Allegheny Retained at Neutral - Analyst Blog

April 20 2012 - 1:45PM

Zacks

We are maintaining our Neutral recommendation on diversified

specialty materials producer Allegheny

Technologies (ATI). Its fourth-quarter 2011 earnings per

share of 31 cents missed the Zacks Consensus Estimate of 54 cents.

However, profit (as reported) more than doubled year over year to

$31.7 million.

Revenues increased at a healthy double-digit clip to $1.25

billion, driven by increased shipments for most high-value

products, higher raw material surcharges and increase in the

average base selling prices for many products. However, sales

missed the Zacks Consensus Estimate of $1.31 billion.

Moving ahead, Allegheny expects revenue growth to be at least

10% year over year in 2012. The company expects to continue to

benefit from its new alloys and products, diversified global growth

markets and differentiated product mix.

Pennsylvania-based Allegheny Technologies is one of the world’s

largest and most diverse specialty metals companies. The company’s

primary competitor is Carpenter Technology Corp.

(CRS).

Allegheny is in the process of finishing several self-funded

capital projects to help augment organic growth and its cost

structure. The company’s Rowley facility is making good progress

with the standard grade qualification program and is expected to

produce more sponge at lesser costs in 2012 compared with 2011.

Allegheny's diversified footprint, focus on growing markets, new

product/technology development initiative and sustained focus on

cost containment strongly place it for future growth. The company

is poised to benefit, in 2012, from strong demand across aerospace,

oil, electrical energy, gas/chemical process and medical

industries.

Moreover, Allegheny continues to improve its cost structure with

its gross cost reduction initiative. The company achieved gross

cost reductions of nearly $124 million in 2011, thereby exceeding

its target of $100 million.

However, Allegheny remains concerned about the soft U.S. and

European economies and believes the continued high unemployment

levels will impact short-term consumer and business confidence.

Moreover, the company is contending with cost-pressures

associated with high raw material costs. Lower volumes and a

decline in nickel prices may also impact the results from the

company’s core Flat Rolled Products segment. Allegheny currently

retains a short-term Zacks #4 Rank (Sell).

ALLEGHENY TECH (ATI): Free Stock Analysis Report

CARPENTER TECH (CRS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

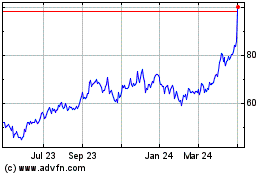

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jun 2024 to Jul 2024

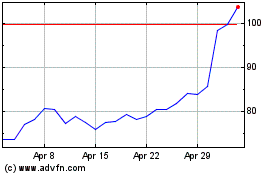

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jul 2023 to Jul 2024