Carpenter Technology Corporation (NYSE:CRS) today reported net

income attributable to Carpenter of $25.5 million or $0.57 per

share for the quarter ended June 30, 2011. Costs in the quarter

related to the recently announced Latrobe Specialty Metals

(Latrobe) acquisition were $2.4 million or $0.04 per diluted share.

Excluding these costs, net income attributable to Carpenter was

$0.61 per diluted share. This compares to net income attributable

to Carpenter of $5.9 million or $0.13 per share for the same

quarter a year earlier.

“We finished the year with another strong quarter of operating

performance,” said William A. Wulfsohn, President and Chief

Executive Officer. “Revenue growth is outpacing volume gains as we

continue driving our mix management and pricing initiatives. These

actions, combined with our cost focus, are translating top-line

growth momentum to our bottom line.

“Over the past year, we have seen strong, sustained demand for

our products. As a result, we are actively seeking ways to expand

our capacity to facilitate further growth. We have announced a

facility expansion in Reading targeting premium remelt, forge

finishing and annealing operations and we are preceding with

capacity investments in our Dynamet titanium wire fastener and

Powder Products businesses. Our recent agreement to acquire Latrobe

Specialty Metals, while providing many strategic benefits, will

also help expand our capacity and facilitate further growth.”

Fourth Quarter and Full Year Fiscal 2011

Results

Financial highlights for the fourth quarter and full year fiscal

year 2011 include:

(in millions, except per share amounts

& pounds sold)

4Q FY

2011

4Q FY

2010

FY 2011

FY 2010

Net Sales $483.6 $364.2

$1,675.1 $1,198.6 Net

Sales Excluding Surcharge (a) $352.4

$269.8 $1,231.1

$921.7 Operating Income Excluding Pension Earnings, Interest

and Deferrals (a) $43.8 $19.7

$131.6 $49.6 Net

Income Attributable to Carpenter $25.5

$5.9 $71.0 $2.1

Diluted Earnings per Share $0.57

$0.13 $1.59 $0.04

Net Pension Expense per Diluted Share (a)

$(0.21 ) $(0.21 ) $(0.84 )

$(0.85 ) Free Cash Flow (a) $61.5

$23.1 $(88.9 )

$40.1 Pounds Sold (000) 58,052

51,790 216,834

172,974

(a) non-GAAP financial measure that is

explained in the attached tables

Net sales for the fourth quarter were $483.6 million, up 33

percent from the prior year. Excluding surcharge revenue, net sales

were $352.4 million, up 31 percent from a year ago.

Total pounds sold in the fourth quarter were 12 percent higher

than the fiscal year 2010 fourth quarter, with the Premium Alloys

Operations (PAO) segment up 40 percent and the Advanced Metals

Operations (AMO) segment up 7 percent.

Gross profit was $77.0 million compared with $43.7 million in

the fiscal year 2010 fourth quarter. The higher gross profit in

this year’s fourth quarter was driven by higher volumes, an

improved product mix, higher prices and better operating

performance.

SG&A expense as a percentage of revenue excluding surcharge

was 1.2 percent lower than the prior year. SG&A expense in the

current quarter was $39.6 million or 11.2 percent of revenue,

compared with $33.5 million or 12.4 percent of revenue for the

fourth quarter of fiscal year 2010. The year-over-year increase is

due to the addition of Amega West overhead cost and higher

compensation related expense.

Operating income for the fourth quarter was $35.0 million

compared with $10.2 million a year earlier. Excluding surcharge

revenue and pension earnings, interest and deferrals (EID),

operating margin was 12.4 percent for the quarter and 13.1 percent

excluding acquisition related costs. This compares to 7.3 percent

in the fiscal year 2010 fourth quarter.

Other income was $2.8 million compared to $0.9 million in the

fiscal year 2010 fourth quarter. The difference is primarily due to

residual payments received under the expired CDSOA anti-dumping

subsidy program. The provision for income tax was $7.7 million or

23 percent of pre-tax income compared to $0.7 million or 11 percent

of pre-tax income in the 2010 fourth quarter.

Net income attributable to Carpenter was $25.5 million or $0.57

per diluted share, compared with fourth quarter net income of $5.9

million or $0.13 per diluted share in fiscal year 2010. For the

full year, net income attributable to Carpenter was $71.0 million

or $1.59 per diluted share, compared with full fiscal year 2010 net

income of $2.1 million or $0.04 per diluted share.

Free cash flow, defined as cash from operations less capital

expenditures, dividends, and the net impact from the purchase and

sale of businesses, was $61.5 million in the current quarter,

driven by working capital improvements. For the full fiscal year,

free cash flow was a negative $88.9 million due to the cash

purchase of Amega West and Oilfield Alloys, as well as increased

working capital to support business growth.

Markets:

Aerospace market sales were $194.1 million in the fourth

quarter, up 24 percent compared with the same period a year ago.

Excluding surcharge revenue, aerospace sales were up 17 percent on

13 percent higher volume. Aerospace results reflect continuing

strong demand for engine components driven by high build rates.

Demand for titanium fastener material is approaching prior peak

levels with continued strong demand expected in the coming year.

Demand for nickel and stainless fastener material has grown over

the last three quarters and channel activity within these segments

indicates demand growth should continue over the next several

quarters.

Industrial market sales were $105.8 million, up 24

percent compared with the fourth quarter of fiscal year 2010.

Excluding surcharge revenue, industrial sales increased 25 percent

on 11 percent higher volume. The year-over-year results reflect the

impact of mix management and pricing actions as well as demand

growth for higher value materials for fittings. In addition, powder

metal sales used for tool steel products were up significantly.

Energy market sales of $70.5 million increased 189

percent from the fourth quarter a year earlier. Excluding surcharge

revenue, energy market sales increased 189 percent on 79 percent

higher volume. A significant increase in demand for materials used

in industrial gas turbines drove the growth and positive mix in

this segment. The oil and gas segment continued to grow due to

increases in directional drilling activity, the Amega West

acquisition and higher pricing. Strong growth trends should

continue in Energy through fiscal year 2012.

Consumer market sales were $40.8 million, an increase of

8 percent from the fourth quarter of fiscal year 2010. Excluding

surcharge revenue, sales increased 10 percent on 4 percent lower

volume. Revenue grew faster than volume as the growing global

demand for higher value materials used in sporting goods

applications outpaced sales of lower value materials used in

housing. Mix management efforts and pricing actions are having a

considerable positive impact on the Consumer market.

Automotive market sales were $37.7 million, an increase

of 21 percent from a year earlier. Excluding surcharge revenue,

automotive sales rose 13 percent on 2 percent higher volumes. The

revenue growth is attributable to mix management efforts that

caused increased participation in higher value turbo charger and

fuel system components, with a corresponding reduction in lower

value products. These efforts are expected to better position

Carpenter to participate in the trend toward premium stainless and

high-temp alloys used in the next generation technologies that

support higher fuel economy.

Medical market sales were $34.7 million in the fourth

quarter, up 19 percent from a year ago. Excluding surcharge

revenue, medical market sales increased 24 percent on 2 percent

higher volume. Share gain drove substantial growth of higher priced

titanium products and a richer product mix. Sales of non-implant

stainless products also grew in the quarter and contributed to the

positive results.

International sales in the fourth quarter were $150.4

million, an increase of 34 percent compared with the same quarter a

year earlier. Sales in Europe were up 41 percent on 29 percent

higher volume driven mainly by increased demand in Aerospace and

Energy and high value Automotive products. Asia revenues increased

13 percent as products for Aerospace continued to show strong

demand. Total international sales in the quarter represented 31

percent of total Company sales, in-line with the prior year.

Fiscal Year 2012 Outlook

“Demand growth remains strong in our strategic end markets,”

said Wulfsohn. “Several of our largest customers are seeking to

expand and extend our supply contracts. Carpenter revenue,

excluding Latrobe, is still expected to grow by more than 10

percent in fiscal year 2012. As previously communicated, operating

income, excluding pension EID, on the base Carpenter business

should be approximately 50 percent higher than fiscal year 2011.

The full-year tax rate is projected to be 33 percent and interest

expense should be about $7 million higher based on $150 million of

incremental debt.

“Free cash flow is expected to be slightly negative after

factoring in higher capital spending of about $200 million aimed at

capacity expansion, and a modest increase in working capital to

support business growth.

“We are also excited about the Latrobe acquisition as it plays

an important role in Carpenter’s growth strategy. Latrobe has a

well-positioned business portfolio that is also benefiting from

strong customer demand. We expect the combined business will enable

production efficiencies which will result in expanded production

capacity The combined entities also have a larger critical mass to

justify the next major increment of premium capacity expansion. The

Latrobe acquisition, including transactions costs, should be

accretive in year one depending on the closing date, and strongly

accretive in later years with the benefit of significant

synergies.”

Pension Effects

During the fourth quarter, the Company recorded expense

associated with its pension and other post retirement benefit plans

of $15.2 million or $0.21 per diluted share. For the full fiscal

year, non-cash pension expense was $60.8 million, or $0.84 per

diluted share. Due primarily to improvement in equity markets

during fiscal 2011 that enabled pension assets to grow by $78.6

million and a slightly higher discount rate assumption, non-cash

pension expense in fiscal year 2012 will decrease to $39.4 million

or $0.55 per diluted share. The expense will be allocated equally

through the fiscal year. The Company currently expects to make cash

contributions of approximately $28 million in fiscal year 2012.

Non-GAAP Financial Measures

This press release includes discussions of financial measures

that have not been determined in accordance with U.S. generally

accepted accounting principles ("GAAP"). The non-GAAP financial

measures, accompanied by reasons why the Company believes the

measures are important, are included in the attached schedules.

Conference Call

Carpenter will host a conference call and webcast today, July

28, at 9:00 a.m., ET, to discuss financial results and operations

for the fiscal fourth quarter. Please call 610-208-2222 for details

of the conference call. Access to the call will also be made

available at Carpenter's web site (http://www.cartech.com) and

through CCBN (http://www.ccbn.com). A replay of the call will be

made available at http://www.cartech.com or at

http://www.ccbn.com.

About Carpenter Technology

Carpenter produces and distributes specialty alloys, including

stainless steels, titanium alloys, and superalloys. Information

about Carpenter can be found on the Internet at

http://www.cartech.com.

Forward Looking Statements

Except for historical information, all other information in this

news release consists of forward-looking statements within the

meaning of the Private Securities Litigation Act of 1995. These

forward-looking statements are subject to risks and uncertainties

that could cause actual results to differ from those projected,

anticipated or implied. The most significant of these uncertainties

are described in Carpenter's filings with the Securities and

Exchange Commission including its annual report on Form 10-K for

the year ended June 30, 2010 and the quarterly reports on Form 10-Q

for the quarters ended September 30, 2010, December 31, 2010 and

March 31, 2011 and the exhibits attached to those filings. They

include but are not limited to: 1) the ability to successfully

close the Latrobe Specialty Metals, Inc. transaction and the

synergies, costs and other anticipated financial impacts of the

transaction; 2) the cyclical nature of the specialty materials

business and certain end-use markets, including aerospace,

industrial, automotive, consumer, medical, and energy, or other

influences on Carpenter's business such as new competitors, the

consolidation of competitors, customers, and suppliers or the

transfer of manufacturing capacity from the United States to

foreign countries; 3) the ability of Carpenter to achieve cost

savings, productivity improvements or process changes; 4) the

ability to recoup increases in the cost of energy, raw materials,

freight or other factors; 5) domestic and foreign excess

manufacturing capacity for certain metals; 6) fluctuations in

currency exchange rates; 7) the degree of success of government

trade actions; 8) the valuation of the assets and liabilities in

Carpenter's pension trusts and the accounting for pension plans; 9)

possible labor disputes or work stoppages; 10) the potential that

our customers may substitute alternate materials or adopt different

manufacturing practices that replace or limit the suitability of

our products; 11) the ability to successfully acquire and integrate

acquisitions; 12) the availability of credit facilities to

Carpenter, its customers or other members of the supply chain; 13)

the ability to obtain energy or raw materials, especially from

suppliers located in countries that may be subject to unstable

political or economic conditions; 14) our manufacturing processes

are dependent upon highly specialized equipment located primarily

in one facility in Reading, Pennsylvania for which there may be

limited alternatives if there are significant equipment failures or

catastrophic event; and 15) our future success depends on the

continued service and availability of key personnel, including

members of our executive management team, management, metallurgists

and other skilled personnel and the loss of these key personnel

could affect our ability to perform until suitable replacements are

found. Any of these factors could have an adverse and/or

fluctuating effect on Carpenter's results of operations. The

forward-looking statements in this document are intended to be

subject to the safe harbor protection provided by Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Carpenter undertakes

no obligation to update or revise any forward-looking

statements.

PRELIMINARY CONSOLIDATED BALANCE SHEETS (in millions)

June 30, June 30, 2011 2010

ASSETS Current assets: Cash and cash equivalents $492.5

$265.4 Marketable securities 30.5 105.2 Accounts receivable, net

259.4 188.5 Inventories 328.6 203.6 Deferred income taxes 14.9 21.5

Other current assets 31.7 36.0 Total current assets

1,157.6 820.2 Property, plant and equipment, net 662.9 617.5

Goodwill 44.9 35.2 Other intangibles, net 30.0 17.6 Deferred income

taxes -- 16.2 Other assets 96.5 76.5 Total assets

$1,991.9 $1,583.2 LIABILITIES Current

liabilities: Accounts payable $170.5 $130.5 Accrued liabilities

124.9 87.6 Current portion of long-term debt 100.0 --

Total current liabilities 395.4 218.1 Long-term debt, net of

current portion 407.8 259.6 Accrued pension liability 188.5 322.6

Accrued postretirement benefits 108.7 146.7 Deferred income taxes

48.3 -- Other liabilities 67.2 62.8 Total liabilities

1,215.9 1,009.8 EQUITY Carpenter stockholders'

equity: Common stock 273.7 273.2 Capital in excess of par value

235.4 223.3 Reinvested earnings 1,022.1 983.2 Common stock in

treasury, at cost (532.2 ) (535.2 ) Accumulated other comprehensive

loss (233.3 ) (371.1 ) Total Carpenter stockholders' equity 765.7

573.4 Noncontrolling interest 10.3 --

Total equity 776.0 573.4 Total liabilities and equity

$1,991.9 $1,583.2 PRELIMINARY

CONSOLIDATED STATEMENTS OF INCOME (in millions, except per share

data)

Three Months Ended Year Ended June 30, June 30, 2011

2010 2011 2010 NET SALES $483.6 $364.2 $1,675.1 $1,198.6

Cost of sales 406.6 320.5 1,426.1

1,053.8 Gross profit 77.0 43.7 249.0 144.8 Selling,

general and administrative expenses 39.6 33.5 149.5 133.1

Acquisition related costs 2.4 -- 3.1 --

Operating income 35.0 10.2 96.4 11.7 Interest expense (4.2 )

(4.5 ) (17.1 ) (17.8 ) Other income, net 2.8 0.9 8.5

10.8 Income before income taxes 33.6 6.6 87.8

4.7 Income tax expense 7.7 0.7 16.1 2.6

Net income 25.9 5.9 71.7 2.1 Less: Net income

attributable to noncontrolling interest 0.4 -- 0.7 --

NET INCOME ATTRIBUTABLE

TO CARPENTER $25.5 $5.9 $71.0 $2.1

EARNINGS PER SHARE: Basic $0.57 $0.13 $1.59

$0.04 Diluted $0.57 $0.13 $1.59

$0.04

WEIGHTED AVERAGE SHARES OUTSTANDING:

Basic 44.2 44.0 44.1 43.9 Diluted 45.0

44.5 44.7 44.4 Cash dividends

per common share $0.18 $0.18 $0.72 $0.72

PRELIMINARY CONSOLIDATED STATEMENTS OF

CASH FLOWS (in millions) Year Ended June 30, 2011

2010 OPERATING ACTIVITIES: Net income $71.7 $2.1

Adjustments to reconcile net income to net

cash provided from operating activities:

Depreciation and amortization 66.5 59.1 Deferred income taxes (4.0

) (1.8 ) Net pension expense 60.8 61.3 Net loss on disposal of

property and equipment 0.8 2.0 Pension contribution (3.9 ) --

Changes in working capital and other: Accounts receivable (56.9 )

(62.5 ) Inventories (116.1 ) (19.1 ) Other current assets 6.4 24.2

Accounts payable 34.5 60.8 Accrued liabilities 4.6 13.4 Other, net

(0.2 ) (24.3 ) Net cash provided from operating activities 64.2

115.2 INVESTING ACTIVITIES: Purchases of

property, equipment and software (79.6 ) (44.2 ) Proceeds from

disposals of property and equipment 1.1 1.0 Acquisition of

businesses, net of cash acquired (45.4 ) -- Acquisition of equity

method investment (6.2 ) -- Purchases of marketable securities

(91.3 ) (145.0 ) Proceeds from sales and maturities of marketable

securities 166.0 55.3 Net cash used for investing

activities (55.4 ) (132.9 ) FINANCING ACTIVITIES: Proceeds

from issuance of long-term debt, net of offering costs 247.4 --

Payments on long-term debt assumed in connection with acquisition

of business (12.4 ) -- Payments on long-term debt -- (20.0 )

Proceeds received from sale of noncontrolling interest 9.1 --

Dividends paid (32.1 ) (31.9 ) Payments of debt issue costs (1.4 )

(2.0 ) Tax benefits on share-based compensation 1.7 0.2 Proceeds

from stock options exercised 1.6 0.2 Net cash

provided from (used for) financing activities 213.9 (53.5 )

Effect of exchange rate changes on cash and cash equivalents

4.4 (3.5 ) INCREASE (DECREASE) IN CASH AND CASH

EQUIVALENTS 227.1 (74.7 ) Cash and cash equivalents at beginning of

period 265.4 340.1 Cash and cash equivalents at end

of period $492.5 $265.4

PRELIMINARY SEGMENT FINANCIAL DATA (in millions)

Three Months Ended Year Ended June 30, June 30, 2011

2010 2011 2010 Pounds sold (000): Advanced Metals Operations 45,666

42,532 171,502 142,008 Premium Alloys Operations 13,002 9,258

47,572 30,966 Intersegment (616 ) -- (2,240 ) --

Consolidated pounds sold 58,052 51,790 216,834

172,974 Net sales: Advanced Metals Operations:

Net sales excluding surcharge $240.2 $197.3 $858.3 $675.4 Surcharge

81.4 63.1 282.8 177.6 Advanced

Metals Operations net sales $321.6 $260.4 $1,141.1

$853.0 Premium Alloys Operations: Net sales

excluding surcharge $105.1 $73.4 $369.8 $249.0 Surcharge 51.9

31.3 163.2 99.3 Premium Alloys

Operations net sales $157.0 $104.7 $533.0

$348.3 Emerging Ventures: Net sales excluding

surcharge $19.1 $ -- $35.3 $ -- Surcharge -- -- --

-- Emerging Ventures net sales $19.1 $

-- $35.3 $ -- Intersegment (14.1

) (0.9 ) (34.3 ) (2.7 ) Consolidated net sales $483.6 $364.2

$1,675.1 $1,198.6 Operating income:

Advanced Metals Operations $22.7 $7.9 $62.3 $11.8 Premium Alloys

Operations 33.6 19.1 110.2 71.2 Emerging Ventures 1.0 -- 3.9 --

Corporate costs (12.5 ) (7.3 ) (42.0 ) (33.5 ) Pension earnings,

interest & deferrals (8.8 ) (9.5 ) (35.2 ) (37.9 ) Intersegment

(1.0 ) - (2.8 ) 0.1 Consolidated operating

income $35.0 $10.2 $96.4 $11.7

We have three reportable business segments: Advanced Metals

Operations, Premium Alloys Operations and Emerging Ventures.

The Advanced Metals Operations (AMO) segment includes the

manufacturing and distribution of high temperature and high

strength metal alloys, stainless steels and titanium in the form of

small bars and rods, wire, narrow strip and powder. AMO sales are

spread across many of our end-use markets including aerospace,

industrial, consumer, automotive, and medical. The Premium

Alloys Operations (PAO) segment includes the manufacturing and

distribution of high temperature and high strength metal alloys and

stainless steels in the form of ingots, billets, large bars and

hollows and primarily services the aerospace and energy markets.

The Emerging Ventures segment currently includes the

operations of the recently completed acquisitions of Amega West

Services and Oilfield Alloys, manufacturers and service providers

of high-precision components for measurement while drilling (MWD)

and logging while drilling (LWD), drill collars, stabilizers and

other down-hole tools used for directional drilling. MWD and LWD

technology is used to ensure critical data is obtained and

transmitted to the surface to monitor progress of the well. The net

sales of Amega West and Oilfield Alloys are to customers in the

energy end use market. The service cost component of net

pension expense, which represents the estimated cost of future

pension liabilities earned associated with active employees, is

included in the operating results of the business segments. The

residual net pension expense, which is comprised of the expected

return on plan assets, interest costs on the projected benefit

obligations of the plans, and amortization of actuarial gains and

losses and prior service costs, is included under the heading

"Pension earnings, interest & deferrals."

PRELIMINARY NON-GAAP FINANCIAL MEASURES (in millions,

except per share data) Three Months Ended Year Ended

June 30, June 30, FREE CASH FLOW 2011 2010 2011 2010 Net

cash provided from operating activities $117.2 $48.1 $64.2 $115.2

Purchases of property, equipment and software (44.0 ) (17.1 ) (79.6

) (44.2 ) Proceeds from disposals of property and equipment 0.1 0.1

1.1 1.0 Acquisition of equity method investment - -- (6.2 ) --

Proceeds received from sale of noncontrolling interest - -- 9.1 --

Acquisition of businesses, net of cash acquired (3.8 ) -- (45.4 )

-- Dividends paid (8.0 ) (8.0 ) (32.1 ) (31.9 ) Free cash flow

$61.5 $23.1 ($88.9 ) $40.1 Management

believes that the free cash flow measure provides useful

information to investors regarding our financial condition because

it is a measure of cash generated which management evaluates for

alternative uses. Three Months Ended Year Ended June

30, June 30, NET PENSION EXPENSE PER DILUTED SHARE 2011 2010 2011

2010 Pension plans expense $13.6 $13.7 $54.0 $54.3 Other

postretirement benefits expense 1.6 1.8 6.8

7.0 Net pension expense 15.2 15.5 60.8 61.3 Income tax

benefit (5.8 ) (6.0 ) (23.2 ) (23.7 ) Net pension expense, net of

tax $9.4 $9.5 $37.6 $37.6 Net

pension expense per diluted share $0.21 $0.21 $0.84

$0.85 Weighted average diluted common shares

45.0 44.5 44.7 44.4 Management

believes that net pension expense per diluted share is helpful in

analyzing the operating performance of the Company, as net pension

expense tends to be volatile due to changes in the financial

markets, which may result in significant fluctuations in operating

results from period to period. OPERATING MARGIN

EXCLUDING SURCHARGE AND Three Months Ended Year Ended PENSION

EARNINGS, INTEREST AND DEFERRALS June 30, June 30, 2011 2010 2011

2010 Net sales $ 483.6 $ 364.2 $1,675.1 $1,198.6 Less:

surcharge revenue 131.2 94.4 444.0 276.9

Consolidated net sales excluding surcharge $352.4

$269.8 $1,231.1 $921.7 Operating income

$35.0 $10.2 $96.4 $11.7 Pension earnings, interest & deferrals

8.8 9.5 35.2 37.9

Operating income excluding pension

earnings, interest and deferrals

$43.8 $19.7 $131.6 $49.6

Operating margin excluding surcharge,

pension earnings, interest and deferrals

12.4 % 7.3 % 10.7 % 5.4 % Management believes that removing

the impacts of raw material surcharges from net sales provides a

more consistent basis for comparing results of operations from

period to period. In addition, management believes that excluding

the impact of pension earnings, interest and deferrals, which may

be volatile due to changes in the financial markets, is helpful in

analyzing the true operating performance of the Company.

PRELIMINARY SUPPLEMENTAL SCHEDULES (in

millions) Three Months Ended Year Ended June 30, June

30, NET SALES BY MAJOR PRODUCT LINE 2011 2010 2011 2010

Product Line Excluding Surcharge: Special alloys $ 147.6 $ 128.2 $

548.2 $ 449.6 Stainless steel 141.3 96.4 466.1 311.7 Titanium

products 41.6 31.5 140.7 112.4 Tool and other steel 17.1 10.4 59.4

37.4 Other materials 4.8 3.3 16.7 10.6 Consolidated net

sales excluding surcharge $352.4 $269.8 $1,231.1 $921.7

Surcharge revenue 131.2 94.4 444.0 276.9 Consolidated net

sales $483.6 $364.2 $1,675.1 $1,198.6 Three Months

Ended Year Ended June 30, June 30, NET SALES BY END USE MARKET 2011

2010 2011 2010 End Use Market Excluding Surcharge: Aerospace

$ 139.1 $ 118.4 $ 502.3 $ 404.0 Industrial 73.2 58.4 262.0 196.5

Energy 54.7 18.9 156.7 64.1 Consumer 28.9 26.3 107.2 87.4

Automotive 26.1 23.2 98.1 80.3 Medical 30.4 24.6 104.8 89.4

Consolidated net sales excluding surcharge $352.4 $269.8 $1,231.1

$921.7 Surcharge revenue 131.2 94.4 444.0 276.9

Consolidated net sales $483.6 $364.2 $1,675.1 $1,198.6

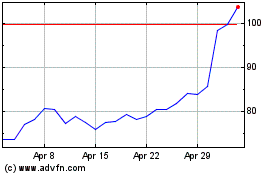

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jun 2024 to Jul 2024

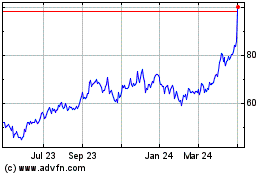

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jul 2023 to Jul 2024