STATEMENT OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS

Northshore Mining Company and Silver Bay Power Company

Retirement Savings Plan

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(In Thousands)

|

|

|

|

|

|

Year Ended December 31,

|

|

|

|

|

|

2019

|

|

2018

|

|

Contributions:

|

|

|

|

|

|

Employer

|

|

$

|

1,550

|

|

|

$

|

1,473

|

|

|

Employee

|

|

4,353

|

|

|

4,152

|

|

|

Rollover

|

|

684

|

|

|

294

|

|

|

Total Contributions

|

|

6,587

|

|

|

5,919

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Investment Income (Loss) from Collective Trust

|

|

21,968

|

|

|

(4,464)

|

|

|

Benefits Paid to Participants

|

|

(11,511)

|

|

|

(11,607)

|

|

|

Administrative Expenses

|

|

(73)

|

|

|

(25)

|

|

|

Net Increase (Decrease)

|

|

16,971

|

|

|

(10,177)

|

|

|

Net Assets Available for Benefits:

|

|

|

|

|

|

Beginning of Year

|

|

103,983

|

|

|

114,160

|

|

|

End of Year

|

|

$

|

120,954

|

|

|

$

|

103,983

|

|

|

|

|

|

|

|

|

See accompanying notes.

|

|

|

|

|

Northshore Mining Company and Silver Bay Power Company Retirement Savings Plan

Notes to Financial Statements

1.Description of the Plan

The following description of The Northshore Mining Company and Silver Bay Power Company Retirement Savings Plan (the “Plan”) provides only general information. Participants should refer to the Plan document for a complete description of the Plan’s provisions.

General:

The Plan, which first became effective on October 1, 1994, is a defined contribution plan covering all employees of Northshore Mining Company and Silver Bay Power Company (together the “Company”) who meet the eligibility requirements. In order to incorporate all amendments implemented after January 1, 2007, the Plan was amended and restated effective January 1, 2012 and was subsequently amended effective as of January 1, 2014, 2015 and 2016 to update certain plan provisions. It is subject to the provisions of the ERISA.

Eligibility:

All full-time employees of the Company are eligible to participate in the Plan.

Contributions:

Employee Contributions - Participants may elect a portion of their compensation, between 1 percent to 35 percent, to be contributed to the Plan.

Employer Contributions - For all participants, the Company made a Safe Harbor election and shall make matching contributions in cash of 100 percent for the participants’ deferrals not in excess of 3 percent of eligible earnings and 50 percent of all participants’ deferrals greater than 3 percent and up to 5 percent of eligible earnings.

Employer Discretionary Contributions - The Company may also contribute for any Plan year additional amounts (as limited) as shall be determined by the Board of Directors of the Company. There were no discretionary contributions for the years ended December 31, 2019 and 2018.

Contributions are subject to limitations on annual additions and other limitations imposed by the Internal Revenue Code as defined in the Plan document.

Participants’ Accounts:

401(k) Accounts - Each participant’s account is credited with the participant’s elective contributions, employer matching contributions, earnings and losses thereon. Plan participants are allocated participation in the fund(s) based on cash value. Under the cash value method, total monthly earnings or losses are divided by the total value of the fund(s) to obtain a ratio, which is then multiplied by each participant’s account balance in the fund(s) at the beginning of the month.

Rollover contributions from other qualified plans are also accepted, provided certain specified conditions are met.

Vesting:

All participants are 100 percent vested in elective deferrals, rollover contributions and Company matching and discretionary contributions made to the Plan.

Notes Receivable From Participants:

Loans are permitted under certain circumstances and are subject to limitations. Participants may borrow from their fund accounts a minimum of $1 thousand, up to a maximum equal to the lesser of $50 thousand or 50 percent of their account balance. Loans are repaid over a period not to exceed 5 years with exceptions for the purchase of a primary residence, which are repaid over a period not to exceed 10 years.

The loans are secured by the balance in the participants' account and bear interest at rates commercially reasonable that are published on the first day of the month preceding the month the loan was granted. Principal and interest are paid ratably through monthly payroll deductions. Loans are valued at unpaid principal plus accrued but

unpaid interest. No allowance for credit losses has been recorded as of December 31, 2019 and 2018. Delinquent participant loans are recorded as distributions on the basis of the terms of the Plan agreement.

Payment of Benefits:

Upon termination of service by reason of retirement, disability, or other reasons, a participant has the option to keep their funds in the Plan without option of contribution until age 70 1/2 or receive a lump sum equal to the value of his or her account. Upon death, a participant’s beneficiary receives a lump sum amount equal to the value of his or her account. Benefit payments to participants are recorded upon distribution.

Hardship Withdrawals:

Hardship withdrawals are permitted in accordance with the Plan and Internal Revenue Service guidelines.

Investment Options:

Upon enrollment in the Plan, a participant may direct his or her contributions to any or all of the investment options offered by the Plan in the Collective Trust (see Note 4). Investment decisions for Fidelity funds are at the discretion of Fidelity Management & Research Company, manager of the Fidelity funds. Participant elections may be adjusted or reallocated at any time by the participants. In the absence of a participant's effective direction as to the investment of all or a portion of the amounts in the participant's account, the amounts for which there is no such direction shall be invested in the investment or investments designated by the Investment Committee for such purpose (each of which shall be a "qualified default investment alternative" within the meaning of Department of Labor regulations).

Cliffs Stock Fund:

The Cliffs Stock Fund is the fund within the Plan that is invested solely in the common stock of Cleveland-Cliffs Inc. ("Cliffs"). Effective January 1, 2016, the Cliffs Stock Fund is no longer an available investment option under the Plan for purposes of future contributions, loan repayments or transfers. The Cliffs Stock Fund is also not a permissible investment option for purposes of Plan participants' self-directed brokerage accounts established under the Plan.

Independent Fiduciary:

Gallagher Fiduciary Advisors, LLC has been appointed since January 1, 2016 as an independent fiduciary and is a “named fiduciary” within the meaning of Section 402(a)(2) of ERISA with respect to the management and disposition of the Cliffs Stock Fund with the power and authority set forth in the Plan as amended.

2.Summary of Significant Accounting Policies Basis of Accounting:

The Plan’s transactions are reported on the accrual basis of accounting. All investment securities are stated at fair value as measured by quoted prices in active markets. Shares of mutual funds are valued at the net asset value of shares held by the Plan at year end. The stable value investment contract financial instrument is valued, and its net asset value ("NAV") per unit is computed at the close of the New York Stock Exchange ("NYSE"), normally 4 p.m. ET, each day the NYSE is open for business (valuation date). There are no unfunded commitments and the redemption frequency is daily.

Purchases and sales of securities are recorded on a trade-date basis. Dividends are recorded on the ex-dividend date.

Valuation of Investments:

Investments held by a defined contribution plan are required to be reported at fair value.

Fidelity Management Trust Company (“the Trustee”) determines the fair value of the assets of each plan in the Collective Trust (see Note 4) and the fair value of the individual participants' accounts every business day. The calculation of fair value is based upon each fund and respective plan in the Collective Trust as determined by the Trustee. Investments in wrapper contracts are fair valued using a discounted cash flow model which considers recent fee bids as determined by recognized dealers, discount rate and the duration of the underlying portfolio securities. There are no unfunded commitments and the redemption frequency is daily.

Recent Accounting Pronouncements:

In February 2017, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update No. 2017-06, Plan Accounting (Topics 960, 962, and 965): Employee Benefit Plan Master Trust Reporting ("ASU 2017-06"). ASU 2017-06 requires the Plan's interest in the master trust and any change in that interest to be presented as separate line items in the statement of net assets available for benefits and in the statement of changes in net assets available for benefits, respectively. The amendment also requires all plans to disclose their master trust's other asset and liability balances and the dollar amount of the plan's interest in each of those balances. In addition, the amendment eliminates the requirement to disclose the percentage interest in the master trust for plans with divided interest and requires that all plans disclose the dollar amount of their interest in each general type of investment. ASU 2017-06 is effective for fiscal years beginning after December 15, 2018 and Management elected to adopt the standard on its effective date of January 1, 2019. The primary impact of this standard on the financial statements are changes to disclosures for the Collective Trust.

Use of Estimates:

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

Risk and Uncertainties

The Plan provides for various investment options through the use of mutual funds and common collective trusts. Investment securities are exposed to various risks such as interest rate, market and credit risks. Due to the level of risk associated with certain investment securities, as well as the level of uncertainty related to changes in the value of the investment securities, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect participants’ account balances and the amounts reported in the Statement of Net Assets Available for Benefits.

Administrative Fees:

Trustee and certain administrative fees are paid from Plan assets. Costs of administering the Plan are paid by the Company.

Plan Termination:

Although it has not expressed any intent to do so, the Company has the right under the Plan to discontinue contributions at any time and to terminate the Plan subject to the provisions of ERISA.

Subsequent Events:

The Plan evaluates events occurring subsequent to the date of the financial statements in determining the accounting for and disclosure of transactions and events that affect the financial statements.

In response to the COVID-19 pandemic, subsequent to the reporting period and effective beginning May 1, 2020, Management took several steps towards preserving liquidity including temporarily suspending the employer 401k match program for salaried exempt employees until economic conditions improve.

Additionally, on March 27, 2020, President Trump signed into law the CARES Act. The CARES Act, among other things waives the 10% early withdrawal penalty on aggregate distributions of up to $100 thousand from certain workplace retirement plans for COVID-19-related purposes, such as this plan. Individuals can also elect to pay the federal income tax on the distribution over 3 years or to repay the distribution within a 3-year period to an eligible retirement plan. Another component of the law suspends the 2020 required minimum distributions from certain defined contribution plans, such as this plan. These changes are in effect through 2020.

3.Tax Status

On March 26, 2014, the Internal Revenue Service stated that the Plan was in compliance with the applicable requirements of the Internal Revenue Code.

Accounting principles generally accepted in the United States require plan management to evaluate tax positions taken by the Plan and recognize a tax liability if the Plan has taken uncertain tax positions that more-likely-

than-not would not be sustained upon examination by applicable taxing authorities. The Plan Administrator has analyzed tax positions taken by the Plan and has concluded that, as of December 31, 2019, there are no uncertain tax positions taken, or expected to be taken, that would require recognition of a liability or disclosure in the financial statements. The Plan is subject to routine audits by tax jurisdictions. However, currently no audits for any tax periods are in progress.

4.Collective Trust

The Collective Trust was amended effective January 1, 2016 to include the Plan as part of the Collective Trust which also includes the Cleveland-Cliffs Inc. and Its Associated Employers Salaried Employees Savings Plan, the Savings Plan for Minnesota Represented Hourly Employees, the Ore Mining Companies Salaried Employees' Retirement Income Plan, and the Savings Plan for Hourly Employees of Empire Iron Mining Partnership, Tilden Mining Company L.C. and The Cleveland-Cliffs Iron Company. The Employee Benefits Administration Department of Cleveland-Cliffs Inc. is the Plan Administrator.

All Collective Trust investment information disclosed in the accompanying financial statements, including investments held at December 31, 2019 and 2018 and net realized and unrealized gains or losses in fair value of investments and interest and dividends for the years then ended, was obtained or derived from information supplied to the Plan Administrator, as defined by the Plan.

The Trustee invests assets of the Collective Trust in stocks, bonds, and other evidences of ownership or indebtedness in accordance with the terms of the Trust Agreement. The Collective Trust is a Master Trust under Department of Labor Rules and Regulations for Reporting and Disclosure under ERISA because Cliffs and its associated employers are related through management agreements. The Plan's undivided interest in the Collective Trust is equal to the current value of the Plan's investment as a percent of the current value of Collective Trust assets as of each month-end valuation date. The Plan's investment in the Collective Trust is the sum of the current value of contributions less the withdrawals and fees, plus or minus net realized and unrealized gains or losses of the Collective Trust, allocated to the Plan based on the current value of the Plan's investment as a percent of the current value of the Collective Trust assets as of the previous month-end valuation.

Investments are stated at aggregate current values determined as follows: securities traded on a national securities exchange on the last business day of the year are valued at the last reported sales price and securities not traded on the last business day of the year are valued at the average of the last reported bid and ask price. Securities traded in the over-the-counter market are valued at the average of the last reported bid and ask price. Securities which do not have an established market are valued by the Trustee.

The change in the difference between the aggregate current value and cost of investments is reflected in the changes in net assets as unrealized gain or loss on investments. The net realized gain or loss on sale of assets is the difference between the proceeds received and the average cost of assets sold.

The following table presents the fair values of investments for the Collective Trust:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(In Thousands)

|

|

|

|

|

|

|

|

|

|

2019

|

|

|

|

2018

|

|

|

|

|

|

Master Trust Balances

|

|

Plan's Interest in Master Trust Balances

|

|

Master Trust Balances

|

|

Plan's Interest in Master Trust Balances

|

|

Cash Equivalents

|

|

$

|

9,667

|

|

|

$

|

2,960

|

|

|

$

|

10,965

|

|

|

$

|

2,926

|

|

|

Equity Funds

|

|

377,684

|

|

|

91,519

|

|

|

365,846

|

|

|

74,570

|

|

|

Fixed Income Funds

|

|

41,877

|

|

|

10,998

|

|

|

45,418

|

|

|

10,980

|

|

|

Self-Directed Accounts

|

|

4,353

|

|

|

1,146

|

|

|

3,541

|

|

|

859

|

|

|

Common Stock

|

|

12,385

|

|

|

12,385

|

|

|

12,726

|

|

|

12,726

|

|

|

Total Investments at Fair Value

|

|

$

|

445,966

|

|

|

$

|

119,008

|

|

|

$

|

438,496

|

|

|

$

|

102,061

|

|

The following table presents investment income (loss) of the Collective Trust:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(In Thousands)

|

|

|

|

|

Year Ended December 31,

|

|

|

|

|

2019

|

|

2018

|

|

Interest and Dividend Income

|

$

|

17,331

|

|

|

$

|

21,198

|

|

|

Net Appreciation (Depreciation) on Investments

|

78,513

|

|

|

(43,770)

|

|

|

Total Investment Income (Loss) - Collective Trust

|

$

|

95,844

|

|

|

$

|

(22,572)

|

|

5.Fair Value of Financial Assets

ASC 820, Fair Value Measurements and Disclosures, establishes a three-level valuation hierarchy for classification of fair value measurements. The valuation hierarchy is based upon the transparency of inputs to the valuation of an asset or liability as of the measurement date. Inputs refer broadly to the assumptions that market participants would use in pricing an asset or liability. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from independent sources. Unobservable inputs are inputs that reflect our own views about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. The three-tier hierarchy of inputs is summarized below:

•Level 1 — Valuation is based upon quoted prices (unadjusted) for identical assets or liabilities in active markets.

•Level 2 — Valuation is based upon quoted prices for similar assets and liabilities in active markets, or other inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the financial instrument.

•Level 3 — Valuation is based upon other unobservable inputs that are significant to the fair value measurement.

The classification of assets and liabilities within the valuation hierarchy is based upon the lowest level of input that is significant to the fair value measurement in its entirety.

The following is a description of the valuation methodologies used for instruments measured at fair value, including the general classification of such instruments pursuant to the valuation hierarchy.

Common Stock, Mutual Funds and Self-Directed Accounts:

The fair value of the common stocks, mutual funds and self-directed accounts are based on quoted market prices. The self-directed accounts allow participants to invest in options not offered directly through the Plan. These instruments are classified in the Level 1 category of the hierarchy.

The following table presents the financial assets of the Collective Trust measured at fair value basis at December 31, 2019:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(In Thousands)

|

|

|

|

|

|

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Mutual Funds

|

|

$

|

413,682

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

413,682

|

|

|

Common Stock

|

|

12,385

|

|

|

—

|

|

|

—

|

|

|

12,385

|

|

|

Self-Directed Accounts

|

|

4,353

|

|

|

—

|

|

|

—

|

|

|

4,353

|

|

|

Investments measured at NAV(1)

|

|

—

|

|

|

—

|

|

|

—

|

|

|

15,546

|

|

|

Total

|

|

$

|

430,420

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

445,966

|

|

The following table presents the financial assets of the Plan measured at fair value on a recurring basis at December 31, 2018:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(In Thousands)

|

|

|

|

|

|

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Mutual Funds

|

|

$

|

403,036

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

403,036

|

|

|

Common Stock

|

|

12,726

|

|

|

—

|

|

|

—

|

|

|

12,726

|

|

|

Self-Directed Accounts

|

|

3,541

|

|

|

—

|

|

|

—

|

|

|

3,541

|

|

|

Investments measured at NAV(1)

|

|

—

|

|

|

—

|

|

|

—

|

|

|

19,193

|

|

|

Total

|

|

$

|

419,303

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

438,496

|

|

(1) Certain investments that are measured at fair value using the NAV per share (or its equivalent) practical expedient have not been categorized in the fair value hierarchy. The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the amounts presented in Note 4 and the Statements of Net Assets Available for Benefits as of December 31, 2019 and 2018, respectively.

6.Party-in-Interest Transactions

As of December 31, 2019 and 2018, certain Plan investments are shares of mutual funds and a stable value fund managed by Fidelity, the trustee as defined by the Plan, and, therefore, these qualify as party-in-interest transactions. Usual and customary fees were paid by the Plan for the investment management services. In addition, the Plan has arrangements with various service providers and these arrangements qualify as party-in-interest.

The Plan sold Cliffs common shares for approximately $1,637 and $1,091 thousand in 2019 and 2018, respectively. The Plan purchased no shares in 2019 or 2018 as the Cliffs Stock Fund is no longer an available investment option under the Plan.

SCHEDULE OF ASSETS HELD FOR INVESTMENT PURPOSES AT END OF YEAR

Form 5500, Schedule H, Part IV, Line 4i

Northshore Mining Company and Silver Bay Power Company

Retirement Savings Plan

EIN 84-1116857

Plan Number 001

December 31, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

|

(b)

Identity of Issue,

Borrower, Lessor,

or Similar Party

|

|

(c)

Description of Investment Including

Maturity Date, Rate of Interest,

Collateral, Par or Maturity Value

|

|

(d)

Cost

|

|

(e)

Current Value

|

|

*

|

|

Fidelity Management Trust Company

|

|

Investments in Collective Trust

|

|

N/A

|

|

$

|

119,008,043

|

|

|

*

|

|

Participant Loans

|

|

Notes receivable (4.25% to 6.50%)

|

|

N/A

|

|

1,946,331

|

|

|

|

|

|

|

|

|

|

|

$

|

120,954,374

|

|

|

*

|

|

Party-in-interest to the Plan.

|

|

|

|

|

|

|

SIGNATURES

The Plan. Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on their behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NORTHSHORE MINING COMPANY and

SILVER BAY POWER COMPANY

RETIREMENT SAVINGS PLAN

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

Employee Benefits Administration Department of Cleveland-Cliffs Inc.,

|

|

|

|

|

|

|

Plan Administrator

|

|

|

|

|

|

|

|

|

Date:

|

June 19, 2020

|

|

By:

|

|

/s/ Maurice D. Harapiak

|

|

|

|

|

|

|

Executive Vice President, Human Resources & Chief Administrative Officer

|

EXHIBIT INDEX

|

|

|

|

|

|

|

|

|

|

|

Exhibit Number

|

|

Description

|

|

|

|

Consent of Independent Registered Public Accounting Firm, filed herewith.

|

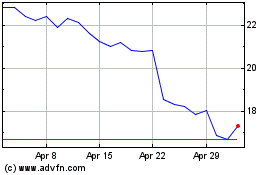

Cleveland Cliffs (NYSE:CLF)

Historical Stock Chart

From Aug 2024 to Sep 2024

Cleveland Cliffs (NYSE:CLF)

Historical Stock Chart

From Sep 2023 to Sep 2024