Carpenter Technology Corporation (NYSE:CRS) today reported net

income attributable to Carpenter of $9.3 million or $0.21 per share

for the quarter ended December 31, 2010. This compares to net

income of $3.5 million or $0.08 per share for the same quarter a

year earlier.

Second quarter earnings benefited from a lower tax rate due to

the retroactive extension of the research and development tax

credit, which was largely offset by Amega West transaction costs,

unplanned equipment outages and customer requested volume shifts

into the third quarter.

Free cash flow for the quarter was negative $89.9 million

including the impact of the Amega West acquisition and further

inventory build. The higher inventory is mostly needed to support

strong expected second half shipments. In certain areas, there was

a build-up of excess inventory that will be reduced over the second

half of the year.

“We are pleased with the continued strong volume and revenue

momentum, which we expect to carry over into the second half of our

fiscal year,” said William A. Wulfsohn, President and Chief

Executive Officer. “Our operating margins should noticeably improve

over the next several quarters as pricing and mix improvement

efforts hit the bottom line. We remain on track to achieve our

fiscal year goals for revenue growth and operating margin

improvement.”

“Longer term, we are increasingly excited about how we are

positioned for growth in our key end-markets of aerospace and

energy. In aerospace, we expect to benefit from a strong projected

build rate, a higher material content per plane and increasing

overall market share with customers who are also improving their

position in the industry. In energy, our recently announced

acquisition of Amega West gives us a stronger position in the fast

growing oil and gas market with key customers, and expands the

opportunities for our high-end alloys.”

Second Quarter Results

Financial highlights for the second quarter include:

(in millions, except per share amounts & pounds sold)

2Q FY 2011 2Q FY 2010

YTD FY 2011 YTD FY 2010

Net Sales $375.6 $263.8 $727.3

$497.5 Net Sales Excluding Surcharge (a) $277.0

$207.3 $540.7 $395.2 Operating Income

Excluding Pension Earnings, Interest and Deferrals (a) $20.9

$11.5 $43.8 $7.7 Net Income (Loss)

Attributable to Carpenter $9.3 $3.5 $16.9

$(5.9 ) Diluted Earnings (Loss) per Share $0.21

$0.08 $0.38 $(0.14 ) Net Pension Expense per

Diluted Share (a) $(0.21 ) $(0.21 ) $(0.43 ) $(0.42 ) Free

Cash Flow (a) $(89.9 ) $6.9 $(136.4 ) $24.7

Pounds Sold (000) 52,732 36,904 100,922

71,462

(a) non-GAAP financial measure that is explained in the attached

tables

Net sales for the second quarter were $375.6 million, up 42

percent from the prior year. Excluding surcharge revenue, net sales

were $277.0 million, up 34 percent from a year ago. Total pounds

sold in the second quarter were 43 percent higher than the fiscal

year 2010 second quarter.

Gross profit was $49.1 million compared with $35.6 million in

the fiscal year 2010 second quarter. The higher gross profit in

this year’s second quarter was driven by significantly higher

volumes and better overall cost performance, partially offset by a

weaker product mix.

SG&A expenses were $37.0 million, compared with $33.6

million for the second quarter of fiscal year 2010. The

year-over-year increase is primarily due to higher variable

compensation expense versus the prior period. SG&A, as a

percentage of sales is nearly 3 percent lower than the prior

year.

Operating income for the second quarter was $12.1 million

compared with $2.0 million a year earlier. Excluding surcharge

revenue and pension earnings, interest and deferrals (EID),

operating margin was 7.5 percent for the quarter compared to 5.5

percent in the fiscal year 2010 second quarter.

Other income was $3.0 million compared to $6.7 million in the

fiscal year 2010 second quarter. The reduction is primarily due to

the close out of the Continued Dumping and Subsidy Offset Act of

2000 (CDSOA) program, which contributed $5.8 million in the prior

year versus only $0.4 million in the current period.

The provision for income tax was $1.4 million or 13 percent of

pre-tax income, reflecting the impact of the recent retroactive

extension of the R&D tax credit. This compares to $0.7 million

or 17 percent of pre-tax income a year ago. The full fiscal year

tax rate is now expected to be about 24 percent.

Net income attributable to Carpenter was $9.3 million or $0.21

per diluted share, compared with second quarter net income of $3.5

million or $0.08 per diluted share in fiscal year 2010.

Free cash flow, which we define as cash from operations less

capital expenditures and dividends, and the net cash impact from

the purchase and sale of businesses, was a negative $89.9 million

in the quarter. The negative cash flow mainly reflects the Amega

West acquisition and an increase in inventory levels to support

second half customer demand. Cash flow performance is expected to

improve over the second half of the year.

Markets:

Aerospace market sales were $150.2 million in the second

quarter, up 27 percent compared with the same period a year ago.

Excluding surcharge revenue, aerospace sales were up 24 percent on

32 percent higher volume. Aerospace results reflect the fifth

consecutive quarter of strong demand for engine components and

returning demand for titanium fastener material. Channel activity

within the nickel and stainless fastener segments still indicates a

pick-up in fastener demand during the second half of the fiscal

year.

Industrial market sales were $88.2 million, up 60 percent

compared with the second quarter of fiscal year 2010. Excluding

surcharge revenue, industrial sales increased 42 percent on 48

percent higher volume. The year-over-year growth reflects increased

demand and supply chain restocking for materials that go into niche

industrial applications.

Energy market sales of $41.8 million increased 104

percent from the second quarter a year earlier. Excluding surcharge

revenue, energy market sales increased 90 percent on 104 percent

higher volume. The increase reflects sharply higher demand for

materials used in oil and gas applications and recovering demand

for high value materials used in industrial gas turbines.

Consumer market sales were $35.7 million, an increase of

49 percent from the second quarter of fiscal year 2010. Excluding

surcharge revenue, sales increased 33 percent on 30 percent higher

volume. Increases in volumes and revenues are due to demand for

fasteners and electronic components used within housing and

appliances.

Automotive market sales were $33.7 million, an increase

of 42 percent from a year earlier. Excluding surcharge revenue,

automotive sales rose 24 percent as volumes increased 36 percent.

The growth rates reflect continued sales of lower value materials

used in valves, combined with renewed demand growth for materials

used in high value turbo charger products and fuel system

components.

Medical market sales were $26.0 million in the second

quarter, up 18 percent from a year ago. Excluding surcharge

revenue, medical market sales increased 20 percent on 26 percent

higher volume. Increased sales of high-end stainless products

outpaced demand growth of the higher value titanium and cobalt

materials.

International sales in the second quarter were $122.0

million, an increase of 42 percent compared with the same quarter a

year earlier. Sales in Europe were up 47 percent on 61 percent

higher volume driven mainly by increased demand in Aerospace,

Energy and Automotive. Asia revenues increased 39 percent on 62

percent higher volume driven by significant broad based growth in

most markets with particular strength in the energy and automotive

sectors. Total international sales in the quarter represented 32.5

percent of total sales, unchanged from the prior year.

Pension Effects

During the second quarter, the Company recorded expense

associated with its pension and other post retirement benefit plans

of $15.1 million or $0.21 per diluted share which reflects our

planned non-cash net pension expense for fiscal 2011 of $61

million, or $0.85 per diluted share. The expense will be allocated

equally through the fiscal year. The Company will make a cash

contribution of approximately $4 million in the fourth quarter of

fiscal year 2011.

Non-GAAP Financial Measures

This press release includes discussions of financial measures

that have not been determined in accordance with U.S. generally

accepted accounting principles ("GAAP"). The non-GAAP financial

measures, accompanied by reasons why the Company believes the

measures are important, are included in the attached schedules.

Conference Call

Carpenter will host a conference call and webcast today, January

25, at 10:00 a.m., ET, to discuss financial results and operations

for the fiscal first quarter. Please call 610-208-2222 for details

of the conference call. Access to the call will also be made

available at Carpenter's web site (http://www.cartech.com) and

through CCBN (http://www.ccbn.com). A replay of the call will be

made available at http://www.cartech.com or at

http://www.ccbn.com.

About Carpenter Technology

Carpenter produces and distributes specialty alloys, including

stainless steels, titanium alloys, and superalloys. Information

about Carpenter can be found on the Internet at

http://www.cartech.com.

Forward Looking Statements

Except for historical information, all other information in this

news release consists of forward-looking statements within the

meaning of the Private Securities Litigation Act of 1995. These

forward-looking statements are subject to risks and uncertainties

that could cause actual results to differ from those projected,

anticipated or implied. The most significant of these uncertainties

are described in Carpenter's filings with the Securities and

Exchange Commission including its annual report on Form 10-K for

the year ended June 30, 2010 and the quarterly report on Form 10-Q

for the quarter ended September 30, 2010 and the exhibits attached

to those filings. They include but are not limited to: 1) the

cyclical nature of the specialty materials business and certain

end-use markets, including aerospace, industrial, automotive,

consumer, medical, and energy, or other influences on Carpenter's

business such as new competitors, the consolidation of competitors,

customers, and suppliers or the transfer of manufacturing capacity

from the United States to foreign countries; 2) the ability of

Carpenter to achieve cost savings, productivity improvements or

process changes; 3) the ability to recoup increases in the cost of

energy, raw materials, freight or other factors; 4) domestic and

foreign excess manufacturing capacity for certain metals; 5)

fluctuations in currency exchange rates; 6) the degree of success

of government trade actions; 7) the valuation of the assets and

liabilities in Carpenter's pension trusts and the accounting for

pension plans; 8) possible labor disputes or work stoppages; 9) the

potential that our customers may substitute alternate materials or

adopt different manufacturing practices that replace or limit the

suitability of our products; 10) the ability to successfully

acquire and integrate acquisitions; 11) the availability of credit

facilities to Carpenter, its customers or other members of the

supply chain; 12) the ability to obtain energy or raw materials,

especially from suppliers located in countries that may be subject

to unstable political or economic conditions; 13) our manufacturing

processes are dependent upon highly specialized equipment located

primarily in one facility in Reading, Pennsylvania for which there

may be limited alternatives if there are significant equipment

failures or catastrophic event; and (14) our future success depends

on the continued service and availability of key personnel,

including members of our executive management team, management,

metallurgists and other skilled personnel and the loss of these key

personnel could affect our ability to perform until suitable

replacements are found. Any of these factors could have an adverse

and/or fluctuating effect on Carpenter's results of operations. The

forward-looking statements in this document are intended to be

subject to the safe harbor protection provided by Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Carpenter undertakes

no obligation to update or revise any forward-looking

statements.

PRELIMINARY CONSOLIDATED BALANCE SHEETS (in millions)

December 31, June 30, 2010 2010 ASSETS

Current assets: Cash and cash equivalents $157.2 $265.4 Marketable

securities 66.7 105.2 Accounts receivable, net 202.6 188.5

Inventories 327.8 203.6 Deferred income taxes 19.1 21.5 Other

current assets 45.3 36.0

Total current assets

818.7 820.2 Property, plant and equipment, net 633.2 617.5

Goodwill 35.2 35.2 Other intangibles, net 38.6 17.6 Deferred income

taxes 7.8 16.2 Other assets 96.5 76.5 Total assets

$1,630.0 $1,583.2 LIABILITIES Current

liabilities: Accounts payable $129.6 $130.5 Accrued liabilities

95.6 87.6 Current portion of long-term debt 100.0 --

Total current liabilities 325.2 218.1 Long-term debt, net of

current portion 159.1 259.6 Accrued pension liability 313.0 322.6

Accrued postretirement benefits 145.1 146.7 Other liabilities 64.9

62.8 Total liabilities 1,007.3 1,009.8

EQUITY Carpenter stockholders' equity: Common stock 273.3

273.2 Capital in excess of par value 228.0 223.3 Reinvested

earnings 984.0 983.2 Common stock in treasury, at cost (533.5 )

(535.2 ) Accumulated other comprehensive loss (338.4 ) (371.1 )

Total Carpenter stockholders' equity 613.4 573.4

Noncontrolling interest 9.3 -- Total equity 622.7

573.4 Total liabilities and equity $1,630.0

$1,583.2 PRELIMINARY CONSOLIDATED STATEMENTS

OF INCOME (in millions, except per share data)

Three Months Ended Six Months Ended December 31,

December 31, 2010 2009 2010 2009 NET SALES $375.6

$263.8 $727.3 $497.5 Cost of sales 326.5 228.2

628.4 442.7 Gross profit 49.1 35.6 98.9 54.8

Selling, general and administrative expenses 37.0 33.6

72.7 66.1 Operating income (loss) 12.1 2.0

26.2 (11.3 ) Interest expense (4.3 ) (4.5 ) (8.5 ) (8.8 )

Other income, net 3.0 6.7 4.5 8.2

Income (loss) before income taxes 10.8 4.2 22.2 (11.9 )

Income tax expense (benefit) 1.4 0.7 5.2 (6.0

) Net income (loss) 9.4 3.5 17.0 (5.9 ) Less: Net

income attributable to noncontrolling interest 0.1 -- 0.1 --

NET INCOME (LOSS) ATTRIBUTABLE TO CARPENTER

$9.3 $3.5 $16.9 ($5.9 ) EARNINGS (LOSS)

PER SHARE: Basic $0.21 $0.08 $0.38 ($0.14 )

Diluted $0.21 $0.08 $0.38 ($0.14 )

WEIGHTED AVERAGE SHARES OUTSTANDING: Basic 44.1 44.0

44.1 43.9 Diluted 44.7 44.2 44.6

43.9 Cash dividends per common share $0.18

$0.18 $0.36 $0.36 PRELIMINARY

CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions)

Six Months Ended December 31, 2010 2009 OPERATING

ACTIVITIES: Net income (loss) $17.0 ($5.9 ) Adjustments to

reconcile net income (loss) to net cash (used for) provided from

operating activities: Depreciation and amortization 30.1 29.2

Deferred income taxes (4.2 ) (9.0 ) Net pension expense 30.3 30.5

Net loss (gain) on disposal of property and equipment 0.5 (0.7 )

Changes in working capital and other: Accounts receivable (4.5 )

1.3 Inventories (116.5 ) (1.8 ) Other current assets 4.3 19.3

Accounts payable (5.5 ) 11.8 Accrued liabilities (15.4 ) (3.4 )

Other, net (0.2 ) (12.4 ) Net cash (used for) provided from

operating activities (64.1 ) 58.9 INVESTING

ACTIVITIES: Purchases of property, equipment and software (17.7 )

(19.1 ) Proceeds from disposals of property and equipment 0.1 0.9

Acquisition of business (41.6 ) -- Acquisition of equity method

investment (6.2 ) -- Purchases of marketable securities (63.0 )

(51.5 ) Proceeds from sales and maturities of marketable securities

101.4 15.0 Net cash used for investing activities

(27.0 ) (54.7 ) FINANCING ACTIVITIES: Payments on long-term

debt assumed in connection with acquisition of business (12.4 ) --

Proceeds received from sale of noncontrolling interest 9.1 --

Dividends paid (16.0 ) (16.0 ) Payments of debt issue costs - (2.0

) Tax benefits on share-based compensation 0.1 0.1 Proceeds from

common stock options exercised 0.3 0.2 Net cash used

for financing activities (18.9 ) (17.7 ) Effect of exchange

rate changes on cash and cash equivalents 1.8 0.9

DECREASE IN CASH AND CASH EQUIVALENTS (108.2 ) (12.6 ) Cash

and cash equivalents at beginning of period 265.4 340.1

Cash and cash equivalents at end of period $157.2

$327.5 PRELIMINARY SEGMENT FINANCIAL DATA (in

millions) Three

Months Ended Six Months Ended December 31, December 31, 2010

2009 2010 2009 Net sales: Advanced Metals Operations:

Net sales excluding surcharge $199.1 $147.9 $390.0 $293.6 Surcharge

65.9 35.0 121.6 64.7 Advanced

Metals Operations net sales 265.0 182.9 511.6

358.3 Premium Alloys Operations: Net sales excluding

surcharge $80.4 $59.9 $155.7 $102.9 Surcharge 32.7 21.5

65.0 37.6 Premium Alloys Operations net

sales 113.1 81.4 220.7 140.5

Intersegment (2.5 ) (0.5 ) (5.0 ) (1.3 ) Consolidated net sales

$375.6 $263.8 $727.3 $497.5

Operating income (loss): Advanced Metals Operations $9.4 $0.1 $17.9

($2.5 ) Premium Alloys Operations 22.2 20.3 46.4 28.1 Corporate

costs (10.6 ) (8.9 ) (20.5 ) (17.9 ) Pension earnings, interest

& deferrals (8.8 ) (9.5 ) (17.6 ) (19.0 ) Intersegment (0.1 )

-- -- -- Consolidated operating income

(loss) $12.1 $2.0 $26.2 ($11.3 ) We

have two reportable business segments: Advanced Metals Operations

and Premium Alloys Operations. The Advanced Metals

Operations (AMO) segment includes the manufacturing and

distribution of high temperature and high strength metal alloys,

stainless steels and titanium in the form of small bars and rods,

wire, narrow strip and powder. AMO sales are spread across many of

our end-use markets including aerospace, industrial, consumer,

automotive, and medical. The Premium Alloys Operations (PAO)

segment includes the manufacturing and distribution of high

temperature and high strength metal alloys and stainless steels in

the form of ingots, billets, large bars and hollows and primarily

services the aerospace and energy markets. The service cost

component of net pension expense, which represents the estimated

cost of future pension liabilities earned associated with active

employees, is included in the operating results of the business

segments. The residual net pension expense, which is comprised of

the expected return on plan assets, interest costs on the projected

benefit obligations of the plans, and amortization of actuarial

gains and losses and prior service costs, is included under the

heading "Pension earnings, interest & deferrals."

PRELIMINARY NON-GAAP FINANCIAL MEASURES (in millions, except per

share data) Three Months

Ended Six Months Ended December 31, December 31, FREE CASH FLOW

2010 2009 2010 2009 Net cash (used for) provided from

operating activities ($33.6 ) $22.7 ($64.1 ) $58.9 Purchases of

property, equipment and software (9.6 ) (7.8 ) (17.7 ) (19.1 )

Proceeds from disposals of property and equipment -- -- 0.1 0.9

Acquisition of equity method investment (6.2 ) -- (6.2 ) --

Proceeds received from sale of noncontrolling interest 9.1 -- 9.1

-- Acquisition of business (41.6 ) -- (41.6 ) -- Dividends paid

(8.0 ) (8.0 ) (16.0 ) (16.0 ) Free cash flow ($89.9 ) $6.9

($136.4 ) $24.7 Management believes that the free

cash flow measure provides useful information to investors

regarding our financial condition because it is a measure of cash

generated which management evaluates for alternative uses.

Three Months Ended Six Months Ended December 31,

December 31, NET PENSION EXPENSE PER DILUTED SHARE 2010 2009 2010

2009 Pension plans expense $13.4 $13.5 $26.9 $27.0 Other

postretirement benefits expense 1.7 1.7 3.4

3.5 Net pension expense 15.1 15.2 30.3 30.5 Income tax

benefit (5.6 ) (5.9 ) (11.3 ) (11.9 ) Net pension expense, net of

tax $9.5 $9.3 $19.0 $18.6 Net

pension expense per diluted share $0.21 $0.21 $0.43

$0.42 Weighted average diluted common shares

44.7 44.2 44.6 43.9 Management

believes that net pension expense per diluted share is helpful in

analyzing the operating performance of the Company, as net pension

expense tends to be volatile due to changes in the financial

markets, which may result in significant fluctuations in operating

results from period to period. OPERATING

MARGIN EXCLUDING SURCHARGE AND Three Months Ended Six Months Ended

PENSION EARNINGS, INTEREST AND DEFERRALS December 31, December 31,

2010 2009 2010 2009 Net sales $ 375.6 $ 263.8 $ 727.3 $

497.5 Less: surcharge revenue 98.6 56.5 186.6

102.3 Consolidated net sales excluding surcharge $277.0

$207.3 $540.7 $395.2 Operating

income (loss) $12.1 $2.0 $26.2 ($11.3 ) Pension earnings, interest

& deferrals 8.8 9.5 17.6 19.0

Operating income excluding pension earnings, interest and deferrals

$20.9 $11.5 $43.8 $7.7 Operating

margin excluding surcharge and pension earnings, interest and

deferrals 7.5 % 5.5 % 8.1 % 1.9 % Management believes that

removing the impacts of raw material surcharges from net sales

provides a more consistent basis for comparing results of

operations from period to period. In addition, management believes

that excluding the impact of pension earnings, interest and

deferrals, which may be volatile due to changes in the financial

markets, is helpful in analyzing the true operating performance of

the Company. PRELIMINARY SUPPLEMENTAL SCHEDULES (in

millions) Three Months Ended Six

Months Ended December 31, December 31, NET SALES BY MAJOR PRODUCT

LINE 2010 2009 2010 2009 Product Line Excluding Surcharge:

Special alloys $ 130.3 $ 108.5 $ 252.6 $ 196.7 Stainless steel

100.0 65.3 191.4 126.3 Titanium products 29.5 23.7 63.4 50.5 Tool

and other steel 13.7 7.9 26.0 17.1 Other materials 3.5 1.9 7.3 4.6

Consolidated net sales excluding surcharge $277.0 $207.3

$540.7 $395.2 Surcharge revenue 98.6 56.5 186.6 102.3

Consolidated net sales $375.6 $263.8 $727.3 $497.5

Three Months Ended Six Months Ended December 31, December 31, NET

SALES BY END USE MARKET 2010 2009 2010 2009 End Use Market

Excluding Surcharge: Aerospace $ 112.1 $ 90.5 $ 219.8 $ 171.7

Industrial 61.3 43.3 121.4 84.6 Energy 33.0 17.4 57.3 26.9 Consumer

25.1 18.9 49.9 37.2 Automotive 23.7 19.1 45.8 35.3 Medical 21.8

18.1 46.5 39.5 Consolidated net sales excluding surcharge

$277.0 $207.3 $540.7 $395.2 Surcharge revenue 98.6 56.5

186.6 102.3 Consolidated net sales $375.6 $263.8 $727.3

$497.5

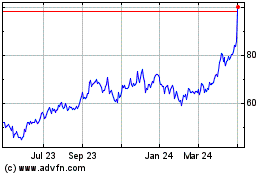

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jun 2024 to Jul 2024

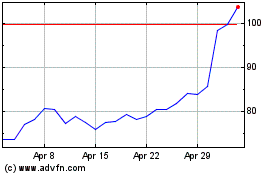

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jul 2023 to Jul 2024