Celanese Corporation (NYSE: CE), a global chemical and specialty

materials company, today reported first quarter 2023 GAAP diluted

earnings per share of $0.86 and adjusted earnings per share of

$2.01. The Company generated net sales of $2.9 billion in the

quarter, an increase of 22 percent over the prior quarter. Net

sales reflected a sequential volume increase of 19 percent over the

prior quarter that was partially offset by a pricing decrease of 4

percent. Volume increased due to an additional month of sales from

the Mobility & Materials (M&M) acquisition as well as

demand recovery in Europe and Asia as the quarter progressed. The

Company exercised its commercial flexibility and global supply

chain to capture improved demand and to offset the impact of

sequentially lower variable margin across many products, due to

moderation in input costs that was more than offset by pricing

declines. As a result of sequentially higher contributions from

Engineered Materials and the Acetyl Chain, the Company reported

first quarter consolidated operating profit of $251 million,

adjusted EBIT of $424 million, and operating EBITDA of $596

million. In the first full quarter under its ownership, Celanese

delivered a significant sequential increase in the M&M earnings

contribution due primarily to higher sequential volume and

approximately $10 million in savings in the quarter from cost

synergies.

The difference between GAAP diluted earnings per share and

adjusted earnings per share in the first quarter was primarily due

to $99 million in M&A-related costs, predominantly related to

the M&M acquisition, and $26 million in exit and shutdown

costs.

"Our team delivered a clear upward inflection in our combined

Engineered Materials and Acetyl Chain earnings to start 2023 with

sequential increases in operating profit and operating EBITDA of 70

percent and 34 percent, respectively," said Lori Ryerkerk, chair

and chief executive officer. "We successfully executed on our

controllable actions across the quarter to drive synergies,

productivity, and base business improvement, particularly in

M&M. Additionally, we captured a significant share of elevated

demand in March, which allowed us to exceed our original earnings

expectations for the quarter."

First Quarter 2023 Financial Highlights:

Three Months Ended

March 31, 2023

December 31,

2022

March 31, 2022

(unaudited)

(In $ millions, except per

share data)

Net Sales

Engineered Materials

1,630

1,237

910

Acetyl Chain

1,250

1,135

1,652

Intersegment Eliminations

(27

)

(24

)

(24

)

Total

2,853

2,348

2,538

Operating Profit (Loss)

Engineered Materials

112

25

124

Acetyl Chain

278

204

503

Other Activities

(139

)

(173

)

(96

)

Total

251

56

531

Net Earnings (Loss)

93

769

504

Adjusted EBIT(1)

Engineered Materials

215

138

211

Acetyl Chain

316

242

543

Other Activities

(107

)

(78

)

(41

)

Total

424

302

713

Equity Earnings and Dividend Income,

Other Income (Expense)

Engineered Materials

10

35

49

Acetyl Chain

34

30

40

Operating EBITDA(1)

596

453

813

Diluted EPS - continuing operations

$

0.86

$

7.03

$

4.61

Diluted EPS - total

$

0.83

$

7.03

$

4.61

Adjusted EPS(1)

$

2.01

$

1.44

$

5.54

Net cash provided by (used in) investing

activities

(178

)

(10,713

)

(149

)

Net cash provided by (used in) financing

activities

(69

)

1,944

(95

)

Net cash provided by (used in) operating

activities

(96

)

541

316

Free cash flow(1)

(261

)

395

175

____________________________

(1)

See "Non-US GAAP Financial Measures"

below.

Recent Highlights:

- Announced the signing of a term sheet to form a standalone Food

Ingredients joint venture (JV) in which Celanese will contribute

its Food Ingredients business and Mitsui will acquire a 70 percent

stake. The transaction is expected to close in the second half and

cash proceeds will be used to pay down debt.

- Expanded the portfolio of Celanese sustainable products to

include bio-based acetic acid, VAM, amines, acetate esters, and

anhydrides designed to help customers in developing more

sustainable product offerings. These products will be designated as

ECO-B, consistent with bio-based products previously introduced in

Engineered Materials.

- Completed the mechanical construction of the new 1.3 million

ton acetic acid production unit at Clear Lake, Texas. The

commissioning and start-up processes are expected to be complete in

the third quarter.

- Announced initiatives to advance the development of Celanese's

VitalDose® EVA drug delivery platform including a research

agreement with Johns Hopkins University on sustained drug delivery

to the suprachoroidal space in the eye and a collaboration with

Alessa Therapeutics for the advancement of oncology

treatments.

First Quarter 2023 Business Segment Overview

Acetyl Chain

The Acetyl Chain delivered first quarter net sales of $1.3

billion, a 10 percent increase from the prior quarter due to a 10

percent increase in volume. While demand for acetyls in Europe and

Asia improved significantly over the prior quarter, volume in the

first quarter lagged the same quarter of last year by 9 percent and

was insufficient to support pricing expansion. Sequential pricing

across the business decreased by 2 percent as pricing moderation

across most products was partially offset by a reset in the pricing

for acetate flake and tow as part of the strategic overhaul of

those products. In response to challenging pricing dynamics,

particularly in China, the business exercised its unique product

and geographic optionality and supply chain capabilities to capture

demand recovery. As a result of these actions, the business

delivered improved earnings performance and offset sequential

contraction in the pricing spread over raw materials across most

products. The Acetyl Chain delivered first quarter operating profit

of $278 million, adjusted EBIT of $316 million, and operating

EBITDA of $370 million at margins of 22, 25, and 30 percent,

respectively. An approximately $75 million sequential increase in

each of these profitability metrics resulted in first quarter

earnings consistent with the foundational earnings power of this

business, despite demand and pricing dynamics for many products and

regions that remained challenging. The Acetyl Chain continues to

take steps to elevate its foundational earnings, including the

mechanical completion of the new acetic acid production unit at

Clear Lake, which is expected to lift earnings by an additional

approximately $100 million annually starting in 2024.

Engineered Materials

Engineered Materials reported first quarter net sales of $1.6

billion, a 32 percent increase from the prior quarter. Volume

expanded by 34 percent due to an additional month of M&M

contributions and sequential growth across most end-markets, with

the exception of medical implants. Sequential volume in auto

outperformed the change in industry build rates across all three

regions due to contributions from project pipeline model wins

realized in 2022. Pricing decreased by 4 percent due to a change in

product mix, a decrease in raw material and energy costs, and

challenging competitive dynamics in Europe. Engineered Materials

delivered first quarter operating profit of $112 million, adjusted

EBIT of $215 million, and operating EBITDA of $327 million at

margins of 7, 13, and 20 percent, respectively. The M&M

contribution to EM earnings increased sequentially through volume

recovery and approximately $10 million in synergies delivered

across the quarter. Affiliate earnings were $11 million for the

quarter, a sequential decrease of $20 million.

Cash Flow and Tax

Celanese reported first quarter operating cash flow of $(96)

million and free cash flow of $(261) million which included an

increase in working capital due to strong March sales, cash

interest expense of $281 million, and cash capital expenditures of

$164 million. The Company anticipates a significant increase in

second quarter free cash flow due to improved business performance

as well as the timing of these cash items. Celanese returned $76

million in cash to shareholders via dividends in the quarter.

The effective U.S. GAAP income tax rate was 21 percent for the

first quarter compared to 18 percent for the same quarter in 2022.

The higher effective rate was primarily due to increases in

valuation allowances on U.S. foreign tax credit carryforwards due

to revised forecasts of foreign sourced income and expenses during

the carryforward period, partially offset by increased earnings in

low-taxed jurisdictions. The effective tax rate for adjusted

earnings was 12 percent based on expected jurisdictional earnings

mix for the full year and consideration of other non-recurring U.S.

GAAP items.

Outlook

"While first quarter demand meaningfully recovered from

exceptionally poor conditions in the fourth quarter, we still saw

first quarter volume, when excluding M&M contributions, that

was significantly lower year over year," said Lori Ryerkerk. "So

far across April and May, underlying demand improvement over March

has been immaterial and not yet substantive enough to support any

pricing expansion. In this environment, our teams are working to

opportunistically deliver modestly higher volume in the second

quarter, due primarily to a stronger start than the prior quarter,

and to preserve our pricing spreads over raw materials. We expect

that sequential earnings growth in our businesses, largely due to

controllable actions, will deliver second quarter adjusted earnings

per share of approximately $2.50, inclusive of approximately $0.30

per share of M&M transaction amortization. We see potential to

exceed $2.50 in earnings per share if demand recovers substantively

enough to support material pricing recovery within the quarter,

particularly in the Acetyl Chain."

A reconciliation of forecasted adjusted earnings per share to

U.S. GAAP diluted earnings per share is not available without

unreasonable efforts because a forecast of Certain Items, such as

mark-to-market pension gains/losses, is not practical. For more

information, see "Non-GAAP Financial Measures" below.

The Company's prepared remarks related to the first quarter will

be posted on its website at investors.celanese.com under Financial

Information/Financial Document Library on May 9, 2023. Information

about Non-US GAAP measures is included in a Non-US GAAP Financial

Measures and Supplemental Information document posted on our

investor relations website under Financial Information/Non-GAAP

Financial Measures. See also "Non-GAAP Financial Measures"

below.

Celanese Corporation is a global chemical leader in the

production of differentiated chemistry solutions and specialty

materials used in most major industries and consumer applications.

Our businesses use the full breadth of Celanese's global chemistry,

technology and commercial expertise to create value for our

customers, employees, shareholders and the corporation. As we

partner with our customers to solve their most critical business

needs, we strive to make a positive impact on our communities and

the world through The Celanese Foundation. Based in Dallas,

Celanese employs approximately 13,300 employees worldwide and had

2022 net sales of $9.7 billion. For more information about Celanese

Corporation and its product offerings, visit www.celanese.com.

Forward-Looking Statements

This release may contain "forward-looking statements," which

include information concerning the Company's plans, objectives,

goals, strategies, future revenues, cash flow, financial

performance, synergies, capital expenditures, financing needs and

other information that is not historical information. All

forward-looking statements are based upon current expectations and

beliefs and various assumptions. There can be no assurance that the

Company will realize these expectations or that these beliefs will

prove correct. There are a number of risks and uncertainties that

could cause actual results to differ materially from the results

expressed or implied in the forward-looking statements contained in

this release. These risks and uncertainties include, among other

things: changes in general economic, business, political and

regulatory conditions in the countries or regions in which we

operate; volatility or changes in the price and availability of raw

materials and energy, particularly changes in the demand for,

supply of, and market prices of ethylene, methanol, natural gas,

wood pulp and fuel oil and the prices for electricity and other

energy sources; the length and depth of product and industry

business cycles, particularly in the automotive, electrical,

mobility, textiles, medical, electronics and construction

industries; the ability to pass increases in raw material prices,

logistics costs and other costs on to customers or otherwise

improve margins through price increases; the accuracy or inaccuracy

of our beliefs or assumptions regarding anticipated benefits of the

acquisition (the "M&M Acquisition") by us of the majority of

the Mobility & Materials business (the "M&M Business") of

DuPont de Nemours, Inc.; the possibility that we will not be able

to realize all of the anticipated improvements in the M&M

Business's financial performance — including optimizing pricing,

currency mix and inventory — or realize all of the anticipated

benefits of the M&M Acquisition, including synergies and growth

opportunities, within the anticipated timeframe, or at all, whether

as a result of difficulties arising from the operation or

integration of the M&M Business or other unanticipated delays,

costs, inefficiencies or liabilities; increased commercial, legal

or regulatory complexity of entering into, or expanding our

exposure to, certain end markets and geographies; risks in the

global economy and equity and credit markets and their potential

impact on our ability to pay down debt in the future and/or

refinance at suitable rates, in a timely manner, or at all;

diversion of management's attention from ongoing business

operations and opportunities and other disruption caused by the

M&M Acquisition and the integration processes and their impact

on our existing business and relationships; risks and costs

associated with increased leverage from the M&M Acquisition,

including increased interest expense and potential reduction of

business and strategic flexibility; the ability to maintain plant

utilization rates and to implement planned capacity additions,

expansions and maintenance; the ability to reduce or maintain their

current levels of production costs and to improve productivity by

implementing technological improvements to existing plants;

increased price competition and the introduction of competing

products by other companies; the ability to identify desirable

potential acquisition or divestiture opportunities and to complete

such transactions, including obtaining regulatory approvals,

consistent with the Company's strategy; market acceptance of our

products and technology; compliance and other costs and potential

disruption or interruption of production or operations due to

accidents, interruptions in sources of raw materials,

transportation, logistics or supply chain disruptions,

cybersecurity incidents, terrorism or political unrest, public

health crises (including, but not limited to, the COVID-19

pandemic), or other unforeseen events or delays in construction or

operation of facilities, including as a result of geopolitical

conditions, the occurrence of acts of war (such as the

Russia-Ukraine conflict) or terrorist incidents or as a result of

weather, natural disasters, or other crises; the ability to obtain

governmental approvals and to construct facilities on terms and

schedules acceptable to the Company; changes in applicable tariffs,

duties and trade agreements, tax rates or legislation throughout

the world including, but not limited to, adjustments, changes in

estimates or interpretations or the resolution of tax examinations

or audits that may impact recorded or future tax impacts and

potential regulatory and legislative tax developments in the United

States and other jurisdictions; changes in the degree of

intellectual property and other legal protection afforded to our

products or technologies, or the theft of such intellectual

property; potential liability for remedial actions and increased

costs under existing or future environmental, health and safety

regulations, including those relating to climate change or other

sustainability matters; potential liability resulting from pending

or future claims or litigation, including investigations or

enforcement actions, or from changes in the laws, regulations or

policies of governments or other governmental activities in the

countries in which we operate; changes in currency exchange rates

and interest rates; our level of indebtedness, which could diminish

our ability to raise additional capital to fund operations or limit

our ability to react to changes in the economy or the chemicals

industry; tax rates and changes thereto; our ability to obtain

regulatory approval for, and satisfy closing conditions to, any

transactions described herein that have not closed; and various

other factors discussed from time to time in the Company's filings

with the Securities and Exchange Commission.

Any forward-looking statement speaks only as of the date on

which it is made, and the Company undertakes no obligation to

update any forward-looking statements to reflect events or

circumstances after the date on which it is made or to reflect the

occurrence of anticipated or unanticipated events or

circumstances.

Non-GAAP Financial Measures

Presentation

This document presents the Company's two business segments,

Engineered Materials and the Acetyl Chain.

Use of Non-US GAAP Financial Information

This release uses the following Non-US GAAP measures: adjusted

EBIT, adjusted EBIT margin, operating EBITDA, operating EBITDA

margin, adjusted earnings per share and free cash flow. These

measures are not recognized in accordance with US GAAP and should

not be viewed as an alternative to US GAAP measures of performance

or liquidity. The most directly comparable financial measure

presented in accordance with US GAAP in our consolidated financial

statements for adjusted EBIT and operating EBITDA is net earnings

(loss) attributable to Celanese Corporation; for adjusted EBIT

margin is operating margin; for operating EBITDA margin is

operating margin; for adjusted earnings per share is earnings

(loss) from continuing operations attributable to Celanese

Corporation per common share-diluted; and for free cash flow is net

cash provided by (used in) operations.

Definitions of Non-US GAAP Financial

Measures

- Adjusted EBIT is a performance measure used by the Company and

is defined by the Company as net earnings (loss) attributable to

Celanese Corporation, plus (earnings) loss from discontinued

operations, less interest income, plus interest expense, plus

refinancing expense and taxes, and further adjusted for Certain

Items (refer to Table 8 of our Non-US GAAP Financial Measures and

Supplemental Information document). We do not provide

reconciliations for adjusted EBIT on a forward-looking basis

(including those contained in this document) when we are unable to

provide a meaningful or accurate calculation or estimation of

reconciling items and the information is not available without

unreasonable effort. This is due to the inherent difficulty of

forecasting the timing and amount of Certain Items, such as

mark-to-market pension gains and losses, that have not yet

occurred, are out of our control and/or cannot be reasonably

predicted. For the same reasons, we are unable to address the

probable significance of the unavailable information. Adjusted EBIT

margin is defined by the Company as adjusted EBIT divided by net

sales.

- Operating EBITDA is a performance measure used by the Company

and is defined by the Company as net earnings (loss) attributable

to Celanese Corporation, plus (earnings) loss from discontinued

operations, less interest income, plus interest expense, plus

refinancing expense, taxes and depreciation and amortization, and

further adjusted for Certain Items, which Certain Items include

accelerated depreciation and amortization expense. Operating EBITDA

is equal to adjusted EBIT plus depreciation and amortization.

Operating EBITDA margin is defined by the Company as operating

EBITDA divided by net sales.

- Adjusted earnings per share is a performance measure used by

the Company and is defined by the Company as earnings (loss) from

continuing operations attributable to Celanese Corporation,

adjusted for income tax (provision) benefit, Certain Items, and

refinancing and related expenses, divided by the number of basic

common shares and dilutive restricted stock units and stock options

calculated using the treasury method. We do not provide

reconciliations for adjusted earnings per share on a

forward-looking basis (including those contained in this document)

when we are unable to provide a meaningful or accurate calculation

or estimation of reconciling items and the information is not

available without unreasonable effort. This is due to the inherent

difficulty of forecasting the timing and amount of Certain Items,

such as mark-to-market pension gains and losses, that have not yet

occurred, are out of our control and/or cannot be reasonably

predicted. For the same reasons, we are unable to address the

probable significance of the unavailable information. Note: The

income tax expense (benefit) on Certain Items ("Non-GAAP

adjustments") is determined using the applicable rates in the

taxing jurisdictions in which the Non-GAAP adjustments occurred and

includes both current and deferred income tax expense (benefit).

The income tax rate used for adjusted earnings per share

approximates the midpoint in a range of forecasted tax rates for

the year. This range may include certain partial or full-year

forecasted tax opportunities and related costs, where applicable,

and specifically excludes changes in uncertain tax positions,

discrete recognition of GAAP items on a quarterly basis, other

pre-tax items adjusted out of our GAAP earnings for adjusted

earnings per share purposes and changes in management's assessments

regarding the ability to realize deferred tax assets for GAAP. In

determining the adjusted earnings per share tax rate, we reflect

the impact of foreign tax credits when utilized, or expected to be

utilized, absent discrete events impacting the timing of foreign

tax credit utilization. We analyze this rate quarterly and adjust

it if there is a material change in the range of forecasted tax

rates; an updated forecast would not necessarily result in a change

to our tax rate used for adjusted earnings per share. The adjusted

tax rate is an estimate and may differ from the actual tax rate

used for GAAP reporting in any given reporting period. Table 3a of

our Non-US GAAP Financial Measures and Supplemental Information

document summarizes the reconciliation of our estimated GAAP

effective tax rate to the adjusted tax rate. The estimated GAAP

rate excludes discrete recognition of GAAP items due to our

inability to forecast such items. As part of the year-end

reconciliation, we will update the reconciliation of the GAAP

effective tax rate to the adjusted tax rate for actual

results.

- Free cash flow is a liquidity measure used by the Company and

is defined by the Company as cash flow from operations, less

capital expenditures on property, plant and equipment, and adjusted

for capital contributions from or distributions to Mitsui &

Co., Ltd. ("Mitsui") related to our methanol joint venture, Fairway

Methanol LLC ("Fairway").

Reconciliation of Non-US GAAP Financial

Measures

Reconciliations of the Non-US GAAP financial measures used in

this press release to the comparable US GAAP financial measure,

together with information about the purposes and uses of Non-US

GAAP financial measures, are included in our Non-US GAAP Financial

Measures and Supplemental Information document filed as an exhibit

to our Current Report on Form 8-K filed with the SEC on or about

May 9, 2023 and also available on our website at

investors.celanese.com under Financial Information/Financial

Document Library.

Results Unaudited

The results in this document, together with the adjustments made

to present the results on a comparable basis, have not been audited

and are based on internal financial data furnished to management.

Quarterly results should not be taken as an indication of the

results of operations to be reported for any subsequent period or

for the full fiscal year.

Supplemental Information

Additional information about our prior period performance is

included in our Quarterly Reports on Form 10-Q and in our Non-US

GAAP Financial Measures and Supplemental Information document.

Consolidated Statements of Operations - Unaudited

Three Months Ended

March 31, 2023

December 31,

2022

March 31, 2022

(In $ millions, except share

and per share data)

Net sales

2,853

2,348

2,538

Cost of sales

(2,222

)

(1,964

)

(1,793

)

Gross profit

631

384

745

Selling, general and administrative

expenses

(285

)

(269

)

(174

)

Amortization of intangible assets

(41

)

(30

)

(11

)

Research and development expenses

(42

)

(37

)

(24

)

Other (charges) gains, net

(23

)

7

(1

)

Foreign exchange gain (loss), net

6

3

(1

)

Gain (loss) on disposition of businesses

and assets, net

5

(2

)

(3

)

Operating profit (loss)

251

56

531

Equity in net earnings (loss) of

affiliates

15

31

56

Non-operating pension and other

postretirement employee benefit (expense) income

1

(57

)

24

Interest expense

(182

)

(168

)

(35

)

Interest income

8

33

1

Dividend income - equity investments

34

30

37

Other income (expense), net

(6

)

5

2

Earnings (loss) from continuing operations

before tax

121

(70

)

616

Income tax (provision) benefit

(25

)

840

(112

)

Earnings (loss) from continuing

operations

96

770

504

Earnings (loss) from operation of

discontinued operations

(3

)

(1

)

—

Income tax (provision) benefit from

discontinued operations

—

—

—

Earnings (loss) from discontinued

operations

(3

)

(1

)

—

Net earnings (loss)

93

769

504

Net (earnings) loss attributable to

noncontrolling interests

(2

)

(2

)

(2

)

Net earnings (loss) attributable to

Celanese Corporation

91

767

502

Amounts attributable to Celanese

Corporation

Earnings (loss) from continuing

operations

94

768

502

Earnings (loss) from discontinued

operations

(3

)

(1

)

—

Net earnings (loss)

91

767

502

Earnings (loss) per common share -

basic

Continuing operations

0.87

7.08

4.64

Discontinued operations

(0.03

)

(0.01

)

—

Net earnings (loss) - basic

0.84

7.07

4.64

Earnings (loss) per common share -

diluted

Continuing operations

0.86

7.03

4.61

Discontinued operations

(0.03

)

—

—

Net earnings (loss) - diluted

0.83

7.03

4.61

Weighted average shares (in millions)

Basic

108.6

108.5

108.2

Diluted

109.2

109.2

108.9

Consolidated Balance Sheets - Unaudited

As of March 31,

2023

As of December 31,

2022

(In $ millions)

ASSETS

Current Assets

Cash and cash equivalents

1,167

1,508

Trade receivables - third party and

affiliates, net

1,606

1,379

Non-trade receivables, net

707

675

Inventories

2,749

2,808

Other assets

219

241

Total current assets

6,448

6,611

Investments in affiliates

1,049

1,062

Property, plant and equipment, net

5,588

5,584

Operating lease right-of-use assets

414

413

Deferred income taxes

813

808

Other assets

553

547

Goodwill

7,139

7,142

Intangible assets, net

4,086

4,105

Total assets

26,090

26,272

LIABILITIES AND EQUITY

Current Liabilities

Short-term borrowings and current

installments of long-term debt - third party and affiliates

1,386

1,306

Trade payables - third party and

affiliates

1,445

1,518

Other liabilities

1,014

1,201

Income taxes payable

6

43

Total current liabilities

3,851

4,068

Long-term debt, net of unamortized

deferred financing costs

13,396

13,373

Deferred income taxes

1,223

1,242

Uncertain tax positions

295

322

Benefit obligations

411

411

Operating lease liabilities

359

364

Other liabilities

425

387

Commitments and Contingencies

Stockholders' Equity

Treasury stock, at cost

(5,491

)

(5,491

)

Additional paid-in capital

365

372

Retained earnings

11,289

11,274

Accumulated other comprehensive income

(loss), net

(502

)

(518

)

Total Celanese Corporation stockholders'

equity

5,661

5,637

Noncontrolling interests

469

468

Total equity

6,130

6,105

Total liabilities and equity

26,090

26,272

Non-US GAAP Financial

Measures and Supplemental Information

May 9, 2023

In this document, the terms the "Company," "we" and "our" refer

to Celanese Corporation and its subsidiaries on a consolidated

basis.

Purpose

The purpose of this document is to provide information of

interest to investors, analysts and other parties including

supplemental financial information and reconciliations and other

information concerning our use of non-US GAAP financial measures.

This document is updated quarterly.

Presentation

This document presents the Company's two business segments,

Engineered Materials and the Acetyl Chain.

Use of Non-US GAAP Financial Measures

From time to time, management may publicly disclose certain

numerical "non-GAAP financial measures" in the course of our

earnings releases, financial presentations, earnings conference

calls, investor and analyst meetings and otherwise. For these

purposes, the Securities and Exchange Commission ("SEC") defines a

"non-GAAP financial measure" as a numerical measure of historical

or future financial performance, financial position or cash flows

that excludes amounts, or is subject to adjustments that

effectively exclude amounts, included in the most directly

comparable measure calculated and presented in accordance with US

GAAP, and vice versa for measures that include amounts, or are

subject to adjustments that effectively include amounts, that are

excluded from the most directly comparable US GAAP measure so

calculated and presented. For these purposes, "GAAP" refers to

generally accepted accounting principles in the United States.

Non-GAAP financial measures disclosed by management are provided

as additional information to investors, analysts and other parties

because the Company believes them to be important supplemental

measures for assessing our financial and operating results and as a

means to evaluate our financial condition and period-to-period

comparisons. These non-GAAP financial measures should be viewed as

supplemental to, and should not be considered in isolation or as

alternatives to, net earnings (loss), operating profit (loss),

operating margin, cash flow from operating activities (together

with cash flow from investing and financing activities), earnings

per share or any other US GAAP financial measure. These non-GAAP

financial measures should be considered within the context of our

complete audited and unaudited financial results for the given

period, which are available on the Financial Information/Financial

Document Library page of our website, investors.celanese.com. The

definition and method of calculation of the non-GAAP financial

measures used herein may be different from other companies' methods

for calculating measures with the same or similar titles.

Investors, analysts and other parties should understand how another

company calculates such non-GAAP financial measures before

comparing the other company's non-GAAP financial measures to any of

our own. These non-GAAP financial measures may not be indicative of

the historical operating results of the Company nor are they

intended to be predictive or projections of future results.

Pursuant to the requirements of SEC Regulation G, whenever we

refer to a non-GAAP financial measure, we will also present in this

document, in the presentation itself or on a Form 8-K in connection

with the presentation on the Financial Information/Financial

Document Library page of our website, investors.celanese.com, to

the extent practicable, the most directly comparable financial

measure calculated and presented in accordance with GAAP, along

with a reconciliation of the differences between the non-GAAP

financial measure we reference and such comparable GAAP financial

measure.

This document includes definitions and reconciliations of

non-GAAP financial measures used from time to time by the

Company.

Specific Measures Used

This document provides information about the following non-GAAP

measures: adjusted EBIT, adjusted EBIT margin, operating EBITDA,

operating EBITDA margin, operating profit (loss) attributable to

Celanese Corporation, adjusted earnings per share, net debt, free

cash flow and return on invested capital (adjusted). The most

directly comparable financial measure presented in accordance with

US GAAP in our consolidated financial statements for adjusted EBIT

and operating EBITDA is net earnings (loss) attributable to

Celanese Corporation; for adjusted EBIT margin and operating EBITDA

margin is operating margin; for operating profit (loss)

attributable to Celanese Corporation is operating profit (loss);

for adjusted earnings per share is earnings (loss) from continuing

operations attributable to Celanese Corporation per common

share-diluted; for net debt is total debt; for free cash flow is

net cash provided by (used in) operations; and for return on

invested capital (adjusted) is net earnings (loss) attributable to

Celanese Corporation divided by the sum of the average of beginning

and end of the year short- and long-term debt and Celanese

Corporation stockholders' equity.

Definitions

- Adjusted EBIT is a performance measure used by the Company and

is defined by the Company as net earnings (loss) attributable to

Celanese Corporation, plus (earnings) loss from discontinued

operations, less interest income, plus interest expense, plus

refinancing expense and taxes, and further adjusted for Certain

Items (refer to Table 8). We believe that adjusted EBIT provides

transparent and useful information to management, investors,

analysts and other parties in evaluating and assessing our primary

operating results from period-to-period after removing the impact

of unusual, non-operational or restructuring-related activities

that affect comparability. Our management recognizes that adjusted

EBIT has inherent limitations because of the excluded items.

Adjusted EBIT is one of the measures management uses for planning

and budgeting, monitoring and evaluating financial and operating

results and as a performance metric in the Company's incentive

compensation plan. We do not provide reconciliations for adjusted

EBIT on a forward-looking basis (including those contained in this

document) when we are unable to provide a meaningful or accurate

calculation or estimation of reconciling items and the information

is not available without unreasonable effort. This is due to the

inherent difficulty of forecasting the timing and amount of Certain

Items, such as mark-to-market pension gains and losses, that have

not yet occurred, are out of our control and/or cannot be

reasonably predicted. For the same reasons, we are unable to

address the probable significance of the unavailable information.

Adjusted EBIT margin is defined by the Company as adjusted EBIT

divided by net sales. Adjusted EBIT margin has the same uses and

limitations as Adjusted EBIT.

- Operating EBITDA is a performance measure used by the Company

and is defined by the Company as net earnings (loss) attributable

to Celanese Corporation, plus (earnings) loss from discontinued

operations, less interest income, plus interest expense, plus

refinancing expense, taxes and depreciation and amortization, and

further adjusted for Certain Items, which Certain Items include

accelerated depreciation and amortization expense. Operating EBITDA

is equal to adjusted EBIT plus depreciation and amortization. We

believe that Operating EBITDA provides transparent and useful

information to investors, analysts and other parties in evaluating

our operating performance relative to our peer companies. Operating

EBITDA margin is defined by the Company as Operating EBITDA divided

by net sales. Operating EBITDA margin has the same uses and

limitations as Operating EBITDA.

- Operating profit (loss) attributable to Celanese Corporation is

defined by the Company as operating profit (loss), less earnings

(loss) attributable to noncontrolling interests ("NCI"). We believe

that operating profit (loss) attributable to Celanese Corporation

provides transparent and useful information to management,

investors, analysts and other parties in evaluating our core

operational performance. Operating margin attributable to Celanese

Corporation is defined by the Company as operating profit (loss)

attributable to Celanese Corporation divided by net sales.

Operating margin attributable to Celanese Corporation has the same

uses and limitations as Operating profit (loss) attributable to

Celanese Corporation.

- Adjusted earnings per share is a performance measure used by

the Company and is defined by the Company as earnings (loss) from

continuing operations attributable to Celanese Corporation,

adjusted for income tax (provision) benefit, Certain Items, and

refinancing and related expenses, divided by the number of basic

common shares and dilutive restricted stock units and stock options

calculated using the treasury method. We believe that adjusted

earnings per share provides transparent and useful information to

management, investors, analysts and other parties in evaluating and

assessing our primary operating results from period-to-period after

removing the impact of the above stated items that affect

comparability and as a performance metric in the Company's

incentive compensation plan. We do not provide reconciliations for

adjusted earnings per share on a forward-looking basis (including

those contained in this document) when we are unable to provide a

meaningful or accurate calculation or estimation of reconciling

items and the information is not available without unreasonable

effort. This is due to the inherent difficulty of forecasting the

timing and amount of Certain Items, such as mark-to-market pension

gains and losses, that have not yet occurred, are out of our

control and/or cannot be reasonably predicted. For the same

reasons, we are unable to address the probable significance of the

unavailable information.

Note: The income tax expense (benefit) on

Certain Items ("Non-GAAP adjustments") is determined using the

applicable rates in the taxing jurisdictions in which the Non-GAAP

adjustments occurred and includes both current and deferred income

tax expense (benefit). The income tax rate used for adjusted

earnings per share approximates the midpoint in a range of

forecasted tax rates for the year. This range may include certain

partial or full-year forecasted tax opportunities and related

costs, where applicable, and specifically excludes changes in

uncertain tax positions, discrete recognition of GAAP items on a

quarterly basis, other pre-tax items adjusted out of our GAAP

earnings for adjusted earnings per share purposes and changes in

management's assessments regarding the ability to realize deferred

tax assets for GAAP. In determining the adjusted earnings per share

tax rate, we reflect the impact of foreign tax credits when

utilized, or expected to be utilized, absent discrete events

impacting the timing of foreign tax credit utilization. We analyze

this rate quarterly and adjust it if there is a material change in

the range of forecasted tax rates; an updated forecast would not

necessarily result in a change to our tax rate used for adjusted

earnings per share. The adjusted tax rate is an estimate and may

differ from the actual tax rate used for GAAP reporting in any

given reporting period. Table 3a summarizes the reconciliation of

our estimated GAAP effective tax rate to the adjusted tax rate. The

estimated GAAP rate excludes discrete recognition of GAAP items due

to our inability to forecast such items. As part of the year-end

reconciliation, we will update the reconciliation of the GAAP

effective tax rate to the adjusted tax rate for actual results.

- Free cash flow is a liquidity measure used by the Company and

is defined by the Company as net cash provided by (used in)

operations, less capital expenditures on property, plant and

equipment, and adjusted for contributions from or distributions to

our NCI joint ventures. We believe that free cash flow provides

useful information to management, investors, analysts and other

parties in evaluating the Company's liquidity and credit quality

assessment because it provides an indication of the long-term cash

generating ability of our business. Although we use free cash flow

as a measure to assess the liquidity generated by our business, the

use of free cash flow has important limitations, including that

free cash flow does not reflect the cash requirements necessary to

service our indebtedness, lease obligations, unconditional purchase

obligations or pension and postretirement funding obligations. Free

cash flow is not a measure of cash available for discretionary

expenditures since the Company has certain debt service and finance

lease payments that are not deducted from that measure.

- Net debt is defined by the Company as total debt less cash and

cash equivalents. We believe that net debt provides useful

information to management, investors, analysts and other parties in

evaluating changes to the Company's capital structure and credit

quality assessment.

- Return on invested capital (adjusted) is defined by the Company

as adjusted EBIT, tax effected using the adjusted tax rate, divided

by the sum of the average of beginning and end of the year short-

and long-term debt and Celanese Corporation stockholders' equity.

We believe that return on invested capital (adjusted) provides

useful information to management, investors, analysts and other

parties in order to assess our income generation from the point of

view of our stockholders and creditors who provide us with capital

in the form of equity and debt and whether capital invested in the

Company yields competitive returns.

Supplemental Information

Supplemental Information we believe to be of interest to

investors, analysts and other parties includes the following:

- Net sales for each of our business segments and the percentage

increase or decrease in net sales attributable to price, volume,

currency and other factors for each of our business segments.

- Cash dividends received from our equity investments.

- For those consolidated ventures in which the Company owns or is

exposed to less than 100% of the economics, the outside

stockholders' interests are shown as NCI. Amounts referred to as

"attributable to Celanese Corporation" are net of any applicable

NCI.

Results Unaudited

The results in this document, together with the adjustments made

to present the results on a comparable basis, have not been audited

and are based on internal financial data furnished to management.

Quarterly results should not be taken as an indication of the

results of operations to be reported for any subsequent period or

for the full fiscal year.

Table 1

Celanese Adjusted EBIT and Operating

EBITDA - Reconciliation of Non-GAAP Measures - Unaudited

Q1 '23

2022

Q4 '22

Q3 '22

Q2 '22

Q1 '22

(In $ millions)

Net earnings (loss) attributable to

Celanese Corporation

91

1,894

767

191

434

502

(Earnings) loss from discontinued

operations

3

8

1

1

6

—

Interest income

(8

)

(69

)

(33

)

(34

)

(1

)

(1

)

Interest expense

182

405

168

154

48

35

Income tax provision (benefit)

25

(489

)

(840

)

127

112

112

Certain Items attributable to Celanese

Corporation (Table 8)

131

422

239

71

47

65

Adjusted EBIT

424

2,171

302

510

646

713

Depreciation and amortization

expense(1)

172

446

151

97

98

100

Operating EBITDA

596

2,617

453

607

744

813

Q1 '23

2022

Q4 '22

Q3 '22

Q2 '22

Q1 '22

(In $ millions)

Engineered Materials

—

13

2

3

4

4

Acetyl Chain

—

2

—

—

—

2

Other Activities(2)

—

1

—

—

1

—

Accelerated depreciation and

amortization expense

—

16

2

3

5

6

Depreciation and amortization

expense(1)

172

446

151

97

98

100

Total depreciation and

amortization expense

172

462

153

100

103

106

______________________________

(1)

Excludes accelerated depreciation and

amortization expense as detailed in the table above, which amounts

are included in Certain Items above.

(2)

Other Activities includes corporate

Selling, general and administrative ("SG&A") expenses, results

of captive insurance companies and certain components of net

periodic benefit cost (interest cost, expected return on plan

assets and net actuarial gains and losses).

Table 1a

M&M Adjusted EBIT and Operating

EBITDA - Reconciliation of Non-GAAP Measures - Unaudited

Q1 '23

Q4 '22

(In $ millions)

Net earnings (loss) attributable to

M&M

(48

)

(69

)

(3)

Income tax provision (benefit)

13

6

Certain Items(1)

86

72

Adjusted EBIT

51

9

Depreciation and amortization expense

68

47

Operating EBITDA(2)

119

56

(4)

______________________________

(1)

Amount is included within total Certain

Items shown in Table 8.

(2)

Excludes $(23) million and $(17) million

of Operating EBITDA included in Other Activities for the three

months ended March 31, 2023 and December 31, 2022,

respectively.

(3)

Excludes $30 million of Net loss for the

month ended October 31, 2022, prior to our acquisition of the

majority of the Mobility & Materials business ("M&M

Business") of DuPont de Nemours, Inc.

(4)

Excludes $22 million of Operating

EBITDA for the month ended October 31, 2022, prior to our

acquisition of the M&M Business.

Table 2 - Supplemental Segment Data and Reconciliation of

Segment Adjusted EBIT and Operating EBITDA - Non-GAAP Measures –

Unaudited

Q1 '23

2022

Q4 '22

Q3 '22

Q2 '22

Q1 '22

(In $ millions, except

percentages)

Operating Profit (Loss) / Operating

Margin

Engineered Materials(1)

112

6.9

%

429

10.7

%

25

2.0

%

114

12.3

%

166

17.5

%

124

13.6

%

Acetyl Chain(1)

278

22.2

%

1,447

25.2

%

204

18.0

%

312

22.3

%

428

27.5

%

503

30.4

%

Other Activities(2)

(139

)

(498

)

(173

)

(118

)

(111

)

(96

)

Total

251

8.8

%

1,378

14.2

%

56

2.4

%

308

13.4

%

483

19.4

%

531

20.9

%

Less: Net Earnings (Loss) Attributable to

NCI(1)

2

8

2

2

2

2

Operating Profit (Loss) Attributable to

Celanese Corporation

249

8.7

%

1,370

14.2

%

54

2.3

%

306

13.3

%

481

19.3

%

529

20.8

%

Operating Profit (Loss) / Operating

Margin Attributable to Celanese Corporation

Engineered Materials(1)

112

6.9

%

429

10.7

%

25

2.0

%

114

12.3

%

166

17.5

%

124

13.6

%

Acetyl Chain(1)

276

22.1

%

1,439

25.1

%

202

17.8

%

310

22.2

%

426

27.3

%

501

30.3

%

Other Activities(2)

(139

)

(498

)

(173

)

(118

)

(111

)

(96

)

Total

249

8.7

%

1,370

14.2

%

54

2.3

%

306

13.3

%

481

19.3

%

529

20.8

%

Equity Earnings and Dividend Income,

Other Income (Expense) Attributable to Celanese Corporation

Engineered Materials

10

207

35

70

53

49

Acetyl Chain

34

143

30

34

39

40

Other Activities(2)

(1

)

12

1

4

1

6

Total

43

362

66

108

93

95

Non-Operating Pension and Other

Post-Retirement Employee Benefit (Expense) Income Attributable to

Celanese Corporation

Engineered Materials

—

—

—

—

—

—

Acetyl Chain

—

—

—

—

—

—

Other Activities(2)

1

17

(57

)

25

25

24

Total

1

17

(57

)

25

25

24

Certain Items Attributable to Celanese

Corporation (Table 8)

Engineered Materials

93

143

78

22

5

38

Acetyl Chain

6

27

10

5

10

2

Other Activities(2)

32

252

151

44

32

25

Total

131

422

239

71

47

65

Adjusted EBIT / Adjusted EBIT

Margin

Engineered Materials

215

13.2

%

779

19.4

%

138

11.2

%

206

22.2

%

224

23.6

%

211

23.2

%

Acetyl Chain

316

25.3

%

1,609

28.0

%

242

21.3

%

349

25.0

%

475

30.5

%

543

32.9

%

Other Activities(2)

(107

)

(217

)

(78

)

(45

)

(53

)

(41

)

Total

424

14.9

%

2,171

22.4

%

302

12.9

%

510

22.2

%

646

26.0

%

713

28.1

%

___________________________

(1)

Net earnings (loss) attributable to NCI is

included within the Engineered Materials and the Acetyl Chain

segments.

(2)

Other Activities includes corporate

SG&A expenses, results of captive insurance companies and

certain components of net periodic benefit cost (interest cost,

expected return on plan assets and net actuarial gains and

losses).

Table 2 - Supplemental Segment Data and

Reconciliation of Segment Adjusted EBIT and Operating EBITDA -

Non-GAAP Measures - Unaudited (cont.)

Q1 '23

2022

Q4 '22

Q3 '22

Q2 '22

Q1 '22

(In $ millions, except

percentages)

Depreciation and Amortization

Expense(1)

Engineered Materials

112

213

90

40

41

42

Acetyl Chain

54

211

52

53

52

54

Other Activities(2)

6

22

9

4

5

4

Total

172

446

151

97

98

100

Operating EBITDA / Operating EBITDA

Margin

Engineered Materials

327

20.1

%

992

24.7

%

228

18.4

%

246

26.5

%

265

28.0

%

253

27.8

%

Acetyl Chain

370

29.6

%

1,820

31.7

%

294

25.9

%

402

28.8

%

527

33.8

%

597

36.1

%

Other Activities(2)

(101

)

(195

)

(69

)

(41

)

(48

)

(37

)

Total

596

20.9

%

2,617

27.1

%

453

19.3

%

607

26.4

%

744

29.9

%

813

32.0

%

___________________________

(1)

Excludes accelerated depreciation and

amortization expense, which amounts are included in Certain Items

above. See Table 1 for details.

(2)

Other Activities includes corporate

SG&A expenses, results of captive insurance companies and

certain components of net periodic benefit cost (interest cost,

expected return on plan assets and net actuarial gains and

losses).

Table 3

Adjusted Earnings (Loss) per Share -

Reconciliation of a Non-GAAP Measure - Unaudited

Q1 '23

2022

Q4 '22

Q3 '22

Q2 '22

Q1 '22

per

per

per

per

per

per

share

share

share

share

share

share

(In $ millions, except per

share data)

Earnings (loss) from continuing operations

attributable to Celanese Corporation

94

0.86

1,902

17.41

768

7.03

192

1.76

440

4.03

502

4.61

Income tax provision (benefit)

25

(489

)

(840

)

127

112

112

Earnings (loss) from continuing operations

before tax

119

1,413

(72

)

319

552

614

Certain Items attributable to Celanese

Corporation (Table 8)

131

422

239

71

47

65

Refinancing and related expenses

—

158

(1)

14

(1)

104

(1)

26

(1)

14

(1)

Adjusted earnings (loss) from continuing

operations before tax

250

1,993

181

494

625

693

Income tax (provision) benefit on adjusted

earnings(2)

(30

)

(259

)

(24

)

(64

)

(81

)

(90

)

Adjusted earnings (loss) from

continuing operations(3)

220

2.01

1,734

15.88

157

1.44

430

3.94

544

4.99

603

5.54

Diluted shares (in

millions)(4)

Weighted average shares outstanding

108.6

108.4

108.5

108.4

108.4

108.2

Incremental shares attributable to equity

awards

0.6

0.8

0.7

0.7

0.7

0.7

Total diluted shares

109.2

109.2

109.2

109.1

109.1

108.9

______________________________

(1)

Includes net interest expense and certain

fees related to debt issued as part of our acquisition of the

M&M Business.

(2)

Calculated using adjusted effective tax

rates (Table 3a) as follows:

Q1 '23

2022

Q4 '22

Q3 '22

Q2 '22

Q1 '22

Adjusted effective tax rate

12

13

13

13

13

13

(3)

Excludes the immediate recognition of

actuarial gains and losses and the impact of actual vs. expected

plan asset returns.

Actual Plan Asset

Returns

Expected Plan Asset

Returns

(In percentages)

2022

(18.4

)

5.4

(4)

Potentially dilutive shares are included

in the adjusted earnings per share calculation when adjusted

earnings are positive.

Table 3a

Adjusted Tax Rate - Reconciliation of a

Non-GAAP Measure - Unaudited

Estimated

Actual

2023

2022

(In percentages)

US GAAP annual effective tax rate

16

(34

)

Discrete quarterly recognition of GAAP

items(1)

(1

)

(6

)

Tax impact of other charges and

adjustments(2)

(3

)

9

Utilization of foreign tax credits

—

—

Changes in valuation allowances, excluding

impact of other charges and adjustments(3)

—

(1

)

Other, includes effect of discrete current

year transactions(4)

—

45

(5)

Adjusted tax rate

12

13

______________________________

Note: As part of the year-end

reconciliation, we will update the reconciliation of the GAAP

effective tax rate for actual results.

(1)

Such as changes in tax laws (including US

tax reform), deferred taxes on outside basis differences, changes

in uncertain tax positions and prior year audit adjustments.

(2)

Reflects the tax impact on pre-tax

adjustments presented in Certain Items (Table 8), which are

excluded from pre-tax income for adjusted earnings per share

purposes.

(3)

Reflects changes in valuation allowances

related to changes in judgment regarding the realizability of

deferred tax assets or current year operations, excluding other

charges and adjustments.

(4)

Includes tax impacts related to full-year

forecasted tax opportunities and related costs.

(5)

Includes the reversal of certain U.S. GAAP

deferred tax benefits in 2022 related to non-recurring internal

restructuring transactions related to the M&M acquisition, to

centralize ownership of intellectual property with the business and

to facilitate future deployment of cash to service acquisition

indebtedness. Certain benefits of the internal restructuring will

be realized in future periods for adjusted earnings purposes.

Table 4

Net Sales by Segment - Unaudited

Q1 '23

2022

Q4 '22

Q3 '22

Q2 '22

Q1 '22

(In $ millions)

Engineered Materials

1,630

4,024

1,237

929

948

910

Acetyl Chain

1,250

5,743

1,135

1,397

1,559

1,652

Intersegment eliminations(1)

(27

)

(94

)

(24

)

(25

)

(21

)

(24

)

Net sales

2,853

9,673

2,348

2,301

2,486

2,538

___________________________

(1)

Includes intersegment sales primarily

related to the Acetyl Chain.

Table 4a Factors Affecting Segment Net Sales Sequentially

- Unaudited

Three Months Ended March 31, 2023

Compared to Three Months Ended December 31, 2022

Volume

Price

Currency

Total

(In percentages)

Engineered Materials

34

(4

)

2

32

Acetyl Chain

10

(2

)

2

10

Total Company

19

(4

)

2

17

Three Months Ended December 31, 2022 Compared to Three Months

Ended September 30, 2022

Volume

Price

Currency

Total

(In percentages)

Engineered Materials

34

(1

)

—

33

(1)

Acetyl Chain

(9

)

(10

)

—

(19

)

Total Company

8

(6

)

—

2

Three Months Ended September 30, 2022

Compared to Three Months Ended June 30, 2022

Volume

Price

Currency

Total

(In percentages)

Engineered Materials

(1

)

2

(3

)

(2

)

Acetyl Chain

(3

)

(5

)

(2

)

(10

)

Total Company

(2

)

(3

)

(2

)

(7

)

Three Months Ended June 30, 2022

Compared to Three Months Ended March 31, 2022

Volume

Price

Currency

Total

(In percentages)

Engineered Materials

1

6

(3

)

4

Acetyl Chain

(6

)

2

(2

)

(6

)

Total Company

(2

)

2

(2

)

(2

)

Three Months Ended March 31, 2022

Compared to Three Months Ended December 31, 2021

Volume

Price

Currency

Total

(In percentages)

Engineered Materials

23

7

(1

)

29

Acetyl Chain

7

(3

)

—

4

Total Company

12

1

(1

)

12

________________________

(1)

2022 includes the effect of the

acquisition of the majority of the M&M Business.

Table 4b

Factors Affecting Segment Net Sales

Year Over Year - Unaudited

Three Months Ended March 31, 2023

Compared to Three Months Ended March 31, 2022

Volume

Price

Currency

Total

(In percentages)

Engineered Materials

80

2

(3

)

79

Acetyl Chain

(9

)

(13

)

(2

)

(24

)

Total Company

23

(8

)

(3

)

12

Three Months Ended December 31, 2022

Compared to Three Months Ended December 31, 2021

Volume

Price

Currency

Total

(In percentages)

Engineered Materials

67

17

(9

)

75

Acetyl Chain

(12

)

(14

)

(3

)

(29

)

Total Company

13

(5

)

(5

)

3

Three Months Ended September 30, 2022

Compared to Three Months Ended September 30, 2021

Volume

Price

Currency

Total

(In percentages)

Engineered Materials

23

25

(12

)

36

Acetyl Chain

(10

)

2

(5

)

(13

)

Total Company

(2

)

9

(5

)

2

Three Months Ended June 30, 2022

Compared to Three Months Ended June 30, 2021

Volume

Price

Currency

Total

(In percentages)

Engineered Materials

24

24

(9

)

39

Acetyl Chain

(5

)

11

(4

)

2

Total Company

3

14

(4

)

13

Three Months Ended March 31, 2022

Compared to Three Months Ended March 31, 2021

Volume

Price

Currency

Total

(In percentages)

Engineered Materials

20

25

(4

)

41

Acetyl Chain

7

38

(3

)

42

Total Company

12

32

(3

)

41

Table 4c

Factors Affecting Segment Net Sales

Year Over Year - Unaudited

Year Ended December 31, 2022 Compared

to Year Ended December 31, 2021

Volume

Price

Currency

Total

(In percentages)

Engineered Materials

33

23

(8

)

48

Acetyl Chain

(6

)

6

(3

)

(3

)

Total Company

6

11

(4

)

13

Table 5

Free Cash Flow - Reconciliation of a

Non-GAAP Measure - Unaudited

Q1 '23

2022

Q4 '22

Q3 '22

Q2 '22

Q1 '22

(In $ millions, except

percentages)

Net cash provided by (used in) investing

activities

(178

)

(11,141

)

(10,713

)

(143

)

(136

)

(149

)

Net cash provided by (used in) financing

activities

(69

)

10,290

1,944

8,600

(159

)

(95

)

Net cash provided by (used in) operating

activities

(96

)

1,819

541

467

495

316

Capital expenditures on property, plant

and equipment

(164

)

(543

)

(143

)

(139

)

(124

)

(137

)

Contributions from/(Distributions) to

NCI

(1

)

(13

)

(3

)

(3

)

(3

)

(4

)

Free cash flow(1)

(261

)

1,263

395

325

368

175

Net sales

2,853

9,673

2,348

2,301

2,486

2,538

Free cash flow as % of Net

sales

(9.1

)%

13.1

%

16.8

%

14.1

%

14.8

%

6.9

%

______________________________

(1)

Free cash flow is a liquidity measure used

by the Company and is defined by the Company as net cash provided

by (used in) operating activities, less capital expenditures on

property, plant and equipment, and adjusted for contributions from

or distributions to our NCI joint ventures.

Table 6

Cash Dividends Received -

Unaudited

Q1 '23

2022

Q4 '22

Q3 '22

Q2 '22

Q1 '22

(In $ millions)

Dividends from equity method

investments

40

217

82

27

82

26

Dividends from equity investments without

readily determinable fair values

34

133

30

30

36

37

Total

74

350

112

57

118

63

Table 7

Net Debt - Reconciliation of a Non-GAAP

Measure - Unaudited

Q1 '23

2022

Q4 '22

Q3 '22

Q2 '22

Q1 '22

(In $ millions)

Short-term borrowings and current

installments of long-term debt - third party and affiliates

1,386

1,306

1,306

977

809

860

Long-term debt, net of unamortized

deferred financing costs

13,396

13,373

13,373

11,360

3,022

3,132

Total debt

14,782

14,679

14,679

12,337

3,831

3,992

Cash and cash equivalents

(1,167

)

(1,508

)

(1,508

)

(9,671

)

(783

)

(605

)

Net debt

13,615

13,171

13,171

2,666

3,048

3,387

Table 8

Certain Items - Unaudited

The following Certain Items attributable

to Celanese Corporation are included in Net earnings (loss) and are

adjustments to non-GAAP measures:

Q1 '23

2022

Q4 '22

Q3 '22

Q2 '22

Q1 '22

Income Statement

Classification

(In $ millions)

Exit and shutdown costs

26

52

2

14

29

7

Cost of sales / SG&A / Other (charges)

gains, net / Gain (loss) on disposition of businesses and assets,

net / Non-operating pension and other postretirement employee

benefit (expense) income

Asset impairments

—

13

2

12

(1

)

—

Cost of sales / Other (charges) gains,

net

Impact from plant incidents and natural

disasters(1)

6

17

17

—

—

—

Cost of sales

Mergers, acquisitions and dispositions

99

267

138

44

29

56

Cost of sales / SG&A

Actuarial (gain) loss on pension and

postretirement plans

—

80

80

—

—

—

Cost of sales / SG&A / Non-operating

pension and other postretirement employee benefit (expense)

income

Legal settlements and commercial

disputes

—

3

—

1

—

2

Cost of sales / SG&A / Other (charges)

gains, net

Other

—

(10

)

—

—

(10

)

—

Cost of sales / SG&A / Gain (loss) on

disposition of businesses and assets, net

Certain Items attributable to Celanese

Corporation

131

422

239

71

47

65

___________________________

(1)

Primarily associated with Winter Storm

Elliott.

Table 9

Return on Invested Capital (Adjusted) -

Presentation of a Non-GAAP Measure - Unaudited

2022

(In $ millions, except

percentages)

Net earnings (loss) attributable to

Celanese Corporation

1,894

Adjusted EBIT (Table 1)

2,171

Adjusted effective tax rate (Table 3a)

13

%

Adjusted EBIT tax effected

1,889

2022

2021

Average

(In $ millions, except

percentages)

Short-term borrowings and current

installments of long-term debt - third parties and affiliates

1,306

791

1,049

Long-term debt, net of unamortized

deferred financing costs

13,373

3,176

8,275

Celanese Corporation stockholders'

equity

5,637

4,189

4,913

Invested capital

14,237

Return on invested capital

(adjusted)

13.3

%

Net earnings (loss) attributable to

Celanese Corporation as a percentage of invested capital

13.3

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230508005513/en/

Investor Relations Brandon Ayache Phone: +1 972 443 8509

brandon.ayache@celanese.com

Media - U.S. Brian Bianco Phone: +1 972 443 4400

media@celanese.com

Media - Europe Petra Czugler Phone: +49 69 45009 1206

petra.czugler@celanese.com

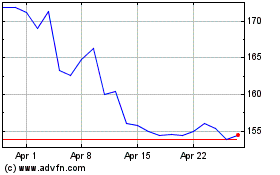

Celanese (NYSE:CE)

Historical Stock Chart

From Apr 2024 to May 2024

Celanese (NYSE:CE)

Historical Stock Chart

From May 2023 to May 2024