|

John

Hancock

|

|

International Core Fund

|

|

SUMMARY

PROSPECTUS 7–1–13

|

|

Before you invest, you may want to review the fund’s prospectus, which contains more information about the fund and its risks. You can find the fund’s prospectus and other information about the fund, including the statement of additional information and most recent reports, online at www.jhfunds.com/Forms/Prospectuses.aspx. You can also get this information at no cost by calling 1-888-972-8696 or by sending an e-mail request to info@jhfunds.com. The fund’s prospectus and statement of additional information, both dated 7-1-13, and most recent financial highlights information included in the shareholder report, dated 2-28-13, are incorporated by reference into this Summary Prospectus.

|

|

Class

R1:

GOCRX

|

Class

R2:

JICGX

|

Class

R3:

JICHX

|

Class

R4:

JICFX

|

Class

R5:

JICWX

|

Investment objective

To seek high total return.

Fees and expenses

This table describes the fees and expenses you may pay if you

buy and hold shares of the fund.

|

Shareholder

fees

(%)

(fees paid directly

from your investment)

|

Class

R1

|

Class

R2

|

Class

R3

|

Class

R4

|

Class

R5

|

|

Maximum front-end sales charge (load) on purchases as a % of purchase price

|

None

|

None

|

None

|

None

|

None

|

|

Maximum deferred sales charge (load) as a % of purchase or sale price, whichever is less

|

None

|

None

|

None

|

None

|

None

|

|

Annual fund

operating expenses

(%)

(expenses that

you pay each year as a percentage of the

value of your

investment)

|

Class

R1

|

Class

R2

|

Class

R3

|

Class

R4

|

Class

R5

|

|

Management fee

|

0.89

|

0.89

|

0.89

|

0.89

|

0.89

|

|

Distribution and service (12b-1) fees

|

0.50

|

0.25

|

0.50

|

0.15

1

|

0.00

|

|

Other expenses

|

5.75

|

19.56

|

45.96

|

41.29

|

20.22

|

|

Service plan fee

2

|

0.25

|

0.25

|

0.15

|

0.10

|

0.05

|

|

Total annual fund operating expenses

|

7.39

|

20.95

|

47.50

|

42.43

|

21.16

|

|

Contractual expense reimbursement

3

|

–5.49

|

–19.30

|

–45.70

|

–41.03

|

–19.96

|

|

Total

annual fund operating expenses after expense reimbursements

|

1.90

|

1.65

|

1.80

|

1.40

|

1.20

|

|

|

1

|

The fund's distributor has contractually agreed to waive 0.10% of Rule 12b-1 fees for Class R4

shares. The current waiver agreement expires on June 30, 2014, unless renewed by mutual agreement of the fund and the distributor

based upon a determination that this is appropriate under the circumstances at that time. Excluding this waiver would result in

Rule 12b-1 fees of 0.25%.

|

|

|

2

|

"Service plan fee" has been restated to reflect maximum allowable fees.

|

|

|

3

|

The advisor has contractually agreed to reduce its management fee or, if necessary, make payment to the fund to the extent

necessary to maintain the fund's total operating expenses at 1.90%, 1.65%, 1.80%, 1.40% and 1.20% for Class R1, Class R2, Class

R3, Class R4 and Class R5 shares, respectively, excluding certain expenses such as taxes, brokerage commissions, interest expense,

litigation and indemnification expenses and other extraordinary expenses not incurred in the ordinary course of the fund's business,

acquired fund fees and expenses paid indirectly and short dividend expense. The current expense limitation agreement expires on

June 30, 2014, unless renewed by mutual agreement of the fund and the advisor based upon a determination that this is appropriate

under the circumstances at that time.

|

Expense example

This example is intended to help you compare

the cost of investing in the fund with the cost of investing in other mutual funds. Please see below a hypothetical example showing

the expenses of a $10,000 investment for the time periods indicated assuming that you redeem all of your shares at the end of those

periods. The example assumes a 5% average annual return. The example assumes fund expenses will not change over the periods. Although

your actual costs may be higher or lower, based on these assumptions, your costs would be:

|

An

International Equity Fund

|

|

John

Hancock

International

Core Fund

|

|

Expenses

($)

|

Class R1

|

Class R2

|

Class R3

|

Class R4

|

Class R5

|

|

1

Year

|

193

|

168

|

183

|

143

|

122

|

|

3

Years

|

1,681

|

3,835

|

6,263

|

5,958

|

3,834

|

|

5

Years

|

3,098

|

6,426

|

8,273

|

8,227

|

6,443

|

|

10 Years

|

6,355

|

10,045

|

9,204

|

9,542

|

10,059

|

Portfolio turnover

The fund pays transaction costs, such as commissions, when it

buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction

costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual

fund operating expenses or in the example, affect the fund’s performance. During its most recent fiscal year, the fund’s

portfolio turnover rate was 53% of the average value of its portfolio.

Principal investment strategies

The subadvisor seeks to achieve the fund’s investment objective

by investing in equity investments or sectors that the subadvisor believes will provide higher returns than the MSCI EAFE Index.

Under normal market conditions, the fund invests at least 80%

of its total assets in equity investments. The fund typically invests in equity investments in companies from developed markets

outside the U.S.

The subadvisor employs an active investment management method,

which means that securities are bought and sold according to the subadvisor’s evaluations of companies’ published financial

information, securities prices, equity and bond markets and the overall economy.

In selecting investments for the fund, the subadvisor may use

a combination of investment methods to identify which stocks present positive relative return potential. Some of these methods

evaluate individual stocks or a group of stocks based on the ratio of their price relative to historical financial information,

including book value, cash flow and earnings, and forecasted financial information provided by industry analysts. These ratios

can then be compared to industry or market averages, to assess the relative attractiveness of a stock. Other methods focus on evaluating

patterns of price movement or volatility of a stock or group of stocks relative to the investment universe. The subadvisor selects

which methods to use, and in what combination, based on the subadvisor’s assessment of what combination is best positioned

to meet the fund’s objective. The subadvisor also may adjust the fund’s portfolio for factors such as position size,

market capitalization and exposure to groups such as industry, sector, country or currency.

The fund’s foreign currency exposure may differ from the

currency exposure represented by its equity investments. The fund may also take active overweighted and underweighted positions

in particular currencies relative to its benchmark.

As a substitute for direct investments in equities, the subadvisor

may use exchange-traded and over-the-counter derivatives. The subadvisor also may use derivatives: (i) in an attempt to reduce

investment exposure (which may result in a reduction below zero); and (ii) in an attempt to adjust elements of its investment exposure.

Derivatives used may include futures, options, foreign currency forward contracts and swap contracts.

Principal risks

An investment in the fund is not a bank deposit and is not insured

or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The fund’s shares will go up and

down in price, meaning that you could lose money by investing in the fund. Many factors influence a mutual fund’s performance.

Instability in the financial markets has led many governments,

including the United States government, to take a number of unprecedented actions designed to support certain financial institutions

and segments of the financial markets that have experienced extreme volatility and, in some cases, a lack of liquidity. Federal,

state and other governments, and their regulatory agencies or self-regulatory organizations, may take actions that affect the regulation

of the instruments in which the fund invests, or the issuers of such instruments, in ways that are unforeseeable. Legislation or

regulation may also change the way in which the fund itself is regulated. Such legislation or regulation could limit or preclude

the fund’s ability to achieve its investment objective.

Governments or their agencies may also acquire distressed assets

from financial institutions and acquire ownership interests in those institutions. The implications of government ownership and

disposition of these assets are unclear, and such a program may have positive or negative effects on the liquidity, valuation and

performance of the fund’s portfolio holdings. Furthermore, volatile financial markets can expose the fund to greater market

and liquidity risk and potential difficulty in valuing portfolio instruments held by the fund.

The fund’s

main risk factors are listed below in alphabetical order.

Before investing, be sure to read the additional descriptions

of these risks

beginning on page 6 of the prospectus.

Active management risk

The

subadvisor’s investment strategy may fail to produce the intended result.

Credit and counterparty risk

The

counterparty to an over-the-counter derivatives contract or a borrower of a fund’s securities may be unable or

unwilling to make timely principal, interest or settlement payments,

or otherwise honor its obligations.

Currency risk

Fluctuations

in exchange rates may adversely affect the U.S. dollar value of a fund’s investments. Currency risk includes the risk that

currencies in which a fund’s investments are traded, or currencies

in which a fund has taken an active position, will decline in value relative to the U.S. dollar.

Equity securities risk

The

value of a company’s equity securities is subject to changes in the company’s financial condition, and overall market

and

economic conditions.

Foreign securities risk

As

compared to U.S. companies, there may be less publicly available information relating to foreign companies.

Foreign

securities may be subject to foreign taxes. The value of foreign securities is subject to currency fluctuations and adverse political

and economic developments.

Hedging, derivatives and other strategic transactions risk

Hedging and other strategic transactions may increase the volatility

of a fund and, if

the transaction is not successful, could

result in a significant loss to a fund. The use of derivative instruments could produce disproportionate gains or losses, more

than the principal amount invested. Investing in derivative instruments involves risks different from, or possibly greater than,

the risks associated with investing directly in securities and other traditional investments and, in a down market, could become

harder to value or sell at a fair price. The following is a list of certain derivatives and other strategic transactions in which

the fund may invest and the main risks associated with each of them:

Foreign currency forward contracts

Counterparty

risk, liquidity risk (i.e., the inability to enter into closing transactions), foreign currency risk

and

risk of disproportionate loss are the principal risks of engaging in transactions involving foreign currency forward contracts.

Futures contracts

Counterparty

risk, liquidity risk (i.e., the inability to enter into closing transactions) and risk of disproportionate loss are the

principal risks of engaging in transactions involving futures contracts.

Options

Counterparty

risk, liquidity risk (i.e., the inability to enter into closing transactions) and risk of disproportionate loss are the principal

risks of engaging in transactions involving options. Counterparty risk

does not apply to exchange-traded options.

Swaps

Counterparty

risk, liquidity risk (i.e., the inability to enter into closing transactions), interest-rate risk, settlement risk, risk of default

of

the underlying reference obligation and risk of disproportionate

loss are the principal risks of engaging in transactions involving swaps.

Issuer risk

An

issuer of a security may perform poorly and, therefore, the value of its stocks and bonds may decline. An issuer of securities

held by

the fund could default or have its credit rating

downgraded.

Large company risk

Large-capitalization

stocks as a group could fall out of favor with the market, causing the fund to underperform investments

that

focus on small- or medium-capitalization stocks. Larger, more established companies may be slow to respond to challenges and may

grow more slowly than smaller companies. For purposes of the fund’s investment policies, the market capitalization of a company

is based on its market capitalization at the time the fund purchases the company’s securities. Market capitalizations of

companies change over time.

Liquidity risk

Exposure

exists when trading volume, lack of a market maker or legal restrictions impair the ability to sell particular securities or close

derivative positions at an advantageous price.

Medium and smaller company risk

The

prices of medium and smaller company stocks can change more frequently and dramatically than those of

large

company stocks. For purposes of the fund’s investment policies, the market capitalization of a company is based on its market

capitalization at the time the fund purchases the company’s securities. Market capitalizations of companies change over time.

Past performance

The following performance information in the bar chart and table

below illustrates the variability of the fund’s returns and provides some indication of the risks of investing in the fund

by showing changes in the fund’s performance from year to year. However, past performance (before and after taxes) does not

indicate future results. All figures assume dividend reinvestment. Performance for the fund is updated daily, monthly and quarterly

and may be obtained at our Web site: www.jhfunds.com/RetirementPerformance, or by calling 1-888-972-8696 between 8:30 A.M. and

5:00 P.M., Eastern Time, on most business days.

Calendar year total returns

Calendar

year total returns are shown only for Class R1 shares and would be different for other share classes.

Average annual total returns

Performance

of a broad-based market index is included for comparison.

After-tax returns

These

are shown only for Class R1 shares and would be different for other classes. They reflect the highest individual federal

marginal income tax rates in effect as of the date provided and do

not reflect any state or local taxes. Your actual after-tax returns may be different. After-tax returns are not relevant to shares

held in an IRA, 401(k) or other tax-advantaged investment plan.

|

John

Hancock

International

Core Fund

|

Class R1 shares commenced operations on June 12, 2006;

Class R3, Class R4 and Class R5 shares commenced operations on May 22, 2009; and Class R2 shares commenced operations on

March 1, 2012. The returns prior to these dates are those of GMO International Disciplined Equity Fund’s (predecessor

fund) Class III shares (through June 9, 2006), first offered September 16, 2005, and the fund’s Class A shares that in

each case have been recalculated to apply the gross fees and expenses of Class R1, Class R2, Class R3, Class R4 and Class R5

shares, as applicable. Returns for Class R1, Class R2, Class R3, Class R4 and Class R5 shares would have been substantially

similar to returns of Class A shares because the share classes are invested in the same portfolio of securities and returns

would differ only to the extent that expenses of the classes are different.

|

Calendar year total returns — Class R1

(%)

|

Year-to-date total return

The

fund’s total return for the three months ended March 31, 2013 was 2.76%.

Best quarter:

Q2

’09, 20.71%

Worst quarter:

Q3

’11, –19.72%

|

Average annual total returns

(%)

|

1 Year

|

5 Year

|

Inception

|

|

as of 12-31-12

|

|

|

9-16-05

|

|

Class R1

before tax

|

13.66

|

–4.60

|

1.67

|

|

After tax on distributions

|

13.26

|

–5.13

|

1.00

|

|

After tax on distributions, with sale

|

9.64

|

–3.96

|

1.32

|

|

Class R2

before tax

|

13.68

|

–5.42

|

0.86

|

|

Class R3

before tax

|

13.81

|

–7.77

|

–4.22

|

|

Class R4

before tax

|

14.21

|

–7.48

|

–3.93

|

|

Class R5

before tax

|

14.47

|

–7.21

|

–3.65

|

|

MSCI EAFE Index (gross of foreign withholding taxes on dividends)

|

17.90

|

–3.21

|

3.32

|

Investment management

Investment advisor

John

Hancock Investment Management Services, LLC

Subadvisor

Grantham,

Mayo, Van Otterloo & Co. LLC

Portfolio management

|

Dr. David Cowan

|

Dr. Thomas Hancock

|

|

|

Co-director of the Global Equity Team

|

Co-director of the Global Equity Team

|

|

|

|

|

|

|

Joined fund in 2012

|

Joined fund at inception

|

|

Purchase and sale of fund shares

There are no minimum initial or subsequent investment requirements

for Class R1, Class R2, Class R3, Class R4 and Class R5 shares of the fund. You may redeem shares of the fund on any business day

by contacting your retirement plan administrator or recordkeeper.

Taxes

The fund’s distributions are taxable, and will be taxed

as ordinary income and/or capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or

individual retirement account. Withdrawals from such tax-deferred arrangements may be subject to tax at a later date.

Payments to broker-dealers and other financial

intermediaries

If you purchase the fund through a broker-dealer or other financial

intermediary (such as a bank, registered investment advisor, financial planner or retirement plan administrator), the fund and

its related companies may pay the intermediary for the sale of fund shares and related services. These payments may create a conflict

of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the fund over another investment.

Ask your salesperson or visit your financial intermediary’s Web site for more information.

© 2013 John Hancock Funds, LLC 66RSP 7-1-13 SEC file number:

811-21777

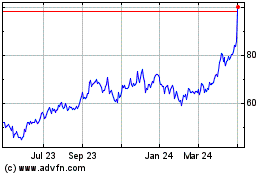

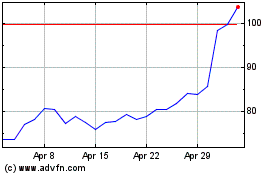

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jul 2023 to Jul 2024