Cleveland-Cliffs Inc. (NYSE: CLF) today reported

full-year and fourth-quarter results for the period ended December

31, 2024.

Full-Year Consolidated Results

Full-year 2024 consolidated revenues were $19.2 billion,

compared to the prior year's consolidated revenues of $22.0

billion.

For the full-year 2024, the Company recorded a GAAP net loss of

$708 million, or $1.57 per diluted share, with adjusted net loss2

of $351 million, or $0.73 per diluted share. This compares to 2023

net income of $450 million, or $0.78 per diluted share, with

adjusted net income2 of $545 million, or $1.07 per diluted share.

For the full-year 2024, Adjusted EBITDA1 was $780 million, compared

to $1.9 billion in 2023. The reduction was primarily driven by

lower steel index pricing in 2024 compared to 2023, partially

offset by lower operating costs.

Fourth-Quarter Consolidated Results

Fourth-quarter 2024 consolidated revenues were $4.3 billion,

compared to prior-year fourth-quarter consolidated revenues of $5.1

billion.

For the fourth quarter of 2024, the Company recorded a GAAP net

loss of $434 million, or $0.92 per diluted share, with an adjusted

net loss2 of $332 million, or $0.68 per diluted share. In the

prior-year fourth quarter, the Company recorded a net loss of $139

million, or $0.31 per diluted share, with an adjusted net loss2 of

$25 million, or $0.05 per diluted share.

For the fourth quarter of 2024, the Company reported an Adjusted

EBITDA1 loss of $81 million, compared to Adjusted EBITDA1 of $279

million in the fourth quarter of 2023.

Lourenco Goncalves, Cliffs’ Chairman, President and CEO said:

“Our results in 2024 were a consequence of the worst steel demand

environment since 2010 (ex-COVID). Cleveland-Cliffs is an American

steel company, designed to supply high-end manufacturers producing

things in the United States. That said, for the first time, the

number of cars sold in the United States that were produced abroad

and imported into the United States surpassed the number of cars

sold that were produced domestically. With this decline in domestic

automotive production, and too much imported steel from abroad that

drove unsustainably low steel prices, Cliffs was deeply impacted.

As a steel producer equipped to supply high-end steel -- like

automotive exposed parts, among others -- we by design carry a

higher fixed cost structure, and we are more impacted than others

when markets are weak. This impact was particularly evident in the

fourth quarter, which we expect to be the trough going forward. Our

cash use in the fourth quarter, due largely to inventory build, has

set us up nicely for the rebound we are seeing so far in 2025.”

Mr. Goncalves concluded: “Since January 20th, President Trump

has made clear that proper enforcement of our trade laws and a

supportive industrial policy prioritizing manufacturing in the

United States are both being implemented. That should benefit

Cleveland-Cliffs more than others. As of late February,

Cleveland-Cliffs is well on the way for a dramatic rebound in 2025.

We can already see the early signals of this rebound in automotive

pull, index pricing, and our overall order book. Also, with the

addition of Stelco’s spot price driven non-automotive book of

business to our footprint, we are even better equipped now to ride

this upside than in previous cycles, as we are now less dependent

on fixed price contracts."

Steelmaking Segment Results

Three Months Ended December

31,

Year Ended

December 31,

Three Months

Ended

2024

2023

2024

2023

Sept. 30, 2024

External Sales

Volumes - In Thousands

Steel Products (net tons)

3,827

4,039

15,596

16,432

3,840

Selling Price -

Per Net Ton

Average net selling price per net ton of

steel products

$

976

$

1,093

$

1,081

$

1,171

$

1,045

Operating Results

- In Millions

Revenues

$

4,168

$

4,954

$

18,529

$

21,331

$

4,419

Cost of goods sold

(4,449

)

(4,798

)

(18,509

)

(19,979

)

(4,533

)

Gross margin

$

(281

)

$

156

$

20

$

1,352

$

(114

)

Full-year 2024 steel product sales volume of 15.6 million net

tons consisted of 36% hot-rolled, 29% coated, 16% cold-rolled, 5%

plate, 3% stainless and electrical, and 11% other, including slabs

and rail. Fourth-quarter 2024 steel product sales volume of 3.8

million net tons consisted of 40% hot-rolled, 26% coated, 16%

cold-rolled, 5% plate, 3% stainless and electrical, and 10% other,

including slabs and rail.

Full-year 2024 Steelmaking revenues of $18.5 billion included

approximately $5.6 billion, or 30%, of sales to direct automotive

customers; $5.3 billion, or 29%, of sales to the distributors and

converters market; $5.2 billion, or 28%, of sales to the

infrastructure and manufacturing market; and $2.5 billion, or 13%,

of sales to steel producers. Fourth-quarter 2024 Steelmaking

revenues of $4.2 billion included approximately $1.2 billion, or

30%, of sales to the infrastructure and manufacturing market; $1.2

billion, or 28%, of sales to direct automotive customers; $1.2

billion, or 27%, of sales to the distributors and converters

market; and $623 million, or 15%, of sales to steel producers.

2025 Expectations

The Company put forth the following expectations for the

full-year 2025, which now include Stelco:

- Steel unit cost reductions of approximately $40 per net ton

compared to 2024

- Capital expenditures of approximately $700 million

- Selling, general and administrative expenses of approximately

$625 million

- Depreciation, depletion and amortization of approximately $1.1

billion

- Cash Pension and OPEB payments and contributions of

approximately $150 million

Conference Call Information

Cleveland-Cliffs Inc. will host a conference call on February

25, 2025, at 8:30 a.m. ET. The call will be broadcast live and

archived on Cliffs' website: www.clevelandcliffs.com

About Cleveland-Cliffs Inc.

Cleveland-Cliffs is a leading North America-based steel producer

with focus on value-added sheet products, particularly for the

automotive industry. The Company is vertically integrated from the

mining of iron ore, production of pellets and direct reduced iron,

and processing of ferrous scrap through primary steelmaking and

downstream finishing, stamping, tooling, and tubing. Headquartered

in Cleveland, Ohio, Cleveland-Cliffs employs approximately 30,000

people across its operations in the United States and Canada.

Forward-Looking Statements

This release contains statements that constitute

"forward-looking statements" within the meaning of the federal

securities laws. As a general matter, forward-looking statements

relate to anticipated trends and expectations rather than

historical matters. Forward-looking statements are subject to

uncertainties and factors relating to our operations and business

environment that are difficult to predict and may be beyond our

control. Such uncertainties and factors may cause actual results to

differ materially from those expressed or implied by the

forward-looking statements. These statements speak only as of the

date of this report, and we undertake no ongoing obligation, other

than that imposed by law, to update these statements. Investors are

cautioned not to place undue reliance on forward-looking

statements. Uncertainties and risk factors that could affect our

future performance and cause results to differ from the

forward-looking statements in this report include, but are not

limited to: continued volatility of steel, scrap metal and iron ore

market prices, which directly and indirectly impact the prices of

the products that we sell to our customers; uncertainties

associated with the highly competitive and cyclical steel industry

and our reliance on the demand for steel from the automotive

industry; potential weaknesses and uncertainties in global economic

conditions, excess global steelmaking capacity and production,

prevalence of steel imports, reduced market demand and oversupply

of iron ore; severe financial hardship, bankruptcy, temporary or

permanent shutdowns or operational challenges of one or more of our

major customers, key suppliers or contractors, which, among other

adverse effects, could disrupt our operations or lead to reduced

demand for our products, increased difficulty collecting

receivables, and customers and/or suppliers asserting force majeure

or other reasons for not performing their contractual obligations

to us; risks related to U.S. government actions and other

countries' reactions with respect to Section 232 of the Trade

Expansion Act of 1962 (as amended by the Trade Act of 1974), the

United States-Mexico-Canada Agreement and/or other trade

agreements, tariffs, treaties or policies, as well as the

uncertainty of obtaining and maintaining effective antidumping and

countervailing duty orders to counteract the harmful effects of

unfairly traded imports; impacts of existing and increasing

governmental regulation, including actual and potential

environmental regulations relating to climate change and carbon

emissions, and related costs and liabilities, including failure to

receive or maintain required operating and environmental permits,

approvals, modifications or other authorizations of, or from, any

governmental or regulatory authority and costs related to

implementing improvements to ensure compliance with regulatory

changes, including potential financial assurance requirements, and

reclamation and remediation obligations; potential impacts to the

environment or exposure to hazardous substances resulting from our

operations; our ability to maintain adequate liquidity, our level

of indebtedness and the availability of capital could limit our

financial flexibility and cash flow necessary to fund working

capital, planned capital expenditures, acquisitions, and other

general corporate purposes or ongoing needs of our business, or to

repurchase our common shares; our ability to reduce our

indebtedness or return capital to shareholders within the currently

expected timeframes or at all; adverse changes in credit ratings,

interest rates, foreign currency rates and tax laws; challenges to

successfully implementing our business strategy to achieve

operating results in line with our guidance; the outcome of, and

costs incurred in connection with, lawsuits, claims, arbitrations

or governmental proceedings relating to commercial and business

disputes, antitrust claims, environmental matters, government

investigations, occupational or personal injury claims,

property-related matters, labor and employment matters, or suits

involving legacy operations and other matters; supply chain

disruptions or changes in the cost, quality or availability of

energy sources, including electricity, natural gas and diesel fuel,

critical raw materials and supplies, including iron ore, industrial

gases, graphite electrodes, scrap metal, chrome, zinc, other

alloys, coke and metallurgical coal, and critical manufacturing

equipment and spare parts; problems or disruptions associated with

transporting products to our customers, moving manufacturing inputs

or products internally among our facilities, or suppliers

transporting raw materials to us; the risk that the cost or time to

implement a strategic or sustaining capital project may prove to be

greater than originally anticipated; our ability to consummate any

public or private acquisition transactions and to realize any or

all of the anticipated benefits or estimated future synergies, as

well as to successfully integrate any acquired businesses into our

existing businesses; uncertainties associated with natural or

human-caused disasters, adverse weather conditions, unanticipated

geological conditions, critical equipment failures, infectious

disease outbreaks, tailings dam failures and other unexpected

events; cybersecurity incidents relating to, disruptions in, or

failures of, information technology systems that are managed by us

or third parties that host or have access to our data or systems,

including the loss, theft or corruption of our or third parties'

sensitive or essential business or personal information and the

inability to access or control systems; liabilities and costs

arising in connection with any business decisions to temporarily or

indefinitely idle or permanently close an operating facility or

mine, which could adversely impact the carrying value of associated

assets and give rise to impairment charges or closure and

reclamation obligations, as well as uncertainties associated with

restarting any previously idled operating facility or mine; our

ability to realize the anticipated synergies or other expected

benefits of the acquisition of Stelco Holdings Inc., as well as the

impact of additional liabilities and obligations incurred in

connection with such acquisition; our level of self-insurance and

our ability to obtain sufficient third-party insurance to

adequately cover potential adverse events and business risks;

uncertainties associated with our ability to meet customers’ and

suppliers’ decarbonization goals and reduce our greenhouse gas

emissions in alignment with our own announced targets; challenges

to maintaining our social license to operate with our stakeholders,

including the impacts of our operations on local communities,

reputational impacts of operating in a carbon-intensive industry

that produces greenhouse gas emissions, and our ability to foster a

consistent operational and safety track record; our actual economic

mineral reserves or reductions in current mineral reserve

estimates, and any title defect or loss of any lease, license,

option, easement or other possessory interest for any mining

property; our ability to maintain satisfactory labor relations with

unions and employees; unanticipated or higher costs associated with

pension and other postretirement benefits obligations resulting

from changes in the value of plan assets or contribution increases

required for unfunded obligations; uncertain availability or cost

of skilled workers to fill critical operational positions and

potential labor shortages caused by experienced employee attrition

or otherwise, as well as our ability to attract, hire, develop and

retain key personnel; and potential significant deficiencies or

material weaknesses in our internal control over financial

reporting.

For additional factors affecting the business of Cliffs, refer

to Part I – Item 1A. Risk Factors of our Annual Report on Form 10-K

for the year ended December 31, 2023, our Quarterly Report on Form

10-Q for the quarterly period ended June 30, 2024, and other

filings with the U.S. Securities and Exchange Commission.

FINANCIAL TABLES FOLLOW

CLEVELAND-CLIFFS INC. AND

SUBSIDIARIES

STATEMENTS OF UNAUDITED

CONDENSED CONSOLIDATED OPERATIONS

Three Months Ended

December 31,

Year Ended

December 31,

Three Months Ended

(In millions, except per share

amounts)

2024

2023

2024

2023

Sept. 30, 2024

Revenues

$

4,325

$

5,112

$

19,185

$

21,996

$

4,569

Operating costs:

Cost of goods sold

(4,598

)

(4,944

)

(19,115

)

(20,605

)

(4,673

)

Selling, general and administrative

expenses

(139

)

(162

)

(486

)

(577

)

(112

)

Restructuring and other charges

2

—

(129

)

—

(2

)

Acquisition-related costs

(30

)

(7

)

(44

)

(12

)

(14

)

Asset impairment

—

—

(79

)

—

—

Goodwill impairment

—

(125

)

—

(125

)

—

Miscellaneous – net

(25

)

26

(88

)

—

(27

)

Total operating costs

(4,790

)

(5,212

)

(19,941

)

(21,319

)

(4,828

)

Operating income (loss)

(465

)

(100

)

(756

)

677

(259

)

Other income (expense):

Interest expense, net

(135

)

(63

)

(370

)

(289

)

(102

)

Loss on extinguishment of debt

—

—

(27

)

—

—

Net periodic benefit credits other than

service cost component

63

54

247

204

62

Other non-operating income (loss)

(33

)

1

(37

)

5

(7

)

Total other expense

(105

)

(8

)

(187

)

(80

)

(47

)

Income (loss) from continuing

operations before income taxes

(570

)

(108

)

(943

)

597

(306

)

Income tax benefit (expense)

136

(30

)

235

(148

)

76

Income (loss) from continuing

operations

(434

)

(138

)

(708

)

449

(230

)

Income (loss) from discontinued

operations, net of tax

—

(1

)

—

1

—

Net income (loss)

(434

)

(139

)

(708

)

450

(230

)

Net income attributable to noncontrolling

interests

(13

)

(16

)

(46

)

(51

)

(12

)

Net income (loss) attributable to

Cliffs shareholders

$

(447

)

$

(155

)

$

(754

)

$

399

$

(242

)

Earnings (loss) per common share

attributable to Cliffs shareholders - basic

Continuing operations

$

(0.92

)

$

(0.31

)

$

(1.57

)

$

0.78

$

(0.52

)

Discontinued operations

—

—

—

—

—

$

(0.92

)

$

(0.31

)

$

(1.57

)

$

0.78

$

(0.52

)

Earnings (loss) per common share

attributable to Cliffs shareholders - diluted

Continuing operations

$

(0.92

)

$

(0.31

)

$

(1.57

)

$

0.78

$

(0.52

)

Discontinued operations

—

—

—

—

—

$

(0.92

)

$

(0.31

)

$

(1.57

)

$

0.78

$

(0.52

)

CLEVELAND-CLIFFS INC. AND

SUBSIDIARIES

STATEMENTS OF UNAUDITED

CONDENSED CONSOLIDATED FINANCIAL POSITION

December 31,

(In millions)

2024

2023

ASSETS

Current assets:

Cash and cash equivalents

$

54

$

198

Accounts receivable, net

1,576

1,840

Inventories

5,094

4,460

Other current assets

183

138

Total current assets

6,907

6,636

Non-current assets:

Property, plant and equipment, net

9,942

8,895

Goodwill

1,768

1,005

Intangible assets

1,170

201

Pension and OPEB assets

427

329

Other non-current assets

733

471

TOTAL ASSETS

$

20,947

$

17,537

LIABILITIES

Current liabilities:

Accounts payable

$

2,008

$

2,099

Accrued employment costs

447

511

Accrued expenses

375

380

Other current liabilities

492

518

Total current liabilities

3,322

3,508

Non-current liabilities:

Long-term debt

7,065

3,137

Pension and OPEB liabilities

751

821

Deferred income taxes

858

639

Asset retirement and environmental

obligations

601

557

Other non-current liabilities

1,453

753

TOTAL LIABILITIES

14,050

9,415

TOTAL EQUITY

6,897

8,122

TOTAL LIABILITIES AND EQUITY

$

20,947

$

17,537

CLEVELAND-CLIFFS INC. AND

SUBSIDIARIES

STATEMENTS OF UNAUDITED

CONDENSED CONSOLIDATED CASH FLOWS

Three Months Ended

December 31,

Year Ended

December 31,

(In millions)

2024

2023

2024

2023

OPERATING ACTIVITIES

Net income (loss)

$

(434

)

$

(139

)

$

(708

)

$

450

Adjustments to reconcile net income (loss)

to net cash provided (used) by operating activities:

Depreciation, depletion and

amortization

258

235

951

973

Pension and OPEB credits

(54

)

(44

)

(211

)

(163

)

Deferred income taxes

(129

)

(18

)

(195

)

114

Other

116

80

485

201

Changes in operating assets and

liabilities, net of business combination:

Accounts receivable, net

106

284

364

120

Inventories

(195

)

132

(5

)

670

Income taxes

29

106

(17

)

122

Pension and OPEB payments and

contributions

(33

)

(10

)

(195

)

(94

)

Payables, accrued employment and accrued

expenses

(191

)

99

(408

)

4

Other, net

55

(73

)

44

(130

)

Net cash provided (used) by operating

activities

(472

)

652

105

2,267

INVESTING ACTIVITIES

Purchase of property, plant and

equipment

(205

)

(165

)

(695

)

(646

)

Acquisition of Stelco, net of cash

acquired

(2,512

)

—

(2,512

)

—

Other investing activities

(18

)

44

(5

)

55

Net cash used by investing activities

(2,735

)

(121

)

(3,212

)

(591

)

FINANCING ACTIVITIES

Repurchase of common shares

—

—

(733

)

(152

)

Proceeds from issuance of debt

1,800

—

3,221

750

Repayments of senior notes

—

—

(845

)

—

Borrowings (repayments) under credit

facilities

1,513

(325

)

1,560

(1,864

)

Debt issuance costs

(36

)

—

(109

)

(34

)

Other financing activities

(48

)

(39

)

(124

)

(204

)

Net cash provided (used) by financing

activities

3,229

(364

)

2,970

(1,504

)

Net increase (decrease) in cash and cash

equivalents

22

167

(137

)

172

Cash, cash equivalents, and restricted

cash at beginning of period

39

31

198

26

Effect of exchange rate changes on

cash

(1

)

—

(1

)

$

—

Cash, cash equivalents, and restricted

cash at end of period

$

60

$

198

$

60

$

198

Restricted cash

(6

)

—

(6

)

—

Cash and cash equivalents at end of

year

$

54

$

198

$

54

$

198

1 CLEVELAND-CLIFFS INC. AND SUBSIDIARIES

NON-GAAP RECONCILIATION - EBITDA AND ADJUSTED EBITDA

In addition to the consolidated financial statements presented

in accordance with U.S. GAAP, the Company has presented EBITDA and

Adjusted EBITDA on a consolidated basis. These measures are used by

management, investors, lenders and other external users of our

financial statements to assess our operating performance and to

compare operating performance to other companies in the steel

industry, showing results exclusive of non-cash and/or

non-recurring items. The presentation of these measures is not

intended to be considered in isolation from, as a substitute for,

or as superior to, the financial information prepared and presented

in accordance with U.S. GAAP. The presentation of these measures

may be different from non-GAAP financial measures used by other

companies. A reconciliation of these consolidated measures to their

most directly comparable GAAP measures is provided in the table

below.

Three Months Ended

December 31,

Year Ended

December 31,

Three Months Ended

(In millions)

2024

2023

2024

2023

Sept. 30, 2024

Net income (loss)

$

(434

)

$

(139

)

$

(708

)

$

450

$

(230

)

Less:

Interest expense, net

(135

)

(63

)

(370

)

(289

)

(102

)

Income tax benefit (expense)

136

(30

)

235

(148

)

76

Depreciation, depletion and

amortization

(258

)

(235

)

(951

)

(973

)

(235

)

Total EBITDA

$

(177

)

$

189

$

378

$

1,860

$

31

Less:

EBITDA from noncontrolling interests

$

20

$

23

$

76

$

83

$

20

Weirton indefinite idle

2

—

(217

)

—

(2

)

Arbitration decision

—

—

(71

)

—

(71

)

Acquisition-related costs

(30

)

(7

)

(44

)

(12

)

(14

)

Changes in fair value of derivatives,

net

(34

)

—

(41

)

—

(7

)

Loss on extinguishment of debt

—

—

(27

)

—

—

Amortization of inventory step-up

(26

)

—

(26

)

—

—

Loss on currency exchange

(20

)

—

(20

)

—

—

Loss on disposal of assets

(5

)

(7

)

(16

)

(15

)

(7

)

Goodwill impairment

—

(125

)

—

(125

)

—

Other, net

(3

)

26

(16

)

18

(12

)

Total Adjusted EBITDA1

$

(81

)

$

279

$

780

$

1,911

$

124

EBITDA of noncontrolling interests

includes the following:

Net income attributable to noncontrolling

interests

$

13

$

16

$

46

$

51

$

12

Depreciation, depletion and

amortization

7

7

30

32

8

EBITDA of noncontrolling interests

$

20

$

23

$

76

$

83

$

20

2 CLEVELAND-CLIFFS INC. AND SUBSIDIARIES

ADJUSTED EARNINGS PER SHARE RECONCILIATION

In addition to the consolidated financial statements presented

in accordance with U.S. GAAP, the Company has presented Adjusted

net income (loss) attributable to Cliffs shareholders and Adjusted

earnings (loss) per common share attributable to Cliffs

shareholders - diluted. These measures are used by management,

investors, lenders and other external users of our financial

statements to assess our operating performance and to compare

operating performance to other companies in the steel industry,

showing results exclusive of non-cash and/or non-recurring items.

The presentation of these measures is not intended to be considered

in isolation from, as a substitute for, or as superior to, the

financial information prepared and presented in accordance with

U.S. GAAP. The presentation of these measures may be different from

non-GAAP financial measures used by other companies. A

reconciliation of these consolidated measures to their most

directly comparable GAAP measures is provided in the table

below.

Three Months Ended

December 31,

Year Ended

December 31,

Three Months Ended

(In millions)

2024

2023

2024

2023

Sept. 30, 2024

Net income (loss) attributable to Cliffs

shareholders

$

(447

)

$

(155

)

$

(754

)

$

399

$

(242

)

Adjustments:

Weirton indefinite idle

2

—

(217

)

—

(2

)

Arbitration decision

—

—

(71

)

—

(71

)

Acquisition-related expenses and

adjustments

(30

)

(7

)

(44

)

(12

)

(14

)

Acquisition-related interest expense

(21

)

—

(53

)

—

(32

)

Changes in fair value of derivatives,

net

(34

)

—

(41

)

—

(7

)

Loss on extinguishment of debt

—

—

(27

)

—

—

Amortization of inventory step-up

(26

)

—

(26

)

—

—

Loss on currency exchange

(20

)

—

(20

)

—

—

Loss on disposal of assets

(5

)

(7

)

(16

)

(15

)

(7

)

Goodwill impairment1

—

(125

)

—

(125

)

—

Other, net

(3

)

26

(16

)

18

(12

)

Tax valuation allowance

—

(14

)

—

(14

)

—

Income tax effect

22

(3

)

128

2

59

Adjusted net income (loss) attributable to

Cliffs shareholders

$

(332

)

$

(25

)

$

(351

)

$

545

$

(156

)

Earnings (loss) per common share

attributable to Cliffs shareholders - diluted

$

(0.92

)

$

(0.31

)

$

(1.57

)

$

0.78

$

(0.52

)

Adjusted earnings (loss) per common share

attributable to Cliffs shareholders - diluted

$

(0.68

)

$

(0.05

)

$

(0.73

)

$

1.07

$

(0.33

)

1Goodwill impairment is non-deductible for

income tax purposes.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250224835810/en/

MEDIA CONTACT: Patricia Persico Senior Director,

Corporate Communications (216) 694-5316

INVESTOR CONTACT: James Kerr Director, Investor Relations

(216) 694-7719

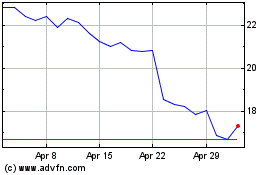

Cleveland Cliffs (NYSE:CLF)

Historical Stock Chart

From Feb 2025 to Mar 2025

Cleveland Cliffs (NYSE:CLF)

Historical Stock Chart

From Mar 2024 to Mar 2025