John

Hancock

International Growth Fund

SUMMARY

PROSPECTUS 7–1–13

Before

you invest, you may want to review the fund’s prospectus, which contains more information about the fund and its risks.

You can find the fund’s prospectus and other information about the fund, including the statement of additional information

and most recent reports, online at www.jhfunds.com/Forms/Prospectuses.aspx. You can also get this information at no cost by calling

1-888-972-8696 or by sending an e-mail request to info@jhfunds.com. The fund’s prospectus and statement of additional information,

both dated 7-1-13, and most recent financial highlights information included in the shareholder report, dated 2-28-13, are incorporated

by reference into this Summary Prospectus.

Class I:

GOGIX

Investment

objective

To seek high total return primarily through capital appreciation.

Fees

and expenses

This table describes the fees and expenses you may pay if you

buy and hold shares of the fund.

|

Shareholder fees

(%) (fees paid directly from your investment)

|

Class I

|

|

Maximum front-end sales charge (load) on purchases as a % of purchase price

|

None

|

|

Maximum deferred sales charge (load) as a % of purchase or sale price, whichever is less

|

None

|

|

Annual fund operating expenses

(%)

|

|

|

(expenses that you pay each year as a percentage of the value of your investment)

|

Class I

|

|

Management fee

|

0.91

|

|

Other expenses

|

0.36

|

|

Total annual fund operating expenses

|

1.27

|

|

Contractual expense reimbursement

1

|

–0.03

|

|

Total annual fund operating expenses after expense reimbursements

|

1.24

|

|

|

1

|

The advisor has contractually agreed to reduce its management fee or, if necessary, make payment

to the fund to the extent necessary to maintain the fund's total operating expenses at 1.24% for Class I shares, excluding certain

expenses such as taxes, brokerage commissions, interest expense, litigation and indemnification expenses and other extraordinary

expenses not incurred in the ordinary course of the fund's business, acquired fund fees and expenses paid indirectly and short

dividend expense. The current expense limitation agreement expies on June 30, 2014, unless renewed by mutual agreement of the fund

and the advisor based upon a determination that this is appropriate under the circumstances at that time.

|

Expense

example

This example is intended to help

you compare the cost of investing in the fund with the cost of investing in other mutual funds. Please see below a hypothetical

example showing the expenses of a $10,000 investment for the time periods indicated assuming that you redeem all of your shares

at the end of those periods. The example assumes a 5% average annual return. The example assumes fund expenses will not change

over the periods. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

|

Expenses

($)

|

Class I

|

|

1

Year

|

126

|

|

3

Years

|

400

|

|

5

Years

|

694

|

|

10 Years

|

1,531

|

|

An

International Equity Fund

|

|

John

Hancock

International

Growth Fund

|

Portfolio

turnover

The fund pays transaction costs, such as commissions,

when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher

transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected

in annual fund operating expenses or in the example, affect the fund’s performance. During its most recent fiscal year, the

fund’s portfolio turnover rate was 61% of the average value of its portfolio.

Principal

investment strategies

The subadvisor seeks to achieve the fund’s investment

objective by investing in equity investments that the subadvisor believes will provide higher returns than the MSCI EAFE Growth

Index.

Under normal market conditions, the fund invests at least

80% of its total assets in equity investments. The fund typically invests in a diversified portfolio of equity investments from

a number of developed markets outside the U.S.

The subadvisor employs an active investment management

method, which means that securities are bought and sold according to the subadvisor’s evaluations of companies’ published

financial information, securities prices, equity and bond markets and the overall economy.

In selecting investments for the fund, the subadvisor

may use a combination of investment methods to identify which stocks present positive relative return potential. Some of these

methods evaluate individual stocks or a group of stocks based on the ratio of their price relative to historical financial information,

including book value, cash flow and earnings, and forecasted financial information provided by industry analysts. These ratios

can then be compared to industry or market averages to assess the relative attractiveness of a stock. Other methods focus on evaluating

patterns of price movement or volatility of a stock or group of stocks relative to the investment universe. The subadvisor selects

which methods to use, and in what combination, based on the subadvisor’s assessment of what combination is best positioned

to meet the fund’s objective. The subadvisor also may adjust the portfolio for other factors such as position size, market

capitalization and exposure to groups such as industry, sector, country or currency.

The fund’s foreign currency exposure may differ

from the currency exposure represented by its equity investments. The fund may also take active overweighted and underweighted

positions in particular currencies relative to its benchmark.

As a substitute for direct investments in equities, the

subadvisor may use exchange-traded and over-the-counter derivatives. The subadvisor also may use derivatives: (i) in an attempt

to reduce investment exposure (which may result in a reduction below zero); and (ii) in an attempt to adjust elements of its investment

exposure. Derivatives used may include futures, options, foreign currency forward contracts and swap contracts.

Principal

risks

An investment in the fund is not a bank deposit and

is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The fund’s shares

will go up and down in price, meaning that you could lose money by investing in the fund. Many factors influence a mutual fund’s

performance.

Instability in the financial markets has led many governments,

including the United States government, to take a number of unprecedented actions designed to support certain financial institutions

and segments of the financial markets that have experienced extreme volatility and, in some cases, a lack of liquidity. Federal,

state and other governments, and their regulatory agencies or self-regulatory organizations, may take actions that affect the

regulation of the instruments in which the fund invests, or the issuers of such instruments, in ways that are unforeseeable. Legislation

or regulation may also change the way in which the fund itself is regulated. Such legislation or regulation could limit or preclude

the fund’s ability to achieve its investment objective.

Governments or their agencies may also acquire distressed

assets from financial institutions and acquire ownership interests in those institutions. The implications of government ownership

and disposition of these assets are unclear, and such a program may have positive or negative effects on the liquidity, valuation

and performance of the fund’s portfolio holdings. Furthermore, volatile financial markets can expose the fund to greater

market and liquidity risk and potential difficulty in valuing portfolio instruments held by the fund.

The

fund’s main risk factors are listed below in alphabetical order.

Before investing, be sure to read the additional

descriptions of these risks beginning

on page 6 of the prospectus.

Active management risk

The

subadvisor’s investment strategy may fail to produce the intended result.

Credit and counterparty risk

The

counterparty to an over-the-counter derivatives contract or a borrower of a fund’s securities may be unable or

unwilling to make timely principal, interest or settlement payments,

or otherwise honor its obligations.

Currency risk

Fluctuations

in exchange rates may adversely affect the U.S. dollar value of a fund’s investments. Currency risk includes the risk that

currencies in which a fund’s investments are traded, or currencies in which a fund has taken an active position, will decline

in value relative to the U.S. dollar.

Equity securities risk

The

value of a company’s equity securities is subject to changes in the company’s financial condition, and overall market

and

economic conditions. The securities of growth companies

are subject to greater price fluctuations than other types of stocks because their market prices tend to place greater emphasis

on future earnings expectations.

Foreign securities risk

As

compared to U.S. companies, there may be less publicly available information relating to foreign companies. Foreign securities

may be subject to foreign taxes. The value of foreign securities is subject to currency fluctuations and adverse political and

economic developments.

Hedging, derivatives and other strategic transactions

risk

Hedging and other strategic transactions may increase the volatility

of a fund and, if

the transaction is not successful, could

result in a significant loss to a fund. The use of derivative instruments could produce disproportionate gains or losses, more

than the principal amount invested. Investing in derivative instruments involves risks different from, or possibly greater than,

the risks associated with investing directly in securities and other traditional investments and, in a down market, could become

harder to value or sell at a fair price. The following is a list of certain derivatives and other strategic transactions in which

the fund may invest and the main risks associated with each of them:

Foreign currency forward contracts

Counterparty

risk, liquidity risk (i.e., the inability to enter into closing transactions), foreign currency risk

and

risk of disproportionate loss are the principal risks of engaging in transactions involving foreign currency forward contracts.

Futures contracts

Counterparty

risk, liquidity risk (i.e., the inability to enter into closing transactions) and risk of disproportionate loss are the

principal risks of engaging in transactions involving futures contracts.

Options

Counterparty

risk, liquidity risk (i.e., the inability to enter into closing transactions) and risk of disproportionate loss are the principal

risks

of engaging in transactions involving options. Counterparty

risk does not apply to exchange-traded options.

Swaps

Counterparty

risk, liquidity risk (i.e., the inability to enter into closing transactions), interest-rate risk, settlement risk, risk of default

of the

underlying reference obligation and risk of disproportionate

loss are the principal risks of engaging in transactions involving swaps.

High portfolio turnover risk

Actively

trading securities can increase transaction costs (thus lowering performance) and taxable distributions.

Issuer risk

An

issuer of a security may perform poorly and, therefore, the value of its stocks and bonds may decline. An issuer of securities

held by the

fund could default or have its credit rating

downgraded.

Large company risk

Large-capitalization

stocks as a group could fall out of favor with the market, causing the fund to underperform investments that

focus

on small- or medium-capitalization stocks. Larger, more established companies may be slow to respond to challenges and may grow

more slowly than smaller companies. For purposes of the fund’s investment policies, the market capitalization of a company

is based on its market capitalization at the time the fund purchases the company’s securities. Market capitalizations of

companies change over time.

Liquidity risk

Exposure

exists when trading volume, lack of a market maker or legal restrictions impair the ability to sell particular securities or close

derivative positions at an advantageous price.

Medium and smaller company risk

The prices of medium and smaller company stocks can change more frequently

and dramatically than those of

large company stocks. For

purposes of the fund’s investment policies, the market capitalization of a company is based on its market capitalization

at the time the fund purchases the company’s securities. Market capitalizations of companies change over time.

Past

performance

The following performance information in the bar chart

and table below illustrates the variability of the fund’s returns and provides some indication of the risks of investing

in the fund by showing changes in the fund’s performance from year to year. However, past performance (before and after taxes)

does not indicate future results. All figures assume dividend reinvestment. Performance for the fund is updated daily, monthly

and quarterly and may be obtained at our Web site: www.jhfunds.com/InstitutionalPerformance, or by calling 1-888-972-8696 between

8:30 A.M. and 5:00 P.M., Eastern Time, on most business days.

Average annual total returns

Performance

of a broad-based market index is included for comparison. The MSCI EAFE Index shows how the fund’s

performance

compares against the returns of similar investments.

After-tax returns

They

reflect the highest individual federal marginal income tax rates in effect as of the date provided and do not reflect any state

or

local taxes. Your actual after-tax returns may be different.

After-tax returns are not relevant to shares held in an IRA, 401(k) or other tax-advantaged investment plan.

MSCI EAFE Growth Index

(gross

of foreign withholding tax on dividends) is a free float-adjusted market capitalization index that is designed to

measure

the performance of growth-oriented developed market stocks within Europe, Australasia and the Far East.

MSCI EAFE Index

(gross

of foreign withholding tax on dividends) is a free float-adjusted market capitalization index that is designed to measure the

equity market performance of developed markets, excluding the U.S.

and Canada.

|

John

Hancock

International

Growth Fund

|

|

Calendar year

total returns — Class I

(%)

|

Year-to-date total return

The

fund’s total return for the three months ended March 31, 2013 was 6.66%.

Best

quarter:

Q3’10, 17.78%

Worst

quarter:

Q3’08, –19.26%

|

Average annual

total returns

(%)

|

1 Year

|

5 Year

|

Inception

|

|

as of 12-31-12

|

|

|

6-12-06

|

|

Class I

before tax

|

19.87

|

–0.90

|

4.15

|

|

After tax on distributions

|

18.74

|

–1.29

|

3.42

|

|

After tax on distributions, with sale

|

14.94

|

–0.77

|

3.39

|

|

MSCI EAFE Growth Index (gross of foreign withholding taxes on dividends)

|

17.28

|

–2.74

|

2.79

|

|

MSCI EAFE Index (gross of foreign withholding taxes on dividends)

|

17.90

|

–3.21

|

1.97

|

Investment

management

Investment advisor

John

Hancock Investment Management Services, LLC

Subadvisor

Grantham,

Mayo, Van Otterloo & Co. LLC

Portfolio

management

|

Dr. David Cowan

|

Dr. Thomas Hancock

|

|

Co-director of the Global Equity Team

|

Co-director of the Global Equity Team

|

|

|

|

|

Joined fund in 2012

|

Joined fund at inception

|

Purchase

and sale of fund shares

The minimum initial investment requirement for Class I

shares of the fund is $250,000. There are no subsequent investment requirements. You may redeem shares of the fund on any business

day by mail: Mutual Fund Operations, John Hancock Signature Services, Inc., P.O. Box 55913, Boston, Massachusetts 02205-5913; or

for most account types through our Web site: www.jhfunds.com or by telephone: 1-888-972-8696.

Taxes

The fund’s distributions are taxable, and will

be taxed as ordinary income and/or capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k)

plan or individual retirement account. Withdrawals from such tax-deferred arrangements may be subject to tax at a later date.

Payments

to broker-dealers and other financial intermediaries

If you purchase the fund through a broker-dealer or other

financial intermediary (such as a bank, registered investment advisor, financial planner or retirement plan administrator), the

fund and its related companies may pay the intermediary for the sale of fund shares and related services. These payments may create

a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the fund over another

investment. Ask your salesperson or visit your financial intermediary’s Web site for more information.

© 2013 John Hancock Funds, LLC 87ISP 7-1-13 SEC file number:

811-21777

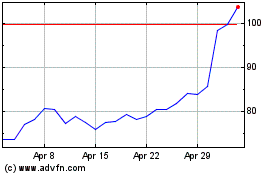

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jun 2024 to Jul 2024

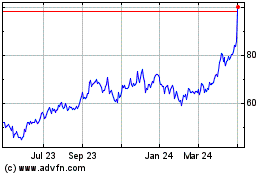

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jul 2023 to Jul 2024