SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of April, 2023

Commission File Number 1-34129

CENTRAIS ELÉTRICAS BRASILEIRAS S.A.

- ELETROBRÁS

(Exact name of registrant as specified in its

charter)

BRAZILIAN ELECTRIC POWER COMPANY

(Translation of Registrant's name into English)

Rua da Quitanda, 196 – 24th floor,

Centro, CEP 20091-005,

Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant

by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule

12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

MARKET

ANNOUNCEMENT

CENTRAIS

ELÉTRICAS BRASILEIRAS S/A

CNPJ: 00.001.180/0001-26 | NIRE: 3330034676-7

PUBLICLY HELD COMPANY

Centrais Elétricas Brasileiras S/A

(“Company” or “Eletrobras”) (B3: ELET3, ELET5 & ELET6; NYSE: EBR & EBR.B; LATIBEX: XELT.O & XELT.B)

informs its shareholders and the market in that its (indirect) subsidiary Santo Antônio Energia S/A (“SAESA”), the company

that operates the Santo Antônio hydroelectric plant, located on the Madeira River, in the city of Porto Velho, State of Rondônia,

published, on this date, the call notice of the first call of the general meeting of debenture holders of the 3rd issue of simple debentures,

non-convertible into shares, of the unsecured type, with additional real and fiduciary guarantee, in two series, for public distribution

by SAESA (“Edital” and “Issuance”, respectively ) to propose to the debenture holders, among other matters, the

(i) prepayment of their debt with the Banco Nacional de Desenvolvimento Econômico e Social (“BNDES”), Banco Santander

(Brasil) S.A. (“Santander”), to Banco do Brasil S.A. (“BB”), to Banco Bradesco S.A. (“Bradesco”),

to Banco Itaú BBA S.A. (“Itaú BBA”), to Banco do Nordeste do Brasil S.A. (“BNB”), Caixa Econômica

Federal (“CEF”), Haitong Banco de Investimento do Brasil S.A. (“Haitong”) and Banco da Amazônia S.A. (“BASA”

and, together with Santander, BB, Bradesco, Itaú BBA, BNB, CEF and Haitong, the “Onlending Banks”); and (ii) assumption,

by Eletrobras, of SAESA's debt with the BNDES and the Onlending Banks, less any prepayments (“Debt Restructuring”).

The Company points out that SAESA's proposal

addressed to the Issuance's debenture holders through the Call Notice constitutes only a non-binding preparatory act, under negotiation,

and that the Debt Restructuring proposal will still be presented and formalized before the BNDES and the Onlending Banks.

Eletrobras, through its subsidiary Furnas –

Centrais Elétricas S.A., consolidates Madeira Energia S.A. – MESA, sole shareholder of SAESA, in its financial statements,

so that the Debt Restructuring will not affect its balance sheet.

The Company reinforces its commitment to keep

its shareholders and the market in general duly informed, in accordance with the applicable regulations, including with regard to the

execution of any definitive and binding documents regarding the Debt Restructuring.

Rio de Janeiro, April 19, 2023

Elvira Cavalcanti Presta

Vice President of Finance and Investor Relations

This document may contain estimates

and forecasts that are not statements of fact that occurred in the past but reflect our management beliefs and expectations and may constitute

future events' forecasts and estimates under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

and Exchange Act of 1934, as amended. The words "believe", "may", "estimate", "continue", "anticipate",

"intend", "expect" and related words are intended to identify estimates that necessarily involve risks and uncertainties,

known or unknown . Known risks and uncertainties include, but are not limited to: general economic, regulatory, political and commercial

conditions in Brazil and abroad, changes in interest rates, inflation and value of the Real, changes in volumes and the pattern of use

of electricity by consumer, competitive conditions, our level of indebtedness, the possibility of receiving payments related to our receivables,

changes in rainfall and water levels in the reservoirs used to operate our hydroelectric plants, our financing and capital investment

plans, existing and future government regulations , and other risks described in our annual report and other documents filed with CVM

and SEC. Estimates and forecasts refer only to the date they were expressed and we assume no obligation to update any of these estimates

or forecasts due to the occurrence of new information or future events. Future results of the Company's operations and initiatives may

differ from current expectations and the investor should not rely solely on the information contained herein. This material contains calculations

that may not reflect accurate results due to rounding.

SIGNATURE

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: April 19, 2023

| CENTRAIS ELÉTRICAS BRASILEIRAS S.A. - ELETROBRÁS |

| |

|

|

| By: |

/S/ Elvira

Baracuhy Cavalcanti Presta

|

|

| |

Elvira Baracuhy Cavalcanti Presta

Vice President of Finance and Investor Relations |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements.

These statements are statements that are not historical facts, and are based on management's current view and estimates offuture

economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes",

"estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended

to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal

operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends

affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect

the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected

events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic

and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual

results to differ materially from current expectations.

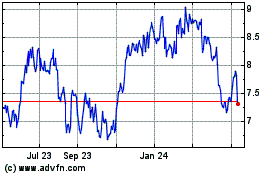

Centrais Eletricas Brasi... (NYSE:EBR)

Historical Stock Chart

From Oct 2024 to Nov 2024

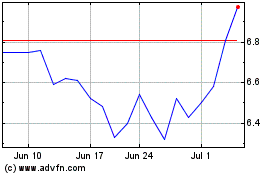

Centrais Eletricas Brasi... (NYSE:EBR)

Historical Stock Chart

From Nov 2023 to Nov 2024