Current Report Filing (8-k)

September 12 2019 - 7:00AM

Edgar (US Regulatory)

CHURCH & DWIGHT CO INC /DE/ false 0000313927 0000313927 2019-09-12 2019-09-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of the report (Date of earliest event reported): September 12, 2019

CHURCH & DWIGHT CO., INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

Delaware

|

|

1-10585

|

|

13-4996950

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

500 Charles Ewing Boulevard, Ewing, NJ 08628

(Address of principal executive offices)

Registrant’s telephone number, including area code: (609) 806-1200

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240. 14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol

|

|

Name of each exchange

on which registered

|

|

Common Stock, $1 par value

|

|

CHD

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

As a result of current market conditions, the Company believes that share repurchases at the current valuation are an attractive use of capital resources and has resumed purchases of its shares of common stock. In its earnings call on July 31, 2019, the Company indicated it did not plan to repurchase any additional share of its common stock in 2019 under the Company’s current stock repurchase program. The resumption of share repurchases reflects management’s and the Board’s confidence in the Company’s continued strong performance and free cash flow generation (cash from operating activities less capital expenditures).

The timing and amount of any share repurchases will be determined by management based on market conditions and other considerations, and such repurchases may be executed in the open market, through derivative, accelerated repurchase and other negotiated transactions and through plans designed to comply with Rule 10b5-1(c) under the Securities Exchange Act of 1934, as amended. There can be no assurance as to amounts repurchased and the Company does not intend to provide updates as to future activity under the Repurchase Program.

This Current Report on Form 8-K contains forward-looking statements, including, among others, statements relating to the Company’s activities under its share repurchase program, performance, and free cash flow generation. These statements represent the intentions, plans, expectations and beliefs of the Company, and are based on assumptions that the Company believes are reasonable but may prove to be incorrect. In addition, these statements are subject to risks, uncertainties and other factors, many of which are outside the Company’s control and could cause actual results to differ materially from such forward-looking statements. Uncertainties include assumptions as to market conditions, market growth and consumer demand. Factors that could cause such differences include, without limitation, declines in market growth, retailer distribution and consumer demand, unanticipated increases in raw material and energy prices, or delays or other problems in manufacturing.

For a description of additional factors that could cause actual results to differ materially from the forward-looking statements, please see the Company’s quarterly and annual reports filed with the SEC, including Item 1A, “Risk Factors” in the Company’s annual report on Form 10-K. The Company undertakes no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by the U.S. federal securities laws. You are advised, however, to consult any further disclosures the Company makes on related subjects in its filings with the SEC.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CHURCH & DWIGHT CO., INC.

|

|

|

|

|

|

|

|

|

|

Date: September 12, 2019

|

|

|

|

By:

|

|

/s/ Matthew T. Farrell

|

|

|

|

|

|

Name:

|

|

Matthew T. Farrell

|

|

|

|

|

|

Title:

|

|

President and Chief Executive Officer

|

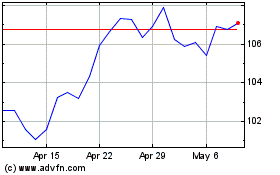

Church and Dwight (NYSE:CHD)

Historical Stock Chart

From Aug 2024 to Sep 2024

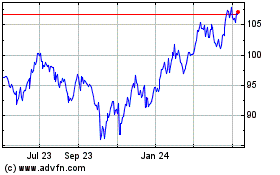

Church and Dwight (NYSE:CHD)

Historical Stock Chart

From Sep 2023 to Sep 2024