net insurance liabilities (12) | 1.45 | % | | 0.69 | % | | 1.23 | % | | 4.47 | % | | 1.94 | % | | 0.91 | % | | 16.42 | % | | 4.63 | % | | | | |

| Total annuity margin | $ | 57.3 | | | $ | 57.1 | | | $ | 57.0 | | | $ | 63.6 | | | $ | 235.0 | | | $ | 52.0 | | | $ | 76.1 | | | $ | 91.1 | | | | | |

| Average net insurance liabilities (11) | $ | 11,284.2 | | | $ | 11,351.6 | | | $ | 11,439.6 | | | $ | 11,557.1 | | | $ | 11,408.1 | | | $ | 11,664.2 | | | $ | 11,753.9 | | | $ | 11,882.0 | | | | | |

| Margin/average net insurance liabilities (12) | 2.03 | % | | 2.01 | % | | 1.99 | % | | 2.20 | % | | 2.06 | % | | 1.78 | % | | 2.59 | % | | 3.07 | % | | | | |

| | | | | | | | | | | | | | | | | | | |

CNO FINANCIAL GROUP, INC.

Margin from Health Products

(Dollars in millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| 1Q | | 2Q | | 3Q | | 4Q | | YTD | | 1Q | | 2Q | | 3Q | | | | |

| 2023 | | 2023 | | 2023 | | 2023 | | 2023 | | 2024 | | 2024 | | 2024 | | | | |

| Health margin (4): | | | | | | | | | | | | | | | | | | | |

| Supplemental health | | | | | | | | | | | | | | | | | | | |

| Insurance policy income | $ | 179.0 | | | $ | 176.2 | | | $ | 177.9 | | | $ | 178.1 | | | $ | 711.2 | | | $ | 179.7 | | | $ | 180.1 | | | $ | 182.0 | | | | | |

| Net investment income (5) | 38.6 | | | 38.9 | | | 39.0 | | | 38.8 | | | 155.3 | | | 39.0 | | | 39.4 | | | 39.6 | | | | | |

| Insurance policy benefits | (128.2) | | | (128.9) | | | (128.0) | | | (81.0) | | | (466.1) | | | (125.8) | | | (127.4) | | | (125.8) | | | | | |

| Amortization and non-deferred commissions | (26.1) | | | (26.3) | | | (26.1) | | | (27.5) | | | (106.0) | | | (27.5) | | | (27.0) | | | (27.2) | | | | | |

| Margin from supplemental health | $ | 63.3 | | | $ | 59.9 | | | $ | 62.8 | | | $ | 108.4 | | | $ | 294.4 | | | $ | 65.4 | | | $ | 65.1 | | | $ | 68.6 | | | | | |

| Margin/insurance policy income | 35 | % | | 34 | % | | 35 | % | | 61 | % | | 41 | % | | 36 | % | | 36 | % | | 38 | % | | | | |

| Medicare supplement | | | | | | | | | | | | | | | | | | | |

| Insurance policy income | $ | 156.5 | | | $ | 155.3 | | | $ | 154.2 | | | $ | 153.9 | | | $ | 619.9 | | | $ | 151.7 | | | $ | 155.8 | | | $ | 156.3 | | | | | |

| Net investment income (5) | 1.3 | | | 1.2 | | | 1.1 | | | 1.3 | | | 4.9 | | | 1.4 | | | 1.3 | | | 1.3 | | | | | |

| Insurance policy benefits | (120.5) | | | (113.4) | | | (107.4) | | | (123.4) | | | (464.7) | | | (116.4) | | | (111.5) | | | (121.6) | | | | | |

| Amortization and non-deferred commissions | (11.2) | | | (10.8) | | | (10.7) | | | (10.5) | | | (43.2) | | | (10.2) | | | (10.1) | | | (9.7) | | | | | |

| Margin from Medicare supplement | $ | 26.1 | | | $ | 32.3 | | | $ | 37.2 | | | $ | 21.3 | | | $ | 116.9 | | | $ | 26.5 | | | $ | 35.5 | | | $ | 26.3 | | | | | |

| Margin/insurance policy income | 17 | % | | 21 | % | | 24 | % | | 14 | % | | 19 | % | | 17 | % | | 23 | % | | 17 | % | | | | |

| Long-term care | | | | | | | | | | | | | | | | | | | |

| Insurance policy income | $ | 65.9 | | | $ | 65.6 | | | $ | 65.7 | | | $ | 66.3 | | | $ | 263.5 | | | $ | 67.0 | | | $ | 67.7 | | | $ | 68.6 | | | | | |

| Net investment income (5) | 34.1 | | | 34.2 | | | 34.1 | | | 34.1 | | | 136.5 | | | 33.9 | | | 34.4 | | | 34.1 | | | | | |

| Insurance policy benefits | (69.4) | | | (80.4) | | | (73.1) | | | (81.2) | | | (304.1) | | | (66.3) | | | (63.4) | | | (66.7) | | | | | |

| Amortization and non-deferred commissions | (3.5) | | | (3.4) | | | (3.5) | | | (2.5) | | | (12.9) | | | (3.5) | | | (3.4) | | | (3.1) | | | | | |

| Margin from long-term care | $ | 27.1 | | | $ | 16.0 | | | $ | 23.2 | | | $ | 16.7 | | | $ | 83.0 | | | $ | 31.1 | | | $ | 35.3 | | | $ | 32.9 | | | | | |

| Margin/insurance policy income | 41 | % | | 24 | % | | 35 | % | | 25 | % | | 31 | % | | 46 | % | | 52 | % | | 48 | % | | | | |

| Total health margin | $ | 116.5 | | | $ | 108.2 | | | $ | 123.2 | | | $ | 146.4 | | | $ | 494.3 | | | $ | 123.0 | | | $ | 135.9 | | | $ | 127.8 | | | | | |

| Margin/insurance policy income | 29 | % | | 27 | % | | 31 | % | | 37 | % | | 31 | % | | 31 | % | | 34 | % | | 31 | % | | | | |

| | | | | | | | | | | | | | | | | | | |

CNO FINANCIAL GROUP, INC.

Margin from Life Products

(Dollars in millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| 1Q | | 2Q | | 3Q | | 4Q | | YTD | | 1Q | | 2Q | | 3Q | | | | |

| 2023 | | 2023 | | 2023 | | 2023 | | 2023 | | 2024 | | 2024 | | 2024 | | | | |

| Life margin (4): | | | | | | | | | | | | | | | | | | | |

| Interest sensitive life | | | | | | | | | | | | | | | | | | | |

| Insurance policy income | $ | 44.5 | | | $ | 45.3 | | | $ | 45.1 | | | $ | 46.2 | | | $ | 181.1 | | | $ | 46.6 | | | $ | 46.9 | | | $ | 47.0 | | | | | |

| Net investment income (5) (7) | 13.1 | | | 12.7 | | | 12.9 | | | 12.8 | | | 51.5 | | | 13.2 | | | 13.2 | | | 13.3 | | | | | |

| Insurance policy benefits | (18.2) | | | (17.1) | | | (18.1) | | | (12.3) | | | (65.7) | | | (19.9) | | | (18.6) | | | (13.6) | | | | | |

| Interest credited (7) | (12.0) | | | (12.0) | | | (11.9) | | | (12.8) | | | (48.7) | | | (12.3) | | | (12.3) | | | (13.2) | | | | | |

| Amortization and non-deferred commissions | (4.6) | | | (4.8) | | | (5.1) | | | (5.0) | | | (19.5) | | | (5.1) | | | (5.3) | | | (5.3) | | | | | |

| Margin from interest sensitive life | $ | 22.8 | | | $ | 24.1 | | | $ | 22.9 | | | $ | 28.9 | | | $ | 98.7 | | | $ | 22.5 | | | $ | 23.9 | | | $ | 28.2 | | | | | |

| Average net insurance liabilities (11) | $ | 1,032.0 | | | $ | 1,035.4 | | | $ | 1,039.6 | | | $ | 1,045.8 | | | $ | 1,038.2 | | | $ | 1,056.1 | | | $ | 1,063.0 | | | $ | 1,070.8 | | | | | |

| Interest margin | $ | 1.1 | | | $ | 0.7 | | | $ | 1.0 | | | $ | — | | | $ | 2.8 | | | $ | 0.9 | | | $ | 0.9 | | | $ | 0.1 | | | | | |

| Interest margin/average net insurance liabilities (12) | 0.43 | % | | 0.27 | % | | 0.38 | % | | — | % | | 0.27 | % | | 0.34 | % | | 0.34 | % | | 0.04 | % | | | | |