Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

July 24 2024 - 5:28PM

Edgar (US Regulatory)

|

Citigroup Global Markets Holdings Inc.

Fully and Unconditionally Guaranteed by Citigroup

Inc. |

|

Term Sheet

No. 2024-USNCH[ ]

dated July

24, 2024 relating to

Preliminary Pricing Supplement No. 2024-USNCH[ ]

dated July

24, 2024

Registration Statement Nos. 333-270327

and 333-270327-01

Filed Pursuant to Rule 433 |

|

Market Linked Notes—Upside Participation with Averaging

and Principal Return at Maturity

Notes Linked to the SPDR® Gold Trust due

August 2, 2028

Term Sheet to Preliminary Pricing Supplement No. 2024-USNCH[

] dated July 24, 2024 |

Summary

of Terms

| Issuer and Guarantor: |

Citigroup Global Markets Holdings Inc. (issuer) and Citigroup Inc. (guarantor) |

| Underlying: |

The SPDR® Gold Trust |

| Pricing Date*: |

July 31, 2024 |

| Issue Date*: |

August 5, 2024 |

| Stated Principal Amount: |

$1,000 per note |

| Maturity Payment Amount (per note): |

·

if

the average ending value is greater than the starting value: $1,000 plus ($1,000 × underlying return × participation

rate);

·

if

the average ending value is less than or equal to the starting value: $1,000 |

| Participation Rate: |

At least 100%, to be determined on the pricing date |

| Calculation Days*: |

Quarterly on the 28th day of each January, April, July and October, beginning in October 2024 and ending on July 28, 2028 (the “final calculation day”) |

| Maturity Date*: |

August 2, 2028 |

| Underlying Return: |

(average ending value – starting value) / starting value |

| Starting Value: |

The closing value of the underlying on the pricing date |

| Average Ending Value: |

The arithmetic average of the closing values of the underlying on the calculation days |

| Calculation Agent: |

Citigroup Global Markets Inc. (“CGMI”), an affiliate of Citigroup Global Markets Holdings Inc. |

| Denominations: |

$1,000 and any integral multiple of $1,000 |

| Agent Discount**: |

Up to 4.325%; dealers, including those using the trade name Wells Fargo Advisors (“WFA”), may receive a selling concession of 2.75% and WFA may receive a distribution expense fee of 0.075%. |

| CUSIP / ISIN: |

17332MKX1 / US17332MKX10 |

| United States Federal Tax Considerations: |

See the preliminary pricing supplement. |

|

* subject to change

** In addition, CGMI may pay a fee of up to 0.20% to selected securities

dealers in consideration for marketing and other services in connection with the distribution

of the notes to other securities dealers. |

|

If the average ending value is less than or equal to the starting

value, you will be repaid the stated principal amount of the notes at maturity but will not receive any positive return on your investment.

The average ending value of the underlying will be based on the

average of the closing values of the underlying on specified dates occurring quarterly during the term of the notes.

On the date of the related preliminary pricing supplement,

Citigroup Global Markets Holdings Inc. expects that the estimated value of the notes on the pricing date will be at least $900.00 per

note, which will be less than the public offering price. The estimated value of the notes is based on CGMI’s proprietary pricing

models and Citigroup Global Markets Holdings Inc.’s internal funding rate. It is not an indication of actual profit to CGMI or other

of Citigroup Global Markets Holdings Inc.’s affiliates, nor is it an indication of the price, if any, at which CGMI or any other

person may be willing to buy the notes from you at any time after issuance. See “Valuation of the Notes” in the accompanying

preliminary pricing supplement.

Preliminary Pricing Supplement:

https://www.sec.gov/Archives/edgar/data/200245/000095010324010640/

dp215055_424b2-us2400971d.htm |

| |

|

The notes have complex features and investing in the notes involves

risks not associated with an investment in conventional debt securities. See “Summary Risk Factors” in this term sheet and

the accompanying preliminary pricing supplement and “Risk Factors” in the accompanying product supplement.

This introductory term sheet

does not provide all of the information that an investor should consider prior to making an investment decision.

Investors should carefully review the accompanying

preliminary pricing supplement, product supplement, underlying supplement, prospectus supplement and prospectus before making a decision

to invest in the notes.

NOT A BANK DEPOSIT AND NOT INSURED OR GUARANTEED BY THE FDIC OR

ANY OTHER GOVERNMENTAL AGENCY |

Summary Risk Factors

The risks set forth below are discussed in detail

in the “Summary Risk Factors” section in the accompanying preliminary pricing supplement and the “Risk Factors”

section in the accompanying product supplement. Please review those risk disclosures carefully.

| · | You May Not Receive Any Positive Return On Your Investment In The Notes. |

| · | The Notes Do Not Pay Interest. |

| · | The Potential For A Return On The Notes At Stated Maturity Is Based On The Average Performance Of The Underlying During The Term

Of The Notes, Which May Be Less Favorable Than The Performance Of The Underlying As Measured From Its Starting Value To Its Closing Value

At Or Near Stated Maturity. |

| · | You Will Not Receive Dividends Or Have Any Other Rights With Respect To The Underlying Or The Underlying Commodity. |

| · | Although The Notes Provide For The Repayment Of The Stated Principal Amount At Maturity, You May Nevertheless Suffer A Loss On

Your Investment In Real Value Terms If The Percentage Change From The Starting Value to the Average Ending Value Is Less Than Or Not Sufficiently

Greater Than Zero. |

| · | The Notes Are Subject To The Credit Risk Of Citigroup Global Markets Holdings Inc. And Citigroup Inc. |

| · | The Notes Will Not Be Listed On Any Securities Exchange And You May Not Be Able To Sell Them Prior To Maturity. |

| · | Sale Of The Notes Prior To Maturity May Result In A Loss Of Principal. |

| · | The Estimated Value Of The Notes On The Pricing Date, Based On CGMI’s Proprietary Pricing Models And Our Internal Funding

Rate, Is Less Than The Public Offering Price. |

| · | The Estimated Value Of The Notes Was Determined For Us By Our Affiliate Using Proprietary Pricing Models. |

| · | The Estimated Value Of The Notes Would Be Lower If It Were Calculated Based On Wells Fargo’s Determination Of The Secondary

Market Rate With Respect To Us. |

| · | The Estimated Value Of The Notes Is Not An Indication Of The Price, If Any, At Which Any Person May Be Willing To Buy The Notes

From You In The Secondary Market. |

| · | The Value Of The Notes Prior To Maturity Will Fluctuate Based On Many Unpredictable Factors. |

| · | We Have Been Advised That, Immediately Following Issuance, Any Secondary Market Bid Price Provided By Wells Fargo, And The Value

That Will Be Indicated On Any Brokerage Account Statements Prepared By Wells Fargo Or Its Affiliates, Will Reflect A Temporary Upward

Adjustment. |

| · | The Notes Are Subject To Risks Associated With Gold. |

| · | The Underlying Is Not An Investment Company Or Commodity Pool And Will Not Be Subject To Regulation Under The Investment Company

Act Of 1940, As Amended, Or The Commodity Exchange Act. |

| · | The Performance And Market Value Of The Underlying, Particularly During Periods Of Market Volatility, May Not Correlate With The

Performance Of The Underlying Commodity As Well As The Net Asset Value Per Share. |

| · | There Are Risks Relating To Commodities Trading On The London Bullion Market Association. |

| · | Single Commodity Prices Tend To Be More Volatile Than, And May Not Correlate With, The Prices Of Commodities Generally. |

| · | Our Offering Of The Notes Is Not A Recommendation Of The Underlying. |

| · | The Closing Value Of The Underlying May Be Adversely Affected By Our Or Our Affiliates’, Or By Wells Fargo And Its Affiliates’,

Hedging And Other Trading Activities. |

| · | We And Our Affiliates And Wells Fargo And Its Affiliates May Have Economic Interests That Are Adverse To Yours As A Result Of Our

And Their Respective Business Activities. |

| · | The Calculation Agent, Which Is An Affiliate Of Ours, Will Make Important Determinations With Respect To The Notes. |

| · | Changes That Affect The Underlying May Affect The Value Of Your Notes. |

| · | The Notes Will Not Be Adjusted For All Events That Could Affect The Value Of The Shares Of The Underlying. |

| · | If A Reorganization Event Occurs With Respect To The Underlying, The Calculation Agent May Make Adjustments To The Terms Of The

Notes That Adversely Affect Your Return On The Notes. |

| · | The Stated Maturity Date May Be Postponed If The Final Calculation Day Is Postponed. |

| · | You Will Be Required To Recognize Taxable Income On The Notes Prior To Maturity. |

| |

| Citigroup Global Markets Holdings Inc. and Citigroup Inc. have filed a registration statement (including a related preliminary pricing supplement, an accompanying product supplement, underlying supplement, prospectus supplement and prospectus) with the Securities and Exchange Commission (“SEC”) for the offering to which this communication relates. You should read the related preliminary pricing supplement and the accompanying product supplement, underlying supplement, prospectus supplement and prospectus in that registration statement (File Nos. 333-270327 and 333-270327-01) and the other documents Citigroup Global Markets Holdings Inc. and Citigroup Inc. have filed with the SEC for more complete information about Citigroup Global Markets Holdings Inc., Citigroup Inc. and this offering. You may get these documents for free by visiting EDGAR on the SEC’s website at www.sec.gov. Alternatively, you can request the related preliminary pricing supplement, accompanying product supplement, underlying supplement, prospectus supplement and prospectus by calling toll-free 1-800-831-9146. |

Wells Fargo Advisors is a trade name used by Wells

Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, members SIPC, separate registered broker-dealers and non-bank

affiliates of Wells Fargo Finance LLC and Wells Fargo & Company.

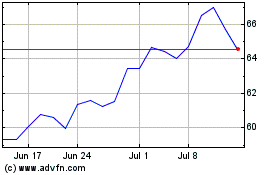

Citigroup (NYSE:C)

Historical Stock Chart

From Jun 2024 to Jul 2024

Citigroup (NYSE:C)

Historical Stock Chart

From Jul 2023 to Jul 2024