0001777393false240 East Hacienda AvenueCampbellCA00017773932023-10-242023-10-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date Earliest Event Reported): October 24, 2023

ChargePoint Holdings, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39004 | | 84-1747686 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | |

240 East Hacienda Avenue Campbell, CA | | 95008 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(408) 841-4500(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e- 4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange

on which registered |

| Common Stock, par value $0.0001 | | CHPT | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On October 24, 2023, ChargePoint Holdings, Inc. (“the Company”) and ChargePoint, Inc. entered into a first supplemental indenture (the “First Supplemental Indenture”) amending the Indenture by and among the Company, ChargePoint, Inc., as guarantor, and Wilmington Trust National Association, as trustee, dated April 12, 2022 (the “Existing Indenture” and, together with the First Supplemental Indenture, the “Indenture”) governing the Company’s outstanding $300 million aggregate principal amount of 3.50% / 5.00% Convertible Senior PIK Toggle Notes due 2027 (the “Existing Notes”). The amended notes (the “Amended Notes”) are substantially identical to the Existing Notes, except that (A) the interest rate on the Amended Notes was increased, to an annual rate of 7.00%, to the extent paid in cash, and 8.50%, to the extent paid in kind, payable semiannually in arrears, (B) the Amended Notes will mature on April 1, 2028 unless earlier accelerated, converted, repurchased or redeemed, (C) the initial Conversion Rate (as defined in the Indenture) of the Amended Notes was increased to 83.3333 shares of the Company’s common stock, par value $0.0001 (the “Common Stock”), per $1,000 principal amount, and (D) the make-whole table for the Amended Notes has been amended to reflect the revised Conversion Rate and maturity date and provides for additional share amounts by which the Conversion Rate for Amended Notes surrendered in connection with Make-Whole Fundamental Changes or called during a Redemption Period (as such terms are defined in the Indenture) may be increased.

The Company received consents to such amendment from all holders of the Existing Notes. The amendments became effective on October 24, 2023, other than the interest rate increase that became effective on October 16, 2023.

The foregoing description of the First Supplemental Indenture is qualified in its entirety by reference to the full text of the First Supplemental Indenture attached hereto as Exhibit 4.1 and incorporated herein by reference.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information in Item 1.01 of this report with respect to the Amended Notes is incorporated by reference in this Item 2.03.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| 4.1 | | |

| 104.0 | | Cover Pager Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: October 24, 2023

| | | | | | | | |

| CHARGEPOINT HOLDINGS, INC. |

| |

| By: | | /s/ Rebecca Chavez |

| | Name: Rebecca Chavez |

| | Title: General Counsel and Corporate Secretary |

FIRST SUPPLEMENTAL INDENTURE

FIRST SUPPLEMENTAL INDENTURE (this “Supplemental Indenture”), dated as of October 24, 2023, among ChargePoint Holdings, Inc., a Delaware corporation (the “Issuer”), ChargePoint, Inc., a Delaware corporation, as Guarantor (the “Guarantor”) and Wilmington Trust, National Association, a national banking association, as Trustee (in such capacity, the “Trustee”) under the Indenture (as defined below).

W I T N E S S E T H

WHEREAS, the Issuer and the Guarantor have heretofore executed and delivered to the Trustee an indenture (the “Indenture”), dated as of April 12, 2022, providing for the issuance of 3.50% / 5.00% Convertible Senior PIK Toggle Notes due 2027 (the “Notes”);

WHEREAS, Section 10.02 of the Indenture provides that, with the consent of the Holders, the Company, the Guarantors and the Trustee may from time to time enter into an indenture or indentures supplemental to the Indenture for purposes of changing in any manner the provisions of the Indenture and the Notes;

WHEREAS, each Holder of an outstanding Note has consented to the amendments set forth in this Supplemental Indenture;

WHEREAS the Issuer has on the date of this Supplemental Indenture delivered to the Trustee (i) an Officer’s Certificate and (ii) an Opinion of Counsel, each relating to the amendments to the Indenture proposed to be made pursuant to this Supplemental Indenture; and

WHEREAS, pursuant to Section 10.02 of the Indenture, the Trustee is authorized to execute and deliver this Supplemental Indenture.

NOW, THEREFORE, in consideration of the foregoing and for other good and valuable consideration, the receipt of which is hereby acknowledged, the Issuer, the Guarantor and the Trustee mutually covenant and agree for the equal and ratable benefit of the Holders as follows:

1. Capitalized Terms. Capitalized terms used herein without definition shall have the meanings assigned to them in the Indenture.

2. Amendments to the Indenture.

a. The Indenture is hereby amended by replacing the reference to “3.50% / 5.00% Convertible Senior PIK Toggle Notes due 2027” on the cover thereof, in the first paragraph of the recitals thereof and in Section 2.01 thereof with “7.00% / 8.50% Convertible Senior PIK Toggle Notes due 2028”.

b. Section 1.01 of the Indenture is hereby amended by adding the following definition in appropriate alphabetical order:

“Interest Change Effective Date” means October 16, 2023.

c. Section 1.01 of the Indenture is hereby amended by replacing the defined terms “Cash Interest Rate”, “Maturity Date” and “PIK Interest Rate” in their entirety with the following terms:

“Cash Interest Rate” means (i) prior to the Interest Change Effective Date, 3.50% per annum and (ii) on and following the Interest Change Effective Date, 7.00% per annum.

“Maturity Date” means April 1, 2028.

“PIK Interest Rate” means (i) prior to the Interest Change Effective Date, 5.00% per annum and (ii) on and following the Interest Change Effective Date, 8.50% per annum.

d. Section 14.01 of the Indenture is hereby amended by replacing “41.6119” with “83.3333”.

e. Section 14.03(e) of the Indenture is hereby amended and restated in full to read as follows:

“(e) The following table sets forth the number of Additional Shares by which the Conversion Rate shall be increased per $1,000 Capitalized Principal Amount of Notes pursuant to this Section 14.03 for each Stock Price and Effective Date or Redemption Notice Date, as applicable, set forth below:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Effective/ Redemption/ Notice Date | Stock Price |

| $12.00 | $14.00 | $16.00 | $20.00 | $25.00 | $30.00 | $40.00 | $50.00 | $60.00 |

| October 16, 2023 | 26.2592 | 20.4236 | 16.3606 | 11.1860 | 7.5292 | 5.3567 | 2.9743 | 1.7500 | 1.0463 |

| April 1, 2024 | 25.4017 | 19.5700 | 15.5538 | 10.5103 | 7.0094 | 4.9597 | 2.7383 | 1.6055 | 0.9561 |

| April 1, 2025 | 23.1055 | 17.3400 | 13.4838 | 8.8235 | 5.7446 | 4.0120 | 2.1892 | 1.2741 | 0.7505 |

| April 1, 2026 | 19.5134 | 13.9347 | 10.4028 | 6.4368 | 4.0484 | 2.7915 | 1.5175 | 0.8807 | 0.5107 |

| April 1, 2027 | 13.7575 | 8.6289 | 5.8741 | 3.3158 | 2.0318 | 1.4087 | 0.7827 | 0.4574 | 0.2594 |

| April 1, 2028 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

The exact Stock Prices and Effective Dates or Redemption Notice Dates, may not be set forth in the table above, in which case:

(i) if the Stock Price is between two Stock Prices in the table above or the Effective Date or the Redemption Notice Date, as the case may be, is between two Effective Dates or Redemption Notice Dates, as applicable, in the table above, the number of Additional Shares by which the Conversion Rate shall be increased shall be determined by a straight-line interpolation between the number of Additional Shares set forth for the higher and lower Stock Prices and the earlier and later Effective Dates or Redemption Notice Dates, as applicable, based on a 365-day year;

(ii) if the Stock Price is greater than $60.00 per share (subject to adjustment in the same manner as the Stock Prices set forth in the column headings of the table above pursuant to subsection (d) above), no Additional Shares shall be added to the Conversion Rate; and

(iii) if the Stock Price is less than $12.00 per share (subject to adjustment in the same manner as the Stock Prices set forth in the column headings of the table above

pursuant to subsection (d) above), no Additional Shares shall be added to the Conversion Rate.

Notwithstanding the foregoing, in no event shall the Conversion Rate per $1,000 Capitalized Principal Amount of Notes exceed 109.5925 shares of Common Stock, subject to adjustment in the same manner as the Conversion Rate pursuant to Section 14.04.”

f. Exhibit A to the Indenture is hereby updated as follows:

i. Each reference therein to “3.50% / 5.00% Convertible Senior PIK Toggle Notes due 2027” is hereby replaced with “7.00% / 8.50% Convertible Senior PIK Toggle Notes due 2028”.

ii. The reference to “April 1, 2027” therein is hereby replaced with “April 1, 2028”.

g. Exhibit B to the Indenture is hereby updated by replacing the reference to “3.50% / 5.00% Convertible Senior PIK Toggle Notes due 2027” therein with “7.00% / 8.50% Convertible Senior PIK Toggle Notes due 2028”.

3. Amendments to the Note.

a. The Note outstanding as of the date hereof under the Indenture is hereby amended as follows:

i. Each reference to “3.50% / 5.00% Convertible Senior PIK Toggle Notes due 2027” therein is hereby replaced with “7.00% / 8.50% Convertible Senior PIK Toggle Notes due 2028”.

ii. The reference to “April 1, 2027” therein is hereby replaced with “April 1, 2028”.

4. Governing Law. THIS SUPPLEMENTAL INDENTURE, AND ANY CLAIM, CONTROVERSY OR DISPUTE ARISING UNDER OR RELATED TO THIS SUPPLEMENTAL INDENTURE, SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF NEW YORK.

5. Execution in Counterpart. This Supplemental Indenture may be executed in any number of counterparts, each of which shall be an original, but such counterparts shall together constitute but one and the same instrument. The exchange of copies of this Supplemental Indenture and of signature pages by facsimile, PDF or other electronic transmission shall constitute effective execution and delivery of this Supplemental Indenture as to the parties hereto. Signatures of the parties hereto transmitted by facsimile, PDF or such other electronic means shall be deemed to be their original signatures for all purposes. Unless otherwise provided in this Supplemental Indenture, the words “execute,” “execution,” “signed” and “signature” and words of similar import used in or related to any document to be signed in connection with this Supplemental Indenture or any of the transactions contemplated hereby (including amendments, waivers, consents and other modifications) shall be deemed to include electronic signatures and the keeping of records in electronic form, each of which shall be of the same legal effect, validity or enforceability as a manually executed signature in ink or the use of a paper-based recordkeeping system, as applicable, to the fullest extent and as provided for in any applicable law, including the Federal Electronic Signatures in Global and National Commerce Act, the New York State Electronic Signatures and Records Act and any other similar state laws based on the Uniform Electronic Transactions Act; provided that, notwithstanding anything herein to the

contrary, the Trustee is not under any obligation to agree to accept electronic signatures in any form or in any format unless expressly agreed to by the Trustee pursuant to procedures approved by the Trustee.

6. Effect of This Supplemental Indenture. This Supplemental Indenture is an amendment supplemental to the Indenture, and the Indenture and this Supplemental Indenture will henceforth be read together. Except as expressly supplemented and amended by this Supplemental Indenture, the Indenture shall continue in full force and effect in accordance with the provisions thereof, and the Indenture (as supplemented and amended by this Supplemental Indenture) is in all respects hereby ratified and confirmed. This Supplemental Indenture and all its provisions shall be deemed a part of the Indenture in the manner and to the extent herein and therein provided and all of the rights, powers, protections and indemnities of the Trustee under the Indenture shall apply to this Supplemental Indenture. To the extent of any inconsistency between the terms of the Indenture and this Supplemental Indenture, the terms of this Supplemental Indenture will control. This Supplemental Indenture shall constitute an indenture supplemental to the Indenture and shall be construed in connection with and form a part of the Indenture for all purposes, and every Holder of the Notes heretofore or hereafter authenticated and delivered shall be bound hereby.

7. Effect of Headings. The Section headings herein are for convenience only and shall not affect the construction hereof.

8. The Trustee. The Trustee shall not be responsible in any manner whatsoever for, or in respect of, the validity or sufficiency of this Supplemental Indenture or for, or in respect of, the recitals contained herein, all of which are made solely by the Issuer. Additionally, the Trustee makes no representation as to the validity or sufficiency of this Supplemental Indenture. For the avoidance of doubt, the Trustee, by executing this Supplemental Indenture in accordance with the terms of the Indenture, does not agree to undertake additional actions nor does it consent to any transaction beyond what is expressly set forth in this Supplemental Indenture, and the Trustee reserves all rights and remedies under the Indenture.

9. Provisions Binding on Successors. All of the covenants, stipulations, promises and agreements made in this Supplemental Indenture by each of the parties hereto shall bind its successors and assigns whether so expressed or not.

10. Severability. In the event any provision in this Supplemental Indenture shall be invalid, illegal or unenforceable, then (to the extent permitted by law) the validity, legality and enforceability of the remaining provisions shall not in any way be affected or impaired.

IN WITNESS WHEREOF, the parties hereto have caused this Supplemental Indenture to be duly executed and attested, all as of the date first above written.

Dated: October 24, 2023

| | | | | |

CHARGEPOINT HOLDINGS, INC. |

| By: | /s/ Rex S. Jackson |

Name: Rex S. Jackson |

Title: Chief Financial Officer |

| | | | | |

CHARGEPOINT, INC.,

as Guarantor |

| By: | /s/ Rex S. Jackson |

Name: Rex S. Jackson |

Title: Authorized Officer |

[Signature Page to First Supplemental Indenture]

| | | | | |

WILMINGTON TRUST, NATIONAL ASSOCIATION, as Trustee |

| By: | /s/ Barry D. Somrock |

Name: Barry D. Somrock |

Title: Vice President |

[Signature Page to First Supplemental Indenture]

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

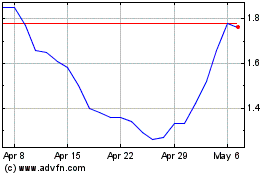

ChargePoint (NYSE:CHPT)

Historical Stock Chart

From Mar 2024 to Apr 2024

ChargePoint (NYSE:CHPT)

Historical Stock Chart

From Apr 2023 to Apr 2024