Carpenter Technology Raises Prices on All Specialty Stainless, High Temperature and Electronic Alloys

May 03 2010 - 4:45PM

Business Wire

Carpenter Technology Corporation (NYSE: CRS) today announced

that it will increase base prices an average of 5 percent on all

specialty stainless, high temperature and electronic alloys in all

product forms. The increases will be effective for orders placed on

or after May 1, 2010 and are due to inflationary pressures and

higher demand for its products. Additionally, Carpenter said all

applicable surcharges will remain in effect.

Carpenter produces and distributes specialty alloys, including

stainless steels, titanium alloys, and superalloys. Information

about Carpenter can be found on the Internet at

http://www.cartech.com.

Except for historical information, all

other information in this news release consists of forward-looking

statements within the meaning of the Private Securities Litigation

Act of 1995. These forward-looking statements are subject to risks

and uncertainties that could cause actual results to differ from

those projected, anticipated or implied. The most significant of

these uncertainties are described in Carpenter's filings with the

Securities and Exchange Commission including its annual report on

Form 10-K for the year ended June 30, 2009 and the quarterly

reports on Form 10-Q for the quarters ended September 30, 2009 and

December 31, 2009, and the exhibits attached to those filings. They

include but are not limited to: 1) the cyclical nature of the

specialty materials business and certain end-use markets, including

aerospace, industrial, automotive, consumer, medical, and energy,

or other influences on Carpenter's business such as new

competitors, the consolidation of competitors, customers, and

suppliers or the transfer of manufacturing capacity from the United

States to foreign countries; 2) the ability of Carpenter to achieve

cost savings, productivity improvements or process changes; 3) the

ability to recoup increases in the cost of energy, raw materials,

freight or other factors; 4) domestic and foreign excess

manufacturing capacity for certain metals; 5) fluctuations in

currency exchange rates; 6) the degree of success of government

trade actions; 7) the valuation of the assets and liabilities in

Carpenter's pension trusts and the accounting for pension plans; 8)

possible labor disputes or work stoppages; 9) the potential that

our customers may substitute alternate materials or adopt different

manufacturing practices that replace or limit the suitability of

our products; 10) the ability to successfully acquire and integrate

acquisitions; 11) the availability of credit facilities to

Carpenter, its customers or other members of the supply chain; 12)

the ability to obtain energy or raw materials, especially from

suppliers located in countries that may be subject to unstable

political or economic conditions; 13) our manufacturing processes

are dependent upon highly specialized equipment located primarily

in one facility in Reading, Pennsylvania for which there may be

limited alternatives if there are significant equipment failures or

catastrophic event; and (14) our future success depends on the

continued service and availability of key personnel, including

members of our executive management team, management, metallurgists

and other skilled personnel and the loss of these key personnel

could affect our ability to perform until suitable replacements are

found. Any of these factors could have an adverse and/or

fluctuating effect on Carpenter's results of operations. The

forward-looking statements in this document are intended to be

subject to the safe harbor protection provided by Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Carpenter undertakes

no obligation to update or revise any forward-looking

statements.

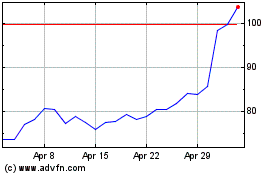

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jun 2024 to Jul 2024

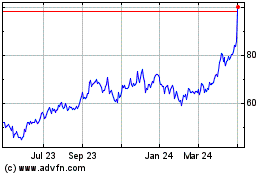

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jul 2023 to Jul 2024