Current Report Filing (8-k)

October 24 2014 - 11:28AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: October 23, 2014

CARPENTER TECHNOLOGY CORPORATION

(Exact name of registrant as specified in its charter)

|

Delaware |

|

1-5828 |

|

23-0458500 |

|

(State of or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(IRS Employer I.D. No.) |

|

|

|

|

|

|

|

P.O. Box 14662

Reading, Pennsylvania |

|

|

|

19612-4662 |

|

(Address of principal executive

offices) |

|

|

|

(Zip Code) |

|

|

|

|

|

|

|

|

|

(610) 208-2000 |

|

|

|

Registrant’s telephone number, including area code |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01 – Other Events

On October 23, 2014, Carpenter Technology Corporation issued a press release announcing its Board of Directors has approved a share repurchase program of up to $500 million of Carpenter’s outstanding common shares effective October 27, 2014 and continuing through October 26, 2016. A copy of the press release is attached as Exhibit 99.1 and incorporated herein by reference.

Item 9.01 - Financial Statements and Exhibits

(d) Exhibits

|

Exhibit No. |

|

Description |

|

|

|

|

|

99.1 |

|

Press Release dated October 23, 2014 announcing that the Board of Directors approved a $500 million share repurchase program. |

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

CARPENTER TECHNOLOGY CORPORATION |

|

|

|

|

|

|

|

|

|

|

By |

/s/ Tony R. Thene |

|

|

|

|

Tony R. Thene |

|

|

|

|

Senior Vice President – Finance and |

|

|

|

|

Chief Financial Officer |

|

|

|

|

|

Date: October 24, 2014 |

|

Exhibit 99.1

|

Media Inquiries: |

Investor Inquiries: |

|

William J. Rudolph Jr. |

Michael A. Hajost |

|

+1 610-208-3892 |

+1 610-208-3476 |

|

wrudolph@cartech.com |

mhajost@cartech.com |

|

|

|

CARPENTER TECHNOLOGY ANNOUNCES $500 MILLION SHARE REPURCHASE PROGRAM

WYOMISSING, Pa. – October 23, 2014 – Carpenter Technology Corporation (NYSE: CRS) today announced that its Board of Directors has authorized a share repurchase program of up to $500 million of its outstanding common stock over the next two years. The shares may be repurchased in the open market or in privately negotiated transactions.

“The stock buyback authorization reaffirms our confidence in the Company’s strategy and long-term growth potential. It also demonstrates our ongoing commitment to deliver value to our shareholders,” said William A. Wulfsohn, President and Chief Executive Officer. “We anticipate strong cash flow beginning later in our fiscal year 2015 as Athens-related capital spending is now largely behind us. That, combined with our working capital initiatives and our strong balance sheet, provides us with the flexibility to initiate this stock repurchase program.”

Repurchases will be made from time to time at the Company’s discretion, based on ongoing assessments of the capital needs of the business, general market conditions and the market price of its common stock. The program may be suspended or discontinued at any time.

Page 1 of 3

About Carpenter Technology

Carpenter produces and distributes premium alloys, including special alloys, titanium alloys and powder metals, as well as stainless steels, alloy steels and tool steels. Information about Carpenter can be found at http://www.cartech.com.

Forward-Looking Statements

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Act of 1995. These forward-looking statements are subject to risks and uncertainties that could cause actual results to differ from those projected, anticipated or implied. The most significant of these uncertainties are described in Carpenter’s filings with the Securities and Exchange Commission including its annual report on Form 10-K for the year ended June 30, 2014 and the exhibits attached to that filing. They include but are not limited to: (1) the cyclical nature of the specialty materials business and certain end-use markets, including aerospace, defense, industrial, transportation, consumer, medical, and energy, or other influences on Carpenter’s business such as new competitors, the consolidation of competitors, customers, and suppliers or the transfer of manufacturing capacity from the United States to foreign countries; (2) the ability of Carpenter to achieve cash generation, growth, profitability, cost savings, productivity improvements or process changes; (3) the ability to recoup increases in the cost of energy, raw materials, freight or other factors; (4) domestic and foreign excess manufacturing capacity for certain metals; (5) fluctuations in currency exchange rates; (6) the degree of success of government trade actions; (7) the valuation of the assets and liabilities in Carpenter’s pension trusts and the accounting for pension plans; (8) possible labor disputes or work stoppages; (9) the potential that our customers may substitute alternate materials or adopt different manufacturing practices that replace or limit the suitability of our products; (10) the ability to successfully acquire and integrate acquisitions; (11) the availability of credit facilities to Carpenter, its customers or other members of the supply chain; (12) the ability to obtain energy or raw materials, especially from suppliers located in countries that may be subject to unstable political or economic conditions; (13) Carpenter’s manufacturing processes are dependent upon highly specialized equipment located primarily in facilities in Reading, Latrobe and Athens for which there may be limited alternatives if there are significant equipment failures or a catastrophic event; (14) the ability to hire and retain key personnel, including members of the executive management team, management, metallurgists and other skilled personnel; and (15) share repurchases are at Carpenter’s discretion and could be affected by changes in Carpenter’s share price, operating results, capital spending, cash flows, inventory, acquisitions, investments, tax laws, and general market conditions. Any of these factors could have an adverse and/or fluctuating effect on Carpenter’s results of operations. The forward-looking statements in this document are intended to be subject to the safe harbor protection provided by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the

Page 2 of 3

Securities Exchange Act of 1934, as amended. Carpenter undertakes no obligation to update or revise any forward-looking statements.

Page 3 of 3

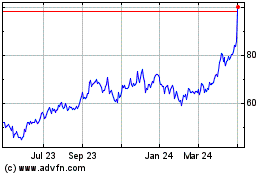

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jun 2024 to Jul 2024

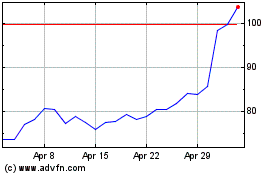

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jul 2023 to Jul 2024